Global Dumper Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Articulated dump trucks, Rigid dump trucks), Type (Standard dump trucks, Off-highway dump truck, Others) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Dumper Market Size

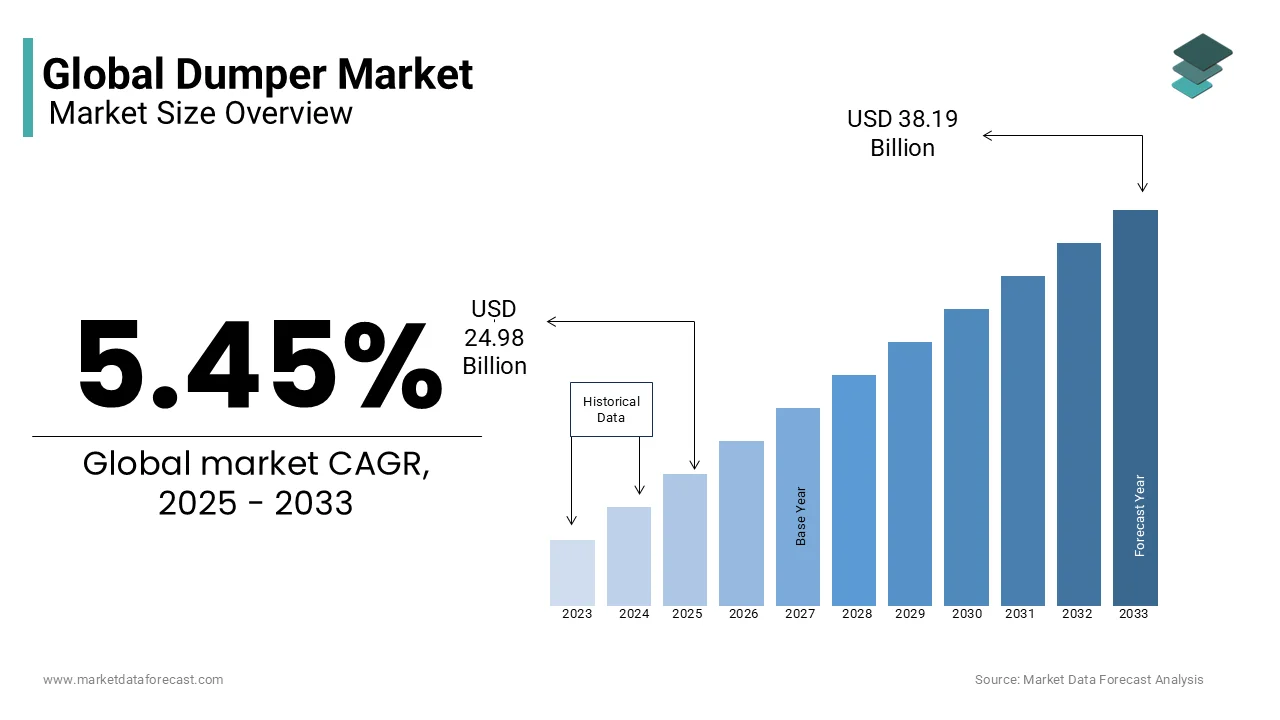

The global dumper market size was valued at USD 23.69 billion in 2024 and is anticipated to reach USD 24.98 billion in 2025 from USD 38.19 billion by 2033, growing at a CAGR of 5.45% during the forecast period from 2025 to 2033.

Market Overview

Dumpers, also known as dump trucks or tipper trucks, are indispensable in large-scale infrastructure projects, road construction, and quarrying operations due to their ability to efficiently handle heavy loads. These vehicles are engineered with hydraulic systems that allow the cargo bed to tilt and discharge materials at designated locations, enhancing productivity and reducing manual labor. According to the data from the International Labour Organization, the construction sector employs over 7% of the global workforce by emphasizing its economic significance and indirectly reflecting the importance of reliable machinery.

In terms of environmental impact, the dumper market faces increasing scrutiny as governments worldwide are showing interest towards greener alternatives. A study published by the World Resources Institute has shown that transportation-related emissions account for nearly 24% of global CO2 emissions that is solely prompting manufacturers to innovate with electric and hybrid models. Additionally, the United Nations Environment Programme, urbanization trends will lead to two-thirds of the world’s population living in cities by 2050. This evolving landscape positions the dumper market not only as a cornerstone of industrial progress but also as an area ripe for technological advancement and sustainability initiatives.

