Global Biofuel Enzymes Market Size, Share, Trends & Growth Forecast Report By Type, Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Biofuel Enzymes Market Size

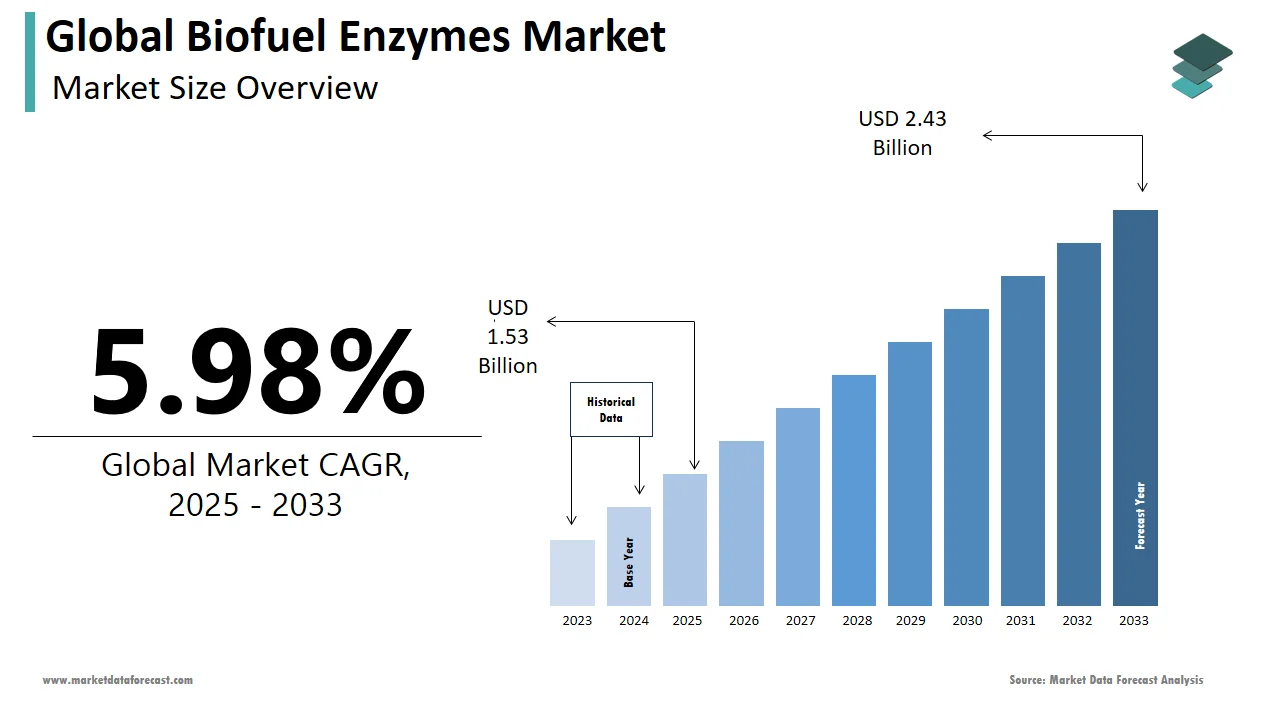

The size of the global biofuel enzymes market was worth USD 1.44 billion in 2024. The global market is anticipated to grow at a CAGR of 5.98% from 2025 to 2033 and be worth USD 2.43 billion by 2033 from USD 1.53 billion in 2025.

Biofuels, mostly made up of waste plant and animal matter, are an unlimited and sustainable energy source. Biofuel proteins are natural catalysts that change and speed up processes, increasing efficiency, performance, and environmental benefits. Biofuel enzymes are used to manufacture ethanol, biodiesel, methanol, and biobutanol, which are all excellent biofuels. They can potentially replace petroleum-based fuels and reduce reliance on imported fuels. Biofuel enzymes improve product specificity and efficiency. Enzymes allow for less energy use during the manufacturing process. Enzymes can also be used with unprocessed feedstock, such as waste oil, without necessitating the extraction of free fatty acids that may be abundant in the feedstock, which is not achievable with traditiona catalysts.

MARKET DRIVERS

Growing environmental concerns and government initiatives to create a blend of biofuels have been the primary drivers of the global biofuel enzymes market.

