Global Decaffeinated Products Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product Type, Others, Process, Distribution Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 to 2033.

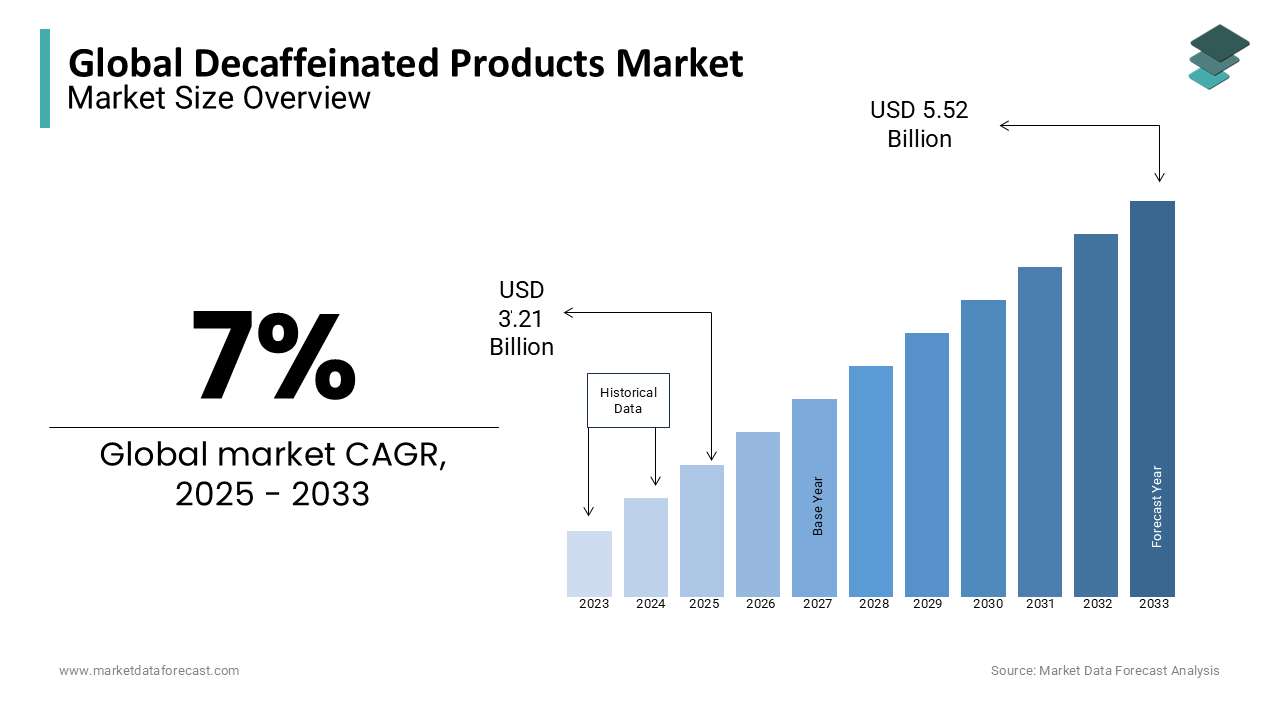

Global Decaffeinated Products Market Size (2025 to 2033)

The global decaffeinated products market size was calculated to be USD 3 billion in 2024 and is anticipated to be worth USD 5.52 billion by 2033 from USD 3.21 billion In 2025, growing at a CAGR of 7% during the forecast period.

CURRENT SCENARIO OF THE GLOBAL DECAFFEINATED PRODUCTS MARKET

The global market for decaffeinated products has witnessed substantial growth over the past decade, primarily attributed to a growing consumer inclination towards healthier alternatives and heightened awareness of the potential health impacts of caffeine. Shifts in lifestyle trends, especially those focused on wellness and a preference for lower caffeine intake, have spurred demand for decaffeinated beverages, including coffee, tea, and other related products.

