Global Bike and Scooter Rental Market Size, Share, Trends & Growth Forecast Report, Segmented By Service (Pay as you go ahead, Subscription-based), Propulsion (Pedal, Electric, Gasoline), Operational Model (Dockless, Station-based), Vehicle Propulsion (Bike, Scooter) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Industry Analysis From 2025 to 2033

Global Bike and Scooter Rental Market Size

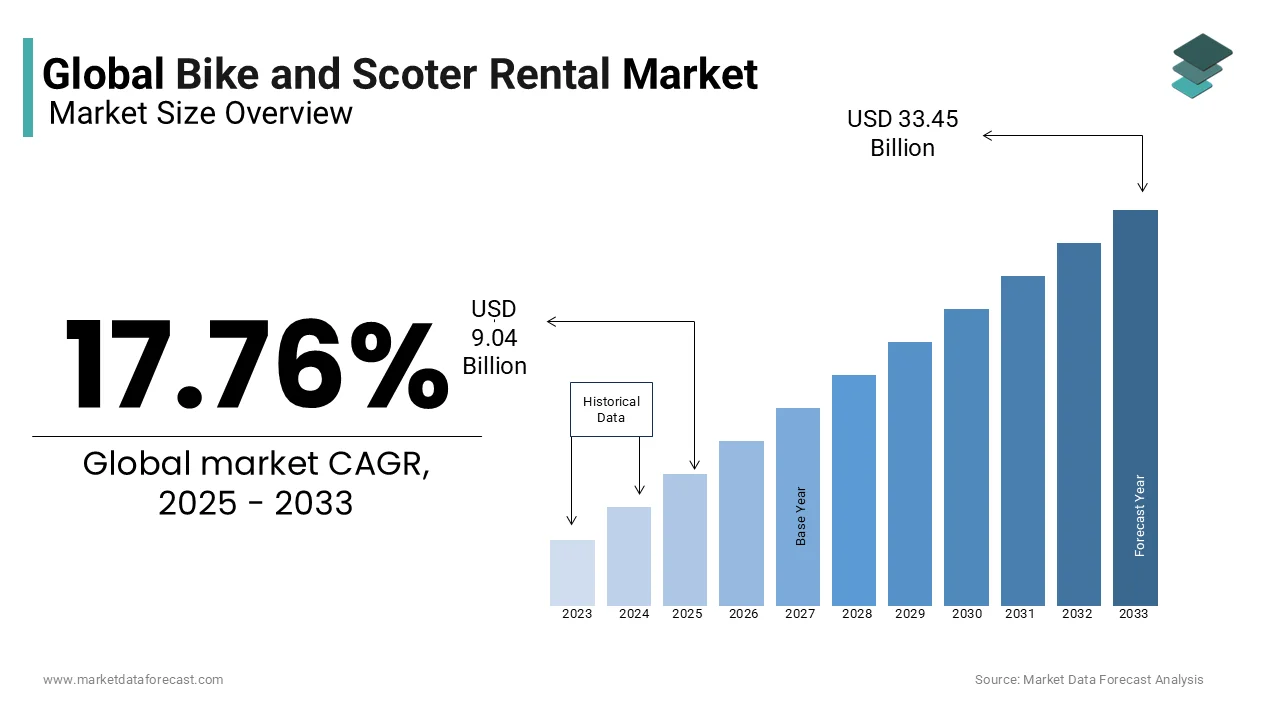

The global bike and scooter rental market was valued at USD 7.68 billion in 2024 and is anticipated to reach USD 9.04 billion in 2025 from USD 33.45 billion by 2033, growing at a CAGR of 17.76% during the forecast period from 2025 to 2033.

Clients can distinguish the docks nearest to them where they will lease the automotive and choose the dock nearest to their destination and submit their automotive at that specific area. The specialist co-ops of this service are offering their varieties of assistance over mobile applications to upgrade the convenience for clients. The growing occasion of interest for climate amicable and outflow-free strategies for transportation is mounting the shares of the market. The scooter and bike rental market is encountering noteworthy development thanks to the expanding adaption of micro-mobility benefits as a straightforward method and budget-friendly method of transportation. The necessity for the advancement of sustainable methods of transportation is the other significant factor driving the event of the bike and scooter rental market.

