Global Electric Ships Market Size, Share, Trends and Growth Forecast Report, Segmented By Power Source (Hybrid, Fully Electric and Others), Vessel Type (Military and Commercial), Power Output (<75 kW, 75 - 745 kW), Autonomy Level (Semi-Autonomous and Fully Autonomous) & And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa),Industry Forecast From 2025 to 2033

Global Electric Ships Market Size

The global electric ships market was valued at USD 5.2 billion in 2024 and is anticipated to reach USD 5.88 billion in 2025 from USD 15.81 billion by 2033, growing at a CAGR of 13.15% during the forecast period from 2025 to 2033.

Electric ships are ships equipped with batteries and run on electricity instead of conventional fuel. These ships follow environmental safety regulations as they do not harm any aquatic life. The development of these boats is very beneficial as there is a crisis for fuel crisis.

Electric Ships Market has witnessed high growth in recent years due to an increase in seaborne trade and the implementation of the IMO Sulfur 2021 Regulation. Moreover, the growing maritime tourism industry is driving the expansion of the market.

MARKET DRIVERS

An increase in seaborne trade, the growing maritime tourism industry, and the implementation of the IMO Sulfur 2021 regulation are the primary factors driving the global electric ship market.

An increase in the use of renewable energy for battery charging and advancements in hybrid propulsion technology may further drive the global market.

MARKET RESTRAINTS

The primary factor restraining the adoption of fully electric vessels is the current battery technology. Also, the associated expenses are considerably high owing to factors like the shortage of battery charging infrastructure and the prices of energy storage, as the current battery capacity is still low. Therefore, these factors are predicted to hamper the growth of the market.

Impact of COVID-19 on Electric Ships Market

The COVID-19 pandemic has forced original equipment manufacturers (OEMs) and investors to delay their investments in specific programs, such as autonomous vessel operations. Besides, disruptions in the supply of materials for battery systems are a primary concern for several manufacturers. Most raw materials, such as cobalt, nickel, and lithium, are shipped from Japan and China. But these nations are under complete lockdown amid the pandemic. We will help you better understand the current situation to look out for essential investment areas.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.15% |

|

Segments Covered |

By Power Source, By Vessel Type, By Power Output, By Autonomy Level. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kongsberg (Norway), ABB (Switzerland), Wartsila (Finland), Norwegian Electric Systems AS (Norway), Corvus Energy (Canada), and General Dynamics Electric Boat (US), among others. |

SEGMENT ANALYSIS

By Power Source Insights

The hybrid segment dominated the electric ship market with a market share of 81.3% in 2019 and is anticipated to hold its leading position throughout the forecast timeframe. Various benefits, such as reliability offered by hybrid electric ships, support their demand due to supplementary propulsion systems and better speed, decreasing the risk of failure, and covering greater distances in less time. Hybrid electric vessel propulsion can be powered in two ways, namely electrical (via diesel-electric or battery power-driven) or mechanical (direct diesel-driven).

Furthermore, ship-owners or shipping and logistics companies worldwide prefer hybrid electric ships to enable lower fuel consumption and reduce operational costs. The diesel-electric system's adoption at low power and a direct diesel-driven system in need of high power, i.e., inland water sailing with varying speed conditions, allows a reduction in operational cost in the electric ship. It is a smarter way to use available energy and save fuel costs by using hybrid electric ship propulsion. A fully electric vessel is foreseen to record moderate growth due to its preference for inland and nearby transportation worldwide.

By Vessel Insights

Commercial electric vessels were valued at the largest market share of 77.1% in 2019. With growing production and globalization of trade, there has been an increase in the marine vessels added to the existing fleet. Rising competitiveness among logistics service providers and the adoption of a competitive pricing strategy are expected to fuel automated systems in commercial ships.

By Power Output Insights

The 75-745 KW power output segment controlled the market for electric ships and held 44.0% in 2019. In previous years, 75-745 KW power output ships have held the major portion of the shipping industry. Increasing awareness related to environmental protection leads to the development of propulsion systems, increasing attention in the medium-sized marine vessel, driving the 75-745 KW segment. Advantages like less vibration and lower engine noise have also boosted electric vessels' growth in medium-sized passenger and luxury ships. Moreover, the electric propulsion system occupies less space, providing more space for the interior and increasing its preference in luxury ships.

