The Asia Pacific Tire Market Size, Share, Trends & Growth Forecast Report By Type (Radial, Bias), End-Use (OEM, Replacement), Vehicle Type (Passenger Cars, LCVs, M&HCVs, Two-Wheelers, Three-Wheelers, OTR), Size (Rim Size, Tire Size, Price Range), Distribution Channel (Offline, Online), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

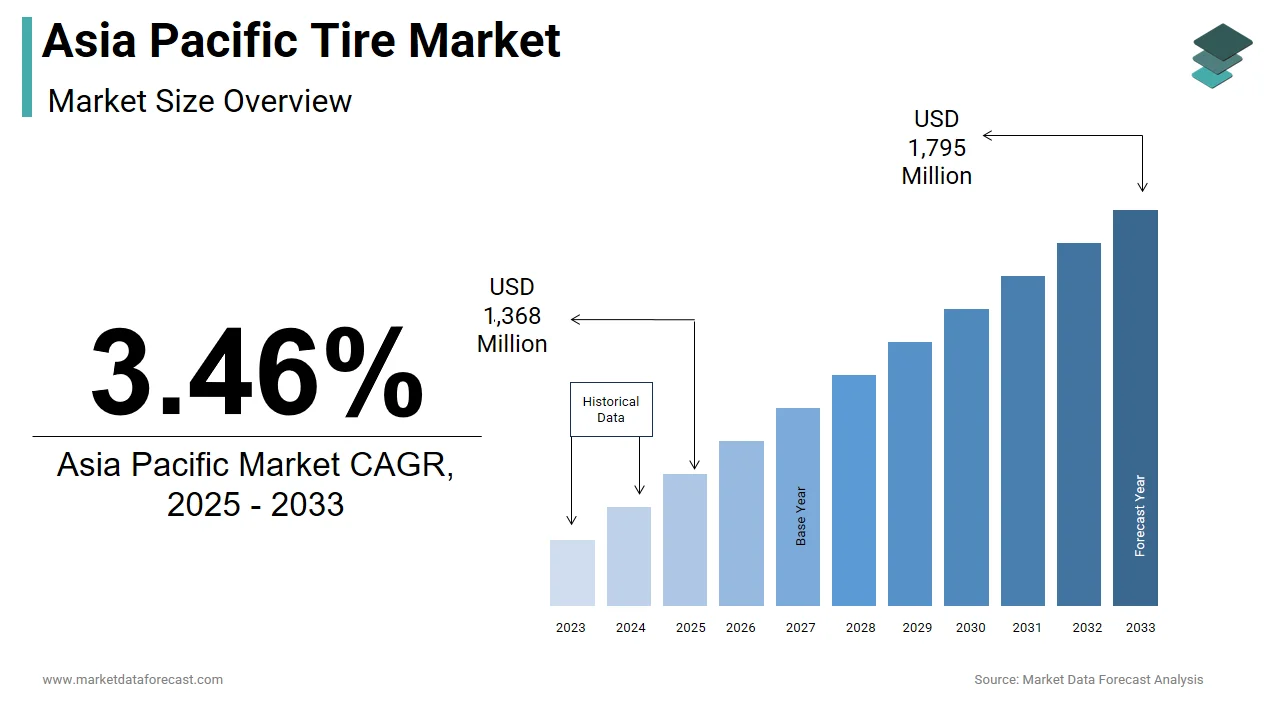

Asia Pacific Tire Market Size

The size of the Asia Pacific tire market was worth USD 1,322 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 3.46% from 2025 to 2033 and be worth USD 1,795 million by 2033 from USD 1,368 million in 2025.

MARKET DRIVERS

Rising Vehicle Production and Sales

The exponential growth in vehicle production across the Asia Pacific region serves as a primary driver for the tire market. This surge is attributed to robust demand from both domestic and international markets in countries like China and India, which collectively account for over 40% of global vehicle sales. Passenger vehicles dominate this growth, but commercial vehicles are also witnessing significant expansion due to increased freight activities and e-commerce penetration. For instance, as per the China Automobile Dealers Association, commercial vehicle sales in China grew by 12% in 2023, with higher tire replacements and original equipment manufacturer (OEM) supplies. With each new vehicle requiring four to six tires, this trend directly correlates with heightened tire demand. Additionally, the growing preference for SUVs, which require larger and more durable tires, amplifies market potential.

