Global Embedded SIM (eSIM) Market Research Report - Segmentation by Application (Laptops and Tablets, Connected Cars, Wearables, Smartphones, M2M and Others), by Vertical (Energy and Utilities, Automotive, Retail, Manufacturing, Transportation and Logistics, Consumer Electronics and Others) and by Region: Forecast of 2024 to 2032.

Global Embedded SIM (eSIM) Market Size (2024 to 2032)

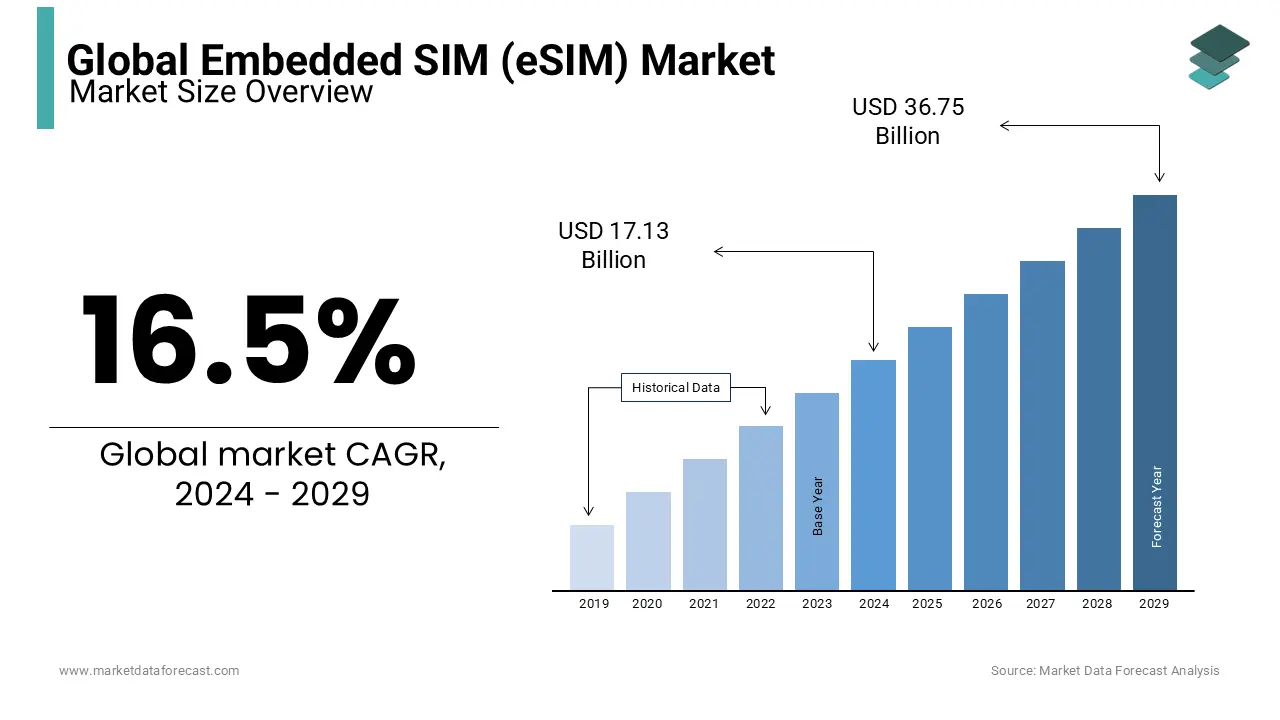

The Global Embedded SIM (eSIM) Market was worth US$ 14.7 billion in 2023 and is anticipated to reach a valuation of US$ 58.11 billion by 2032 from US$ 17.13 billion in 2024, and it is predicted to register a CAGR of 16.5% during the forecast period 2024-2032

Current Scenario of the Global Embedded SIM (eSIM) Market

eSIM (also known as Embedded SIM) is a standardized SIM chip that allows you to work with multiple mobile devices around the world. With eSIM, a device can have a profile where multiple devices work at the same time, so you can use the same device at the same time using different profiles. The eSIM (Integrated Simulation) industry is expected to deliver significant growth in the coming years as the application of IoT-connected devices in manufacturing increases. It is based on secure wireless remote SIM provisioning, which allows subscribers to register wirelessly with network providers without an existing SIM card. eSIM helps make these connected devices work and supports new types of devices with less damage. Wearables are a category that derives significant benefits from eSIMs, as it compensates for taking up extra space and damaging the wearable's battery size by incorporating physical simulations that are more important to the device. Car manufacturers using eSIM allow users to quickly connect their cars to cell phones. Laptops take advantage of the addition of eSIM while giving brands and resellers the opportunity to up-sell or cross-sell through flexible data packages. The arrival of 5G will allow faster data communication with lower latency, which will help the eSIM market. This is because higher communication speeds allow eSIMs to send and receive data with lower latency, provide better navigation, and provide more connected devices in a smart home.

MARKET DRIVERS

The global embedded SIM (eSIM) market is expected to experience significant growth during the foreseen period.

This increase is due to the practical adoption of IoT technologies across all industries. This growth is due to the emphasis on remote SIM provisioning for mobile to mobile (M2M), favorable government regulations that strengthen M2M communications, and the high adoption of IoT technologies. The growth of the embedded SIM (eSIM) market is also related to the presence of a large number of well-known players and startups around the world. The eSIM (embedded SIM) market is driven by the ability to seamlessly switch between network operators. Traditionally, device owners have had to replace their physical SIM when switching to another carrier, and there have been cases where SIM data was lost during carrier transition. With eSIM, the SIM is permanently embedded in the device, so there is no such threat of data loss. The fact that eSIM allows users to simultaneously store multiple carrier profiles on their device and remotely switch between these profiles is increasing the demand for the eSIM market. In addition to this, the rapid adoption of IoT in various industries for the manufacture of smart and connected devices is increasing the demand for these eSIMs. Smart homes, rising global trends in vehicle production, and increasing consumer propensity for a more connected ecosystem are some of the key drivers of the growth of the global eSIM market. With the increasing popularity and application of machine learning, eSIM implementation is on the rise.

