Global Biosolids Market Size, Share, Trends and Growth Analysis Report – Segmented By Form (cake, Liquid And Pellets), Class (class A, Class A - EQ, And Class B), Application (agricultural Land Application, Non-agricultural Land Application, And Energy Production) And By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Biosolids Market Size

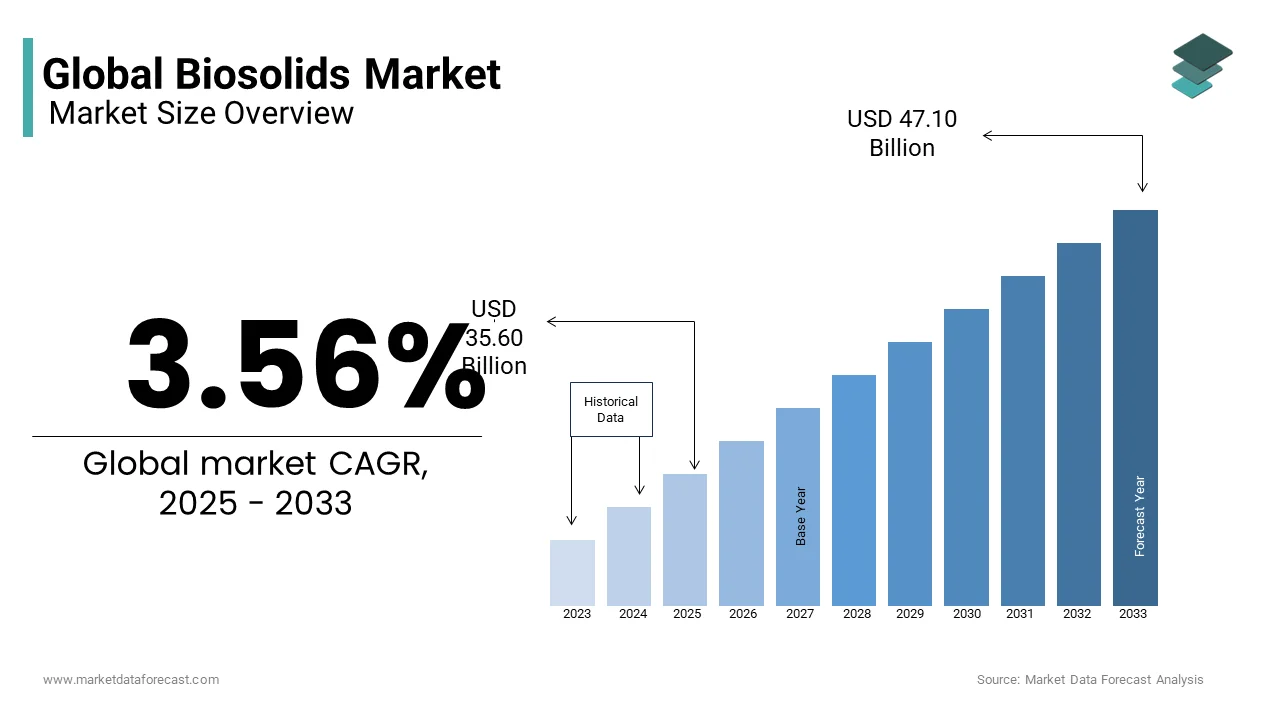

The global biosolids market was valued at USD 34.38 billion in 2024 and is anticipated to reach USD 35.60 billion in 2025 from USD 47.10 billion by 2033, growing at a CAGR of 3.56% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL BIOSOLIDS MARKET

The biosolids market is developing at an exceptionally quick pace. Biosolids are treated sewage sludge that is intended to be used as soil conditioners. These are considered organic solids which are derived from the sewage treatment processes. They are rich in minerals and nutrients and are used in various sectors, ranging from agriculture to energy production. Mostly they are used as a natural fertilizer. Biosolids have major applications in the sector of agriculture, energy recovery, mine reclamation, water treatment, and crop fertilizer.

