Europe Aerospace Avionics Market Size, Share, Trends & Growth Forecast Report By Systems Insights (Flight Management, Traffic & Collision Management), Platform, Fit, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Aerospace Avionics Market Size

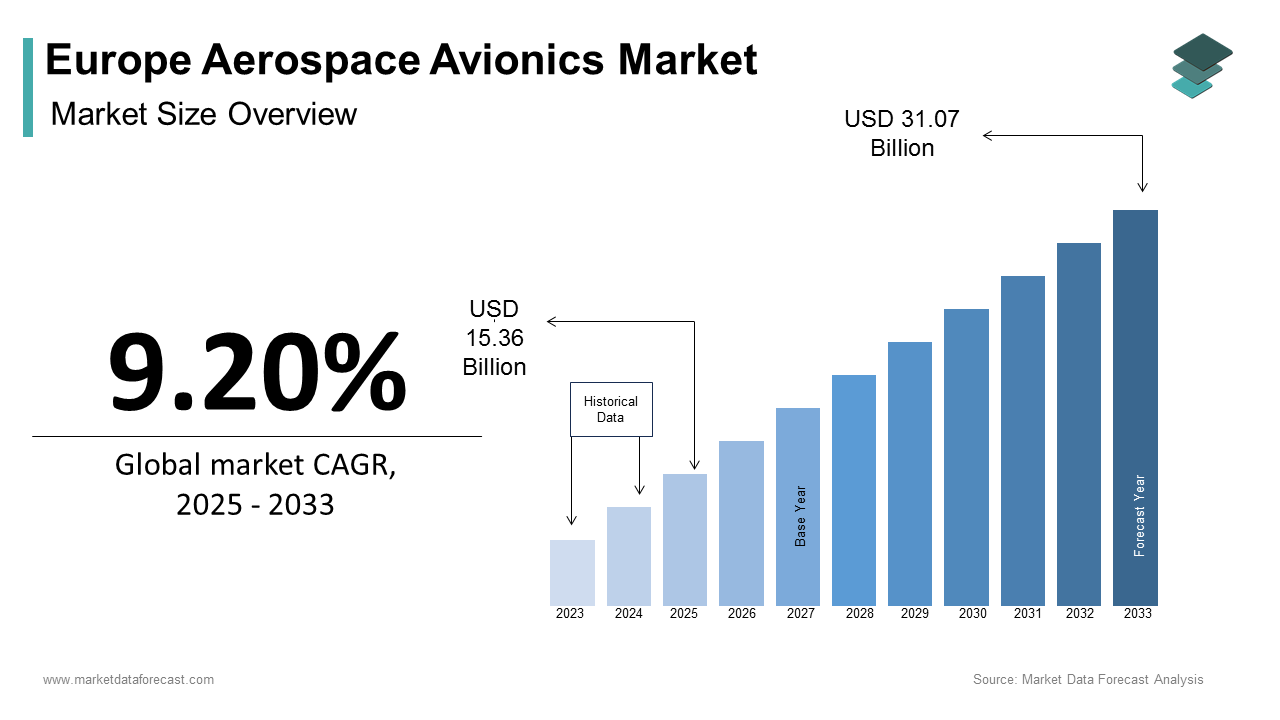

The Europe Aerospace Avionics Market size was calculated to be USD 14.07 billion in 2024 and is anticipated to be worth USD 31.07 billion by 2033, from USD 15.36 billion in 2025, growing at a CAGR of 9.20% during the forecast period.

The European aerospace avionics market covers the development, manufacturing, and integration of electronic systems used in aircraft for navigation, communication, flight control, and monitoring functions. These advanced technologies are critical for ensuring flight safety, operational efficiency, and compliance with evolving air traffic management standards. The market serves both commercial aviation and defense sectors, with key players including Airbus, Leonardo S.p.A., Thales Group, and Safran Electronics & Defense.

Europe's strong industrial base, supported by leading research institutions and government-backed aerospace programs, has positioned the region as a global leader in avionics innovation. Additionally, as per the European Aviation Safety Agency (EASA), more than 9,000 commercial aircraft were in active service across EU member states, necessitating ongoing upgrades to meet NextGen and SESAR (Single European Sky ATM Research) regulatory requirements. Moreover, increasing investments in digital flight decks, fly-by-wire systems, and satellite-based navigation solutions are driving modernization efforts across legacy fleets.

