Asia Pacific Surgical Equipment Market Research Report – Segmented By Product ( surgical sutures staplers, handheld surgical devices ) Application and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Surgical Equipment Market Size

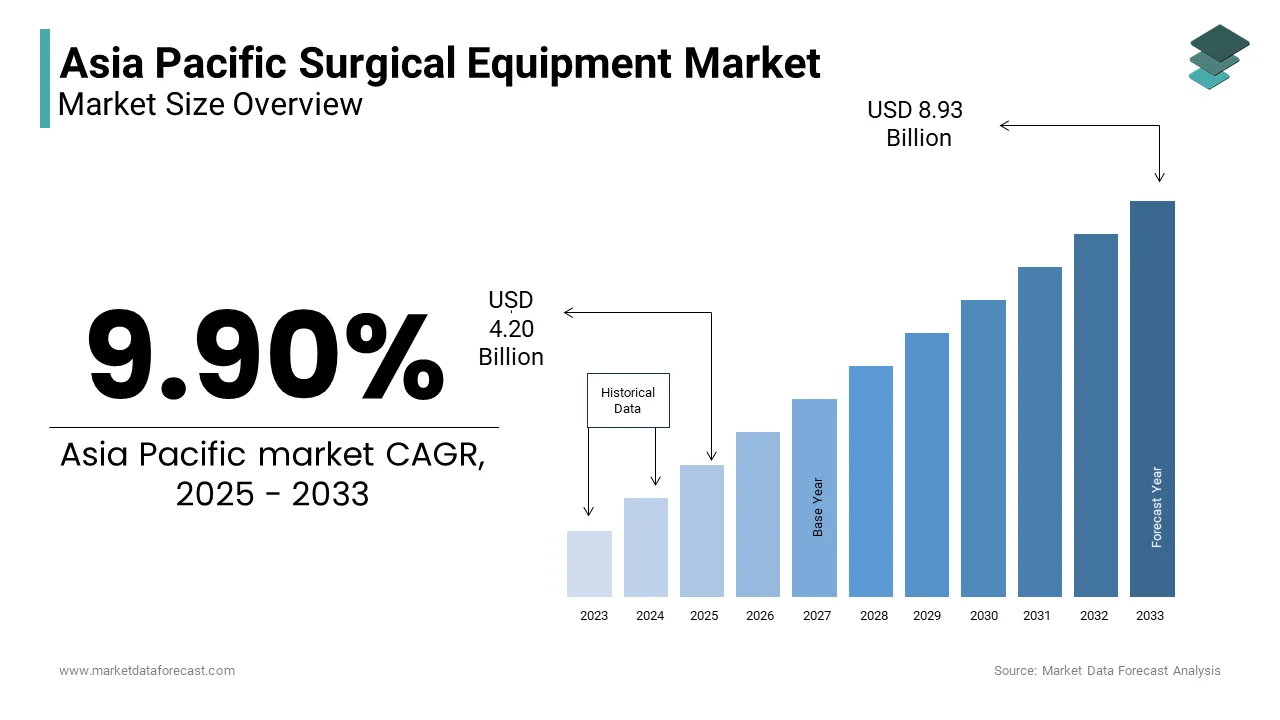

The Asia Pacific Surgical Equipment Market Size was valued at USD 3.82 billion in 2024. The Asia Pacific Surgical Equipment Market Size is expected to have 9.90 % CAGR from 2025 to 2033 and be worth USD 8.93 billion by 2033 from USD 4.20 billion in 2025.

The Asia Pacific surgical equipment market is witnessing robust growth, driven by the increasing prevalence of chronic diseases and a surge in surgical procedures across the region. According to the World Health Organization, non-communicable diseases account for over 60% of deaths in the Asia Pacific, necessitating advanced surgical interventions. Countries like China, Japan, and India are leading contributors, with Japan alone representing nearly 35% of the regional revenue as per industry estimates. The growing geriatric population further amplifies demand as older individuals are more prone to conditions requiring surgical care. Additionally, advancements in minimally invasive surgical technologies, such as robotic-assisted systems and laparoscopic tools, have improved patient outcomes while reducing recovery times.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The increasing burden of chronic diseases such as cancer, cardiovascular conditions, and diabetes is a significant driver of the surgical equipment market in the Asia Pacific region. According to the Global Burden of Disease Study, chronic diseases account for over 70% of all healthcare expenditures in the region, necessitating frequent surgical interventions. Similarly, in China, the Chinese Medical Furthermore, government initiatives to combat non-communicable diseases, such as China’s Healthy China 2030 program, emphasize early detection and treatment through surgery.

