Asia Pacific Textile Recycling Market Size, Share, Trends & Growth Forecast Report By Material (Cotton, Polyester, Wool, Polyamide), Source, Process, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Textile Recycling Market Size

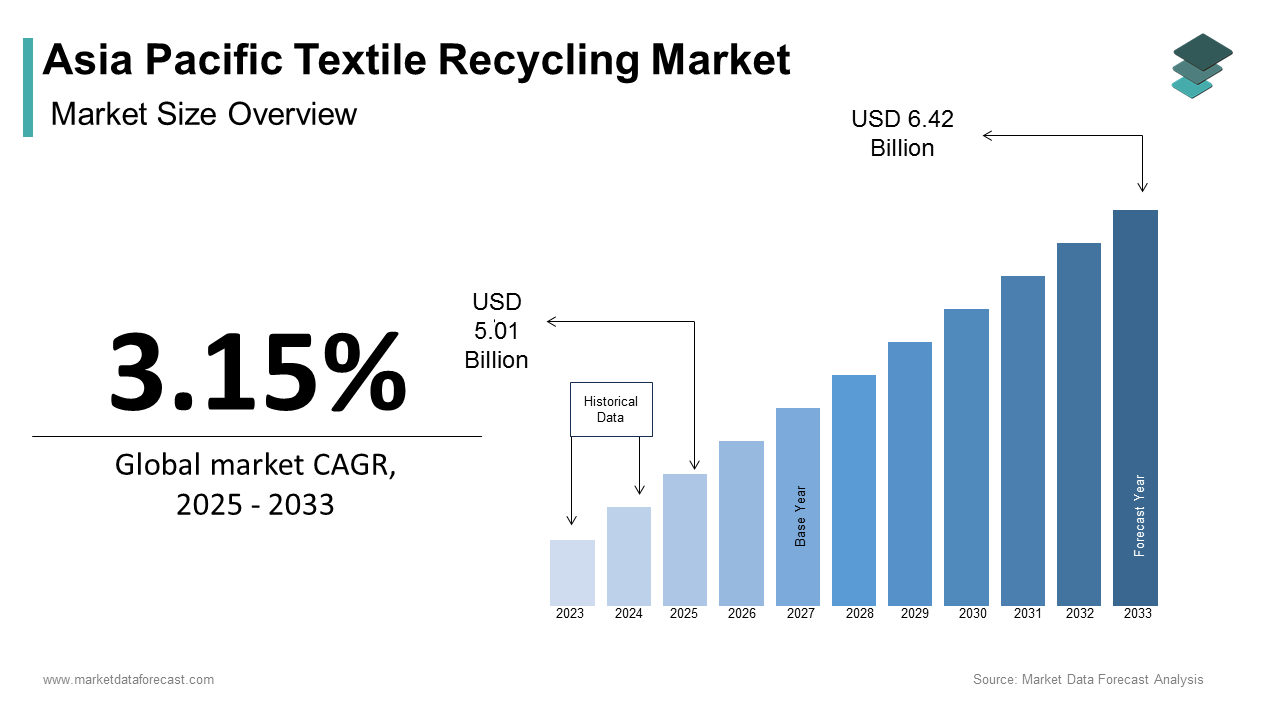

The Asia Pacific textile recycling market size was calculated to be USD 4.86 billion in 2024 and is anticipated to be worth USD 6.42 billion by 2033, from USD 5.01 billion in 2025, growing at a CAGR of 3.15% during the forecast period.

Textile recycling is emerging as a critical solution to address the growing environmental and economic challenges posed by textile waste. As per the Ellen MacArthur Foundation, the global fashion industry produces over 92 million tons of textile waste annually, with a significant portion originating from the Asia Pacific region. This alarming figure underscores the urgent need for sustainable practices like textile recycling, which involves converting discarded fabrics into reusable fibers or raw materials for new products. The region’s dominance in textile production and consumption, coupled with rising awareness about sustainability, has positioned it as a focal point for innovation in recycling technologies.

