Asia Pacific Transformer Oil Market Size, Share, Trends & Growth Forecast Report By Oil Type (Mineral Oil (Naphthenic and Paraffinic), Bio-Based Oils), Application, End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Transformer Oil Market Size

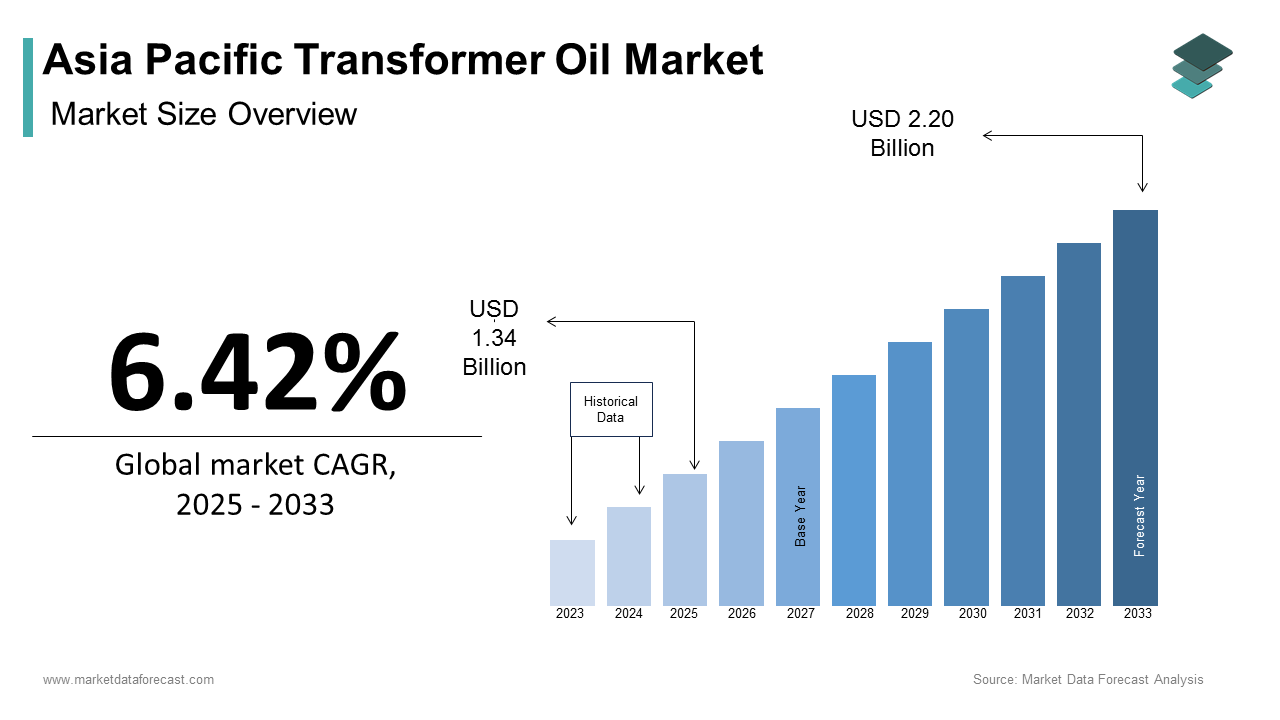

The Asia Pacific transformer oil market size was calculated to be USD 1.26 billion in 2024 and is anticipated to be worth USD 2.20 billion by 2033, from USD 1.34 billion in 2025, growing at a CAGR of 6.42% during the forecast period.

Transformer oil, a critical component in electrical power systems, serves as both a coolant and an insulating medium for transformers. The Asia Pacific transformer oil market is intricately tied to the region's energy infrastructure development, driven by rapid urbanization, industrial growth, and increasing electrification. Besides, the environmental impact of transformer oil disposal also looms large.

MARKET DRIVERS

Growing Demand for Reliable Power Infrastructure

The Asia Pacific region’s escalating energy consumption has placed immense pressure on power utilities to ensure an uninterrupted electricity supply. According to the Asian Development Bank, the region requires substantial investment in energy infrastructure through 2030 to meet growing demand. This surge in infrastructure spending directly impacts the transformer oil market, as transformers are pivotal in minimizing energy losses during transmission. For instance, in India, transmission and distribution losses accounted for a major share of total electricity generated. Efficient transformer oils play a crucial role in mitigating these losses by enhancing thermal stability and reducing breakdown risks. Furthermore, China’s State Grid Corporation plans to expand its ultra-high-voltage (UHV) transmission network, which involves installing advanced transformers requiring premium-grade oils.

