Asia Pacific Vacuum Coating Equipment Market Size, Share, Trends & Growth Forecast Report By Equipment Type (Physical Vapor Deposition (PVD), Magnetron Sputtering), End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Vacuum Coating Equipment Market Size

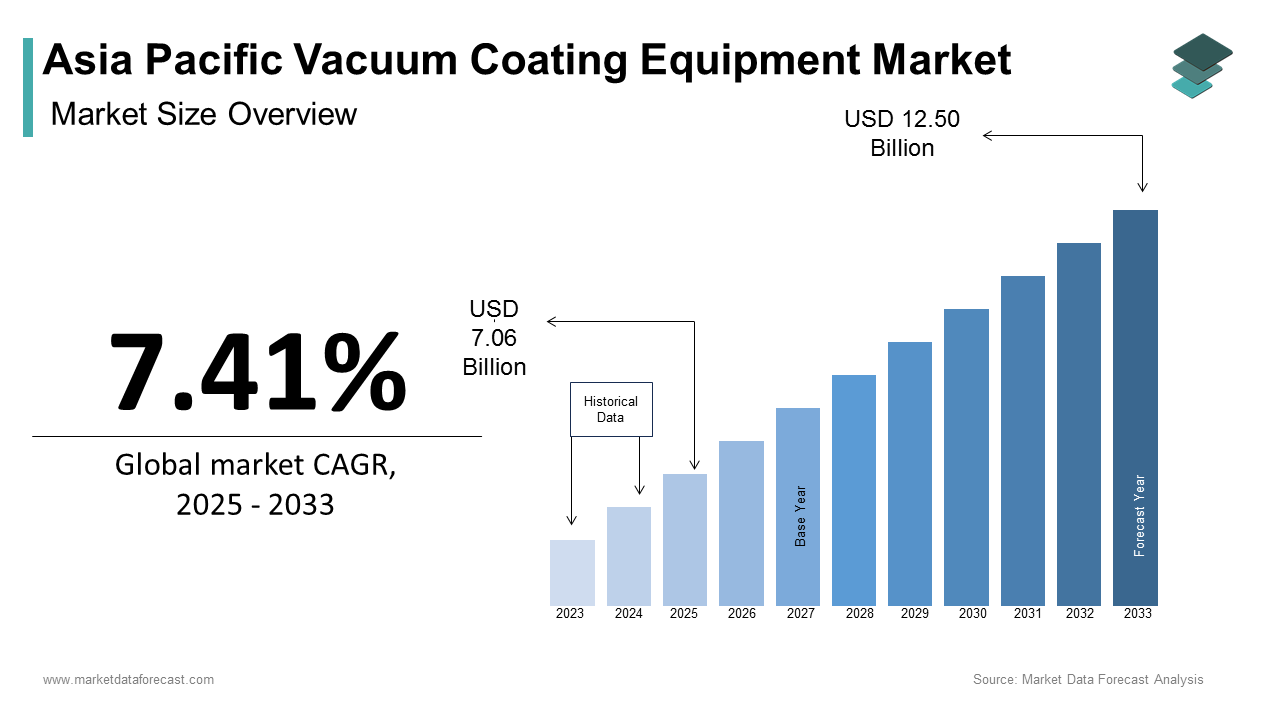

The Asia Pacific vacuum coating equipment market size was calculated to be USD 6.57 billion in 2024 and is anticipated to be worth USD 12.50 billion by 2033, from USD 7.06 billion in 2025, growing at a CAGR of 7.41% during the forecast period.

The Asia Pacific vacuum coating equipment market is a critical part of the broader surface treatment and advanced manufacturing industries. Vacuum coating technology involves depositing thin layers of material onto substrates in a controlled environment, ensuring high precision and superior-quality finishes. This process is widely utilized in industries such as electronics, automotive, optics, and packaging to enhance product durability, aesthetics, and functionality. The region's prominence in global manufacturing, coupled with its growing emphasis on innovation and sustainability, has positioned it as a key hub for vacuum coating solutions.

