Asia Pacific Weight Management Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Function And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Weight Management Market Size

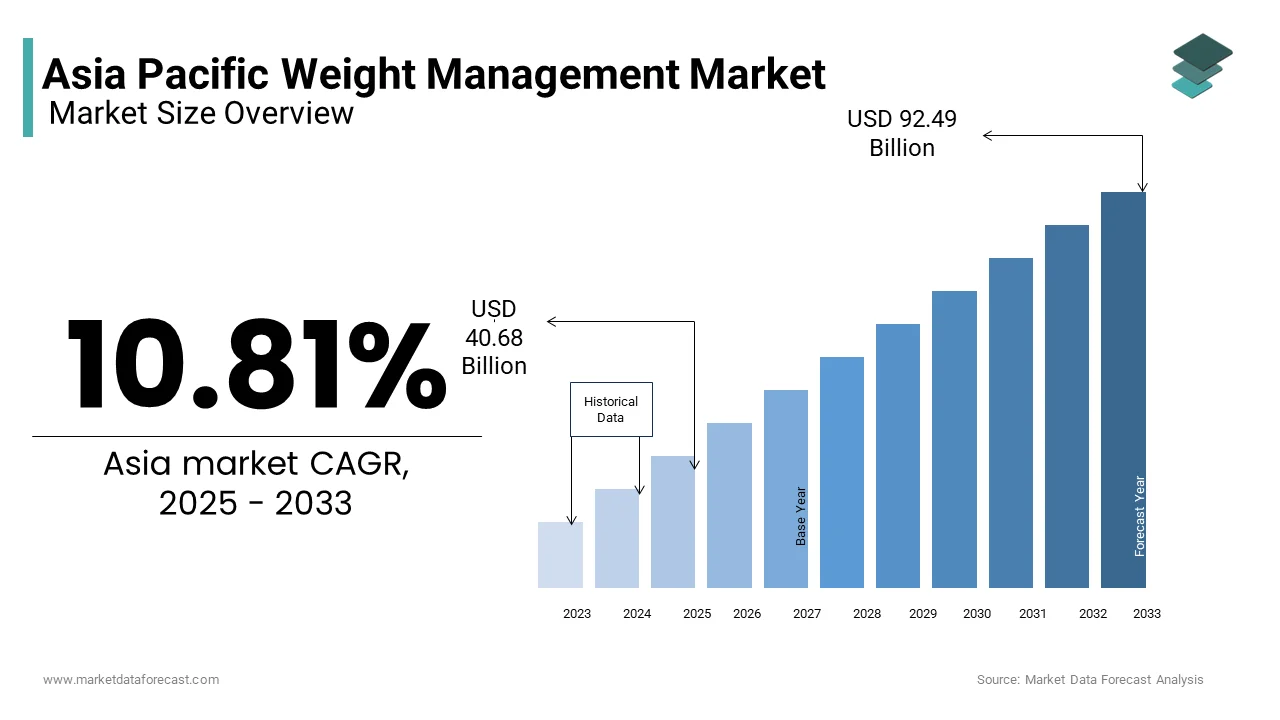

The Asia Pacific weight management market size was valued at USD 36.70 billion in 2024 and is anticipated to reach USD 40.68 billion in 2025 from USD 92.49 billion by 2033, growing at a CAGR of 10.81% during the forecast period from 2025 to 2033.

The Asia Pacific weight management market is a dynamic and evolving sector that addresses the growing need for solutions to combat obesity and maintain healthy lifestyles. According to the World Health Organization, over 25% of adults in the Asia Pacific region are overweight or obese, with urbanization and sedentary lifestyles contributing significantly to this trend. For instance, as per the Australian Institute of Health and Welfare, nearly 67% of Australian adults were classified as overweight or obese in 2021, amplifying the urgency for effective weight management interventions. The rise of digital health platforms has further expanded access to personalized weight management solutions, with countries like Japan and South Korea leading in smart health technologies.

