Global Drill Bit Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Fixed Bits and Rolling Cone Bits), Application (Onshore and Offshore), & Region - Industry Forecast From 2024 to 2032

Global Drill Bit Market Size (2024 to 2032)

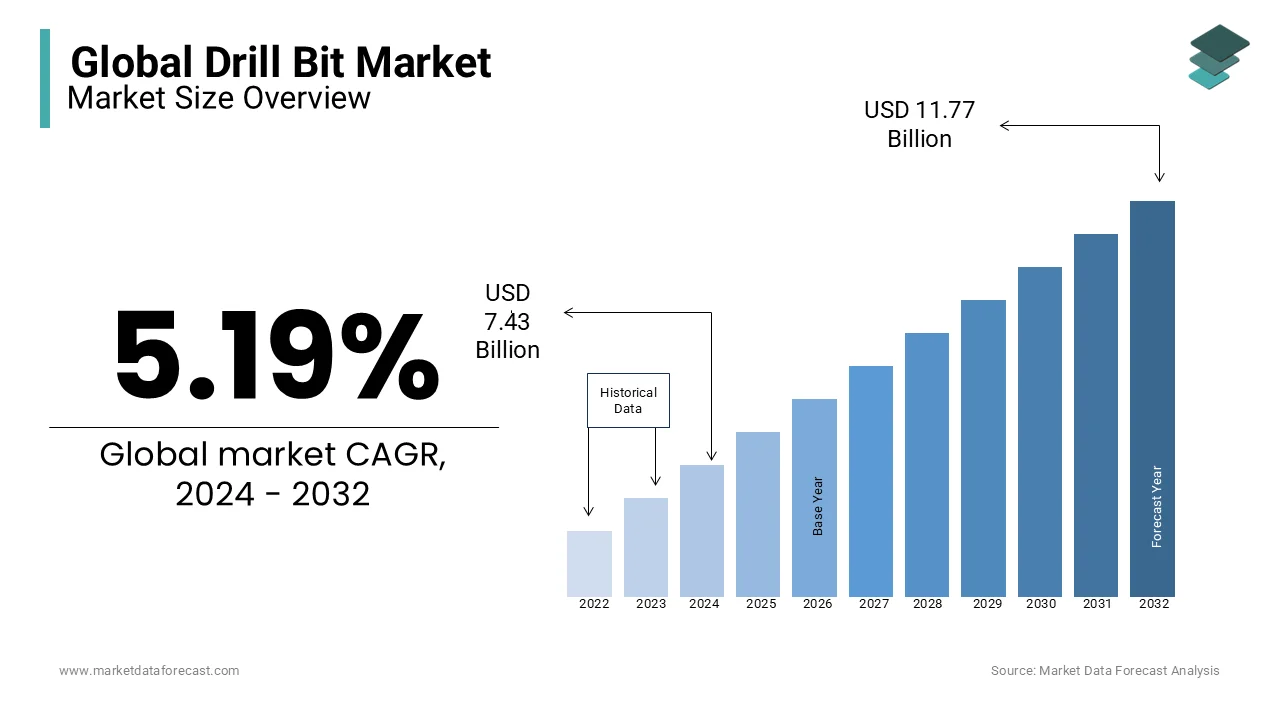

The Global Drill Bit Market was valued at USD 7.02 billion in 2023 and is expected to reach USD 11.77 billion by 2032 from USD 7.43 billion in 2024, with a current CAGR of 5.91% during the forecast period 2024 to 2032.

Current Scenario of the Global Drill Bit Market

Drill bits are one of the important tools in any drilling operation. They are used to cut rocks to drill any oil and gas well. The bit has a rotating device that cuts through the rock. Drill bits are generally made of two or three cones, which are made of solid materials like steel, tungsten carbide, diamonds, etc. The global market for drill bits is expected to see growth during the forecast period due to increased drilling for crude oil and natural gas exploration and production in Australia, the Middle East, and the United States. The economies of India, China, and Brazil are likely to increase the drilling bit market. The construction industry is expected to be a potential application for the drill bit given the increasing consumption of foundation and maintenance work in the housing sectors.

