Global Digital Audio Workstation Market Size, Share, Trends, & Growth Forecast Report By Type (Recording, Editing, Mixing), End-Use (Commercial and Non-Commercial), Component (Software and Services), Deployment Model (Cloud and Local), Operating Systems (Mac OS, Windows, Linux, Others), & Region, Industry Forecast From 2024 to 2033

Global Digital Audio Workstation Market Size

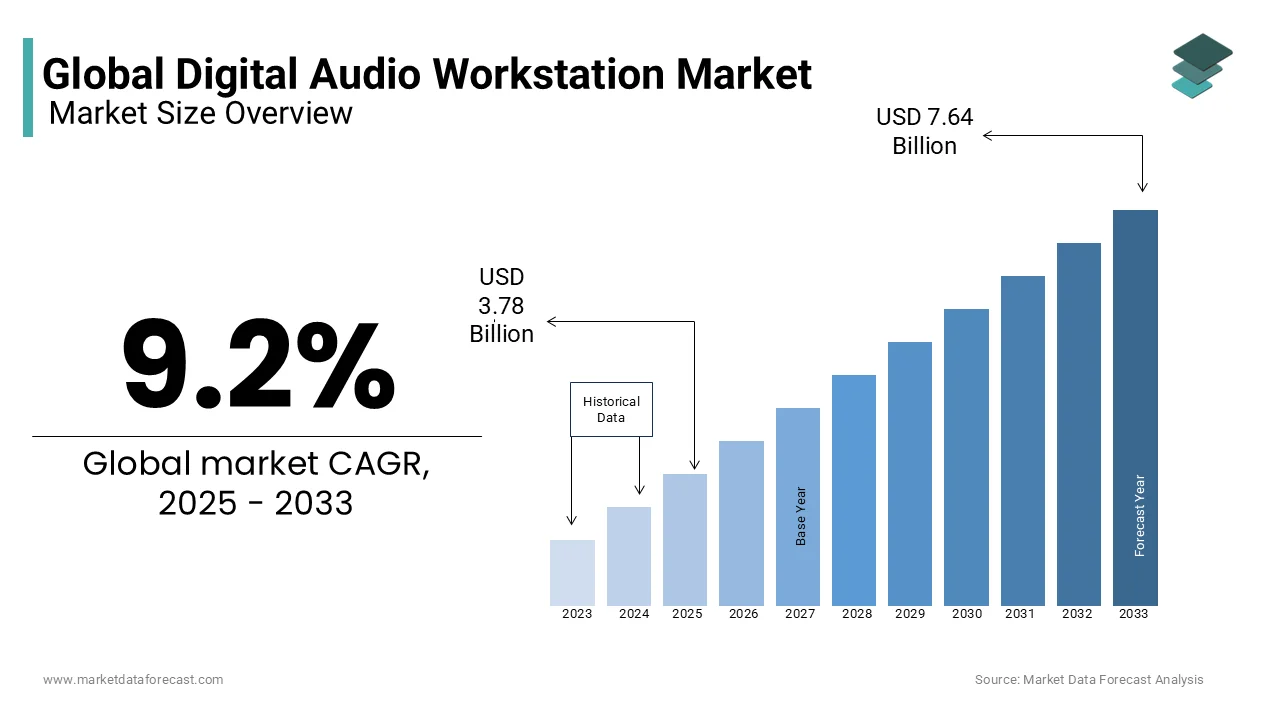

The global digital audio workstation (DAW) market was worth USD 3.46 billion in 2024. The global market is expected to reach USD 3.78 billion in 2025 and USD 7.64 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2025 to 2033.

Digital Audio Workstations (DAW) are designed to record, edit, and manipulate audio. There are currently several DAWs circulating in the industry, including Logic, Ableton, Fruit Loops, Garage Bunch, and Cakewalk. Apart from that, Pro Tools is mainly used by professionals because it is powerful and flexible by nature. Over time, the use and purpose of DAW has evolved and changed.

There is greater adoption of various digital audio workstations due to technological improvements in R&D by manufacturers in the market and the entertainment and media industries to improve customer experience. In addition, several key players are using music production software widely known as digital audio workstations for music composition, music applications, digital recording, and electronic music creation.

Also, due to the increasing number of live shows and the number of professional DJs in the world, the market is expected to grow. Highly skilled personnel should focus on updating and innovating existing devices to bring new products to market and support market growth.

Current Scenario of the Market

Today, DAWs were designed to record and manipulate sounds and music from the computer outside, much like other sophisticated editing software would. However, due to various technological developments, they are now used to creating music first-hand. These are widely used in the music industry, music or audio art of any genre can be created using them. Product innovation and upgrading are taking place in the digital audio workstation market.

