Global Automotive Filters Market Size, Share, Growth, Trends, And Growth Forecast Report, Segmented By Filter Type (Fuel Filter, Engine Oil Filter, Engine Air Filter and Cabin Air Filter, Steering Filter, Coolant Filter), Application (Passenger Cars and Commercial Vehicles), Distribution Channel (OEM and Aftermarket), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis Forecast (2025 to 2033)

Global Automotive Filters Market Size

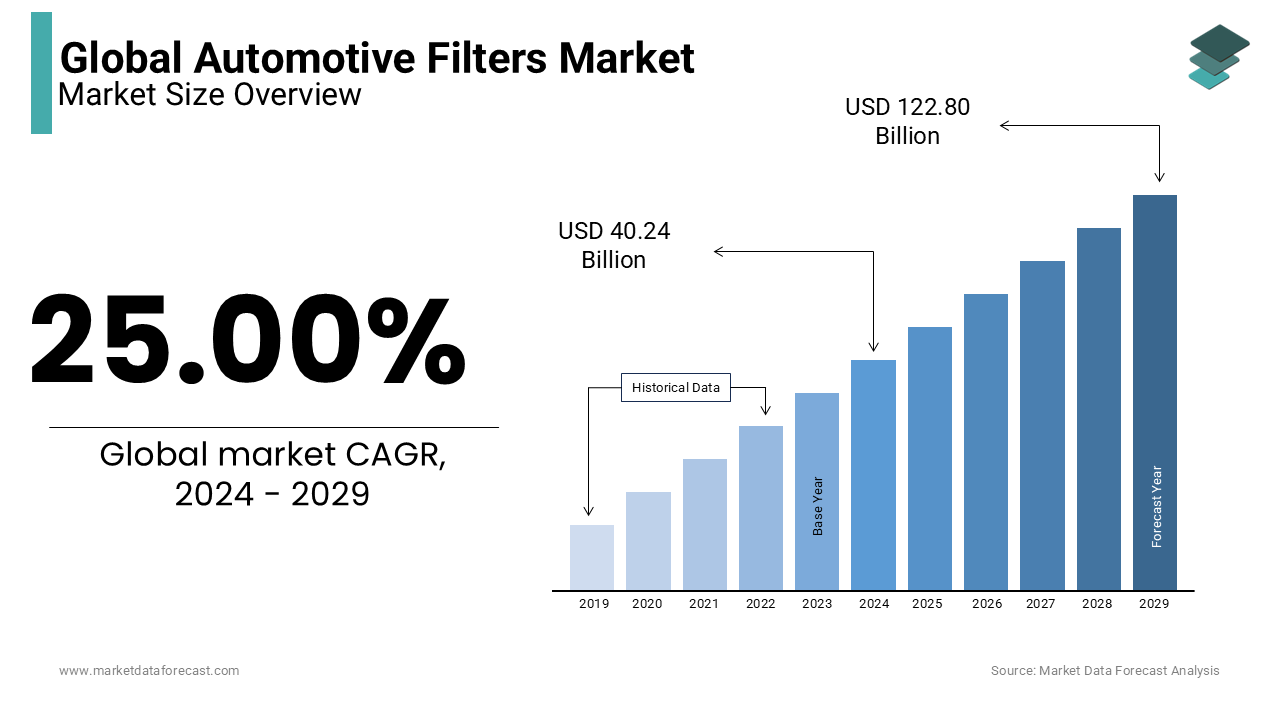

The global automotive filters market was valued at USD 40.24 billion in 2024 and is predicted to reach USD 50.30 billion in 2025 from USD 299.81 billion by 2033, growing at a CAGR of 25.00% during the forecast period from 2025 to 2033.

It is forecasted that due to factors such as the increase in vehicle production and the increase in the vehicle fleet, as well as the average number of kilometers traveled in all regions, the demand for automobile filters is increasing every year.

The booming automotive industry was the reason for the growth of the global market for vehicle filters. It is expected that a significant investment in the automotive sector in emerging economies will also bring a contraction to adjacent industries. In addition, it is expected that the government's growing interest in boosting economies through foreign investment will boost the growth of the automotive sector, which will have a positive impact on the global market for automotive filters in the coming years.

The filters of the cars prevent the entry of dirt particles, such as pollen, exhaust gases, bacteria, etc., into the carburetor and the engine. This minimizes air pollutants emitted by vehicles, reduces maintenance costs, and prolongs the life of the vehicle. The government and the emission agencies have issued strict emission laws for vehicles that emit dangerous gases, such as hydrocarbons (HC), nitrogen oxides (NOx), carbon monoxide (CO), and others. For example, the United States Environmental Protection Agency (EPA) has modified standards, such as the Greenhouse Gas Emissions (GHG) fuel consumption standards and light commercial vehicles (automobiles and trucks)). Similarly, German cities may prohibit old diesel vehicles in accordance with EU legislation to reduce air pollution. These factors are expected to drive global growth in the global automotive filter market.