Advancements in Minimally Invasive Surgical Technologies

Another key driver is the rapid adoption of minimally invasive surgical technologies, which rely heavily on advanced surgical equipment. According to the Journal of Minimally Invasive Surgery, procedures such as laparoscopy and robotic-assisted surgeries have grown by over 15% annually in the Asia Pacific region. These techniques offer benefits like reduced recovery times and lower complication rates, which is making them increasingly popular among both patients and surgeons. For instance, in South Korea, the Ministry of Health and Welfare reports that minimally invasive surgeries now account for nearly 40% of all cardiac interventions. Surgical equipment, such as harmonic scalpels and robotic arms, play a pivotal role in these procedures by enabling precise navigation and control. Moreover, innovations such as AI-driven imaging systems and ergonomic designs have improved usability, further boosting adoption. These technological advancements position surgical equipment as a transformative force in the healthcare sector.

MARKET RESTRAINTS

High Cost of Advanced Surgical Equipment

One of the primary restraints in the Asia Pacific surgical equipment market is the high cost associated with advanced products, which limits accessibility for many healthcare facilities. According to the Asian Development Bank, over 60% of hospitals in low-income countries allocate less than 10% of their budget to medical devices, which is making premium surgical tools unaffordable. For instance, robotic-assisted surgical systems can cost upwards of $2 million by deterring widespread adoption in rural and underserved areas. Additionally, maintenance costs and the need for skilled technicians further exacerbate affordability issues. Even in developed nations like Japan, where healthcare is subsidized, out-of-pocket expenses for advanced surgical procedures remain substantial, discouraging potential users.

Shortage of Skilled Surgeons and Technicians

Another significant restraint is the shortage of skilled professionals trained in handling advanced surgical equipment and performing complex procedures. According to the World Health Organization, the density of specialized medical personnel, such as surgeons and anesthesiologists, is alarmingly low in many parts of the Asia Pacific region. For instance, in Bangladesh and Nepal, there are fewer than one surgeon per million people by leaving vast populations underserved. This scarcity is compounded by uneven distribution, with most qualified practitioners concentrated in urban centers, while rural areas face acute shortages. Furthermore, the cost and duration of training programs act as deterrents for aspiring professionals, which is perpetuating the workforce gap.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Surgical Consultations

The rise of telemedicine and remote surgical consultations presents a significant opportunity for the Asia Pacific surgical equipment market. Telemedicine platforms are enabling consultations and procedural planning for patients in remote areas with the ongoing digital transformation in healthcare. Surgical equipment, being essential for advanced procedures, benefits from this trend as remote consultations often lead to referrals for surgeries. For instance, in countries like Thailand and Malaysia, government-led telehealth initiatives have connected rural patients with urban specialists, driving demand for surgical tools. Additionally, partnerships between telemedicine providers and equipment manufacturers are streamlining supply chains, which is ensuring timely availability of products

Growing Investments in Healthcare Infrastructure

Increased investments in healthcare infrastructure across the Asia Pacific region offer another promising opportunity for the surgical equipment market. Governments and private entities are channeling funds into building state-of-the-art hospitals and upgrading existing facilities to meet the rising demand for advanced surgical care. The rising investments is particularly evident in countries like India and Indonesia, where new surgical centers are being established to address the growing burden of chronic diseases. Similarly, in Southeast Asia, public-private partnerships are fostering the development of specialized surgical units. These infrastructural advancements create a conducive environment for the adoption of surgical equipment by ensuring sustainable market growth.