MARKET DRIVERS

The rising traffic congestion on roads plus the adoption of electrically powered vehicles is anticipated to produce lucrative growth opportunities for the market. The increased preferences for micro-mobility services as a means of transport due to their cost effectiveness will drive this market growth. Concentration on the development and availability of sustainable modes of transportation has a positive impact on the expansion of this market.

Various marketing campaigns and promotional offers provided by various market players of these services are enhancing the speed of adoption; this factor also will boost the expansion of the bike and scooter rental market.

MARKET RESTRAINTS

Players are offering some discounts and offers to attract customers despite the actual fact that customer retention is one of the numerous challenges faced by players within the scooter and bike rental market. The absence of framework accessibility is required for the successful tasks of this service; this factor is relied upon to hamper the event of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.76% |

|

Segments Covered |

By Service, Propulsion, Operational Model, Vehicle Propulsion, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bird, Jump, Grow Mobility, Lime, Ofo, nextbike, COUP, and Cityscoot, and Others. |

SEGMENT ANALYSIS

By Service Insights

By Operational Model Insights

Today, bikes are often found and unlocked using cellular phone Operational Models and this can is likely to upsurge the event of the scooter and bike rental industry over the estimated time span.

By Vehicle Propulsion Insights

The scooter and bike rental or hire business leases scooter and bike for a shorter timeframe, explicitly for the number of hours. The service co-ops give scooters and bikes to individuals who haven't got access to automobiles, that is, travelers and tourists. The service organizations who deal in giving scooters and bikes on lease have specialized their stores in areas, for instance, sea shores, vacation areas, and parks.

