China Over the Counter (OTC) Drugs Market Size, Share, Trends & Growth Forecast By Formulation Type (Tablets, Liquid, Ointments, Sprays ), Product Type, Distribution and Country, Industry Analysis From 2025 to 2033

China Over-the-Counter Drugs Market Size

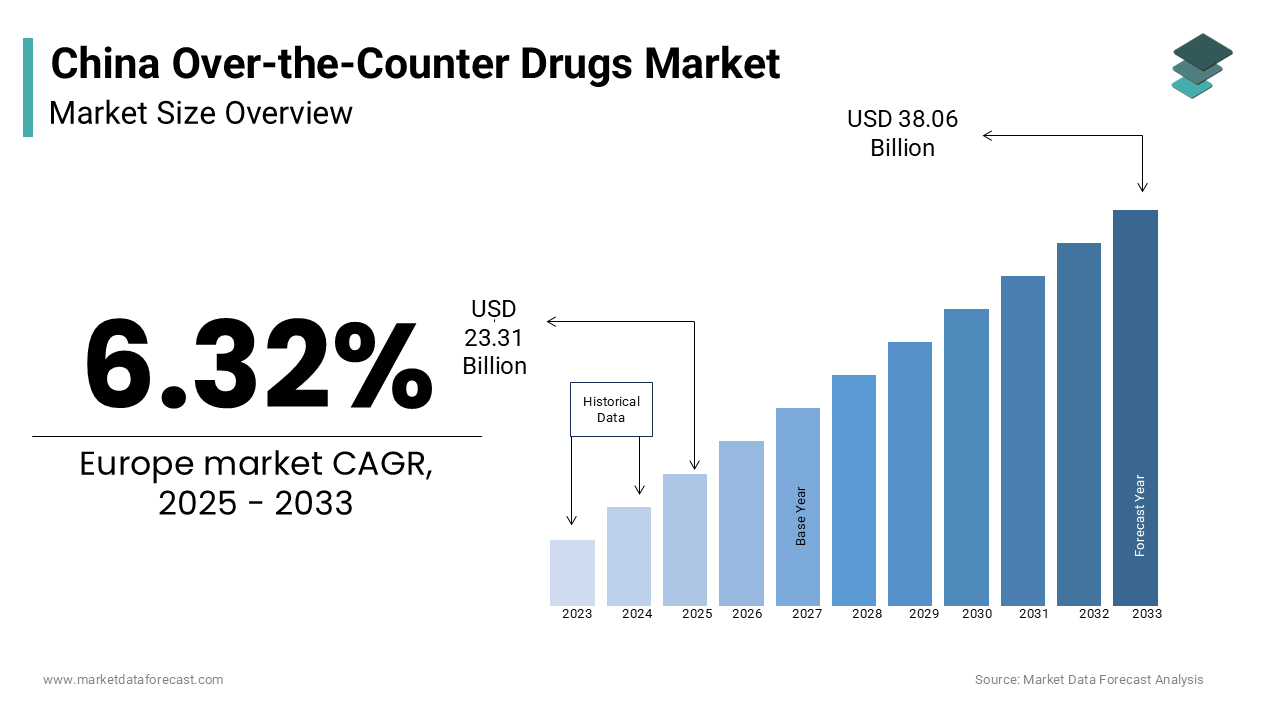

The over-the-counter drugs market size in China was worth USD 21.92 billion in 2024. The Chinese market is estimated to reach USD 23.31 billion in 2025 and USD 38.06 billion by 2033, growing at a CAGR of 6.32% from 2025 to 2033. China held a 33.4% share of the APAC market in 2024.

The term over-the-counter (OTC) refers to pharmaceuticals that are bought without any prescription over the counter. The OTC medicine market in China was characterized by a late start but accounted for the fastest growth, along with vast potential compared to that of the mature Western countries' OTC markets. OTC drug sales account for 16.8% of total pharmaceutical sales.

