Global Clinical Information System (CIS) Market Size, Share, Trends & Growth Forecast Report Segmented By Deployment (Cloud-based, On-Premises), Component, Application, End-User and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Clinical Information System (CIS) Market Size

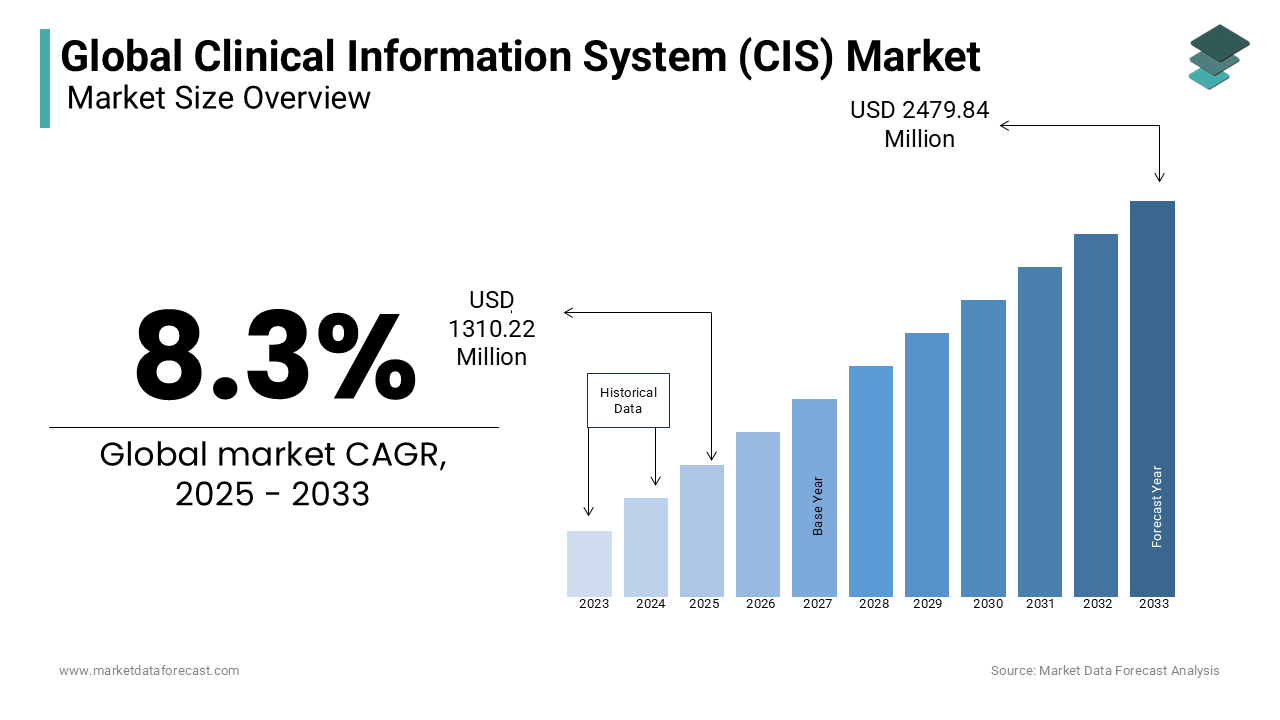

The global clinical information system (cis) market size was estimated at USD 1209.81 million in 2024 and is projected to reach USD 2479.84 million by 2033 from USD 1310.22 million in 2025, growing at a CAGR of 8.3% from 2025 to 2033.

Clinical information system (CIS) market is evolving rapidly sector and is driven by the increasing adoption of digital solutions in healthcare. These systems streamline the management of medical records, diagnostic information and treatment plans by enhancing patient care and operational efficiency. According to the World Health Organization (WHO), approximately 30% of global healthcare spending is wasted due to inefficiencies highlighting the critical need for systems that improve workflows. In 2022, the Centers for Medicare & Medicaid Services (CMS) reported that electronic health record (EHR) adoption among office-based physicians in the United States reached over 89% emphasizing the growing reliance on digital systems. Furthermore, the U.S. Department of Health and Human Services (HHS) noted a significant decline in adverse drug events due to improved clinical decision support tools integrated within these systems. The demand for effective information systems becomes indispensable for better care delivery and data management because of the rising prevalence of chronic diseases. This is supported by the World Health Organization (WHO) by saying that it impacts nearly 60% of adults worldwide.