Infrastructure Development and Urbanization

Urbanization and infrastructure development are propelling the Asia Pacific tire market forward in the commercial and off-road segments. According to the Asian Development Bank, urban populations in the region are projected to grow by 30% by 2030, which is resulting in increased demand for transportation solutions and logistics networks. This demographic shift has spurred investments in road networks, ports, and industrial zones by creating opportunities for tire manufacturers catering to construction and mining vehicles. For example, as per the Indian Ministry of Road Transport and Highways, over 10,000 kilometers of national highways were constructed in India during 2022-23 alone, boosting demand for heavy-duty tires. Similarly, China’s Belt and Road Initiative has led to massive infrastructure projects across Southeast Asia, further escalating tire requirements. Moreover, urbanization drives the need for public transportation systems, including buses and taxis, which rely heavily on consistent tire replacements.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

One of the most pressing challenges for the Asia Pacific tire market is the volatility in raw material prices, particularly natural rubber and synthetic rubber. According to the Natural Rubber Producers’ Association, the price of natural rubber fluctuated by nearly 30% in 2023 alone due to adverse weather conditions in key producing regions like Thailand and Malaysia. Such instability creates cost pressures for manufacturers, who must either absorb these increases or pass them onto consumers, potentially stifling demand. Additionally, synthetic rubber, derived from petrochemicals, is equally susceptible to oil price fluctuations. For instance, as per the International Energy Agency, crude oil prices surged by 15% in early 2023, driving up synthetic rubber costs. This dual dependency on volatile commodities makes profitability unpredictable, especially for smaller players lacking economies of scale. Moreover, the inability to secure long-term supply contracts exacerbates risks, forcing manufacturers to operate under constant uncertainty. These financial burdens hinder expansion plans and technological innovations, ultimately constraining market growth.

Stringent Environmental Regulations

Environmental regulations pose another significant restraint for the tire market in the Asia Pacific region. Governments across the region are introducing stricter emission norms and sustainability standards, compelling manufacturers to adopt cleaner production technologies. For example, as per the Japan Automobile Tyre Manufacturers Association, Japanese tire companies face mandatory carbon footprint labeling, increasing compliance costs. Similarly, China’s National Development and Reform Commission has mandated energy-efficient tire designs for all vehicles sold domestically. While these measures aim to reduce environmental impact, they impose additional expenses on manufacturers already grappling with thin profit margins. Furthermore, the push for sustainable alternatives, such as bio-based materials, requires substantial R&D investment, which many firms struggle to afford. Non-compliance risks penalties or bans, while compliance limits flexibility in pricing strategies. These regulatory pressures, coupled with evolving consumer preferences for eco-friendly products, create operational complexities that slow down market momentum despite growing demand.

MARKET OPPORTUNITIES

Electric Vehicle Revolution

The rapid adoption of electric vehicles (EVs) presents a transformative opportunity for the Asia Pacific tire market. This shift necessitates specialized tires designed for EV-specific requirements, such as enhanced load-bearing capacity and reduced rolling resistance to maximize battery efficiency. For instance, as per the Korea Tire Manufacturers Association, South Korean tire companies have already developed low-rolling-resistance tires tailored for EVs. Similarly, Chinese manufacturers are leveraging their proximity to the world’s largest EV market to innovate and capture significant market share. Beyond OEM contracts, the aftermarket segment offers immense potential, as EV tires wear out faster than traditional ones due to their heavier weight and instant torque delivery.

Sustainability and Circular Economy Initiatives

Sustainability-driven initiatives are opening new avenues for growth within the Asia Pacific tire market. According to the World Business Council for Sustainable Development, the concept of a circular economy is gaining traction, encouraging tire manufacturers to explore recycling and retreading solutions. For example, as per the Australian Tyre Recyclers Association, Australia recycles approximately 70% of its end-of-life tires by creating a robust secondary market for recycled rubber products. In India, the Ministry of Environment, Forest, and Climate Change has mandated extended producer responsibility (EPR) policies, incentivizing companies to invest in sustainable practices. These efforts not only address environmental concerns but also unlock cost-saving opportunities through material recovery. Furthermore, advancements in biodegradable and bio-based materials, such as dandelion-derived rubber, offer innovative pathways to meet consumer demand for greener products.

