Asia Pacific Thermal Transfer Ribbon Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Type, Print Head, Function, Application, End-User, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Thermal Transfer Ribbon Market Size

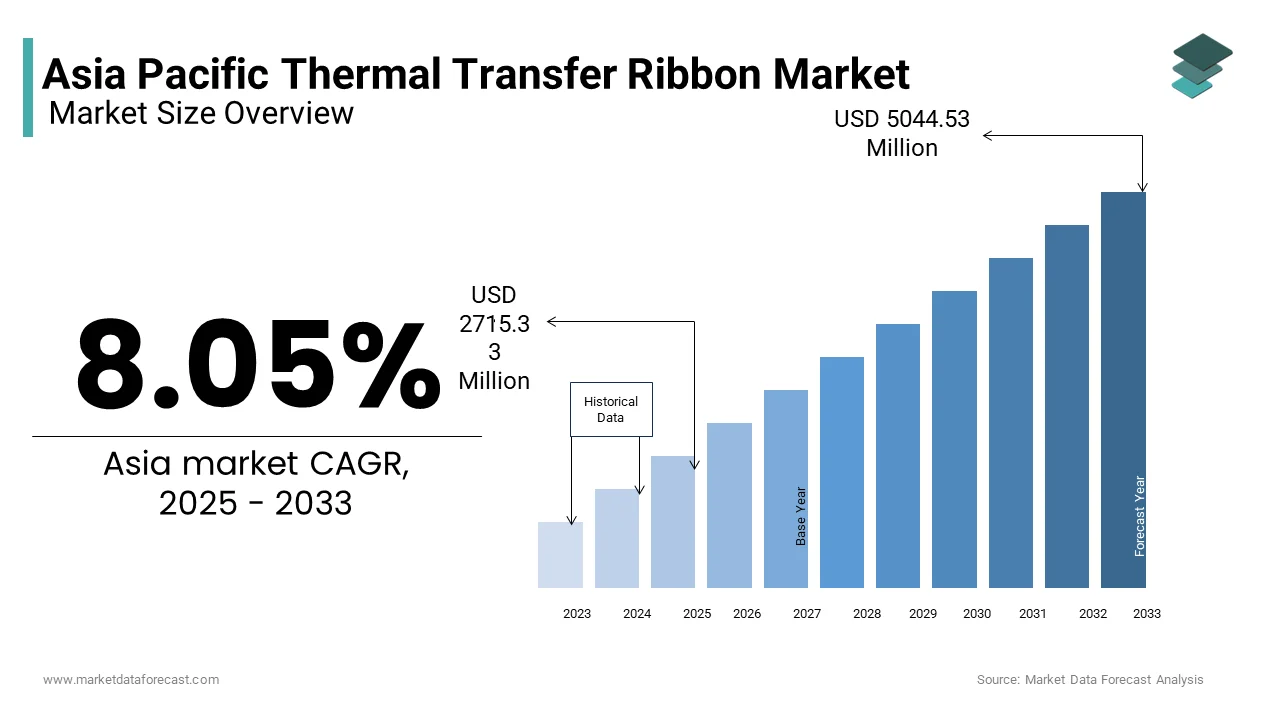

The Asia Pacific thermal transfer ribbon market was valued at USD 2513.03 million in 2024 and is anticipated to reach USD 2715.33 million in 2025 from USD 5044.53 million by 2033, growing at a CAGR of 8.05% during the forecast period from 2025 to 2033.

Thermal transfer ribbons are essential components in thermal printing technology, used to transfer ink onto various substrates such as paper, polyester, and polypropylene. These ribbons are widely employed across industries for barcode labeling, packaging, logistics, healthcare, and retail applications due to their durability, clarity, and compatibility with different printing systems. Moreover, in the Asia Pacific region, the demand for thermal transfer ribbons has grown significantly alongside the expansion of e-commerce, supply chain digitization, and automated inventory management systems.

According to the Asian Productivity Organization, over 60% of medium and large-scale manufacturers in Southeast Asia implemented automated labeling systems between 2021 and 2023 to improve traceability and operational efficiency.