MARKET DRIVERS

The significant driver is the stringent government emission laws that force chemical plants and factories to treat wastewater (sludge) to an acceptable level. Biosolids are good alternatives to chemical fertilizers, hence the use of biosolids as fertilizers are driving the market. However limited advancements in technology and huge capital cost are proving to be a barrier in the Biosolids market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.56% |

|

Segments Covered |

By Form, Class, Application, Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Synagro, GeoEnvironment Technologies, Casella Organics, BIODISK Corporation, Wm. H. Reilly & Company and Others. |

SEGMENT ANALYSIS

Global Biosolids Market Analysis By Form

REGIONAL ANALYSIS

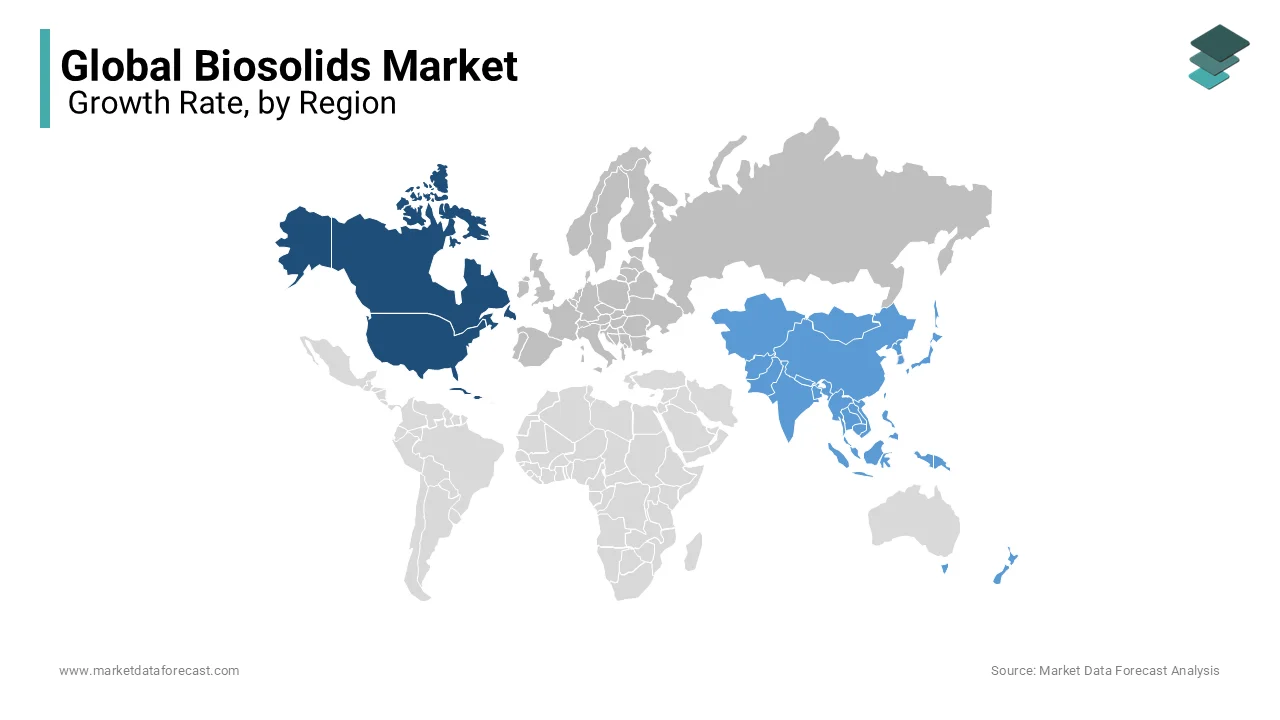

North America dominates the market owing to the government and the public sector support for the environmental friendly technologies in countries like USA and China.

North America is estimated to constitute the largest share in this market followed by Europe, while the Asia Pacific region is expected to witness the fastest growth.

KEY MARKET PLAYERS

Synagro, GeoEnvironment Technologies, Casella Organics, BIODISK Corporation, Wm. H. Reilly & Company. Some of the major market players dominate the global biosolids market.

MARKET SEGMENTATION

This research report on the global biosolids market is segmented and sub-segmented based on the Form, Class, Application, and Region.

By Form

- Cake

- Liquid and pellets

By Class

- Class A

- Class A-EQ and Class B

By Application

- Agricultural land application

- Non-agriculture land application

- Energy production

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East Asia

Frequently Asked Questions

What is the current market size of the global biosolids market?

The current market size of the global biosolids market was valued at USD 35.60 billion in 2025

What segments are added in the global biosolids market?

This research report on the global biosolids market is segmented and sub-segmented based on the Form, Class, Application, and Region.

Who are the market players that are dominating the global biosolids market?

Synagro, GeoEnvironment Technologies, Casella Organics, BIODISK Corporation, Wm. H. Reilly & Company. Some of the major market players dominate the global biosolids market.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com