MARKET DRIVERS

Growing Demand for Consumer Electronics

The explosive growth of the consumer electronics industry is one of the primary drivers propelling the Asia Pacific vacuum coating equipment market. The region serves as a global manufacturing hub for smartphones, tablets, and wearables, which require advanced coatings to enhance durability, scratch resistance, and aesthetic appeal. Vacuum coating technologies, including physical vapor deposition (PVD) and chemical vapor deposition (CVD), play a pivotal role in meeting these requirements. For instance, anti-reflective and fingerprint-resistant coatings are essential for improving user experience, driving manufacturers to invest in cutting-edge vacuum coating systems. Moreover, the proliferation of 5G technology has intensified the demand for high-performance electronic devices, further boosting the adoption of vacuum coating equipment.

Stringent Environmental Regulations

Another significant driver of the vacuum coating equipment market in the Asia Pacific is the implementation of stringent environmental regulations aimed at reducing emissions and promoting sustainable manufacturing practices. Governments across the region have introduced policies to curb the use of hazardous materials and encourage eco-friendly alternatives. For example, as per the Ministry of Ecology and Environment in China, the country has mandated the adoption of low-emission coatings in industries such as automotive and packaging to combat air pollution. Vacuum coating technologies offer an effective solution by enabling the application of thin, uniform layers without generating harmful byproducts. This aligns with regional initiatives such as Japan’s Green Growth Strategy, which emphasizes the transition to sustainable industrial practices. Furthermore, the increasing focus on circular economy principles has encouraged businesses to adopt resource-efficient processes like vacuum coating, which minimizes material wastage.

MARKET RESTRAINTS

High Initial Investment Costs

One of the most significant restraints hindering the growth of the Asia Pacific vacuum coating equipment market is the high initial investment required for procurement and installation. Vacuum coating systems are sophisticated and involve advanced technologies such as magnetron sputtering and thermal evaporation, making them expensive compared to traditional coating methods. According to the Asian Development Bank, small and medium-sized enterprises (SMEs) in the manufacturing sector often face financial constraints, limiting their ability to adopt capital-intensive solutions. For instance, businesses operating in emerging economies like Vietnam and Indonesia may find it challenging to justify the upfront costs associated with setting up vacuum coating facilities. In addition, the operational expenses related to maintenance and energy consumption further exacerbate the financial burden.

Complexity in Operation and Maintenance

Another major restraint is the complexity involved in operating and maintaining vacuum coating equipment, which requires specialized technical expertise. Many end-users, particularly in rural or semi-urban areas, lack the necessary skills and knowledge to operate these systems effectively. Like, the skills gap in the manufacturing sector is widening, with only a small fraction of workers receiving formal training in advanced technologies. This deficit poses a significant challenge, as improper handling can lead to inefficiencies and increased downtime. For example, in countries like Bangladesh and Myanmar, where traditional coating methods are still prevalent, the transition to vacuum coating technologies is hindered by a lack of understanding about their functionality and benefits. Moreover, the absence of skilled personnel trained in troubleshooting and maintenance complicates the issue further.

MARKET OPPORTUNITIES

Expansion of Automotive Industry

The rapid expansion of the automotive industry presents a lucrative opportunity for the Asia Pacific vacuum coating equipment market. The region is home to some of the world’s largest automotive manufacturing hubs, with countries like China, Japan, and India leading the way. According to the International Organization of Motor Vehicle Manufacturers, vehicle production in the Asia Pacific region accounted for a large share of global output in 2022. This growth has created a strong demand for advanced coating solutions to enhance the durability and performance of automotive components. Vacuum coating technologies are increasingly being used to apply wear-resistant and corrosion-resistant coatings on engine parts, exhaust systems, and decorative trims. For instance, in South Korea, the adoption of vacuum-deposited coatings has surged due to their ability to meet stringent emission standards while improving fuel efficiency. Similarly, in India, the push for electric vehicles (EVs) has amplified the need for lightweight, high-performance coatings, offering new avenues for vacuum coating equipment manufacturers.

