Global DNA Sequencing Market Size, Share, Trends & Growth Forecast Report By Product & Services (Consumables, Instruments and Services), Technology (Sanger Sequencing, Next-Generation Sequencing, Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing & Resequencing, Third Generation DNA Sequencing, Single-Molecule Real-Time Sequencing (SMRT) and Nanopore Sequencing), Workflow, Application, End User, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global DNA Sequencing Market Size

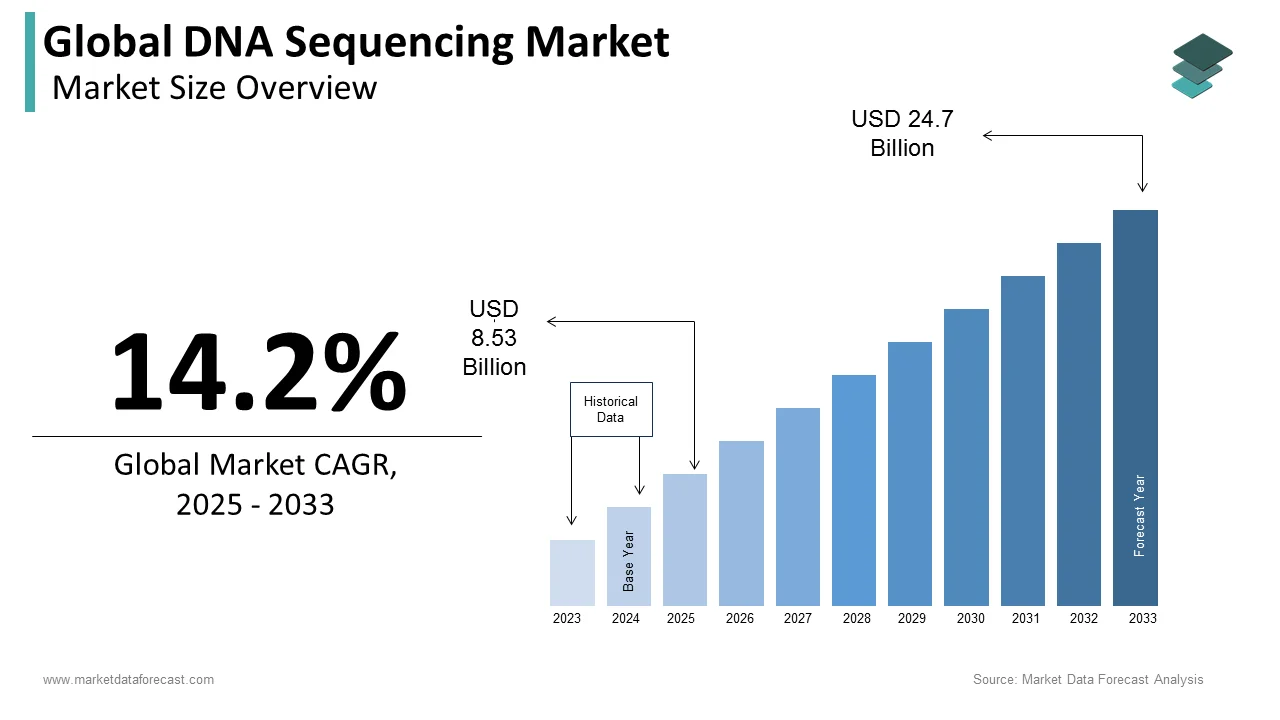

The global DNA sequencing market was worth US$ 7.47 billion in 2024 and is anticipated to reach a valuation of US$ 24.7 billion by 2033 from US$ 8.53 billion in 2025, and it is predicted to register a CAGR of 14.2% during the forecast period 2025-2033.

MARKET DRIVERS

The rising incidence of genetic diseases is one of the key factors propelling the DNA sequencing market growth.

The number of people suffering from generic disorders such as cancer, Alzheimer's disease, and cystic fibrosis has grown substantially over the last few years, resulting in the increasing need for efficient and accurate DNA sequencing methods to support the diagnosis and treatment procedures. In addition, WHO says an estimated 240,000 new-borns die annually from congenital disabilities within 28 days of birth, and genetic disorders are considered the leading factor contributing to these deaths. An increase in the usage of DNA sequencing methods and technologies has been noticed in recent years to diagnose and treat genetic disorders. The trend is predicted to accelerate in the coming years and results in the growth of the DNA sequencing market.

