Global DLP Projectors Market Research Report - Segmentation By Lens (Ultra-Short Throw Projector, Short Throw Projector, and Standard Throw Projector), By Technology (1-chip DLP Projector and 3-chip DLP Projector), By Light Source (Lamp, LED, and Laser), By Chip Model (One Chip and Three Chip), By Brightness (Less than 2,999 Lumens, 3,000 to 5,999 Lumens, and 6,000 Lumens & Above), By Throw Distance (Normal Throw, Short Throw, and Ultra-Short Throw), and By Application (Home Entertainment & Cinema, Business, Education & Government, Large Venues, and Others) Industry Forecast | 2024 to 2032.

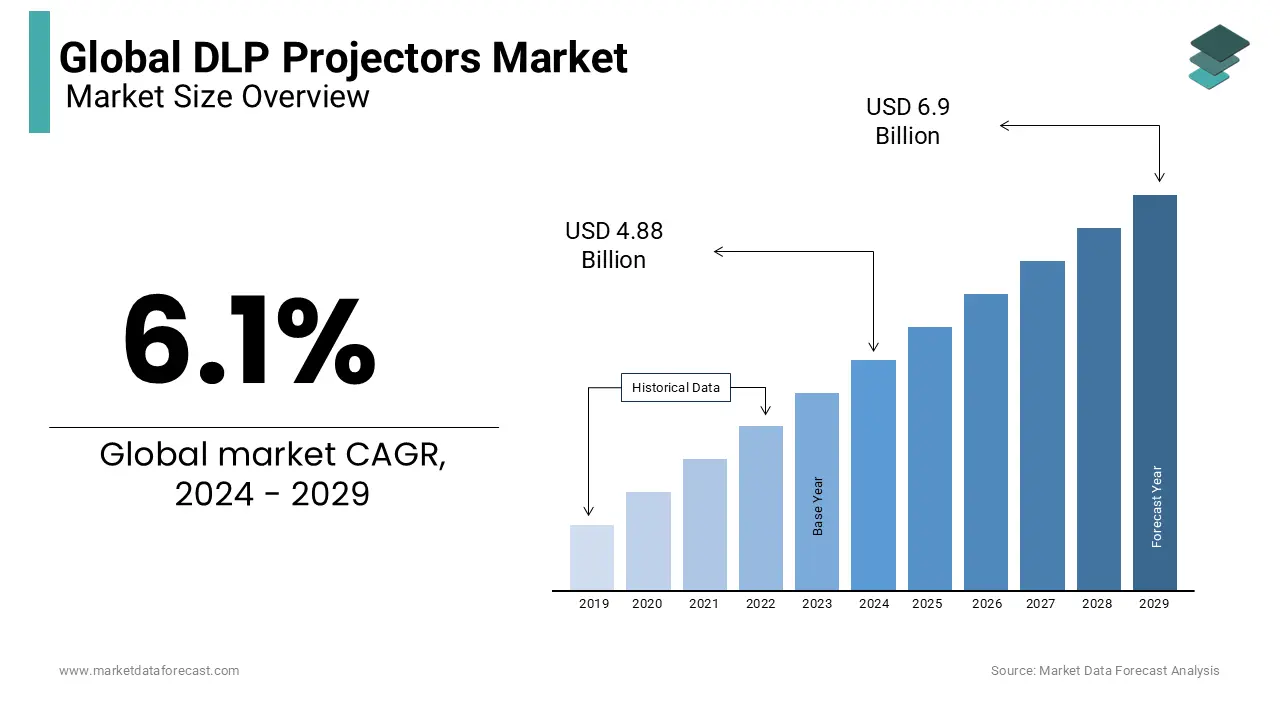

Global DLP Projectors Market Size (2024-2032)

The size of the global DLP projectors market was worth USD 4.6 billion in 2023. The global market is anticipated to grow at a CAGR of 6.1% from 2024 to 2032 and be worth USD 7.84 billion by 2032 from USD 4.88 billion in 2024.

MARKET SCENARIO

DLP is the abbreviated form of Digital Light Processing. DLP is a chipset that works on optical micro-electro-mechanical technology by using a digital micromirror device. In 1997, Digital Projection Ltd developed the first DLP-based projector. The light beam from the DLP projector travels through a color wheel, a reflection mirror, and a lens. It has wide usage in display applications such as traditional static displays to interactive displays and in medical, security, and industrial uses. DLP technology has the features such as more pixels for sharper images, a filter-free design for virtually no maintenance, smooth, clear, jitter-free images, a sealed chipset that prevents dust spots, and environment-friendly laser technology.

MARKET DRIVERS

A rise in the demand for productive, high-quality digital screens can act as a market driver.

The demand for cloud DVR adoption can be driven by the increase in the demand for cost-effective and high-quality digital screens. Consumers always seek immersive and engaging experiences for entertainment or professional use; this demand has led to the development of various display technologies. The convenience and flexibility offered by cloud-based services drive the demand for cloud DVR services and their adoption. To meet the demands, the DLP projectors can be a better choice due to their ability to deliver high-quality visuals and versatile projections. These features of the DLP projectors indeed drive the DLP Projectors market and have a positive impact.

In the education sector, the growing demand for digitalization drives the market.

The educational sector is focusing on the adoption of digital technology into the education system to offer an enhanced teaching and learning experience to students. This includes multimedia content, e-learning platform, collaborative tools, and others that the learning more interesting and enjoyable. As the expansion of digitalization continues in the educational sector, the demand for DLP projectors also grows positively. The benefits of the use of DLP projectors in the education sector are the provision of engaging visual content, flexibility, supportive, interactive learning, and cost-effective nature will always have a growing demand for the DLP projectors market.