Apart from these, the rapid growth of the pharmaceutical and food & beverage sectors in India and China has further intensified the need for high-quality labeling solutions that ensure regulatory compliance and product safety.

MARKET DRIVERS

Growth in E-Commerce and Logistics Sector

A significant growth enabler for the Asia Pacific thermal transfer ribbon market is the exponential growth of the e-commerce and logistics sector, which relies heavily on accurate and durable labeling for efficient supply chain operations. Thermal transfer ribbons are preferred for printing shipping labels, barcodes, and tracking codes due to their smudge-proof, heat-resistant, and long-lasting print quality. According to the Alibaba Group’s 2023 Digital Economy Report, cross-border e-commerce transactions in the Asia Pacific grew by 24% compared to the previous year, necessitating robust labeling solutions to handle increased parcel volumes.

The surge in last-mile delivery networks and warehouse automation across China, South Korea, and Australia has also contributed to rising demand for high-performance thermal ribbons. With governments across the region pushing for digital supply chains and smart logistics infrastructure, the adoption of thermal transfer ribbons is expected to remain strong.

Expansion of Retail and Point-of-Sale (POS) Systems

Another key driver of the Asia Pacific thermal transfer ribbon market is the widespread expansion of modern retail formats and point-of-sale (POS) systems, particularly in emerging economies such as Indonesia, Vietnam, and the Philippines. Thermal transfer ribbons are integral to POS printers used for generating receipts, shelf labels, and pricing tags due to their ability to produce sharp, tamper-resistant prints on various media types. According to the ASEAN Retail Council, the number of organized retail outlets across Southeast Asia increased greatly between 2021 and 2023, leading to higher deployment of electronic cash registers and self-checkout kiosks equipped with thermal printers.

In China, contactless payment and digital receipt systems drove an increase in the installation of compact POS printers in convenience stores and quick-service restaurants. This trend translated into a notable rise in thermal ribbon consumption among retail-focused suppliers in recent years. The growing emphasis on omnichannel retail strategies and real-time inventory management has further reinforced the need for reliable and high-speed printing solutions.

MARKET RESTRAINTS

Availability of Alternative Printing Technologies

A significant restraint affecting the growth of the Asia Pacific thermal transfer ribbon market is the increasing availability and adoption of alternative printing technologies that reduce reliance on thermal ribbons. Inkjet and laser printing systems, along with direct thermal label printing, offer cost-effective or ribbon-free options that appeal to budget-conscious businesses, especially in small and medium enterprises (SMEs).

Moreover, these systems eliminate the need for separate ribbons, offering a more streamlined approach to coding and marking. While thermal transfer ribbons remain superior in terms of durability and compatibility with harsh environments, the growing preference for alternatives in certain applications poses a challenge to market expansion in the Asia Pacific region.

Price Volatility of Raw Materials

Another critical restraint impacting the Asia Pacific thermal transfer ribbon market is the volatility in raw material prices, particularly those of resins, waxes, and synthetic films used in ribbon production. Fluctuations in global oil prices directly affect the cost of petroleum-derived components such as polyethylene and polypropylene, which are essential for manufacturing high-performance ribbons.

Additionally, China recorded an increase in the import cost of specialty waxes used in premium-grade ribbons, driven by export restrictions from European suppliers. This inflationary pressure has forced some manufacturers to either pass on the increased costs to end-users or compromise on formulation quality, both of which can negatively impact market dynamics. In India, the Federation of Indian Chambers of Commerce and Industry (FICCI) highlighted that small-scale producers struggled to maintain competitive pricing amid fluctuating input costs, leading to consolidation within the industry. As raw material markets remain unstable, the thermal transfer ribbon sector faces ongoing challenges in sustaining affordability and profitability across the Asia Pacific.

