Asia Pacific Yeast Extract Market Size, Share, Trends & Growth Forecast Report By Technology (Autolyzed Yeast Extract, Hydrolyzed Yeast Extract), Application, And Region, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Yeast Extract Market Size

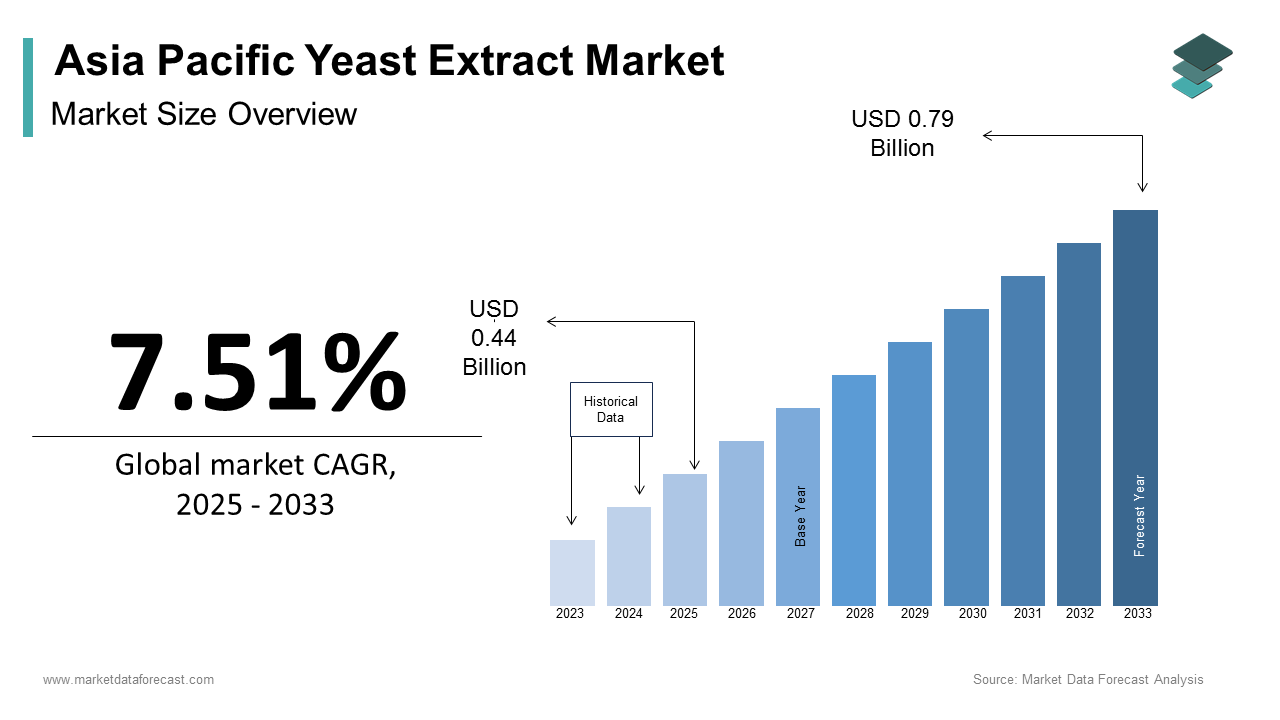

The Asia Pacific yeast extract market size was calculated to be USD 0.41 billion in 2024 and is anticipated to be worth USD 0.79 billion by 2033, from USD 0.44 billion in 2025, growing at a CAGR of 7.51% during the forecast period.

Yeast extract is a nutrient-rich substance derived from yeast cells through autolysis or enzymatic hydrolysis, widely used as a natural flavor enhancer, nutritional supplement, and functional ingredient across food, pharmaceutical, and animal feed industries. In the Asia Pacific region, the yeast extract market has gained significant traction due to shifting consumer preferences toward clean-label ingredients, increasing demand for processed foods with enhanced taste profiles, and growing awareness of yeast extract’s health benefits such as immune support and digestive wellness.