Countries such as China, India, and Japan are leading efforts to transition from linear textile consumption models to circular economies. According to the United Nations Environment Programme, the Asia Pacific region accounts for approximately 60% of global textile manufacturing, making it both a contributor to and a potential resolver of textile waste issues. Governments in the region are increasingly implementing policies to promote recycling, alongside initiatives to reduce landfill dependency. For instance, Australia’s National Waste Policy Action Plan emphasizes achieving an 80% recovery rate for textiles by 2030. Meanwhile, consumer behavior is shifting, with younger demographics showing a preference for sustainable fashion, as noted by the World Economic Forum. These factors collectively create a fertile environment for the growth of the Asia Pacific textile recycling market, fostering innovation and collaboration across the value chain.

MARKET DRIVERS

Rising Environmental Concerns and Regulatory Support

Environmental concerns are one of the key factors propelling the growth of the Asia Pacific textile recycling market due to the region's status as a major contributor to global textile waste. According to the World Bank, textile waste contributes to nearly 5% of global greenhouse gas emissions, with landfills in countries like India and China nearing capacity. In response, governments are enacting stringent regulations to curb waste generation. For example, China’s "Zero Waste City" initiative mandates cities like Shenzhen to adopt comprehensive waste management systems, including textile recycling. Similarly, Japan’s Ministry of the Environment has introduced Extended Producer Responsibility (EPR) policies, requiring manufacturers to manage post-consumer textile waste. These regulatory frameworks are complemented by international commitments, such as the Paris Agreement, which encourages member nations to reduce their carbon footprints. As per the International Resource Panel, adopting circular economy principles, including textile recycling, can reduce resource extraction by up to 28%. This alignment of local and global policies creates a conducive environment for the growth of the textile recycling market, encouraging industries and consumers to embrace sustainable practices.

Increasing Consumer Awareness and Demand for Sustainable Fashion

Consumer awareness about the environmental impact of fast fashion is driving demand for recycled textiles in the Asia Pacific region. According to a survey conducted by the Global Fashion Agenda, over 70% of consumers in the region prioritize eco-friendly products when making purchasing decisions. This shift in consumer behavior is particularly evident among millennials and Gen Z, who are more likely to support brands that demonstrate environmental responsibility. Moreover, as per the World Economic Forum, the rise of social media platforms has amplified awareness campaigns led by environmental organizations, influencing public perception of textile waste. Brands like H&M and Uniqlo have capitalized on this trend by launching take-back programs and incorporating recycled fibers into their collections. For instance, H&M’s garment collection initiative has collected over 29,000 tons of clothing globally, with a significant portion processed in Asia Pacific facilities. This growing preference for sustainable fashion not only drives demand for recycled textiles but also incentivizes manufacturers to invest in recycling infrastructure, further propelling the market forward.

MARKET RESTRAINTS

Limited Technological Advancements and Infrastructure

The lack of advanced technologies and infrastructure required for efficient recycling processes is primarily hindering the growth of the textile recycling market in Asia-Pacific. According to the United Nations Industrial Development Organization, less than 1% of textiles are currently recycled into new garments due to technological limitations. While mechanical recycling methods are widely used, they often degrade fiber quality, limiting the scope of applications for recycled materials. Chemical recycling, though promising, remains expensive and underdeveloped in the region. Furthermore, many countries in Southeast Asia and South Asia lack dedicated textile recycling facilities, relying instead on informal waste collectors and small-scale operators. This fragmented system results in inefficiencies and inconsistent quality of recycled outputs. For instance, in India, where over 4.5 million tons of textile waste is generated annually, only a fraction is processed through formal channels. The absence of standardized recycling protocols exacerbates these challenges, hindering the scalability of the market and deterring investment in large-scale operations.

