Global Automotive Chassis Market Size, Share, Trends and Growth Forecasts Report, Segmented By Component (Tie-Rods, Stabilizer Links, Suspension Ball Joints, Cross-Axis Joints, Control Arms, and Knuckles & Hubs), Chassis System (Front Axle, Rear Axle, Corner Modules, and Active Kinematics Control), Vehicle type (Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Construction Equipment Vehicles, Defense Vehicles, and Farm Tractors), Industry Analysis From 2025 to 2033

Global Automotive Chassis Market Size

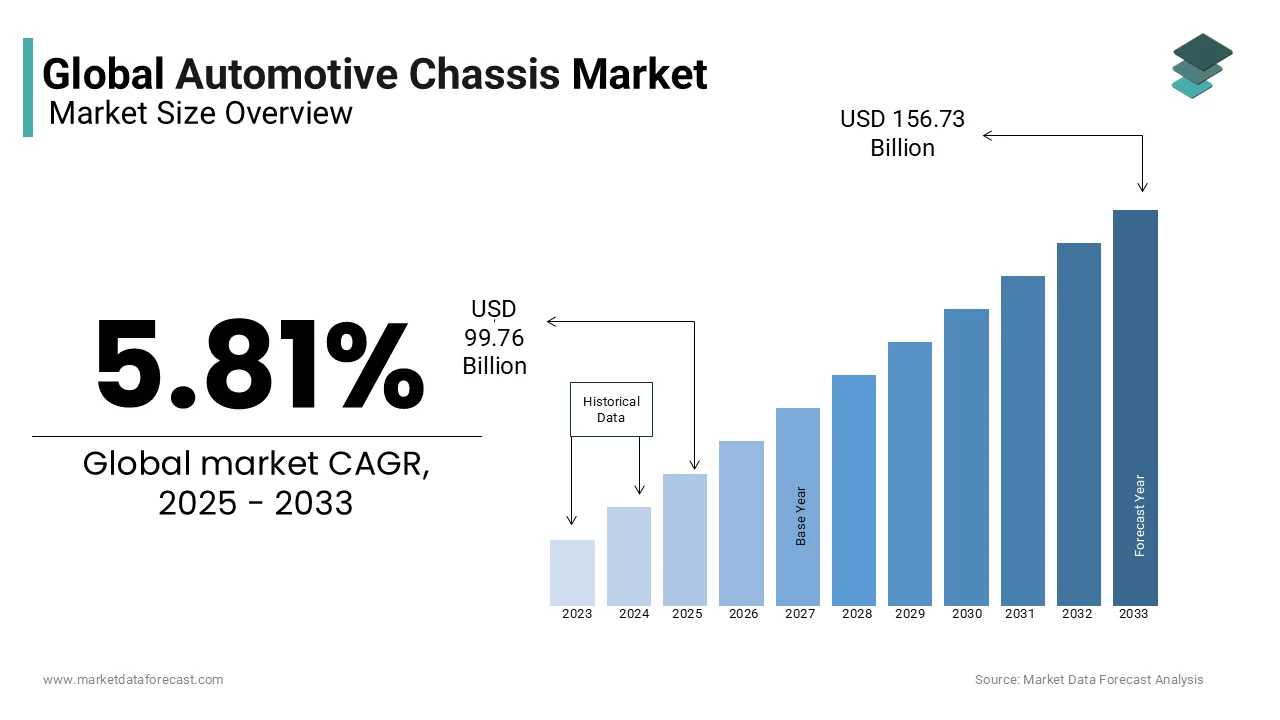

The global automotive chassis market was valued at USD 94.28 billion in 2024 and is anticipated to reach USD 99.76 billion in 2025 from USD 156.73 billion by 2033, growing at a CAGR of 5.81% during the forecast period from 2025 to 2033.

