Global Diesel Generators Market Size, Share, Trends, & Growth Forecast Report By Portability (Stationary and Portable), Power Rating, Application, End-user, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Diesel Generators Market Size

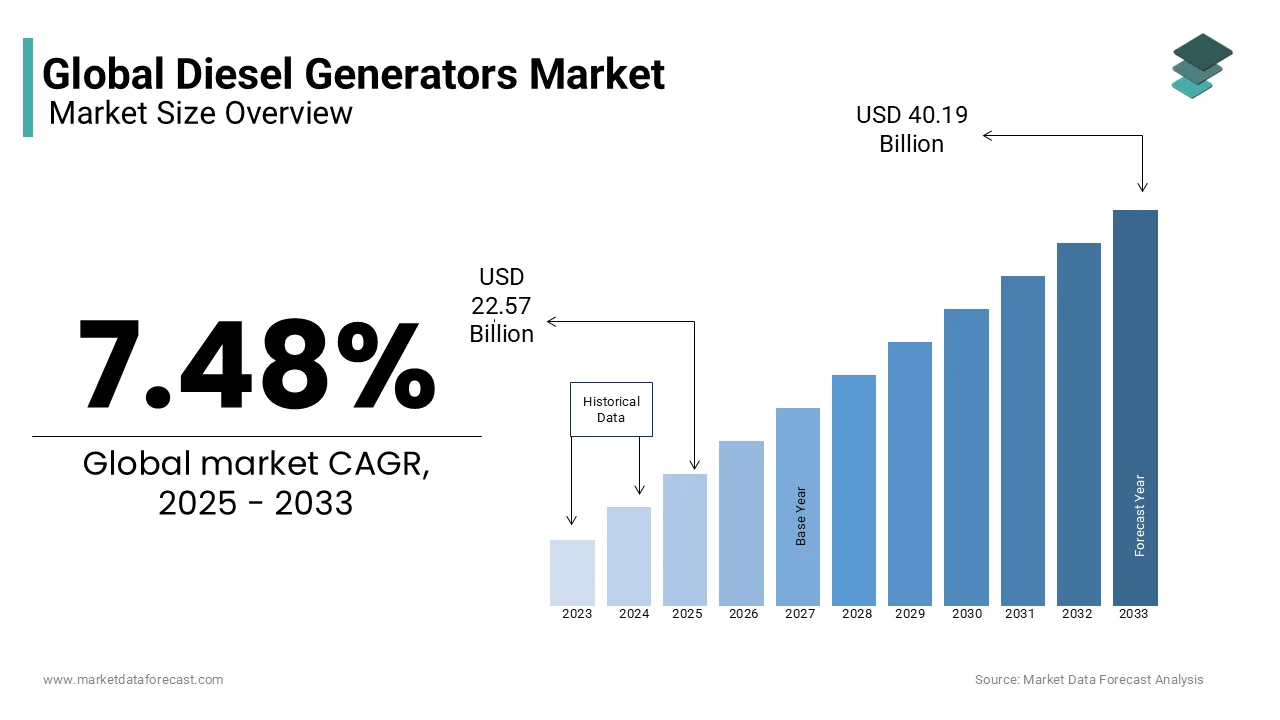

The global diesel generators market was worth USD 21 billion in 2024. The global market is projected to reach USD 40.19 billion by 2033 from USD 22.57 billion in 2025, rising at a CAGR of 7.48% from 2025 to 2033.

The diesel generators are internal combustion engines that convert diesel fuel into electrical energy through mechanical means by ensuring uninterrupted power supply during grid failures or in remote areas devoid of centralized electricity infrastructure. As of recent years, their indispensability has been underscored by increasing instances of extreme weather events, aging power grids, and rising demand for off-grid energy systems in developing economies. According to the International Energy Agency (IEA), approximately 770 million people worldwide still lack access to electricity by creating a persistent need for decentralized power sources like diesel generators.

In addition to serving as emergency backups, diesel generators play a pivotal role in disaster recovery efforts. For instance, following Hurricane Ian in 2022, according to the Federal Emergency Management Agency (FEMA), deploying thousands of generators to restore essential services in affected regions. According to the World Health Organization, over 50% of healthcare facilities in low-income countries rely on diesel-powered generators to maintain operations during power outages. Despite growing emphasis on renewable energy alternatives, diesel generators remain entrenched due to their cost-effectiveness, durability, and ability to deliver high power outputs under demanding conditions. However, environmental concerns linked to carbon emissions continue to shape regulatory frameworks is driving innovation toward cleaner technologies within this space.

