Global Demand Response Management System Market Size, Share, Trends & Growth Forecast Report By Service (Consulting, Curtailment, Maintenance, and Managed), By Solution (Commercial, Industrial, and Residential), By End Use (Agriculture, Commercial Spaces, Public Buildings, Energy and Power), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis 2024 to 2033

Global Demand Response Management System Market Size

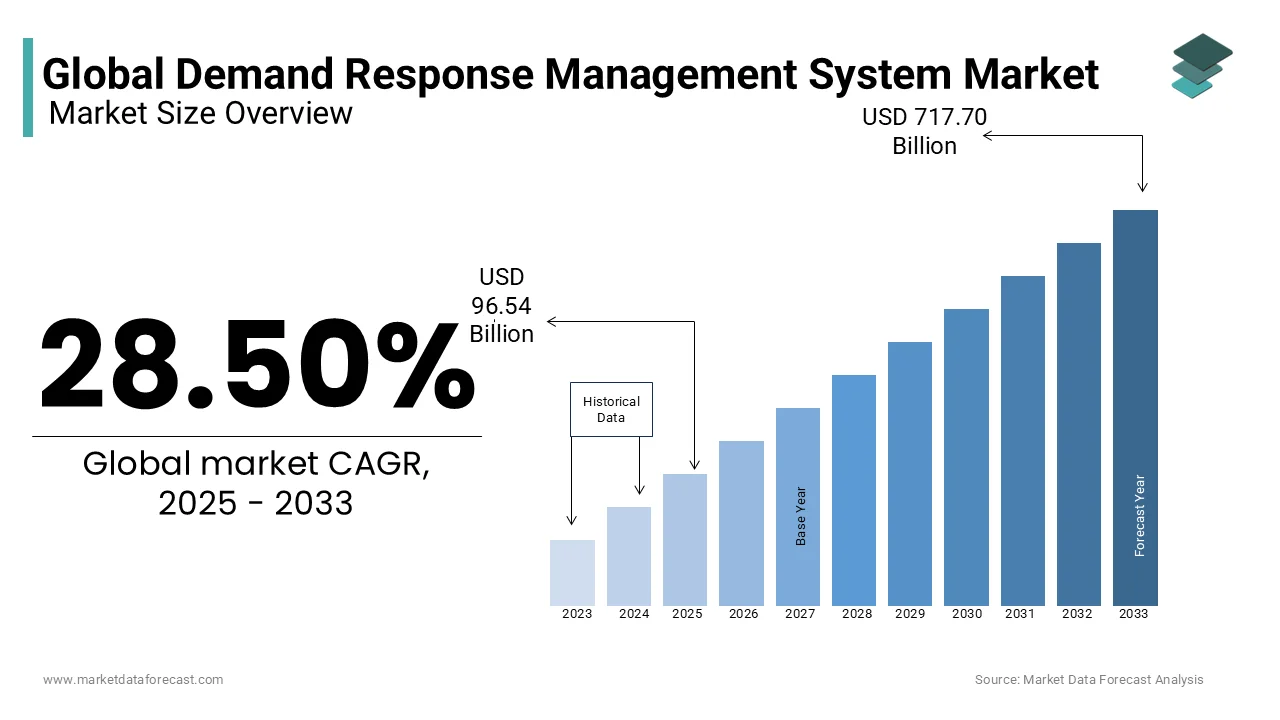

The global demand response management system market size was valued at USD 75.13 billion in 2024. The global market is anticipated to grow from USD 96.54 billion in 2025 to USD 717.70 billion by 2033, exhibiting a CAGR of 28.50% from 2025 to 2033.

The integration of the Internet of Things (IoT) and information and communication technologies (ICT) in energy has led to an enormous expansion in automation as well as real-time data processing. Service providers also analyze users' electricity consumption patterns, helping to increase energy efficiency through the cumulative participation of users and service providers. North America is predicted to dominate the market in terms of market size over the outlook period. Among the verticals, manufacturing is supposed to have the largest market share due to high electricity consumption.