Market Drivers

Infrastructure Development Initiatives

The dumper market is significantly propelled by global infrastructure development projects, which are a cornerstone of economic growth. Governments worldwide are investing heavily in constructing roads, highways, bridges, and urban transit systems to accommodate growing populations and enhance connectivity. For instance, the Global Infrastructure Hub reveals that global infrastructure investment needs will reach $94 trillion by 2040 to keep pace with urbanization and economic expansion. According to the U.S. Department of Transportation, the Biden administration's Infrastructure Investment and Jobs Act allocates $1.2 trillion for rebuilding roads, bridges, and other critical infrastructure by directly boosting demand for dumpers. These projects require efficient material handling equipment to manage large volumes of construction materials like asphalt, concrete, and aggregates.

Mining Industry Expansion

The rising demand from the mining sector due to its reliance on heavy-duty machinery for transporting extracted materials is ascribed to propel the growth of the dumper market. According to the International Energy Agency, the mineral demand is expected to increase by over 50% by 2030 due to the rise in clean energy technologies by including electric vehicles and renewable energy systems. This surge necessitates advanced mining operations, where dumpers play a pivotal role in hauling ores and waste materials. According to the United Nations Conference on Trade and Development, mining contributes approximately $2.3 trillion annually to the global economy. The need for high-capacity dumpers remains critical with countries like Australia and Chile are leading in mineral exports. The robust expansion of mining activities was coupled with technological advancements in extraction processes that ensures steady growth in demand for dumpers tailored to handle challenging terrains and heavy payloads.

Market Restraints

Stringent Emission Regulations

The dumper market faces significant challenges due to increasingly stringent emission regulations imposed by governments worldwide. According to the Environmental Protection Agency, heavy-duty vehicles, including dumpers, account for nearly 23% of greenhouse gas emissions from the transportation sector in the United States alone. To combat this, regulatory bodies are enforcing stricter emission standards, such as the Euro VI norms in Europe and similar frameworks globally, which mandate reductions in nitrogen oxides and particulate matter. Compliance with these regulations requires manufacturers to invest heavily in developing cleaner engines or transitioning to electric and hybrid models, increasing production costs. According to the International Council on Clean Transportation, meeting these standards could raise vehicle prices by up to 15%, potentially impacting affordability. These regulatory pressures pose a restraint by limiting the flexibility of manufacturers and slowing down market growth as companies adapt to evolving environmental mandates.

High Operational and Maintenance Costs

Another major restraint in the dumper market is the high operational and maintenance costs associated with these vehicles. As per U.S. Bureau of Labor Statistics, maintenance and repair costs for heavy machinery can account for up to 30% of the total cost of ownership over the equipment's lifecycle. Dumpers, often operating in harsh environments like construction sites and mines, are prone to wear and tear by requiring frequent servicing and part replacements. According to the World Bank, fuel expenses constitute approximately 40% of the operational costs for heavy-duty vehicles, further straining budgets amid volatile fuel prices. These financial burdens are particularly challenging for small and medium-sized enterprises, which may struggle to afford or maintain a fleet of dumpers.

Market Opportunities

Adoption of Electric and Hybrid Dumpers

The transition toward sustainable construction practices presents a significant opportunity for the dumper market through the adoption of electric and hybrid models. According to the International Energy Agency, global sales of electric commercial vehicles are projected to grow by 35% annually over the next decade, which was driven by government incentives and corporate sustainability goals. For instance, the European Union’s Green Deal aims to reduce carbon emissions by 55% by 2030 by encouraging industries to adopt eco-friendly machinery. According to the U.S. Department of Energy, businesses can benefit from tax credits of up to $40,000 per vehicle under the Inflation Reduction Act for purchasing zero-emission heavy-duty equipment. These initiatives create a favorable environment for manufacturers to innovate and capture new market segments. The demand for electric dumpers is expected to surge by offering a lucrative growth for the market.

Expansion in Emerging Economies

Emerging economies present a promising opportunity for the dumper market due to rapid industrialization and urbanization. According to the World Bank, urban populations in developing countries are expected to increase by 2.5 billion people by 2050 by necessitating extensive infrastructure development. Countries like India and Indonesia are investing heavily in road networks, housing projects, and industrial zones, with India’s Ministry of Finance allocating $1.4 trillion for infrastructure development over the next five years. According to the African Development Bank, Africa requires $170 billion annually to bridge its infrastructure gap, creating substantial demand for construction equipment. These regions offer untapped potential for dumper manufacturers to expand their footprint. Companies can capitalize on the growing demand for efficient material handling equipment in emerging economies by tailoring cost-effective and durable solutions to meet the needs of these markets.