MARKET DRIVERS

Increasing Frequency of Power Outages and Grid Instability

The rising frequency of power outages and grid instability has emerged as a significant driver for the diesel generator market. According to the U.S. Energy Information Administration, the United States experienced an average of 1.44 power interruptions per customer in 2021, with an average duration exceeding 7 hours. This trend is exacerbated by aging electrical infrastructure, which struggles to meet growing energy demands. Additionally, extreme weather events, such as hurricanes and heatwaves, have become more frequent due to climate change. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. witnessed 20 separate billion-dollar weather disasters in 2021 alone by causing widespread blackouts. In such scenarios, diesel generators serve as a reliable backup, ensuring continuity for businesses and critical facilities like hospitals.

Rising Industrialization and Infrastructure Development in Emerging Economies

The rapid pace of industrialization and infrastructure development in emerging economies significantly propels the demand for diesel generators. According to the International Monetary Fund (IMF), emerging markets accounted for over 60% of global GDP growth in 2022, driven by sectors such as manufacturing, construction, and mining. These industries often operate in regions with inadequate or unreliable grid connectivity with alternative power solutions. For instance, the African Development Bank reports that nearly 600 million people in Sub-Saharan Africa lack access to electricity by creating a strong reliance on decentralized power systems. Diesel generators are particularly favored due to their high energy density and ability to operate in remote locations. Furthermore, government initiatives to boost industrial output, such as India's "Make in India" campaign that have spurred investments in backup power systems. This industrial expansion ensures sustained demand for diesel generators in developing nations.

MARKET RESTRAINTS

Stringent Environmental Regulations and Emission Standards

The stringent environmental regulations targeting carbon emissions have emerged as a significant restraint for the diesel generator market. The Environmental Protection Agency (EPA) has implemented Tier 4 emission standards in the United States by mandating a 90% reduction in particulate matter and nitrogen oxide emissions from diesel engines compared to previous tiers. These regulations increase manufacturing costs and necessitate advanced technologies like selective catalytic reduction systems, which can raise the price of generators by up to 30%. According to the European Environment Agency, diesel-powered equipment contributes approximately 15% of total nitrogen oxide emissions in urban areas, prompting stricter controls across the European Union. As governments globally prioritize climate goals under frameworks like the Paris Agreement, the pressure to adopt cleaner energy alternatives intensifies. This regulatory landscape poses challenges for the diesel generator market in regions with aggressive decarbonization targets.

Rising Competition from Renewable Energy Solutions

The growing adoption of renewable energy solutions presents a notable restraint for the diesel generator market. According to the International Renewable Energy Agency (IRENA), the cost of solar photovoltaic systems has decreased by over 82% since 2010 by making them a competitive alternative for off-grid power generation. According to the U.S. Department of Energy, wind and solar energy accounted for 75% of new electricity capacity additions in the United States in 2022. Hybrid power systems are renewables with battery storage that are increasingly replacing traditional diesel generators in remote and rural areas. For instance, the World Bank has funded numerous projects in Sub-Saharan Africa to deploy solar mini-grids by reducing reliance on diesel-powered systems. The shift toward renewable energy undermines the long-term growth potential of the diesel generator market in regions with abundant renewable resources.

MARKET OPPORTUNITIES

Expansion of Data Centers and Digital Infrastructure

The exponential growth of data centers and digital infrastructure presents a significant opportunity for the diesel generator market. According to the U.S. Department of Energy, data centers consume approximately 2% of total global electricity, with demand projected to grow by 40% over the next decade due to the rise of cloud computing, artificial intelligence, and 5G networks. Diesel generators are critical for ensuring uninterrupted power supply to these facilities during grid failures, as downtime can cost companies up to $5,600 per minute, as reported by the Ponemon Institute. According to the Global e-Sustainability Initiative, emerging markets in Asia-Pacific, such as India and China, are witnessing a surge in data center investments, with China alone adding over 10 gigawatts of capacity in 2022. This expansion creates a robust demand for reliable backup power solutions by positioning diesel generators as an essential component of the digital economy.