In recent years, consumers have changed their preference for electric/plug-in vehicles because these vehicles do not consume fuels such as gasoline, diesel, and gasoline. In addition, low maintenance costs reduce overall spending, which increases the demand for battery-powered electric vehicles, which in turn drives the growth of the vehicle filter market. According to statistics from the Federal Office for Motor Transport, sales of plug-in electric vehicles in 2018 increased by 61% over the previous year. Likewise, sales of battery-powered electric vehicles increased by 124%, while sales of traditional plugless hybrids increased by up to 70%. Since no fuel or oil is used in these electric vehicles, there is no need for oil and fuel filters, which should hamper the growth of the oil and fuel filter market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.00% |

|

Segments Covered |

By Filter Type, Application, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MANN+HUMMEL (Germany), Donaldson (US), Robert Bosch (Germany), MAHLE (Germany), Sogefi (Italy), Denso (Japan), Ahlstrom-Munksjö (Sweden), ACDelco (US), Hengst (Germany), K&N Engineering (US), Volkswagen (Germany), Daimler AG (Germany), Ford Motor Company (US), Hyundai Motor Company (South Korea), Toyota Motor Corporation (Japan), Tata Motors (India), Mahindra & Mahindra Ltd (India), component manufacturer associations, Automotive Component Manufacturers Association of India (ACMA), Japan Automotive Manufacturers Association (JAMA), European Automobile Manufacturers' Association (ACEA), Canadian Vehicle Manufacturers' Association. |

REGIONAL ANALYSIS

In 2022, the largest share of the global automotive filter market was acquired by the Asia Pacific on account of burgeoning production in Asian countries. Europe, followed by the Asia Pacific, jointly held about 74% of the market in terms of revenue in 2016. The key factors that are driving the growth of the market in these regions are an increasing need for efficiency and productivity, coupled with the impetus to increase manufacturing activities. The emerging countries of Asia Pacific are expected to record the highest growth rate during the forecast period. Increasing production of passenger vehicles, owing to several factors such as lower cost of production, increase in productivity, and safety in the operation of vehicles, are set to drive the automotive filters market in this region during the forecast period.

KEY MARKET PLAYERS

MANN+HUMMEL (Germany), Donaldson (US), Robert Bosch (Germany), MAHLE (Germany), Sogefi (Italy), Denso (Japan), Ahlstrom-Munksjö (Sweden), ACDelco (US), Hengst (Germany), K&N Engineering (US), Volkswagen (Germany), Daimler AG (Germany), Ford Motor Company (US), Hyundai Motor Company (South Korea), Toyota Motor Corporation (Japan), Tata Motors (India), Mahindra & Mahindra Ltd (India), component manufacturer associations, Automotive Component Manufacturers Association of India (ACMA), Japan Automotive Manufacturers Association (JAMA), European Automobile Manufacturers' Association (ACEA), Canadian Vehicle Manufacturers' Association. Some of the major key players involved in the global automotive filters market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2018, Mercedes-Benz USA Offers the First Certified asthma & allergy-friendly automotive cabin air filter.

MARKET SEGMENTATION

This research report on the global automotive filters market has been segmented & sub-segmented based on the product type, type, and region.

By Filter Type

- Fuel Filter

- Diesel Filter

- Gasoline Filter

- Engine Oil Filter

- Engine Air Filter

- Cabin Air Filter

- Steering Filter

- Coolant Filter

By Application

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the projected market size and growth rate of the automotive filters market?

The global automotive filters market was valued at USD 40.24 billion in 2024 and is predicted to reach USD 50.30 billion in 2025 from USD 299.81 billion by 2033, growing at a CAGR of 25.00% during the forecast period from 2025 to 2033.

what segments are covered in the automotive filters market?

The automotive filters market is segmented By Filter Type, Application, Distribution Channel, and Region.

which type has the largest market share in automotive filters market?

Engine Oil Filter has the largest market share in the automotive filters market.

which is the fastest growing region in the automotive filters market?

Asia Pacific is estimated to grow with the highest CAGR 25% over the forecast period FROM 2025 to 2033.

who are the key market players in automotive filters market?

MANN+HUMMEL (Germany), Donaldson (US), Robert Bosch (Germany), MAHLE (Germany), Sogefi (Italy), Denso (Japan), Ahlstrom-Munksjö (Sweden), ACDelco (US), Hengst (Germany) etc... These are some major key players in automotive filters market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]