MARKET DRIVERS

The leading factors driving the global drill bit market include increased exploration and development activity, increased unconventional field development activity, and increased directional drilling.

The demand for drill bits is expected to increase in the direction of providing wear resistance and strength properties. The growing demand for fast drilling with minimal wear in terms of medium hard and hard formations is driving the global market. A strong platinum mining base in South Africa is expected to increase the demand for PCD rigs and thus drive the drilling industry growth in the near future. Increased spending on shale field drilling due to the deployment of enhanced oil recovery in the United States is likely to enhance the market for drilling bits. The expansion of crude oil fields in the Middle East due to the increase in crude oil production domestically is expected to positively impact market growth. The Iranian government is expected to seek investments to increase petrochemical production domestically, which is likely to increase the drilling bit industry.

MARKET RESTRAINTS

The rapid awareness of environmental damage due to excessive mining activities in different regions of the world is expected to restrict the growth or demand for mining bits in the near future.

The high cost of drilling and strict government regulations on offshore drilling are major factors that can hamper the market growth. The lack of investment in the offshore sector compared to onshore is expected to slow down the growth of the market in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.91% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Atlas Copco (Sweden), Baker Hughes Inc. (U.S), Cangzhou Great Drill Bits Co., Ltd. (China), ESCO Corporation (U.S), Equinor, Halliburton Company (U.S.), and Irwin Industrial Tool Company (U.S.). NewTech Drilling Products LLC (Russia) National Oilwell Varco Inc. (U.S.), Scientific Drilling International Inc. (U.S.), Kingdream Public Limited Company (China), Varel International, Inc. (U.S.), Torquato Drilling Accessories, Inc. (U.S.), and Ulterra Drilling Technologies (U.S) and Others. |

SEGMENTAL ANALYSIS

Global Drill Bit Market Analysis By Type

In stationary bits, polycrystalline diamond bits and natural diamond bits contribute a lot. Roller cone cutter bits are further classified as countersunk tooth bits and tungsten carbide inserts.

Global Drill Bit Market Analysis By Application

With the advancement of unconventional drilling techniques such as horizontal and vertical drilling businesses, the market is expected to see further increase for drill bits.

