Global Catering Services and Food Contractors Market Size, Share, Trends & Growth Forecast Report By Type (Mobile Food Services, Buffets, Cafeterias, Limited-Service Restaurants, and Full-Service Restaurants), By Ownership (Economy and High-End), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Catering Services and Food Contractors Market Size

The global catering services and food contractors market size is estimated at USD 310 billion in 2024 to reach a valuation of USD 606.64 billion by 2033 from USD 333.64 billion in 2025, and is predicted to register a CAGR of 7.76% throughout the projection period 2025-2033.

The catering services and food contractors market consists of the provision of services related to food based on unique events in institutional, government, commercial, or other sites, on the basis of contractual agreements with these types of organizations for a period specified by the entities. The catering services and food contractors market is studied separately for two categories of food contractors and catering services.

MARKET DRIVERS

The rapidly growing tourism industry around the world is a key factor that is expected to drive the growth of the global catering services and food contractors market during the forecast period.

Additionally, growing consumer preference for mini buffets is another factor that is estimated to drive growth in the target market over the foreseen period. Since mini meals are convenient and packed in disposable trays, this type of meal is preferred for small gatherings or functions where space is limited. Also, the increasing industrialization of various industries is another factor that is predicted to drive the growth of the target market during the conjecture period. In addition, the establishment of various medical and educational institutes is also likely to support the growth of the world market.

MARKET RESTRAINTS

The growing preference of consumers for online food delivery services is a major factor that is determined to slow the growth of the global market over the outlook period.

The online food service offers a simple and convenient ordering process through a mobile app. The continued trend observed in the market is that air travel around the world is anticipated to support the growth of the target market in the coming years. Technological advancements and innovative product launches are the main factors that can create potential revenue opportunities for players operating in the target market during the conjecture period. In addition, intensified collaboration, merger, and acquisition activities by manufacturers operating in the target market to enhance the company's product portfolio and sales are supposed to support global market growth during the envisioned period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.76% |

|

Segments Covered |

By Type, Ownership, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Delaware North, Compass Group plc, Elior Group, Aramark Corporation, Sodexo, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