The demand response management system (DRMS) is one of the crucial peak load management tools with huge benefits to reducing the imbalance between power supply and demand. Demand response (DR) and energy efficiency (EE) collectively contribute to Energy Demand Management (DSM), which encourages consumers to change their levels and patterns of electricity use while improving grid reliability. RD and EE programs can defer the need to build very expensive power plants for power generation that are also harmful to the environment. Growing smart grid deployments have increased the application of AMI meters, improved energy management systems for customers, transmission and distribution (T&D) system automation, and renewable energy integration.

MARKET DRIVERS

Growing Demand for DRMS

Commercial demand response management systems continue to play a central role in the generation, transmission, and distribution of electricity, with dramatic transformations in the energy industry. The commercial demand management systems market will continue to see the benefits of the requirement for efficient energy management systems in power grids to offset concerns about the increased voltage on power grids. Business demand management system vendors focus on providing multi-deployment business demand response management systems for utility control center applications. Better interface with utility back-office IT systems and expanded functionality are the main areas of development for players in the enterprise demand management systems market. Leading companies in the demand response management system market are focused on providing end-to-end services while focusing on integrating enterprise demand response management systems with operations. utilities. The focus of regulatory authorities such as the United States Department of Energy (DOE) on improving the efficiency of electricity transmission and distribution systems has further supported the adoption of management systems. of commercial demand. In addition, commercial companies' preference to improve energy efficiency and the adoption of smart meters are other key expansion drivers for the demand response management systems market. Overall, the future prospects for the market will remain optimistic.

Growing Emphasis on Renewable Energy

The rising focus on the demand to meet renewable energy goals with respect to stringent rules and regulations of the country's government policies is attributed to escalating the growth rate of the demand response management system market. Soaring prices of electricity are a burden for small-scale industries, where the installation of this system can lower production costs at the time of electricity bill, which will be profitable for the companies. The need for the installation of these systems is increasing aggressively in both developed and developing countries, with growing support from government organizations, which also fuels the growth rate of the demand response management system market.

MARKET RESTRAINTS

High Initial Costs and Maintenance Costs

Though demand response management has had a huge growth rate in the past few years, there are some restraining factors that limit the growth rate of the market. High initial cost and maintenance of the equipment is a burden for small and medium-scale industries, along with the lack of support from government policies, which can directly impede the growth rate of the market. In addition, the unavailability of required facilities for the installation of the system due to poor infrastructure, especially in some developing countries, is additionally degrading the growth rate of the market. The demand response management systems work properly only with the proper infrastructure along with the required facilities for smooth flow, whereas the lack of these facilities leads to a decline in the growth rate of the demand response management system market.

MARKET OPPORTUNITIES

Increasing Demand for Smart Grids

The growing demand for smart grids and residential demand response management systems is likely to be a great opportunity for market players during the foreseen period. The residential sector has become an important market for smart grid technology in recent years, as individual consumers and families are increasingly aware of the positive environmental impact they can have through simple measures such as adopting smart grids and control of their energy consumption. The financial benefits of smart grid systems have also convinced residential consumers to switch to smart grids in recent years. It is likely to be an important demand channel for the global demand response management systems market during the conjecture period. DRMS acts as a crucial arrangement to balance power supply with consumer needs and to stabilize load on grids during peak hours.

Active plans to conserve energy and reduce CO2 emissions are also to leverage the growth opportunities for the demand response management system market. Developed and developing countries are strongly enforcing stringent rules to combat the release of carbon emissions from various sources while producing electricity. Emerging countries like China are stepping forward to swiftly adopt non-fossil fuel energy consumption to reduce CO2 emissions through advanced technologies, which is attributed to leveraging the growth rate of the demand response management system market in the coming years.