MARKET DRIVERS

Rising Chronic Disease Burden

The surge in chronic illnesses such as diabetes, cardiovascular diseases and cancer is a major catalyst for the adoption of Clinical Information Systems (CIS). According to the World Health Organization (WHO), chronic conditions contribute to 74% of global deaths each year. In the United States, the Centers for Disease Control and Prevention (CDC) highlights that 60% of adults manage at least one chronic ailment. CIS enables seamless monitoring of patient data, optimizing treatment protocols and medication management. These systems improve care coordination which reduces hospital readmissions and empowering healthcare providers to deliver better outcomes for patients with long-term conditions.

Healthcare Digitization Initiatives

Government-backed digitization programs are fueling CIS adoption, promoting efficiency and better care. The U.S. HITECH Act incentivized widespread use of electronic health records, with 89% of physicians utilizing EHRs by 2022 (CMS). Similarly, Europe’s EU Health Data Space fosters interoperability and secure information sharing. These policies prioritize modernizing healthcare infrastructure enhancing data accessibility and improving clinical workflows. CIS has become vital for achieving regulatory objectives with growing investment in digital health to streamline operations and ensure superior patient management.

MARKET RESTRAINTS

High Deployment Costs

The significant expenses associated with implementing Clinical Information Systems act as a major obstacle for smaller healthcare providers. Reports from the American Hospital Association indicate that establishing a standard electronic health record platform can cost between $1 million and $5 million with additional yearly maintenance accounting for 10–20% of this figure. Smaller hospitals and clinics often struggle to afford such investments due to limited budgets. Furthermore, the need for upgraded infrastructure, staff training, and system integration adds to these financial challenges creating a barrier to broader adoption especially in underfunded healthcare settings.

Privacy and Security Challenges

Concerns around data protection and cybersecurity create substantial resistance to adopting Clinical Information Systems. The U.S. Department of Health and Human Services reported that over 52 million healthcare records were compromised in 2023 due to cyber incidents highlighting vulnerabilities. The Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe mandate strict compliance measures, adding complexity and raising costs for providers. Fear of unauthorized access to sensitive patient data fosters skepticism among stakeholder and, thereby limiting the implementation of these advanced systems in healthcare institutions.

MARKET OPPORTUNITIES

Advancements in Artificial Intelligence Integration

Integrating artificial intelligence into clinical systems offers substantial potential for transforming healthcare delivery. Advanced algorithms enable predictive analytics, personalized treatment planning, and accurate diagnosis. The National Institutes of Health states that pilot programs using AI have achieved a 30% reduction in diagnostic errors. Furthermore, these technologies streamline administrative tasks by freeing up time for patient care. The push toward precision medicine and value-based healthcare amplifies the importance of AI-driven tools in clinical information systems. These advancements present an avenue for significant innovation in improving patient outcomes and operational performance by enhancing efficiency and enabling data-driven decision-making.

Expansion of Telehealth Capabilities

The increasing use of telemedicine creates opportunities to enhance clinical systems for remote care management. According to the U.S. Centers for Disease Control and Prevention, telehealth usage surged by 154% during the pandemic’s peak in 2020. Integrating remote consultation capabilities with clinical systems allows seamless sharing of medical data, supporting better care coordination and access for patients in underserved areas. These platforms enable real-time monitoring and virtual interactions ensuring continuity of treatment. As telehealth becomes integral to healthcare delivery systems equipped with robust remote-care functionalities will be instrumental in shaping the future of medical services globally.

MARKET CHALLENGES

Integration Challenges Across Platforms

Achieving seamless connectivity between different clinical systems remains a critical obstacle in the market. The Office of the National Coordinator for Health Information Technology highlights that only 46% of hospitals in the United States can efficiently exchange patient records with external providers. This lack of compatibility hinders data sharing creating inefficiencies in treatment workflows and delaying critical decisions. Many healthcare providers still depend on outdated technologies that struggle to align with modern systems leading to data silos. Overcoming these integration barriers is essential to enhance operational efficiency and ensure comprehensive access to patient information across care networks.

