Global Container Handling Equipment Market Size, Share, Trends, & Growth Forecast Report - Segmented By Tonnage (<10 tons, 10-40 tons, 41-70 tons, and 71-100 tons), Propulsion (Diesel, Electric, and Hybrid), Power Output (<150kw, 150-200kw, 201-300kw, >300kw), Equipment (Automatic stacking cranes, Empty container handling FLT, Ship to shore cranes, Mobile harbor cranes, Laden Forklift trucks, RMG, RTG, Straddle carriers, Reach stackers, and Terminal tractors), & Region - Industry Forecast From 2024 to 2032

Global Container Handling Equipment Market Size (2024 to 2032)

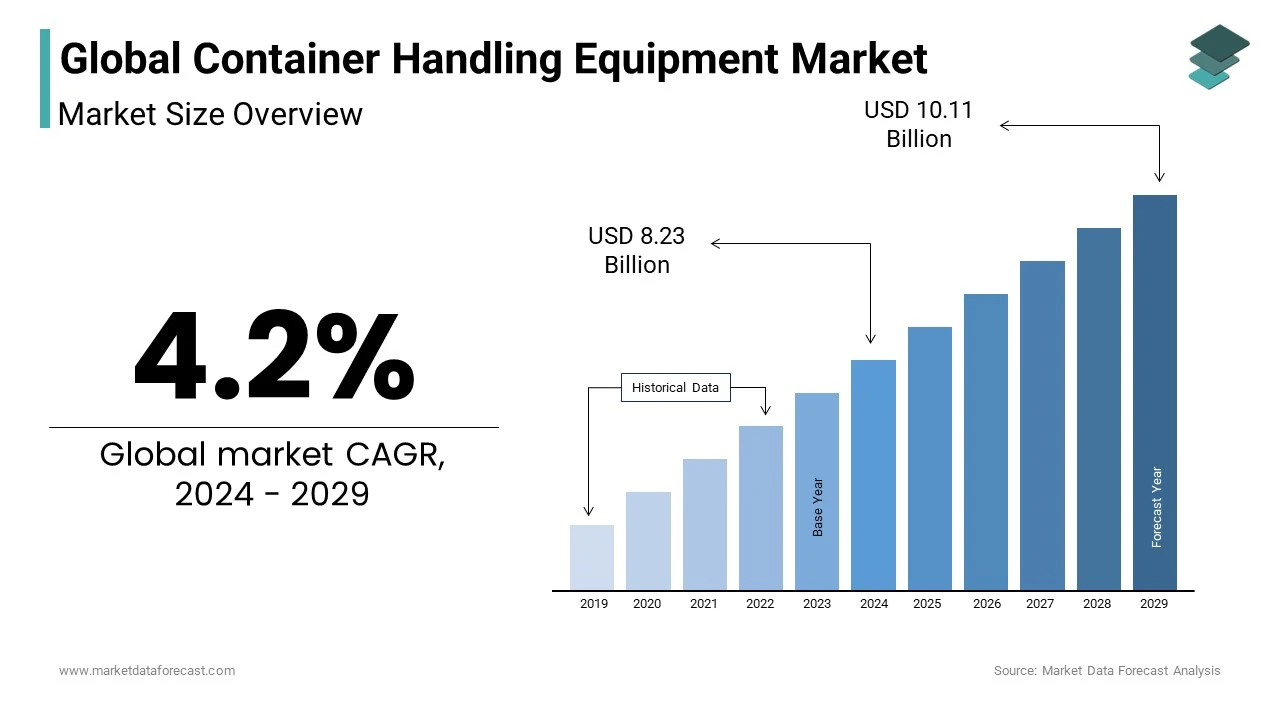

The size of the global container handling equipment market was worth USD 7.90 billion in 2023. The global market is expected to be worth USD 8.23 billion in 2024 and USD 11.44 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

Current Scenario of the Container Handling Equipment Market

Container handling equipment is used to store containerized goods and materials effectively in the operation of shipping ports and terminals. This equipment is designed in a specific way to store, move, or protect the standardized containers and cargo. This equipment has changed the handling and transportation techniques in a positive way. Investors are planning to understand different types of equipment to improve their operational efficiency.

MARKET DRIVERS

Growing demand from various industries such as automotive, petrochemicals, chemicals and materials, and others are adopting automation technology that is helping them to improve the efficiency of the trades.

The trend towards automation technology in ports is a major factor propelling the demand of the container handling equipment market. These companies have millions of trade exports and imports every year from different regions that are ascribed to boost the growth rate of the container handling equipment market. The growing demand for the transportation of goods in the Asia Pacific region is adding fuel to the growth rate of the market. The increasing volume of trade from the past few years is leveling the demand for the market as well. In addition, the rising economy in both developed and developing countries is boosting the growth rate of the market.

Increasing investments and the rising prevalence of containerized trade are increasing the growth rate of the container-handling equipment market.

The launch of innovative products using advanced technology is additionally enhancing the demand of the market. Constantly growing demand for containerized trade is accelerating the demand of the market.

MARKET RESTRAINTS

The penetration of advanced technology is bringing new aspects to the cargo handling industry. However, the new technologies adopted in this industry are facing a lot of challenges with the complexity of the machines. The cost of the installation and maintenance of the equipment is rising, which is acting as a big barrier to the growth rate of the container handling equipment market.