MARKET OPPORTUNITY

Adoption of Smart Labeling and IoT Integration

One of the most promising opportunities for the Asia Pacific thermal transfer ribbon market lies in the growing adoption of smart labeling and integration with Internet of Things (IoT) technologies. As industries increasingly embrace digital tracking and real-time data monitoring, there is a rising demand for high-quality, durable labels that can support advanced scanning and connectivity features. Thermal transfer ribbons play a crucial role in ensuring legible and scannable barcodes, QR codes, and RFID tag identifiers across supply chain operations.

According to the Asia IoT Business Platform, a significant portion of large-scale logistics providers in Southeast Asia introduced smart labeling systems in recent years to enhance shipment visibility and inventory accuracy. In Singapore, the Infocomm Media Development Authority reported that more than 60% of cold-chain logistics operators now use thermal-printed labels with temperature-sensitive indicators to monitor perishable goods in transit.

Expansion of Cold Chain and Pharmaceutical Labeling Requirements

Another emerging opportunity for the Asia Pacific thermal transfer ribbon market is the expanding cold chain infrastructure and evolving labeling requirements in the pharmaceutical industry. With the increasing demand for temperature-sensitive medications, vaccines, and biologics, there is a growing need for durable, chemical-resistant labels that can withstand extreme storage conditions without compromising readability. Thermal transfer ribbons, particularly resin-based variants, offer superior resistance to moisture, abrasion, and low temperatures, making them ideal for cryogenic and refrigerated applications.

In India, the Department of Pharmaceuticals mandated the use of tamper-evident, machine-readable labels on all export-bound pharmaceutical products, prompting manufacturers to adopt high-resolution thermal transfer printing. Additionally, in Australia, the Therapeutic Goods Administration emphasized the importance of permanent label integrity for medical device packaging, leading to a rise in resin-coated ribbon usage. As regulatory scrutiny intensifies and healthcare logistics become more complex, the demand for specialized thermal ribbons tailored for pharmaceutical applications is poised for sustained growth in the Asia Pacific.

MARKET CHALLENGES

Regulatory Compliance Across Diverse Markets

A major challenge facing the Asia Pacific thermal transfer ribbon market is the complexity of navigating diverse regulatory frameworks across countries. Each nation imposes unique standards regarding material safety, environmental impact, and product labeling, which complicates the commercialization of thermal ribbons, particularly for multinational suppliers. According to the ASEAN Committee on Science and Technology, discrepancies in chemical registration procedures delay market entry by an average of six to nine months in countries like Thailand, Malaysia, and the Philippines.

For instance, in Japan, the Ministry of Health, Labour and Welfare enforces strict migration limits for ink components used in food-related labeling, requiring extensive testing before approval. Meanwhile, in Australia, the Australian Competition and Consumer Commission mandates specific labeling disclosures for imported thermal ribbons, adding administrative burdens for exporters. In China, the Ministry of Ecology and Environment introduced revised hazardous substance control guidelines in 2023, imposing additional certification requirements on manufacturers of solvent-based ribbons. These fragmented regulatory landscapes create barriers to scale, particularly for smaller suppliers aiming to enter multiple regional markets, thereby challenging the overall growth trajectory of the thermal transfer ribbon industry in the Asia Pacific.

Limited Awareness and Technical Support in Rural and SME Segments

Another significant challenge impeding the growth of the Asia Pacific thermal transfer ribbon market is the limited awareness and inadequate technical support available to rural and small-to-medium enterprise (SME) users. Many businesses in these segments continue to rely on outdated printing methods due to a lack of understanding regarding the advantages of thermal transfer ribbons, such as improved print durability and compatibility with automated systems.

Furthermore, misconceptions about the cost and complexity of thermal printing equipment contribute to resistance among local entrepreneurs. Addressing this knowledge gap requires targeted outreach initiatives and partnerships between government agencies and industry stakeholders to promote education and facilitate access to after-sales support across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.05% |

|

Segments Covered |

By Type, Print Head, Function, Application, End-User, And Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Honeywell International Inc., Zebra Technologies Corp., FUJICOPIAN CO. LTD, ITW Brand Identity, IIMAK, Todaytec, PAC EDGE LABELS PVT. LTD., Norwood Marking Systems, WALTVEST Sdn Bhd, KMP PrintTechnik AG. |

SEGMENTAL ANALYSIS

By Type Insights

The wax-resin material segment holds the largest market share, accounting for 47.2% of the Asia Pacific thermal transfer ribbon market in 2024. This dominance is attributed to its balanced performance characteristics, offering a combination of cost-effectiveness, print quality, and durability that makes it suitable for a wide range of applications across logistics, retail, and light manufacturing sectors.