The rising preference for personalized medicine by healthcare providers and patients is accelerating the DNA sequencing market growth. The adoption of personalized medicine to cure various diseases is on the rise and this trend is expected to grow further in the coming years as these are tailor-made medical procedures to address the specific needs of individual patients. DNA sequencing plays a significant role in the development of personalized medicine as the understanding of genetics is much required in these situations, and personalized medicine has been one of the major applications of DNA sequencing. Researchers are using DNA sequencing to identify genetic mutations that accelerate the growth of tumors and to develop effective personalized medicine therapies.

The growing number of initiatives and funding by various governments in favor of DNA sequencing is further fuelling the market’s growth rate.

The Precision Medicine Initiative (PMI) by the U.S. government, The All Of Us Research Program by NIH, Genomics England by the UK government, and The China Precision Medicine Initiative by the Chinese government were some of the recent initiatives by governmental organizations worldwide resulted in the favour of the DNA sequencing. In addition, the European Union's Horizon 2020 program was one of the funds allocated for the R&D of personalized medicine and DNA sequencing. In the future, more such happenings are expected to address the growing burden of various chronic diseases and genetic diseases and result in the market growth of DNA sequencing.

In addition, the growing number of developments in sequencing technologies boosts the DNA sequencing market growth. Furthermore, the rising expansion of genomics research, increasing demand for NIPT procedures, growing adoption of cloud computing in genomics, and increasing competition among the market participants are predicted to accelerate the growth of the DNA sequencing market during the forecast period.

MARKET RESTRAINTS

DNA technology was costly, but the costs associated with DNA sequencing have reduced dramatically over the years. However, it is still an expensive technology for some researchers and healthcare providers. These costs are making it difficult to access and afford, which is expected to hamper the growth of the DNA sequencing market. In addition, issues associated with the accuracy and reliability of DNA sequencing technology are further limiting the market’s growth rate. The scarcity of skilled professionals who can analyze and interpret data is another notable factor hindering the growth of the DNA sequencing market. Furthermore, regulatory hurdles, ethical concerns, fewer applications, and lack of standardization are expected to impede market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.2% |

|

Segments Covered |

By Product & Services, Technology, Workflow, Application, End User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Agilent Technologies, Inc., Abbott Laboratories, Danaher Corporation (Beckman Coulter, Inc.), F. Hoffmann-La Roche Ltd, Illumina, Inc., LI-COR Biosciences, Inc., Pacific Biosciences of California, Inc., SIEMENS AG, PerkinElmer Inc., and Thermo Fisher Scientific, Inc, and Others. |

SEGMENTAL ANALYSIS

By Product & Services Insights

Based on the product & services, the consumables segment accounted for 39.4% of the global DNA sequencing market in 2024. The segment’s domination is anticipated to continue during the forecast period. The segment's growth is driven by the growing demand for DNA sequencing services and the increasing adoption of next-generation sequencing technologies. In addition, the rising usage of consumables in executing DNA sequencing activities is further contributing to segmental growth.

The instruments segment had the second-largest share of the worldwide market in 2024 and is considered another lucrative segment. The instruments segment is estimated to showcase a healthy CAGR during the forecast period. Factors such as growing demand for high-throughput sequencing and the development of advanced sequencing technologies are majorly propelling segmental growth. In addition, the segment's growth rate is further favored by the rising demand for PCR-based methods for DNA sequencing.

The services segment is predicted to hold a considerable share of the worldwide market during the forecast period. The growing demand for outsourcing sequencing services is primarily boosting segmental growth. In addition, the rising adoption of DNA sequencing among healthcare providers to diagnose and treat genetic disorders is fuelling the segment’s growth rate.

By Technology Insights

Based on the technology, the NGS segment accounted for the major share of the global DNA sequencing market in 2024. Furthermore, the segment’s domination is likely to continue during the forecast period. The next-generation sequencing technology has revolutionized genomics in recent years and led to several developments in diagnosing and treating genetic disorders. The growth of the NGS segment is primarily boosted by the cost-effectiveness of the technology and its high throughput nature. In addition, the growing number of applications of NGS is further accelerating segmental growth.On the other hand, the third-generation DNA sequencing segment is anticipated to hold a considerable share of the worldwide market during the forecast period. Sub-segments such asnanopore sequencing and SMRT sequencing technologies are expected to witness a healthy growth rate in the coming years owing to the growing emphasis by the market participants to improve the effectiveness of the technologies and increasing applications of these technologies in research and clinical settings.