High Costs and Economic Viability Challenges

The economic viability of textile recycling presents another major restraint, as the costs associated with collection, sorting, and processing often outweigh the financial returns. According to the Ellen MacArthur Foundation, the cost of collecting and sorting post-consumer textiles can account for up to 50% of the total recycling process, making it unprofitable for many businesses. Additionally, the low resale value of recycled fibers compared to virgin materials further reduces profitability. As per the World Bank, the absence of subsidies or financial incentives in many Asia Pacific countries discourages private sector participation in textile recycling. For example, in Vietnam, where textile manufacturing is a key industry, companies face high operational costs without adequate government support to offset expenses. This financial barrier limits the ability of small and medium enterprises to enter the market, stifling innovation and growth. Moreover, the lack of consumer willingness to pay premium prices for recycled products adds to the economic challenges, creating a cycle of low demand and limited investment in recycling initiatives.

MARKET OPPORTUNITIES

Integration of Circular Economy Principles in Fashion Supply Chains

The integration of circular economy principles offers immense opportunities for the Asia Pacific textile recycling market, particularly within the fashion supply chain. For instance, the adoption of circular practices can generate $560 billion in economic benefits globally by 2030, with the Asia Pacific region poised to capture a significant share. Brands are increasingly collaborating with recycling firms to develop closed-loop systems, where post-consumer textiles are repurposed into raw materials for new products. For instance, Adidas launched its "Parley" line, using recycled ocean plastics and textile waste sourced from the region. Moreover, as per the Ellen MacArthur Foundation, governments and industry bodies are promoting circularity through initiatives like the ASEAN Circular Economy Stakeholder Platform, which fosters knowledge-sharing and innovation. By leveraging advanced sorting and recycling technologies, the region can transform its textile waste into valuable resources, reducing dependency on virgin materials. This shift not only aligns with global sustainability goals but also creates new revenue streams, positioning the Asia Pacific as a leader in sustainable fashion production.

Expansion of E-Commerce Platforms for Recycled Textiles

The rapid growth of e-commerce platforms is another lucrative opportunity for the Asia Pacific textile recycling market. According to Statista, the revenue of the global e-commerce sector is projected to reach $4.32 trillion by 2025 due to the increasing internet penetration and digital literacy. Online marketplaces like Lazada and Flipkart are beginning to feature recycled and upcycled textile products, catering to environmentally conscious consumers. Additionally, as per the Global Fashion Agenda, direct-to-consumer models enabled by e-commerce allow smaller brands specializing in recycled textiles to reach a wider audience without traditional retail barriers. For example, platforms like Carousell in Singapore facilitate peer-to-peer exchanges of second-hand clothing, promoting reuse and extending product lifecycles. By integrating digital tools like blockchain for transparency and traceability, e-commerce platforms can enhance consumer trust and drive demand for recycled textiles, unlocking untapped potential in the market.

MARKET CHALLENGES

Complex Sorting and Contamination Issues

The complexity of sorting and contamination of textile waste is one of the major challenges to the growth of the Asia Pacific textile recycling market. According to the United Nations Environment Programme, mixed fabric compositions and non-recyclable additives such as dyes and coatings make it difficult to process post-consumer textiles efficiently. Unlike single-material plastics, textiles often consist of blended fibers, complicating mechanical recycling efforts. Moreover, as per the Ellen MacArthur Foundation, contamination from food spills, dirt, or other substances further reduces the usability of collected textiles. In countries like Thailand and Indonesia, informal waste collectors often lack the expertise or equipment to sort materials effectively, resulting in low-quality outputs. This challenge is compounded by the absence of standardized collection systems, leading to inconsistent feedstock quality. Addressing these issues requires significant investments in sorting technologies and infrastructure, which remain limited in the region, posing a barrier to scaling up recycling operations.