Smartphone manufacturers are supposed to require eSIM to improve product offering. Opportunities to switch networks remotely are affecting individual eSIM options, and growing demand has led smartphone manufacturers to increasingly emphasize integrating the same functionality into modern phones. These factors are driving the growth of the global Integrated SIM (eSIM) market. 5G is foreseen to provide much faster data transmission capacity in the forecast period and support faster deployment of autonomous vehicles. The launch of 5G will benefit the eSIM market as it enables faster data communication with lower latency. With faster communication, eSIM can send and receive data with lower latency, provide better navigation, and provide more connected devices in a smart home. Additionally, the rise of mobile computing devices, the growing demand for smart solutions, and the growing adoption of portable electronic devices provide favorable opportunities for the e-SIM market. The global eSIM market is estimated to accelerate as adoption of these SIM cards increases by major smartphone manufacturers such as Google and Apple.

MARKET RESTRAINTS

Consumers can only select one profile from all profiles at a time. This is a major drawback of the eSIM that is holding back the growth of the market.

The built-in SIM depends on the network that supports it. If the network is not maintained, the device cannot be used with the e-SIM. The growing privacy and security issues prevailing in various industries pose a serious threat to the global e-SIM market. Increased security threats are expected to hamper the growth of the worldwide market during the conjecture period. This is due to the increase in technological advancement, the spread of M2M services and the spread of IoT devices. This complicates the protection of eSIM devices from a variety of cyber threats, which is supposed to hamper the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

16.5% |

|

Segments Covered |

By Application, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Gemalto NV, Deutsche Telekom AG, NXP Semiconductors N.V., Infineon Technologies AG, Idemia, STMicroelectronics, Sierra Wireless, Giesecke & Devrient, Vodafone and NTT DOCOMO. |

SEGMENTAL ANALYSIS

Global Embedded SIM (eSIM) Market Analysis By Application

M2M applications are expected to remain the largest on the market during the forecast period due to several extended benefits of implementing eSIM on M2M devices.

Global Embedded SIM (eSIM) Market Analysis By Vertical

The market is segmented into Energy and Utilities, Automotive, Retail, Manufacturing, Transportation and Logistics, Consumer Electronics, and others.

The consumer electronics sector is one of the key sectors shaping chaos, innovation and boom in a variety of tech industries. eSIM is supposed to be a game changer in consumer electronics applications.

REGIONAL ANALYSIS

North America is dominating the global Embedded SIM (eSIM) market in terms of share during the conjecture period. The market is driven due to the presence of many eSIM network service providers which provides network to support the eSIM devices. Europe is the second largest market in the eSIM market in terms of market share during the forecast period. Europe has been subdivided into Germany, Great Britain, Spain, and the rest of Europe. Germany is expected to have the largest market share, followed by the UK, Spain and other countries in Europe. Some of the drivers of market growth include the presence of numerous platform providers that provide basic hardware for eSIM integration.

KEY PLAYERS IN THE GLOBAL EMBEDDED SIM (eSIM) MARKET

Companies playing a prominent role in the global embedded SIM (eSIM) market include Gemalto NV, Deutsche Telekom AG, NXP Semiconductors N.V., Infineon Technologies AG, Idemia, STMicroelectronics, Sierra Wireless, Giesecke & Devrient, Vodafone and NTT DOCOMO., and Others.

RECENT HAPPENINGS IN THE GLOBAL EMBEDDED SIM (eSIM) MARKET

- In February 2020, US software companies MobileIron Inc. and IDEMIA announced support for Windows 10 enterprise devices with eSIM.

- In March 2020, Jio activated support for eSIM service on Motorola Razr. The eSIM service allows Jio users to access the Internet, make phone calls, and use other web applications from their smartphones.

- In July 2020, Vodafone Idea Ltd., a telecommunications service provider in India, offered eSIM to Vodafone postpaid customers for eSIM-compatible Apple devices.

DETAILED SEGMENTATION OF THE GLOBAL EMBEDDED SIM (eSIM) MARKET INCLUDED IN THIS REPORT

This research report on the global embedded SIM (eSIM) market has been segmented and sub-segmented based on application, vertical, and region.

By Application

- Laptops and Tablets

- Connected Cars

- Wearables

- Smartphones

- M2M

By Vertical

- Energy and Utilities

- Automotive

- Retail

- Manufacturing

- Transportation and Logistics

- Consumer Electronics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What was the size of the global Embedded SIM (eSIM) market in 2023, and what is the projected size by 2029?

The eSIM market was valued at USD 14.7 billion in 2023 and is expected to reach USD 58.11 billion by 2032, with a CAGR of 16.5% during the forecast period (2024-2032).

What is eSIM, and how does it function?

eSIM, also known as Embedded SIM, is a standardized SIM chip that allows for seamless connectivity across multiple mobile devices worldwide. It enables devices to have multiple carrier profiles simultaneously, facilitating the use of the same device with different profiles. eSIM eliminates the need for physical SIM cards and allows for remote SIM provisioning.

What recent developments have occurred in the eSIM market, and what are the primary drivers of market growth?

Recent developments include support for eSIM in Windows 10 enterprise devices, activation of eSIM services by telecom providers like Jio and Vodafone, and initiatives by car manufacturers to incorporate eSIM for quick connectivity. Primary drivers of market growth include the practical adoption of IoT technologies, favorable government regulations, and the ability of eSIM to seamlessly switch between network operators.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]