Adoption in Remote Mining and Oil & Gas Operations

The increasing exploration of remote mining and oil & gas operations offers another key opportunity for the diesel generator market. According to the International Energy Agency (IEA), global mining activities account for approximately 10% of total energy consumption, with diesel being the primary fuel source in off-grid locations. For instance, Australia's Department of Industry, Science, and Resources notes that the country’s mining sector relies heavily on diesel generators to power operations in its vast, remote regions. According to the U.S. Energy Information Administration, offshore oil rigs often depend on diesel-powered systems for auxiliary power with over 90% of such rigs utilizing them globally. The demand for durable and high-capacity diesel generators is expected to rise, particularly in regions like Africa and Latin America, where mining projects are proliferating under government initiatives to boost economic growth.

MARKET CHALLENGES

High Operational and Maintenance Costs

The high operational and maintenance costs associated with diesel generators pose a significant challenge to their widespread adoption. According to the U.S. Department of Energy, fuel expenses account for up to 70% of the total lifecycle cost of operating a diesel generator by making it economically burdensome for long-term use. Additionally, routine maintenance, including oil changes, filter replacements, and engine overhauls, can increase operational costs by 15-20%, as per National Institute of Standards and Technology. In remote areas, logistical challenges further inflate these costs due to the difficulty of transporting diesel fuel. According to the African Development Bank, fuel transportation in Sub-Saharan Africa can increase generator operating costs by up to 50% in rural regions. These financial barriers limit the feasibility of diesel generators for small-scale users or in areas where alternative energy solutions are gaining traction.

Vulnerability to Fuel Supply Chain Disruptions

The diesel generators are highly vulnerable to disruptions in the fuel supply chain, which presents a critical challenge for their reliability. According to the International Energy Agency (IEA), geopolitical tensions and natural disasters have caused global diesel shortages, with fuel prices surging by over 50% in certain regions during 2022. According to the U.S. Energy Information Administration, Hurricane Ida disrupted nearly 95% of Gulf Coast refining capacity, leading to prolonged fuel shortages. A report by the United Nations Conference on Trade and Development revealed that landlocked countries in Africa face chronic fuel supply issues due to inadequate infrastructure, exacerbating the unreliability of diesel generators. Such vulnerabilities are particularly concerning for critical sectors like healthcare and telecommunications, where uninterrupted power is essential. This susceptibility to external factors undermines the dependability of diesel generators in regions prone to logistical and geopolitical uncertainties.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.48% |

|

Segments Covered |

By Portability, Power Rating, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Caterpillar Inc. (U.S.), Aggreko (U.K.), Cummins Inc. (U.S.), Himoinsa (Spain), John Deere (U.S.), Kohler SDMO (France), PRAMAC (Italy), Kirloskar Electric Co. Ltd. (India), Generac Power Systems (U.S.), FG Wilson (U.K.), Atlas Copco (Sweden), American Honda Motor Company Inc. (U.S.), Briggs & Stratton (U.S.), Ingersoll Rand (U.S.), and Yamaha Motor Co. Ltd. (Japan). |

SEGMENT ANALYSIS

By Portability Insights

The stationary segment was the largest by occupying 55.1% of the global diesel generators market share in 2024 owing to their widespread use in industrial facilities, data centers, and healthcare institutions, where consistent power supply is critical. According to the U.S. Department of Energy, stationary generators account for over 80% of backup power systems in hospitals. These systems are preferred due to their higher power output capabilities and durability by making them indispensable for large-scale operations. Additionally, their integration with grid systems for peak shaving and load balancing further escalates the market growth by ensuring stability in regions with unreliable electricity infrastructure.

The portable segment is projected to grow with an estimated CAGR of 6.5% from 2025 to 2033. This growth is driven by increasing demand in construction, outdoor events, and disaster recovery operations. The Federal Emergency Management Agency reported that portable generators were deployed in over 90% of disaster-stricken areas during 2022 due to their importance in emergencies. Furthermore, the rise in remote mining and oil exploration activities in Africa and Asia-Pacific that has bolstered demand, as per the African Development Bank. Their compact design, ease of transportation, and ability to provide immediate power make them ideal for dynamic applications by ensuring rapid adoption in both developed and developing economies.

By Power Rating Insights

The 75 - 375 kVA segment dominated the diesel generator market by capturing 40.2% of the global market share in 2024 due to its widespread use in commercial and industrial applications by including small-scale manufacturing, retail complexes, and healthcare facilities. According to the U.S. Department of Energy, nearly 60% of businesses rely on generators within this range for backup power due to their balance of cost-effectiveness and capacity. Additionally, this range is critical for disaster recovery efforts, with FEMA reporting that over 70% of emergency power systems deployed during natural disasters fall within this category. Its versatility and ability to meet diverse power needs make it the most prominent segment.