MARKET DRIVERS

Increasing Demand for Modernized Commercial Aircraft Fleets

One of the primary drivers of the Europe aerospace avionics market is the rising demand for modernized commercial aircraft fleets, driven by aging aircraft inventories and stringent environmental regulations. Airlines across the region are actively upgrading or replacing older planes with newer models equipped with advanced avionics systems that enhance fuel efficiency, reduce emissions, and improve operational performance.

According to the International Air Transport Association (IATA), a significant portion of the commercial aircraft operating in Europe were over 15 years old in 2023, prompting fleet renewal initiatives to comply with the European Union’s Fit for 55 sustainability goals. New-generation aircraft such as the Airbus A320neo and Boeing 787 Dreamliner incorporate sophisticated avionics packages featuring integrated modular avionics (IMA), synthetic vision systems, and enhanced flight management units. These systems not only optimize route planning and fuel consumption but also improve situational awareness and pilot decision-making. For example, the deployment of Automatic Dependent Surveillance-Broadcast (ADS-B) technology across European airspace has mandated avionics upgrades to maintain air traffic compatibility. As part of its Green Deal initiative, the European Commission has encouraged airline operators to adopt next-generation avionics that align with carbon reduction targets.

Expansion of Military and Defense Avionics Programs Across Europe

Another significant driver shaping the Europe aerospace avionics market is the expansion of military and defense-related avionics programs, spurred by heightened geopolitical tensions and increased national security expenditures. Several European countries have ramped up investments in fighter jets, surveillance drones, and transport aircraft, all requiring cutting-edge avionics for mission-critical operations. The Future Combat Air System (FCAS), a joint initiative between France, Germany, and Spain, aims to develop next-generation combat aircraft with highly integrated avionics architectures featuring AI-enabled sensor fusion, electronic warfare capabilities, and secure communication links. Also, the UK’s Tempest program and Sweden’s Gripen E series are incorporating advanced cockpit displays, radar warning receivers, and self-protection suites to ensure battlefield superiority and survivability.

MARKET RESTRAINTS

High Development and Certification Costs for Avionics Systems

A major restraint affecting the European aerospace avionics market is the high cost associated with developing and certifying new avionics systems, which can significantly delay product launches and increase financial risk for manufacturers. Unlike consumer electronics, aerospace-grade components must undergo rigorous testing and compliance procedures to meet regulatory standards set by the European Union Aviation Safety Agency (EASA) and other international bodies. Like, the certification process for a single avionics module can take up to three years and cost several million euros, depending on complexity and integration requirements. This burden is particularly challenging for small and medium-sized enterprises (SMEs) seeking to enter the market or introduce innovative solutions. Furthermore, evolving regulatory frameworks—such as the introduction of cybersecurity mandates for airborne systems—are adding additional layers of compliance scrutiny. In 2023, EASA issued updated guidelines requiring avionics suppliers to implement robust software verification processes, extending development timelines and increasing R&D expenditures.

Supply Chain Disruptions and Component Shortages

Supply chain disruptions and component shortages have emerged as a significant challenge for the Europe aerospace avionics market, impacting production schedules and delivery timelines. The global semiconductor shortage that began during the pandemic continues to affect avionics manufacturers, particularly those relying on microchips for flight control computers, radar systems, and communication modules. Critical elements such as field-programmable gate arrays (FPGAs), power management ICs, and radiation-hardened processors remain in short supply, affecting both civil and military programs. Besides, geopolitical uncertainties and trade restrictions have complicated access to specialized materials and subassemblies from non-EU suppliers. Until supply chain resilience improves, these constraints will continue to impede growth and create bottlenecks for manufacturers striving to meet rising avionics demand in both commercial and military aviation sectors.

MARKET OPPORTUNITIES

Growth of Urban Air Mobility and eVTOL Aircraft Development

An emerging opportunity within the Europe aerospace avionics market is the rapid development of urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft, which require highly integrated and lightweight avionics systems tailored for autonomous and semi-autonomous flight operations. As cities across Europe explore air taxis and drone-based logistics networks, the demand for compact, energy-efficient avionics is gaining momentum.

According to the European Union Aviation Safety Agency (EASA), over 30 UAM and eVTOL projects were in active development across Germany, France, and the UK in 2023, each requiring customized flight control, sense-and-avoid, and data link systems. Companies like Lilium, Vertical Aerospace, and Volocopter are working closely with avionics integrators to design scalable solutions that support beyond-visual line-of-sight (BVLOS) operations and real-time air traffic coordination. Also, the establishment of the Urban Air Mobility Initiative by the European Commission has facilitated regulatory alignment and infrastructure planning, accelerating market readiness.