MARKET DRIVERS

One of the primary drivers of the Asia Pacific yeast extract market is the increasing demand for natural flavor enhancers in the food industry, especially as consumers become more conscious about avoiding artificial additives. Like, regulatory bodies in Japan, Australia, and Singapore have imposed restrictions on synthetic flavoring agents, prompting manufacturers to seek alternatives that align with clean-label trends. As a result, yeast extract which is known for its rich umami profile and ability to enhance savory flavors without artificial preservatives has gained widespread adoption in soups, sauces, snacks, and meat substitutes.

In China, it was reported an increase in product launches featuring yeast extract as a flavor booster between 2021 and 2023, particularly in instant noodles and seasoning cubes. Indian food companies have reformulated several snack and instant meal products by replacing monosodium glutamate (MSG) with yeast extract to cater to health-conscious consumers. Similarly, in South Korea, CJ CheilJedang has introduced a range of fermented yeast extract-based seasonings integrated into popular kimchi-flavored instant noodles.

Expansion of Nutritional Supplements and Functional Foods

Another significant driver of the Asia Pacific yeast extract market is the growing incorporation of yeast extract into nutritional supplements and functional food formulations aimed at addressing micronutrient deficiencies and promoting overall wellness. According to the World Health Organization (WHO), certain regions within the Asia Pacific continue to struggle with vitamin B-complex deficiencies, particularly among vegetarian populations and lower-income groups. Yeast extract, being a rich source of B vitamins, amino acids, and minerals, has emerged as an effective bioavailable solution for fortifying everyday foods and dietary supplements.

Similarly, fortified breakfast cereals, plant-based protein powders, and infant formulas containing yeast extract have experienced a marked uptick in sales over the past three years. In India, government-backed programs under the National Nutrition Mission have encouraged the integration of yeast extract into school midday meals and community nutrition initiatives. Japanese healthcare providers have also endorsed yeast extract-enriched oral supplements for elderly patients suffering from weakened immunity.

MARKET RESTRAINTS

High Production Costs and Raw Material Price Volatility

A major restraint affecting the Asia Pacific yeast extract market is the high production costs associated with yeast cultivation, extraction, and downstream processing, which limit affordability for smaller manufacturers and regional players. Unlike synthetic flavor enhancers, yeast extract requires a sophisticated fermentation and hydrolysis process that demands significant energy input and specialized equipment. According to the United Nations Industrial Development Organization (UNIDO), fluctuations in raw material prices, particularly for molasses—a key carbon source in yeast growth—have added financial uncertainty for producers. The Thai Sugar Millers Association reported that molasses prices in Southeast Asia increased considerably in 2024 due to supply chain disruptions and climate-related crop losses.

In Indonesia, where palm-based molasses is a primary feedstock, the Indonesian Bioindustry Association noted that raw material shortages during peak harvesting seasons often lead to inconsistent production schedules. In addition, energy-intensive drying and concentration techniques further contribute to elevated manufacturing expenses. As per the China Fermentation Industry Association, small-scale yeast extract producers in Central and Western China face difficulties competing with larger firms due to higher cost structures.

Limited Consumer Awareness and Acceptance in Certain Markets

Despite growing demand in urban centers, another key challenge for the Asia Pacific yeast extract market is limited consumer awareness and acceptance in rural and traditional markets where alternative flavoring methods remain dominant. Many consumers associate yeast extract primarily with brewer’s yeast or probiotic supplements rather than recognizing its role as a food enhancer.

In Malaysia, traditional cooking techniques rely heavily on shrimp paste, fish sauce, and coconut milk as primary flavor bases, making it difficult for yeast extract-based seasonings to gain mainstream traction. Moreover, marketing budgets for yeast extract-containing products tend to be limited compared to those of well-established seasoning brands, reducing visibility among first-time buyers.