The above 750 kVA segment is anticipated to register a CAGR of 8.5% during the forecast period. This growth is driven by increasing demand for large-scale power solutions in data centers, mining operations, and heavy industries. According to the U.S. Energy Information Administration, data centers alone are projected to consume 3.5% of global electricity by 2030 with high-capacity generators. According to the African Development Bank, large-scale mining projects in Africa require generators exceeding 1,000 kVA, which is fueling demand in emerging markets.

By Application Insights

The standby load applications segment held with 45.6% of diesel generators market share in 2024 by ensuring power reliability during grid failures, particularly in regions with unstable electricity infrastructure. According to the Federal Emergency Management Agency, standby generators were deployed in over 70% of disaster recovery operations following major power outages in 2022. The World Health Organization states that standby generators are vital for maintaining life-saving equipment in healthcare facilities in low-income countries where grid reliability is poor.

The continuous load segment is the fastest-growing application in the diesel generator market, with a CAGR of 6.8% during the forecast period. This rapid growth is driven by increasing industrialization and the expansion of mining and oil & gas operations in remote areas. According to the U.S. Energy Information Administration, continuous diesel generators are essential for powering off-grid mining projects, with global mining energy consumption expected to rise by 25% by 2030. As per the African Development Bank, over 600 million people in Sub-Saharan Africa rely on decentralized power systems, including continuous diesel generators, for basic electricity needs. This segment's importance lies in its ability to provide uninterrupted power in regions lacking centralized grids by making it indispensable for economic development.

By End-user Insights

The mining sector dominated the diesel generator market with 25.2% of the global market share in 2024. The industry's reliance on diesel-powered equipment in remote locations lacking grid connectivity is ascribed to fuel the growth of the market. According to the U.S. Department of Energy, mining operations consume about 10% of global energy, with diesel generators providing over 80% of off-grid power in this sector. Their durability and ability to deliver high-capacity power make them indispensable for continuous operations. For instance, Australia’s Department of Industry studies have shown that the diesel generators support nearly all mining activities in the country’s remote Pilbara region is sustaining productivity and economic growth.

The data centers segment is attributed to exhibit a prominent CAGR of 12.5% from 2025 to 2033 in the diesel generators market. This rapid growth is driven by the increasing demand for cloud computing, artificial intelligence, and 5G networks, which require uninterrupted power supply. As per the Ponemon Institute, data center downtime costs an average of $9,000 per minute, emphasizing the need for reliable backup systems. According to the Global e-Sustainability Initiative, Asia-Pacific regions like China and India are witnessing exponential data center expansion, with China adding over 10 gigawatts of capacity in 2022 alone. Diesel generators play a pivotal role in ensuring operational continuity by making them vital for this rapidly expanding sector.