The music industry has experienced a remarkable evolution in the last twenty years, owing to the advancement in the field of DAWs. These robust instruments have revolutionised the way method song or music is blended, recorded, as well as produced, allowing artists to unlock their creativity potential like never before. Currently, the leading digital audio workstations in this market and music industry are Ableton Live, Pro Tools, Logic Pro X, FL Studio, and Cubase.

- According to Gear4Music, Ableton Live is the leading DAW, utilised by about 23.4 per cent of producers and musicians in a survey of more than 25 thousand. The rest DAWs comprise Logic Pro at 16.95 per cent, Pro Tools at 15.13 per cent, FL Studio at 13.63 per cent, Cubase at 9.03 per cent, Studio One at 3.8 per cent, Reason at 3.46 per cent, and GarageBand at 2.49 per cent.

In the present day, musicians can establish their own home studio and produce professional-quality recordings using an electronic sound workstation and a computer.

MARKET TRENDS

The MAC operating system is likely to develop with the highest demand over the anticipated period because it is used in several end-use industries. The MAC segment is also expected to experience healthy growth and expansion. The increased adoption of Mac services for recording and editing digital audio files is expected to drive demand for the operating system over the forecast period.

Mac offers a better collective solution for many users, given its excellent build quality and stability. Mac also offers improved solutions to a variety of consumers due to its excellent design structure, which in turn should drive growth in the MAC segment in the market. Software such as FL Studio for MAC OS can be used. It is one of the best DAW software for MAC. For a beginner in music creation, it's best to consider FL Studio.

Ableton Live is also one of MAC's best music production programs, ideal for live performances and studio work. He has a double vision, which allows him to work in the studio and at the same time have live performances. Its session view works seamlessly with network-based hardware drivers and features an excellent design and user interface with sharp and elegant graphics.

Similarly, Studio One has gained immense popularity and is considered one of the best DAWs for MAC. This software is a complete DAW and is a good solution for professionals. It enhances your composing job and comes with different features designed to make composting easier, like automatic MIDI chord change and sheet music printing.

MARKET DRIVERS

The main drivers of growth in the digital audio workstation market include increased demand for HD video and audio, increased demand from the entertainment industry, and increased use of technology in audio and video production. And the growing demand for high production capacity with less equipment. In addition, further adaptation by radio producers will drive the growth of the digital audio workstation market.

MARKET RESTRAINTS

One of the key problems in using a DAW is that it can also have some issues and risks for the music creation and composition. Also, it may face technical problems, like hardware failures, compatibility, or software bugs. It might also encounter creative difficulties, for example, originality, motivation, or losing inspiration. Moreover, creators might face ethical problems, such as unfair compensation, copyright infringement, or plagiarism. A DAW can usually need a considerable amount of investment and maintenance, like learning new skills or tools, plugins, or hardware, or upgrading or buying software.

The main challenges in the digital audio workstation market are the rate of Internet penetration worldwide, financial uncertainty, and macroeconomic situations, such as currency exchange rates and economic difficulties.

MARKET OPPORTUNITIES

The future of the digital audio workstation market is expected to experience a major transition into cloud-based platforms. This will allow real-time partnerships between producers and artists across the globe. It can transform the manner of music creation and production, evolving it into a more cooperative and global process, productively changing the DAW into a mutual and engaging musical instrument even beyond the contemporary studio functions as a ‘musical instrument’.

Pop music is progressively incorporating the compositional techniques of EDM and hip-hop (electronic dance music). This is another factor providing potential opportunities for the expansion of the market and the shift is propelled by a fresh generation of Digital Audio Workstations (DAWs). These rely less on traditional recording studio principles and greater on the mix of loop manipulation and the interconnection nature of ubiquitous computing culture. Therefore, both these factors are predicted to drive the market further in the coming years

MARKET CHALLENGES

The growth of the digital audio workstation market may be affected by the lack of enough of third-party resources and tutorials. Like, Studio One which is a well-known DAW platform, but still it has a smaller user base against its competitors, leading to limited tutorials and other resources. Also, there is no assistance for middle mouse button view pan, which is one of the of the user experience pain points.

