Europe 3D Mapping And Modeling Market Size, Share, Trends & Growth Forecast Report By Offering (Software Solutions, Services), Technology, Vertical, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe 3D Mapping and Modeling Market Size

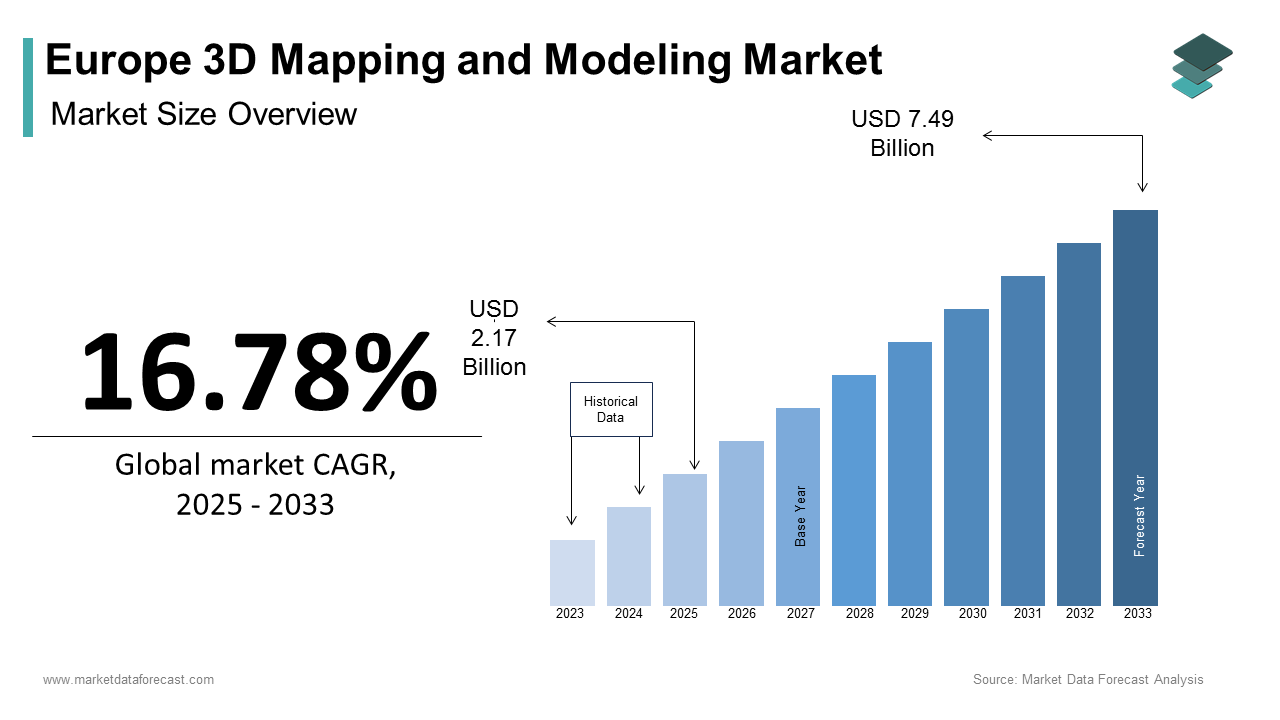

The Europe 3D Mapping and Modeling Market size was calculated to be USD 1.85 billion in 2024 and is anticipated to be worth USD 7.49 billion by 2033, from USD 2.17 billion in 2025, growing at a CAGR of 16.78% during the forecast period.

The Europe 3D mapping and modeling market refers to the development, application, and integration of advanced spatial data technologies that enable the creation of three-dimensional representations of physical environments. These solutions are widely used across urban planning, construction, defense, automotive navigation, cultural heritage preservation, and environmental monitoring. Utilizing technologies such as LiDAR, photogrammetry, UAVs (drones), and terrestrial scanning systems, the market supports both public and private sector needs for high-precision geospatial visualization. The integration of 3D modeling into autonomous vehicle development has further expanded the market’s scope, particularly in Germany and Sweden, where automotive companies are leveraging real-time 3D maps for ADAS testing.

