Global Automotive Interior Market Size, Share, Trends, And Growth Forecasts Report, Segmented By Vehicle Type (Passenger Car, Light Weight Commercial Vehicles, Heavy Weight Commercial Vehicles), Component Type (Cockpit Module, Central Console, Dome Module, And Interior Lighting, Headliner, Door Panel, Infotainment System, and Seat), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis 2025 to 2033

Global Automotive Interior Market Size

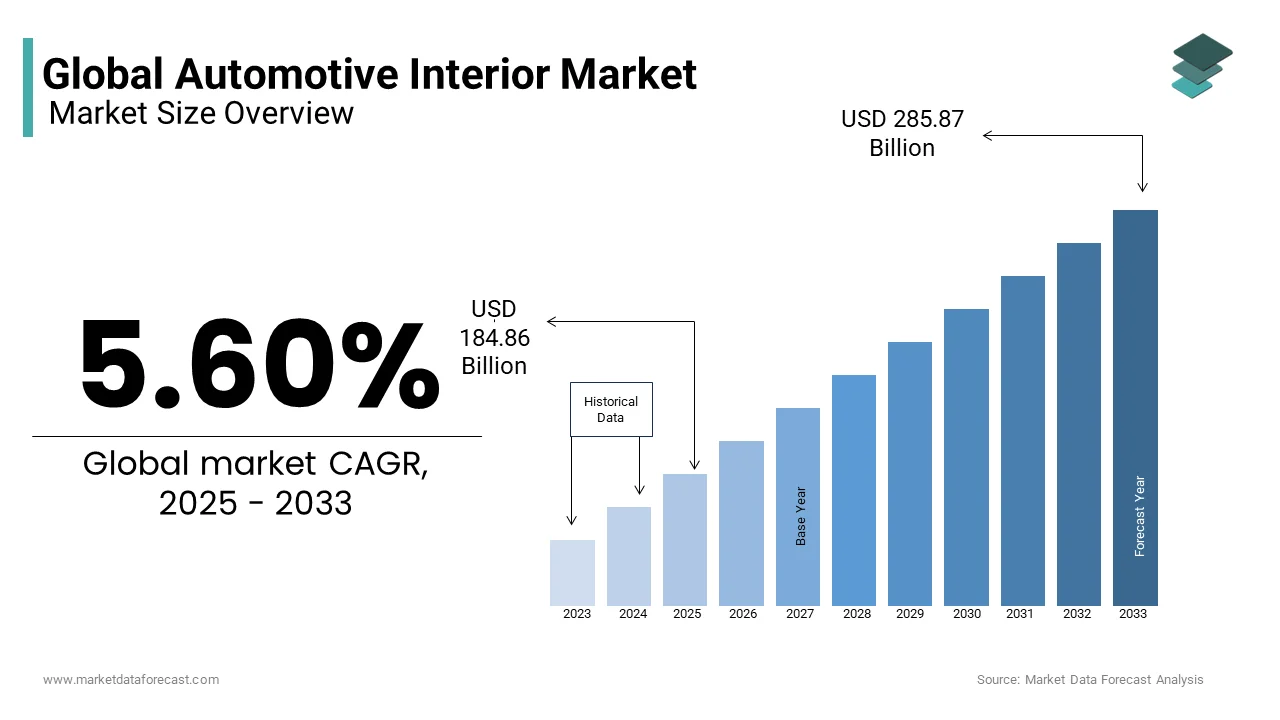

The global automotive interior market was valued at USD 175.06 million in 2024 and is anticipated to reach USD 184.86 billion in 2025, from USD 285.87 billion by 2033 and growing at a CAGR of 5.60% during the forecast period from 2025 to 2033.

The interior of the vehicle, consisting of components such as cockpit modules, headliners, door panels, automotive seats, and others, is specifically designed to provide the comfort, grip, and sound insulation of the vehicle cabin. Interior trims, upholstery, and other embellishments play a crucial role in the saleability of a car. In addition, the interior of the vehicle is the first and foremost factor that influences the buyer's understanding of the performance of the car.

The key factors driving the growth of the automotive interior market are the need to increase fuel efficiency, the technological advancement of cars and to focus on the well-being of drivers. Apart from the pure technological developments, there has been a tremendous increase in urbanization, and the average income of people has increased marginally, which led to the rise in the demand for better and luxury vehicles. This is a significant driver of the automotive interior market.