Expanding the use of bio-based ethanol and biodiesel, which lowers fuel costs and reduces carbon dioxide emissions, propels the growth of the biofuel chemicals market. The biofuel enzymes market is expected to develop due to a shift in consumer preference for celluloses and related enzymes in ethanol production. The market is likely to grow as government policies and legislation encouraging biofuel blends become more prevalent. The availability of coal is driving the demand for biofuel enzymes. Coal is the most extensively used feedstock in the biofuel enzymes market because it is abundantly available and easy to get. Coal is also very compatible with various synthetic natural gas production technologies employed in the coal industry.

The global market for biofuel enzymes is being driven by the increasing replacement of the global demand for biofuel due to the higher conversion of biomass to biofuels made possible by biofuel enzymes, which helps to provide a good source of clean and sustainable energy. Many industries, including transportation, power, chemical, home, and agriculture, have begun to use biofuel enzymes in their manufacturing processes, increasing the demand for biological enzymes in the coming years. In addition, stringent environmental regulations and growing demand for fuel-efficient automobiles will boost market progress. The growing focus on pollution control and energy-efficient fuel in the automotive and manufacturing sectors is expected to boost market growth.

MARKET RESTRAINTS

One of the significant hurdles for the biofuel enzymes market is the capital expenditure required to set up biofuel facilities. Setting up biofuel gas operating plants also necessitates a considerable cost of resources and time, a massive challenge in the biofuel enzymes market. The leading market companies face challenges in commercializing lignocellulosic ethanol and developing low-cost enzymes for lignocellulosic biofuel.

IMPACT OF COVID-19 ON THE GLOBAL BIOFUEL ENZYMES MARKET

The COVID-19 epidemic has significantly impacted the global market for biofuel enzymes. The COVID-19 epidemic slowed economic growth in nearly every major country, changing consumer purchasing patterns. In addition, national and international transportation have been hampered because of the lockdown imposed in some countries, which has significantly impacted the supply chains of various industries worldwide, worsening the supply-demand imbalance. As a result, insufficient raw material supply is projected to slow the production rate of biofuel enzymes, reducing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Novozymes A/S, E.I. du Pont de Nemours and Company, SunsonIndustry Group Co. Ltd., SinoBios, Specialty Enzymes & Biotechnologies, Transbiodiesel Ltd., Enzyme Supplies Limited, Koninklijke DSM N.V., AB Enzymes GmbH, and Advanced Enzyme Technologies Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