With increasing consumer awareness, competition in this space has intensified. Major industry players such as Nestlé, Swiss Water, and The Kraft Heinz Company are expanding their decaffeinated product portfolios to cater to the health-conscious consumer segment. Leading markets include North America and Europe, where consumer awareness around wellness products remains particularly high. The United States, in particular, has emerged as a key region, driven by growing demand for premium decaf options. Similarly, European nations, such as Germany and Italy, are experiencing increased consumption of decaffeinated coffee.

The market is further being shaped by innovations in eco-friendly decaffeination processes, including the chemical-free Swiss Water Process, which is gaining traction among environmentally-conscious consumers. Additionally, the rise in specialty and organic decaffeinated products reflects a broader consumer base increasingly seeking products that combine quality with sustainability.

MARKET TRENDS

Growing Demand for Health-Conscious Beverages

The increasing focus on health and wellness continues to drive the growth of the decaffeinated products market. Consumers are increasingly looking for beverages that deliver the same taste and experience of coffee or tea but without the caffeine-related health concerns, such as anxiety, insomnia, or cardiovascular issues. This shift is particularly evident among health-conscious millennials and Gen Z consumers, who are adopting healthier lifestyle choices. A 2023 report from the National Coffee Association indicates that 66% of U.S. consumers are actively reducing their caffeine intake, positioning decaf coffee as a growing alternative. Consequently, beverage manufacturers are broadening their decaffeinated offerings, with companies such as Starbucks expanding their range of decaf products to meet this rising demand.

Adoption of Sustainable Decaffeination Methods

Sustainability is becoming an increasingly important consideration for consumers, and this is driving demand for decaffeinated products that utilize eco-friendly production methods. The Swiss Water Process, which uses water rather than chemicals for decaffeination, has gained substantial traction in recent years, particularly among consumers seeking both quality and environmental responsibility in their products. In 2022, Swiss Water Decaffeinated Coffee Inc. reported a 15% surge in demand for its chemical-free decaf offerings, underscoring the growing consumer preference for greener production techniques. Other industry leaders, including Nestlé, are also investing in sustainable decaffeination methods to attract environmentally-conscious consumers.

Expansion of Specialty Decaffeinated Products

The specialty decaffeinated products segment is witnessing notable growth as consumers increasingly seek out high-quality, artisan, and organic decaf beverages. Standard decaf offerings are no longer sufficient, as discerning consumers now demand single-origin and ethically sourced decaf products that do not compromise on flavor. Specialty coffee roasters are responding to this demand by introducing premium decaf options, with companies like Blue Bottle Coffee enhancing their decaf product lines to feature richer, more complex flavor profiles. The rise in organic and fair-trade certifications for decaf products is also driving this trend, with many consumers willing to pay a premium for decaf beverages that prioritize ethical sourcing and superior craftsmanship.

MARKET DRIVERS

Increasing Awareness of Caffeine-Related Health Issues

Heightened awareness of the potential health risks associated with excessive caffeine consumption is a primary driver of the decaffeinated products market. Studies have indicated that high caffeine intake can contribute to sleep disturbances, anxiety, and cardiovascular issues, particularly in individuals with heightened sensitivity to caffeine. As a result, consumers are increasingly opting for decaffeinated alternatives. A 2022 survey conducted by the International Food Information Council (IFIC) found that nearly 40% of U.S. adults are moderating their caffeine intake due to health concerns. This shift in consumer preferences is boosting the demand for decaffeinated coffee, tea, and other beverages, with major brands such as Starbucks and Dunkin’ Donuts responding by expanding their decaf product offerings to meet the needs of health-conscious consumers.

Rising Demand for Non-Alcoholic Beverages

A global trend toward reduced alcohol consumption is also contributing to the rising demand for non-alcoholic alternatives, including decaffeinated beverages. Consumers, particularly those in younger demographics, are increasingly seeking alternatives that align with their health-focused lifestyles. According to a 2023 report by NielsenIQ, the non-alcoholic beverage market is projected to grow at a compound annual growth rate (CAGR) of 7% through 2030, with decaffeinated products playing a crucial role in this expansion. Leading coffee brands are capitalizing on this trend by introducing a broader array of decaf options, enabling consumers to enjoy their favorite beverages without the stimulating effects of caffeine. The continued shift toward wellness-oriented products is fueling the growth of decaf beverages in cafes, restaurants, and retail outlets globally.