Limited Availability of Skilled Personnel

The complexity of managing advanced clinical systems requires a specialized workforce, yet many institutions face difficulties in finding qualified professionals. According to the U.S. Bureau of Labor Statistics, the demand for healthcare IT roles is expected to grow by 13% by 2030 but supply remains insufficient. This shortage delays system implementations and restricts the ability to fully utilize existing platforms. Moreover, inadequate training often results in underperformance of these technologies limiting their impact. Addressing this challenge through focused educational initiatives and workforce development programs is vital to support the growing reliance on digital healthcare solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Deployment, Component, Application, End-users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Cerner Corporation (An Oracle Company), Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., GE HealthCare, Philips Healthcare, McKesson Corporation, Siemens Healthineers, eClinicalWorks, Meditech, IBM Watson Health |

SEGMENTAL ANALYSIS

By Deployment Insights

The on-premises deployment segment dominated the clinical information systems market by accounting for the leading share of the global market in 2024 owing to the strong emphasis on data security and direct control over infrastructure. Healthcare providers favour this approach to ensure compliance with stringent regulatory standards and minimize risks linked to third-party data handling. The U.S. Department of Health and Human Services (HHS) highlights that relying on external storage solutions can expand potential vulnerabilities prompting organizations to manage sensitive information internally. This deployment method allows institutions to maintain robust oversight of patient records safeguarding privacy while meeting healthcare-specific data protection requirements.

The cloud-based deployment segment is experiencing the highest CAGR during the forecast period due to its flexibility, scalability and cost-efficiency. The National Institutes of Health (NIH) underscores the cloud’s ability to dynamically allocate resources improving operational efficiency and reducing expenditures. Additionally, the Centers for Disease Control and Prevention (CDC) notes that modernizing data systems with cloud technologies enhances interoperability and facilitates real-time data sharing. These attributes enable healthcare providers to adapt quickly to changing needs, improve collaboration and access critical clinical data remotely making cloud-based solutions increasingly vital in advancing healthcare delivery.

By Component Insights

The software & systems segment led the market by capturing 45.4% of global clinical information system market share in 2024. This dominance is due to the widespread adoption of advanced software solutions, such as Electronic Health Records (EHRs), Radiology Information Systems (RIS), and Laboratory Information Systems (LIS). These systems streamline workflows that enhances patient data management and improve decision-making in healthcare facilities. For example, in the United States, 96% of non-federal acute care hospitals have adopted certified EHRs highlighting the importance of software in healthcare operations. The growing emphasis on interoperability, regulatory compliance, and digital transformation in healthcare further solidifies this segment's leading position.

The services segment is swiftly emerging with a CAGR of 14.5% over the forecast period. This growth is driven by the increasing demand for implementation, training, maintenance, and technical support services as healthcare providers adopt sophisticated IT solutions. Managed services are gaining traction due to their scalability and cost-effectiveness with the rise of cloud-based platforms. Governments and healthcare organizations globally are investing in staff training and system upgrades to ensure optimal utilization of clinical IT solutions. This rising reliance on services to support complex healthcare ecosystems makes it the most dynamic and rapidly expanding component of the market.

By Application Insights

The hospital information systems (HIS) segment dominated the clinical information system market in 2024 with 35.9% of the global market share due to its essential role in managing patient data, administrative workflows, and clinical operations. The World Health Organization (WHO) reports that nearly 89% of hospitals in high-income nations have adopted electronic health records which is a core feature of HIS. These systems significantly reduce medical errors by up to 55%, according to the U.S. Department of Health and Human Services (HHS). HIS enhances operational efficiency by streamlining communication between departments by optimizing resource allocation and improving patient care delivery. HIS remains critical to modern hospital infrastructure with the increasing digitization of healthcare services.

On the other hand, the medical imaging information systems segment is the fastest-growing segment and is projected to grow at a CAGR of 15.1% during the forecast period. This growth is driven by the rising prevalence of chronic diseases, such as cardiovascular conditions which cause 17.9 million deaths annually according to the WHO. The adoption of AI-powered imaging solutions and the digitization of healthcare further contribute to the segment's rapid expansion. While HIS dominates due to its comprehensive role in hospital management, Medical Imaging Information Systems are expanding rapidly as they address the critical need for diagnostic accuracy and efficient imaging workflows.

By End-Users Insights

The hospitals and clinics segment was the largest segment in the global clinical information system market with 55% of the total market share in 2024. This dominance is attributed to the high adoption of advanced clinical information systems, such as Electronic Health Records (EHRs) and Hospital Information Systems (HIS) which are critical for managing patient data, enhancing care delivery, and ensuring compliance with regulatory standards. Hospitals are the primary healthcare providers that require robust IT infrastructure to handle the increasing patient influx and improve operational efficiency. According to the Office of the National Coordinator for Health Information Technology (ONC), 96% of U.S. non-federal acute care hospitals have adopted certified EHR systems, underscoring the segment's prominence. The rising demand for interoperability and the integration of telehealth solutions in hospital workflows further bolster this segment's leading position.