MARKET OPPORTUNITIES

Growth of Plant-Based and Alternative Protein Products

A key opportunity for the Asia Pacific yeast extract market lies in the expanding plant-based and alternative protein sector, where yeast extract plays a crucial role in enhancing flavor, texture, and nutritional value. As concerns around sustainability, animal welfare, and health drive a shift away from conventional meat consumption, manufacturers of plant-based meats, mycoproteins, and insect proteins are turning to yeast extract to replicate the savory depth traditionally provided by animal sources.

In China, Shanghai-based Zhenmeat and other alternative protein companies have incorporated yeast extract into their plant-based burger patties and dumpling fillings to enhance umami richness and improve mouthfeel. The Indian Plant-Based Foods Association reported that yeast extract usage in vegan cheese and tofu-based snacks rose significantly following the launch of fortified ready-to-eat meals targeting fitness enthusiasts. In Japan, Ajinomoto has collaborated with local food tech firms to develop yeast extract-infused mycoprotein patties designed to mimic the taste and texture of beef.

Integration into Functional Beverages and Sports Nutrition

Another significant opportunity for the Asia Pacific yeast extract market is its application in functional beverages and sports nutrition products, driven by increasing consumer focus on performance enhancement and recovery. Yeast extract contains essential amino acids, peptides, and B vitamins that support muscle repair, energy metabolism, and hydration, making it a valuable ingredient in electrolyte drinks, post-workout shakes, and endurance supplements. The Australian Institute of Sport confirmed that yeast extract-based hydration formulas are gaining popularity among endurance athletes due to their natural composition and minimal side effects. Meanwhile, in Thailand, local health drink manufacturer Namyang has introduced a yeast extract-infused sports shake aimed at young consumers seeking natural energy boosters.

MARKET CHALLENGES

A pressing challenge facing the Asia Pacific yeast extract market is the intense competition from established artificial flavoring agents such as monosodium glutamate (MSG), disodium inosinate, and synthetic yeast derivatives. Despite growing consumer preference for clean-label ingredients, artificial flavor enhancers remain deeply entrenched in regional cuisines due to their low cost, strong taste impact, and long-standing consumer familiarity. According to the ASEAN Food Safety Network, MSG continues to dominate flavoring applications in processed foods across Southeast Asia, particularly in instant noodles, canned vegetables, and frozen meals.

Apart from these, some synthetic yeast extracts produced through chemical hydrolysis are marketed as "natural" alternatives, confusing consumers and diluting the perceived differentiation of pure yeast extracts.

Regulatory Hurdles and Labeling Ambiguity

Another major challenge confronting the Asia Pacific yeast extract market is the lack of standardized regulatory frameworks governing its classification, labeling, and permitted usage levels across different countries. Unlike Europe or North America, where clear directives define yeast extract’s status and allowable claims, regulatory guidelines in Asia Pacific vary significantly, creating compliance complexities for manufacturers. Like, inconsistencies exist in how yeast extract is categorized as either a food additive, flavor enhancer, or nutritional ingredient depending on the jurisdiction. In India, the Food Safety and Standards Authority of India (FSSAI) has yet to finalize precise regulations regarding permissible yeast extract concentrations in packaged foods, causing delays in product approvals. In Japan, while the Ministry of Health, Labour and Welfare permits yeast extract in most food categories, strict labeling requirements for allergens and processing aids can deter smaller brands from incorporating it into their recipes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.51% |

|

Segments Covered |

By Technology, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Angel Yeast, Lesaffre Group, Lallemand Inc., DSM, Kerry Group, Alltech, Associated British Foods plc, BioSpringer, Titan Biotech, Biorigin |

