Global Automotive Coolant and Lubricant Market Size, Share, Trends and Growth Forecast Report, Segmented By Vehicle Type (Passenger Car, LCV, & HCV), Application (Coolant-Engine & HVAC, Lubricant-Engine, Brake, & Transmission), By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Automotive Coolant and Lubricant Market Size

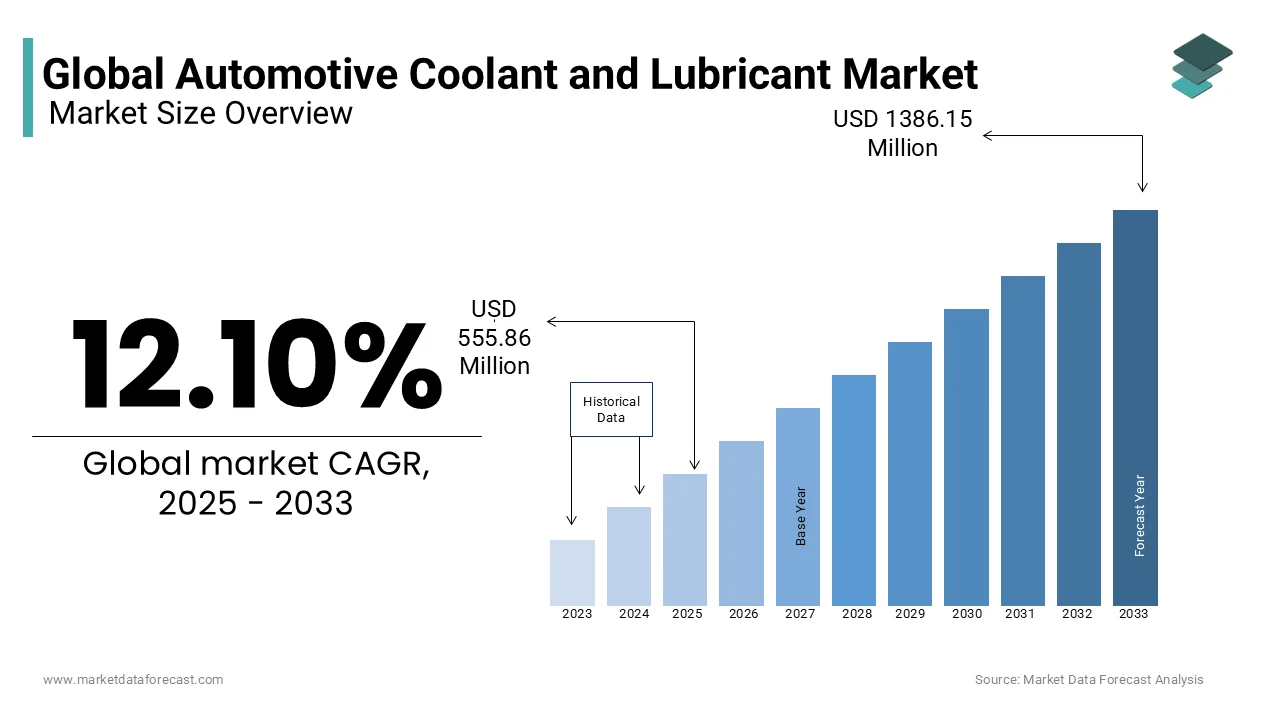

The global automotive coolant and lubricant market was valued at USD 495.86 million in 2024 and is anticipated to USD 555.86 million in 2025 from USD 1386.15 million by 2033, growing at a CAGR of 12.10% during the forecast period from 2025 to 2033.

The automotive coolant and lubricant market size is anticipated to be very slow in growth. The Asia Pacific region is expected to be leading the global automotive coolant & lubricant market, followed by North America, and is expected to grow during the forecast period of 2022 to 2027.