Moreover, the European Commission has emphasized the importance of geospatial data in its Digital Strategy for Europe, promoting cross-border data harmonization and open-access platforms. As a result, the region is witnessing increased collaboration between government agencies, academic institutions, and private enterprises to advance 3D mapping capabilities.

MARKET DRIVERS

Expansion of Smart City Initiatives Across Urban Centers

One of the primary drivers of the Europe 3D mapping and modeling market is the rapid expansion of smart city initiatives aimed at enhancing urban infrastructure, mobility, and sustainability. Governments across the continent are increasingly adopting digital twins—virtual replicas of physical environments—to optimize traffic management, energy distribution, and disaster response planning. Cities like Amsterdam, Barcelona, and Helsinki are leading the way in deploying 3D models for real-time urban analytics, enabling planners to simulate scenarios and assess infrastructure impacts before implementation. Like, these digital tools can reduce urban development costs through improved design accuracy and resource allocation. Furthermore, the European Commission's Horizon Europe program has allocated significant funding to support the interoperability of city-level geospatial data, reinforcing the foundational role of 3D mapping in next-generation urban ecosystems. Additionally, the integration of Internet of Things (IoT) sensors with 3D city models allows for dynamic updates and predictive maintenance of public assets.

Growth of Autonomous Vehicle Development and Testing

Another key driver fueling the European 3D mapping and modeling market is the rapid growth of autonomous vehicle (AV) research, development, and testing activities. Accurate and high-resolution 3D maps are essential for the functioning of self-driving cars, as they provide the foundational layer for localization, path planning, and obstacle detection. According to ACEA – The European Automobile Manufacturers’ Association, over 40 AV pilot programs were active across Europe in 2023, involving major automakers such as BMW, Mercedes-Benz, and Volvo. Germany, in particular, has emerged as a leader in regulatory approvals for autonomous driving, with several test corridors mapped using ultra-detailed 3D models. As per the Fraunhofer Institute, the precision required for Level 4 and Level 5 autonomy necessitates centimeter-level mapping accuracy, which is achieved through a combination of LiDAR, photogrammetry, and AI-based processing techniques. These detailed maps are continuously updated to reflect real-world changes, ensuring safe and efficient autonomous navigation. Furthermore, the European Union’s Connected and Automated Mobility (CAM) initiative has spurred investments in cooperative intelligent transport systems (C-ITS), which rely heavily on integrated 3D mapping frameworks.

MARKET RESTRAINTS

High Costs Associated with Data Acquisition and Processing

A major restraint affecting the European 3D mapping and modeling market is the high cost associated with acquiring, processing, and maintaining high-resolution spatial data. Advanced technologies such as LiDAR, photogrammetry, and multispectral imaging require specialized hardware, software, and skilled personnel, all of which contribute to elevated project expenses. This financial burden limits widespread adoption, particularly among small municipalities and mid-sized enterprises that lack dedicated budgets for geospatial projects. Moreover, the need for continuous updates to maintain data accuracy adds to long-term operational costs. Also, cloud storage and computational requirements for large-scale 3D datasets further escalate expenditures. Like, managing terabytes of spatial data often necessitates investment in high-performance computing infrastructure or subscription-based SaaS platforms, which may not be feasible for smaller organizations. Until cost-effective solutions become more accessible, financial limitations will continue to hinder the broader deployment of 3D mapping technologies across the region.

Data Privacy and Regulatory Compliance Challenges

An ongoing challenge impacting the European 3D mapping and modeling market is the complex landscape of data privacy regulations and compliance requirements, particularly under the General Data Protection Regulation (GDPR). While 3D mapping enables valuable applications in urban planning, security, and autonomous mobility, it also raises concerns regarding the capture and use of personal information, including identifiable features in publicly available imagery. According to the European Data Protection Board (EDPB), the collection of street-level 3D scans must ensure that individuals' biometric and location data are adequately anonymized to comply with GDPR mandates. Failure to meet these standards can lead to legal penalties and delays in project implementation, discouraging private sector investment in high-resolution mapping initiatives. Moreover, varying national policies across EU member states create additional hurdles for cross-border data sharing and standardization.