SEGMENTAL ANALYSIS

By Technology Insights

The autolyzed yeast extract segment held the largest share of 58.5% of the Asia Pacific yeast extract market in 2024 due to its widespread use in food flavoring, nutritional supplements, and pharmaceutical applications. This technology involves a natural process where yeast cells are broken down using their enzymes, resulting in a nutrient-rich extract with a distinctive umami taste. Also, autolyzed yeast extract is preferred over hydrolyzed forms in many Asian countries because it aligns with clean-label trends and does not involve strong chemical treatments. In China, the National Center for Food Safety Risk Assessment reported that autolyzed yeast extract is used in more than 60% of processed savory snacks and seasonings, particularly in instant noodles and ready-to-eat meals. Indian food manufacturers such as Britannia and Patanjali have also adopted this form in fortified biscuits and breakfast cereals aimed at improving B-vitamin intake among schoolchildren. In Japan, where the concept of “umami” is deeply embedded in culinary traditions, the Japanese Society of Nutrition and Food Science has endorsed autolyzed yeast extract as a safe and effective flavor enhancer in soups and dashi-based broths. Moreover, regulatory authorities in Australia and New Zealand recognize autolyzed yeast extract as a food ingredient rather than an additive, contributing to its growing acceptance in health-conscious markets.

The hydrolyzed yeast extract segment is emerging as the fastest-growing part of the Asia Pacific yeast extract market, projected to expand at a CAGR of approximately 9.4%. This rise is primarily driven by increasing demand from the plant-based food and functional beverage sectors, where hydrolyzed yeast extract serves as a rich source of amino acids, peptides, and bioactive compounds. Unlike autolyzed variants, hydrolyzed yeast extract undergoes enzymatic or acid hydrolysis, which allows for greater customization in protein content and flavor intensity, making it ideal for sports nutrition, infant formulas, and meat alternatives. Besides, in China, the National Health Commission has approved hydrolyzed yeast extract for inclusion in medical nutrition products prescribed for cancer patients suffering from cachexia and muscle wasting.

By Application Insights

The food and beverages segment dominated the Asia Pacific yeast extract market with a share of approximately 65%, driven by its extensive use in savory seasoning blends, ready-to-eat meals, plant-based meat alternatives, and functional beverages. Consumers are increasingly seeking natural flavor enhancers that offer both taste and nutritional benefits without artificial additives. According to the ASEAN Food Safety Network, a significant portion of packaged savory snack and soup products launched in Southeast Asia in 2023 contained yeast extract as a flavor booster. In China, the National Center for Food Safety Risk Assessment confirmed that yeast extract is a staple ingredient in popular food items such as instant noodles, bouillons, and fermented sauces, with major brands like Master Kong incorporating it to enhance umami depth. Additionally, in Australia, leading retailers such as Woolworths and Coles have introduced yeast extract-infused smoothies and hydration drinks designed for athletes and wellness-focused consumers.

The pharmaceuticals segment exhibits the rapidly accelerating application area for yeast extract in the Asia Pacific market, expanding at an estimated CAGR of 10.2%. This sudden growth is fueled by the increasing incorporation of yeast extract in dietary supplements, immune-modulating formulations, and microbiome-targeted therapies. Yeast extract is valued for its high concentration of B vitamins, amino acids, cell wall components like beta-glucan, and prebiotic properties, all of which support immune function and digestive health. According to the World Health Organization (WHO), micronutrient deficiencies remain a public health concern in parts of South and Southeast Asia, prompting governments and healthcare providers to explore yeast extract as a cost-effective fortification agent in essential health products. In India, the Indian Council of Medical Research observed a surge in yeast extract-containing oral supplements aimed at combating vitamin B complex deficiencies among vegetarians and elderly populations. Meanwhile, the Australian Institute of Health and Welfare reported a doubling in over-the-counter sales of yeast extract-containing probiotic blends between 2021 and 2023, reflecting heightened consumer awareness of its therapeutic potential.