Integration of Artificial Intelligence and Predictive Maintenance Technologies

The integration of artificial intelligence (AI) and predictive maintenance technologies into aerospace avionics presents a transformative opportunity for the Europe market. As airlines and defense organizations seek to reduce unplanned downtime and optimize operational efficiency, avionics systems embedded with machine learning algorithms are becoming increasingly valuable. According to a study, AI-driven health monitoring systems can predict potential avionics failures with up to 95% accuracy, allowing for proactive maintenance interventions and minimizing costly aircraft groundings. This capability is especially beneficial for long-haul commercial fleets and military aircraft where system reliability is paramount. European avionics manufacturers are responding by embedding AI functionalities into flight data recorders, engine monitoring units, and flight control systems. For instance, Thales and Safran have launched smart avionics platforms that analyze real-time sensor data to detect anomalies and recommend corrective actions before system degradation occurs.

MARKET CHALLENGES

Cybersecurity Threats to Avionics Systems

Cybersecurity threats pose a major challenge to the Europe aerospace avionics market, as modern aircraft rely heavily on interconnected digital systems that are vulnerable to cyberattacks. With the rise of connected cockpits, cloud-based flight data management, and software-defined avionics, ensuring robust protection against unauthorized access has become a top priority for regulators and manufacturers alike. Also, the number of reported cyber incidents targeting aviation systems increased in 2023 compared to the previous year. Avionics software, particularly in fly-by-wire and automated flight control systems, has been identified as a potential entry point for malicious actors aiming to compromise aircraft functionality. In response, EASA introduced stricter cybersecurity certification requirements under its CS-ETSO regulations, mandating extensive vulnerability assessments and penetration testing for new avionics installations. However, implementing these measures adds complexity and cost to system development, forcing manufacturers to invest in dedicated cybersecurity engineering teams and secure software development life cycles.

The complexity of Integrating New Avionics with Legacy Aircraft Platforms

Integrating modern avionics with legacy aircraft platforms poses a significant challenge for the Europe aerospace avionics market. Many commercial and military aircraft in operation today were designed decades ago, lacking the digital architecture necessary to support the latest generation of avionics systems, including open-system architectures, software-defined radios, and digital flight decks. These upgrades often involve redesigning electrical systems, updating software stacks, and reconfiguring cockpit layouts—processes that are time-consuming and expensive. Similarly, in the commercial aviation sector, airlines face technical and financial hurdles when upgrading older aircraft with modern avionics compliant with SESAR and ICAO standards. Retrofitting legacy fleets with ADS-B Out, CPDLC (Controller-Pilot Data Link Communications), and enhanced GPS navigation systems requires extensive engineering work and regulatory approvals.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.20% |

|

Segments Covered |

By Systems, Platform, Fit, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Thales Group, Safran S.A., BAE Systems, Airbus SE, Leonardo S.p.A., Honeywell International Inc., Collins Aerospace, Garmin Ltd., Curtiss-Wright Corporation, L3Harris Technologies |

SEGMENTAL ANALYSIS

By Systems Insights

The Flight management systems hold the largest share of the Europe aerospace avionics market accounting for 24% in 2024. These systems are essential for optimizing aircraft navigation, fuel efficiency, and overall flight performance, making them indispensable across both commercial and military aviation. According to the European Organisation for the Safety of Air Navigation (EUROCONTROL), over 35,000 commercial flights operate daily within European airspace, necessitating advanced flight management capabilities to comply with NextGen and SESAR air traffic control modernization initiatives. The integration of Performance-Based Navigation (PBN) and Required Navigation Performance (RNP) standards has further increased demand for sophisticated flight management units (FMUs). These systems support real-time route optimization, reduce pilot workload, and enhance air traffic coordination.

Traffic & collision management systems are emerging as the fastest-growing segment in the Europe aerospace avionics market, projected to expand at a CAGR of 9.7% through 2033. This surge is driven by increasing air traffic density and regulatory mandates requiring enhanced situational awareness to prevent mid-air collisions and near misses. Moreover, the implementation of the Single European Sky ATM Research (SESAR) program has mandated the deployment of upgraded transponders and onboard surveillance systems capable of real-time data exchange with ground-based ATC networks. As part of this initiative, EASA introduced revised equipage requirements for TCAS Version 7.1 compliance, compelling operators to retrofit existing fleets. Additionally, the rise of urban air mobility (UAM) and unmanned aerial vehicle (UAV) operations is expanding the scope of traffic management beyond traditional aviation.