By Autonomy Level Insights

Based on the level of autonomy, the market for the electric ship is categorized into semi-autonomous and fully autonomous. Semi-autonomous vessels captured the largest market share of 99.8% in 2019. Since fully autonomous marine vessels are predicted to be commercialized by 2021, the market sales have been primarily driven by semi-autonomous vessels. These naval ships are pre-equipped with systems and components like sensors, cameras, and navigation systems. Moreover, these systems can be installed in existing vessels that previously had a manual operation.

The fully autonomous segment is predicted to observe the fastest growth from 2021 to 2027 due to several advantages that these vessels offer compared to semi-autonomous marine ships.

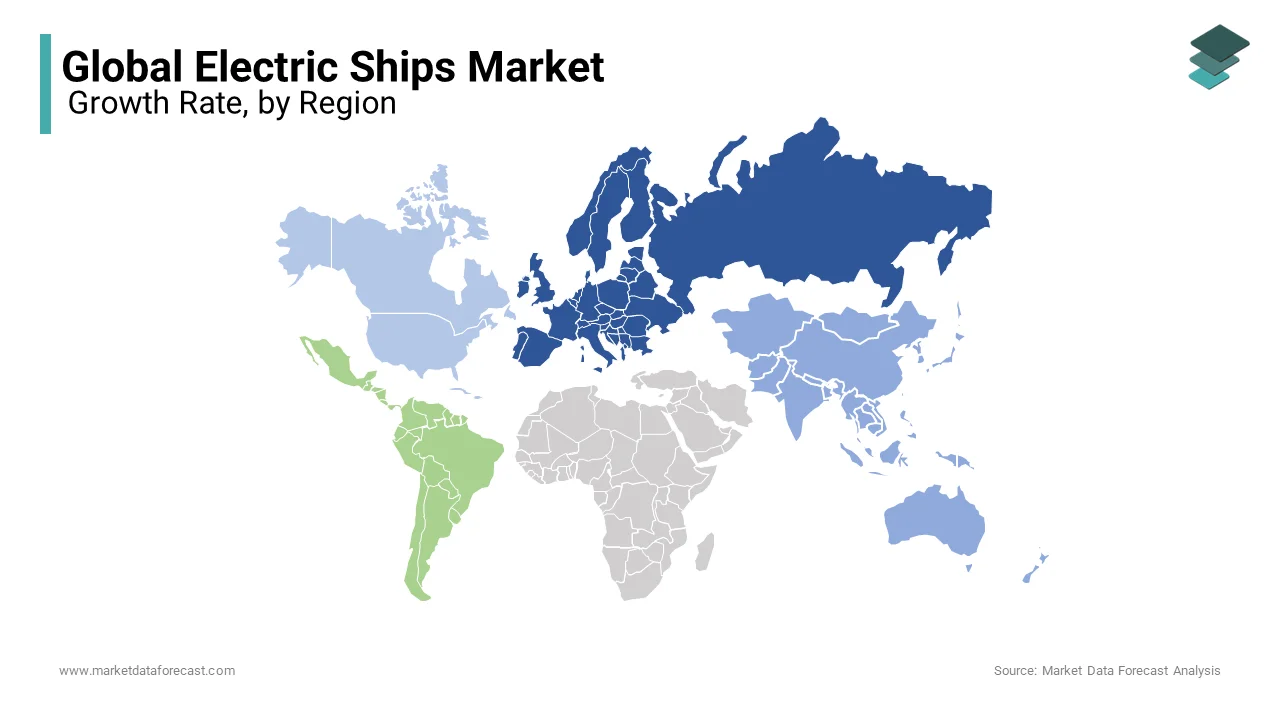

REGIONAL ANALYSIS

Europe was valued for the largest market share of 34.9% in 2019 and is anticipated to witness considerable growth over the forecast period. Germany emerged as a significant contributor to Europe's market growth due to the general population's rising environmental awareness and government initiatives to expand electrically operated transportation modes. Besides, the increasing popularity of electric recreational and leisure ships in marine tourism, aquatic sports, and fishing activities is anticipated to drive regional market growth. Nonetheless, the COVID-19 pandemic, which recently spread across European countries, especially Italy, the U.K., Spain, and Germany, is expected to negatively impact regional market growth.