Stringent norms by the government authorities over trade are slowly restraining the demand of the market. In addition, regularly changing norms for the upgradation of the products is degrading the demand of the container handling equipment market. The productivity at the port terminals is reducing due to the lack of integration of the new technologies. The lack of integration is certainly a major challenging factor for the market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.2% |

|

Segments Covered |

By Propulsion Type, Power Output, Tonnage Capacity, Equipment Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kalmar, Konecranes, Liebherr, Hyster, Sany and Others. |

SEGMENTAL ANALYSIS

Global Container Handling Equipment Market By Propulsion Type

The electric segment is witnessed the highest shares of the market in the past two years, whereas the hybrid segment is all set to hit the highest CAGR in the foreseen years.

Growing prevalence of environmental safety measures, the demand for the electric segment is growing at a random rate. Launch of various equipment in electric variants such as RMG, ASC, and ship to shore are fuelling the demand for the electric container handling equipment market. Also, government initiatives are prompting the growth rate of the market to an extent.

Global Container Handling Equipment Market By Power Output

150-200kW segment is anticipated to have the largest shares of the market. Following stringent norms released by higher authorities in respective regions by key players and launching equipment favorable to the norms is ascribed to bolster the demand of the market eventually. >300kW segment is to have growth opportunities in the coming years.

Global Container Handling Equipment Market By Tonnage Capacity

41-70 Tons segment is ruling the largest shares of the market. In emerging countries such as China, India, South Korea, and others, the large ports are handling more than 15 million TEU every year, which is inclined to show a positive impact on the growth rate of this segment. The increasing need for the storage of huge containers in ports is accelerating the demand of the market.

Global Container Handling Equipment Market By Equipment Type

The ship-to-shore cranes segment is anticipated to lead the significant shares of the market.

Following this segment, the automatic stacking cranes segment is accounted to have the largest shares, whereas the RMG segment is to have the highest CAGR by the end of 2028. The terminal tractors segment is esteemed to have huge growth opportunities during the forecast period.

REGIONAL ANALYSIS

Asia Pacific container handling equipment market is projected to gain traction of shares during 2024 to 2029.

The growing economy in emerging countries and rising trade values are major contributing factors for the highest shares of the market in Asia Pacific. An increasing number of ports in China and the growing need to adopt new technological equipment in the terminals for easy handling are likely to surge the demand of the market in the future. Also, growing investment from both the public and private sectors is setting up new market value. Increasing traffic in the large port terminals is adding fuel to the market in the Asia Pacific.

North American container handling equipment is next in having the dominant shares owing to growing per capita income in developed countries like the US and Canada.

Also, the growing number of players and rapid urbanization are the factors attributed to the increase in the shares of the market.

Europe region is to show up the highest growth rate during the forecast period 2024 to 2029.

The increasing economy is a major growth factor in this region. Growing imports & export activities in major countries like UK, Italy, and Spain are lavishing the shares of the Europe container handling equipment market.

KEY MARKET PLAYERS

Major Key Players in the Global Container Handling Equipment Market are Kalmar (Finland), Konecranes (Finland), Liebherr (Switzerland), Hyster (US), Sany (China) and others.

RECENT HAPPENINGS IN THE MARKET

In 2021, Konecranes received an order of Konecranes Gottwald ESP.8 Mobile Crane from Terminal San Giorgio for its Terminal in Italy. In 2022, this crane got delivered, which is the very first generation 6 crane in Italy.

DETAILED SEGMENTATION OF THE GLOBAL CONTAINER HANDLING EQUIPMENT MARKET INCLUDED IN THIS REPORT

This research report on the global container handling equipment market has been segmented and sub-segmented based on propulsion type, power output, tonnage capacity, equipment type, and region.

By Propulsion Type

- Diesel

- Electric

- Hybrid

By Power Output

- <150 kW

- 150-200 kW

- 201-300 kW

- >300 kW

By Tonnage Capacity

- <10 Tons

- 10-40 Tons

- 41-70 Tons

- 71-100 Tons

By Equipment Type

- Automatic stacking cranes

- Empty container handling FLT

- Ship-to-shore cranes

- Mobile harbor cranes

- Laden Forklift trucks

- RMG

- RTG

- Straddle carriers

- Reach stackers

- Terminal tractors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the global container handling equipment market?

Key drivers include increasing global trade, the expansion of port infrastructure, advancements in automation and electrification of equipment, and the growing demand for efficient and sustainable container handling solutions.

What types of equipment are included in the container handling equipment market?

The market includes equipment such as ship-to-shore cranes, yard cranes, straddle carriers, reach stackers, forklifts, and automated guided vehicles (AGVs). These are essential for efficient loading, unloading, and transportation of containers.

What are the key trends influencing the container handling equipment market?

Key trends include the shift towards electric and hybrid equipment to reduce carbon emissions, the integration of IoT and AI for predictive maintenance, and the development of more compact and efficient equipment designs.

What is the future outlook for the global container handling equipment market?

The future outlook is positive, with continuous growth expected due to the rise in global trade, advancements in technology, and the ongoing need for efficient and sustainable port operations. Innovations in automation and electrification will further enhance market dynamics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com