MARKET OPPORTUNITIES

Integration of 3D Mapping with Augmented Reality (AR) Applications

A significant opportunity shaping the future of the Europe 3D mapping and modeling market is the growing integration of spatial data with augmented reality (AR) applications across industries such as retail, tourism, education, and industrial training. AR relies heavily on accurate 3D models to overlay digital content onto real-world environments, creating immersive experiences for users in both consumer and enterprise settings. In the retail sector, companies like IKEA and Decathlon have leveraged 3D-mapped interiors to allow customers to visualize products in their homes before purchasing. Similarly, in tourism, historical sites across France and Italy have adopted AR-powered virtual reconstructions based on 3D scans, enhancing visitor engagement and accessibility. With continued improvements in edge computing and real-time rendering, the convergence of 3D mapping and AR presents a compelling avenue for expanding the commercial applications of geospatial technologies across Europe.

Use of 3D Modeling in Cultural Heritage Preservation

An emerging opportunity within the Europe 3D mapping and modeling market lies in the field of cultural heritage preservation, where digital documentation is increasingly being used to protect historical sites, artifacts, and architectural landmarks. Given the continent’s rich historical legacy and vulnerability to climate change, conflict, and natural disasters, there is growing interest in creating high-fidelity digital replicas for conservation and restoration purposes. Countries such as Greece, Poland, and Germany have spearheaded initiatives to document ancient monuments, cathedrals, and war-torn structures using laser scanning and drone-based surveys. According to the European Commission’s Creative Europe program, significant funding has been allocated to support digital heritage projects, encouraging universities, museums, and private firms to collaborate on advanced 3D modeling efforts. Also, these initiatives not only safeguard cultural assets but also open new revenue streams through virtual tourism and educational applications.

MARKET CHALLENGES

Technological Fragmentation and Lack of Standardization

One of the most pressing challenges facing the European 3D mapping and modeling market is the fragmentation of technologies and the absence of universally accepted data formats and interoperability standards. The sector encompasses a wide array of hardware manufacturers, software developers, and service providers, each employing proprietary file formats, processing algorithms, and delivery mechanisms. As a result, seamless data exchange between platforms and stakeholders remains a significant hurdle. According to the European Committee for Standardization (CEN), inconsistencies in metadata tagging, coordinate referencing, and resolution levels make it difficult to integrate 3D models from multiple sources into cohesive geographic information systems (GIS). Moreover, variations in data quality and format compatibility pose challenges for real-time applications such as autonomous navigation and emergency response coordination. Without a unified framework for data structuring and sharing, the full potential of 3D mapping technologies in cross-sector applications cannot be realized, limiting scalability and efficiency gains.

Limited Availability of Skilled Professionals and Technical Expertise

Another critical challenge affecting the European 3D mapping and modeling market is the limited availability of skilled professionals capable of operating advanced geospatial technologies and interpreting complex datasets. Despite the growing demand for 3D mapping solutions across industries, there is a notable shortage of trained surveyors, GIS analysts, and software engineers with expertise in photogrammetry, LiDAR processing, and point cloud analysis. Additionally, the complexity of 3D modeling software requires continuous upskilling, yet access to structured professional training programs remains uneven across regions. Addressing this challenge will require coordinated efforts between academia, industry associations, and policymakers to develop targeted education initiatives and foster a sustainable pipeline of technical experts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.78% |

|

Segments Covered |

By Offering, Technology, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Autodesk Inc., Bentley Systems Incorporated, Dassault Systèmes, Adobe Systems Inc., Trimble Inc., Intermap Technologies, Esri, Airbus, Google Inc., Hexagon AB |

SEGMENTAL ANALYSIS

By Offering Insights

Software solutions represented the largest segment in the Europe 3D mapping and modeling market by capturing 56.12% of the total market share in 2024. This dominance is primarily attributed to the increasing adoption of specialized 3D modeling platforms across industries such as architecture, engineering, urban planning, and autonomous vehicle development. Leading software providers such as Bentley Systems, Autodesk, and Hexagon offer comprehensive tools that enable real-time visualization, simulation, and data integration for large-scale infrastructure projects. Apart from these, as per Deloitte, government-led digital twin initiatives in cities like Amsterdam, Berlin, and Paris rely heavily on advanced 3D mapping software to support smart city planning and disaster response systems. The demand for cloud-based and AI-integrated software platforms has further strengthened this segment’s position, making it a critical enabler of geospatial transformation across both public and private sectors in Europe.