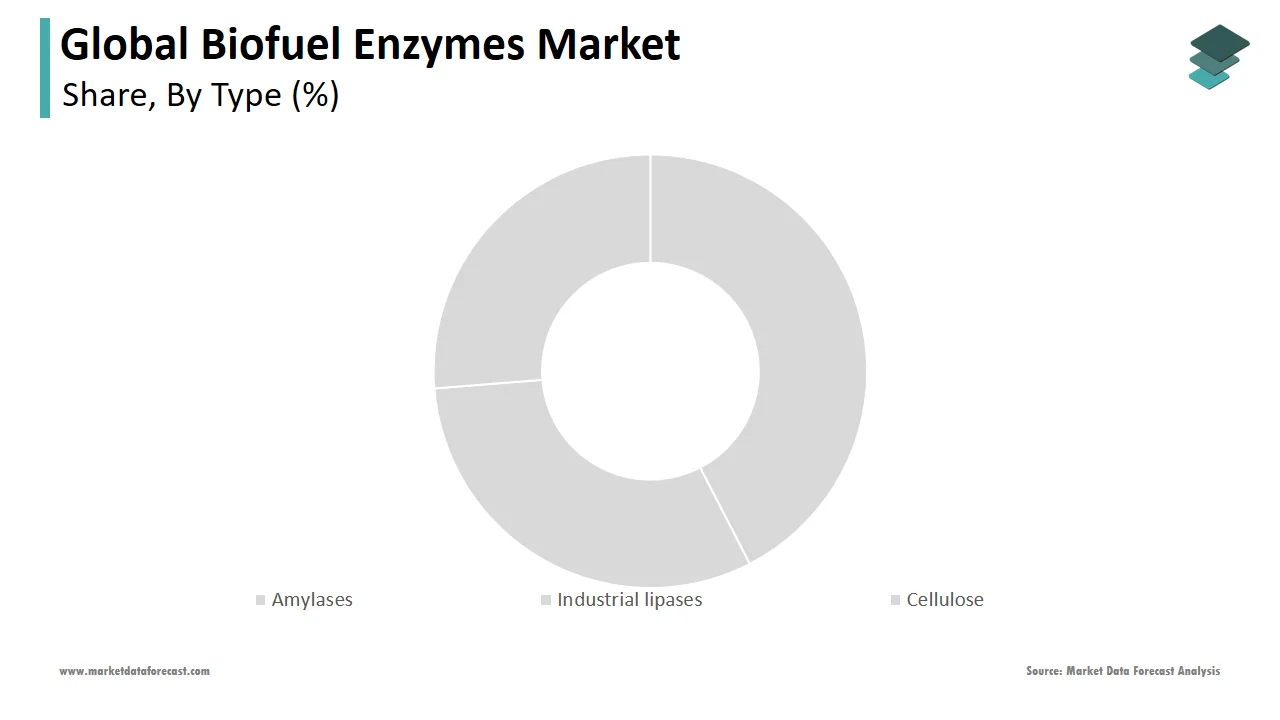

In 2024, the cellulase segment dominated the biofuel enzymes market. Cellulase is one of the numerous enzymes that catalyze cellulolysis, which is the degradation of cellulose and similar polysaccharides. Cellulase is produced mainly by fungi, bacteria, and protozoans. In addition, different forms of metazoan creatures, such as termites, snails, and earthworms, produce endogenous cellulases. Cellulase enzymes are often employed to break down the cellulose in plant cell walls into simple sugars that can be converted into fuels, predominantly ethanol, chemicals, polymers, textiles, detergents, medicines, and a variety of other products by microbes. This mainly drives the demand for cellulose in the biofuel enzymes market.

By Application Insights

Because of the increased preference for biofuels over conventional fuels in automotive and power generation applications, the biodiesel segment will likely dominate the biofuel enzymes market. Biodiesel can meet current engine criteria in automobiles, which is expected to increase the demand for fuel. Furthermore, the market expansion is likely to be aided by government mandates requiring greener fuels. The demand for biodiesel is expected to be driven by the increasing depletion of fossil fuels and the need to optimize renewable sources in the energy mix for long-term growth. Biodiesels, unlike other biofuels, can be manufactured in existing diesel-producing plants, which is projected to have a substantial impact.