Emergence of Smart Packaging Solutions

Another promising opportunity lies in the emergence of smart packaging solutions, which rely heavily on vacuum coating technologies to enhance functionality and sustainability. The Asia Pacific region is witnessing a surge in demand for innovative packaging designs that extend shelf life, improve barrier properties, and incorporate interactive features such as QR codes and sensors. Vacuum coating plays a crucial role in this context by enabling the application of ultra-thin barrier films that protect perishable goods from moisture, oxygen, and UV exposure. For example, Similarly, in Australia, the emphasis on recyclable and biodegradable packaging has spurred investments in vacuum coating technologies.

MARKET CHALLENGES

Energy Consumption Concerns

A significant challenge facing the Asia Pacific vacuum coating equipment market is the concern over energy consumption and its environmental impact. Vacuum coating systems are known to consume substantial amounts of electricity due to the high-vacuum environments required for deposition processes, which can strain power grids, especially in regions with limited energy resources. In countries like the Philippines and Indonesia, where energy costs are relatively high, businesses are often reluctant to adopt energy-intensive technologies. For instance, the average electricity tariff in the Philippines is approximately $0.20 per kilowatt-hour, making it challenging for small businesses to justify the operational costs of vacuum coating equipment. Moreover, the environmental implications of high energy usage cannot be overlooked. As per the United Nations Environment Programme, the carbon footprint of industrial processes is a growing concern, prompting calls for more sustainable alternatives. While manufacturers are working to develop energy-efficient models, the current generation of vacuum coating systems still poses a challenge in terms of balancing performance with environmental responsibility.

Logistical Barriers in Remote Areas

Another pressing challenge is the logistical difficulty of deploying vacuum coating equipment in remote and underdeveloped areas. The Asia Pacific region is characterized by diverse geographical landscapes, ranging from densely populated urban centers to vast rural expanses with limited infrastructure. This disparity creates significant barriers to the widespread adoption of vacuum coating equipment, particularly in agricultural communities that could benefit from its use. For example, in Papua New Guinea, where road connectivity is limited, transporting and installing heavy equipment like vacuum coating systems becomes a daunting task. Similarly, in parts of Nepal and Bhutan, the lack of a stable power supply hinders the effective operation of these systems. Even when vacuum coating equipment is successfully deployed, maintaining it in such environments poses additional challenges. As per the Asian Infrastructure Investment Bank, the cost of servicing and repairing equipment in remote locations can be up to three times higher than in urban areas, further deterring businesses from investing in these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.41% |

|

Segments Covered |

By Equipment Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Applied Materials, ULVAC Inc., Lam Research, Bühler AG, Optorun Co., Ltd., AIXTRON SE, Evatec AG, Shincron Co., Ltd., Von Ardenne GmbH, Jusung Engineering Co., Ltd., Veeco Instruments Inc., CVD Equipment Corporation, IHI Corporation, BOBST, Hanil Vacuum Co., Ltd., Dongguan Huicheng Technology Co., Ltd., Platit AG, Lung Pien Vacuum Industry Co., Ltd., Beijing Power Tech Co., Ltd., Hongda Vacuum Equipment Co., Ltd., Denton Vacuum LLC, Mustang Vacuum Systems Inc., SKY Technology Development Co., Ltd., Guangdong Zhenhua Technology Co., Ltd., Satisloh AG, Impact Coatings AB, HCVAC, ZHEN HUA, KYZK |

SEGMENTAL ANALYSIS

By Equipment Type

The physical Vapor Deposition (PVD) segment dominated the Asia Pacific vacuum coating equipment market by capturing 45% of the total market share in 2024. This dominance is driven by its versatility and ability to produce high-quality coatings with exceptional adhesion, hardness, and corrosion resistance. PVD is widely used in industries such as electronics, automotive, and medical devices, where precision and durability are paramount. According to the International Organization for Standardization, PVD coatings are preferred for their ability to meet stringent quality standards, making them indispensable in applications like semiconductor manufacturing and aerospace components. A key factor behind PVD’s prominence is its compatibility with advanced materials such as titanium nitride and chromium nitride, which are increasingly used in cutting-edge technologies. For instance, in South Korea, the adoption of PVD coatings in semiconductor fabrication has grown notably. Another driving factor is the growing demand for eco-friendly coating solutions. As per the United Nations Environment Programme, industries are transitioning to sustainable practices, and PVD offers a cleaner alternative to traditional wet coating methods. Unlike chemical-based processes, PVD operates in a vacuum environment, minimizing waste and harmful emissions. This aligns with regional initiatives such as Japan’s Green Growth Strategy, which emphasizes reducing the environmental impact of industrial processes. Besides, the increasing focus on lightweight materials in the automotive sector has further fueled the adoption of PVD coatings. According to McKinsey & Company, the global demand for lightweight automotive components is projected to grow significantly, creating a robust market for PVD technologies.

