Global Christmas Tree Market Size, Share, Trends & Growth Forecast Report By Type (Natural Trees, Artificial Trees, Pre-Lit Trees, Tabletop Trees), material, size, sales channel, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Global Christmas Tree Market Size

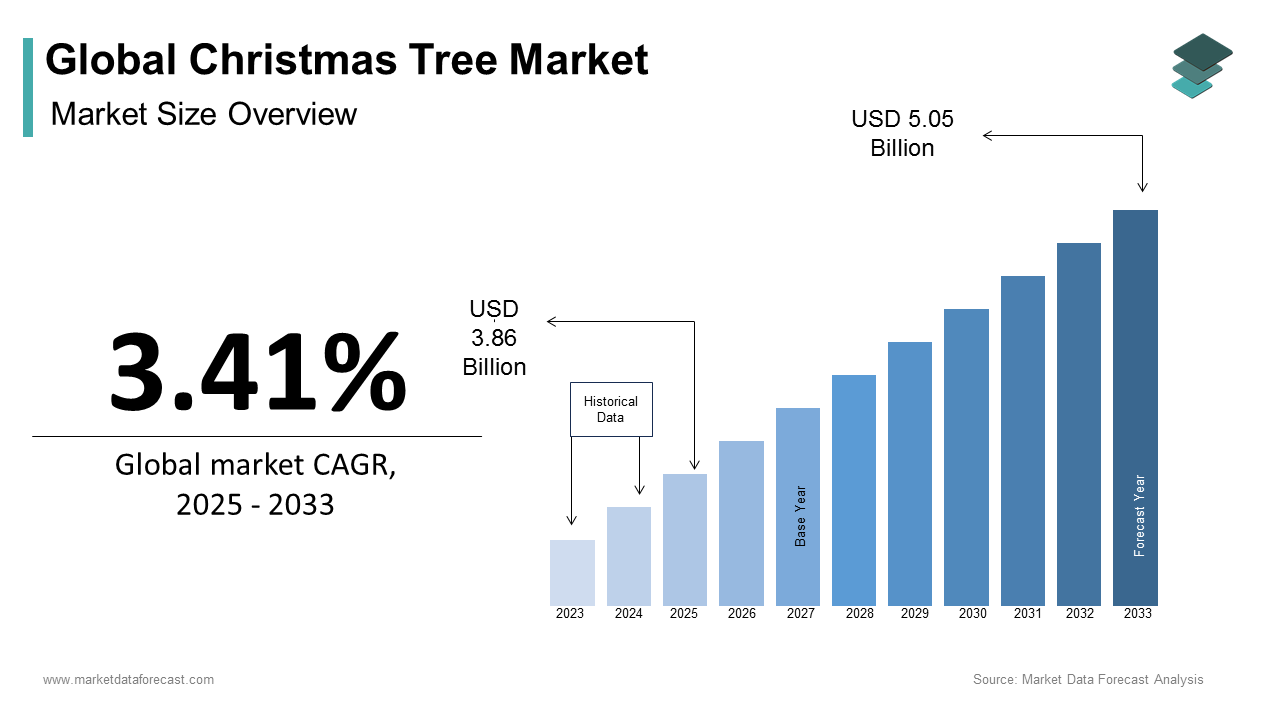

The global Christmas tree market size was calculated to be USD 3.73 billion in 2024 and is anticipated to be worth USD 5.05 billion by 2033 from USD 3.86 billion In 2025, growing at a CAGR of 3.41 % during the forecast period.

MARKET DRIVERS

Cultural Traditions and Seasonal Sentiment

Cultural traditions play a pivotal role in driving the Christmas tree market, particularly in Western countries. This deep-rooted tradition ensures consistent demand year after year. In Europe, similar trends persist, with the UK’s British Christmas Tree Growers Association reporting that 8 million families purchase trees annually by reflecting the enduring appeal of this festive symbol.

Sentimental value further amplifies demand. A survey by Deloitte revealed that 65% of consumers prioritize creating memorable experiences during the holidays, often associating Christmas trees with nostalgia and family bonding. Additionally, social media platforms like Instagram have amplified this trend, with hashtags like #ChristmasTree, which is encouraging more households to invest in elaborate decorations. These cultural and emotional drivers ensure that the Christmas tree remains an indispensable part of holiday celebrations globally.