By Platform Insights

Commercial aviation dominates the Europe aerospace avionics market, capturing 58.5% of total value in 2024. This is linked to the region's strong presence of major airline carriers, high passenger traffic volumes, and continuous fleet modernization efforts aimed at improving fuel efficiency and reducing environmental impact. Airlines such as Lufthansa, Air France, and British Airways have significantly invested in upgrading their fleets with next-generation flight management, communication, and electronic flight display systems. With the expansion of low-cost carriers and long-haul network expansions, the commercial aviation segment remains the primary driver of avionics investment across Europe, supported by ongoing aircraft deliveries from manufacturers like Airbus and Boeing.

Military aviation is the swiftest expanding platform segment in the Europe aerospace avionics market, anticipated to expand at a CAGR of approximately 7.4%. This growth is fueled by heightened defense spending, geopolitical tensions, and the development of next-generation combat aircraft programs across key European nations. Like, defense expenditures among NATO members in Europe rose in 2023, with Germany, France, and Italy leading procurement investments in fighter jets, transport aircraft, and reconnaissance drones. The Future Combat Air System (FCAS) program—a collaborative effort between France, Germany, and Spain—is expected to drive significant avionics demand, incorporating AI-enabled sensor fusion, electronic warfare suites, and secure data link communications.

By Fit Insights

Line-fit avionics installations spearheaded the Europe aerospace avionics market by capturing a5.5% of total revenue in 2024. This segment benefits from steady aircraft production rates and the incorporation of advanced digital cockpits, fly-by-wire controls, and integrated modular avionics (IMA) in newly manufactured planes. The widespread adoption of the A320neo, A350, and Boeing 787 Dreamliner models—featuring centralized avionics architectures—has reinforced line-fit dominance. In the military sector, ongoing production of Eurofighter Typhoons, Rafales, and F-35 Lightning II aircraft procured by European defense forces has further bolstered line-fit avionics demand. With continued aircraft deliveries and the rollout of future programs like FCAS and Tempest, line-fit avionics will remain the cornerstone of Europe’s aerospace electronics ecosystem.

Retro-fit avionics installations represent the quickest developing segment in the Europe aerospace avionics market, projected to expand at a CAGR of approximately 6.9% through 2033. This growth is primarily driven by aging aircraft fleets and regulatory mandates requiring compliance with modern navigation, communication, and surveillance standards. In the military domain, retrofit activities are gaining momentum as legacy platforms such as the Tornado, Mirage 2000, and Panavia Tornado undergo life extension programs. With airlines and defense agencies seeking cost-effective ways to extend aircraft service lives while meeting contemporary safety and efficiency benchmarks, the retrofit segment is poised for sustained expansion across Europe.

REGIONAL ANALYSIS

Germany possessed the largest share of the Europe aerospace avionics market, accounting for .3% in 2024. As a hub for aerospace manufacturing and technology innovation, Germany plays a central role in shaping avionics development and deployment across both civil and defense sectors. Also, Germany is a key participant in the Future Combat Air System (FCAS) program, which entails extensive avionics integration for next-generation combat aircraft. The Luftwaffe’s ongoing modernization efforts, including avionics upgrades for Eurofighters and Tornados, further reinforce domestic demand. Moreover, the presence of leading avionics suppliers such as Diehl Aerospace and Thales Avionics in Frankfurt enhances Germany’s industrial capability.

France is another important player in the market. As home to Airbus headquarters and major defense contractors like Dassault Aviation and Thales Group, France plays a pivotal role in both commercial and military avionics development. The widespread use of the Airbus A320neo and A350 fleets has further intensified the demand for integrated avionics solutions. On the defense front, France leads the Future Combat Air System (FCAS) initiative alongside Germany and Spain, which includes the development of next-generation avionics for sixth-generation fighters. Also, the Rafale fighter jet received an avionics upgrade package in 2023, enhancing radar warning receivers, electronic warfare capabilities, and mission computing systems.