MARKET CHALLENGES

Intense Market Competition

The Asia Pacific tire market is characterized by intense competition, with both established players and emerging local manufacturers vying for market dominance. For instance, as per the Indonesian Tire Industry Association, domestic players in Indonesia often undercut international brands to gain market share by resulting in reduced profitability. This hyper-competitive environment forces companies to continuously innovate while managing operational costs by creating a delicate balancing act. Additionally, the influx of low-cost imports from countries like Vietnam and Thailand exacerbates pricing pressures in price-sensitive markets such as India and Southeast Asia. Larger corporations like Bridgestone and Michelin maintain their edge through advanced technology and branding, but smaller firms struggle to compete without significant capital investment. The lack of product differentiation further compounds the issue, as consumers prioritize affordability over brand loyalty. Navigating this challenging landscape requires strategic foresight and adaptability by posing a formidable hurdle for market participants.

Supply Chain Disruptions

Supply chain vulnerabilities represent another critical challenge for the Asia Pacific tire market. According to the United Nations Conference on Trade and Development, disruptions caused by geopolitical tensions, natural disasters, and pandemics have severely impacted regional supply chains. The 2022 floods in Malaysia disrupted natural rubber exports by causing delays and shortages for tire manufacturers reliant on timely deliveries. Similarly, the ongoing U.S.-China trade tensions have forced companies to diversify sourcing, which is increasing logistical complexities and costs. These disruptions not only affect raw material availability but also hinder production schedules, leading to lost revenues and customer dissatisfaction. Smaller manufacturers are disproportionately affected, as they lack the resources to establish alternative supply routes or stockpile inventory. Moreover, the reliance on just-in-time manufacturing models amplifies the impact of even minor delays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Radial/Bias Tires, End-use, Vehicle Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli C. S.p.A., Yokohama Tire Corporation, Hankook Tire & Technology Co., Ltd., Toyo Tire Corporation, Kumho Tire Co., Ltd., and others. |

SEGMENTAL ANALYSIS

By Radial/Bias Tires Insights

The radial tires segment dominated the Asia Pacific tire market by holding a significant share in 2024, owing to the superior performance characteristics, such as enhanced fuel efficiency, durability, and better handling compared to bias tires. The increasing adoption of radial tires in passenger cars and commercial vehicles has been a key factor behind their stronghold. For instance, according to the China Rubber Industry Association, over 90% of new passenger vehicles in China are equipped with radial tires due to stringent safety and emission regulations. Additionally, government policies promoting the use of radial tires have further solidified their position. India’s Automotive Research Association of India mandates the use of radial tires for medium and heavy commercial vehicles, which has led to a surge in demand. Furthermore, consumer awareness about the long-term cost savings from radial tires, coupled with rising disposable incomes, has fueled their popularity. According to a study by the International Rubber Study Group, radial tires reduce rolling resistance by up to 20%, leading to a 5-10% improvement in fuel economy by making them an attractive choice for both OEMs and replacement markets.

The bias tires segment is expected to grow with a CAGR of 6.5% during the forecast period. The growth of the segment is driven by their affordability and suitability for low-speed, heavy-load operations, such as mining and construction. For example, according to the Indonesian Mining Association, bias tires account for nearly 80% of tire usage in Indonesia’s mining sector due to their robust sidewalls and ability to withstand harsh terrains. Additionally, the expansion of agriculture and infrastructure projects across Southeast Asia has bolstered demand for bias tires. Thailand’s Ministry of Agriculture reported a 12% increase in tractor sales in 2022, directly driving bias tire consumption. Another contributing factor is the lower cost of production by enabling manufacturers to offer competitive pricing for budget-conscious consumers in rural areas.

By End-Use Insights

The replacement tire segment held 60.2% of the Asia Pacific tire market share in 2024 owing to the high frequency of tire replacements required for aging vehicle fleets and growing aftermarket demand. According to the Indian Automotive Components Manufacturers Association, the average age of vehicles in India exceeds eight years, necessitating frequent tire changes. Moreover, the proliferation of e-commerce and logistics services has increased commercial vehicle usage, accelerating tire wear and tear. For instance, Malaysia’s Road Transport Department reported a 15% annual rise in commercial vehicle registrations, correlating with higher replacement tire sales. Additionally, consumer preference for premium brands in the replacement market has expanded revenue opportunities.