The magnetron sputtering segment is emerging as the fastest-growing in the Asia Pacific vacuum coating equipment market, with a projected CAGR of 9.8% during the forecast period. This rapid expansion is fueled by its ability to deposit ultra-thin, uniform coatings on complex substrates, making it ideal for advanced applications in electronics and renewable energy. Like, the demand for thin-film solar panels is expected to increase, creating a strong market for magnetron sputtering systems. For example, in China, the world’s largest producer of solar panels, the adoption of magnetron sputtering has surged over the past five years, as per data from the China Renewable Energy Engineering Institute. Another significant factor propelling the growth of magnetron sputtering is its integration with smart manufacturing technologies. Magnetron sputtering systems, equipped with real-time monitoring and adaptive control features, align perfectly with this trend. This technology is particularly beneficial in countries like Japan and South Korea, where precision manufacturing is a cornerstone of economic growth. Apart from these, advancements in sputtering targets and deposition techniques have improved the efficiency and scalability of magnetron sputtering systems.

By End-Use Industry

The electronics and semiconductors industry exhibited the largest end-use segment in the Asia Pacific vacuum coating equipment market accounting for 35.4% of the total market share in 2024. This prominence is caused by the exponential growth of the consumer electronics and semiconductor sectors, which rely heavily on advanced coating technologies to enhance product performance and durability. Vacuum coating technologies, including PVD and CVD, play a pivotal role in meeting these requirements by providing scratch-resistant, anti-reflective, and conductive coatings. Another key factor contributing to the segment’s leadership is the increasing adoption of 5G technology. For instance, in Taiwan, the semiconductor industry has witnessed a surge in demand for high-performance coatings to support 5G infrastructure development. Similarly, in Japan, the push for miniaturized electronic components has amplified the need for precise and reliable coating solutions. Besides, the growing emphasis on sustainability has encouraged businesses to adopt eco-friendly processes like vacuum coating, which minimize material wastage and reduce environmental impact. The electronics and semiconductors industry’s reliance on vacuum coating equipment to support these trends underscores its position as the largest end-use segment.

The energy sector, particularly solar energy, is the swiftest advancing end-use segment in the Asia Pacific vacuum coating equipment market, with a CAGR of 10.2%. This development is influenced by the increasing adoption of thin-film solar panels, which require advanced coating technologies to enhance efficiency and durability. For instance, in 2022, China installed over 87 gigawatts of solar capacity, driving the demand for vacuum coating systems like magnetron sputtering. Another driving factor is the transition to renewable energy sources, supported by government policies and incentives. For example, in India, the government’s target of achieving 500 gigawatts of renewable energy capacity by 2030 has spurred the adoption of advanced coating solutions for solar panels. Apart from these, the growing focus on energy storage systems, such as lithium-ion batteries, has created new opportunities for vacuum coating equipment.

REGIONAL ANALYSIS

China stood as the largest contributor to the Asia Pacific vacuum coating equipment market by commanding a 30.3% market share in 2024. The country’s dominance is underpinned by its status as a global leader in electronics, semiconductors, and renewable energy manufacturing. Vacuum coating equipment plays a crucial role in producing high-performance components for smartphones, solar panels, and electric vehicles, aligning with the country’s focus on technological innovation and sustainability. Another significant factor is the government’s push for green manufacturing. This emphasis on sustainability ensures China’s leadership in the regional market while fostering long-term growth opportunities.