Lack of Consumer Participation in Collection Systems

The insufficient participation of consumers in textile collection systems that hampers the availability of recyclable materials is another major challenge to the growth of the textile recycling market in Asia-Pacific. According to the World Bank, less than 20% of post-consumer textiles in urban areas across the Asia Pacific are collected for recycling, with rural regions lagging even further behind. A lack of awareness about available collection programs and skepticism about the effectiveness of recycling initiatives contribute to this issue. Additionally, cultural perceptions of used textiles as inferior or undesirable discourage donations or returns. For instance, in countries like Malaysia and the Philippines, second-hand clothing is often stigmatized, reducing consumer willingness to participate in take-back schemes. Without widespread public engagement, the volume of textiles entering recycling streams remains inadequate to meet industrial demands, undermining efforts to build a robust recycling ecosystem. Overcoming this challenge requires targeted awareness campaigns and incentives to encourage active consumer involvement.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.15% |

|

Segments Covered |

By Material, Source, Process, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Anandi Enterprises, Boer Group Recycling Solutions, Khaloom Textiles India Pvt. Ltd., Kishco Group, Hyosung TNC Corporation, Lenzing AG, Patagonia Inc., Renewcell AB, The Woolmark Company, Worn Again Technologies, and Resyntex |

SEGMENTAL ANALYSIS

By Material Insights

The polyester segment accounted for 39.8% of the Asia Pacific textile recycling market share in 2024 due to its widespread use in apparel, home furnishings, and industrial textiles. According to the World Economic Forum, polyester accounts for over 50% of global fiber production, making it the most abundant material available for recycling. Its dominance is further amplified by the growing demand for recycled polyester (rPET), which is increasingly used as a substitute for virgin polyester in sustainable fashion. For instance, brands like Nike and Adidas have committed to using 100% recycled polyester in their products by 2025, driving demand for recycled fibers. The energy efficiency of recycling polyester compared to producing virgin polyester is further boosting the domination of the polyester segment in the Asia-Pacific market. As per the Ellen MacArthur Foundation, recycling polyester reduces energy consumption by up to 59% and greenhouse gas emissions by 32%. This environmental advantage aligns with regional sustainability goals, particularly in countries like China and India, where governments incentivize eco-friendly practices. Additionally, the availability of advanced mechanical recycling technologies tailored for polyester ensures high-quality outputs, making it a preferred choice for manufacturers. These dynamics collectively solidify polyester's position as the largest segment in the market.

On the other hand, the polyamide segment is anticipated to register the fastest CAGR of 13.3% over the forecast period owing to its extensive use in automotive textiles, sportswear, and technical fabrics, all of which are witnessing increased demand across the Asia Pacific region. For instance, the Asia Pacific automotive industry is projected to grow by 8% annually, creating a robust market for recycled polyamide in car interiors and components. Technological advancements in chemical recycling are another key driver. As per the United Nations Industrial Development Organization, chemical recycling methods can now depolymerize nylon into its monomers, enabling the production of high-quality recycled fibers. This innovation addresses the challenge of downcycling, which has traditionally limited polyamide recycling. Furthermore, as per the Global Fashion Agenda, the rise of performance wear and athleisure trends has boosted demand for durable, lightweight materials like recycled nylon. These factors, combined with growing investments in recycling infrastructure, position polyamide as the fastest-growing material in the textile recycling market.

By Source Insights

The apparel waste segment was the largest source segment and held 51.4% of the Asia Pacific textile recycling market share in 2024. The dominance of apparel waste segment in the Asia-Pacific market is attributed to the region's status as a global hub for fast fashion production and consumption. According to the Ellen MacArthur Foundation, the average consumer in the Asia Pacific discards approximately 30 kg of clothing annually, creating a massive supply of recyclable materials. Countries like Bangladesh and Vietnam, major apparel exporters, contribute significantly to this waste stream. Government initiatives also play a crucial role. For example, Japan’s Ministry of the Environment has introduced programs to collect and recycle post-consumer apparel, reducing landfill dependency. As per the Asian Development Bank, these efforts are supported by public awareness campaigns that encourage consumers to donate or recycle old clothing. Additionally, the growing adoption of take-back schemes by brands like H&M and Uniqlo ensures a steady flow of apparel waste into recycling systems.