MARKET DRIVERS

Rising Prevalence of Obesity

The escalating prevalence of obesity is one of the primary drivers of the Asia Pacific weight management market. Urbanization and the adoption of Westernized diets have led to an increase in calorie-dense food consumption, contributing to rising obesity rates. According to the International Diabetes Federation, over 150 million people in the Asia Pacific region are living with diabetes, a condition often linked to obesity. For example, in India, the National Family Health Survey reported that 20% of adults are either overweight or obese, with urban areas witnessing higher incidences due to sedentary lifestyles. This trend has prompted governments to implement public health campaigns promoting weight management solutions. Additionally, the economic burden of obesity-related diseases is substantial. As per the World Obesity Federation, the annual healthcare costs associated with obesity in the region exceed $10 billion, which is incentivizing individuals and organizations to invest in preventive measures.

Growing Awareness of Preventive Healthcare

Another significant driver is the increasing awareness of preventive healthcare among consumers in the Asia Pacific region. As per McKinsey & Company, over 60% of consumers in urban centers like Singapore and Sydney now prioritize preventive health measures over reactive treatments. This shift in mindset has led to a surge in demand for weight management solutions that emphasize holistic well-being. For instance, the popularity of wearable fitness devices, such as Fitbit and Apple Watch, has grown exponentially, enabling users to track their physical activity and caloric intake in real time. Additionally, the integration of artificial intelligence into digital health platforms has enhanced the personalization of weight management programs.

MARKET RESTRAINTS

High Costs of Premium Solutions

One of the most significant restraints facing the Asia Pacific weight management market is the high cost associated with premium solutions, such as personalized diet plans, gym memberships, and advanced fitness equipment. These expenses often make such services inaccessible to a large segment of the population, particularly in developing economies like Indonesia and Vietnam. For example, a comprehensive weight loss program offered by a leading brand in Australia can cost upwards of $500 per month, limiting its adoption to affluent consumers. This financial barrier restricts market penetration in rural areas where disposable incomes are lower, which is hindering widespread adoption of weight management solutions.

Lack of Awareness in Rural Areas

Another major restraint is the limited awareness of weight management solutions in rural and semi-urban areas across the Asia Pacific region. While urban centers have embraced wellness trends, rural populations often lack access to information about the importance of maintaining a healthy weight. According to the United Nations Development Programme, over 40% of rural communities in countries like Bangladesh and Myanmar have limited exposure to health education campaigns, resulting in low prioritization of weight management. Additionally, cultural perceptions in some regions view overweight as a sign of prosperity, discouraging individuals from seeking weight loss interventions.

MARKET OPPORTUNITIES

Integration of Digital Health Technologies

The integration of digital health technologies presents a transformative opportunity for the Asia Pacific weight management market. Wearable devices, mobile applications, and telehealth platforms are revolutionizing how individuals monitor and manage their weight. According to Frost & Sullivan, the adoption of health-focused mobile apps in the region grew by 40% in 2022, driven by the convenience and accessibility they offer. For example, apps like MyFitnessPal and Calorie Mama enable users to track their daily calorie intake and physical activity, fostering accountability and consistency. Moreover, advancements in artificial intelligence and machine learning have enhanced the personalization of weight management programs. A study by Accenture revealed that AI-driven platforms can tailor recommendations based on individual metabolic rates by improving adherence and outcomes.

Expansion into Emerging Markets

Another promising opportunity lies in expanding weight management solutions into emerging markets within the Asia Pacific region. Countries like Vietnam, Thailand, and Indonesia are experiencing rapid economic growth, leading to increased disposable incomes and greater emphasis on health and wellness. According to the World Bank, the middle-class population in Southeast Asia is projected to double by 2030, creating a lucrative market for affordable and scalable weight management products. For instance, affordable fitness equipment and localized dietary supplements are gaining traction in these markets, addressing the unique needs of price-sensitive consumers. Additionally, partnerships with local governments and non-governmental organizations can facilitate awareness campaigns and community-based programs. These initiatives not only enhance brand visibility but also foster trust among local populations, which is enabling companies to tap into untapped potential and drive sustainable growth.