The Asia Pacific is estimated to come out as the second-fastest-growing regional market over the outlook period. Strong economic growth and high manufacturing rates are expected to help the region maintain its position as a manufacturing hub worldwide. Nonetheless, in recent months, there has been a considerable economic impact of the coronavirus pandemic on financial markets and vulnerable sectors, such as manufacturing, tourism, hospitality, and travel, in Asia Pacific countries, such as China and Japan, and India. These countries add significantly to market growth in the Asia Pacific. However, the slow growth of these countries due to the pandemic is expected to impact regional market growth. However, since China is coming close to its recovery phase, it is anticipated that this pandemic's impact on China's market development would be at a lesser rate over the forecast period.

KEY MARKET PLAYERS

Kongsberg (Norway), ABB (Switzerland), Wartsila (Finland), Norwegian Electric Systems AS (Norway), Corvus Energy (Canada), General Dynamics Electric Boat (US). These are the market players that are dominating the global electric ships market.

RECENT HAPPENINGS IN THE MARKET

- In November 2021, Hyundai Motors entered into a venture with Vinssen, a start-up based in Korea, to produce a new ship powered by hydrogen fuel cells by December 2021. Vinssen will provide 95 kW hydrogen fuel cells. If the eco-friendly ship matches the expected level in terms of performance, it will be manufactured on a large scale.

- In September 202, Corvus Energy was chosen by Holland Ship Electric for lithium-ion battery-based energy storage systems (ESS). They will be used in the five new all-electric ferries developed by Holland Shipyards Group for GVB, the municipal public transport operator for Amsterdam.

MARKET SEGMENTATION

This research report on the global electric ships market is segmented and sub-segmented into the following categories.

By Power Source

- Hybrid

- Fully Electric

By Vessel Type

- Military

- Commercial

By Power Output

- <75 kW

- 75 - 745 kW

By Autonomy Level

- Semi-Autonomous

- Fully Autonomous

By Region

- North America

- Europe

- Asia-pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

What is the projected CAGR of the Global Electric Ships Market from 2025 to 2033?

The global electric ships market is expected to grow at a CAGR of 13.15% from 2025 to 2033, driven by stricter emissions regulations, falling battery costs, and increased investment in zero-emission vessel technologies.

Which region leads in electric ship adoption globally?

Asia-Pacific accounts for over 45% of global electric ship deployments , with China alone operating more than 300 all-electric inland vessels, making it the largest adopter due to aggressive green shipping policies.

How many fully electric vessels were in operation worldwide as of 2024?

As of early 2024, there were over 600 fully electric vessels registered globally, including ferries, cargo boats, and workboats, according to the International Maritime Organization (IMO) and classification society records.

Which type of vessel dominates the electric ships market?

Electric ferries lead the market, accounting for nearly 55% of all electric vessel orders , especially in Europe and Asia, where short-distance passenger transport is ideal for battery-powered operations.

What is the average range of modern all-electric ships on a single charge?

Most modern all-electric ships have an operational range of between 50–150 km per charge , depending on battery capacity and load, which makes them ideal for inland waterways and coastal ferry routes .

How much has lithium-ion battery cost declined since 2020, and how has it impacted electric shipbuilding?

Battery prices have fallen by over 40% since 2020 , enabling larger-scale deployment of electric propulsion systems in ships, particularly in retrofitting diesel ferries with hybrid or full-electric setups.

What percentage of new ship builds in Europe include hybrid or electric propulsion options?

In the EU, approximately 32% of new commercial ship builds in 2023 included hybrid or full-electric propulsion, up from just 8% in 2019, reflecting compliance with the EU Green Shipping Strategy and Emission Control Areas (ECAs).

Which country launched the world’s first hydrogen-powered inland cargo ship?

Germany launched the “Hydronaut” in late 2023, a hydrogen fuel cell-powered inland cargo vessel capable of carrying 1,000 tons of freight, marking a major milestone in sustainable river transport.

How much carbon emission reduction do electric ships offer compared to traditional diesel vessels?

Fully electric ships can reduce CO₂ emissions by up to 95% , and NOₓ and PM emissions by nearly 100%, when powered by renewable energy sources such as hydro, wind, or solar electricity.

Which ports globally are investing most heavily in shore power infrastructure for electric ships?

Leading ports like Los Angeles (USA), Gothenburg (Sweden), and Shenzhen (China) are investing heavily in shore-to-ship power systems, allowing docked vessels to shut down engines and plug into clean grid power, reducing harbor pollution.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com