The rise in the trade war, the increase in car import tariffs, and the increase in raw material prices hinder the growth of the automotive interior market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.60% |

|

Segments Covered |

By Vehicle Type, Component, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities. |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lear Corporation (U.S.), Faurecia S.A. (France), Magna International, Inc. (Canada), Hyundai Mobis Co. Ltd. (South Korea), Panasonic Corporation (Japan), Toyota Boshoku Corporation (Japan), Continental AG (Germany), Calsonic Kansei Corporation (Japan), Delphi Automotive PLC (U.K.), and Tachi-S Co. Ltd. (Japan), and Others. |

SEGMENT ANALYSIS

By Vehicle Type Insights

The Passenger Car interior market is the largest market globally. The reason for this can be attributed to the passenger vehicles being the segment the automotive interior manufacturers most focus on. The technologies used in this type of vehicle are often changing due to high consumer demand for luxurious features.

Apart from this, the heavy commercial vehicle market is growing at the fastest CAGR. Such types of vehicles are used for the transport of bulky goods and public transport. Drivers of these vehicles spend a lot of time in the long-haul vehicle transporting goods and passengers. The interiors of these cars should, therefore, be more convenient and comfortable for both passengers and drivers. As a result of increased transportation facilities and urbanization, the need for the distribution of goods increased.

By Component Insights

The cockpit module holds the largest market share in terms of segmentation by component. The cockpit module is a pre-assembly of the driver systems in the dashboard. Over the years, both the usability and the features provided in the cockpit module have improved. The design of the module varies depending on the vehicle model and the increasing integration of electronics such as HVAC units, navigation, and safety systems.

REGIONAL ANALYSIS

Geographically speaking, the automotive interior market is led by the Asia-Pacific region, quickly followed by Europe and North America. The automotive industry is growing rapidly, with the middle-class population buying more vehicles, which, in turn, creates lucrative opportunities for players in the automotive interior industry.

Government initiatives in Asia-Pacific, such as subsidies and tax exemptions, are attracting automotive OEMs across countries to build their manufacturing plants in the region. China is one of the biggest vehicle buyers in the world. The demand for premium interiors, comfort, and new and innovative features, such as head-up displays and navigation systems, together with a growing focus on meeting safety standards, is driving the market in the region.

KEY MARKET PLAYERS

Some of the key players dominating the global automotive interior market include Lear Corporation (U.S.), Faurecia S.A. (France), Magna International, Inc. (Canada), Hyundai Mobis Co. Ltd. (South Korea), Panasonic Corporation (Japan), Toyota Boshoku Corporation (Japan), Continental AG (Germany), Calsonic Kansei Corporation (Japan), Delphi Automotive PLC (U.K.), Tachi-S Co. Ltd. (Japan).

GLOBAL AUTOMOTIVE INTERIOR MARKET RESEARCH REPORT KEY HIGHLIGHTS

- Evaluation of the current stage of the market and future implications of the market based on the detailed observation of Recent key developments.

- Address the matter by better understanding the market size estimates through CAGR analysis to forecast the future market.

- Comprehensive segmentation of the market, a detailed evaluation of the market by further sub-segments.

- Address market drivers and restraints and provide insights for gaining market share.

- Porter’s Five Forces are used to analyze the factors responsible for the shaping of the industry as a result of a competitive environment.

RECENT HAPPENINGS IN THE MARKET

- There have been significant developments in the world, and many top competitors in the market are adopting these values. For example, in January 2017, Yanfeng Automotive Interiors introduced a powered drum door to allow large-scale illumination with maximum design flexibility.

- Faurecia has launched an efficient wellness seat that senses the pressure or drowsiness of the driver and takes counter-measures to overcome these problems. The seat comes with enhanced features, such as a massage facility and uniquely designed sensors that monitor the heartbeat and breathing rhythm of the driver.

MARKET SEGMENTATION

This research report on the global automotive interior market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Car

- Light Weight Commercial Vehicles

- Heavy Weight Commercial Vehicles

By Component

- Cockpit Module

- Central Console

- Dome Module

- Interior Lighting

- Headliner

- Door Panel

- Infotainment System

- Seat

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global automotive interior market?

As of the latest data, the automotive interior market in North America is valued at USD 184.86 billion in 2024.

Which factors are contributing to the growth of the automotive interior market in Europe?

The growth in Europe is fueled by increasing consumer demand for advanced in-car technologies, emphasis on premium interior materials, and a rising trend towards electric vehicles.

What are the key trends shaping the automotive interior market in Asia-Pacific?

In Asia-Pacific, key trends include the integration of smart technologies, a focus on lightweight materials for fuel efficiency, and a surge in demand for luxury features in vehicles.

How does the trend of autonomous vehicles impact the automotive interior market in North America?

In North America, the trend toward autonomous vehicles is driving innovations in interior design, focusing on comfort, entertainment, and flexible seating arrangements.

What is the role of artificial intelligence in enhancing user experience in the Automotive Interior Market in Japan?

In Japan, artificial intelligence is playing a significant role in enhancing user experience, with AI-powered systems for voice recognition, climate control, and adaptive infotainment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]