Rising Adoption of Renewable Energy Projects

The proliferation of renewable energy projects across the Asia Pacific region acts as another significant driver for the transformer oil market. Solar and wind energy installations require transformers to stabilize voltage fluctuations and integrate power into the grid seamlessly. These projects often operate in remote locations with harsh environmental conditions, necessitating durable transformer oils that can withstand extreme temperatures and resist oxidation. In Australia, the Clean Energy Council reported that renewable energy sources supplied 32.5% of the country’s electricity in 2021, driving investments in grid-supportive technologies. Similarly, Vietnam witnessed a many-fold increase in solar capacity between 2018 and 2020. Each megawatt of installed renewable capacity translates into higher transformer oil demand, ensuring the market’s sustained growth trajectory.

MARKET RESTRAINTS

Stringent Environmental Regulations

Environmental concerns surrounding the use of conventional mineral-based transformer oils pose a significant restraint to the market. These oils contain polychlorinated biphenyls (PCBs) and other hazardous compounds that can contaminate ecosystems if improperly disposed of. According to the United Nations Environment Programme, improper handling of transformer oils results in the release of toxic substances, impacting biodiversity and human health. Regulatory frameworks, such as those enforced by the Environmental Protection Authority in Australia, mandate stringent guidelines for oil disposal and recycling. Compliance with these regulations increases operational costs for utilities and manufacturers, creating financial barriers. In addition, the European Union’s Restriction of Hazardous Substances (RoHS) directive influences Asia Pacific markets due to international trade linkages. Like, a significant portion of transformer oils globally are recycled effectively, leaving a substantial gap in sustainable practices. This regulatory pressure is compelling stakeholders to explore costlier alternatives like synthetic esters, which may not be economically viable for smaller enterprises operating within the region.

Economic Volatility and Supply Chain Disruptions

Economic uncertainties and supply chain disruptions further hinder the growth of the Asia Pacific transformer oil market. Fluctuations in crude oil prices, a primary raw material for mineral-based oils, directly affect production costs. Moreover, geopolitical tensions and pandemic-induced disruptions have exacerbated logistical challenges. These delays disrupted the timely procurement of essential materials required for transformer oil manufacturing. Besides, inflationary pressures in economies like India and Indonesia have increased operational expenses for power utilities, limiting their ability to invest in high-quality oils.

MARKET OPPORTUNITIES

Emergence of Biodegradable Ester-Based Oils

The transition toward environmentally friendly transformer oils presents a lucrative opportunity for the Asia Pacific market. Biodegradable ester-based oils, derived from natural sources, offer superior performance while being eco-friendly. According to a study by the American Chemical Society, ester-based oils degrade 97% within 28 days under standard test conditions, making them far less harmful than traditional mineral oils. Governments across the region are promoting green energy solutions, with Japan’s Ministry of Economy, Trade, and Industry allocating $2.4 billion in subsidies for sustainable technologies. Furthermore, Australia’s National Waste Policy Action Plan aims to achieve an 80% recovery rate for all waste streams by 2030, encouraging industries to adopt recyclable materials. The adoption of ester-based oils is gaining traction in sectors like railways and renewable energy, where safety and sustainability are paramount.

Expansion of Smart Grid Technologies

The integration of smart grid technologies offers another significant opportunity for the Asia Pacific transformer oil market. Smart grids enhance energy efficiency and reliability by leveraging real-time data analytics and automation. Countries like South Korea and Singapore have implemented advanced metering infrastructure (AMI) systems, which rely on high-performance transformers. These transformers require premium oils capable of withstanding frequent load fluctuations and elevated temperatures. Also, China’s State Grid Corporation announced plans to invest $70 billion in smart grid development by 2025, creating a ripple effect for transformer oil manufacturers.

MARKET CHALLENGES

Counterfeit Products and Quality Issues

The prevalence of counterfeit transformer oils poses a significant challenge to the Asia Pacific market. Substandard products often infiltrate supply chains, leading to equipment failures and safety hazards. These counterfeit oils lack the necessary dielectric strength and thermal stability, compromising transformer performance. Such incidents erode consumer trust and impose additional repair costs on utilities. Furthermore, distinguishing genuine products from counterfeits remains challenging for end-users, especially small-scale enterprises with limited technical expertise.