Another factor hindering the market expansion is audio and MIDI issues. Several users have faced these difficulties in DAWs that can obstruct workflow of recording and playback at the time of music production. Frequent issues comprise difficulties with recording quality, performance lag, and interface connectivity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.2% |

|

Segments Covered |

By Type, End Use, Component, Deployment Mode, Operating System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Apple (USA), Adobe (USA), Avid (USA), Steinberg (Germany), Ableton (Germany), MOTU (USA), Acoustica (USA), Native Instruments (Germany), MAGIX (Germany), Presonus (United States), Cakewalk (United States), Inage Line Software (Belgium), Bitwig (Germany), Renoise (Germany), Harrison Consoles (United States), and Others. |

SEGMENTAL ANALYSIS

By Component Insights

Based on components, the digital audio workstation market is segmented into software and services. In terms of revenue, in the software segment, the suite software segment represented a significant market share in the world and is expected to maintain its leading position during the forecast period. The growth of the segment can be attributed to the increase in audio content creation, especially via audiobooks and podcasts, which has considerably escalated demand for DAW software. Creators are searching for powerful tools that provide premium-quality mixing, editing and recording abilities.

- According to a report, a big portion of content creators, musicians, and audio producers, i.e. possibly about 70 to 80 per cent of persons involved in audio creation, are utilising some type of DAW software for their projects. This comprises both amateur and professional users.

Another factor contributing to the expansion of this segment is the rise of cloud-based DAWs has enhanced accessibility, encouraging more users to embrace software solutions for audio production.

By Operating System Insights

In terms of compatibility with operating systems, the Mac OS segment represents a significant part of the market and is expected to maintain its leading position in the market during the forecast period. The growing adoption of Mac OS in recording and editing digital audio files is expected to drive demand during the forecast period. Mac offers a better overall solution for many users due to the excellent build quality and stability of Mac OS. Besides these, audio innovators are emphasizing adaptability and flexibility as virtualisation expedites. Industry experts have said the perception that broadcast audio is undergoing a significant shift, i.e. moving away from committed hardware to virtualised systems which can assist an enormous variety of outputs and workflows, cannot be overlooked. So, the segment is expected to grow further in the coming years. Even though both PCs and Macs are utilised in post-production studios in Hollywood and there are convincing reasons for both sides, Apple excels with its native software such as Motion and Final Cut Pro, whereas Macs and PCs perform effectively with other NLE software like Adobe Premiere Pro. On the other hand, PCs are usually available at a reduced cost and are affordable choices for hardware customization and upgrade options.

By Deployment Mode Insights

Based on implementation, the cloud is one of the most favoured segments of digital audio workstations and is constantly evolving due to the increasing number of users in different end-use industries. Cloud-based DAW is a transformative force redefining the market in the constantly changing dynamics of music production. As 2030 comes closer, these unique platforms are not only gaining attention they are primarily changing music creation, collaboration, and sharing, as a result, the market share of segment is also increasing. Moreover, digital DAWs depict a seismic transition to powerful, accessible, and flexible online platform. It utilises cloud technology to deliver superior quality music production available over an internet connection for anyone. With its affordability and accessibility, it democratises music production by facilitating regular updates with latest features and enhancements without extra costs, flexible subscription models, instant tools availability, and inexpensive hardware. Additionally, the segment grew substantially owing to the removal of geographical barriers and facilitating integrated communication tools, shared libraries, real-time editing, and video chat.

By Type Insights

The global digital audio workstation market is classified into recording, editing, and mixing. The mixing segment holds a significant share under this category of the digital audio workstation market.

- According to a survey published in the Film Music Theory, 28.3 per cent of the participants found mixing and mastering as the toughest aspect of the music composition. Followed by a tie for the second position between arrangement and orchestration, and harmony and chord progression stood at 27.3 per cent, and melody creation at last with 17.2 per cent.

Apart from these, the segment’s market size also expanded with podcasting, which quickly became popular and became a mainstream audio channel for education, entertainment, and news.

The editing segment is also growing in popularity, owing to the rising attention to small details by movie viewers and enthusiasts. Since the outbreak of COVID-19, the movie preferences have significantly changed. Also, the increased shift of Asian consumers to online streaming platforms and subsequent growth in their frequency of watching movies and elevated time spent on these platforms escalated the demand for DAWs in the regions by indigenous music and film producers.

By End Use Insights

The global digital audio workstation market is classified as commercial and non-commercial based on the end-use industry. In terms of revenue, the commercial segment includes the professional sector, which has widely used DAW software and services to record, edit, and produce digital audio files. Their commercial application has spiked substantially because of the heightened interest in social media and podcasts, the availability of cost-effective software choices, and technological developments such as 5G. Today, a computer operating a digital audio workstation is at the center of any modern commercial studio. These studios increasingly emphasize providing top-tire equipment and acoustically optimised environments that are difficult to duplicate in a home setting, along with expert guidance in production and recording.