The automotive waste segment is another major segment and is predicted to grow at the highest CAGR of 12.2% over the forecast period owing to the increasing use of textiles in vehicle interiors and components. According to the International Organization of Motor Vehicle Manufacturers, the Asia Pacific automotive industry produces over 40 million vehicles annually, generating significant textile waste from seat covers, carpets, and insulation materials. This waste stream presents a lucrative opportunity for recycling firms. Advancements in recycling technologies are also accelerating growth. As per the United Nations Industrial Development Organization, mechanical and chemical processes can now efficiently recover fibers from automotive textiles, ensuring high-quality outputs. Furthermore, stringent regulations mandating the recycling of end-of-life vehicles, such as those implemented in Japan and South Korea, are propelling demand for automotive textile recycling. As per the World Economic Forum, the push toward sustainable mobility solutions further amplifies the need for eco-friendly materials, positioning automotive waste as a rapidly expanding segment in the market.

By Process Insights

The mechanical recycling segment dominated the market by accounting for 64.7% of the regional market share in 2024. The growth of the mechanical recycling segment is attributed to its cost-effectiveness and widespread adoption. According to the United Nations Environment Programme, mechanical recycling involves shredding and reprocessing textiles into fibers, making it suitable for handling large volumes of waste. This method is particularly prevalent in countries like India and China, where informal waste collectors dominate the recycling ecosystem. The affordability of mechanical recycling is a key factor. As per the Asian Development Bank, the process is up to 40% cheaper than chemical recycling, making it accessible to small-scale operators. Additionally, the versatility of mechanically recycled fibers, which can be used in applications like insulation and carpet backing, ensures consistent demand. However, challenges such as fiber degradation and contamination are being addressed through innovations in sorting and processing technologies, as noted by the Ellen MacArthur Foundation.

The chemical recycling segment is predicted to witness a CAGR of 15.5% over the forecast period due to its ability to produce high-quality outputs from complex textile blends. According to the United Nations Industrial Development Organization, chemical processes such as depolymerization and solvolysis can break down synthetic fibers like polyester and nylon into their original monomers, enabling closed-loop recycling. This innovation addresses the limitations of mechanical recycling, particularly for blended fabrics. Government incentives are also propelling the growth of the chemical recycling segment in the Asia-Pacific market. For instance, countries such as Japan and South Korea are investing heavily in R&D for chemical recycling technologies, fostering collaboration between academia and industry. Moreover, the rising demand for sustainable fashion, as highlighted by the Global Fashion Agenda, is encouraging brands to adopt chemically recycled fibers. These dynamics, coupled with decreasing costs due to technological advancements, position chemical recycling as the fastest-growing process in the market.

REGIONAL ANALYSIS

China held 60.7% of the Asia Pacific textile recycling market share in 2024. China generates over 20 million tons of textile waste annually, according to the World Bank, which is creating a vast resource for recycling. Government policies, such as the "Zero Waste City" initiative, mandate cities like Shenzhen to implement comprehensive waste management systems, boosting textile recycling. Additionally, China’s robust manufacturing base supports the development of advanced recycling technologies. As per the United Nations Environment Programme, investments in chemical recycling facilities have surged, enabling the production of high-quality recycled fibers. The country’s strategic partnerships with global fashion brands further enhance its leadership, as companies seek to meet sustainability targets by sourcing recycled materials from China.

India is another major market for textile recycling in the Asia-Pacific region. The growth of the Indian market is driven by its thriving textile industry and growing emphasis on sustainability. According to the Asian Development Bank, India produces approximately 1.2 million tons of textile waste annually, much of which is processed through informal channels. The government’s Swachh Bharat Mission promotes waste segregation and recycling, encouraging formal participation in the sector. Moreover, as per the Ellen MacArthur Foundation, India’s low labor costs make mechanical recycling economically viable, attracting investment in large-scale facilities. The rise of sustainable fashion startups, such as Doodlage, highlights the growing domestic demand for recycled textiles. These factors position India as a key player in the regional market, with immense growth potential.