The services segment is emerging as the fastest-growing component of the Europe 3D mapping and modeling market, expanding at a CAGR of 14.8%. This rapid expansion is driven by the growing need for outsourced data acquisition, processing, and consulting services among organizations lacking in-house expertise. Companies like Topcon Positioning Group and RIEGL Laser Measurement Systems have expanded their service portfolios to meet rising demand from infrastructure and environmental monitoring sectors. Moreover, the proliferation of UAV-based mapping services for agricultural, forestry, and coastal management applications has significantly contributed to this segment’s momentum.

By Technology Insights

The LiDAR (Light Detection and Ranging) technology was the top performer in the European 3D mapping and modeling market accounting for 49.7% of total technology adoption in 2024. This is largely due to its superior accuracy, speed, and adaptability across diverse applications including autonomous vehicles, topographic mapping, and precision agriculture. The technology’s ability to generate high-resolution, three-dimensional maps in real time makes it indispensable for ADAS testing and urban mobility planning. Furthermore, as reported by the European Environment Agency, national agencies responsible for flood risk assessment and forest inventory are increasingly deploying airborne and terrestrial LiDAR systems to improve data reliability and coverage. In addition, the European Space Agency (ESA) has incorporated LiDAR into satellite missions for climate monitoring, further validating its strategic importance in scientific and infrastructural domains.

SLAM (Simultaneous Localization and Mapping) is the quickest-advancing technology in the European 3D mapping and modeling market, registering a CAGR of 21.3%. This rapid expansion is driven by its increasing application in robotics, indoor navigation, and mobile mapping where GPS signals are unavailable or unreliable. Unlike traditional mapping techniques, SLAM allows devices to map an unknown environment while simultaneously tracking their location within it—an essential capability for autonomous robots and delivery vehicles operating indoors or in complex urban settings. With advancements in sensor miniaturization and edge computing, SLAM is becoming more accessible and scalable, enabling broader deployment in both industrial and consumer markets.

By Vertical Insights

The Architecture, Engineering & Construction (AEC) sector commanded the Europe 3D mapping and modeling market by commanding 43.5% of the total market share in 2024. This influence is primarily attributed to the widespread adoption of digital design tools, BIM (Building Information Modeling), and virtual prototyping across large-scale infrastructure and real estate development projects. Countries like Germany, the UK, and the Netherlands have mandated BIM adoption for public infrastructure projects, accelerating the transition toward digital construction methodologies. Furthermore, the use of 3D mapping in urban planning has gained momentum, with cities like Barcelona, Vienna, and Copenhagen utilizing digital twins to optimize energy efficiency, traffic flow, and emergency response strategies.

The media & entertainment segment is rising as the swiftest progressing vertical in the Europe 3D mapping and modeling market, expanding at a compound annual growth rate (CAGR) of 19.2%. This is caused by the increasing use of immersive technologies such as augmented reality (AR), virtual reality (VR), and mixed reality (MR) in gaming, film production, and live event broadcasting. Like, major European studios and game developers are leveraging 3D scanning and photogrammetry to create hyper-realistic environments for interactive storytelling and digital heritage recreation. Notably, cultural institutions in Italy and Greece have partnered with VR content creators to digitally reconstruct ancient ruins, enhancing educational and tourism experiences. Additionally, the rise of remote production workflows during the pandemic accelerated the adoption of 3D modeling in virtual set design and live-streamed performances.

REGIONAL ANALYSIS

Germany is Europe’s largest economy and a global leader in engineering and automotive innovation, which has been at the forefront of adopting advanced geospatial technologies for industrial and transportation applications. Additionally, the country’s construction and infrastructure sectors have embraced BIM and digital twin initiatives to enhance project efficiency and sustainability. Moreover, the German Aerospace Center (DLR) has played a pivotal role in advancing satellite-based 3D mapping for environmental monitoring and disaster management. With strong institutional backing and a robust ecosystem of tech startups and research institutes, Germany continues to shape the direction of Europe’s 3D mapping and modeling industry.