One key driver behind the wax-resin segment’s leadership is its extensive use in labeling applications within the e-commerce and logistics industries, where moderate resistance to abrasion and smudging is sufficient for short-to-medium term handling.

Another critical factor contributing to this segment’s widespread adoption is its cost advantage over high-end resin-based ribbons, making it particularly attractive to small and medium-sized enterprises (SMEs) that require reliable but affordable printing solutions. Additionally, in China, the National Technical Committee on Printing Technology observed that wax-resin ribbons accounted for over 50% of all thermal ribbon sales in the mid-tier manufacturing sector, especially in electronics assembly and consumer goods packaging. Given its versatility and affordability, the wax-resin segment continues to dominate the regional thermal transfer ribbon landscape.

The resin material segment is projected to grow at the fastest rate, registering a CAGR of 9.8% from 2025 to 2033, outpacing other types due to increasing demand for high-durability labels in harsh environments. Resin-based thermal transfer ribbons are known for their exceptional resistance to heat, chemicals, and abrasion, making them ideal for industrial and healthcare applications where long-term print integrity is essential.

One major driver of this growth is the rising demand for durable labeling in the pharmaceutical and biotechnology sectors, particularly in cold chain logistics and medical device packaging.

Another significant contributor is the expansion of high-tech manufacturing in countries such as South Korea and Singapore, where resin ribbons are extensively used for component and product identification in semiconductor, automotive, and aerospace industries. As industrial complexity and regulatory scrutiny intensify, the resin material segment is poised for accelerated growth across the Asia Pacific.

By Print Head Insights

The flat type segment accounted for the largest market share, capturing 62.7% of the Asia Pacific thermal transfer ribbon market in 2024. This superiority is primarily attributed to the widespread installation of flat-head thermal printers in industrial and commercial settings, which offer simplicity, durability, and cost-efficiency.

One key driver behind the flat type segment’s growth is its compatibility with a broad range of existing thermal printers, especially those deployed in logistics, retail, and manufacturing environments. According to the Asia Pacific Printing Equipment Association, a notable share of thermal printers installed in Southeast Asian warehouses and distribution centers as of 2023 were equipped with flat-head technology. These printers are preferred for their ease of maintenance and lower operational costs, making them ideal for high-volume label printing operations. In Thailand, the Ministry of Industry reported that a substantial portion of garment exporters adopted flat-head printers integrated with wax-resin ribbons for apparel tagging and shipment labeling.

Another important factor is the cost-effectiveness and reliability of flat-head printers, which appeal to small and medium-sized enterprises (SMEs) seeking efficient yet affordable labeling solutions. With a large installed base and strong user preference, the flat type segment remains the dominant force in the Asia Pacific thermal transfer ribbon market.

The near-edge print head segment is emerging as the fastest-growing category within the Asia Pacific thermal transfer ribbon market, projected to register a CAGR of 10.2%. This rapid expansion is driven by the rising adoption of compact, high-speed printers that offer enhanced print resolution and flexibility, particularly in mobile and automated environments.

One major factor fueling this growth is the increasing deployment of near-edge printers in mobile and handheld labeling devices, especially in logistics and field service applications. According to the ASEAN Mobile Solutions Forum, the number of mobile asset tracking and delivery verification systems utilizing near-edge thermal printers surged in 2023, with Indonesia and Vietnam witnessing the highest adoption rates. In Malaysia, the Ministry of Transport reported that over 40% of express delivery services introduced mobile labeling units equipped with near-edge heads to streamline last-mile operations and reduce manual errors.