REGIONAL ANALYSIS

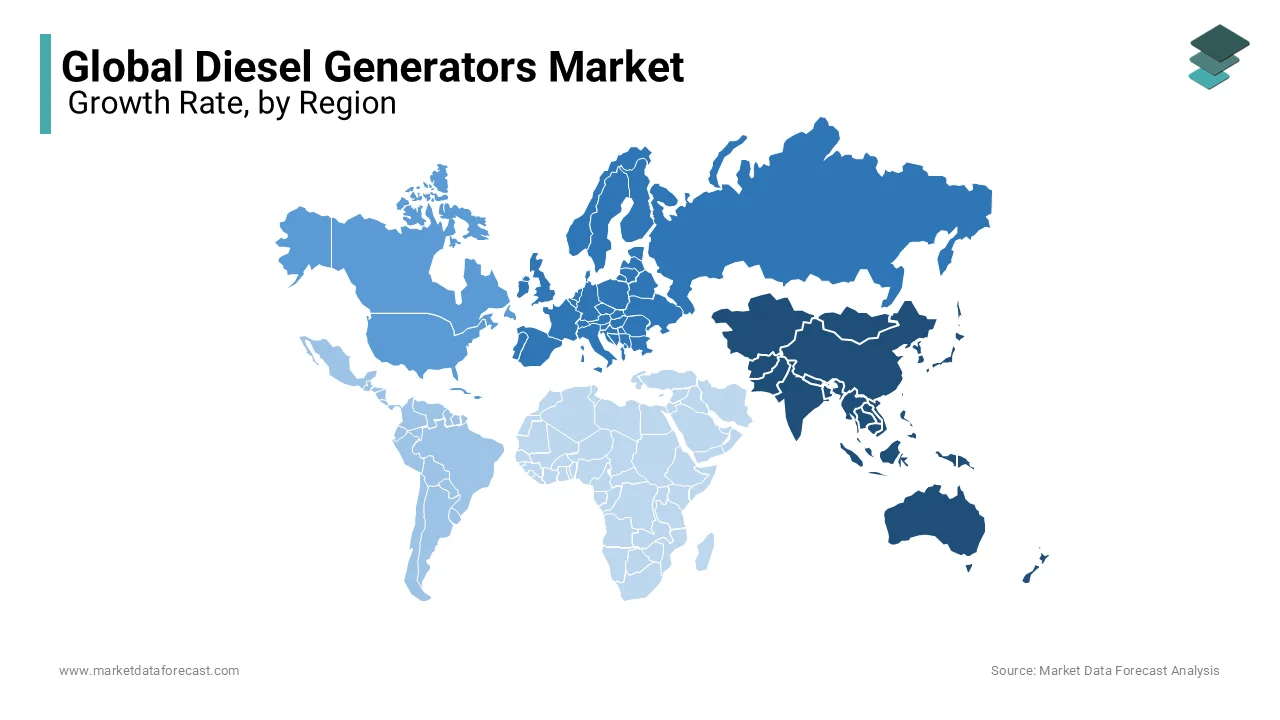

Asia-Pacific outperformed other regions in the global diesel generator market by accounting for 40.1% of global revenue in 2024. This dominance is driven by rapid industrialization, urbanization, and unreliable grid infrastructure in countries like India and China. According to the Asian Development Bank, nearly 600 million people in the region lack access to electricity by creating a strong demand for decentralized power solutions. As per China's National Bureau of Statistics, the country’s manufacturing sector, which relies heavily on backup power, grew by 9.6% in 2022. The diesel generators are critical for ensuring uninterrupted operations in industries, construction, and rural electrification projects.

North America is ascribed to grow with a CAGR of 9.2% from 2025 to 2033. This rapid expansion is driven by increasing investments in data centers, telecommunications, and renewable energy integration. According to the Ponemon Institute, data center downtime costs an average of $9,000 per minute by fueling demand for reliable backup power solutions like diesel generators. As per Federal Emergency Management Agency (FEMA), extreme weather events, such as hurricanes and wildfires, have caused prolonged power outages that further boosts the reliance on generators. For instance, Hurricane Ian in 2022 led to widespread blackouts, prompting significant deployment of diesel-powered systems. The region’s focus on enhancing grid resilience and expanding critical infrastructure ensures sustained growth in this segment.

Europe and Latin America are expected to witness moderate growth due to aging infrastructure and renewable energy hybrid systems. According to the European Environment Agency, need for resilient power solutions amid rising climate-related disruptions. In Latin America, the Inter-American Development Bank projects $700 billion in infrastructure investments by 2030 by driving generator adoption. Meanwhile, the Middle East and Africa will maintain steady demand due to oil and gas exploration and healthcare facility needs, as per World Health Organization. These regions collectively contribute to diversified market opportunities globally.

KEY MARKET PLAYERS

The major players in the global diesel generators market include Caterpillar Inc. (U.S.), Aggreko (U.K.), Cummins Inc. (U.S.), Himoinsa (Spain), John Deere (U.S.), Kohler SDMO (France), PRAMAC (Italy), Kirloskar Electric Co. Ltd. (India), Generac Power Systems (U.S.), FG Wilson (U.K.), Atlas Copco (Sweden), American Honda Motor Company Inc. (U.S.), Briggs & Stratton (U.S.), Ingersoll Rand (U.S.), and Yamaha Motor Co. Ltd. (Japan).

TOP 3 PLAYERS IN THE MARKET

Caterpillar Inc. (U.S.)

Caterpillar Inc. is a global leader in the diesel generator market, commanding a significant market share from past few years. The company’s dominance stems from its extensive product portfolio, which includes high-capacity generators for industrial, commercial, and residential applications. Caterpillar’s robust distribution network spans over 190 countries, ensuring widespread accessibility. Its focus on innovation is evident in its development of hybrid power systems that integrate renewable energy with diesel generators, aligning with global sustainability goals. Additionally, Caterpillar plays a critical role in disaster recovery efforts; for instance, FEMA deployed thousands of Caterpillar generators during Hurricane Ian in 2022.