The United Kingdom benefits from a well-developed digital infrastructure and a strong presence of academic and research institutions focused on geospatial technologies. Like, London has emerged as a key hub for AR/VR and immersive media applications, with numerous creative studios leveraging 3D mapping for entertainment, education, and cultural preservation projects. In addition, as per the UK Ordnance Survey, government-backed initiatives such as the National Underground Asset Register are utilizing 3D subsurface mapping to improve utility network management and safety. With increasing investments in smart city development and defense applications, the UK remains a key player in shaping the future of 3D mapping technologies across Europe.

France occupies a prominent position in the European 3D mapping and modeling market. The country’s strategic adoption of geospatial technologies spans multiple sectors, including urban planning, transportation, defense, and cultural heritage conservation. Also, as reported by IGN (Institut Géographique National), national mapping agencies are leveraging aerial LiDAR and photogrammetry to update topographic databases and support environmental monitoring. Moreover, French aerospace and defense firms are utilizing high-precision 3D models for mission planning and terrain simulation. Collaborations between tech startups and academic institutions are fostering innovation in mobile mapping and autonomous navigation systems.

The Netherlands is another key player in the market. Known for its progressive approach to urban planning and sustainability, the country has become a model for integrating digital mapping into smart city and water management initiatives. The country’s extensive use of BIM in infrastructure projects ensures seamless coordination between architects, engineers, and contractors. Furthermore, the Dutch Ministry of Infrastructure and Water Management, 3D mapping plays a crucial role in maintaining the nation’s complex waterways and dike systems. With strong government backing and early adoption of open geospatial standards, the Netherlands remains a leader in innovative 3D mapping applications across Europe.

Sweden has positioned itself as a pioneer in autonomous mobility, industrial digitization, and sustainable urban development, all of which rely heavily on advanced geospatial technologies. Like, Swedish automotive leaders such as Volvo and Scania are at the forefront of using high-definition 3D maps for autonomous vehicle testing and fleet management. In addition, national-level 3D mapping projects are supporting smart infrastructure planning and rural connectivity initiatives. Moreover, Sweden’s commitment to digitalization extends to the construction and mining sectors, where 3D modeling is used for site surveying, resource estimation, and safety assessments.

LEADING PLAYERS IN THE EUROPE 3D MAPPING AND MODELING MARKET

Hexagon AB

Hexagon is a global leader in sensor, software, and autonomous solutions, with a strong footprint in the European 3D mapping and modeling market. The company provides advanced geospatial technologies that support applications ranging from smart city planning to industrial digitization. Through its Geosystems division, Hexagon delivers high-precision LiDAR, photogrammetry, and point cloud processing tools that are widely adopted by governments and enterprises across Europe. Its commitment to innovation has positioned it as a key enabler of digital transformation in infrastructure, manufacturing, and autonomous mobility.

Bentley Systems Incorporated

Bentley Systems plays a central role in advancing 3D mapping and modeling for engineering and construction projects throughout Europe. The company’s comprehensive software portfolio enables professionals to create detailed digital twins of physical assets, enhancing decision-making and lifecycle management. Bentley’s emphasis on open standards and interoperability has made its platforms integral to public infrastructure initiatives, urban development programs, and sustainability efforts. By fostering collaboration across disciplines, Bentley continues to shape how European nations approach digital asset modeling and spatial data integration.

Autodesk Inc.

Autodesk is a dominant force in the Europe 3D mapping and modeling landscape, offering industry-leading design and engineering software used across architecture, construction, and entertainment sectors. Its tools facilitate immersive visualization, simulation, and real-time modeling, supporting both traditional and emerging applications such as augmented reality and virtual heritage reconstruction. Autodesk’s cloud-based platforms enable seamless data sharing and remote collaboration, making them essential for large-scale projects across the continent. With continuous investment in AI-driven modeling capabilities, Autodesk remains at the forefront of digital innovation in Europe.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading players in the Europe 3D mapping and modeling market is strategic partnerships and ecosystem collaborations, where companies align with academic institutions, government agencies, and technology providers to enhance product capabilities and expand application areas. These alliances allow for shared R&D initiatives, regulatory alignment, and broader access to domain-specific datasets.