Technological Advancements in Decaffeination Processes

Technological innovations are improving the quality and appeal of decaffeinated beverages, making them more attractive to consumers. Traditional decaffeination methods, which often relied on chemical solvents, are being replaced by advanced processes such as the Swiss Water Process and CO2 extraction methods. These newer technologies effectively remove caffeine while preserving the flavor and aroma of coffee, resulting in superior-quality decaf products. Companies like Swiss Water Decaffeinated Coffee Inc. are at the forefront of this technological shift, with an increasing number of roasters and manufacturers adopting these methods to meet the growing demand for cleaner, better-tasting decaffeinated options.

MARKET RESTRAINTS

High Production Costs of Decaffeinated Products

The decaffeination process, particularly those utilizing chemical-free methods, incurs high costs, creating a significant barrier to broader market expansion. Advanced techniques, such as the Swiss Water Process and CO2 decaffeination, involve expensive technology and additional steps to ensure the preservation of natural flavors while removing caffeine. Consequently, decaffeinated products are priced at a premium, which may deter cost-conscious consumers. According to a 2022 Coffee Review report, decaffeinated coffee can be up to 20% more expensive than regular coffee due to these production expenses. This pricing disparity restricts the market's reach, particularly in price-sensitive developing regions, where affordability is a key determinant of purchasing decisions.

Perception of Inferior Taste

A longstanding challenge in the decaffeinated products market is the consumer perception that decaf beverages lack the rich flavor of their caffeinated counterparts. Historically, the decaffeination process has been associated with diminished taste, leading to the notion that decaf products are of inferior quality. While advancements in technology have significantly improved flavor retention, this negative perception continues to influence consumer choices. A 2023 survey by the Specialty Coffee Association found that 30% of coffee drinkers avoid decaf products due to concerns about taste, highlighting the importance of marketing efforts aimed at educating consumers about the improvements in decaf quality.

Limited Availability in Certain Markets

Despite the rising demand for decaffeinated products, availability remains limited in several regions, particularly in areas where traditional coffee and tea consumption dominate. In developing markets, where caffeine consumption is deeply embedded in cultural practices, decaf options are scarce in both retail and hospitality settings. Furthermore, logistical challenges, such as the need for specialized decaffeination facilities, restrict widespread distribution. This limited availability poses a challenge to market growth, particularly in regions where consumer interest in health-conscious alternatives is growing but access to decaffeinated products remains limited.

MARKET OPPORTUNITIES

Rising Demand for Decaf in Functional Foods and Beverages

The increasing incorporation of decaffeinated coffee and tea into functional foods and beverages presents a promising growth opportunity. As consumers seek out functional products with added health benefits—such as those enriched with vitamins, antioxidants, or probiotics—there is a growing demand for decaffeinated options within this category. Manufacturers can tap into this trend by integrating decaf ingredients into functional beverages like protein shakes and energy drinks, providing consumers with health benefits while avoiding caffeine's stimulating effects.

Growth in Decaf E-commerce Sales

The rise of e-commerce presents a significant opportunity for expanding the reach of decaffeinated products. As online retail continues to grow, consumers are increasingly purchasing specialty and niche products, including decaf beverages, through digital channels. E-commerce platforms offer brands the ability to reach a wider audience without the limitations of physical retail space. A 2022 report from the National Coffee Association noted that 25% of U.S. coffee consumers now buy their coffee online, a trend that has been accelerated by the COVID-19 pandemic. By optimizing their e-commerce strategies, decaf brands can target specific consumer segments more effectively and drive higher sales.

Growing Popularity of Decaf Cold Brew

The growing popularity of cold brew coffee presents a unique opportunity for decaf products within this fast-growing segment. Known for its smoother taste and lower acidity, cold brew appeals to health-conscious consumers, and decaf cold brew offers the additional benefit of being caffeine-free. Brands that introduce innovative decaf cold brew options can cater to the increasing demand for refreshing, health-oriented beverages that deliver on taste without the stimulating effects of caffeine.