Rise of Eco-Friendly Preferences

Eco-consciousness is reshaping the Christmas tree market, with consumers increasingly favoring sustainable options. The National Christmas Tree Association states that real trees are biodegradable and support local economies by making them an attractive choice for environmentally aware buyers. Urban consumers, however, are gravitating toward potted living trees, which can be replanted after the season. According to the Royal Horticultural Society, the UK saw a 20% increase in potted tree sales in 2022, with the campaigns promoting sustainability. Furthermore, carbon footprint concerns are influencing purchasing decisions, with Life Cycle Assessment studies showing that artificial trees must be reused for at least 10 years to match the environmental impact of real trees.

MARKET RESTRAINTS

Supply Chain Disruptions and Rising Costs

Supply chain disruptions have become a significant restraint for the Christmas tree market, particularly affecting real tree producers. According to the American Farm Bureau Federation, extreme weather events like droughts and floods have reduced tree yields by 15-20% in recent years, limiting supply. Additionally, transportation costs surged by 25% in 2023, driven by fuel price hikes and labor shortages that is prompting the growth of the market.

These challenges are compounded by inflationary pressures. The U.S. Bureau of Labor Statistics reports that the average cost of a real Christmas tree rose from 75 in 2021 to 90 in 2023, deterring budget-conscious buyers. Smaller growers, who lack the resources to absorb rising expenses, are exiting the market, exacerbating supply constraints.

Short Lifecycle of Artificial Trees

Artificial Christmas trees, while convenient, face criticism for their short lifecycle and environmental impact, constraining market growth. Research by the Ellen MacArthur Foundation indicates that most artificial trees are discarded within 5-7 years, which contributes significantly to landfill waste. Made from non-biodegradable materials like PVC, these trees pose environmental hazards that is discouraging eco-conscious consumers.

Furthermore, quality concerns limit repeat purchases. Consumer Reports found that 30% of artificial tree buyers reported dissatisfaction due to durability issues, such as broken branches or fading colors. These factors reduce customer loyalty and increase skepticism about artificial alternatives.

MARKET OPPORTUNITIES

Customization Trends Driving Premium Sales

Customization is emerging as a lucrative opportunity in the Christmas tree market by appealing to modern consumers seeking unique holiday experiences. Retailers like Home Depot and Lowe’s have capitalized on this trend by offering customizable artificial trees with modular components. High-end retailers, such as Neiman Marcus, now sell designer trees adorned with handcrafted ornaments, priced upwards of $2,000, which is targeting affluent buyers. Over 40% of millennials prioritize exclusivity when making holiday purchases, which is fueling demand for bespoke products.

Expansion into Emerging Markets

Emerging markets present the untapped potential for the Christmas tree market, driven by globalization and the cultural adoption of Western traditions. Countries like China and India are seeing a surge in demand, with Alibaba reporting a 35% increase in online tree sales during the 2023 holiday season. Localized marketing strategies are key to success. For instance, Brazilian retailers have partnered with local influencers to promote Christmas trees as symbols of modern festivities, boosting sales by 25% in 2022. Similarly, African nations like South Africa are embracing Christmas traditions, with Woolworths introducing affordable tree options tailored to regional preferences. The companies can unlock significant growth opportunities in these burgeoning markets by adapting products and campaigns to align with cultural nuances.

MARKET CHALLENGES

Environmental Concerns Surrounding Artificial Trees

The environmental impact of artificial Christmas trees poses a significant challenge, threatening long-term market viability. According to the Carbon Trust, producing a single artificial tree generates approximately 40 kilograms of CO2, which is equivalent to driving 100 miles in a gasoline-powered car. This alarming statistic has sparked a backlash from eco-conscious consumers, with Greenpeace estimating that 40% of buyers now consider sustainability before purchasing. Moreover, improper disposal exacerbates the issue. The Environmental Protection Agency states that artificial trees contribute to over 25 million tons of plastic waste annually in the U.S. alone. Efforts to introduce recyclable materials have been met with resistance due to higher production costs, which is limiting widespread adoption.

Declining Farm Outputs and Aging Farmers

Aging farmers and declining farm outputs are major challenges threatening the supply of real Christmas trees. The USDA reports that the average age of tree farmers in the U.S. is 65 years , with fewer young individuals entering the profession. This demographic shift has led to a 10% reduction in planted acreage over the past decade, creating a supply gap.