Another key approach is technology integration and platform convergence, wherein firms incorporate artificial intelligence, machine learning, and cloud computing into their 3D mapping and modeling solutions. This enables real-time analytics, automated feature extraction, and scalable deployment across industries such as autonomous mobility, infrastructure monitoring, and cultural preservation.

Lastly, expansion through mergers and acquisitions is a common strategy among major players seeking to strengthen their portfolios and enter new verticals. By acquiring niche startups specializing in mobile mapping, SLAM algorithms, or immersive visualization, established vendors can rapidly integrate cutting-edge capabilities and maintain leadership in a fast-evolving market landscape.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Europe 3D Mapping and Modeling Market include Autodesk Inc., Bentley Systems Incorporated, Dassault Systèmes, Adobe Systems Inc., Trimble Inc., Intermap Technologies, Esri, Airbus, Google Inc., and Hexagon AB.

The competition in the Europe 3D mapping and modeling market is characterized by a dynamic interplay between global technology leaders, regional specialists, and innovative startups striving to capture strategic opportunities across diverse industry verticals. Established multinational corporations dominate the high-end software and hardware segments, leveraging their extensive R&D capabilities, brand recognition, and mature distribution networks to maintain a strong foothold. However, they face increasing pressure from agile tech firms that are introducing cost-effective, cloud-native solutions tailored for specific applications such as indoor navigation, digital heritage, and immersive media.

Market participants must continuously innovate to stay ahead, particularly as demand grows for real-time 3D data processing, AI-enhanced modeling, and integration with emerging technologies like autonomous vehicles and smart cities. Additionally, the need for compliance with evolving data privacy regulations and standardization frameworks adds another layer of complexity to competitive positioning. As a result, differentiation is increasingly achieved through specialized use cases, customer-centric service models, and strategic collaborations that bridge technological silos. This evolving landscape fosters sustained innovation but also intensifies the race for talent, intellectual property, and cross-sector partnerships.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Hexagon AB launched a new AI-powered point cloud classification tool designed specifically for urban mapping and infrastructure planning. This advancement enhances automation in data interpretation, improving efficiency for municipal and transportation projects across Europe.

- In June 2023, Bentley Systems announced a long-term partnership with a leading European university to develop next-generation digital twin applications for smart infrastructure. The initiative focuses on integrating real-time sensor data with 3D models to support predictive maintenance and climate resilience planning.

- In October 2023, Autodesk expanded its cloud-based 3D modeling platform by introducing collaborative editing features tailored for architectural and engineering teams working on large-scale pan-European infrastructure developments. This enhancement supports remote coordination and accelerates project delivery timelines.

- In January 2024, Topcon Positioning Group acquired a German-based mobile mapping startup to bolster its offerings in autonomous vehicle testing and urban mobility applications. This move strengthens Topcon’s presence in the European market for high-precision spatial data acquisition.

- In May 2024, RIEGL Laser Measurement Systems introduced an ultra-fast terrestrial laser scanner optimized for heritage documentation and forensic mapping. Designed for high-resolution detail capture in complex environments, this solution caters to expanding demand in the cultural preservation and security sectors across Europe.

MARKET SEGMENTATION

This research report on the Europe 3D Mapping and Modeling Market has been segmented and sub-segmented based on offering, technology, vertical, and region.

By Offering

- Software Solutions

- Services

By Technology

- LiDAR

- SLAM (Simultaneous Localization and Mapping)

By Vertical

- Architecture, Engineering & Construction (AEC)

- Media & Entertainment

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the main drivers of the Europe 3D mapping and modeling market?

Growth is driven by smart city initiatives, increasing adoption of BIM (Building Information Modeling), demand for geospatial data, and advancements in LiDAR and photogrammetry technologies.

2. Who are the major players in this market?

Major players include Autodesk Inc., Bentley Systems Incorporated, Dassault Systèmes, Adobe Systems Inc., Trimble Inc., Intermap Technologies, Esri, Airbus, Google Inc., and Hexagon AB.

3. How is 3D mapping used in urban planning?

It is used for city modeling, infrastructure development, traffic planning, and environmental monitoring, helping planners make informed decisions.

4. Which industries are driving the demand for 3D mapping and modeling in Europe?

Key industries include construction, urban planning, automotive, aerospace & defense, entertainment, real estate, and geospatial analysis.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com