Another significant driver is the integration of near-edge printers into automated production and packaging lines, particularly in the electronics and pharmaceutical sectors. According to the Korea Electronics Association, South Korean semiconductor manufacturers increased their investment in high-precision labeling systems using near-edge technology by 28% in 2023, aiming to improve traceability and meet global export standards. As automation and mobility continue to reshape industrial workflows, the near-edge segment is positioned for robust growth across the Asia Pacific region.

By Function Insights

The labelling segment commanded the biggest market share, accounting for 68.1% of the Asia Pacific thermal transfer ribbon market in 2024. This is due to the growing need for durable, scannable, and compliant labels across industries such as logistics, healthcare, manufacturing, and retail, where accurate product identification and traceability are paramount.

One of the key drivers behind the labelling segment’s leadership is the expansion of the logistics and supply chain industry, which relies heavily on barcode and QR code labels for inventory management and shipment tracking. According to the ASEAN Logistics Council, the volume of cross-border freight shipments in Southeast Asia grew between 2021 and 2023, necessitating standardized and durable labelling solutions.

Another crucial factor driving this segment’s growth is the regulatory emphasis on product traceability and compliance labelling in the pharmaceutical and food & beverage sectors. According to the Food Safety and Standards Authority of India (FSSAI), over 70% of packaged food manufacturers upgraded their labelling systems to include tamper-evident and scannable codes in compliance with updated regulations. As governments across the Asia Pacific tighten labelling requirements for safety and authenticity, the labelling function remains the cornerstone of thermal transfer ribbon consumption.

The printing function segment is anticipated to grow at the highest rate in the Asia Pacific thermal transfer ribbon market, registering a CAGR of 9.1%. This acceleration is primarily fueled by the rising demand for high-quality receipts, tickets, and transactional documents in the retail, hospitality, and financial services sectors, where clarity and permanence are essential.

One of the key drivers of this growth is the adoption of digital payment systems and point-of-sale (POS) technologies, particularly in emerging economies such as Indonesia, the Philippines, and Vietnam.

Another significant contributor is the modernization of ticketing and self-service kiosks in transportation hubs, including airports, railway stations, and metro networks. As digital transformation accelerates across service-oriented industries, the printing function is set to gain momentum in the regional thermal transfer ribbon market.

By Application Insights

The industrial printer segment holds the largest market share, accounting for 56.3% of the Asia Pacific thermal transfer ribbon market in 2024. This control is primarily attributed to the extensive use of industrial-grade thermal printers in manufacturing, logistics, and packaging operations, where high-volume and high-speed label printing is required.

One of the key drivers behind the industrial printer segment’s leadership is the growing adoption of automated production lines and warehouse management systems, particularly in countries like China, India, and South Korea.

Another major factor contributing to this segment’s strength is the stringent regulatory environment mandating product traceability and serialization, especially in the pharmaceutical and food & beverage industries. As regulatory compliance and automation drive industrial efficiency, the industrial printer segment remains the core application area for thermal transfer ribbons in the Asia Pacific.

The mobile printer application segment is expected to grow at a rapid pace, registering a CAGR of 11.3%, driven by the rising demand for portable and on-the-go printing solutions in logistics, field services, and retail. Mobile thermal printers are increasingly being adopted for real-time labelling, proof-of-delivery documentation, and mobile point-of-sale transactions, enhancing workflow efficiency and reducing manual errors.

One key driver of this growth is the expansion of e-commerce delivery networks and last-mile logistics, particularly in rapidly urbanizing markets such as Indonesia, Thailand, and the Philippines. In Vietnam, the Ministry of Transport reported that many express delivery companies issued mobile printers to their riders to enhance parcel tracking accuracy and customer satisfaction.

Another significant factor is the integration of mobile printers into field service and healthcare operations, where portability and instant documentation are crucial. According to the Singapore Infocomm Media Development Authority, over 60% of home healthcare providers adopted mobile thermal printers in 2023 to generate patient wristbands, medication labels, and service records on-site. As mobility becomes a central component of modern business operations, the mobile printer segment is set to lead the future growth trajectory of the Asia Pacific thermal transfer ribbon market.