Cummins Inc. (U.S.)

Cummins Inc. ranks as another top player, contributing approximately 18% to the global diesel generator market, according to the U.S. Energy Information Administration. Renowned for its high-performance engines and generators, Cummins serves diverse sectors, including mining, oil & gas, and data centers. The company’s recent innovations, such as low-emission diesel engines compliant with Tier 4 standards, address environmental concerns while maintaining efficiency. Cummins has also expanded its presence in emerging markets like India and Africa, where it powers critical infrastructure projects. For example, the African Development Bank promotes the Cummins’ role in supplying generators for rural electrification programs. With a strong emphasis on R&D and strategic partnerships, Cummins continues to drive market growth and customer trust.

Aggreko (U.K.)

Aggreko, a key player in the rental power solutions segment with the company specializes in temporary power solutions, catering to industries such as construction, events, and emergency response. Aggreko’s modular and scalable generator systems are widely used in large-scale projects, including the Tokyo Olympics in 2021, where it provided uninterrupted power supply. Its ability to deliver rapid deployment solutions in remote or disaster-affected areas enhances its global reputation. Furthermore, Aggreko is investing in hybrid and renewable-integrated systems, positioning itself at the forefront of the transition toward cleaner energy solutions while maintaining its stronghold in the traditional diesel generator market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the diesel generator market, such as Cummins Inc. and Caterpillar Inc., have heavily relied on strategic collaborations to expand their global footprint and enhance product offerings. For instance, Cummins partnered with Hyundai Heavy Industries in 2021 to develop advanced power systems for marine applications, leveraging Hyundai’s expertise in shipbuilding and Cummins’ engine technology. Similarly, Caterpillar has collaborated with global energy firms to integrate renewable energy solutions with diesel generators, addressing the growing demand for hybrid systems. These partnerships enable companies to access new markets, particularly in emerging economies, while fostering innovation. According to the U.S. Department of Commerce, such alliances have helped these firms secure contracts worth billions in regions like Africa and Southeast Asia, strengthening their competitive edge.

Investment in Research and Development (R&D)

Investing in R&D is a cornerstone strategy for companies like Kohler SDMO and Generac Power Systems to maintain its dominance in the diesel generator market. Kohler SDMO, for example, has developed ultra-low emission diesel generators compliant with stringent environmental regulations, such as the EU’s Stage V standards. Generac has focused on integrating smart technologies, including IoT-enabled monitoring systems, to enhance operational efficiency and remote diagnostics. According to the European Environment Agency, companies investing over 5% of their revenue in R&D have successfully introduced next-generation products, such as hybrid generators, which appeal to environmentally conscious consumers. This focus on innovation ensures compliance with global emission norms while meeting evolving customer demands.

Expansion into Emerging Markets

Market leaders like Aggreko and Kirloskar Electric Co. Ltd. have aggressively expanded into emerging markets to capitalize on rapid industrialization and infrastructure development. Aggreko has established rental power hubs in Sub-Saharan Africa, providing temporary power solutions for mining and healthcare facilities. The African Development Bank notes that such initiatives have positioned Aggreko as a preferred supplier in regions with unreliable grid infrastructure. Similarly, Kirloskar Electric has strengthened its presence in India by aligning with government programs like "Make in India," supplying generators for rural electrification projects. By tailoring products to local needs and investing in regional distribution networks, these companies have bolstered their market share in high-growth regions.

Mergers and Acquisitions

Mergers and acquisitions (M&A) have been pivotal for companies like Atlas Copco and Briggs & Stratton to consolidate their market position. Atlas Copco acquired Finnish company Tamrotor in 2020 to enhance its compressor and generator portfolio, enabling it to offer comprehensive power solutions. Briggs & Stratton, despite financial challenges, acquired SimpliPhi Power in 2021 to diversify into energy storage systems, complementing its traditional diesel generator business. As per U.S. Federal Trade Commission, such M&A activities allow companies to streamline operations, reduce competition, and tap into complementary technologies, ensuring long-term sustainability in a rapidly evolving market.