MARKET CHALLENGES

Regulatory Hurdles for Weight Loss Products

One of the foremost challenges faced by the Asia Pacific weight management market is navigating the stringent regulatory frameworks governing weight loss products and services. Many countries in the region impose strict guidelines on the approval and marketing of dietary supplements, fitness equipment, and digital health applications. For example, Japan’s Pharmaceuticals and Medical Devices Agency mandates rigorous clinical trials for all weight loss supplements, delaying product launches and increasing costs for manufacturers. Similarly, Australia’s Therapeutic Goods Administration requires detailed labeling and safety certifications, which can be a barrier for small and medium-sized enterprises (SMEs) entering the market. These regulatory hurdles not only impede innovation but also limit the availability of diverse solutions for consumers.

Cultural Resistance to Lifestyle Changes

Another pressing challenge is the cultural resistance to adopting lifestyle changes necessary for effective weight management. In many parts of the Asia Pacific region, traditional diets and eating habits are deeply ingrained in local cultures, making it difficult to promote alternative nutritional approaches. For instance, a study by the Food and Agriculture Organization revealed that over 50% of households in South Asia consume calorie-dense staples like rice and wheat, which are resistant to substitution despite their contribution to weight gain. Additionally, social norms in some communities discourage physical activity, particularly among women, due to safety concerns or cultural restrictions. These cultural factors create significant obstacles for market players seeking to introduce behavior-changing interventions, which is requiring tailored strategies to address regional nuances effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.06% |

|

Segments Covered |

By Function and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Herbalife International, Inc., NutriSystem, Inc., Weight Watchers International, Inc., Glanbia PLC, Atkins Nutritionals, Inc, Technogym, Now Health Group, Inc., Johnson Health Tech, The Kellogg Company, Nestle SA, Abbott Laboratories, Amer Sports, GNC Holdings, Inc., Alticor corporation. |

SEGMENT ANALYSIS

By Function Insights

KEY MARKET PLAYERS

Herbalife International, Inc., NutriSystem, Inc., Weight Watchers International, Inc., Glanbia PLC, Atkins Nutritionals, Inc, Technogym, Now Health Group, Inc., Johnson Health Tech, The Kellogg Company, Nestle SA, Abbott Laboratories, Amer Sports, GNC Holdings, Inc., Alticor corporation. are the market players that are dominating the weight management market.

Top Players In The Market

Herbalife Nutrition

Herbalife Nutrition is a global leader in the weight management market, which is offering a wide range of dietary supplements, meal replacement shakes, and personalized nutrition plans. The company’s focus on direct selling through independent distributors has enabled it to penetrate diverse markets across the Asia Pacific region effectively. Herbalife’s emphasis on science-backed formulations and localized product offerings, such as protein shakes infused with traditional Asian ingredients, has strengthened its appeal among regional consumers.

Amway

Amway is renowned for its innovative health and wellness products, including Nutrilite dietary supplements and weight management solutions. The company leverages its extensive distribution network to reach urban and rural consumers alike, ensuring accessibility to affordable and high-quality products. Amway’s commitment to sustainability and natural ingredients resonates with the growing demand for eco-friendly and health-conscious choices in the Asia Pacific region.

Johnson & Johnson (via Ethicon)

Johnson & Johnson, through its subsidiary Ethicon, specializes in surgical weight management solutions such as bariatric surgeries and minimally invasive procedures. The company’s advanced medical technologies and partnerships with healthcare providers have made it a leader in addressing severe obesity cases. Ethicon’s focus on patient safety and long-term outcomes has earned it a reputation for excellence in the medical community.

Top Strategies Used By Key Players In The Market

Product Localization and Innovation

Key players are increasingly focusing on product localization and innovation to cater to the unique needs of consumers in the Asia Pacific region. For example, companies like Herbalife and Amway have introduced dietary supplements infused with traditional ingredients such as ginseng and green tea, aligning with cultural preferences. This strategy not only enhances consumer appeal but also fosters trust and loyalty. Additionally, continuous investment in research and development ensures that products remain at the forefront of technological advancements by enabling companies to offer differentiated and effective solutions.