By Workflow Insights

Based on workflow, the sequencing segment is predicted to hold a major share of the global DNA sequencing market during the forecast period. The growing number of applications of DNA sequencing, such as precision medicine, drug discovery, and others majorly drives the segment's growth.The pre-sequencing segment is expected to register a promising CAGR during the forecast period. The growing adoption of next-generation sequencing technologies and the increasing number of applications of NGS technologies are boosting segmental growth.The data analysis segment is predicted to witness a moderate CAGR in the coming years owing to the increasing demand for data analysis services and tools in DNA sequencing.

By Application Insights

Based on the application, the oncology segment held the major share of the DNA sequencing market in 2024 and is expected to be the leader among all the segments during the forecast period. The increasing usage of DNA sequencing majorly drives the growth of the oncology segment in oncology for cancer diagnosis, treatment selection, and monitoring of treatment response. In addition, the growing cancer patient population worldwide and increasing awareness among healthcare providers regarding DNA sequencing technology are further fuelling the segment’s growth rate.

The reproductive segment is another promising segment in the global DNA sequencing market by application and is expected to register a notable CAGR in the coming years. Factors such as the increasing patient population suffering from infertility and rising demand for DNA sequencing technologies in assisted reproductive technology are primarily boosting segmental growth.

The consumer genomics segment is predicted to register a healthy growth rate in the global DNA sequencing market during the forecast period. Factors such as the growing demand for direct-to-consumer genetic testing, growing accessibility and affordability of DNA sequencing technologies, and increasing patient population suffering from genetic disorders are propelling segmental growth. Furthermore, the growing awareness among people regarding consumer genomics and increasing demand for personalized medicine are promoting the segment's growth rate.

By End-use Insights

Based on the end-user, the academic research segment is anticipated to hold the largest share of the global DNA sequencing market during the forecast period owing to the widespread use of sanger technology and NGS in academic and institutional research initiatives.The clinical research segment is predicted to showcase a promising CAGR during the forecast period owing to the growing usage of DNA sequencing in clinical trials.The pharmaceutical and biotechnological companies segment is estimated to post a notable CAGR in the coming years. Factors such as increasing usage of DNA sequencing in drug discovery and clinical trial activities and growing demand for precision medicine are propelling segmental growth.The hospitals and clinics segment is expected to witness a healthy CAGR during the forecast period. The segment's growth is driven by the increasing usage of DNA sequencing patient diagnosis and treatment and the increasing adoption of precision medicine and personalized healthcare.