Market Challenges

Supply Chain Disruptions and Raw Material Shortages

The dumper market faces significant challenges due to ongoing supply chain disruptions and shortages of critical raw materials. According to the U.S. Department of Commerce, the global semiconductor shortage, which impacts vehicle production, has led to a 20% decline in heavy machinery manufacturing capacity in some regions during 2022. Steel, a primary material used in dumper construction, has seen price volatility, with the World Steel Association noting a 30% increase in steel costs over the past two years due to geopolitical tensions and trade restrictions. These factors have delayed production timelines and increased manufacturing expenses. As per the International Transport Forum, port congestion and shipping delays have extended lead times for imported components by up to 50%. Such disruptions hinder manufacturers' ability to meet rising demand by creating bottlenecks and reducing market responsiveness.

Workforce Skill Gaps and Training Needs

Another pressing challenge for the dumper market is the growing skill gap among operators and maintenance personnel. According to the U.S. Bureau of Labor Statistics, employment in heavy vehicle operation roles is expected to grow by only 6% over the next decade, significantly slower than other industries, due to a lack of qualified workers. Advanced dumpers equipped with modern technologies like GPS and telematics require specialized training, whereas the National Center for Construction Education and Research studies have shown that only 20% of current operators are proficient in using such systems. Also, as per the International Labour Organization, inadequate training contributes to a 15% higher rate of equipment misuse and accidents by increasing operational risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.45% |

|

Segments Covered |

By Product, Type and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AB Volvo, BEML Ltd., Caterpillar Inc., CNH Industrial NV, Deere and Co., Epiroc AB, Hinduja Group Ltd., Hitachi Ltd., J C Bamford Excavators Ltd., Kamaz Export, Komatsu Ltd., Kubota Corp., Liebherr International AG, Mercedes Benz Group AG, PACCAR Inc., Sany Group, Shine India Technology and Co., Xuzhou Construction Machinery Group Co. Ltd. |

SEGMENT ANALYSIS

By Product

The rigid dump trucks segment was the largest and held 55.6% of the dumper market share in 2024. The growing demand to use these trucks for large-scale mining and construction projects is anticipated to fuel the growth of this segment. According to the U.S. Department of Energy, rigid dump trucks can carry payloads exceeding 300 tons by making them indispensable in heavy-duty operations. Their robust design and cost-effectiveness ensure widespread adoption in developed economies with extensive infrastructure needs.

The articulated dump trucks segment is estimated to register a CAGR of 7.2% during the forecast period. According to the World Bank, infrastructure investments in developing nations are increasing at an annual rate of 8%, that is driving demand for adaptable machinery. Additionally, advancements in fuel efficiency and off-road capabilities have expanded their application in agriculture and road construction. The United Nations Industrial Development Organization emphasizes that articulated dump trucks reduce operational costs by 15% in challenging environments that further boosting their adoption.

By Type

The standard dump trucks dominated the dumper market with 59.1% of total share in 2024. According to the U.S. Department of Transportation, standard dump trucks account for over 70% of material transportation in highway construction projects. Their ability to operate on public roads and handle moderate payloads efficiently contributes to their widespread adoption. The demand for these trucks remains robust as cities expand and infrastructure projects grow.

The off-highway dump truck segment is likely to experience a fastest CAGR of 8.5% from 2025 to 2033. This rapid growth is driven by the increasing scale of mining operations and large-scale infrastructure projects in remote areas. According to the World Bank, global mining investments are projected to rise by 10% annually that is boosting demand for heavy-duty off-highway dumpers capable of handling extreme terrains and massive payloads. Additionally, the United Nations Conference on Trade and Development studies have revealed that mineral extraction contributes $2.3 trillion annually to the global economy. The shift toward automation and advanced technologies in mining enhances operational efficiency by making off-highway dump trucks critical for future industrial growth.