REGIONAL ANALYSIS

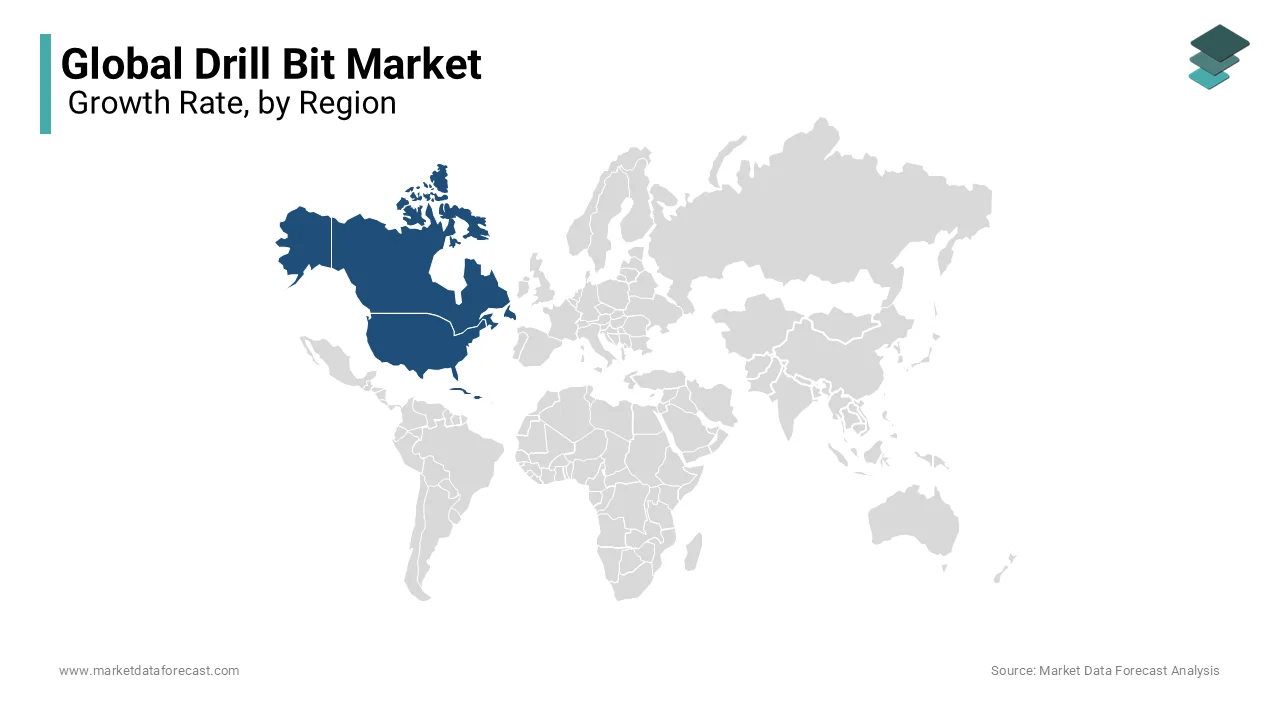

North America is expected to be the largest market for drill bits with an increase in horizontal and unconventional drilling activity.

The United States has recently established itself as one of the top crude oil-producing countries with the most onshore drilling activity for the extraction of shale oil and gas. In addition, the Gulf of Mexico region is experiencing an increase in enhanced oil and gas recovery projects that can extend the life of mature oil wells. With the rise of shale gas development projects in China, the Asia-Pacific region is also expected to see rapid growth in the market for drilling bits. With increasing oil and gas discovery activity in countries such as Indonesia, Australia, and the Philippines, the area is expected to suppose high demand for bits.

KEY PLAYERS IN THE GLOBAL DRILL BIT MARKET

Companies playing a prominent role in the global drill bit market include Atlas Copco (Sweden), Baker Hughes Inc. (U.S), Cangzhou Great Drill Bits Co., Ltd. (China), ESCO Corporation (U.S), Equinor, Halliburton Company (U.S.), and Irwin Industrial Tool Company (U.S.). NewTech Drilling Products LLC (Russia) National Oilwell Varco Inc. (U.S.), Scientific Drilling International Inc. (U.S.), Kingdream Public Limited Company (China), Varel International, Inc. (U.S.), Torquato Drilling Accessories, Inc. (U.S.), and Ulterra Drilling Technologies (U.S) and Others.

RECENT HAPPENINGS IN THE GLOBAL DRILL BIT MARKET

- Halliburton announced the launch of GeoTech HE, a robust bit that incorporates new features and materials to offer better performance and greater reliability in today's high-energy drilling systems characterized by heavyweight and very high drilling torque.

- Equinor, a leading oil company in Norway, confirmed that the coronavirus had a negative impact on its offshore development projects, but the combined portfolio of projects is still very resilient.

DETAILED SEGMENTATION OF THE GLOBAL DRILL BIT MARKET INCLUDED IN THIS REPORT

This research report on the global drill bit market has been segmented and sub-segmented based on type, application, and region.

By Type

- Fixed bits

- Rolling cone bits

By Application

- Onshore

- Offshore

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Drill Bit Market growth rate during the projection period?

The Global Drill Bit Market is expected to grow with a CAGR of 5.91% between 2024-2032.

What can be the total Drill Bit Market value?

The Global Drill Bit Market size is expected to reach a revised size of USD 9.91 billion by 2032.

Name any three Drill Bit Market key players?

Halliburton Company (U.S.), Irwin Industrial Tool Company (U.S.), and NewTech Drilling Products LLC (Russia) are the three Drill Bit Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com