REGIONAL ANALYSIS

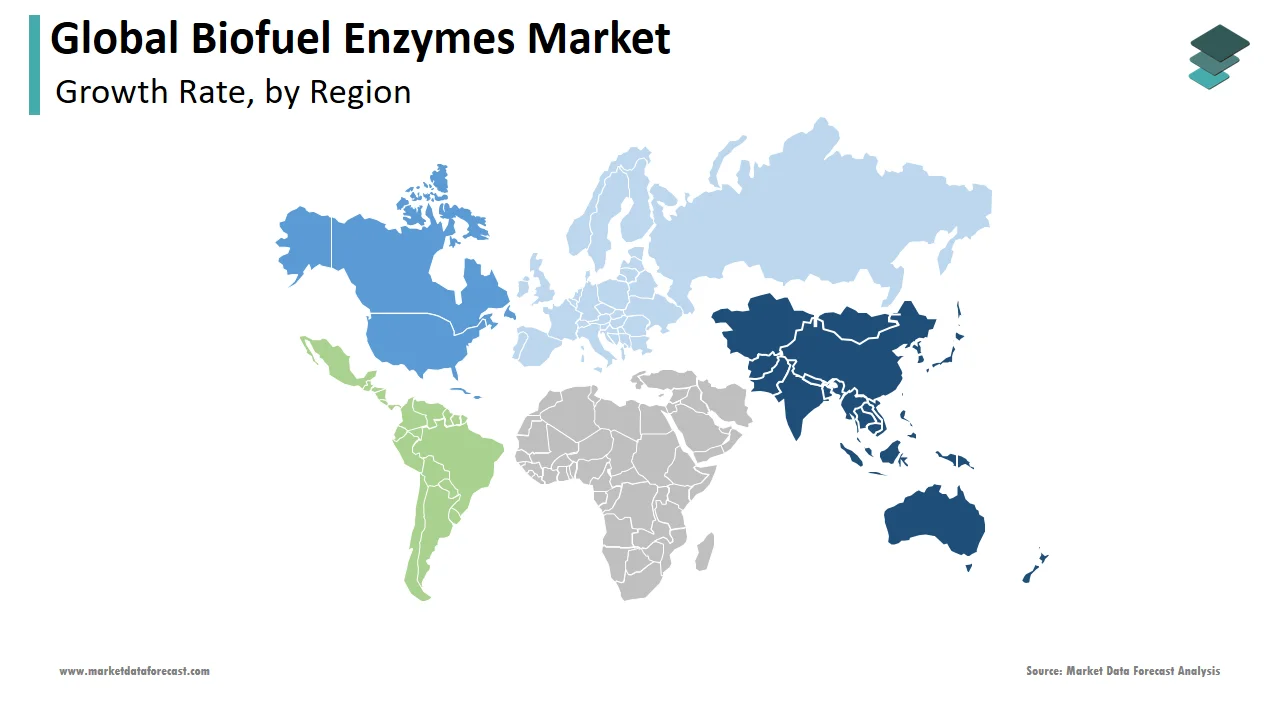

In 2024, the Asia-Pacific region had the highest share of the biofuel enzymes market. The rapid growth of the population in nations such as India and China and the rising need for fuel and power is driving up the demand for biofuel enzymes in the region. India is one of the world's top oil consumers, with the world's highest LPG (Liquefied Petroleum Gas) demand. In comparison to CNG, biofuel enzymes have a faster flame speed.

Because of increased ethanol production in the United States and rising biofuel use in Canada, the North American region is predicted to grow fastest throughout the forecast period. The majority of ethanol is made from corn/starch, one of the lower-yielding feedstocks. With bioenergy for transportation, the region is making significant progress toward replacing gasoline with cleaner biofuels. As a result, it has substantially impacted the biofuel enzymes market's growth.

Because of the increased need for biofuels, the market for biofuel enzymes is rapidly growing in Europe. Biofuels meet the region's significant challenges, including greenhouse gas emissions, depletion of natural resources, and the requirement to adhere to Kyoto Protocols, which has helped the lucrative expansion of the biofuel enzyme market. In addition, the European Union is making significant progress in bioenergy for transportation and biofuel in response to rising oil prices. As a result of this problem, the market for biofuel enzymes has expanded.

KEY MARKET PARTICIPANTS

Novozymes A/S, E.I. du Pont de Nemours and Company, SunsonIndustry Group Co. Ltd., SinoBios, Specialty Enzymes & Biotechnologies, Transbiodiesel Ltd., Enzyme Supplies Limited, Koninklijke DSM N.V., AB Enzymes GmbH, and Advanced Enzyme Technologies Ltd are a few of the promising companies operating in the global biofuel enzymes market profiled in this report.

RECENT HAPPENINGS IN THIS MARKET

- In 2021, Novozymes' two most recent bioinnovations in yeast and fiber continued to create new ethanol production efficiency standards.

MARKET SEGMENTATION

This global biofuel enzymes market research report is segmented and sub-segmented into the following categories.

By Type

- Amylases

- Industrial lipases

- Cellulose

By Application

- Lignocellulosic Ethanol

- Biodiesel

- Corn/Starch-Based Ethanol

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global biofuel enzymes market?

By 2033, the size of the global biofuel enzymes market is expected to be worth USD 2.43 billion by 2033.

Which country across the world is leading the biofuel enzymes market?

The U.S. led and accounted for the most significant share of the global biofuel enzymes market in 2024.

What are the companies playing a key role in the global biofuel enzymes market?

Novozymes A/S, E.I. du Pont de Nemours and Company, SunsonIndustry Group Co. Ltd., SinoBios, Specialty Enzymes & Biotechnologies, Transbiodiesel Ltd., Enzyme Supplies Limited, Koinklijke DSM N.V., AB Enzymes GmbH and Advanced Enzyme Technologies Ltd are some of the companies playing a leading role in the global biofuel enzymes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com