Focus on Sustainability and Hybrid Solutions

To address environmental concerns, major players like Caterpillar and PRAMAC have prioritized the development of sustainable and hybrid power solutions. Caterpillar has launched solar-diesel hybrid systems for off-grid applications, reducing fuel consumption by up to 30%, as reported by the International Renewable Energy Agency (IRENA). PRAMAC has introduced eco-friendly generators powered by biofuels, targeting environmentally sensitive industries like tourism and agriculture. These strategies not only align with global decarbonization goals but also cater to customers seeking cleaner alternatives, ensuring continued relevance in an increasingly eco-conscious market landscape.

COMPETITIVE LANDSCAPE

The diesel generator market is characterized by intense competition, with a mix of global giants and regional players vying for market share. Key players such as Caterpillar Inc., Cummins Inc., and Aggreko dominate the landscape, leveraging their extensive product portfolios, technological expertise, and robust distribution networks to maintain top position. These companies focus on innovation, offering advanced solutions like hybrid systems, IoT-enabled generators, and low-emission engines to address evolving customer demands and regulatory requirements. For instance, Caterpillar’s integration of renewable energy with diesel generators has set a benchmark in sustainability, while Cummins’ compliance with stringent emission standards underscores its commitment to environmental responsibility.

Regional players like Kirloskar Electric Co. Ltd. and FG Wilson also contribute significantly, particularly in emerging markets. Kirloskar’s alignment with government initiatives in India, such as rural electrification projects, promotes its strategic localization efforts. Similarly, FG Wilson’s strong presence in Europe and Africa is bolstered by its cost-effective and durable products tailored to local needs.

The competitive dynamics are further intensified by strategies such as mergers and acquisitions, partnerships, and aggressive expansion into high-growth regions like Asia-Pacific and Sub-Saharan Africa. According to the International Energy Agency, these regions account for a significant portion of global demand due to unreliable grid infrastructure and industrialization. Additionally, rental power solutions offered by companies like Aggreko cater to temporary needs, adding another layer of competition. Overall, the market is shaped by a balance of innovation, sustainability, and adaptability, with companies striving to differentiate themselves through superior technology, customer-centric solutions, and strategic market penetration.

RECENT MARKET DEVELOPMENTS

- In June 2022, Cummins Inc. launched the C1000D6RE, a 1MW twin-pack rental generator designed for diverse applications across North America. This innovative model combines two 15-liter, 500-kW generators in a single 40-foot unit, adhering to Tier 4 final emissions standards while ensuring dependable high output.

- In February 2023, Caterpillar introduced the Cat XQ330 mobile diesel generator set, a new power solution for standby and prime power applications that meets U.S. EPA Tier 4 Final emission standards. This launch reflects Caterpillar's commitment to providing reliable and environmentally compliant power solutions.

- In June 2022, Kirloskar Oil Engines Ltd. (KOEL) unveiled iGreen Version 2.0, an upgraded series of highly efficient power generators equipped with the advanced RS5O series of engines. This variant boasts a compact design, exceptional fuel efficiency, and superior power quality, aiming to enhance KOEL's competitiveness in the diesel generator market.

- In October 2024, Caterpillar, Cummins, and Generac leveraged technological advancements like common rail direct fuel injection (CRDI) and hybrid systems to improve efficiency and sustainability. These innovations were implemented to enhance their competitiveness in the diesel generator market.

MARKET SEGMENTATION

This research report on the global diesel generators market is segmented and sub-segmented into the following categories.

By Portability

- Stationary

- Portable

By Power Rating

- Below 75 kVA

- 75 - 375 kVA

- 375 - 750 kVA

- Above 750 kVA

By Application

- Continuous Load

- Peak Load

- Standby Load

By End-user

- Mining, Oil & Gas, Construction

- Residential

- Marine

- Manufacturing

- Pharmaceutical

- Commercial

- Telecom

- Electric Utility

- Data Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary applications of diesel generators?

Diesel generators are primarily used for standby, continuous, and peak load applications across residential, commercial, and industrial sectors.

What factors are driving the growth of the diesel generator market?

The increasing demand for reliable backup power solutions across sectors such as healthcare, data centers, manufacturing, and construction is propelling market growth.

What are the alternatives to diesel generators?

Alternatives include natural gas generators, solar power systems with battery storage, and grid power solutions in areas with reliable electricity infrastructure.

How has technological advancement influenced diesel generators?

Advancements such as integration with IoT for remote monitoring and the development of hybrid systems combining diesel with renewable energy sources have enhanced efficiency and reduced emissions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]