Compounding the issue is the lengthy growth cycle of Christmas trees, which takes 7-10 years to reach maturity. As per the Pacific Northwest Christmas Tree Association, inadequate replanting efforts have resulted in a 20% shortfall in available inventory for the 2023 season. Rising operational costs further discourage new entrants by leaving the industry vulnerable to shortages. Addressing these structural challenges requires targeted investments and incentives to attract younger farmers and modernize cultivation practices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.41% |

|

Segments Covered |

By Type, Material, Size, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hallmark, Balsam Hill, National Tree Company, Puleo International, Oncor, Treetopia, Vickerman, General Foam Plastics, King of Christmas, Crystal Valley Decorating |

SEGMENTAL ANALYSIS

By Type Analysis

The natural trees segment was the largest and held 50.4% of the Christmas tree market share in 2024 due to its cultural significance and eco-friendly appeal. In North America alone, over 25-30 million real trees are sold annually, as per the National Christmas Tree Association. A key factor behind this dominance is consumer preference for authenticity during the holiday season.

Another driving force is the environmental push toward biodegradable products. The Royal Horticultural Society states that real trees are compostable and support local economies, with each tree absorbing approximately 48 pounds of CO2 during its growth cycle. Additionally, initiatives like “Tree-Cycling” programs, which recycle trees into mulch or wildlife habitats, have gained traction, with participation rates exceeding 90% in urban areas.

The pre-lit trees segment is expected to hit a CAGR of 8.5% from 2025 to 2033. This rapid expansion is fueled by convenience and technological advancements. Consumers increasingly seek hassle-free solutions, with Deloitte reporting that 60% prioritize ease of setup when purchasing holiday decorations. Pre-lit trees eliminate the need for stringing lights by appealing to busy households. Innovation in LED technology has also played a pivotal role. Furthermore, customizable lighting options, such as color-changing LEDs have boosted demand. Retailers like Balsam Hill report a 25% increase in pre-lit tree sales annually. The pre-lit trees are poised to capture an even larger share of the market, as urbanization accelerates and disposable incomes rise.

By Material Analysis

Plastic dominated the Christmas tree material market share in 2024 due to its affordability, durability, and versatility. Artificial trees made from PVC plastic are particularly popular in urban areas, where space constraints and convenience drive demand. According to Home Depot, plastic-based trees outsell wooden alternatives by a 4:1 ratio due to their reusability and low maintenance requirements.

Another key factor is the adaptability of plastic to various designs. Manufacturers can mold it into realistic pine needles, enabling mass production of lifelike trees at competitive prices. A study by McKinsey notes that 80% of artificial tree buyers cite affordability as their primary motivation. Despite environmental concerns, innovations in recyclable plastics are addressing criticisms, with companies like IKEA introducing eco-friendly models made from recycled materials.

The fiber optic trees segment is likely to register a CAGR of 10.4% in the coming years throughout the forecast period. This growth is driven by their aesthetic appeal and technological integration. Fiber optic trees feature embedded light strands that emit vibrant colors, creating visually stunning displays. Advancements in fiber optic technology have also enhanced functionality. Retailers like Wayfair have capitalized on this trend, reporting a 35% annual increase in fiber optic tree sales.

By Size Analysis

The 6 to 8-foot size category led the Christmas tree market by capturing 45.4% of the share in 2024 due to its versatility by catering to both small apartments and spacious living rooms. The National Christmas Tree Association reports that 70% of American households prefer this size range by balancing aesthetics and practicality. Consumer behavior plays a significant role in this dominance. Many buyers prioritize tree height when selecting a centerpiece by ensuring it complements room dimensions without overwhelming the space. Additionally, retailers stock abundant inventory in this range, offering diverse styles and price points.

The under-4 feet segment is projected to exhibit a CAGR of 9.4% in the coming years. This surge is driven by the rising popularity of tabletop and apartment-friendly trees. Urbanization trends in Asia-Pacific, where over 50% of the population lives in cities, have fueled demand for compact decorations.

Social media platforms like Pinterest also play a role, with hashtags like #MiniChristmasTree, which is inspiring creative setups. Retailers like Amazon report a 40% increase in sales of mini trees, priced affordably to attract younger buyers. Moreover, businesses are adopting small trees for office decor, boosting commercial demand. Under 4 feet trees are becoming a staple in modern holiday celebrations as lifestyles shift toward minimalism and multi-purpose space.

By Sales Channel Insights

The department stores segment accounted in holding 35.4% of the Christmas tree market share in 2024 due to extensive product ranges and immersive shopping experiences.A survey by Deloitte found that 60% of consumers prefer one-stop shopping by combining tree purchases with other holiday essentials. Department stores capitalize on this by bundling trees with ornaments and lights, increasing average transaction values. Additionally, loyalty programs and seasonal discounts enhance customer retention.