REGIONAL ANALYSIS

The global market for digital audio workstations by region encompasses North America, Asia-Pacific (APAC), Europe, the Middle East and Africa (EMEA), and Latin America. North America has the largest market share due to the early adoption of advanced technology solutions and vendor initiatives to reach the end user base. The United States and Canada are increasingly seeing the adoption of advanced technologies, including Android and Linux operating systems. Moreover, explosive growth has been experienced in the demand for music recording studios in the United States since the beginning of 2022, as a result, the region’s market size expanded significantly. In addition, from powerful DAW applications such as FL Studio Mobile and Garage Band to simple mixers like MicPad, the transformation of mobile music apps has also contributed to the rise of the market expansion in the region. This has taken music or audio composition on mobile devices as effective and serious as it is on workstations or personal computers.

- Furthermore, in October 2024, Ardour 8.10, an open-source digital audio workstation (DAW), was introduced and is available for customers in the USA and worldwide. This release comprises several bug fixes and enhancements over previous versions. Also, it solves considerable performance problems, improves MIDI operations.

Europe's digital audio workstation market is predicted to expand during the forecast period, owing to the fusion of modern technology and culture. The European Union is a key music market; however, it is not progressing as quickly as other global markets.

- According to a study by the International Federation of the Phonographic Industry, in 2023, the EU revenue generation from recorded music grew to an overall 5.2 billion euros by 8.2 per cent. However, compared to other markets and regions, its growth rate is substantially less, i.e. Mexico expanded by 8.2 per cent and China by 25.8 per cent, whereas Europe fell behind the world’s by 10.2 per cent.

KEY PLAYERS IN THE MARKET

The major companies operating in the global digital audio work station market include Apple (USA), Adobe (USA), Avid (USA), Steinberg (Germany), Ableton (Germany), MOTU (USA), Acoustica (USA), Native Instruments (Germany), MAGIX (Germany), Presonus (United States), Cakewalk (United States), Inage Line Software (Belgium), Bitwig (Germany), Renoise (Germany), Harrison Consoles (United States), and others.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, PreSonus unveiled the newest version of its flagship product DAW Studio One. It comes with a bunch of new characteristics involving pioneering Splice incorporation, a Live-style clip launcher, and stem separation. In addition, this allows consumers to access and browse Slice’s extensive library of more than a million samples directly under the Studio One Pro. It benefits from its AI-powered search coupled with sound feature to find similar samples. This is the 7th version which makes Studio One Pro the foremost DAW to completely incorporate sample platform Splice.

- In February 2024, Apple launched the first digital audio workstation (DAW) called RipX DAW. It is made for Apple Vision Pro with an immersive experience and 3D display. Moreover, it provides all types of audio, irrespective of whether recorded or live, stem separated or MIDI as completely editable notes, with tools and instruments differentiated by their spatial positioning. The sound is showcased in a fully 3d environment, enabling users to engage and navigate with the music. Additionally, RipX DAW also comprises inbuilt live effects which start from Reverse to Delay to Vibrato.

MARKET SEGMENTATION

This research report on the global digital audio workstation market has been segmented and sub-segmented based on the type, end-use, component, deployment mode, operating system, and region.

By Component

-

Software

-

Services

By Operating System

-

Mac OS

-

Windows

-

Linux

By Deployment Mode

-

Cloud

-

Local

By Type

-

Recording

-

Editing

-

Mixing

By End Use

-

Non-Commercial

-

Commercial

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How do cloud-based digital audio workstations differ from traditional DAW software?

Cloud-based digital audio workstations offer the advantage of accessibility from any device with an internet connection, collaborative features for remote work, and automatic updates without the need for manual installations. However, they may require a stable internet connection for optimal performance.

Are there any regulatory factors impacting the digital audio workstation market?

Regulatory factors such as copyright laws, data protection regulations, and licensing agreements for audio samples and plugins can influence the digital audio workstation market, particularly concerning the legal use of copyrighted material and compliance with industry standards.

How does the emergence of AI and machine learning technologies affect the digital audio workstation market?

AI and machine learning technologies are increasingly being integrated into digital audio workstations to automate tasks such as audio editing, mixing, and mastering. This can improve workflow efficiency and enhance the creative capabilities of users by providing intelligent suggestions and automating repetitive processes.

How do educational institutions contribute to the growth of the digital audio workstation market?

Educational institutions play a crucial role in the growth of the digital audio workstation market by incorporating DAW software into music production and audio engineering curricula, thereby familiarizing students with industry-standard tools and preparing them for careers in the music and entertainment industry. Additionally, student discounts and educational licenses offered by DAW developers encourage adoption among aspiring musicians and producers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com