The chassis might be a system of auto construction on which different pieces of the vehicle are mounted. The undercarriage of the vehicle is framed of such a material that has adequate strength in touch with the heap of the vehicle and is touch adaptable to support the strain and shocks that are brought about by turning and track conditions. It's the undercarriage on which every one of the frameworks of the vehicle, like directing gathering, the suspension, the slowing mechanism, the body of the vehicle, and so on, is joined. Case framework plans incorporate dynamic kinematic control, point modules, uncommon pivots, and a front hub. During these new years, the producers are more engaged towards diminishing the heap of the undercarriage, which can ultimately diminish the fossil fuel by-product; additionally, it'll likewise cause an expansion in the productivity of the vehicle. So innovative work is being controlled in this field to make more productive and lighter chassis Systems with ideal strength and versatility.

MARKET DRIVERS

The principal factors driving the development of the market for auto body frameworks incorporate the developing interest in energy-effective vehicles, expanded mechanical developments and progressions, and expanded auto creation. Actually, fluctuating costs of staples and diminishing vehicle possession because of expanding shared versatility are some of the components that may limit the development of the market. Be that as it may, rising electric vehicle creation is expected to supply worthwhile freedoms for the extension of the market. Likewise, the occasion of super light body frameworks, which clears a path for spic and span organizations to enter the market absent a lot of R&D speculation, is anticipated to supply openings for market development.

MARKET RESTRAINTS

The raw materials used for manufacturing of the automotive chassis system mainly consist of steel, aluminum alloys, et al. Therefore, the value of metals, such as aluminum, carbon et al., used in the manufacture of chassis systems is increasing in some regions of the world due to the reform of the European emissions trading system. These variables are expected to frustrate the reception of those metals for assembling body frameworks. Accordingly, changes in the costs of crude materials utilized in chassis frameworks are relied upon to hinder the development of the world market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.81% |

|

Segments Covered |

By Component, Chassis System, vehicle, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

American Axle & Manufacturing, Robert Bosch GmbH, ZF Friedrichshafen, Magna International Inc., Aisin Seiki Co., Continental AG, Hyundai Mobis, Schaeffler AG, Benteler International AG, American Axle & Manufacturing, and Others. |

SEGMENTAL ANALYSIS

By Chassis System Analysis

Driving vehicle producers are making chassis systems with advancements and types of progress in view of extending interest for premium and further developed execution vehicles. For example, AUDI AG, one of the principal automakers, introduced the new Audi A6, which involves a typically weighted electric power coordinating and a unique skeleton mode that engages customized choke moving and works on the driving experience and driving even on mountain roads, empowering an interest for an especially extreme vehicle. Henceforth, advancements and creative degrees of progress in body systems will drive the augmentation of the overall vehicle case structures market.

By Vehicle Type Analysis

In electric vehicle type, skateboard casing will get a more prominent piece of the general business during the expected period. The Skateboard case involves an edge that licenses it to pass on the colossal battery pack that navigates the whole region of the packaging for instance between the four wheels nearby the suspension, brakes, and thusly the barrel molded motors. Furthermore, this underside structure can maintain assorted body styles for various applications.