REGIONAL ANALYSIS

China occupied the top position in the Asia Pacific yeast extract market by accounting for 28.5% of total regional consumption in 2024. The country’s prowess is due to its robust food processing industry, significant investments in fermentation biotechnology, and strong domestic demand for yeast extract in flavoring, nutritional supplements, and plant-based food products. The National Center for Food Safety Risk Assessment highlighted that yeast extract is a core ingredient in a significant portion of instant noodle seasoning packets and ready-to-eat meal powders produced in China. Also, the Chinese Academy of Agricultural Sciences is exploring yeast extract applications in functional beverages and infant nutrition formulations.

Japan is another major player in the market. The country is widely recognized for its sophisticated application of yeast extract in gourmet cuisine, pharmaceuticals, and premium supplements. According to the Japanese Society of Nutrition and Food Science, yeast extract has been a staple in Japanese kitchens for decades, particularly in dashi broth and umami-rich seasoning blends. Leading companies such as Ajinomoto and Kyowa Hakko Bio have pioneered yeast extract fermentation technologies that cater to both domestic and global markets.

India is emerging as one of the fastest-growing economies in the space. The country’s growth trajectory is being shaped by increasing consumer focus on immunity, digestive wellness, and clean-label nutrition. According to the Indian Council of Medical Research, vitamin B deficiency affects millions of individuals nationwide, prompting the integration of yeast extract into fortified foods and dietary supplements. The Food Safety and Standards Authority of India (FSSAI) has encouraged the use of yeast extract in midday meal programs and community nutrition initiatives, further boosting demand. Major food and supplement brands such as Patanjali, Nestlé, and Amway have launched yeast extract-enriched products ranging from energy bars to immunity boosters. In addition, domestic yeast extract producers like Vaatsalya Healthcare and NutriScience Innovations are scaling up manufacturing capacities to meet the rising demand.

South Korea is a key player in the market which is distinguished by its emphasis on premium, functional, and scientifically backed yeast extract formulations. The country’s rapidly evolving food and beverage industry, coupled with a strong healthcare sector, has led to increased adoption of sports nutrition, fermented foods, and specialty diets. The Korean Institute of Oriental Medicine has explored yeast extract’s role in traditional medicine formulations aimed at boosting vitality and metabolic function. Leading beverage company Orion recently launched a line of isotonic drinks enriched with yeast extract, gaining popularity among office workers and fitness enthusiasts.

Australia is known for its mature retail ecosystem and high consumer preference for clean-label and functional food products. The country’s population has shown a strong inclination towards yeast extract as a natural alternative to synthetic flavor enhancers and fortificants. According to the Australian Institute of Health and Welfare, over 4 million Australians identify as having specific dietary restrictions, including gluten intolerance and low-protein conditions, directly influencing yeast extract consumption patterns. Major retailers such as Woolworths and Aldi have expanded their frozen and refrigerated yeast extract-infused beverage assortments, offering plant-based, vegan, and protein-enriched variants.

LEADING PLAYERS IN THE ASIA PACIFIC YEAST EXTRACT MARKET

DSM (Royal DSM)

DSM is a global leader in nutrition, health, and sustainable living, with a strong presence in the yeast extract market across the Asia Pacific region. The company offers innovative yeast-based ingredients that cater to the food, beverage, and pharmaceutical sectors. Known for its commitment to sustainability and product innovation, DSM plays a vital role in shaping consumption trends by providing natural flavor enhancers and nutrient-rich extracts.

Kerry Group

Kerry Group is a key player in taste and nutrition, offering high-quality yeast extracts used across various applications in the food and beverage industry. With a significant footprint in Asia Pacific, Kerry leverages its deep technical expertise and customer-centric approach to deliver customized flavor solutions. The company contributes to global market growth by integrating yeast extracts into broader taste enhancement systems, supporting the demand for natural and savory food products.

Angel Yeast Co., Ltd.