Japan captured a substantial share of the Asia-Pacific textile recycling market in 2024. The advanced technological capabilities and stringent environmental regulations of Japan are driving the Japanese market growth. For instance, Japan aims to achieve a 70% recycling rate for textiles by 2030, driving innovation in the sector. Programs like the "Recycle Design Project" promote the use of recycled fibers in fashion and home furnishings. The country’s expertise in chemical recycling is another advantage. As per the United Nations Industrial Development Organization, Japanese firms have pioneered technologies to depolymerize synthetic fibers, ensuring high-quality outputs. Additionally, consumer awareness about sustainability, as noted by the World Economic Forum, fosters demand for recycled products, reinforcing Japan’s leadership in the market.

South Korea is projected to showcase a healthy CAGR in the Asia-Pacific market over the forecast period due to its focus on circular economy principles and green technologies. According to the Korean Ministry of Environment, the country has implemented Extended Producer Responsibility (EPR) policies, requiring manufacturers to manage post-consumer textile waste. This regulatory framework has spurred investments in recycling infrastructure. Innovations in textile-to-textile recycling in South Korea are also aiding the South Korean market growth. As per the Global Fashion Agenda, South Korean researchers have developed enzymatic processes to recycle cotton and polyester blends, addressing a key industry challenge. Additionally, the country’s strong e-commerce platforms, such as Coupang, facilitate the sale of recycled products, enhancing market penetration and consumer engagement.

Australia and New Zealand collectively hold a considerable share of the Asia-Pacific textile recycling market due to their commitment to sustainability and waste reduction. For instance, Australia aims to achieve an 80% recovery rate for textiles by 2030, which is driving investments in recycling facilities. Programs like "Textile Take-Back" encourage consumers to recycle old clothing, ensuring a steady supply of feedstock. Moreover, as per the Ellen MacArthur Foundation, collaborations between local governments and private firms have led to the development of innovative recycling solutions. For instance, Australian startup BlockTexx specializes in chemical recycling of blended textiles, setting a benchmark for the region. The growing popularity of sustainable fashion among millennials further boosts demand, positioning Australia and New Zealand as emerging leaders in the market.

LEADING PLAYERS IN THE ASIA PACIFIC TEXTILE RECYCLING MARKET

Welspun India

Welspun India is a global leader in home textiles and has emerged as a key player in the Asia Pacific textile recycling market. The company has pioneered initiatives to integrate recycled fibers into its product lines, aligning with global sustainability goals. Welspun’s focus on innovation has led to the development of eco-friendly products like recycled cotton towels and bedding, which cater to environmentally conscious consumers. By collaborating with international brands and adopting advanced recycling technologies, Welspun contributes significantly to reducing textile waste globally. Its efforts not only enhance its market position but also set benchmarks for sustainable practices in the industry.

Unifi, Inc.

Unifi, Inc., a U.S.-based company with a strong presence in the Asia Pacific, specializes in transforming plastic bottles and textile waste into high-quality recycled polyester fibers. Through its REPREVE® brand, Unifi has established itself as a leader in sustainable fiber production. The company actively partners with fashion and automotive industries in the region to provide innovative solutions for reducing environmental impact. Unifi’s commitment to circularity and resource efficiency has positioned it as a trusted supplier of recycled materials, contributing to global sustainability efforts while driving market growth.

Hyosung Corporation

Hyosung Corporation, a South Korean conglomerate, is renowned for its advancements in textile recycling technologies. The company focuses on producing high-performance recycled fibers, such as MIPAN® regen nylon, derived from post-industrial and post-consumer waste. Hyosung’s emphasis on research and development has enabled it to offer cutting-edge solutions that meet the demands of diverse industries, including sportswear and automotive textiles. By promoting eco-friendly practices and fostering collaborations with regional stakeholders, Hyosung plays a pivotal role in advancing the Asia Pacific textile recycling market and supporting global sustainability initiatives.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Adoption of Circular Economy Models

Key players are increasingly embracing circular economy principles to minimize waste and maximize resource efficiency. By implementing closed-loop systems, companies ensure that textile waste is continuously repurposed into new products, reducing dependency on virgin materials. For instance, partnerships with fashion brands enable firms to collect post-consumer garments and reintegrate them into the supply chain. This strategy not only enhances sustainability but also strengthens brand reputation and consumer loyalty, positioning companies as leaders in eco-friendly innovation.