China now has the fastest development rate and the most significant potential in the over-the-counter drugs market compared to the mature Western countries’ OTC markets. The sales of over-the-counter drugs account for 16.8% of overall pharmaceutical revenue. For more than two decades, the Chinese economy has maintained a high rate of growth, fuelled by consecutive increases in consumer demand, import and export, industrial output, and capital investments.

In addition, the growing geriatric population is significantly contributing to the counter drugs market; the aged population has poorer immune systems, there will be a higher need for health services as the population ages, resulting in a more increased need for health services as the population ages, resulting in a higher incidence of illness. The senior population currently accounts for 40 to 50 percent of the OTC medicine market.

Increasing healthcare expenditure, more outstanding manufacturing and export, and development and government investment for improved healthcare favor the growth of the OTC drugs market in China. In addition, the Affordability of the medicine is majorly driving the over-the-counter medicine market. Furthermore, the influx of novel pharmaceuticals into the market due to technological improvements is boosting the over-the-counter drugs market’s growth rate.

On the other hand, the growing public awareness of OTC medicine applications in China is helping the market’s growth. Furthermore, increasing healthcare expenditures and strengthening the country’s constantly growing population and increased disposable income will likely provide profitable opportunities for market players throughout the forecast period. Furthermore, with an expanding number of pharmaceutical industries, drug stores, supermarkets, retail outlets, hospital pharmacies, and e-commerce, the country’s over-the-counter medicine market has various potential to grow.

Competition in China is key to fierceness among the significant companies aiming to penetrate the market, which is one factor limiting the market growth. In addition, the government has adopted an ambiguous attitude regarding OTC medications and is reticent to promote self-medication, whereas newcomers confront increased hazards.

REGIONAL ANALYSIS

The Chinese economy continues a high-speed growth that has been stirred by successive increases in consumer consumption, import & export, industrial output, and capital investment for over two decades. In addition, the aging population will trigger a higher demand for health facilities since the elderly population has weaker immune systems, resulting in an increased incidence of sickness. Currently, the elderly population generates 40 to 50 percent of the OTC drug market.

Growing healthcare expenditure internally, increased manufacture and export, improvement, and government investment for better healthcare further accelerate the market’s growth rate. However, the factors restraining the growth of the market are that competition in China is key to a fierce among the major companies seeking to penetrate the market. Intricate knowledge of the region and pricing will decide who gets ahead. In contrast, newcomers face increasing risks. In addition, the government has implemented an ambivalent attitude towards OTC Products and is unwilling to promote self-medication.

KEY MARKET PLAYERS

Companies playing a major role in the China over the counter drugs market profiled in this report include Harbin Pharmaceutical Group, Jiangzhong Pharmaceutical Co., Ltd, Renhe (Group) Development Co., Ltd, Tianjin SK&F Pharmaceutical Co., Ltd, Wyeth Pharmaceutical, Xi'an-Janssen Pharmaceutical, Yangtze River Pharmaceutical Group, Yunnan Baiyao Group Co., Ltd, Zhejiang Conba Pharmaceutical Co., Ltd, GlaxoSmithKline, Bayer Beijing, and Novartis.

MARKET SEGMENTATION

This research report on the China Over-the-Counter Drugs Market has been segmented and sub-segmented into the following categories.

By Formulation Type

- Tablets

- Liquids

- Ointments

- Sprays

By Product Type

- Cough, Cold, and Flu Drugs

- Analgesics

- Dermatologicals

- Gastrointestinal Drugs

- Antiseptics

- Anti-Allergy Drugs

- Smoking Cessation Aids

- Ophthalmic Drugs

- Vitamins and Minerals

- Sleep Aids

- Weight Loss/Diet Products

- Others (Ear Drops & Diuretics)

By Distribution Channel

- Pharmacies/Drugstores

- Supermarkets/Hypermarkets

- Convenience stores

- Others (Online Drugstores)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com