Angel Yeast is one of China’s leading yeast producers with a growing influence in the Asia Pacific yeast extract market. The company specializes in yeast derivatives, including yeast extract, which is widely used in seasonings, soups, sauces, and processed foods. Angel Yeast has built a strong regional supply chain and focuses on expanding its product portfolio through continuous innovation. It plays a crucial role in meeting local demand and exporting to international markets.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific yeast extract market utilize several strategic approaches to maintain and strengthen their competitive positions. One major strategy is product innovation, where companies invest heavily in research and development to create new yeast extract variants tailored for specific applications such as umami flavoring, fortification, or clean-label reformulation.

Another critical approach is strategic partnerships and collaborations. Companies often partner with food manufacturers, flavor houses, and ingredient suppliers to co-develop customized solutions, ensuring better integration of yeast extracts into end-use products.

Lastly, expansion and localization play a crucial role. Market leaders are increasing their regional presence through facility expansions, joint ventures, and localized marketing efforts to cater to diverse consumer preferences across the Asia Pacific region.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific yeast extract market include Angel Yeast, Lesaffre Group, Lallemand Inc., DSM, Kerry Group, Alltech, Associated British Foods plc, BioSpringer, Titan Biotech, and Biorigin.

The Asia Pacific yeast extract market is highly competitive, characterized by the presence of both global giants and regional specialists vying for market share. As consumer demand shifts toward natural, clean-label ingredients, companies are increasingly leveraging yeast extracts for their functional benefits such as flavor enhancement, nutritional enrichment, and preservative properties. This has intensified competition among key players who are continuously innovating and adapting to regional tastes and dietary habits.

Multinational corporations like DSM and Kerry Group bring global expertise and extensive distribution networks, allowing them to dominate premium segments. Meanwhile, regional players such as Angel Yeast are strengthening their foothold by capitalizing on local market knowledge, cost advantages, and government support for domestic industries. These companies are also investing in advanced production technologies and sustainable practices to differentiate themselves in a crowded marketplace.

Collaboration and customization have become essential tools in gaining a competitive edge, as firms work closely with food and beverage manufacturers to develop application-specific solutions. Additionally, branding and marketing strategies focused on health benefits and transparency are being employed to build trust with consumers and business clients alike.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, DSM expanded its manufacturing facility in Singapore to enhance local production capacity for yeast extract and related ingredients, aiming to better serve food and pharmaceutical clients across Southeast Asia.

- In June 2023, Kerry Group launched a new line of yeast extract-based flavor solutions tailored for the Asian market, focusing on plant-based and umami-rich applications to meet growing consumer demand for natural taste enhancers.

- In February 2025, Angel Yeast Co., Ltd. formed a strategic partnership with a leading Japanese seasoning manufacturer to co-develop customized yeast extract blends for use in traditional Asian cuisine and modern food products.

- In September 2023, DSM introduced an educational initiative targeting food manufacturers in India and Australia to promote the benefits of yeast extract in clean-label and fortified food formulations.

- In May 2024, Kerry Group opened a new application center in Shang

MARKET SEGMENTATION

This research report on the Asia Pacific yeast extract market has been segmented and sub-segmented based on technology, application, and region.

By Technology

- Autolyzed Yeast Extract

- Hydrolyzed Yeast Extract

By Application

- Food & Beverages

- Pharmaceuticals

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of this market in Asia Pacific?

Key growth drivers include increasing demand for natural food ingredients, rising consumption of processed and convenience foods, and the growing popularity of clean-label and plant-based products.

2. Which countries in Asia Pacific are the major consumers of yeast extract?

China, India, Japan, South Korea, and Australia are among the leading markets due to large food processing industries and growing urban populations.

3. Who are the key players operating in the Asia Pacific yeast extract market?

Major players include Angel Yeast, Lesaffre Group, Lallemand Inc., DSM, Kerry Group, Alltech, Associated British Foods plc, BioSpringer, Titan Biotech, and Biorigin.

4. How to predict future trends in the Asia Pacific yeast extract market?

Future trends include increased demand for vegan and plant-based products, innovations in yeast-derived nutritional products, and rising applications in biotechnology and pharmaceuticals.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com