REGIONAL ANALYSIS

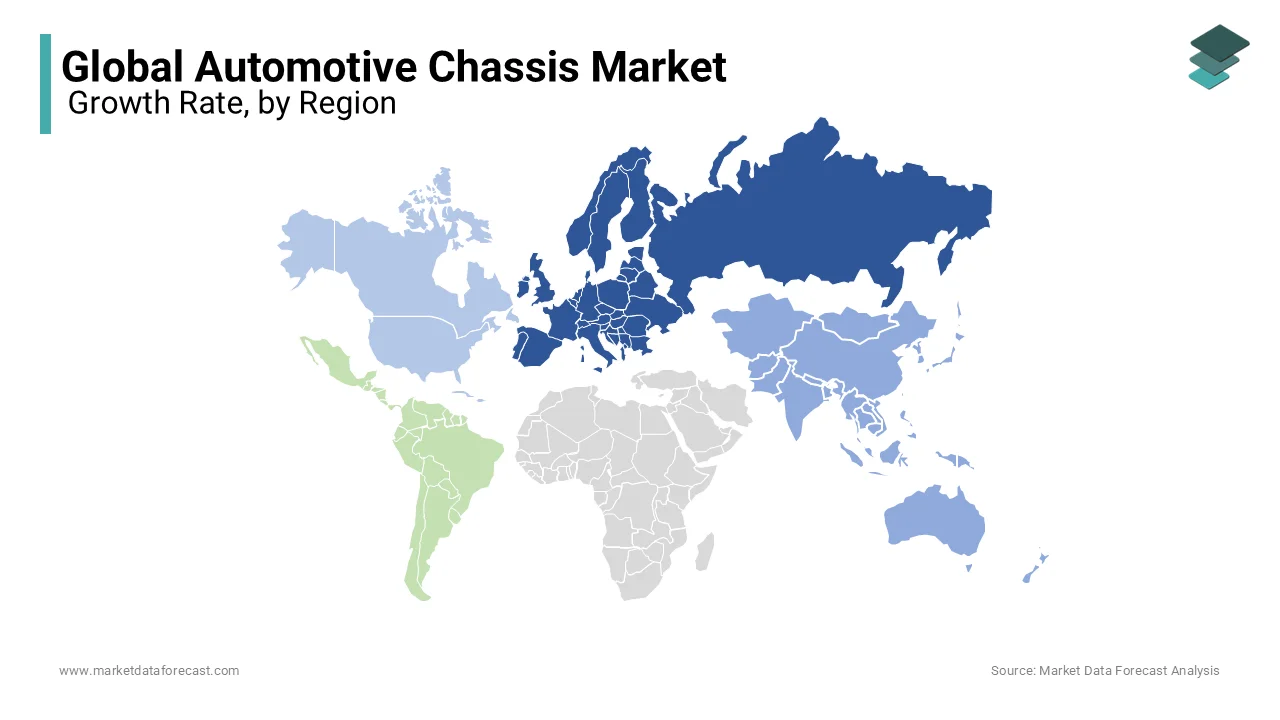

Europe has a significant share of the global automotive chassis systems market due to the presence of the leading OEMs in this region.

Asia Pacific is predicted to point out significant growth within the forecast period for various reasons like an increase in per capita income of the country, much less concentration of automobiles as compared to Europe and America, and government initiatives within the countries like China and India to market manufacturing also will contribute towards the expansion of this market.

KEY MARKET PLAYERS

American Axle & Manufacturing, Robert Bosch GmbH, ZF Friedrichshafen, Magna International Inc., Aisin Seiki Co., Continental AG, Hyundai Mobis, Schaeffler AG, Benteler International AG, American Axle & Manufacturing. Some of the market players that dominate the global automotive chassis market.

RECENT HAPPENINGS IN THIS MARKET

- The Japanese overall blend Toshiba Digital and Consulting Corporation (TDX) and the Spanish Gestamp, a world boss in metallic portions for cars, have announced their cooperation in an endeavor to convey advanced observing and examination to the welding of vehicle suspension parts.

MARKET SEGMENTATION

This research report on the global automotive chassis market has been segmented and sub-segmented into the following categories.