The OEM tire segment is poised to witness a CAGR of 8.2% during 2025-2033. The growth of the segment is attributed to the booming automotive manufacturing industry in the region, particularly in China and India, where vehicle production is surging. For instance, as per the China Association of Automobile Manufacturers, China produced over 30 billion vehicles in 2022, which is creating significant demand for OEM tires. The shift toward electric vehicles (EVs) further amplifies this trend, as EV manufacturers require specialized tires designed for heavier loads and improved energy efficiency. Additionally, government incentives for domestic vehicle production, such as tax breaks and subsidies, have encouraged OEM partnerships with tire manufacturers. For example, India’s Production Linked Incentive (PLI) scheme has spurred investments in local manufacturing by boosting OEM tire demand.

By Vehicle Type Insights

The passenger car tires segment was the largest by occupying 50.1% of the Asia Pacific tire market share in 2024. This prominence is driven by the exponential rise in passenger vehicle ownership, particularly in urban areas. Rising disposable incomes and urbanization have made personal mobility more accessible, further fueling this trend. Additionally, the growing preference for SUVs, which require larger and more durable tires, has amplified market potential. Moreover, government initiatives promoting affordable vehicle financing have expanded consumer access.

The medium and heavy commercial vehicle tire segment is swiftly emerging with a CAGR of 9.5% in the coming years. This growth is propelled by the expansion of logistics and freight industries, driven by e-commerce and infrastructure development. For example, according to Indonesia’s Ministry of Public Works, the country’s ongoing highway expansion projects have increased demand for heavy-duty tires used in construction vehicles. Additionally, stricter load-bearing regulations have encouraged fleet operators to adopt specialized tires designed for heavy loads and long hauls. Furthermore, the rise of cross-border trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), has boosted freight activities across the region.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific tire market with 40.4% of the share in 2024 due to its status as the world’s largest automotive manufacturing hub, with tire production exceeding 800 million units annually. According to the China Association of Automobile Manufacturers, vehicle production in China reached 30 million units in 2022, which is creating immense demand for both OEM and replacement tires. The push toward electric vehicles is prompting the growth of the market in this country. Government support through subsidies and R&D incentives has further strengthened the market growth.

India's tire market accounted in holding 15.6% of the share in 2024, with the country’s burgeoning automotive sector, coupled with a growing middle class, driving tire demand. For instance, the Society of Indian Automobile Manufacturers reported a 12% increase in vehicle sales in 2022, directly impacting tire consumption. The government’s focus on infrastructure development, including the Bharatmala Project, has spurred demand for commercial vehicle tires. Furthermore, India’s emphasis on self-reliance through the “Make in India” initiative has boosted domestic tire manufacturing. As per the Ministry of Heavy Industries, local tire production grew by 18% in 2023, reducing import dependency.

Japan is likely to have lucrative growth opportunities in the coming years. The country’s advanced automotive ecosystem and technological leadership drive innovation in tire manufacturing. For example, Japanese companies lead in developing eco-friendly tires, with over 30% of domestic sales comprising low-rolling-resistance models. Additionally, Japan’s aging population has increased demand for reliable and durable tires in the replacement segment.

South Korea’s strong focus on R&D and innovation has enabled it to capture premium segments, particularly in EV tires. The strategic partnerships with major automotive OEMs have ensured steady growth. For instance, Hyundai and Kia’s global expansion has created substantial opportunities for domestic tire manufacturers.

Thailand tire market is likely to have prominent growth opportunities in the coming years. The country’s strategic location and robust manufacturing capabilities make it a regional export hub. According to the Board of Investment Thailand, the country exported over $5 million worth of tires in 2023, benefiting from free trade agreements. Additionally, Thailand’s rubber plantations provide a stable supply of raw materials, reducing production costs. Government initiatives, such as the Eastern Economic Corridor, have attracted foreign investments by strengthening the market growth.

MARKET KEY PLAYERS

Companies playing a dominant role in the Asia Pacific tire market profiled in this report are Michelin, Bridgestone Corporation, Continental AG, Goodyear Tire & Rubber Company, Sumitomo Corporation, Pirelli C. S.p.A., Yokohama Tire Corporation, Hankook Tire & Technology Co., Ltd., Toyo Tire Corporation, Kumho Tire Co., Ltd., and others.

TOP LEADING PLAYERS IN THE MARKET

Bridgestone Corporation

Bridgestone is a global leader in the tire market, with a strong presence in the Asia Pacific region. The company has focused on innovation and sustainability, aligning itself with the growing demand for eco-friendly tires. In 2023, Bridgestone launched its Enliten technology, which reduces rolling resistance and material usage by enhancing fuel efficiency. Additionally, the company expanded its manufacturing facilities in Thailand to cater to rising regional demand.