The United Kingdom occupies the key position in the Europe aerospace avionics market. The UK’s aerospace industry remains a global leader, particularly in defense avionics, supported by BAE Systems' contributions to the Eurofighter Typhoon and the upcoming Tempest next-generation fighter program. The Royal Air Force (RAF) has been actively upgrading its fleet of Typhoon and Voyager aircraft with enhanced electronic warfare and mission management systems, aligning with NATO interoperability standards. In addition, as per NATS (National Air Traffic Services), the UK’s airspace handles over two million flights annually, necessitating advanced avionics for commercial aircraft operating at Heathrow, Gatwick, and Manchester airports. Ongoing retrofitting programs for older Boeing 737NG and Airbus A320ceo aircraft further sustain avionics demand.

Italy is contributing a notable portion of total revenue in 2024. The country’s strategic involvement in defense programs and its growing emphasis on air force modernization contribute significantly to avionics demand. Like, one of Europe’s leading avionics providers, Italy accounted for a substantial portion of avionics system integrations for the Eurofighter Typhoon and M-346 Master training aircraft. The Italian Air Force also initiated several retrofitting campaigns in 2023, focusing on GPS modernization, radar enhancements, and mission system upgrades. The country’s participation in multinational defense projects such as the Future Cruise/Anti-Ship Weapon (FC/ASW) and its collaboration with European partners on drone-based avionics further strengthen its position.

Spain’s aerospace sector is characterized by strong participation in joint defense programs and a growing emphasis on avionics modernization for both civil and military aircraft. Indra Sistemas, a key Spanish avionics supplier, has been instrumental in developing airborne radar and communication systems for national and international clients. Furthermore, Spain is deepening its involvement in next-generation avionics research, particularly in sensor fusion, mission computing, and secure data transmission. The Spanish Air and Space Force has also launched avionics upgrade programs for its Eurofighter Typhoon and F-18 Hornet fleets, ensuring alignment with NATO and EU defense protocols.

LEADING PLAYERS IN THE EUROPE AEROSPACE AVIONICS MARKET

Thales Group

Thales Group is a leading global player in aerospace avionics, with a strong footprint across both commercial and defense aviation sectors in Europe. The company provides cutting-edge solutions including flight management systems, cockpit displays, radar technologies, and secure communication modules.

Thales plays a pivotal role in shaping the future of digital cockpits and integrated modular avionics (IMA), supporting next-generation aircraft programs such as Airbus commercial jets and the Future Combat Air System (FCAS). Its expertise in cyber-secure avionics and sensor fusion has made it a preferred partner for European defense agencies.

With a focus on innovation and strategic collaborations, Thales continues to influence avionics development across Europe, contributing significantly to global aerospace modernization efforts and setting high standards for performance, safety, and connectivity.

Leonardo S.p.A.

Leonardo S.p.A. is a key contributor to the Europe aerospace avionics market, offering advanced electronic systems for military and civil aircraft. The company specializes in radar, electronic warfare, mission computers, and integrated avionics architectures that enhance situational awareness and operational efficiency.

As a major participant in multinational defense programs such as the Eurofighter Typhoon and Tempest, Leonardo delivers high-performance avionics tailored for next-generation combat platforms. In the civil aviation space, its subsidiaries supply flight control and navigation systems for regional and business aircraft.

Leonardo’s emphasis on indigenous R&D and digital transformation ensures continuous technological advancement. With strong government backing and integration into pan-European defense initiatives, Leonardo remains a central force in advancing European aerospace capabilities and maintaining global competitiveness.

Safran Electronics & Defense

Safran Electronics & Defense is a major driver of avionics innovation in Europe, delivering mission-critical systems for navigation, flight control, surveillance, and onboard electronics. The company supports both commercial and military aviation through its advanced software-defined avionics and embedded cybersecurity solutions.

Safran plays a crucial role in flagship programs like the Rafale fighter jet, A400M transport aircraft, and various helicopter platforms, where it supplies integrated avionics suites that improve pilot interface, data fusion, and system interoperability.

In the civil domain, Safran collaborates closely with Airbus on avionics standardization and contributes to sustainable aviation through lightweight, energy-efficient components. With a commitment to digital transformation and open architecture systems, Safran enhances Europe's strategic autonomy in avionics while reinforcing its presence in global aerospace markets.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Europe aerospace avionics market is deepening vertical integration and expanding in-house capabilities to control critical aspects of avionics design, manufacturing, and certification. Companies are acquiring specialized firms in software development, cybersecurity, and sensor technology to ensure end-to-end system reliability and faster time-to-market deployment.