MARKET CHALLENGES

The demand response management system requires accurate information, where difficulty in providing access and accurate information for the systems gives inappropriate responses that may lead to huge losses, which is a great challenge for the market key players. These challenges can only be solved with the improvement in the overall infrastructure that is inclined with support from the private and public sectors. Other than this, the difficulty in integrating modern technology with the existing systems is acting as a big barrier to the growth rate of the demand response management systems market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

28.50% |

|

Segments Covered |

By Service, Solution, End Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB (Switzerland), Enel X North America, Inc. (U.S.), Siemens AG (Germany), Eaton (Republic of Ireland), Schneider Electric (France), Honeywell International Inc. (U.S.), Opower, Inc. (U.S.), Comverge, Inc. (U.S.), and Johnson Controls, Inc. (U.S.), and Others. |

SEGMENTAL ANALYSIS

By Service Insights

The consulting segment is leading with the dominant share of the demand response management system market. The implementation of specific strategies in any organization to provide synchrony with the various departments. Synchronizing all the information from various departments and cumulating the final outcomes that direct on the right priorities. The maintenance segment is deemed to have prominent growth opportunities during the forecast period.

By Solution Insights

The industrial solution segment is inclined to hold the dominant share of the demand response management system market. The installation of these systems in industries plays a major role in optimizing the demand and supply by quietly managing the electricity costs and lowering the overall production cost as well. The high demand for electricity in industries is constantly elevating the need to use demand response management systems, which is likely to propel the growth rate of the market in the coming years. The commercial segment is positioned as the next industrial segment and is gaining huge traction over the growth rate of the market.

By End Use Insights

The agriculture segment is projected to have a prominent share of the demand response management system market. There is a need for a prominent reduction of the overall power consumption in agricultural practices where the dominance of improving systems in groundwater extraction is substantially needed to elevate the market's growth rate. The energy and power segment is attributed to hitting the highest CAGR by the end of 2032. Installations of the modern grid infrastructure to reduce high energy consumption using different strategies are likely to promote the growth rate of the market.