Michelin Group

Michelin has established itself as a key player in the Asia Pacific tire market through its emphasis on advanced R&D and premium product offerings. The company introduced its Uptis airless tire prototype in India in 2023, targeting commercial fleets to reduce downtime and maintenance costs. Michelin also partnered with local governments to promote sustainable mobility solutions, including low-carbon tire production. Furthermore, the company strengthened its distribution network across Southeast Asia by ensuring better access to replacement markets and enhancing customer satisfaction.

Goodyear Tire & Rubber Company

Goodyear has made significant strides in the Asia Pacific market by focusing on technological advancements and strategic partnerships. In 2023, the company unveiled its SightLine technology, enabling real-time tire monitoring for fleet operators, which boosts safety and efficiency. Goodyear also collaborated with Chinese automakers like BYD to develop EV-specific tires, addressing the unique requirements of electric vehicles. Additionally, the company invested in expanding its retail footprint in India and Australia by improving accessibility for consumers and strengthening its brand presence.

MAJOR STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the Asia Pacific tire market have adopted diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop sustainable and high-performance products. Partnerships with OEMs and fleet operators are another critical strategy by enabling tailored solutions for specific applications. For instance, collaborations with EV manufacturers have become pivotal as the automotive industry shifts toward electrification. Additionally, market leaders are expanding their production capacities in emerging economies like Thailand and Indonesia to leverage cost advantages and meet regional demand. Digitalization is also gaining traction, with firms integrating IoT-enabled tire monitoring systems to enhance user experience. Finally, companies are emphasizing sustainability by adopting circular economy practices, such as recycling end-of-life tires and using bio-based materials. These strategies collectively ensure long-term growth and resilience in a dynamic market environment.

COMPETITION OVERVIEW

The Asia Pacific tire market is characterized by intense competition, driven by both global giants and regional players striving to capture market share. Global leaders like Bridgestone, Michelin, and Goodyear dominate through innovation by leveraging cutting-edge technologies to offer premium products. Meanwhile, regional players such as Apollo Tyres and Yokohama Rubber focus on affordability and localized strategies to appeal to price-sensitive consumers. The rise of electric vehicles has intensified rivalry, prompting companies to develop specialized tires for EVs. Sustainability initiatives, including the adoption of recycled materials and energy-efficient production processes, have become key differentiators. Price wars and aggressive marketing tactics further escalate competition, particularly in mature markets like China and India. Despite these challenges, opportunities abound in emerging segments like OTR and agricultural tires by encouraging players to diversify their portfolios.

RECENT MARKET DEVELOPMENTS

- In April 2023, Bridgestone Corporation launched its Enliten technology in Japan, which is introducing lightweight and eco-friendly tires designed to reduce rolling resistance and carbon emissions.

- In June 2023, Michelin Group partnered with the Indian government to establish a sustainable mobility hub in Pune by focusing on low-carbon tire production and recycling initiatives.

- In August 2023, Goodyear Tire & Rubber Company expanded its retail network in Australia by opening 15 new outlets by enhancing accessibility for replacement tire customers.

- In October 2023, Continental AG inaugurated a new production facility in Thailand, which is boosting capacity for radial tires catering to the growing ASEAN market.

- In December 2023, Yokohama Rubber announced a joint venture with a Chinese EV manufacturer to develop specialized tires for electric buses by targeting urban transit systems.

MARKET SEGMENTATION

This research report on the Asia Pacific tire market has been segmented and sub-segmented into the following categories.

By Radial/Bias Tires

- Radial

- Bias

By End-Use

- OEM

- Replacement

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two-Wheelers

- Off-The-Road (OTR)

- Three- Wheelers

By Size

- Passenger Cars

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Light Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Medium and Heavy Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Two-Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Three-Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

- Off-The-Road (OTR)

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Market Breakup by Price Range

By Distribution Channel

- Offline

- Online

By Country

- India

- China

- Japan

- South Korea

- Australia

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific tire market growth?

Growth is driven by rising vehicle production, urbanization, infrastructure projects, and EV adoption, increasing demand for radial tires and replacements.

2. What challenges affect the Asia Pacific tire market?

Challenges include raw material price volatility, environmental regulations, supply chain disruptions, and intense competition among global and regional players.

3. What opportunities exist in the Asia Pacific tire market?

Opportunities include EV-specific tires, sustainable materials, recycling initiatives, and partnerships with OEMs for specialized tire solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]