REGIONAL ANALYSIS

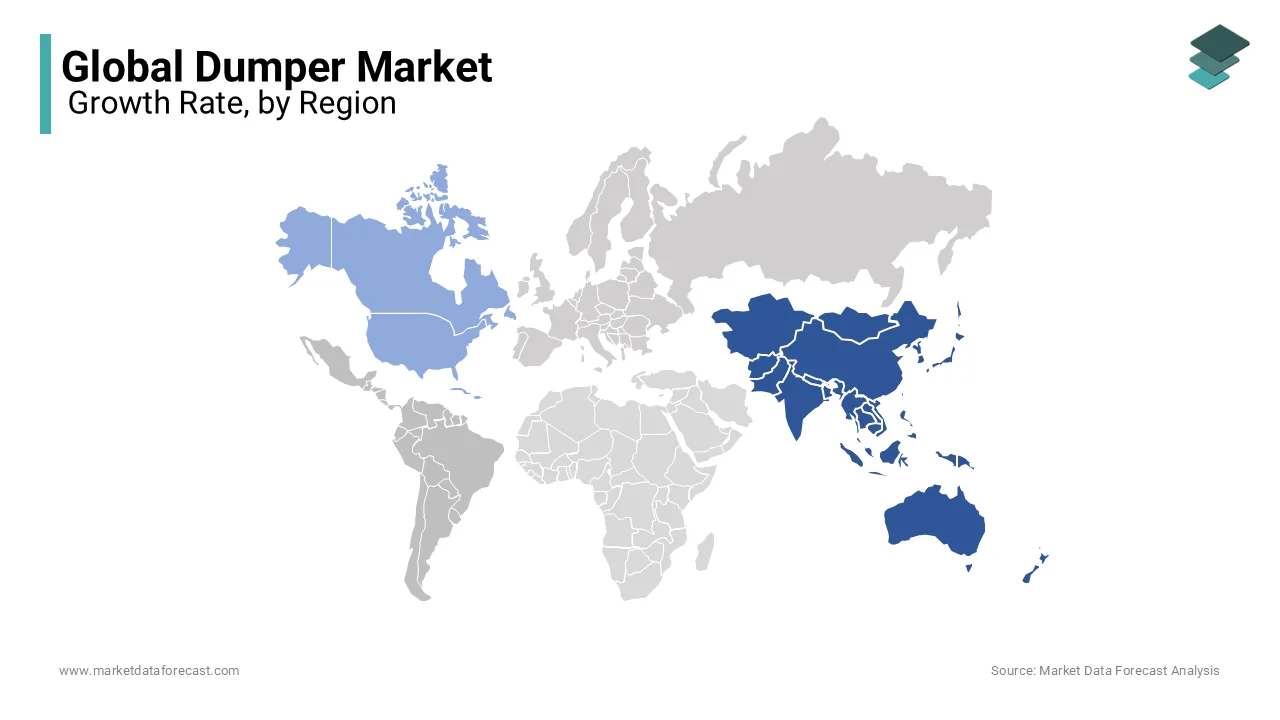

The Asia-Pacific region was the top performer in the global dumper market with an expected share of 45.3% in 2024. Rapid urbanization and infrastructure development, with China and India accounting for over 60% of global construction growth is ascribed to bolster the growth of the market in this region. According to the Asian Development Bank, the region requires $1.7 trillion annually in infrastructure investments until 2030 to sustain economic growth. Governments are prioritizing large-scale projects like highways, railways, and smart cities, driving demand for dumpers. As per the United Nations, Asia-Pacific's urban population will grow by 500 million people by 2035, that further escalates the need for efficient material handling equipment.

The Middle East and Africa region with a CAGR of 9.2% from 2025 to 2033. This growth is driven by massive investments in infrastructure and mining in Gulf nations and Sub-Saharan Africa. According to the World Bank, infrastructure spending in the Middle East is projected to exceed $300 billion annually, while Africa’s mining sector contributes $400 billion to its GDP. Saudi Arabia’s Vision 2030 and Africa’s push for industrialization are key catalysts. According to the United Nations Economic Commission for Africa, urbanization rates in Africa are the highest globally, at 3.5% annually, creating demand for construction equipment. These factors position the region as a high-potential market for dumpers.

North America and Europe are expected to witness steady growth due to aging infrastructure upgrades and green initiatives. The U.S. Department of Transportation estimates $1 trillion in road repairs by 2030. Latin America, however, faces slower growth due to economic instability but benefits from mining activities, contributing $300 billion annually to regional GDP, as per the Inter-American Development Bank. Collectively, these regions will likely experience moderate expansion, with technological advancements and sustainability measures driving incremental demand for dumpers in the coming years.