By End User Industry Insights

The transportation and logistics segment held the maximum market share, accounting for 31.2% of the Asia Pacific thermal transfer ribbon market in 2024. This dominance is primarily driven by the sector’s heavy reliance on durable and scannable labels for package tracking, route optimization, and customs documentation.

One of the key factors propelling this segment’s leadership is the rapid expansion of cross-border e-commerce and express delivery services, particularly in China, India, and Southeast Asia. Also, the volume of intra-regional freight shipments increased between 2021 and 2023, necessitating standardized and high-performance labeling solutions.

Another major contributor is the implementation of digital tracking and smart logistics systems, which require high-quality, machine-readable labels for seamless integration with scanning and sorting infrastructure. As supply chain digitization accelerates across the Asia Pacific, the transportation and logistics industry will continue to be the largest consumer of thermal transfer ribbons.

The healthcare segment is anticipated to grow at a quick rate in the Asia Pacific thermal transfer ribbon market, registering a CAGR of 10.7% from 2025 to 2033. This sudden expansion is primarily driven by the increasing demand for durable, chemical-resistant, and tamper-proof labels in pharmaceutical packaging, medical device tracking, and hospital inventory management.

One key driver of this growth is the strengthening regulatory framework governing drug serialization and traceability, particularly in Japan, South Korea, and Australia. In Japan, the Pharmaceuticals and Medical Devices Agency mandated serialized barcodes on all prescription medications starting in 2023, significantly boosting thermal ribbon demand.

Another significant factor is the expansion of cold chain logistics for vaccine distribution and biologics, which require high-performance labels capable of withstanding extreme temperatures without degradation. As healthcare digitization and regulatory enforcement continue to evolve, the healthcare segment is positioned for substantial growth in the regional thermal transfer ribbon market.

COUNTRY-LEVEL ANALYSIS

China had the largest market share, accounting for 34.2% of the Asia Pacific thermal transfer ribbon market in 2024, driven by its vast manufacturing base, booming logistics sector, and aggressive industrial automation initiatives. As the world’s largest exporter, China has a high demand for durable and scannable labels across its supply chain operations, particularly in e-commerce, electronics, and pharmaceutical exports. With ongoing investments in smart factories and digital logistics, China remains the dominant force in the regional thermal transfer ribbon market.

India is a key player in the market, supported by rapid urbanization, expanding retail formats, and government-led digitization efforts. The country’s growing e-commerce ecosystem, led by platforms such as Flipkart and Amazon India, has intensified demand for durable labels in shipping and warehouse operations. The Ministry of Consumer Affairs also mandated the use of scannable labels on packaged food and consumer electronics, prompting manufacturers to upgrade their printing infrastructure. As India continues to invest in digital infrastructure and supply chain modernization, the thermal transfer ribbon market is expected to expand significantly.

Japan occupies a notable market share of the Asia Pacific thermal transfer ribbon market, driven by its highly regulated industrial and healthcare ecosystems. Japanese industries prioritize high-quality, long-lasting labels, particularly in electronics, pharmaceuticals, and medical devices, where precision and compliance are critical. With continuous innovation in clean manufacturing and digital healthcare, Japan remains a key market for high-performance thermal transfer ribbons.

South Korean market is bolstered by its advanced industrial and logistics infrastructure. The country’s emphasis on high-tech manufacturing, particularly in semiconductors and automotive components, has led to increased reliance on durable and scannable labels for traceability and compliance. With strong policy support and industrial sophistication, South Korea is well-positioned for continued growth in the thermal transfer ribbon market.

Australia & New Zealand collectively hold a considerable market share of the Asia Pacific thermal transfer ribbon market, driven by stringent food safety laws, environmental consciousness, and advanced healthcare systems. The Australian Water Association noted that several desalination plants in Perth and Sydney integrated PAA into their final disinfection stages to improve membrane longevity and reduce biofouling. With a strong commitment to sustainability and regulatory excellence, Australia & New Zealand represent a niche but growing market for PAA in the region.