Another crucial approach is strengthening partnerships within pan-European defense and aviation programs, such as FCAS and Tempest, to align product roadmaps with national and regional procurement strategies. These collaborations enable companies to co-develop next-generation avionics architectures while securing long-term contracts and shared intellectual property rights.

Lastly, manufacturers are increasingly focusing on digital transformation and AI-driven avionics systems, investing heavily in research to integrate machine learning, predictive maintenance, and autonomous flight support features. This not only enhances aircraft performance but also positions companies at the forefront of emerging urban air mobility and unmanned aerial vehicle (UAV) applications, ensuring sustained relevance in a rapidly evolving industry landscape.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the European aerospace avionics market include Thales Group, Safran S.A., BAE Systems, Airbus SE, Leonardo S.p.A., Honeywell International Inc., Collins Aerospace, Garmin Ltd., Curtiss-Wright Corporation, L3Harris Technologies.

The competition in the European aerospace avionics market is intense and characterized by a blend of established defense and aerospace conglomerates, niche technology specialists, and emerging startups aiming to disrupt traditional paradigms. Dominant players leverage deep engineering expertise, extensive certification experience, and long-standing relationships with original equipment manufacturers (OEMs) and defense ministries to maintain their market positions.

However, rising demand for digital avionics, increased emphasis on cybersecurity, and the push for open-system architectures are reshaping competitive dynamics. Companies are under pressure to innovate rapidly while navigating complex regulatory landscapes and stringent qualification requirements set by the European Union Aviation Safety Agency (EASA) and national defense authorities.

New entrants and smaller firms are capitalizing on agile development cycles and niche specialization in areas such as radar warning systems, AI-based flight management, and miniaturized sensors. Meanwhile, larger players are consolidating their offerings through acquisitions and joint ventures to provide comprehensive, scalable avionics ecosystems.

Ultimately, the battle for dominance extends beyond hardware to encompass software superiority, system integration capabilities, and lifecycle service support—making adaptability and technological foresight the defining attributes of success in this high-stakes sector.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Thales Group launched a new family of compact, software-defined avionics units designed for light combat aircraft and unmanned aerial vehicles (UAVs), enhancing its portfolio for future battlefield and reconnaissance applications across European defense forces.

- In March 2024, Leonardo S.p.A. entered into a strategic collaboration with a German defense electronics firm to co-develop next-generation radar warning receivers and self-protection suites for Eurofighter Typhoon upgrades, strengthening its foothold in multi-role fighter avionics.

- In June 2024, Safran Electronics & Defense unveiled an AI-integrated flight management system tailored for commercial airliners, featuring adaptive route optimization and real-time weather avoidance capabilities, positioning itself at the forefront of smart avionics for the post-pandemic aviation recovery phase.

- In September 2024, BAE Systems announced a significant investment in a new avionics test and integration center in the UK, aimed at accelerating retrofitting programs for RAF aircraft and supporting export contracts with allied nations seeking avionics modernization.

- In November 2024, Diehl Aerospace partnered with a French software security firm to develop hardened operating systems for avionics used in both military and civil aviation, addressing growing concerns over airborne cybersecurity threats and regulatory compliance in European airspace operations.

MARKET SEGMENTATION

This research report on the Europe Aerospace Avionics Market has been segmented and sub-segmented based on Systems, Platform, Fit, and region.

By Systems Insights

- Flight Management

- Traffic & Collision Management

By Platform Insights

- Commercial Aviation

- Military Aviation

By Fit Insights

- Line-fit

- Retro-fit

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the Europe aerospace avionics market?

Key drivers include increasing demand for next-generation aircraft, rising air passenger traffic, advancements in avionics technology, and modernization of existing aircraft fleets.

2. Which countries are leading in the European aerospace avionics market?

Leading countries include France, Germany, the United Kingdom, and Italy, owing to strong aerospace manufacturing capabilities and major industry players.

3. Who are the major players in this market?

Key players include Thales Group, Safran S.A., BAE Systems, Airbus SE, Leonardo S.p.A., Honeywell International Inc., Collins Aerospace, and Garmin Ltd.

4. How is the market expected to grow in the future?

The market is expected to grow steadily due to increasing aircraft deliveries, the shift towards more electric aircraft, and the integration of AI and automation in avionics.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com