Japan is advancing. The country’s position is bolstered by its advanced electronics and automotive industries, which rely heavily on precision coating technologies. Vacuum coating systems are essential for producing high-quality displays, sensors, and automotive components, ensuring compliance with stringent quality standards. Another key driver is Japan’s commitment to sustainability and innovation. Vacuum coating equipment, with its ability to minimize waste and emissions, aligns with this goal, solidifying Japan’s position as a key player in the regional market.

South Korea accounts for a notable share of the Asia Pacific vacuum coating equipment market and is supported by its thriving electronics and semiconductor sectors. Vacuum coating technologies are integral to this growth, enabling manufacturers to produce high-performance components with superior durability and precision. Another factor is the government’s investment in smart manufacturing. South Korea’s focus on innovation and export-oriented growth positions it as a significant contributor to the regional market.

India holds a decent market share in the Asia Pacific vacuum coating equipment market. This is driven by its rapidly expanding renewable energy and automotive sectors. These systems are essential for producing efficient thin-film solar panels and lightweight automotive components, supporting the country’s sustainability goals. Another key factor is the government’s Make in India initiative, which aims to boost domestic manufacturing. India’s strategic focus on industrial growth and environmental responsibility ensures its steady presence in the regional market.

Taiwan is another significant player in the Asia Pacific vacuum coating equipment market, supported by its leadership in the semiconductor and electronics industries. Vacuum coating technologies are critical for producing high-performance chips and displays, ensuring compliance with global quality standards. Another factor is the country’s focus on research and development. This commitment to technological advancement positions Taiwan as a key player in the regional market, driving sustained growth and competitiveness.

LEADING PLAYERS IN THE ASIA PACIFIC VACUUM COATING EQUIPMENT MARKET

Applied Materials, Inc.

Applied Materials, Inc. is a global leader in the vacuum coating equipment market, renowned for its innovative solutions tailored to industries such as semiconductors, electronics, and solar energy. The company’s cutting-edge technologies, including physical vapor deposition (PVD) and chemical vapor deposition (CVD), have set industry benchmarks for precision and efficiency. Applied Materials has played a pivotal role in advancing global manufacturing standards by providing scalable and eco-friendly coating systems. Its focus on research and development has enabled it to introduce groundbreaking products that align with sustainability goals.

ULVAC Technologies, Inc.

ULVAC Technologies, Inc. is a prominent player in the Asia Pacific vacuum coating equipment market, offering advanced solutions for industries like automotive, aerospace, and medical devices. The company excels in developing high-performance magnetron sputtering and electron beam evaporation systems, which are widely used for producing durable and functional coatings. ULVAC’s commitment to quality and customer-centric innovations has positioned it as a preferred choice for businesses seeking reliable and efficient coating technologies. With a strong emphasis on sustainability, ULVAC integrates eco-friendly practices into its product designs, contributing to the global transition toward cleaner manufacturing processes.

Oerlikon Group

Oerlikon Group is a key contributor to the Asia Pacific vacuum coating equipment market, known for its expertise in surface solutions and advanced materials. The company specializes in developing thermal evaporation and PVD systems that cater to diverse applications, including automotive components and renewable energy. Oerlikon’s focus on delivering high-quality, customizable solutions has enabled it to establish a strong foothold in the region. By leveraging its extensive R&D capabilities and global network, Oerlikon continues to drive technological advancements and enhance its contribution to the global market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the Asia Pacific vacuum coating equipment market are increasingly forming strategic collaborations and partnerships to expand their reach and enhance product offerings. By teaming up with local distributors, technology providers, and government bodies, companies can access new markets and address logistical challenges. These alliances also facilitate knowledge sharing and the development of integrated solutions tailored to specific industries. For instance, partnerships with semiconductor manufacturers enable players to co-develop advanced coating systems that meet the unique demands of the electronics sector.

Investment in Research and Development

Investment in research and development is a cornerstone strategy for strengthening market position. Leading companies are focusing on innovating new coating technologies, such as magnetron sputtering and electron beam evaporation, to meet evolving industry requirements. By prioritizing R&D, manufacturers can introduce cutting-edge features like real-time monitoring and adaptive control, enhancing operational efficiency. Additionally, these innovations help align products with sustainability goals, appealing to environmentally conscious consumers. Continuous advancements in coating materials and techniques ensure that companies remain competitive while addressing emerging trends in sectors like renewable energy and automotive manufacturing.