MARKET CHALLENGES

Limited Consumer Awareness in Emerging Markets

One of the most significant challenges facing the decaffeinated products market is the limited awareness of decaf options in emerging markets. In regions such as Africa, Asia, and Latin America, where caffeine consumption is deeply rooted in cultural practices, consumers often lack information about the health benefits of decaffeinated alternatives. This lack of awareness slows market penetration in these regions, where regular coffee and tea dominate. For instance, in Brazil—one of the largest coffee-consuming nations—decaf represents less than 10% of the total coffee market, according to a 2023 report by ABIC (Brazilian Coffee Industry Association). To grow demand, manufacturers will need to prioritize consumer education and awareness campaigns in these regions.

Complex Supply Chain and Sourcing Challenges

The decaffeination process requires specialized, often costly, technology and infrastructure, leading to significant challenges in sourcing and supply chain management. The capital-intensive nature of establishing decaffeination plants, particularly those using advanced processes like the Swiss Water or CO2 methods, limits the number of suppliers capable of producing high-quality decaf products. Moreover, the geographic concentration of decaffeination facilities in regions like Europe and North America creates logistical barriers for coffee producers in regions such as Africa or South America, who must export their beans for decaffeination before re-importing them for sale. This complex supply chain raises costs and reduces the accessibility of decaf products in certain markets.

Difficulty in Preserving Taste and Quality

A persistent challenge in the decaffeinated products market is maintaining the taste and quality of beverages after caffeine is removed. The decaffeination process—particularly older, chemical-based methods—can strip coffee and tea of their natural flavors and aromas, resulting in a less appealing product for consumers. While advancements such as the Swiss Water Process have improved flavor retention, overcoming the negative perception of decaf beverages remains an ongoing challenge for the industry. Brands must continue to innovate and communicate the improved taste and quality of decaf options to shift consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7% |

|

Segments Covered |

By Product type, Process, Others, Distribution Channel, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestlé S.A., Swiss Water Decaffeinated Coffee Inc., The Kraft Heinz Company, Starbucks Corporation, The Coca-Cola Company (Costa Coffee), Peet's Coffee, Tata Consumer Products Limited, J.M. Smucker Company, Illycaffè S.p.A., and Lavazza Group |

SEGMENTAL ANALYSIS

By Product Type Insights

Ground coffee represents the largest segment within the coffee category, capturing approximately 40% of the market. It is anticipated to exhibit steady growth, with a projected CAGR of 4.2%. The consistent quality and ease of preparation associated with ground coffee have solidified its global appeal, making it a favored choice among consumers. Prominent brands such as Nestlé and Lavazza have further driven its widespread presence across retail and hospitality sectors. Additionally, the growing consumer preference for artisanal and specialty coffee, as well as the increasing popularity of organic and fair-trade options, has bolstered this segment, particularly among health-conscious and environmentally-aware buyers.

Ready-to-drink (RTD) coffee beverages are emerging as the fastest-growing segment, with a robust CAGR of 8.1%. This growth is fueled by health-conscious consumers and the increasing demand for convenience. Leading brands such as Starbucks and Coca-Cola have capitalized on this trend by expanding their RTD offerings. The segment’s appeal lies in its ability to provide functional benefits, with many options incorporating protein or energy-boosting ingredients. RTD coffee sales are projected to surpass $30 billion globally by 2030, underscoring its significant growth trajectory.

Black tea continues to dominate the overall tea market, holding about 45% of the global market share. Its widespread acceptance, steeped in cultural traditions across regions like the UK and India, underpins its leading position. Moreover, the rising interest in antioxidant-rich beverages and innovations in flavors and packaging have contributed to the segment’s sustained growth. Premium and organic black tea offerings are particularly gaining traction, aligning with the increasing consumer shift towards healthier, higher-quality products.

