Global Battery Recycling Market Size, Share, Trends & Growth Forecast Report - Segmented By Chemistry of Battery (Lead Acid, Lithium-ion Based, Nickel-Based And Others), Source of Spent Battery(Automotive, Industrial, Consumer & Electronic Appliance And Others), End-User, Material, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

Global Battery Recycling Market Size (2024 to 2032)

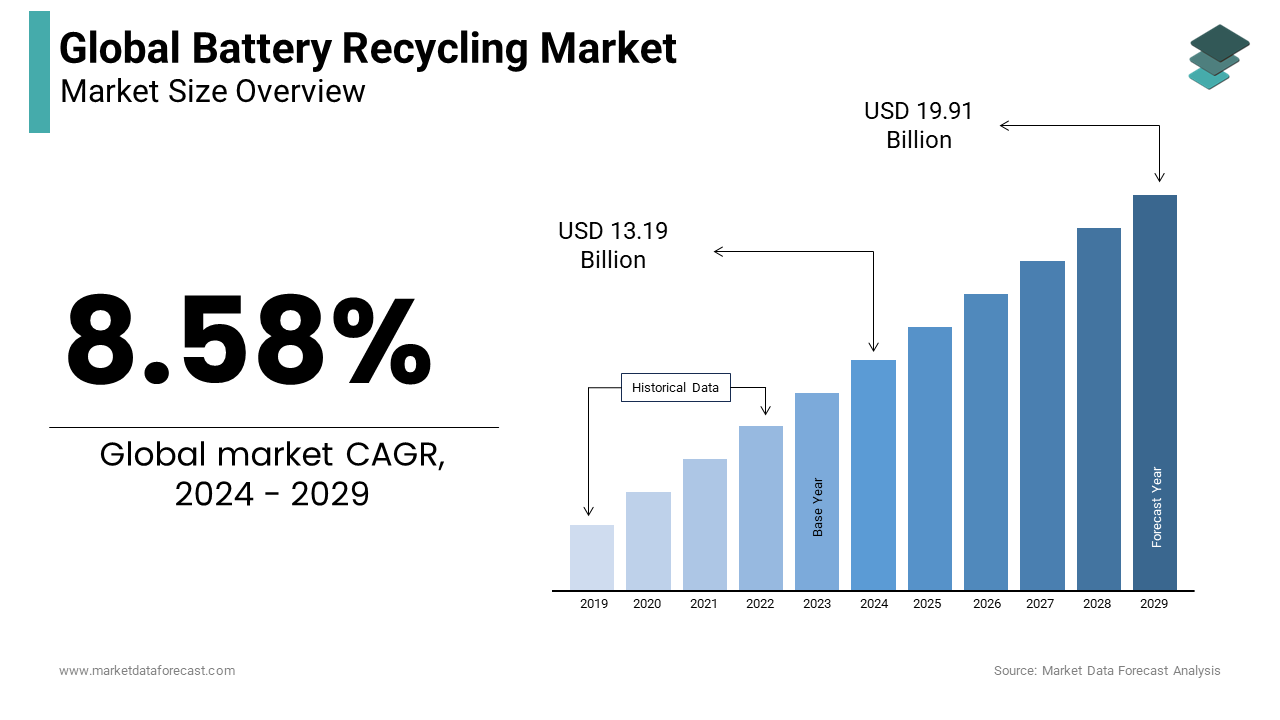

The Global Battery Recycling market was valued at USD 12.15 billion in 2023. The global market size is expected to grow at a CAGR of 8.58% from 2024 to 2032 and be worth USD 25.48 billion by 2032 from USD 13.19 billion in 2024.

MARKET OVERVIEW

The Battery Recycling Market is a newly emerging, fast-growing market with the scope to expand worldwide. The demand for an innovative and better solution for alternate sources of energy in the urbanizing world can be satisfied by recycling. The United States Department of Energy has announced a total of USD 20.5 million to be invested in lithium-ion battery recycling. The investment consists of USD 15 million to be invested in the R&D recycling center in collaboration with The National Renewable Energy Laboratory, Argonne National Laboratory, and Oakridge National Laboratory, and a USD 5.5 million reward for the company which comes up with an innovative solution for collecting, storing and recycling lithium-ion batteries.

MARKET DRIVERS AND RESTRAINTS

Strict government rules to control environmental dangers during battery manufacturing and disposal are driving the expansion of the battery recycling market. Market experts and major decision-makers of the governments in several countries are stressing the requirement for systematic approaches for the recycling of batteries to achieve more recycling rates.

The laws and regulations relating to the disposal and recycling of spent batteries differ from country to country and also local governments. Worldwide, the rising government directives and rules to curb pollution levels and control greenhouse gas releases will offer momentum to drive the battery recycling market. Strict government rules to control environmental barriers throughout battery manufacturing and disposal are driving the expansion of the battery recycling market. Business. In spite of the soaring interest in battery recycling from the automotive segment, interest in battery recycling from battery material miners is on the rise.