Expansion of Manufacturing Facilities

Expanding manufacturing facilities is another key strategy adopted by market players to meet rising demand and improve supply chain resilience. By establishing production units in strategic locations across the Asia Pacific region, companies can reduce lead times and better serve local markets. This expansion also enables businesses to leverage regional incentives and resources, reducing operational costs. Furthermore, localized manufacturing allows for greater customization and quicker response to customer needs, enhancing brand loyalty.

KEY MARKET PLAYERS AND Competition Overview

Major Players in the Asia Pacific Vacuum coating equipment market include Applied Materials, ULVAC Inc., Lam Research, Bühler AG, Optorun Co., Ltd., AIXTRON SE, Evatec AG, Shincron Co., Ltd., Von Ardenne GmbH, Jusung Engineering Co., Ltd., Veeco Instruments Inc., CVD Equipment Corporation, IHI Corporation, BOBST, Hanil Vacuum Co., Ltd., Dongguan Huicheng Technology Co., Ltd., Platit AG, Lung Pien Vacuum.

The Asia Pacific vacuum coating equipment market is characterized by intense competition, driven by the presence of established multinational corporations and emerging regional players. Companies are vying for market leadership by leveraging their technological expertise, extensive distribution networks, and customer-centric strategies. The competitive landscape is shaped by rapid advancements in coating technologies, increasing demand for sustainable solutions, and stringent regulatory frameworks. To maintain their edge, key players are continuously innovating and expanding their product portfolios to cater to diverse applications across industries like electronics, automotive, and renewable energy. Additionally, the growing emphasis on Industry 4.0 and digital transformation has prompted companies to adopt smart features and IoT-enabled systems.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Applied Materials, Inc. launched a new line of eco-friendly vacuum coating systems designed for the solar energy sector. This move aimed to support the global transition to renewable energy while enhancing the company’s reputation as a leader in sustainable technologies.

- In July 2023, ULVAC Technologies, Inc. announced a partnership with a leading automotive manufacturer in Japan to develop advanced magnetron sputtering systems for lightweight vehicle components. This collaboration focused on meeting the growing demand for fuel-efficient and durable automotive solutions.

- In October 2023, Oerlikon Group expanded its manufacturing facility in India to cater to the rising demand for thermal evaporation systems in the electronics and packaging industries. This expansion underscored the company’s commitment to supporting regional industrial growth.

- In December 2023, Leybold GmbH acquired a mid-sized vacuum coating equipment provider in South Korea. This acquisition enabled Leybold to diversify its product offerings and enhance its distribution network across the Asia Pacific region.

- In February 2024, Von Ardenne GmbH introduced a modular vacuum coating system tailored for small and medium enterprises in Vietnam. This initiative addressed the growing need for cost-effective and scalable coating solutions, bolstering the company’s market share in emerging economies.

MARKET SEGMENTATION

This research report on the Asia Pacific Vacuum Coating Equipment Market has been segmented and sub-segmented based on equipment type, end user, and region.

By Equipment Type

- Physical Vapor Deposition (PVD)

- Magnetron Sputtering

By End Use

- Electronics & Semiconductors

- Energy (Including Solar)

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. How does technological advancement impact the vacuum coating equipment market in Asia Pacific?

Technological advancements such as plasma-enhanced coating and atomic layer deposition have improved precision and efficiency, driving demand for advanced vacuum coating systems in the region.

2. Who are the major players in the Asia Pacific Vacuum Coating Equipment Market?

Major players include Bühler AG, Applied Materials Inc., Oerlikon Balzers, ULVAC Inc., and Veeco Instruments Inc.

3. Which industries are the primary users of vacuum coating equipment in Asia Pacific?

The primary industries include electronics & semiconductors, automotive, optics, and packaging.

4. What is driving the growth of the vacuum coating equipment market in Asia Pacific?

Key drivers include rising demand for consumer electronics, rapid industrialization, and advancements in semiconductor manufacturing.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com