KEY MARKET PLAYERS

Honeywell International Inc., Zebra Technologies Corp., FUJICOPIAN CO. LTD, ITW Brand Identity, IIMAK, Todaytec, PAC EDGE LABELS PVT. LTD., Norwood Marking Systems, WALTVEST Sdn Bhd, KMP PrintTechnik AG. Are the market players that are dominating the Asia Pacific thermal transfer ribbon market?.

Top Players in the Market

One of the leading players in the Asia Pacific thermal transfer ribbon market is Brother Industries, Ltd., a Japanese multinational company known for its extensive range of printing solutions. Brother has established a strong presence in the region by offering high-quality thermal transfer ribbons tailored for industrial, commercial, and consumer applications. The company’s focus on innovation and product reliability has made it a preferred choice among the logistics and retail sectors. Its commitment to sustainability and technological advancement positions it as a key contributor to the global thermal transfer ribbon landscape.

Another major player is Ricoh Company, Ltd., which plays a significant role in shaping the thermal transfer ribbon market through its integrated printing systems and consumables. Ricoh’s emphasis on delivering durable and high-resolution print solutions has strengthened its position in industries such as healthcare, manufacturing, and document services across Asia Pacific. The company's long-standing reputation for quality and customer-centric service offerings supports its influence both regionally and globally.

Zebra Technologies Corporation, although headquartered in the United States, maintains a dominant footprint in the Asia Pacific region. Zebra is a global leader in labeling and marking technologies, with a strong portfolio of thermal transfer printers and compatible ribbons. In Asia Pacific, Zebra serves critical sectors including supply chain, retail, and transportation by providing reliable, scalable, and technologically advanced printing solutions. Its strategic partnerships and localized support have enhanced its market penetration and brand loyalty across the region.

Top Strategies Used by Key Market Participants

A primary strategy adopted by key players in the Asia Pacific thermal transfer ribbon market is product innovation and customization. Companies are continuously developing specialized ribbon formulations tailored to specific industry needs, such as high-resistance labels for pharmaceuticals or cost-effective options for small businesses. This approach allows manufacturers to cater to diverse end-user demands while maintaining a competitive edge in performance and durability.

Another crucial strategy is expanding regional distribution networks and establishing local partnerships . By strengthening their supply chains and collaborating with regional distributors, companies ensure timely delivery and after-sales support, which is essential for maintaining customer trust and satisfaction. This localized presence also enables firms to adapt more effectively to regulatory requirements and market-specific preferences.

Lastly, investing in digital transformation and customer engagement platforms has become increasingly important. Leading players are leveraging e-commerce channels, technical support portals, and training programs to enhance user experience and drive adoption. These initiatives not only improve accessibility but also foster long-term relationships with business clients, reinforcing brand loyalty in a competitive market landscape.

COMPETITIVE OVERVIEW

The competition in the Asia Pacific thermal transfer ribbon market is characterized by a mix of global leaders and emerging regional players striving to capture market share through differentiation, innovation, and strategic expansion. While multinational corporations dominate due to their extensive product portfolios, technological expertise, and well-established distribution networks, local manufacturers are gaining traction by offering cost-effective alternatives tailored to regional needs. The market remains moderately concentrated, with a few key players holding significant influence over pricing, product development, and industry standards. However, increasing demand from diverse sectors such as logistics, healthcare, and e-commerce is encouraging new entrants and niche suppliers to invest in specialized formulations and application-specific solutions. Additionally, rising environmental awareness is prompting companies to develop eco-friendly and recyclable ribbon options, further intensifying the competition. As regulatory frameworks evolve and industry digitization accelerates, players are focusing on enhancing technical support, expanding their regional footprints, and integrating smart labeling technologies to maintain a strong market position and respond to dynamic customer expectations.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Brother Industries launched a new line of wax-resin thermal transfer ribbons designed specifically for high-speed logistics labeling in Southeast Asia, aiming to meet the growing demand for durable scannable codes in e-commerce fulfillment centers.