Expansion of Digital Platforms

The adoption of digital platforms has become a cornerstone of success in the weight management market. Companies are leveraging mobile apps, telehealth services, and AI-driven tools to provide personalized experiences for users. For instance, platforms like CureFit and Practo offer virtual consultations and fitness tracking, making weight management more accessible and convenient. By integrating wearable devices and real-time monitoring systems, these platforms enhance user engagement and adherence, giving companies a competitive edge in the market.

Strategic Partnerships and Collaborations

Strategic partnerships with local governments, healthcare providers, and fitness centers have enabled key players to expand their reach and influence. Collaborations with public health organizations help promote awareness campaigns and community-based programs, fostering a culture of wellness. Additionally, partnerships with tech firms facilitate the integration of advanced technologies into weight management solutions, ensuring scalability and reliability. These alliances not only strengthen market presence but also drive long-term growth by addressing regional challenges effectively.

COMPETITION OVERVIEW

The Asia Pacific weight management market is characterized by intense competition, driven by a mix of global giants and regional innovators striving to capture market share. Established players like Herbalife, Amway, and Johnson & Johnson bring extensive resources and expertise, enabling them to dominate key segments such as dietary supplements and surgical equipment. At the same time, regional companies leverage their deep understanding of local cultures and consumer preferences to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements, which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies, particularly in emerging markets. Additionally, the rise of e-commerce and digital health platforms has created new opportunities for differentiation, as companies strive to offer seamless and personalized solutions. This interplay of innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Herbalife Nutrition launched a new line of plant-based protein shakes tailored to Southeast Asian tastes. This initiative aims to cater to the growing demand for vegan and sustainable weight management solutions, enhancing its market presence in the region.

- In June 2023, Amway partnered with a leading fitness chain in India to offer bundled packages of dietary supplements and gym memberships. This collaboration seeks to promote holistic wellness while expanding its customer base in urban centers.

- In September 2023, Johnson & Johnson introduced a minimally invasive bariatric surgery program in partnership with hospitals in Australia. This move strengthens its leadership in surgical weight management solutions and addresses the rising prevalence of severe obesity.

- In February 2024, CureFit acquired a regional telehealth platform specializing in nutritional counseling. This acquisition allows CureFit to integrate AI-driven dietary advice into its existing services, improving user engagement and retention.

- In November 2023, Practo partnered with a wearable device manufacturer in South Korea to launch a smart fitness tracker with integrated weight management features. This innovation enhances its digital health offerings and appeals to tech-savvy consumers.

MARKET SEGMENTATION

This research report on the Asia Pacific weight management system market is segmented and sub-segmented into the following categories.

By Function

- Diet

-

- Meals

- Beverages

- Supplements

- Proteins

- Fibers

- Green tea extract

- Conjugate linoleic acid

- Green coffee

- L-carnitine

-

- Fitness equipment

- Cardiovascular training equipment

- Strength training equipment

- Others

- Surgical equipment

- Minimally invasive surgical equipment

- Noninvasive surgical equipment

- Services

- Fitness centers

- Slimming centers

- Consultation services

- Online weight loss service

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is fueling the rise in demand for weight management solutions across APAC?

Urban lifestyle changes, a growing middle class, and rising obesity rates, especially in countries like China, India, and Australia, are pushing demand for diet plans, fitness tech, and functional foods.

How are cultural and dietary preferences shaping product innovation in this market?

Brands are localizing solutions—like plant-based meals in Southeast Asia or Ayurveda-inspired supplements in India—to match traditional diets and cultural health beliefs.

What role does technology play in weight management adoption across the region?

Mobile apps, AI-based coaching, and wearables are rapidly expanding, especially in urban areas, enabling real-time tracking and personalized programs in languages like Mandarin, Hindi, and Bahasa.

How do regulatory frameworks impact weight loss supplements and services in APAC?

Countries like Japan and South Korea have strict approval processes for nutraceuticals, while others like India are tightening FSSAI norms to ensure product safety and efficacy.

Is preventive healthcare influencing consumer behavior in weight control?

Yes post-pandemic, there's a strong shift toward preventive care, with consumers prioritizing long-term wellness, leading to growth in functional beverages, low-GI foods, and metabolic health services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]