MARKET CHALLENGES

Stringent Regulatory Frameworks

Navigating stringent regulatory frameworks poses a significant challenge for the Asia Pacific surgical equipment market, as compliance requirements vary widely across countries. Each nation within the region has its own set of approval processes, which is creating a fragmented landscape that complicates market entry. For instance, as per the Pharmaceuticals and Medical Devices Agency of Japan, obtaining regulatory clearance for new surgical equipment can take up to two years, delaying their availability to healthcare facilities. Similarly, in India, the Central Drugs Standard Control Organization mandates rigorous clinical trials before approving advanced surgical tools, which increases development costs and timelines. These regulations, while ensuring product safety, often hinder smaller companies from entering the market. Additionally, frequent updates to guidelines necessitate continuous adaptation, which is placing a financial strain on manufacturers. Such complexities impede innovation and slow down market growth.

Cultural Resistance to Advanced Surgical Procedures

Cultural perceptions and resistance to adopting advanced surgical procedures present another formidable challenge to the surgical equipment market in the Asia Pacific region. In many rural areas, traditional beliefs and mistrust of modern healthcare interventions deter individuals from seeking advanced surgical solutions. According to the Southeast Asian Journal of Public Health, over 50% of respondents in rural communities associate minimally invasive surgeries with high risks is leading to reluctance in adoption. Additionally, language barriers and inadequate patient education exacerbate the problem, as per the World Health Organization. For example, in Vietnam, only 20% of the population is aware of the benefits of laparoscopic surgeries, as reported by the Vietnamese Ministry of Health. These cultural and socioeconomic barriers not only limit market penetration but also necessitate extensive awareness campaigns to build trust and dispel misconceptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.90% |

|

Segments Covered |

By Product, Application & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson & Johnson, Zimmer Biomet Holdings Inc, B. Braun, Smith & Nephew PLC, Stryker Corp, Aspen Group Inc, Medtronic PLC, BD |

SEGMENTAL ANALYSIS

By Product Insights

The surgical sutures and staplers was the largest and held 50.4% of the Asia Pacific surgical equipment market share in 2024 owing to their widespread use in a variety of surgical procedures, from routine wound closures to complex reconstructive surgeries. According to the Journal of Surgical Research, over 80% of surgical interventions require some form of suturing or stapling due to critical role in healthcare settings. For instance, data from the Japanese Society of Surgeons reveals that hospitals in Japan perform nearly 1.5 million surgeries annually, with sutures and staplers being indispensable tools in these procedures. Additionally, advancements in materials, such as bioabsorbable sutures and titanium staples that have improved patient outcomes while reducing recovery times. Furthermore, government initiatives to enhance access to affordable surgical care in countries like India and Indonesia, have bolstered adoption rates.

The handheld surgical devices segment is likely to experience a CAGR of 12.5% in the next coming years. This rapid growth is fueled by the increasing adoption of minimally invasive surgical techniques, which rely heavily on advanced handheld tools like scalpels, forceps, and electrosurgical devices. According to the International Journal of Minimally Invasive Surgery, minimally invasive procedures account for over 40% of all surgeries performed in the Asia Pacific region is driving demand for specialized handheld devices. A key driver is the rising prevalence of chronic diseases, which necessitate frequent surgical interventions. For example, the Korean Ministry of Health reports a 30% annual increase in laparoscopic surgeries, which is boosting demand for handheld surgical tools. Additionally, innovations such as ergonomic designs and AI-driven precision systems have enhanced usability, further accelerating adoption.

By Application Insights

The plastic and reconstructive surgery segment was accounted in holding 35.4% of the Asia Pacific surgical equipment market share in 2024. The growth of the segment is attribute to be driven by growing demand for aesthetic procedures and reconstructive surgeries is the primary driver, with conditions like trauma, burns, and congenital defects necessitating advanced surgical tools. For instance, data from the Indian Association of Plastic Surgeons reveals that over 1.2 million reconstructive surgeries are performed annually in India, driving adoption rates. Additionally, government initiatives to combat road accidents and workplace injuries, such as China’s Occupational Safety and Health Program, emphasize the importance of reconstructive surgical tools.