REGIONAL ANALYSIS

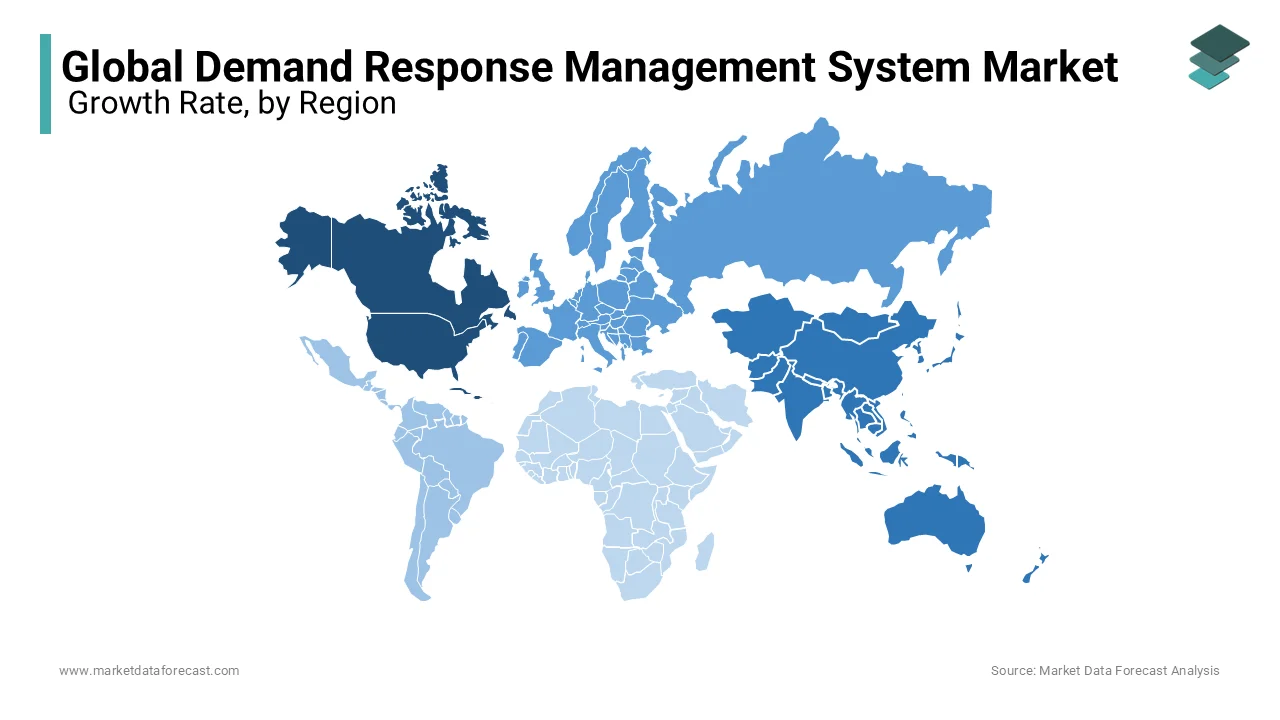

North America is likely to be the largest contributor to the global demand response management systems market during the estimated period due to the widespread establishment of smart grid infrastructure in countries like the United States, which has facilitated the adoption of demand response management systems on a similar scale. Canada and the United States are predicted to dominate the market for demand response management systems in North America, primarily due to the proliferation of smart meter installations. The focus on 100% electrification in the United States has led the country to focus on improving the efficiency of the electrical grid. This, combined with various programs and incentives offered by utilities to encourage participation in the adoption of commercial demand management systems, will continue to drive the expansion of commercial demand management systems in North America. Furthermore, the Central American and Caribbean regions are supposed to experience unique near-term opportunities in terms of smart grid investments, which in turn will support the expansion of the demand response management systems market in these regions.

Asia Pacific is likely to hit the highest CAGR by the end of the forecast period 2025-2033. The demand for the conservation of energy is growing popularly in India and China. China is the most populous country in the world, and the need to properly conserve the production of energy by various means is gearing up the need for the installation of demand response management systems. These systems help manage the supply of electricity while reducing the overall cost. The rising number of power plants in China and India will also promote the market growth rate during the forecast period.

Europe is projected to hit the highest CAGR by the end of 2033, with the growing prominence of achieving a net zero emissions goal by the end of 2025. The net zero emissions goal is to reduce the carbon footprints totally, thereby creating a positive impact on the environment. The strategic moves by supporting the implementation of the demand response management regulations in the energy and power and other industries will certainly help the strong efforts in making a clean environment by the end of 2050. European countries are all set to reach the goal by 2050 when the region will be the first in the world to be free from carbon footprints.

KEY MARKET PLAYERS

Companies playing a prominent role in the global demand response management system market include ABB (Switzerland), Enel X North America, Inc. (U.S.), Siemens AG (Germany), Eaton (Republic of Ireland), Schneider Electric (France), Honeywell International Inc. (U.S.), Opower, Inc. (U.S.), Comverge, Inc. (U.S.), and Johnson Controls, Inc. (U.S.), and Others.

RECENT HAPPENINGS IN THE MARKET

- GE launches demand response management technology. GE has launched its PowerOn Precision demand optimization technology to help utilities reduce peak demand.

- Comverge launches the new Apollo Demand Response Management System.

MARKET SEGMENTATION

This research report on the global demand response management system market has been segmented and sub-segmented based on service, solution, end use, and region.

By Service

- Consulting

- Curtailment

- Maintenance

- Managed

By Solution

- Commercial

- Industrial

- Residential

By End Use

- Agriculture

- Commercial Spaces

- Public Buildings

- Energy and Power

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Demand Response Management System Market growth rate during the projection period?

The Global Demand Response Management System Market is expected to grow with a CAGR of 28.50% between 2025 and 2033.

What can be the total Demand Response Management System Market value?

The Global Demand Response Management System Market size is expected to reach a revised size of USD 717.70 billion by 2033.

Name any three Demand Response Management System Market key players?

Siemens AG (Germany), Eaton (Republic of Ireland), and Schneider Electric (France) are the three demand response management System market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com