REGIONAL ANALYSIS

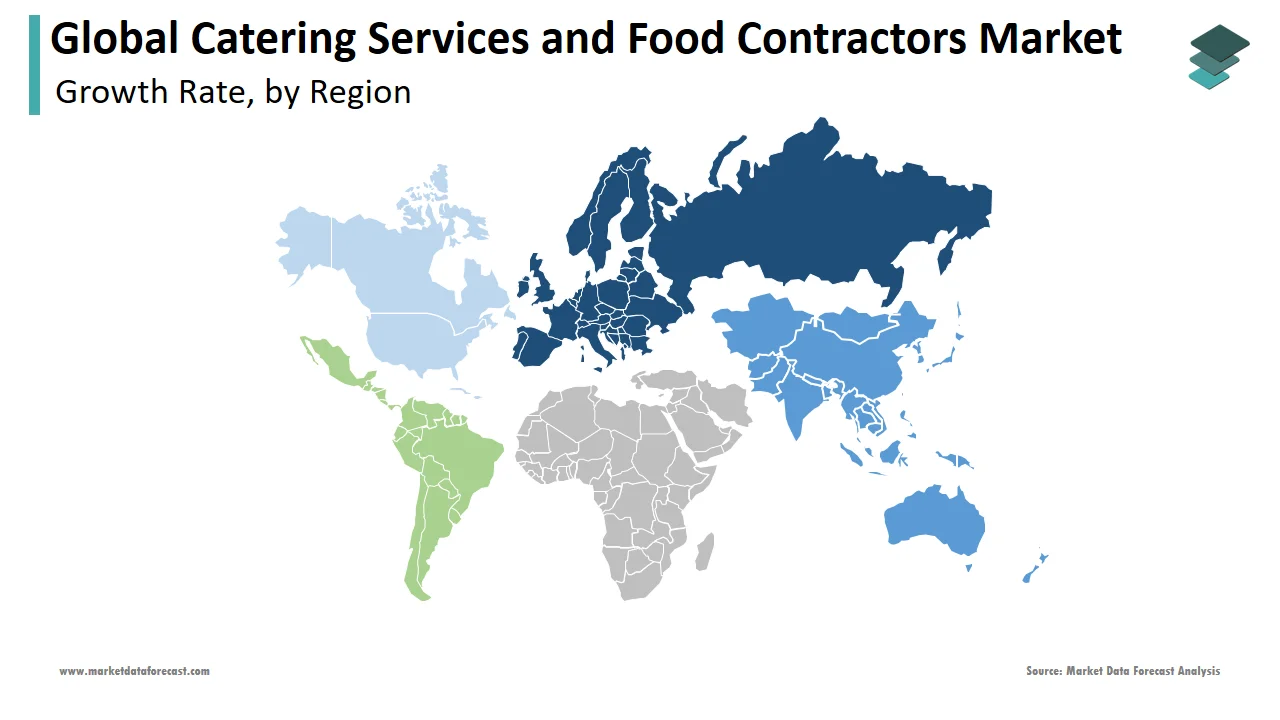

The European market is expected to register significant growth in terms of revenue during the forecast period, due to the increasing number of M&A activities among manufacturers operating in the region's target market. The Asia-Pacific region market is foreseen to experience the fastest growth rate during the predicted period, due to strict government food safety regulations and a growing preference for promoting healthy eating in several countries in this region. For example, in April 2017, the Singapore government introduced a Comprehensive Government Food Service Healthier Policy (WOG) to encourage healthier eating in Singapore's homes, workplaces, and communities. In accordance with this policy, Singaporean government entities have provided healthy food and beverages at government events, training, meetings, and conferences.

KEY MARKET PLAYERS

Companies playing a prominent role in the global catering services and food contractors market include Delaware North, Compass Group plc, Elior Group, Aramark Corporation, Sodexo, and Others.

RECENT MARKET HAPPENINGS

- SAirGroup Holding AG, Swissair's parent company, agreed to acquire Dobbs International Services Inc. in the United States for $ 780 million in cash, creating a world leader in airline catering in response to customer demands for global services from a single source. Dobbs, the world's third-largest airline catering company, wholly owned by US finance company VIAD Corp., will merge with Sair's airline catering division, Gate Gourmet International, the world's second-largest airline.

- Compass Group would acquire Nordic catering service Fazer Food Services in a € 475 million deal, expanding the northern European reach of the world's largest contract food service company. London-listed Compass, which serves more than 5.5 billion meals a year in 45 countries, will make an initial cash payment of € 420 million to the Nordic group, with the remaining € 55 million to be paid out over seven years under certain conditions.

- Fazer Food Services operates catering services in the Nordic region, Finland, Sweden, Norway, and Denmark, and in various sectors, including trade and industry, education, health, and defense. Dominic Blakemore, CEO of Compass Group, said it was a "very interesting acquisition" for Compass, which already has a presence in the region.

MARKET SEGMENTATION

This global catering services and food contractors market research report has been segmented and sub-segmented based on type, ownership, and region.

By Type

- Mobile Food Services

- Buffets

- Cafeterias

- Limited-Service Restaurants

- Full-Service Restaurants

By Ownership

- Economy

- High-End

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Catering Services and Food Contractors Market growth rate during the projection period?

The Global Catering Services and Food Contractors Market is expected to grow with a CAGR of 7.76% between 2025-2033.

2. What can be the total Catering Services and Food Contractors Market value?

The Global Catering Services and Food Contractors Market size is expected to reach a revised size of USD 606.64 billion by 2033.

3. Name any three Catering Services and Food Contractors Market key players?

Delaware North, Compass Group plc, and Elior Group are the three Catering Services and Food Contractors Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com