The neurosurgery segment is likely to grow with a projected CAGR of 13.8% in the next coming years. This growth is driven by the increasing prevalence of neurological disorders, such as brain tumors, strokes, and spinal injuries, which require precise surgical interventions. For example, the Korean Neurological Society reports a 25% annual increase in neurosurgical procedures, which is boosting demand for specialized equipment like microscopes and robotic arms. Additionally, investments in neurosurgical infrastructure, particularly in urban centers, have expanded access to these procedures.

COUNTRY LEVEL ANALYSIS

China was the largest contributor for the Asia Pacific surgical equipment market with a share of 35.4% in 2024 due to a massive population base and rising awareness about advanced healthcare solutions. The country’s aging population, with over 250 million people aged 60 and above, creates a sustained need for efficient surgical tools. Additionally, government initiatives like the Healthy China 2030 program emphasize upgrading healthcare infrastructure, ensuring widespread adoption of surgical equipment. For instance, subsidies for medical devices have encouraged hospitals to invest in cutting-edge technologies will further bolster the growth of the market in China.

Japan led the Asia Pacific surgical equipment market with 21.1% of share in 2024 with the advanced healthcare system and high geriatric population are pivotal factors driving its prominence. According to the Japanese Ministry of Health, Labour and Welfare, over 28% of the population is aged 65 or above, necessitating frequent use of surgical tools for conditions like cancer and cardiovascular diseases. Japan’s stringent regulatory framework ensures the availability of high-quality products, with advanced surgical equipment being widely adopted due to their reliability.

India surgical equipment market growth is likely to register prominent growth opportunities in the next coming years. The country’s burgeoning middle class and increasing disposable incomes are key drivers of this growth. According to the Confederation of Indian Industry, the medical devices market in India expanded by 18% annually between 2019 and 2022, with surgical equipment being a major contributor. Rising awareness about chronic diseases, coupled with government initiatives like Ayushman Bharat, has boosted adoption rates. For instance, data from the Indian Council of Medical Research shows that the number of hospitals equipped with advanced surgical tools has doubled since 2018.

South Korea’s dominance in advanced healthcare infrastructure and technological innovation are majorly propelling the growth of the market. According to the Korean Medical Association, South Korea boasts one of the highest densities of surgeons in the Asia Pacific region by ensuring widespread access to specialized care. The popularity of minimally invasive surgeries, driven by technological advancements, has significantly boosted demand for surgical tools. Data from the Seoul National University Hospital shows that over 70% of patients undergoing oncology-related interventions use advanced surgical equipment.

Australia’s robust healthcare system and high per capita income levels will further propel the growth of the Asia Pacific surgical equipment market. Additionally, private health insurance coverage, which includes benefits for advanced surgical procedures, supports affordability.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific Surgical Equipment Market are Johnson & Johnson, Zimmer Biomet Holdings Inc, B. Braun, Smith & Nephew PLC, Stryker Corp, Aspen Group Inc, Medtronic PLC, BD.

The Asia Pacific surgical equipment market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture market share. Global leaders like Johnson & Johnson and Medtronic dominate through their extensive portfolios, cutting-edge technologies, and strong brand equity. Regional players, such as Stryker Corporation, counter this dominance by offering cost-effective solutions tailored to local preferences. The competitive landscape is further shaped by rapid technological advancements, with companies investing heavily in innovations like robotic-assisted systems and AI-driven tools to stay ahead. Additionally, the rise of medical tourism has intensified rivalry, as countries like Thailand and Malaysia attract international patients seeking affordable yet high-quality care.

Top Players in the Market

Johnson & Johnson (DePuy Synthes)

Johnson & Johnson, through its subsidiary DePuy Synthes, is a global leader in surgical equipment and holds a significant presence in the Asia Pacific market. The company’s innovative portfolio, including advanced sutures, staplers, and handheld devices, caters to diverse surgical needs across the region. Its contribution to the global market lies in its relentless focus on research and development, which has led to breakthroughs like bioabsorbable materials and AI-driven precision tools. DePuy Synthes’ strong distribution network ensures accessibility even in remote areas, while partnerships with local healthcare providers foster education and awareness about cutting-edge solutions.