REGIONAL ANALYSIS

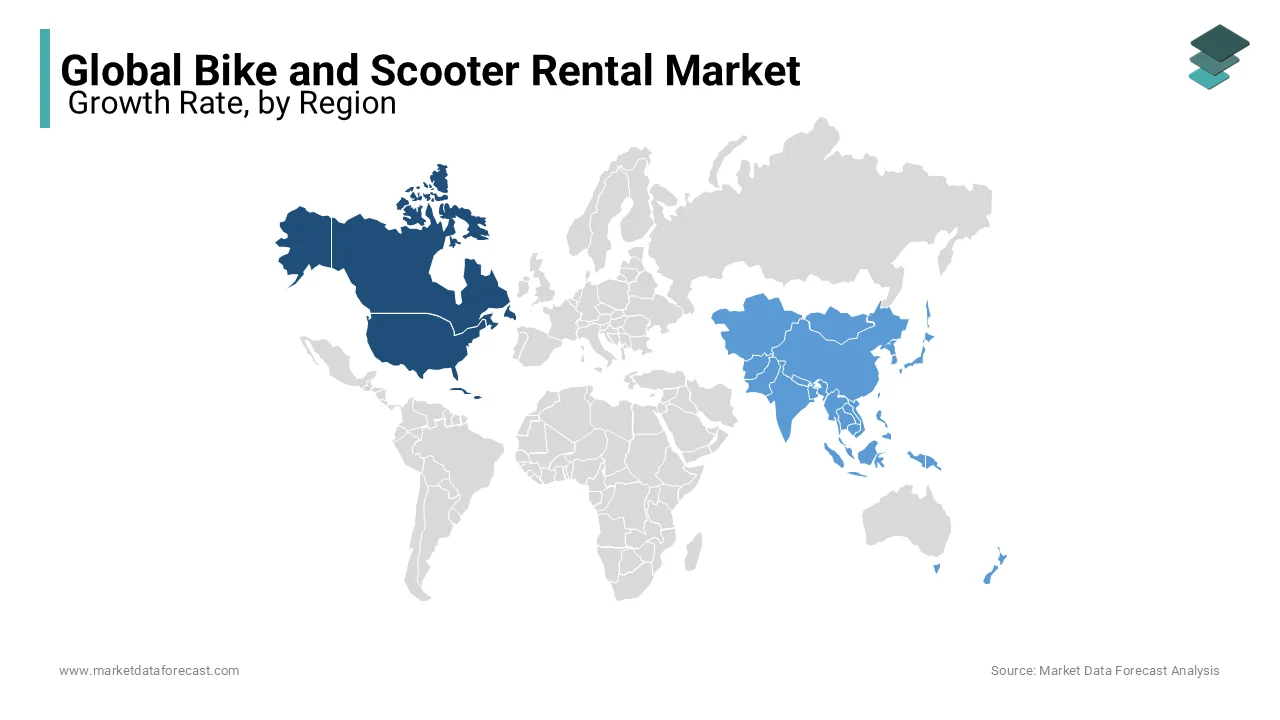

North America is probably going to carry a high share of the scooter and bike rental market. This can be fundamentally thanks to the presence of some prevalent players within the district.

Asia-pacific is relied upon to develop because the quickest area within the worldwide scooter and bike market. Asia-Pacific is likewise foreseen to display the most elevated development rate/CAGR over the figure timeframe 2019-2026 due to progress in lifestyle and increment in the working populace. The administration activity with regard to producing low-pollution automobiles within the developing nations of Asia Pacific, for instance, China and India, together with the presence of big market players in the vehicle industry, are flooding the Asia Pacific area within the scooter and bike rental market.

KEY MARKET PLAYERS

Bird, Jump, Grow Mobility, Lime, Ofo, Nextbike, COUP, Cityscoot. These are the market players that are dominating the global bike and scooter rental market.

RECENT HAPPENINGS IN THIS MARKET

- The bird will not stop rolling out new cars and new mobility services. Bird has recently divulged the Bird Cruiser, an electrical automobile that's basically a combination between a bicycle and a moped. The Bird Cruiser can accommodate up to 2 people and, depending on the market, the Cruiser will help pedal or simply have an ankle. This indicates Bird's first movement out of the scooter space.

- Bird, perceiving the developing chance that individuals will claim electric bikes as against sharing them, is propelling another bike model accessible for procurement. Called the Bird One, it'll be accessible for proprietorship and shared-use cases. Bird is additionally dumping the Ninebot ES and betting on its own M365 model for month-to-month personal rentals.

- E-bike rental start-ups Lime and Bird are suspending their services in many urban areas across Europe and the past because the coronavirus episode puts further a money pressure on the technology industry. Lima also drives its bikes and scooters off avenues across vast areas of the United States and Canada.

- Jump, the scooter and bicycle rental organization claimed by Uber, is getting a makeover. The bike share organization uncovered the subsequent age of its electric-powered bikes. The expectation is that these new, technology bikes will spike Uber's push to dominate the micro-mobility space, which is becoming progressively serious and increasingly costly to explore.

- Ojo, a California electric bike organization, declared its aim to obtain Gotcha, a motorcycle and scooter rental service. It's another sign that the mutual micro-mobility industry is oversaturated and requires consolidating.

MARKET SEGMENTATION

This research report on the global bike and scooter rental market is segmented and sub-segmented into the following categories.

By Service

- Pay as You Go

- Subscription-Based

By Propulsion

- Pedal

- Electric

- Gasoline

By Operational Model

- Dockless

- Station-Based

By Vehicle Propulsion

- Bike

- Scooter

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the global bike and scooter rental market?

Increasing urbanization, rising fuel prices, demand for eco-friendly transportation, smart city initiatives, and advancements in IoT-enabled fleet management.

How do pricing models vary among different bike and scooter rental services?

Operators use pay-per-minute, subscription-based, and fixed-rate models, with dynamic pricing influenced by demand, location, and peak hours.

What are the key challenges faced by bike and scooter rental companies?

Regulatory restrictions, fleet maintenance costs, vandalism, parking issues, and the need for infrastructure improvements like docking stations and charging hubs.

Which regions dominate the bike and scooter rental market, and why?

North America, Europe, and Asia-Pacific lead due to high urban density, strong government support for micro-mobility, and advanced smart mobility ecosystems.

Who are the major players in the global bike and scooter rental industry?

Bird, Jump, Grow Mobility, Lime, Ofo, Nextbike, COUP, Cityscoot. These are the market players that are dominating the global bike and scooter rental market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]