Market Drivers and Restraints

The quick increment in sales of vehicles in developing nations and the advancement of the framework has made a substantial demand for these coolants and lubricants, where the coolant contributes around 66% to the overall coolant and lubricant market as far as value. Different drivers of the lubricants and coolant market are the expanding interest in light-passenger vehicles and heavy-duty vehicles, expanding costs of traditional fuels, and the ascent in the average life expectancy of vehicles in the activity. Likewise, stringent emission standards forced by governments will similarly drive the lubricants and coolant markets for the automotive. The selection of bio-based oils that will diminish unsafe ecological impacts is the present pattern, and it will support the general development of the market. The interest in the eco-friendliness of vehicles has prompted the supplanting of conventional lubricants with engineered lubricants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.10% |

|

Segments Covered |

By Vehicle Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sinopec Corporation (China), J.X. Nippon Oil & Energy Corporation, Royal Dutch Shell Plc (Netherland), ConocoPhillips Lubricants, Exxon Mobil Corporation (U.S.), Royal Dutch Shell PLC, B.P. Plc (U.K.), Idemitsu Kosan Co. Ltd., Total S.A. (France), Chevron Corporation (U.S.), Lukoil Company, and PETRONAS (Malaysia), and Others. |

SEGMENT ANALYSIS

By Vehicle Type Insights

The passenger car segment was dominated the global automotive coolant market in the recent years.

REGIONAL ANALYSIS

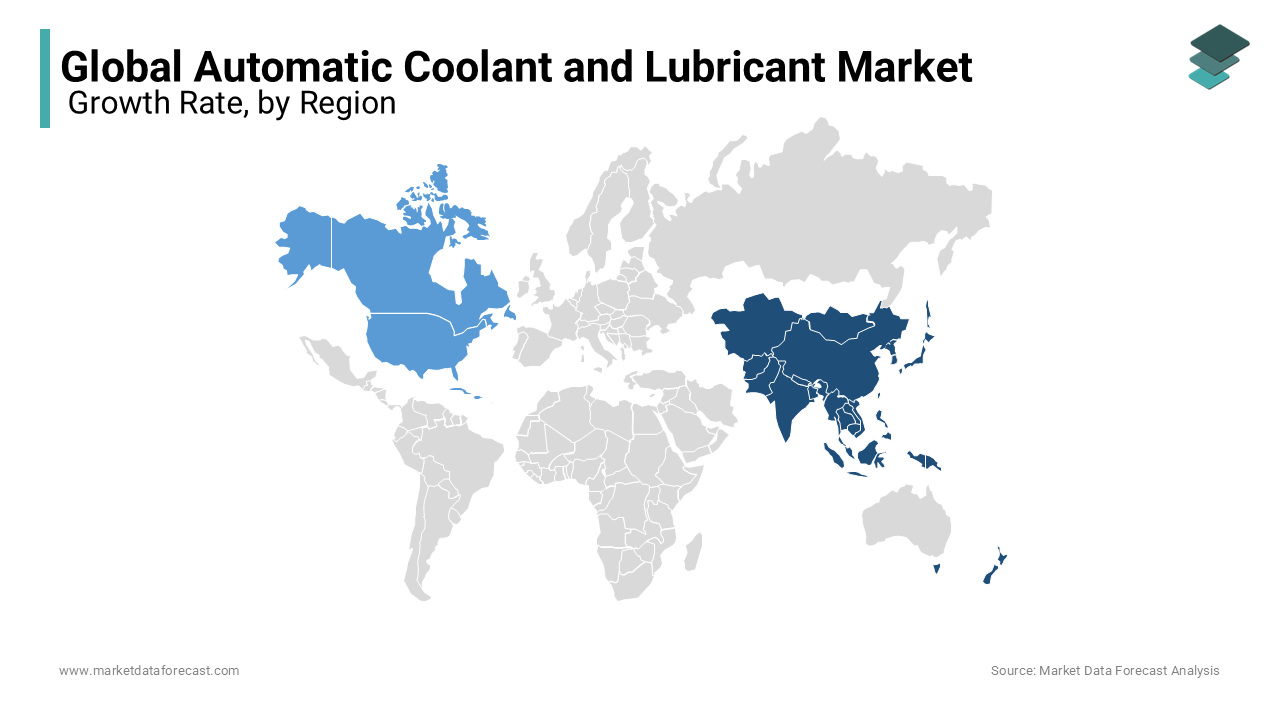

The business sectors for coolant and lubricant are assessed to be the biggest in the Asia Pacific region, which has a piece of the overall industry of about 53.63% and 51.68% for lubricant and coolant separately in 2017. China is a significant supporter of the development of the lubricant and coolant market in the Asia Pacific region. The worldwide interest in the lubricant and coolant markets is impelled by the expanding number of vehicles over the globe, the up-and-coming government guidelines, and the expanding lifespan expectancy of vehicles. North America is assessed to hold the second position in the business sectors for lubricant and coolant in 2017. A noteworthy supporter of these business sectors in the North American region is the U.S., which has the most significant manufacturing facilities of vehicles in this area.