- In March 2024, Ricoh expanded its partnership network in India by collaborating with a leading local distributor to enhance product availability and after-sales service for thermal transfer ribbons used in retail and manufacturing applications.

- In June 2024, Zebra Technologies introduced an online technical support portal tailored for the Asia Pacific region, offering real-time assistance, troubleshooting guides, and ribbon compatibility tools to improve customer engagement and streamline printer integration.

- In August 2024, a joint initiative between Fujifilm Business Innovation and a South Korean logistics provider led to the deployment of high-performance resin-based thermal ribbons across automated sorting hubs, enhancing label longevity and scanning accuracy.

- In October 2024, Toshiba Tec Corporation announced the establishment of a dedicated thermal ribbon research center in Japan, focused on developing next-generation formulations that offer superior resistance to extreme temperatures and chemical exposure for use in medical and industrial settings.

MARKET SEGMENTATION

This research report on the Asia Pacific thermal transfer ribbon market is segmented and sub-segmented into the following categories.

By Type

- Wax Ribbon

- Wax-Resin Ribbon

- Resin Ribbon

By Print Head

- Flat Type

- Near Edge

By Application

- Industrial Printer

- Mobile Printer

By End-User

- Food & Beverages Market Size

- Healthcare Market Size

- Logistics and Transportation Market Size

- Industrial Goods & Products Market Size

- Electrical& Electronics Market Size

By Function

- Labelling Segment

- Printing Segment

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the projected CAGR of the Asia Pacific Thermal Transfer Ribbon Market from 2024 to 2033?

The Asia Pacific thermal transfer ribbon market is expected to grow at a CAGR of 6.1% from 2024 to 2033, driven by rising e-commerce, food safety regulations, and increasing adoption of barcode and RFID labeling systems.

Which country leads in TTR consumption within the Asia Pacific region?

China accounts for over 38% of total TTR demand , fueled by its vast manufacturing base, export-driven supply chains, and rapid growth in cold chain logistics and pharmaceutical labeling.

How many billion meters of thermal transfer ribbons were consumed in Asia Pacific in 2023?

Approximately 14.7 billion meters of TTRs were used across the Asia Pacific region in 2023, primarily in packaging, apparel, and electronics industries, according to the Asia Labeling Association (ALA)

Which type of thermal transfer ribbon dominates the APAC market?

Wax-based ribbons hold the largest market share , especially in retail and logistics sectors, due to their cost-effectiveness and suitability for short-to-medium term labeling applications such as parcel tracking and price tags.

What percentage of food & beverage companies in India use TTR-printed labels?

Over 62% of F&B manufacturers in India now rely on thermal transfer printed labels for compliance with FSSAI traceability standards, particularly in packaged snacks, dairy, and beverages.

How has the rise of cross-border e-commerce impacted TTR demand in Southeast Asia?

With a 22% increase in cross-border shipments via platforms like Shopee and Lazada , there has been a corresponding 18% rise in TTR usage for shipping label printing across Indonesia, Thailand, and Vietnam.

Which cities in APAC have seen the fastest growth in industrial label printer installations?

Cities like Guangzhou, Bangalore, and Ho Chi Minh City reported the highest growth in label printer installations in 2023, directly boosting local demand for compatible thermal transfer ribbons.

What role do environmental regulations play in TTR material innovation in Japan?

Japan’s Ministry of Economy, Trade and Industry (METI) has encouraged the development of bio-based and recyclable TTR films , resulting in a 12% increase in eco-friendly ribbon sales among electronics and automotive firms since 2022.

How much has online procurement of TTRs grown in the APAC region since 2022?

Digital B2B sales of thermal transfer ribbons grew by over 28% annually , with platforms like Alibaba, Amazon Business, and local distributors expanding access for SMEs and remote warehouses.

Which application segment is driving new TTR demand in South Korea?

The pharmaceutical and healthcare sector in South Korea is emerging as a key growth driver, with KMFDS (Korean FDA) mandates requiring tamper-proof, scannable labels on all prescription drugs, boosting TTR adoption by 15% year-on-year.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com