The diagnostic centers segment is emerging steadily and anticipated to have a CAGR of 14.2% during the forecast period. This growth is driven by the increasing adoption of Laboratory Information Systems (LIS) and Radiology Information Systems (RIS) to improve diagnostic accuracy and streamline workflows. The rising prevalence of chronic diseases which require advanced diagnostic procedures is a key driver for the growth rate of this segment. For instance, the World Health Organization (WHO) states that 17.9 million people die annually from cardiovascular diseases, many of which require diagnostic imaging. Diagnostic centers are also adopting AI-driven imaging solutions to enhance efficiency and reduce turnaround times. The global push for digitization in healthcare is coupled with the demand for cost-effective and accurate diagnostic services that makes this segment the fastest growing segment in the market.

REGIONAL ANALYSIS

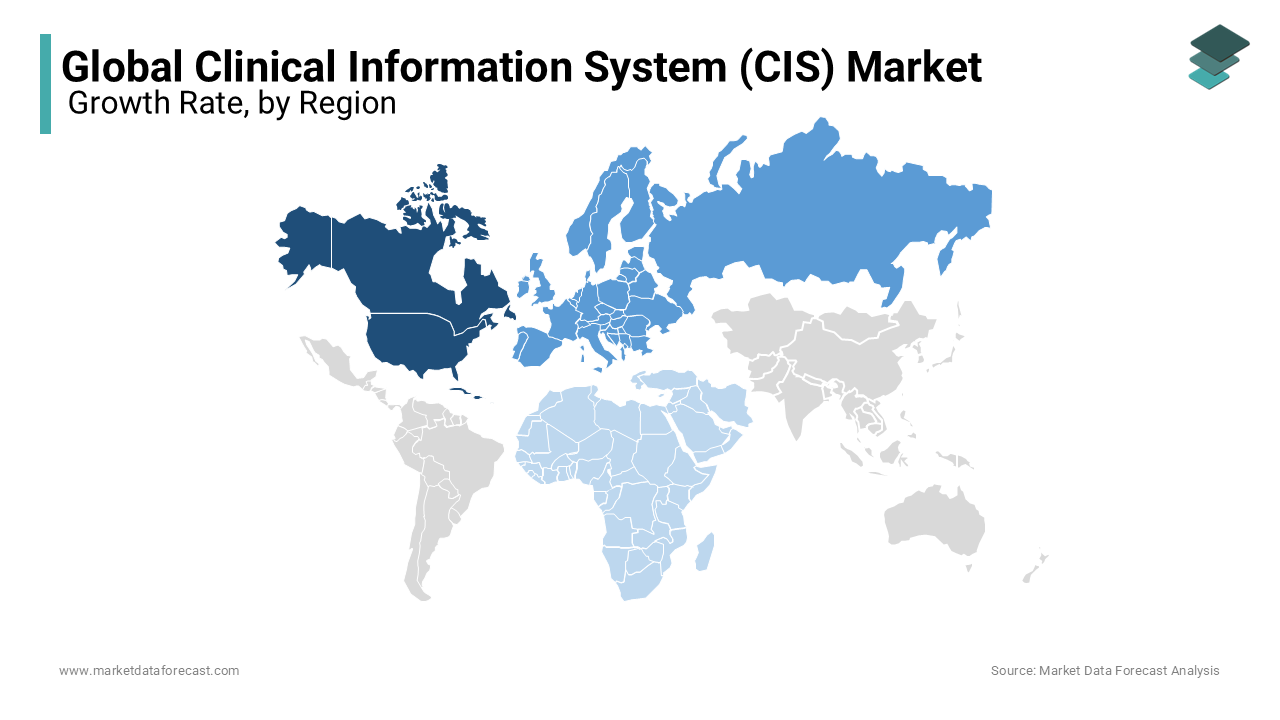

North America dominated the market and accounted for 40.9% of the global clinical information system market share in 2024. This dominance is driven by the widespread adoption of health IT solutions and strong government support for digital healthcare systems. In the United States, 96% of non-federal acute care hospitals had adopted certified Electronic Health Records (EHRs) by 2021, according to the Office of the National Coordinator for Health IT (ONC). The region is expected to grow at a CAGR of 8.2% from 2025 to 2033, supported by advancements in interoperability, telehealth integration, and increasing investments in artificial intelligence that drives the demand for the clinical systems.

Europe is projected to grow at a significant CAGR over the forecast period as healthcare providers increasingly adopt AI-powered decision support systems and advanced data analytics tools. Countries such as Germany, the United Kingdom, and France lead the region due to their advanced healthcare infrastructure and stringent regulations regarding patient data management. The European Union’s Digital Health Europe initiative promotes the adoption of clinical information systems to enhance healthcare quality and patient outcomes.