Limited Awareness About Advanced Oil Solutions

Another pressing challenge is the limited awareness among end-users regarding advanced transformer oil solutions. Many utilities and industrial operators in the Asia Pacific region still rely on conventional mineral oils, unaware of the benefits offered by synthetic and biodegradable alternatives. This knowledge gap impedes the adoption of innovative products, particularly in rural areas where access to technical information is scarce. Also, misconceptions about the higher upfront costs of advanced oils deter potential buyers, despite their long-term cost-effectiveness. For instance, synthetic ester oils reduce maintenance frequency by up to 30%, as per a study published in IEEE Transactions on Dielectrics and Electrical Insulation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.42% |

|

Segments Covered |

By Oil Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

APAR Industries Limited, Cargill Incorporated, Nynas AB, Sinopec Corporation, PetroChina Company Limited, Shell plc, TotalEnergies, Exxon Mobil Corporation, Ergon Inc., Calumet Specialty Products Partners L.P., Savita Oil Technologies Limited, Gandhar Oil Refinery (India) Limited, Dow, HCS Group, CASTROL LIMITED, Powerlink Oil Refinery Ltd, Valvoline Inc., HP Lubricants, Wacker Chemie AG, M&I Materials Ltd, Eaton, PSP Specialities Public Company Limited, ABBA S.p.A, Engen Petroleum Limited, San Joaquin Refining Co. Inc., Hydrodec Group PLC |

SEGMENTAL ANALYSIS

By Oil Type Insights

The mineral oil segment dominated the Asia Pacific transformer oil market. This dominance is driven by its cost-effectiveness, widespread availability, and proven performance in electrical applications. The affordability of mineral oils makes them the preferred choice for developing economies like India and Indonesia, where budget constraints often dictate procurement decisions. Another critical aspect driving this segment’s place is its compatibility with existing transformers. As per the Asian Development Bank, a large share of transformers in the region are legacy systems that rely on mineral oils due to their established reliability. Retrofitting these systems with alternative oils would require significant capital investment, making mineral oils the default choice. In addition, advancements in refining technologies have improved the thermal stability and oxidation resistance of mineral oils, extending their lifespan.

The bio-based transformer oils segment is emerging as the fastest-growing, with a projected CAGR of 12.8% during the forecast period. This rise is fueled by increasing environmental consciousness and stringent regulations governing the disposal of conventional oils. Bio-based oils degrade exceeding 60% within 28 days, significantly reducing ecological damage compared to mineral oils, according to the American Chemical Society.

Another influencing aspect is the rising adoption of renewable energy projects. Vietnam, for instance, added 16.5 gigawatts of solar capacity between 2018 and 2020, as reported by the International Energy Agency. These installations often operate in remote areas, necessitating environmentally safe oils to prevent contamination. Furthermore, government incentives are accelerating this transition. Japan’s Ministry of Economy, Trade, and Industry allocated $2.4 billion for sustainable technologies, including bio-based oils, in 2022.

By Application Insights

The transformers segment accounted for 68.8% of the total market share in 2024. This control over the market is because of the critical role transformers play in power transmission and distribution systems. In densely populated countries like India and China, urbanization has accelerated electricity demand, with annual consumption growing. Transformers equipped with high-quality oils are essential to minimize energy losses and ensure grid reliability. For instance, India’s Central Electricity Authority estimates that upgrading transformers could reduce transmission losses.

Another factor driving this segment’s leadership is the ongoing modernization of aging grids. South Korea’s KEPCO plans to replace 30% of its outdated transformers by 2025, creating a robust demand for transformer oils. Also, renewable energy integration further amplifies this demand. These projects require specialized transformers capable of handling fluctuating loads, thereby boosting oil consumption. The combination of grid modernization and renewable energy adoption ensures transformers remain the largest application segment.

Switchgear is the rapidly expanding application segment, with a CAGR of 9.5%. This progress is caused by the expansion of industrial and commercial sectors, which require reliable switchgear systems to manage electrical loads efficiently. For example, Thailand’s Board of Investment reported an increase in foreign direct investment in manufacturing hubs, necessitating advanced switchgear solutions.

Another contributing point is the rise of smart cities. These technologies rely heavily on switchgear systems, which in turn drive demand for high-performance oils. Furthermore, safety concerns are prompting utilities to upgrade switchgear equipment.

