Global Cereals Market Size, Share, Trends & Growth Forecast Report By Type (Hot Cereals and Ready To Eat Cereals), Ingredient Type (Rice, Wheat, Corn, Barley and Others), Distribution Channel (Supermarkets And Hypermarkets, Independent Retailers, Specialist Retailers, Convenience Stores and Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Cereals Market Size

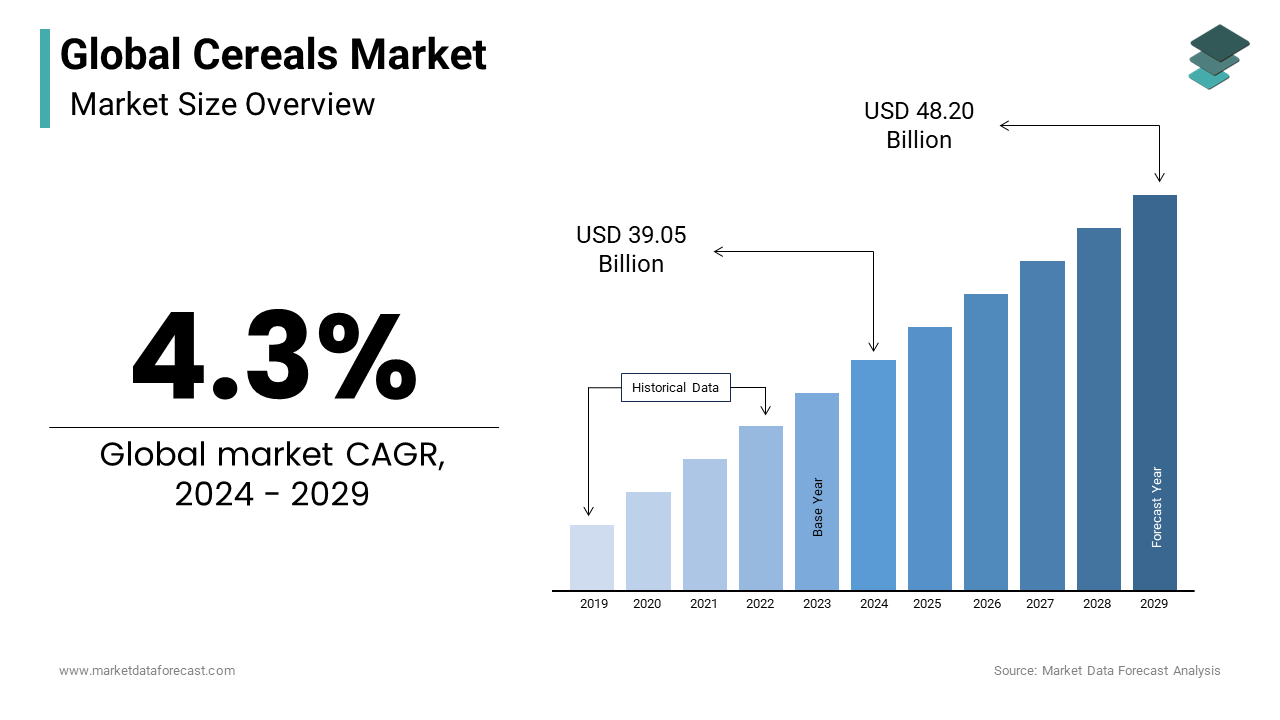

The size of the global cereals market was valued at USD 39.05 billion in 2024 and is expected to be worth USD 40.73 billion in 2025 and 57.04 Billion in 2033, growing at a CAGR of 4.3% from 2025 to 2033

Cereals are foods highly fortified with vitamins, minerals, and other nutritional additives. It is considered the most important meal of the day because it helps to revitalize the body, keeping it active and productive until the next meal. The demand for a full breakfast is increasing due to busy schedules and the need to improve consumers' overall nutritional needs. In general, cereals are prepared when the grains are turned into flour, cooked, mixed with other ingredients, dried, and formed. Cereals are available in puffed, flaked, or crushed form. They also act as a good source of fiber, iron, zinc, and other minerals, folic acid that maintains cell formation, vitamins such as vitamin B and vitamin D, and calcium, thereby improving consumers' bone health. Cereal makers spend a lot on television commercials to promote the many health benefits of cereals for children, which is expected to drive the global Cereal market during the outlook period.