Herbal tea is the fastest-growing tea segment, with a projected CAGR of 7.9%. Consumers are increasingly opting for wellness-oriented products, propelling demand for caffeine-free, health-enhancing options such as chamomile, ginger, and turmeric teas. The purported health benefits, including improved digestion and stress relief, have made herbal teas popular among health-conscious individuals. In 2023, the herbal tea market was valued at approximately $4 billion, and its growth is expected to continue as more consumers gravitate towards functional beverages.

CSDs maintain a commanding position, accounting for over 55% of the total soft drink market. Despite growing health concerns regarding sugar content, CSDs remain popular due to aggressive marketing, brand loyalty, and easy availability. However, brands are increasingly introducing sugar-free and low-calorie variants to appeal to health-conscious consumers. The addition of flavored carbonated waters and functional soft drinks demonstrates the industry’s shift towards more health-conscious offerings.

Functional drinks, including sports drinks and vitamin-infused beverages, represent the fastest-growing segment in the soft drinks category, with a CAGR of 6.7%. Consumer interest in wellness and fitness is driving demand for these beverages, which offer functional benefits such as added vitamins and electrolytes. In 2023, global sales in this segment surpassed $12 billion, with the Asia-Pacific region leading the growth.

Regular energy drinks, which contain caffeine and sugar, dominate the energy drinks market, accounting for 60% of the segment. These beverages primarily appeal to younger consumers, including athletes and students, due to their ability to provide quick energy boosts and enhance mental alertness. Brands like Red Bull and Monster continue to innovate by expanding their product lines with new flavors and collaborations.

Sugar-free energy drinks are witnessing rapid growth, boasting a CAGR of 9.3%. Growing health awareness and concerns regarding sugar consumption have prompted consumers to seek healthier alternatives. Major players, including Red Bull and Monster, have responded to this demand by introducing sugar-free variants. In 2023, the U.S. market alone saw a 25% increase in sales within this segment.

By Others Insights

Bottled water holds over 30% of the "others" beverage category. Growing concerns about water safety and convenience have driven bottled water sales, particularly in developing regions where it serves as a reliable source of safe drinking water. Additionally, the industry’s shift towards eco-friendly packaging and sustainability initiatives is driving the growth of premium bottled water brands.

Kombucha is the fastest-growing segment in the "others" category, with a projected CAGR of 15.2%. Its popularity stems from its health benefits, particularly its probiotic content, which supports digestion and immunity. Having gained mainstream acceptance, especially among millennials, the global kombucha market was valued at $2.4 billion in 2022 and is poised for significant growth through 2030.

By Process Insights

Chemical solvent extraction dominates with approximately 35% of the market share, particularly in large-scale coffee and tea production. This method is favored for its cost-effectiveness and efficiency in extracting compounds. Although there are concerns about potential chemical residues, advancements in food safety regulations ensure that consumer safety is prioritized.

Water processing, with a CAGR of 6.4%, is the fastest-growing segment. Rising consumer demand for cleaner, more natural products is driving adoption, particularly in decaffeinated coffee production. In 2022, water-based processing methods saw a 12% increase in usage, driven by a focus on sustainability and organic claims.

By Distribution Channel Insights

The B2C channel remains the largest segment, accounting for nearly 55% of the market. The expansion of direct-to-consumer strategies, including store-based retail and online platforms, is a key driver of growth. Subscription models, particularly for coffee and tea, are becoming increasingly popular in this space.

Online retailers are the fastest-growing distribution channel, with a projected CAGR of 9.5%. The COVID-19 pandemic accelerated the shift towards e-commerce, reshaping the beverage distribution landscape. Online platforms provide consumers with greater convenience and a broader range of product options compared to traditional brick-and-mortar stores. In 2023, online beverage sales reached over $25 billion and are expected to double by 2028.

