Global E-Tourism Market Size, Share, Trends & Growth Forecast Report By System Type (Distribution Systems, Social Media, Property Management Systems, Computer Reservation Systems, and Others), By Application (Medical, Aerospace, and Hospitality), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global E-Tourism Market Size

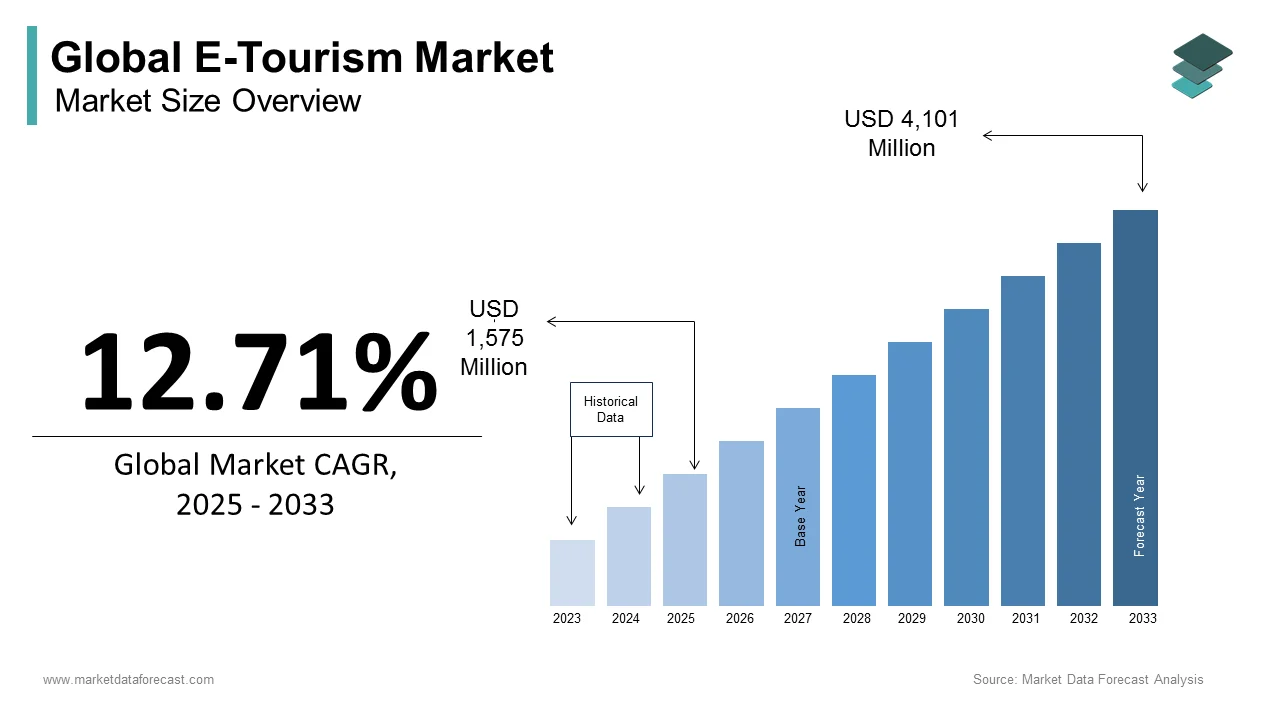

The size of the global E-Tourism market was worth USD 1,397 million in 2024. The global market is anticipated to grow at a CAGR of 12.71% from 2025 to 2033 and be worth USD 4,101 million by 2033 from USD 1,575 million in 2025.

Technology has played an important role in the tourism industry, giving rise to e-tourism or electronic tourism even more. The design, implementation, and application of IT with e-commerce solutions have helped the travel and tourism industry grow. There is an emergence of the e-commerce sector in tourism, known as e-tourism that involves the digitization of all processes, including members of the value chain involved in the tourism, travel, and hospitality industries. It is a means of establishing business relationships through the use of the Internet to offer tourism-related products such as flights, hotel reservations, car rentals, etc., allowing organizations to maximize efficiency and overall efficiency. For tourism companies, the Internet offers immense help by making information and reservation services available at a low cost to a large number of tourists. It also provides a useful tool for communication between tourism intermediaries, suppliers, and end consumers.

MARKET DRIVERS

E-Tourism Provides Convenience and Control to Travelers

The comfort factor associated with applying and implementing the e-tourism market has been essential to its development. E-tourism allows customers to access all relevant information from the desired and associated websites. Additionally, the processes associated with e-tourism are fast and secure while providing the control and freedom to plan the trip accordingly. Access to the complete travel package and the strategic possibility of knowing all the relevant information related to the place has helped customers opt for electronic means to make their travel plans. In addition, it also saves time and reduces the need for physical effort, which has also been a significant benefit, acting as another critical driver for this e-tourism market.