The online retail segment is likely to grow with a CAGR of 12.4% in the coming years. The growth of the segment is fueled by the convenience of e-commerce and advancements in digital tools. Amazon dominates this space, with Christmas tree sales growing by 25% annually, as per Bloomberg. Augmented reality (AR) technology has revolutionized online shopping, which allows customers to visualize tree sizes and styles in their homes. Home Depot’s AR app reportedly boosted online conversions by 20% in 2023. Additionally, free shipping and easy return policies attract budget-conscious buyers.

REGIONAL ANALYSIS

North America was the largest contributor in the global Christmas tree market with 40.4% of the share in 2024. The U.S. leads consumption, with over 25-30 million trees sold annually, driven by deeply ingrained holiday traditions. According to the National Christmas Tree Association, 90% of American households celebrate Christmas by ensuring consistent demand.

Urbanization has influenced regional dynamics, with cities like New York and Los Angeles favoring artificial trees due to space constraints. Retailers like Walmart and Home Depot have capitalized on this trend, offering compact, pre-lit options. Additionally, eco-friendly initiatives, such as tree recycling programs, have strengthened the market’s sustainability narrative.

Europe accounted for 30.4% of the global Christmas tree market share in 2024. Germans purchase nearly 28 million trees annually by reflecting their strong cultural ties to the holiday season. The British Christmas Tree Growers Association reports that 8 million families buy trees each year, which is prioritizing premium quality and authenticity.

Innovation is reshaping the market, with fiber optic trees gaining traction among younger buyers. Retailers like John Lewis report a 20% increase in tech-enabled tree sales in 2023. Sustainability is another driver, with potted living trees seeing a 15% rise in demand as consumers seek reusable alternatives. Europe’s blend of tradition and innovation ensures its continued prominence in the global market.

Asia-Pacific is likely to grow with a prominent growth rate in the foreseen years with rapid urbanization fueling demand for artificial trees. China is the largest producer and consumer, exporting over 10 million trees annually. Urban centers like Tokyo and Mumbai favor compact, low-maintenance options, which is driving growth in the under-4 feet category. E-commerce platforms like Alibaba have transformed accessibility, with online sales growing by 30% in 2023. Social media trends, such as Instagram-worthy mini trees, have also influenced purchasing decisions.

Latin America is likely to have significant growth opportunities with Brazil leading adoption. Western influences have introduced Christmas trees to urban households, with imports exceeding 100,000 units annually. Retailers like Magazine Luiza have capitalized on this trend, which is offering affordable options tailored to regional preferences. Localized marketing strategies, such as partnerships with influencers, have boosted awareness.

The Middle East and African Christmas tree market is lucratively to have steady pace in the coming years. Urban centers like Dubai embrace artificial trees, importing over 50,000 units annually. Retailers like Virgin Megastore offer premium designs by appealing to affluent buyers.

Cultural diversity influences preferences, with potted trees gaining popularity among environmentally conscious consumers. According to Greenpeace, 30% of African buyers prioritize sustainability by encouraging innovation in recyclable materials.

LEADING PLAYERS IN THE CHRISTMAS TREE MARKET

Balsam Hill

Balsam Hill is a premium player in the Christmas tree market, renowned for its high-quality artificial trees and innovative designs. The company focuses on realism, offering lifelike trees with advanced materials like True Needle technology, which mimics natural pine needles. Balsam Hill caters to affluent buyers, with products priced significantly higher than mass-market alternatives. Its commitment to sustainability is evident through initiatives like recyclable packaging and energy-efficient LED lights.

Home Depot

Home Depot is a major retail powerhouse in the Christmas tree market, offering a wide range of options from real trees to pre-lit artificial ones. The company leverages its vast distribution network to ensure accessibility across North America. Home Depot partners with local farms to supply fresh trees while also stocking exclusive artificial models. Its emphasis on affordability and convenience, coupled with seasonal promotions, attracts millions of customers annually.