KEY MARKET PLAYERS

AB Volvo, BEML Ltd., Caterpillar Inc., CNH Industrial NV, Deere and Co., Epiroc AB, Hinduja Group Ltd., Hitachi Ltd., J C Bamford Excavators Ltd., Kamaz Export, Komatsu Ltd., Kubota Corp., Liebherr International AG, Mercedes Benz Group AG, PACCAR Inc., Sany Group, Shine India Technology and Co., Xuzhou Construction Machinery Group Co. Ltd. These are the market players that are dominating the global dumper market.

Top 3 Players in the market

AB Volvo

AB Volvo is a key player in the global dumper market, renowned for its innovative and sustainable construction equipment solutions. The company has established itself as a leader by focusing on eco-friendly technologies, including electric and hybrid dumpers, to meet stringent emission standards. Volvo’s advanced telematics systems enhance operational efficiency, making its products ideal for large-scale infrastructure projects. With a strong presence in Europe and North America, Volvo has also expanded its footprint in emerging markets through strategic partnerships. Its commitment to sustainability and cutting-edge technology has solidified its reputation as a trusted brand in the industry.

Caterpillar Inc.

Caterpillar Inc. is a dominant force in the dumper market, known for its durable and high-capacity equipment designed for mining, construction, and quarrying applications. Caterpillar has set benchmarks in productivity and safety through innovations like autonomous dumpers and IoT-enabled machinery. The company’s focus on technological advancements ensures its equipment meets the demands of modern industries. Caterpillar’s global reach and ability to cater to diverse sectors have made it a preferred choice for heavy-duty operations. Its emphasis on sustainable practices, such as energy-efficient machinery.

Komatsu Ltd.

Komatsu Ltd. is a major contributor to the dumper market, particularly excelling in off-highway dump trucks designed for challenging terrains in mining operations. The company integrates smart technologies, such as AI-driven fleet management systems, to improve precision and reduce downtime. Komatsu’s focus on emerging markets, including Asia-Pacific and Africa, has driven significant growth and strengthened its global presence. By prioritizing sustainability, Komatsu has introduced hydrogen-powered prototypes and other eco-friendly solutions, positioning itself as an innovator addressing future industry needs. Its dedication to quality and innovation makes it a vital player in the global dumper market.

Top strategies used by the key market participants

Product Innovation and Technological Advancements

Leading companies like Caterpillar Inc. and Komatsu Ltd. focus heavily on research and development to introduce advanced technologies. For instance, autonomous dumpers and IoT-enabled machinery have become pivotal in improving operational efficiency and safety. These innovations not only cater to modern industrial needs but also differentiate their offerings in a competitive market. Additionally, the integration of telematics and AI-driven systems allows for real-time monitoring, predictive maintenance, and optimized fleet management, enhancing customer satisfaction.

Strategic Partnerships and Collaborations

Players such as AB Volvo and Hitachi Ltd. often collaborate with regional distributors, governments, and technology firms to expand their reach and capabilities. These partnerships help them penetrate emerging markets, secure large-scale infrastructure contracts, and co-develop cutting-edge solutions. For example, collaborations with local firms in Asia-Pacific and Africa enable companies to tailor products to regional requirements while leveraging local expertise.

Acquisitions and Expansions

Acquisitions are a common strategy to consolidate market share and diversify product portfolios. Companies like Deere & Co. and CNH Industrial NV have acquired smaller firms specializing in niche technologies or regional markets. This approach allows them to integrate innovative solutions and expand their geographic footprint. Furthermore, establishing new manufacturing facilities or service centers in high-growth regions enhances accessibility and reduces delivery times.

Sustainability and Green Initiatives

With increasing regulatory pressure and environmental concerns, companies like Sany Group and Liebherr International AG are investing in sustainable solutions. This includes developing electric, hybrid, and hydrogen-powered dumpers to reduce carbon emissions. Such initiatives align with global green policies and appeal to environmentally conscious customers, strengthening brand reputation.

Geographic Expansion into Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities. Key players are focusing on expanding their presence in these regions by setting up localized production units, offering cost-effective solutions, and providing training programs for operators. This approach ensures they capitalize on rising urbanization and infrastructure investments in these markets.