By End-User Insights

The transmission and distribution sector held the largest share of the Asia Pacific transformer oil market. This is attributed to the region’s massive investments in grid infrastructure. These investments are crucial to meet the growing electricity demand, which is expected to rise through 2030. Another key driver is the push for rural electrification. India’s Deen Dayal Upadhyaya Gram Jyoti Yojana aims to provide electricity to 18,000 villages, requiring extensive transmission networks. These networks rely on transformers and associated oils to ensure uninterrupted power supply. Also, cross-border interconnections, such as the ASEAN Power Grid, are driving demand for high-capacity transformers.

Railways and metros represented the highest-growing end-user segment, with a CAGR of 10.2%. This development is fueled by rapid urbanization and the expansion of metro networks across major cities. For example, India plans to construct 1,000 kilometers of metro lines by 2025. These projects require traction transformers, which depend on specialized oils to withstand high voltages and frequent load changes.

Another driving factor is the shift toward electric mobility. Japan’s Ministry of Land, Infrastructure, Transport, and Tourism announced plans to electrify 50% of its railway network by 2030, creating a surge in demand for transformer oils. Besides, safety regulations are compelling operators to adopt premium oils.

REGIONAL ANALYSIS

China led the Asia Pacific transformer oil market by commanding a 35.7% share in 2024. The country’s dominance is driven by its ambitious renewable energy goals and extensive grid modernization programs. With a target of achieving carbon neutrality by 2060, China has invested $200 billion in renewable energy projects, as stated by the National Energy Administration. These projects necessitate advanced transformers and high-quality oils to integrate clean energy into the grid.

Another factor is the rapid urbanization rate, with a large share of the population residing in cities. This has intensified electricity demand, prompting investments in ultra-high-voltage (UHV) transmission lines.

India is a lucrative market. The country’s growth is fueled by its focus on rural electrification and industrial development. Initiatives like the Saubhagya Scheme aim to provide electricity to a large number of households, requiring extensive transformer installations. In addition, India’s renewable energy capacity exceeded 100 gigawatts in 2022. Solar and wind projects demand durable transformer oils to handle fluctuating loads, ensuring a consistent energy supply.

Japan possesses a significant position in the market. The country’s leadership stems from its advanced technological infrastructure and emphasis on sustainability. Japan’s push for hydrogen-based energy systems requires transformers equipped with eco-friendly oils. Moreover, the aging grid infrastructure is being upgraded.

South Korea is experiencing growth in the market. The country’s growth is driven by its smart city initiatives and renewable energy targets. South Korea aims to generate 20% of its electricity from renewables by 2030, as stated by the Ministry of Trade, Industry, and Energy. Apart from these, the expansion of electric vehicle charging stations has increased demand for compact transformers, which rely on high-performance oils.

Australia and New Zealand collectively account for a smaller share of the market. Their growth is fueled by renewable energy integration and strict environmental regulations. Australia’s Clean Energy Council reported that renewables supplied 32.5% of electricity in 2021, driving investments in grid-supportive technologies. Furthermore, New Zealand’s commitment to achieving 100% renewable energy by 2030 has spurred demand for eco-friendly transformer oils, aligning with regional sustainability goals.

LEADING PLAYERS IN THE ASIA PACIFIC TRANSFORMER OIL MARKET

Nynas AB

Nynas AB is a leading player in the Asia Pacific transformer oil market, renowned for its high-quality naphthenic-based oils. The company has established itself as a global leader by focusing on innovation and sustainability. Its products are widely used in transformers and switchgear systems, offering superior thermal stability and insulation properties. Nynas AB contributes to the global market by setting benchmarks in product quality and environmental compliance, ensuring that its oils meet stringent international standards.

Ergon International

Ergon International is another key player, known for its premium paraffinic transformer oils. The company has strengthened its global presence by emphasizing customization and technical support. Ergon’s products are designed to withstand extreme operating conditions, making them ideal for the Asia Pacific region's varied climates. By fostering strong relationships with utilities and manufacturers, Ergon has positioned itself as a reliable partner in delivering efficient and durable solutions.

Cargill Incorporated

Cargill Incorporated stands out for its bio-based transformer oils, which cater to the growing demand for eco-friendly alternatives. The company leverages its expertise in agricultural commodities to produce biodegradable oils that minimize environmental impact. Cargill’s contribution to the global market lies in its ability to combine sustainability with performance, addressing both regulatory requirements and consumer preferences.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Leading players in the Asia Pacific transformer oil market prioritize product innovation to meet evolving customer demands. Companies invest heavily in research and development to introduce advanced formulations, such as synthetic esters and biodegradable oils, that offer superior performance and environmental benefits. This strategy allows them to differentiate themselves from competitors while aligning with global sustainability goals.