MARKET DRIVERS

The growth of the global cereals market is mainly due to the evolution of eating habits and the influence of Western culture on the eating habits of consumers, as it offers a practical solution for easily accessible foods that optimize ease of consumption without additional preparation. Also, consumers' preference for nutritious and healthy food on a regular basis is stimulating the market. In addition, strong growth in convenience stores that promotes brand visibility fuels the growth of the Cereal market. The increasing popularity of breakfast on the go, coupled with the growing demand for organic grains and increased health awareness among consumers, is one of the main trends that are accelerating the growth of the market. Common grains used in these cereals include oats, rice, barley, wheat, and corn. A few hot bowls of cereal like oatmeal contain no other ingredients, while other variations may include colors, yeasts, salts, minerals, vitamins, sweeteners, and food preservatives. Palm oil is an essential ingredient used in the processing stage. Some natural cereals can be sweetened with the help of concentrated fruit juices. A wide variety of flavors is often added, including cinnamon, chocolate, spice, and fruit flavors. Besides, essential vitamins and minerals are also added to replace the nutrients lost during cooking.

MARKET RESTRAINTS

The demand for Cereals is limited by the wide availability of alternatives. Most consumers prefer eggs, frozen waffles, sausages, puddings, smoothies, yogurt, and other healthier breakfasts that are made with fresh ingredients. In addition, the easier availability of convenient, affordable, and nutritious food options threatens the demand for grains. Emerging economies are witnessing a paradigm shift in customer purchasing behavior and eating habits. The rapid urbanization and growth of the middle-class population in these economies is causing a change in lifestyle and an increase in the demand for take-out food. Because cereals are considered to offer many health benefits and are easy to prepare, they are experiencing increased demand from consumers around the world. However, the market is stagnating due to consumers' equitable inclination towards traditional breakfast foods, which is holding back market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Ingredient Type, Distribution channel, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Pepsico, Inc., Marico Limited, Nestlé S.A, General Mills, Kellogg Company, Bagrrys India Ltd, B&G Foods Inc. |

REGIONAL ANALYSIS

North America dominated the entire market in 2023, followed by Europe. The growing health disorders like diabetes, obesity, and others complement the growth of the region. Makers are introducing healthier variants to attract a large consumer base. Rapidly growing economies in Asia Pacific result in a burgeoning population base that engages in busy lifestyles. This, in turn, stimulates the demand for prepared meals, which favors the regional market. The growing demand for natural nutritional products due to increased consumer awareness of healthy lifestyles is slated to trigger demand for cereals in the APAC region during the foreseen period.

KEY MARKET PLAYERS

Pepsico, Inc., Marico Limited, Nestlé S.A, General Mills, Kellogg Company, Bagrrys India Ltd and B&G Foods Inc. are a few of the notable companies in the global cereals market.

RECENT HAPPENINGS IN THE MARKET

- In February 2019, Post Holdings, Inc., St. Louis, made a deal with TreeHouse Foods, Inc to purchase the private label, ready-to-eat cereal business. The grain company generated revenue of $ 268 million in 2018. TreeHouse Foods acquired the R.-T.-E.

- The company called “TreeHouse Foods” has agreed to mutually agree with Post Holdings to cancel the formerly announced agreement to sell its ready-to-eat (RTE) grain business on Post.

- In January 2020, Post Holdings Inc., a consumer packaged company based in Brentwood, declared that it had concluded a deal with TreeHouse Foods Inc, following a complaint filed earlier this month passed by the Federal Trade Commission that opposes the agreement. Tree Brook, based in Oak Brook, Illinois, said that it had mutually agreed with Post to end the deal and will now put the business back on the market.

MARKET SEGMENTATION

This research report on the global cereals market has been segmented and sub-segmented based on type, ingredient type, distribution channel, and region.

By Type

- Hot cereals

- Ready-to-eat cereals

By Ingredient Type

- Rice

- Wheat

- Corn

- Barley

- Others

By Distribution Channel

- Hypermarkets and supermarkets

- Independent retailers

- Specialist retailers

- Convenience stores

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the main products derived from cereals?

Cereals are used to produce a wide range of food products, including Breakfast cereals: Ready-to-eat cereals marketed as breakfast options, including flakes, puffs, granola, and muesli.

What factors drive the demand for cereals?

The demand for cereals is driven by several factors, including:

Population growth and increasing urbanization, leading to higher consumption of convenience foods and ready-to-eat cereals.

3.What are some health considerations associated with cereals?

Cereals can be a nutritious part of a balanced diet, providing essential nutrients such as carbohydrates, fiber, vitamins, and minerals. However, health considerations may vary depending on factors such as processing methods, added ingredients, and individual dietary needs. Whole grains are generally considered healthier than refined grains, as they retain more nutrients and fiber

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com