IKEA

IKEA plays a pivotal role in democratizing access to affordable Christmas trees. Known for its flat-pack designs, the company offers compact, eco-friendly options like potted living trees and fiber optic models made from recycled materials. IKEA’s global presence allows it to cater to diverse markets, from Europe to Asia-Pacific. Its focus on sustainability aligns with consumer preferences, as evidenced by campaigns promoting reusable decorations.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Sustainability Initiatives

Sustainability is a cornerstone strategy for Christmas tree companies aiming to appeal to eco-conscious consumers. Retailers like IKEA emphasize recyclable materials and reusable products, such as potted living trees. Balsam Hill incorporates energy-efficient LEDs and recyclable packaging into its designs, reducing environmental impact. According to Greenpeace, 40% of buyers now prioritize sustainability by making green initiatives a competitive advantage. Companies investing in these practices not only meet regulatory standards but also build brand loyalty among environmentally aware shoppers.

Technological Integration

Technology adoption is reshaping the Christmas tree market, enhancing both production and customer experience. Home Depot uses augmented reality (AR) tools to help buyers visualize tree sizes and styles in their homes, boosting online sales by 20% in 2023. Similarly, Balsam Hill integrates programmable lighting systems controlled via smartphone apps, appealing to tech-savvy millennials. These innovations streamline shopping processes and differentiate brands in a crowded marketplace, ensuring long-term relevance.

Customization and Premium Offerings

Customization is a key strategy for targeting affluent consumers seeking unique holiday experiences. Balsam Hill offers bespoke trees with modular components and handcrafted ornaments, priced upwards of $2,000 . Retailers like Neiman Marcus stock designer trees tailored to luxury lifestyles.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the global Christmas tree market include Hallmark, Balsam Hill, National Tree Company, Puleo International, Oncor, Treetopia, Vickerman, General Foam Plastics, King of Christmas, Crystal Valley Decorating

The Christmas tree market is highly competitive, characterized by a mix of established retailers, niche players, and emerging innovators vying for dominance. Large-scale retailers like Home Depot and Walmart dominate mass-market segments, leveraging extensive distribution networks and economies of scale to offer affordable options. Meanwhile, premium brands like Balsam Hill cater to affluent buyers, focusing on realism, customization, and sustainability. Niche players, such as IKEA, target eco-conscious consumers with innovative, budget-friendly designs.

Technological advancements have intensified competition, with AR tools and smart features becoming critical differentiators. Additionally, regional dynamics shape strategies; for instance, Asia-Pacific’s urban centers favor compact artificial trees, while North America prioritizes authenticity. Despite these variations, sustainability remains a common battleground, as companies strive to align with evolving consumer values.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Balsam Hill launched a “Sustainable Holidays” campaign, introducing carbon-neutral shipping options and biodegradable packaging, enhancing its reputation as an eco-friendly brand.

- In November 2023, Home Depot introduced an augmented reality feature on its app, enabling customers to preview tree sizes and styles in their living spaces, which resulted in a 15% increase in online sales during the holiday season.

- In August 2023, IKEA partnered with local nurseries across Europe to offer potted living Christmas trees, which customers could replant after the holidays, boosting sales by 20% in urban markets.

- In December 2022, Amazon expanded its “Holiday Subscription Box” service, allowing users to rent premium artificial trees annually by addressing storage concerns and reducing environmental waste.

- In October 2022, Lowe’s collaborated with small U.S. tree farms to create a “Farm-to-Family” program, ensuring fresh tree delivery while supporting local economies, which is increasing real tree sales by 25% during the 2022 season.

MARKET SEGMENTATION

This research report on the global Christmas tree market has been segmented and sub-segmented based on type, material, size, sales channel, and region.

By Type

- Natural Trees

- Artificial Trees

- Pre-Lit Trees

- Tabletop Trees

By Material

- Plastic

- Wood

- Metal

- Glass

- Fiber Optic

By Size

- Under 4 Feet

- 4 to 6 Feet

- 6 to 8 Feet

- 8 to 10 Feet

- Above 10 Feet

By Sales Channel

- Online Retail

- Department Stores

- Home Improvement Stores

- Specialty Stores

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who are the key players in the Christmas tree market?

Major companies include Hallmark, Balsam Hill, National Tree Company, Puleo International, Oncor, and King of Christmas.

2. What are the major trends driving the Christmas tree market?

Trends include rising demand for eco-friendly and reusable artificial trees, customization options, and smart features like pre-lit trees with app control.

3. Which regions hold the largest share of the Christmas tree market?

North America, especially the U.S., holds a significant share, followed by Europe. Emerging markets in Asia-Pacific are showing growing interest.

4. How is e-commerce influencing the Christmas tree market?

Online retail is growing rapidly, offering consumers greater variety, convenience, and direct-to-door delivery options.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]