Strategic Partnerships and Collaborations

Key players often collaborate with regional utilities, governments, and research institutions to strengthen their market position. These partnerships enable them to gain insights into local requirements and develop tailored solutions. For instance, collaborations with renewable energy projects help companies align their offerings with the growing trend of clean energy integration.

Focus on Sustainability and Compliance

Sustainability has become a cornerstone of competitive strategies in the transformer oil market. Companies emphasize eco-friendly practices, from sourcing raw materials to end-of-life disposal, to comply with stringent environmental regulations. By adopting green technologies and promoting recycling initiatives, they demonstrate their commitment to reducing carbon footprints.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific transformer oil market include APAR Industries Limited, Cargill Incorporated, Nynas AB, Sinopec Corporation, PetroChina Company Limited, Shell plc, TotalEnergies, Exxon Mobil Corporation, Ergon Inc., Calumet Specialty Products Partners L.P., Savita Oil Technologies Limited, Gandhar Oil Refinery (India) Limited, Dow, HCS Group, CASTROL LIMITED, Powerlink Oil Refinery Ltd, Valvoline Inc., HP Lubricants, Wacker Chemie AG, M&I Materials Ltd, Eaton, PSP Specialities Public Company Limited, ABBA S.p.A, Engen Petroleum Limited, San Joaquin Refining Co. Inc., Hydrodec Group PLC.

The Asia Pacific transformer oil market is characterized by intense competition, driven by the presence of both global giants and regional players. Established companies leverage their technological expertise and extensive distribution networks to maintain leadership, while smaller firms focus on niche segments like bio-based oils to carve out a foothold. The market’s competitive landscape is shaped by rapid urbanization, industrial growth, and the increasing adoption of renewable energy, all of which create opportunities for innovation. Companies strive to differentiate themselves through product quality, pricing strategies, and sustainability initiatives. Regulatory pressures further intensify competition, as players race to develop compliant solutions. Additionally, the rise of smart grid technologies and electrification projects has heightened the demand for high-performance oils, prompting companies to invest in research and development.

RECENT HAPPENINGS IN THE MARKET

- In June 2023, Nynas AB launched a new range of naphthenic transformer oils specifically designed for high-temperature applications in the Asia Pacific region. This move aimed to address the growing demand for durable oils capable of withstanding extreme climatic conditions.

- In March 2024, Ergon International partnered with a leading Indian utility provider to supply premium paraffinic oils for a large-scale grid modernization project. This collaboration reinforced Ergon’s presence in South Asia while showcasing its expertise in customized solutions.

- In August 2023, Cargill Incorporated expanded its production capacity for bio-based transformer oils in Southeast Asia. This expansion was part of the company’s strategy to meet the rising demand for sustainable alternatives in countries like Thailand and Malaysia.

- In November 2023, Shell plc introduced a next-generation synthetic ester oil tailored for renewable energy applications in Australia and New Zealand. This product launch underscored Shell’s commitment to supporting clean energy transitions in the region.

- In January 2024, Mitsubishi Corporation acquired a stake in a Japanese transformer oil recycling facility to promote circular economy practices. This investment aligned with Mitsubishi’s broader sustainability goals and strengthened its position in the domestic market.

MARKET SEGMENTATION

This research report on the Asia Pacific transformer oil market has been segmented and sub-segmented based on oil type, application, end-user, and region.

By Oil Type

- Mineral Oil (Naphthenic and Paraffinic)

- Bio-Based Oils

By Application

- Transformers

- Switchgear

By End User

- Transmission & Distribution

- Railways & Metros

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the market growth?

Growth is driven by rising electricity demand, increasing installation of power transformers, urbanization, and renewable energy integration.

2. Who are the major players in the Asia Pacific transformer oil market?

Key players include APAR Industries, Nynas AB, Cargill Inc., PetroChina, Sinopec, and Shell.

3. Which countries dominate the market in Asia Pacific?

China and India are the major markets due to large-scale investments in power infrastructure, expansion of electrical grids, and industrial development.

4. How is the Asia Pacific region contributing to transformer oil market growth?

The region is witnessing rapid industrialization, infrastructure development, and increasing investments in power transmission and distribution networks, all of which are driving the demand for transformer oil.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com