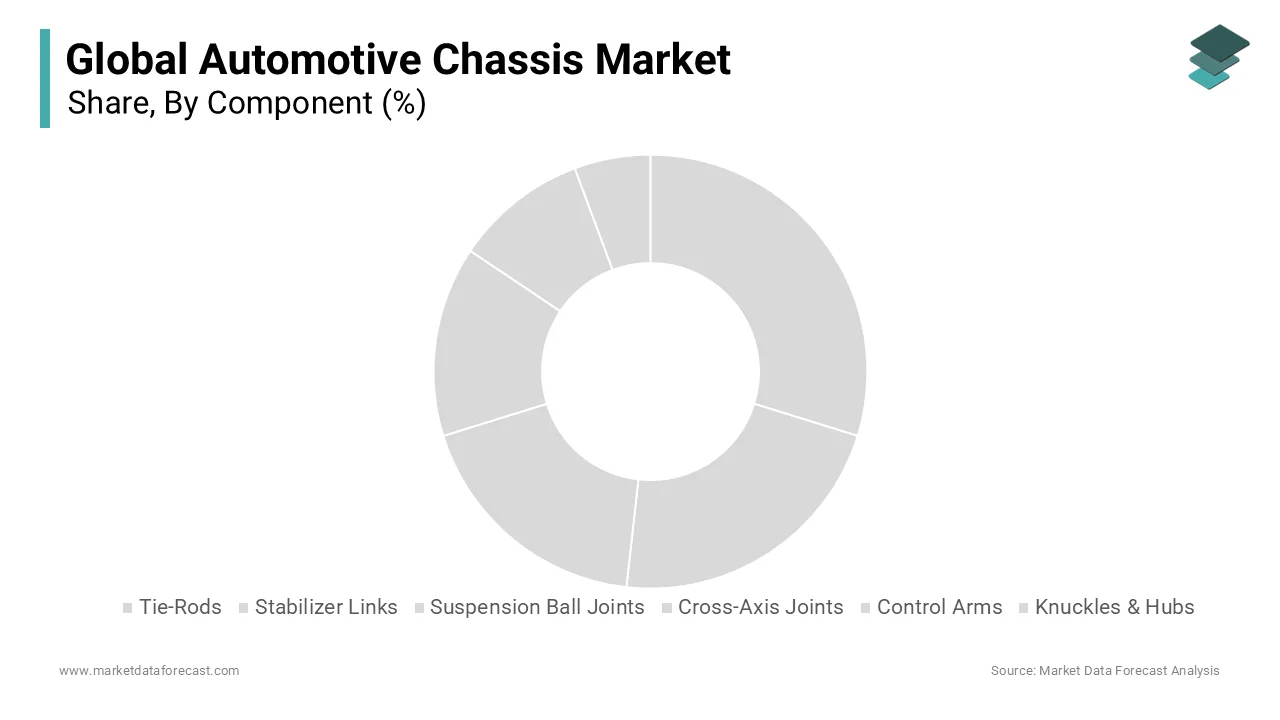

By Component

- Tie-Rods

- Stabilizer Links

- Suspension Ball Joints

- Cross-Axis Joints

- Control Arms

- Knuckles & Hubs

By Chassis System

- Front Axle

- Rear Axle

- Corner Modules

- Active Kinematics Control

By Vehicle Type

- Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Construction Equipment Vehicles

- Defense Vehicles

- Farm Tractors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the major factors influencing the growth of the global automotive chassis market?

Rising vehicle production, demand for lightweight chassis materials, advancements in electric vehicle (EV) architecture, and stringent fuel efficiency regulations are key drivers.

How is the shift toward electric vehicles impacting the automotive chassis industry?

EVs require specialized chassis designs with integrated battery packs, lightweight materials like aluminum, and enhanced aerodynamics for efficiency and performance.

What are the different types of automotive chassis, and how do they vary in application?

Key types include monocoque, ladder-frame, backbone, and modular chassis, each suited for different vehicle categories such as passenger cars, SUVs, trucks, and EVs.

Which regions hold the largest market share in the global automotive chassis sector?

Asia-Pacific dominates due to high vehicle production in China, India, and Japan, followed by North America and Europe with strong innovation in lightweight and EV chassis.

Who are the key players driving innovations in the automotive chassis market?

Leading companies include ZF Friedrichshafen, Magna International, Hyundai Mobis, Continental AG, and Aisin Seiki, focusing on lightweight materials, smart chassis systems, and modular designs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com