Battery material miners are highly investing in research and development, as their present technologies are suitable and adaptive to recycling procedures. In spite of many efforts being made to enhance the efficiency, safety, and energy density of lithium-ion batteries, focusing on recycling lithium-ion batteries is estimated to gain high momentum. In the present scenario, technological developments together with government initiatives are some of the major factors which are influencing the expansion of the market for battery recycling. Also, a notable development in recycling technologies, changes in recycling procedures, and positive impacts of recycling on the environment are some of the other factors which will continue to drive the battery recycling market throughout the foreseen period.

The rising center of attention on lithium-ion battery recycling is one of the new battery recycling industry fashions seen in recent years. This is owing to more great expansion opportunities related to the lithium-ion battery sector. Moreover, the worldwide industry furthermore is estimated to witness expansion opportunities in response to the rising industrial battery recycling segment. The high recycling rate related to lead-acid batteries and the rise in focus on the lithium-ion battery furthermore boosts the worldwide battery recycling industry expansion. Disposal of these batteries in garbage slums also hinders the recycling procedure owing to the hard time faced in arranging these batteries. This leads to pollution in the environment together with different other dangers.

MARKET OPPORTUNITIES

The automotive segment has risen as the dominating application of batteries owing to the employment of lead-acid batteries in vehicles. This on the other hand is estimated to create high development opportunities for the major players in the worldwide battery recycling industry. The rising number of hybrid and EV batteries is also making lucrative expansion opportunities for the expansion of the battery recycling industry in the upcoming years.

MARKET CHALLENGES

Obstacles regarding lithium-ion batteries are estimated to hinder the total industry expansion during the foreseen period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.58% |

|

Segments Covered |

By Chemistry, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

Call2Recycle Inc. (U.S.), Battery Solutions LLC (U.S.) Exide Technologies (U.S.), Gravita India Limited (India), Johnson Controls Inc.(U.S.), Retriev Technologies Inc.(US), East Penn Manufacturing Company(US), EnerSys(US), G & P Batteries(UK), Umicore N.V.(Belgium), Accurec Recycling GmbH(Germany), Aqua Metals Inc.(US), Vinton Batteries Limited(UK), Recupyl SaS(France), COM2 Recycling Solutions (Canada) |

SEGMENTAL ANALYSIS

Global Battery Recycling Market By Chemistry

Among the different types of chemicals used in batteries, the lead-acid battery sector dominated the global market in 2023 and is anticipated to witness the highest growth rate among others. Lead acid is the most common chemical used in many automotive and industrial applications which is the exact reason for its leading growth rate. Lithium-ion batteries are next hight revenue generators in this market followed by nickel-based batteries.

Global Battery Recycling Market By Application

Of the mentioned, applications in the automotive sector are the largest in terms of volume and value. Since the automotive battery is the most important source of power in a vehicle that is independent of fuel, there is an immense demand in this sector which keeps driving the global market.

REGIONAL ANALYSIS

On the basis of regions, Europe led the global battery recycling industry due to strict governmental rules like battery directives. Battery recycling is known to be a judicial perspective in this region which is the significant factor that makes this region the biggest one in the battery recycling industry. The European Commission has stated that this command bestows the shielding, preservation, and enhancement of the quality of the atmosphere. Nevertheless, the industry in the Asia Pacific is estimated to develop at a major pace due to the rise in the call for batteries in advancing nations like India and China. On the other side, the recycling rate of employed lead-acid batteries is more in the North American regions. More than 20 states in the United States have state recycling needs in impact and close to eight states have sanctioned battery makers to provide battery recycling.

Europe is estimated to be the quickest developing market, as it is a key recycler of all chemistries of used batteries. The rising result of spent batteries from different end-use sources, like automotive, industrial, and customer & electronic appliances is responsible for the expansion of the Europe battery recycling market. Strict environmental rules for proper disposal and recycling of batteries in economies, like Germany and the U.K., are also among the factors estimated to drive the European battery recycling market during the foreseen period. Major countries in the European business are Germany, the U.K., France, Russia, and Italy.

RECENT HAPPENINGS IN THE MARKET

- Call2Recycle, an industry-funded battery recycling company that recycled over 7.2 million pounds of batteries in 2020, has launched its branch in the United States ahead of National Battery Day.

- Porter’s Five Forces are used to analyze the factors responsible for the shaping of the industry as it is as a result of the competitive environment.

KEY PLAYERS IN THE BATTERY RECYCLING MARKET

Call2Recycle Inc. (U.S.), Battery Solutions LLC (U.S.) Exide Technologies (U.S.), Gravita India Limited (India), Johnson Controls Inc.(U.S.), Retriev Technologies Inc.(US), East Penn Manufacturing Company(US), EnerSys(US), G & P Batteries(UK), Umicore N.V.(Belgium), Accurec Recycling GmbH(Germany) are some of the notable companies in the global battery recycling market.

DETAILED SEGMENTATION OF THE GLOBAL BATTERY RECYCLING MARKET INCLUDED IN THIS REPORT

This research report on the global battery recycling market has been segmented and sub-segmented based on chemistry, application, end-user, and region.

By Chemistry

- Nickel-Based

- Lithium-ion Based

- Lead Acid

By Application

- Automotive

- Industrial

- Consumer & Electronic Appliances

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com