Medtronic plc

Medtronic is another major player driving advancements in the Asia Pacific surgical equipment market. Known for integrating cutting-edge technology into its products, the company offers a wide range of surgical tools tailored to applications like neurosurgery, plastic surgery, and minimally invasive procedures. Globally, Medtronic contributes by setting benchmarks in precision and safety, particularly through innovations like robotic-assisted systems and ergonomic handheld devices. In the Asia Pacific region, its emphasis on training programs and collaborations with hospitals enhances adoption rates.

Stryker Corporation

Stryker Corporation is a dominant force in the Asia Pacific surgical equipment market, particularly in countries like Japan and Australia. The company’s success stems from its cost-effective yet high-quality surgical tools, which cater to both urban and rural populations. On the global stage, Stryker has gained recognition for its innovative designs and user-friendly interfaces. Its commitment to sustainability and patient-centric solutions has earned it a loyal customer base.

Top Strategies Used by Key Market Participants

Strategic Collaborations and Partnerships

Key players in the Asia Pacific surgical equipment market are increasingly forming strategic partnerships with local hospitals, universities, and governments to enhance their reach. These collaborations help companies tap into underserved regions while fostering education and awareness about advanced surgical technologies. For instance, partnerships with medical schools enable manufacturers to train students and professionals on the latest tools, ensuring higher adoption rates. Such initiatives also facilitate regulatory compliance, as companies gain insights into regional requirements and preferences, allowing them to tailor their offerings effectively.

Product Innovation and R&D Investments

Investing in research and development is a cornerstone strategy for strengthening market position. Companies are focusing on developing next-generation surgical equipment with improved accuracy, speed, and usability. Innovations such as AI-driven precision tools and bioabsorbable materials address evolving consumer demands for efficiency and safety. This focus on innovation ensures that companies remain at the forefront of technological advancements while addressing unmet clinical needs.

Expansion of Distribution Networks

Expanding distribution networks is another critical strategy adopted by key players to boost their presence in the Asia Pacific regions. The companies can ensure timely delivery of products while reducing logistical costs by establishing robust supply chains and localized distribution hubs. This approach is particularly effective in reaching rural and remote areas where access to advanced surgical equipment is limited. Additionally, partnerships with e-commerce platforms and digital health startups enable companies to leverage online channels for marketing and sales. Such strategies enhance accessibility and affordability, which is making surgical equipment more inclusive across diverse demographics.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Johnson & Johnson launched a new line of bioabsorbable surgical sutures specifically designed for the Asia Pacific market. This move aimed to cater to the growing demand for advanced tools that improve patient outcomes and reduce recovery times.

- In June 2023, Medtronic partnered with a leading hospital chain in India to establish a training center for surgeons. This initiative focused on educating practitioners about the latest minimally invasive surgical techniques, improving adoption rates in the region.

- In February 2023, Stryker Corporation opened a state-of-the-art manufacturing facility in Vietnam. This expansion allowed the company to meet rising demand in Southeast Asia while reducing production costs, thereby improving affordability.

- In September 2022, Olympus Corporation collaborated with a prominent surgical center in Australia to offer subsidized robotic-assisted surgical systems. This partnership increased accessibility to premium surgical tools among underserved populations.

- In November 2021, B. Braun introduced a mobile app for healthcare professionals in the Asia Pacific region, providing real-time guidance on surgical equipment usage. This innovation aimed to streamline workflows and improve operational efficiency.

MARKET SEGMENTATION

This research report on the asia pacific surgical equipment market has been segmented and sub-segmented into the following.

By Product

- surgical sutures and staplers

- handheld surgical devices

By Application

- plastic and reconstructive surgery

- neurosurgery

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the Asia Pacific Surgical Equipment Market?

The Asia Pacific Surgical Equipment Market refers to the regional market for tools and instruments used during surgical procedures, including electrosurgical devices, handheld instruments, sutures, staplers, and surgical lights.

Which countries are the key contributors in the Asia Pacific market?

The major contributors include China, Japan, India, South Korea, and Australia, with emerging growth seen in Southeast Asian countries like Vietnam, Thailand, and Indonesia.

How is the demand for minimally invasive surgery impacting the market?

Minimally invasive surgery is a major growth driver due to Faster recovery times Reduced hospital stays Improved patient outcomes.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com