Competitive Landscape

The dumper market is characterized by intense competition, with key players striving to differentiate themselves through innovation, product quality, and strategic initiatives. The market is fragmented, comprising global giants like Caterpillar Inc., Komatsu Ltd., and AB Volvo, alongside regional manufacturers such as BEML Ltd. and Sany Group. These companies compete on multiple fronts, including technological advancements, sustainability efforts, and geographic expansion. Innovation remains a cornerstone of competition, with firms investing heavily in R&D to develop autonomous dumpers, IoT-enabled systems, and eco-friendly models like electric and hydrogen-powered vehicles. This focus on cutting-edge solutions not only enhances operational efficiency but also aligns with stringent emission regulations and growing environmental concerns.

Geographic diversification is another critical aspect of competition, as companies seek to capitalize on emerging markets in Asia-Pacific, Africa, and Latin America. These regions, driven by rapid urbanization and infrastructure development, present lucrative opportunities for growth. Strategic partnerships, acquisitions, and collaborations further intensify the competitive landscape, enabling firms to expand their product portfolios and penetrate new markets. For instance, Caterpillar and Komatsu have established strongholds in mining-heavy regions by offering robust off-highway dumpers tailored for extreme terrains.

RECENT HAPPENINGS IN THIS MARKET

- In January 2024, Caterpillar Inc. introduced electric construction equipment featuring Lithium Iron Phosphate (LFP) battery technology. This initiative aims to enhance their sustainable machinery offerings and to promote eco-friendly construction equipment.

- In January 2024, Komatsu Ltd. launched electric construction equipment powered by LFP batteries. This move aligns with the industry's shift toward electrification and supports Komatsu's commitment to sustainability.

- In January 2024, Xuzhou Construction Machinery Group Co., Ltd. (XCMG) expanded its electric construction equipment lineup by incorporating LFP battery technology. This expansion reinforces XCMG's commitment to providing sustainable solutions in the construction industry.

- In 2022, Deere & Company (John Deere) maintained a strong market presence, securing a 5.4% global market share in construction machinery. This market positioning the John Deere’s continued dominance in the sector.

- In 2022, Sany Heavy Industry Co., Ltd. achieved a significant global market share of 5.2% in construction machinery equipment. This growth reflects the company's robust market penetration and increasing global competitiveness.

- In 2022, Volvo Construction Equipment (part of AB Volvo) secured a 4.3% global market share in construction machinery. This solidifies Volvo's competitive position in the industry and strengthens its influence in key markets.

- In 2022, Liebherr Group maintained a significant position in the European and global markets with a 4.3% share in construction machinery. This steady market presence escalates the Liebherr’s impact in the construction equipment sector.

- In 2022, Hitachi Construction Machinery Co., Ltd. held a 4% global market share in construction machinery. This emphasizes the company’s strong presence in the Asia-Pacific region and its continued growth in international markets.

- In 2022, J C Bamford Excavators Ltd. (JCB) captured a 2% global market share in construction machinery. This growth reflects JCB's expanding international presence and commitment to innovation in the sector.

- In 2023, Kubota Corporation emerged as a key player in the U.S. construction equipment market. This expansion strengthens Kubota’s market position by offering a diverse range of machinery to meet growing industry demands.

MARKET SEGMENTATION

This research report on the global dumper market is segmented and sub-segmented into the following categories.

By Product

- Articulated dump trucks

- Rigid dump trucks

By Type

- Standard dump trucks

- Off-highway dump truck

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global dumper market?

The current market size of the global dumper market size was valued at USD 24.98 billion in 2025.

What are the market drivers that are driving the global dumper market?

The infrastructure development initiatives and mining industry expansion are the major market drivers that are driving the global dumper market.

Based on Product which segment is most dominating the global dumper market?

The rigid dump trucks segment was the largest and held 55.6% of the dumper market share in 2024.

Who are market players that are dominating the global dumper market?

AB Volvo, BEML Ltd., Caterpillar Inc., CNH Industrial NV, Deere and Co., Epiroc AB, Hinduja Group Ltd., Hitachi Ltd., J C Bamford Excavators Ltd., Kamaz Export, Komatsu Ltd., Kubota Corp., Liebherr International AG, Mercedes Benz Group AG, PACCAR Inc., Sany Group, Shine India Technology and Co., Xuzhou Construction Machinery Group Co. Ltd. These are the market players that are dominating the global dumper market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]