Asia-Pacific is anticipated to showcase a remarkable CAGR of 9.8% during the forecast period in the global clinical information system market. This rapid growth is attributed to the expanding healthcare sectors in countries such as China, India, and Japan. In China, significant government initiatives like "Healthy China 2030" are driving investments in healthcare digitization, including the adoption of clinical information systems. India is also witnessing growth with initiatives like the National Digital Health Mission (NDHM), which aims to create a unified digital health infrastructure. The increasing prevalence of chronic diseases and rising healthcare expenditure are further accelerating growth in this region.

Latin America is expected to be a notable market for clinical information systems globally by the end of forecast period. The market growth in Latin America is driven by countries like Brazil and Mexico, where governments and healthcare organizations are investing in digital solutions to enhance patient care and operational efficiency. The region’s market is expected to grow at a CAGR of 6.8% from 2025 to 2033 owing to the increasing adoption of telemedicine platforms and electronic health records to address the challenges of limited healthcare access.

The market in Middle East and Africa is anticipated to witness a steady CAGR over the forecast period. Growth in the region is driven by government initiatives in countries like the UAE and Saudi Arabia, which are investing in healthcare IT to modernize their healthcare systems. Additionally, the increasing need for efficient resource management and digital patient records is boosting the adoption of clinical information systems.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

Cerner Corporation (An Oracle Company), Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., GE HealthCare, Philips Healthcare, McKesson Corporation, Siemens Healthineers, eClinicalWorks, Meditech, IBM Watson Health are some of the key market players.

The Clinical Information System (CIS) market is intensely competitive, featuring prominent global firms, regional providers, and emerging innovators. Industry leaders such as Cerner Corporation, Epic Systems, Allscripts and GE Healthcare dominate due to their comprehensive product offerings, advanced technologies, and established reputations. These organizations maintain their competitive advantage by developing integrated platforms addressing areas like patient monitoring, clinical decision-making and electronic health records. Strategic collaborations and continuous innovation further strengthen their market standing.

Regional players contribute significantly, especially in localized markets, by delivering solutions tailored to specific healthcare challenges and regulatory environments. These companies often compete by offering adaptable and affordable systems, appealing to mid-sized healthcare facilities and clinics.

The market has seen notable consolidation, as larger companies acquire smaller firms to enhance capabilities and broaden their reach. Oracle’s acquisition of Cerner exemplifies this trend, highlighting the growing focus on cloud-based technologies and data analytics in healthcare.

Advances in artificial intelligence, telehealth integration, and interoperability are driving competition, pushing organizations to differentiate through cutting-edge innovation and enhanced user experiences. Key factors such as regulatory adherence, cybersecurity measures, and system usability continue to shape competitive strategies. The ongoing digital transformation ensures that the CIS market remains dynamic and highly contested.

RECENT MARKET DEVELOPMENTS

- In December 2024, Verily Life Sciences, a subsidiary of Alphabet, announced plans to pivot toward artificial intelligence. The company aims to offer tech infrastructure that supports AI models and app development for healthcare companies.

- In March 2024, Deciphex, a Dublin-based medical technology company, secured €31 million in Series C funding to expand its AI-driven pathology platforms, aiming to address the global shortage of pathologists.

MARKET SEGMENTATION

This research report on the clinical information system (cis) market is segmented and sub-segmented into the following categories.

By Deployment

- Cloud-based

- On-Premises

By Component

- Hardware

- Software & Systems

- Services

By Application

- Hospital Information Systems

- Pharmacy Information Systems

- Laboratory Information Systems

- Revenue Cycle Management

- Medical Imaging Information Systems

- Radiology Information Systems

- Others

By End-Users

- Hospitals and Clinics

- Academic & Research Centers

- Pharmaceutical & Biotechnology Companies

- Diagnostic Center

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the Clinical Information System (CIS) Market?

The growth is driven by increased EHR adoption, technological advancements in healthcare IT, and government regulations promoting digital healthcare. Rising demand for better patient care and operational efficiency also plays a key role.

What are the challenges faced by the Clinical Information System (CIS) Market?

Challenges include high implementation costs, integration issues with existing systems, and concerns over data privacy and security. Regulatory compliance and the shortage of skilled professionals also hinder market growth.

Which region is leading the Clinical Information System (CIS) Market?

North America leads the Clinical Information System (CIS) Market driven by advanced healthcare infrastructure and regulatory support for digital health systems

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]