MARKET RESTRAINTS

Technology Dependence Limits Accessibility

Certain restrictions limit its growth. One of these important factors is technology dependence on customers, which is a major constraint for this e-tourism market. People who do not have access to a computer or the Internet cannot benefit from all its features, which limits this business. Another important limitation is the misinterpretation of the information, which can cause problems for various customers. After considering all these factors and limitations, technological advances, as well as the penetration of the Internet for the provision of various services, are supposed to provide growth opportunities for this market in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.71% |

|

Segments Covered |

By Type of System, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

G Adventures, Fred Harvey Company, Balkan Holidays Ltd., Accor Group, Crown Ltd., and Others. |

SEGMENTAL ANALYSIS

By Type of System Insights

REGIONAL ANALYSIS

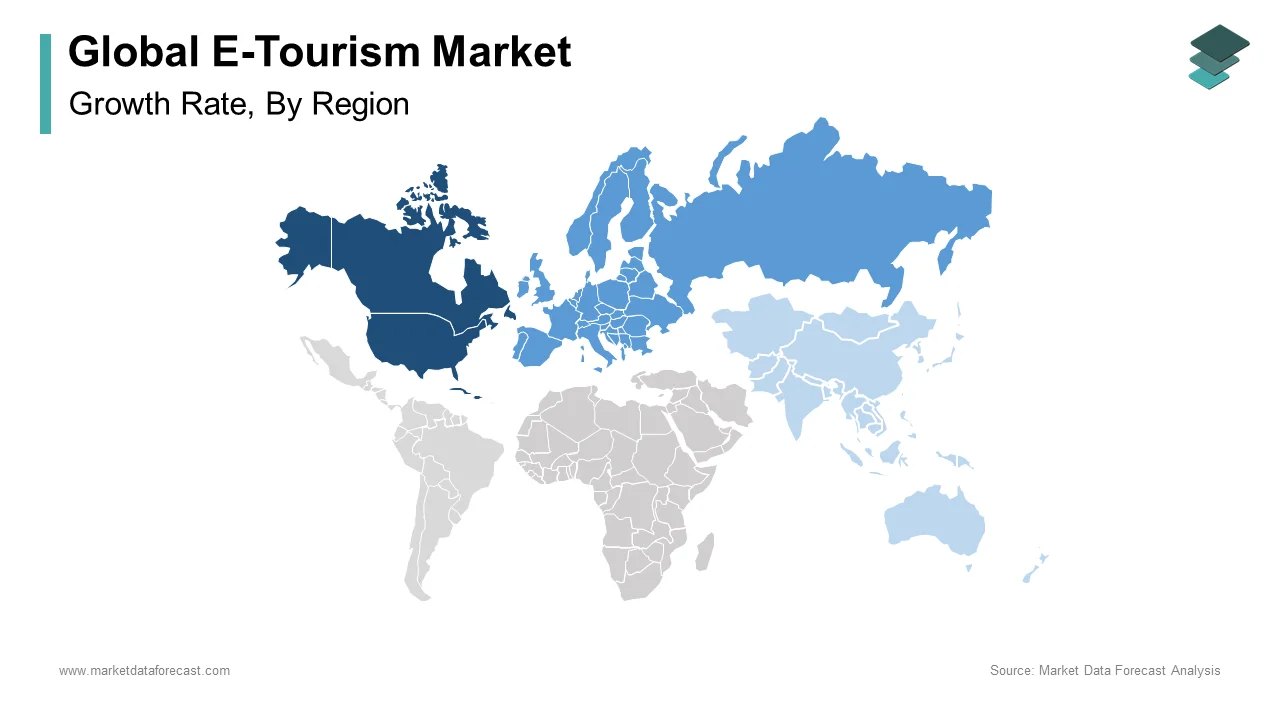

It is North America, followed by Europe, forms some of the main regions in this market. Technological advances, as well as better access to information, have been one of the main drivers in this area. The Asia-Pacific is an important region and has one of the fastest-growing regions in the world. Japan, India, and China are some of the main areas contributing to the expansion of this market. The advent of technology and the growing demand for secure access to information have been some of the main drivers in this locale.

KEY MARKET PLAYERS

Companies playing a prominent role in the global E-tourism market include G Adventures, Fred Harvey Company, Balkan Holidays Ltd., Accor Group, Crown Ltd., and Others.

RECENT MARKET HAPPENINGS

- SoftBank Group Corp. rode red-hot stock markets to a big quarterly profit, largely on the back of investment gains at its $100 billion Vision Fund and its $10 billion successor. The Japanese technology investor witnessed a net profit of ¥1.17 trillion, which is almost equivalent to USD 11 billion, during the quarter that ended on December 31. Nearly 80% of the investment gains were due to strong performance at Vision Funds 1 and 2.

- IBM will pay GlobalFoundries $1.5 billion over the next three years to bring the Mubadala-owned company back to its failed microelectronics business. IBM is moving away from the unit to focus on cloud computing development, big data and mobile data analytics, and semiconductor research, in which it has invested $3 billion over five years. New York-based GlobalFoundries will acquire IBM's semiconductor, engineering, and intellectual property business assets.

MARKET SEGMENTATION

This research report on the global E-tourism market has been segmented and sub-segmented based on type of system, application, and region.

By Type of System

- Computer Reservation Systems

- Property Management Systems

- Social Networks

- Global Distribution Systems

By Application

- The hospitality industry

- The aerospace and medical industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]