KEY MARKET PLAYERS

Sinopec Corporation (China), J.X. Nippon Oil & Energy Corporation, Royal Dutch Shell Plc (Netherland), ConocoPhillips Lubricants, Exxon Mobil Corporation (U.S.), Royal Dutch Shell PLC, B.P. Plc (U.K.), Idemitsu Kosan Co. Ltd, Total S.A. (France), Chevron Corporation (U.S.), Lukoil Company, PETRONAS (Malaysia). Some of the market players dominate the global automotive coolant and lubricant market.

Syntix Lubricants renders high-quality lubricants, coolants, greases, and fluids for the entire automotive industry, allowing dealerships and professional garages to keep quality in their services to consumers. On meeting with each automotive organization, the company provides a customized supply of high-quality products, monitoring and adjusting usage, salvation, and costs to enable the sufficient trading flow.

MARKET RESEARCH REPORT KEY HIGHLIGHTS

- The calculation of the current market for your product or services and the future implications of the Automotive Coolant & Lubricant Market.

- Approaching the opportunities and demonstrating better the Automotive Coolant & Lubricant Market through size calculations and growth rate analysis. To predict the market for the forthcoming comprehensive segmentation and to learn the dynamics of the market at a very granular level by segmenting the market into the smallest segments.

- Approaching the Automotive Coolant & Lubricant Market dynamics including the drivers, restraints, and challenges to manifest insights for achieving market share.

- Broader segmentation to better learn the dynamics of the market at a minimal level by segmenting the market into small segments.

- Porter's Five Forces model is used to explain the competing scenario in the global Automotive Coolant & Lubricant Market. This report also includes an industry analysis that is focused on endeavoring a broad view of the Automotive Coolant & Lubricant Market.

RECENT HAPPENINGS IN THIS MARKET

- Gulf Oil India has agreed with Tata Motors to launch a range of co-branded lubricants for its passenger vehicle segment in India. According to Gulf Oil India, both companies will be marketing co-branded Tata Motors Genuine Oil in the high street bazaar market under this partnership.

- India's one of the largest carmakers Maruti Suzuki India (MSI), has extended the reach of its Ecstar branded lubricants, coolant, and car care products with the start of the range at 3,400 workshops under its Arena network.

MARKET SEGMENTATION

This research report on the global automotive coolant and lubricant market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Car

- LCV

- HCV

By Application

- Coolant-Engine & HVAC

- Lubricant-Engine

- Brake

- Transmission

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the major factors driving the demand for automotive coolants and lubricants worldwide?

Increasing vehicle production, rising demand for fuel efficiency, stringent emission regulations, and advancements in synthetic lubricants are key growth drivers.

How do technological advancements impact the formulation of modern coolants and lubricants?

Innovations in nano-lubricants, bio-based coolants, and low-viscosity synthetic oils enhance engine performance, reduce wear, and improve thermal management.

Which vehicle segments contribute the most to the growth of the coolant and lubricant market?

Passenger cars, commercial vehicles, and electric vehicles (EVs) significantly influence market growth, with EVs requiring specialized thermal management fluids.

What are the key environmental and regulatory challenges affecting the coolant and lubricant industry?

Stricter EURO 6, EPA, and ACEA regulations, sustainability goals, and the push for biodegradable and low-toxicity formulations impact product development and adoption.

Who are the leading players in the global automotive coolant and lubricant market, and what strategies are they adopting?

Companies like Shell, ExxonMobil, BP, Chevron, and TotalEnergies focus on R&D, mergers, and eco-friendly product lines to maintain a competitive edge.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com