Investment in R&D for Advanced Recycling Technologies

Investment in research and development is a critical strategy for overcoming challenges related to textile recycling. Companies are focusing on developing chemical recycling methods capable of handling complex blends like cotton-polyester. These innovations improve the quality and versatility of recycled fibers, enabling their use in high-value applications. By staying at the forefront of technological advancements, firms can differentiate themselves in a competitive market while addressing industry-wide limitations, ensuring long-term growth and relevance.

Expansion of Collection and Sorting Infrastructure

To secure a steady supply of recyclable materials, companies are expanding their collection and sorting networks across urban and rural areas. Collaborations with local governments and NGOs facilitate the establishment of textile collection bins and awareness campaigns, encouraging public participation. Additionally, investments in automated sorting technologies enhance the efficiency and accuracy of material processing. This strategy ensures scalability, reduces operational costs, and fosters community engagement, strengthening the overall recycling ecosystem.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Textile Recycling Market include Anandi Enterprises, Boer Group Recycling Solutions, Khaloom Textiles India Pvt. Ltd., Kishco Group, Hyosung TNC Corporation, Lenzing AG, Patagonia Inc., Renewcell AB, The Woolmark Company, Worn Again Technologies, and Resyntex

The Asia Pacific textile recycling market is characterized by intense competition, driven by the convergence of global sustainability trends and regional industrial dynamics. Established players leverage their technological expertise and extensive distribution networks to maintain dominance while emerging startups introduce innovative solutions tailored to niche markets. The market landscape is shaped by collaborations between private firms, governments, and non-profits, fostering a collaborative approach to tackling textile waste. Regulatory pressures and consumer demand for eco-friendly products have heightened rivalry, pushing companies to adopt aggressive strategies such as mergers, acquisitions, and strategic partnerships. Additionally, the race to achieve cost-effective and scalable recycling solutions has further intensified competitive dynamics. As sustainability becomes a core priority, players are investing heavily in branding and marketing to position themselves as pioneers in the green revolution. This competitive environment fosters rapid advancements, benefiting the market as a whole while challenging companies to continuously innovate and adapt to evolving demands.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Welspun India launched a take-back program in collaboration with Indian retailers to collect used home textiles, aiming to recycle them into new products and promote circularity in the supply chain.

- In March 2024, Unifi, Inc. partnered with a leading sportswear brand in Japan to develop a line of activewear made entirely from REPREVE® recycled fibers, enhancing its market presence in the region.

- In May 2024, Hyosung Corporation introduced a state-of-the-art chemical recycling plant in South Korea, capable of processing nylon waste into high-performance fibers for automotive applications.

- In July 2024, a Chinese recycling firm collaborated with local municipalities to establish textile collection hubs in major cities, ensuring greater accessibility for consumers and increasing feedstock availability.

- In September 2024, an Australian startup launched a blockchain-based platform to track the lifecycle of recycled textiles, improving transparency and building consumer trust in sustainable products.

MARKET SEGMENTATION

This research report on the Asia Pacific textile recycling market has been segmented and sub-segmented based on material, source, process, and region.

By Material

- Cotton

- Polyester

- Wool

- Polyamide

By Source

- Apparel

- Waste

By Process

- Mechanical

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. Which factors are driving the growth of the Asia Pacific textile recycling market?

Growing environmental awareness, strict government regulations on waste management, increasing demand for sustainable fashion, and rising textile waste volumes are key drivers.

2. What challenges does the textile recycling industry face in Asia Pacific?

Challenges include low collection rates, contamination of textile waste, lack of advanced recycling technologies, and limited consumer awareness.

3. Who are the major players in the Asia Pacific textile recycling market?

Major companies include Birla Cellulose, Worn Again Technologies, Tytec Recycling, and others focusing on sustainable textile solutions.

4. How is technology impacting textile recycling in Asia Pacific?

Advanced sorting technologies, chemical recycling methods, and AI-driven material identification are improving efficiency and scalability of textile recycling operations.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com