REGIONAL ANALYSIS

North America: "Health-Conscious Consumers Drive Decaf Surge"

North America captures 35% of the global decaffeinated products market, with a forecasted CAGR of 6.2% through 2030. The region leads in decaf adoption, driven by increasing health consciousness and the desire to reduce caffeine consumption. The U.S. spearheads this trend, particularly in urban centers where premium and specialty decaf coffee and tea are in high demand. The rise of e-commerce, along with the surge in at-home coffee consumption during the pandemic, has accelerated market growth. Brands like Starbucks and Nestlé have expanded their decaf lines to meet growing consumer demand. Additionally, advancements in decaffeination technology have improved product quality, making premium decaf options more widely available. North America is expected to maintain its strong position in the global market, supported by continued innovation and consumer health trends.

Europe: "Sustainability and Specialty Lead Decaf Expansion"

Europe is a key market for decaffeinated products, with a projected CAGR of 5.8% through 2030. The demand for organic, sustainably sourced, and fair-trade decaf options is on the rise, particularly in countries like Germany, the U.K., and Italy. Germany leads the region in decaf consumption, reflecting broader European consumer preferences for eco-friendly decaffeination processes such as the Swiss Water Process and CO2 extraction. The focus on sustainability aligns with Europe’s growing commitment to environmental responsibility. Specialty cafés and artisan roasters are increasingly offering high-quality decaf options, catering to health-conscious consumers. With a growing emphasis on reducing caffeine intake, Europe is poised for continued growth in the decaf market.

Asia-Pacific: "Decaf on the Rise as Wellness Gains Momentum"

Asia-Pacific is emerging as a high-growth region in the decaffeinated products market, with Japan, China, and South Korea at the forefront of adoption. Wellness trends are gaining traction, leading to a growing demand for decaf products as consumers become more aware of caffeine-related health issues. Japan has seen a notable increase in decaf coffee consumption, particularly among working professionals, with sales up 12% in 2022. Meanwhile, China’s burgeoning coffee culture, traditionally centered around tea, is seeing a rise in decaf coffee demand among younger consumers. This shift is further supported by the expansion of café culture in major cities, where decaf options are becoming more accessible.

Middle East & Africa: "Emerging Markets with Untapped Potential"

Decaffeinated products are still in the early stages of adoption in the Middle East and Africa, though interest is growing among affluent, urban consumers. In the Middle East, the UAE and Saudi Arabia are seeing rising demand for decaf beverages, driven by increasing health and wellness awareness. In Africa, early adopters in Kenya and South Africa are contributing to the gradual rise in demand for decaf products. As consumers in these regions become more health-conscious, major coffee brands are beginning to introduce decaf options. While the market is still nascent, its potential is substantial as preferences shift towards healthier alternatives.

Latin America: "Coffee Culture Shifts Towards Decaf"

In Latin America, a region renowned for its coffee production, the decaffeinated products market is gradually gaining traction. Brazil, a leading coffee producer, is seeing increased domestic demand for decaf coffee, particularly among urban consumers focused on health and wellness. Decaf consumption in Brazil grew by 5% in 2022, reflecting this shift. Argentina and Colombia are also experiencing rising demand for decaf products, with younger consumers driving a movement towards wellness-oriented lifestyles. Latin American coffee producers are expanding their decaf offerings and adopting more sustainable decaffeination processes. As the region’s coffee culture evolves, decaf is expected to gain further momentum, particularly in urban centers.

KEY MARKET PLAYERS And COMPETITIVE LANDSCAPE

Major players of the decaffeinated products market include Nestlé S.A., Swiss Water Decaffeinated Coffee Inc., The Kraft Heinz Company, Starbucks Corporation, The Coca-Cola Company (Costa Coffee), Peet's Coffee, Tata Consumer Products Limited, J.M. Smucker Company, Illycaffè S.p.A., and Lavazza Group

The decaffeinated products market is highly competitive, with both global giants and regional players striving to capture a growing consumer base focused on health and wellness. Major companies such as Nestlé, Starbucks, and Swiss Water Decaffeinated Coffee Inc. lead the market, leveraging advanced decaffeination processes and strong brand recognition to dominate key regions like North America and Europe. These companies are increasingly investing in chemical-free methods, like the Swiss Water Process, to meet rising consumer demand for clean-label and premium decaf products.