REGIONAL ANALYSIS

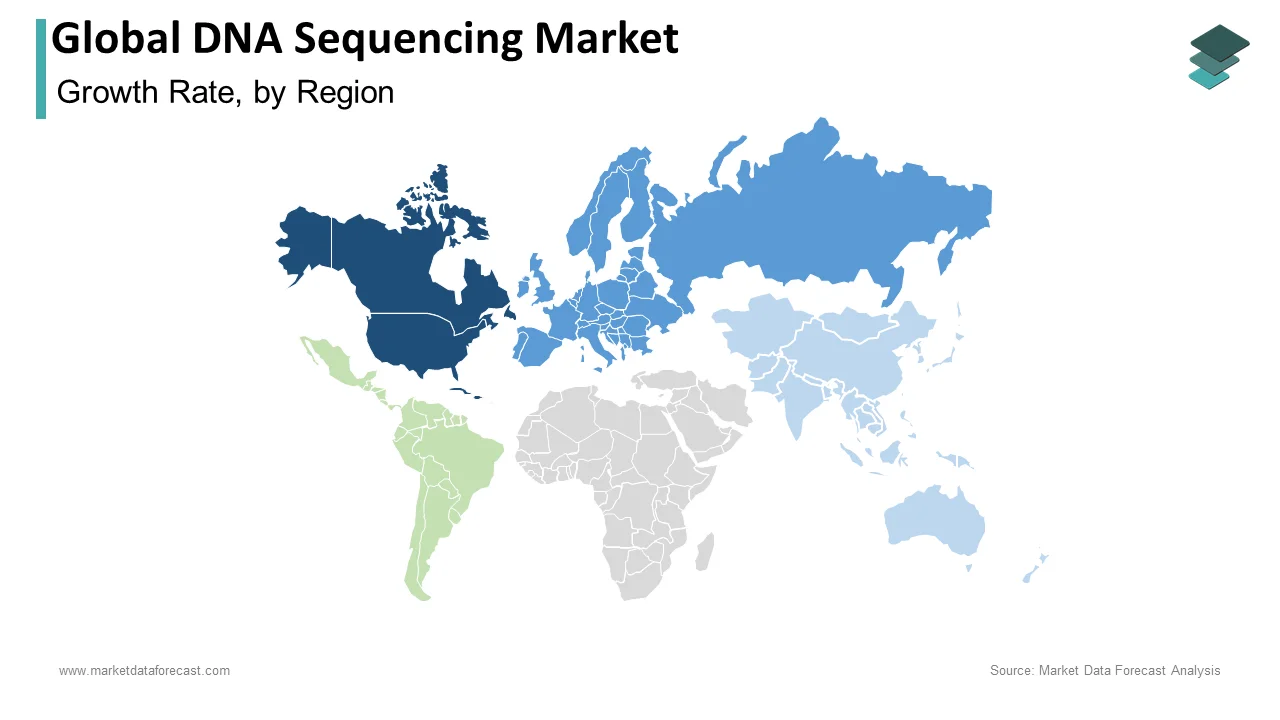

Among all the regions, the North American region accounted for the leading global market share in 2024 and is expected to continue dominating the market during the forecast period. The rise in the prevalence of cancer, the growing geriatric population, and the development of innovation ecology favor the North American market. Moreover, major market key players in this region and large buying power further fuel the market's growth. In addition, because of increased funding and support operations by government and non-government organizations, particularly in the United States, the U.S. is likely to dominate the market in the North American region.

The European region was the second leading region globally in 2024 and is predicted to register a robust CAGR between 2025 to 2033. The rise in the aging population and the increase in cancer patients, sedentary lifestyles, and efficient reimbursement scenarios are expected to favor the European market growth.

Due to many patients, the Asia-pacific region is predicted to hike significantly during the forecast period. Moreover, improving healthcare infrastructure and increasing healthcare expenditure in this region is a big plus to the global market.

The Latin American DNA sequencing market is predicted to showcase a healthy CAGR during the forecast period.

As expected, the lowest share was contributed by the MEA DNA sequencing market to the global market in 2024. Some hampers are a shortage of advanced technologies and poor medical facilities.

KEY MARKET PLAYERS

Agilent Technologies, Inc., Abbott Laboratories, Danaher Corporation (Beckman Coulter, Inc.), F. Hoffmann-La Roche Ltd, Illumina, Inc., LI-COR Biosciences, Inc., Pacific Biosciences of California, Inc., SIEMENS AG, PerkinElmer Inc., and Thermo Fisher Scientific, Inc. are some of the companies dominating the global DNA sequencing market.

RECENT MARKET DEVELOPMENTS

- In August 2020, NovaSeq 6000 v1.5 Reagent Kit was launched by Illumina Inc. that kit was made for the WGS technique with high cost-effectiveness. This is accessible to all laboratories and also helps to reduce costs.

- In August 2020, an FDA provision was made for the first liquid biopsy companion diagnostic by leveraging NGS technology to guide cancer treatment.

- In April 2020, EUA was received from Helix OpCo LLC for the Helix COVID-19 NGS Test to detect SARS-CoV-2 infection.

MARKET SEGMENTATION

This research report on the global DNA sequencing market has been segmented and sub-segmented based on the product & services, technology, workflow, application, end-user, and region.

By Product & Services

- Consumables

- Instruments

- Services

By Technology

- Sanger Sequencing

- Next-Generation Sequencing

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- Targeted Sequencing & Resequencing

- Third Generation DNA Sequencing

- Single-Molecule Real-Time Sequencing (SMRT)

- Nanopore Sequencing

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Oncology

- Reproductive Health

- Clinical Investigation

- Agri-genomics & Forensics

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Consumer Genomics

- Others

By End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other Users

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of EU

- Asia-Pacific

- India

- China

- Japan

- Australia

- South Korea

- Rest of APAC

- Latin America

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global DNA sequencing market going to be worth by 2033?

The global market size for DNA sequencing will be worth USD 24.7 billion by 2033.

Which region is growing the fastest in the global DNA sequencing market?

Geographically, the North American DNA sequencing market is estimated to showcase the fastest CAGR in the global market during the forecast period.

Who are the key players in the global DNA sequencing market?

Companies playing a key role in the global DNA sequencing market are Agilent Technologies, Inc., Abbott Laboratories, Danaher Corporation (Beckman Coulter, Inc.), F. Hoffmann-La Roche Ltd, Illumina, Inc., LI-COR Biosciences, Inc., Pacific Biosciences of California, Inc., SIEMENS AG, PerkinElmer Inc., and Thermo Fisher Scientific, Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com