MARKET RESTRAINTS

High cost and lack of knowledge would be restraints in the DLP projectors market, hindering its growth worldwide.

The leakage problems and rainbow effect are also concerns associated with the DLP projectors. The leakage problem means the unintended escape of the light from the projector’s optical system results in diminished contrast and affects the image quality. The rainbow effect is seen in the high-contrast scenes or with rapid eye movement where the momentary flashes of the rainbow colors flash to the viewers. In the future, these restraints would reduce the adoption of DLP projectors by potential customers.

MARKET OPPORTUNITIES

The opportunity for the growth of the DLP projectors market would be attributed to its features like high contrast, reduced pixilation, durability, portability, and dependability. There are high market expansion opportunities in different sectors such as education, entertainment, and corporate. There are significant opportunities for the market to have a high revenue growth rate with the increased adoption into the educational sector due to its beneficial features and availability of customization. In the entertainment sector, the cost-effective feature and scalable solutions for the large-screen display drive the demand for the DLP projectors market. The increasing adoption in theatres, event venues, and theme parks provides market growth for DLP projectors. The opportunity to further enhance the functionality and connectivity options of the DLP projects provides more adoption in the corporate sector. The continuous advancements towards innovative and high-performance DLP projectors would always cater to high market growth rate opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.1% |

|

Segments Covered |

By Light Source, Chip Model, Throw Distance, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Acer, Inc., BenQ Corporation, Delta Electronics, Inc., Digital Projection Ltd., NEC Corporation, Optoma Corp., Texas Instruments, Inc., ViewSonic Corporation, XGIMI, Sharp, and Others. |

SEGMENTAL ANALYSIS

Global DLP Projectors Market Analysis By Light Source

The lamp segment is expected to be the largest market share in the DLP projectors market. New light sources such as lasers and LEDs have new developments to provide a high-intensity discharge and long lifespan. The manufacturers are focusing on the development of novel technologies to decrease the cost of installation and operations.

Global DLP Projectors Market Analysis By Chip Model

Prominent growth is anticipated in the one-chip segment of the DLP Projectors market. The primary colors are generally created by placing the color wheel between the white wheel and the DLP chip. Nowadays, white is replaced by the other primary hues, cyan, magenta, and yellow.

Global DLP Projectors Market Analysis By Throw Distance

The short-throw segment is expected to have a dominant demand in the DLP Projectors Market trends. The flexibility of the short throw to fix in educational settings and medium-sized rooms increase its deployment. It also provides a comfortable viewing experience for all the people in the room. The Ultra-short Throw is currently having demand in the market owing to its wide usage for interactive learning environments and provides a seamless & immersive experience in the home theatre setup. An increase in the development of advancements in the short and ultra-short throws, along with growing demand, also drives the market.

Global DLP Projectors Market Analysis By Application

Home Entertainment and cinema are anticipated to have a large market share in the DLP Projectors market. The upsurging popularity of home theatres and demand for an immersive viewing experience are driving the market. Consumers are investing in high-quality projectors, and the market for DLP projectors is increasing due to the exceptional benefits offered by them, as per the requirements of the consumers. Business is also a high-demand holding segment to deliver impactful presentations and effective communication in business meetings/conferences.

REGIONAL ANALYSIS

The Asia-Pacific region is projected to have a significant market share in the DLP Projectors market. The region is owing to the increase in digitalization in education and the rise in the entertainment sector in emerging countries such as India, China, and Japan. The region is also home to many market-leading companies like BenQ Corporation, Panasonic, LG Electronics, and others. In India, the government is also promoting smart classroom projects that make the increased adoption and demand for the market. North America has a high demand for the market owing to the rise in the demand for high-quality, 4K UHD display solutions, and the developing education and corporate sector drive the market demand in the region.

KEY PLAYERS IN THE GLOBAL DLP PROJECTORS MARKET

Companies playing a prominent role in the global DLP projectors market include Acer, Inc., BenQ Corporation, Delta Electronics, Inc., Digital Projection Ltd., NEC Corporation, Optoma Corp., Texas Instruments, Inc., ViewSonic Corporation, XGIMI, Sharp, and Others.

RECENT HAPPENINGS IN THE GLOBAL DLP PROJECTORS MARKET

- In 2023, GT2160HDR is a new gaming and cinema projector released by Optoma, and it is equipped with a 4K UHD DLP chipset. Some other features include HDR tone, hue mapping technology, and a fast-switching display. Additionally, it has an automatic switch to HDR display mode.

- In 2022, an agreement for USD 18.2 million was made by Barco Technology with a Korean design company to provide projectors. For fleet management, BARCO Technologies will provide G-series DLP projectors and hardware delivery of the UDM as a part of the agreement.

DETAILED SEGMENTATION OF THE GLOBAL DLP PROJECTORS MARKET INCLUDED IN THIS REPORT

This research report on the global DLP projectors market has been segmented and sub-segmented based on light source, chip model, throw distance, application, and region.

By Light Source

- Lamp

- LED

- Laser

By Chip Model

- One Chip

- Three Chip

By Throw Distance

- Normal Throw

- Short Throw

- Ultra-Short Throw

By Application

- Home Entertainment & Cinema

- Business

- Education & Government

- Large Venues

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com