The competition is intensifying as smaller, specialty brands like Peet’s Coffee and Illycaffè expand their decaf offerings, focusing on high-quality, organic, and single-origin decaf products to attract discerning coffee drinkers. Additionally, companies like Lavazza and Tata Consumer Products are targeting emerging markets, such as Asia-Pacific and Latin America, where decaf consumption is on the rise due to shifting lifestyle trends and increasing awareness of caffeine-related health concerns.

The market also sees competition from brands exploring niche segments like ready-to-drink (RTD) decaf beverages, with The Coca-Cola Company (Costa Coffee) being a key player in this area. As consumer preferences evolve, innovation and product differentiation will be critical for companies to maintain competitive advantages in this growing market.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Nestlé launched a new line of organic, fair-trade decaffeinated coffee under its Nescafé brand. This move aims to cater to growing consumer demand for sustainably sourced and health-conscious products.

- In March 2023, Swiss Water Decaffeinated Coffee Inc. expanded its production facility in British Columbia, increasing its output capacity by 40%. This expansion is expected to meet the rising global demand for chemical-free decaffeinated coffee.

- In February 2024, The Kraft Heinz Company partnered with a leading coffee chain in Brazil to introduce new decaf options to its Maxwell House brand, aiming to capture more of the Latin American market.

- In September 2023, Starbucks Corporation introduced new decaf cold brew coffee options in its U.S. stores, capitalizing on the growing popularity of cold brew and health-focused beverages.

- In June 2023, The Coca-Cola Company (Costa Coffee) launched a ready-to-drink decaf coffee line in Japan, targeting the expanding demand for convenience-based, health-conscious coffee options in the Asia-Pacific region.

- In November 2023, Peet’s Coffee announced a partnership with Blue Bottle Coffee to co-develop a line of premium decaffeinated, single-origin coffees, focusing on expanding its specialty coffee offerings.

- In April 2023, Tata Consumer Products acquired a stake in an Indian decaffeinated tea brand to expand its portfolio in the growing decaf beverage segment in the Indian market.

- In August 2023, J.M. Smucker Company upgraded its decaffeination process for Folgers Decaf to the Swiss Water Process, offering a cleaner and more natural product to align with consumer trends.

- In October 2023, Illycaffè S.p.A. launched an organic decaf coffee range across Europe, aiming to strengthen its position in the premium, eco-conscious segment of the market.

- In July 2023, Lavazza Group expanded its decaf product distribution in South America, partnering with local retailers to increase market penetration and capitalize on the region’s growing health and wellness trends

DETAILED SEGMENTATION OF THE GLOBAL DECAFFEINATED PRODUCTS MARKET INCLUDED IN THIS REPORT

This research report on the global decaffeinated products market has been segmented and sub-segmented based on product type, others, process, distribution channel and region.

By Product Type

- Ground Coffee

- Ready-to-Drink (RTD) Coffee

- Black Tea

- Herbal Tea

- Carbonated Soft Drinks (CSDs)

- Functional Drinks

- Energy Drinks

- Sugar-Free Energy Drinks

By Process

- Chemical Solvent Extraction

- Water Processing

By Others

- Bottled Water

- Kombucha

By Distribution Channel

- B2C

- Online Retailers

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who regulates decaffeinated product standards and labeling?

Regulatory bodies like the FDA (U.S.), EFSA (Europe), and FSSAI (India) oversee caffeine content limits and labeling requirements.

2. Which certifications should consumers look for in decaffeinated products?

Organic, Fair Trade, Swiss Water Process, and Rainforest Alliance certifications indicate high-quality and eco-friendly decaffeination processes.

3. What challenges do manufacturers face in the decaffeinated products market?

High production costs, maintaining flavor consistency, and consumer perception of decaf products being inferior to regular versions are key challenges.

4. How can brands effectively market decaffeinated products?

Brands can highlight health benefits, sustainable production processes, and premium taste through targeted digital marketing, influencer partnerships, and health-based branding.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]