Europe Agricultural Drones Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, Application, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Agriculture Drones Market Size

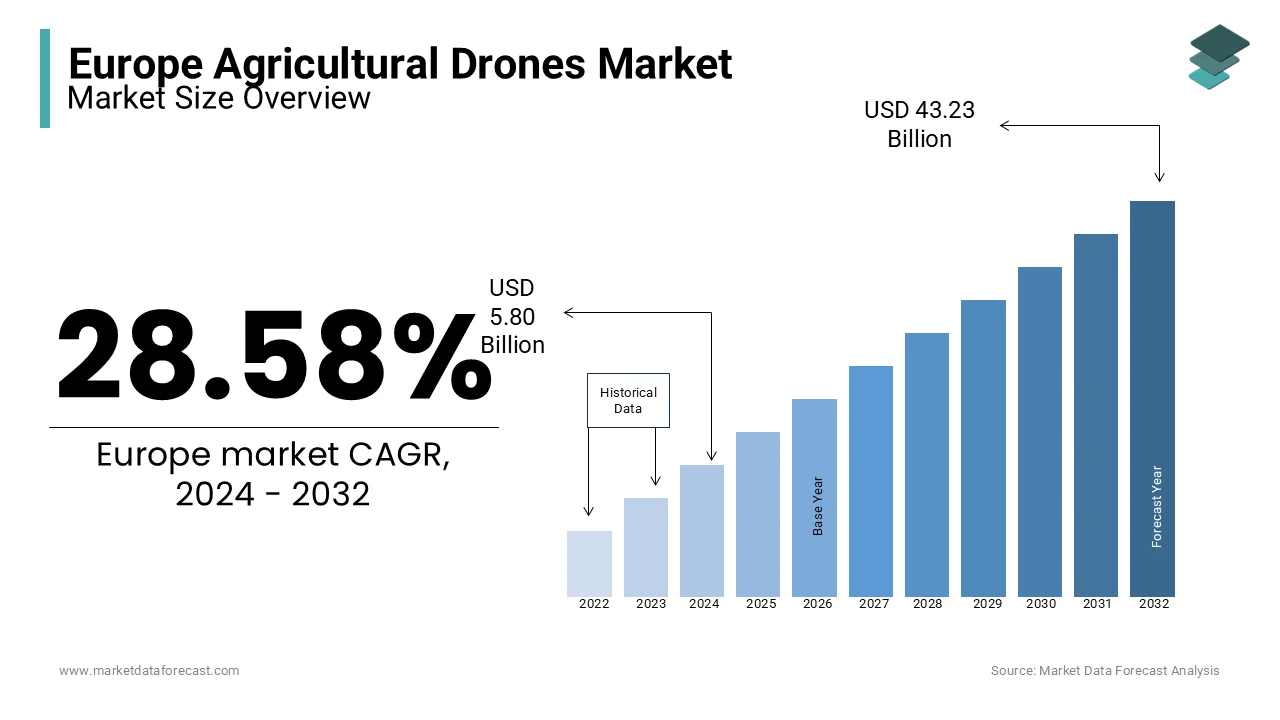

The Europe agricultural drones market was valued at USD 5.80 billion in 2024 and is anticipated to reach USD 7.46 billion in 2025 from USD 55.72 billion by 2033, estimated to grow at a CAGR of 28.58% during the forecast period from 2025 to 2033.

Agricultural drones use an automated process to make farming more productive, and they are about to be the brink of becoming the new workhorses on farms. Drones provide better, more flexible visualization. With the focus on productivity in agriculture spiraling upward in the farming sector, drones could be the answer to improved automation and precise control of farm monitoring and operations.

Robots are beginning to transform the way the agriculture sector functions, and the advent of agricultural drones could take that change to a whole new level. Farmers are adapting to drone availability, using aerial cameras to visualize plants. Video, specialized video, targeted video, and agricultural spraying systems are offered. Agricultural Drones use Technology for spraying, Mapping, Pest Control, Seeding, Remote Sensing, and precision agriculture.

The market is primarily driven by the increasing adoption of drones for crop spraying applications, resulting in an increase in the yield and reducing the wastage in spraying fertilizers & pesticides. Also, farmers are increasingly implementing this technology in farming to gain better productivity and to increase the efficiency in the use of water, land, and fertilizers. Moreover, the technological advancements, including sensors, better materials, and imaging capabilities, are also expected to drive the agricultural sector. However, a lack of awareness and a limited number of skilled professionals are restraining the growth of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

28.58% |

|

Segments Covered |

By Product, Application, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Trimble Navigation Ltd., DJI Technology, 3D Robotics, PrecisionHawk, AeroVironment, Inc., Parrot SA, and DroneDeploy. |

SEGMENT ANALYSIS

By Product Insights

From all these rotary blade drone types market has grown at the highest rate, owing to their advantages of hovering & flying in all directions, like horizontally & vertically. This drone is also popular among European customers.

By Application Insights

Hardware accounted for the majority of the agricultural drone market share in 2016, owing to high-cost components such as a fixed wing, rotary blade, and hybrid UAVs. Hybrid UAVs will witness growth in the forecast period since they can perform long-distance tasks along with hovering over the agricultural fields. Field mapping applications dominated the Europe agricultural drones market size. Benefits such as increasing yield by analyzing and monitoring the crops are expected to support the segment's growth over the forecast timeline. Crop scouting is expected to witness significant growth owing to its accuracy in fertilizer spraying.

COUNTRY ANALYSIS

The Europe market has been geographically segmented into Germany, the U.K., France, Spain, and Italy. In Europe, Germany leads the Agriculture drones market, followed by France and the U.K. The market in this region is projected to grow strongly during the forecast period due to various factors such as growing awareness, financial strength to procure expensive tools, and favorable reimbursement policies.

KEY MARKET PLAYERS

Some of the major key players in the market are Trimble Navigation Ltd., DJI Technology, 3D Robotics, PrecisionHawk, AeroVironment, Inc., Parrot SA, and DroneDeploy.

MARKET SEGMENTATION

This research report on the europe agricultural drones market is segmented and sub-segmented into the following categories.

By Product Insights

-

Hardware

- fixed-wing,

- rotary blade

- hybrid whereas

- Software

- data management

- imaging software

- data analysis.

By Application

- field mapping

- variable rate application

- crop scouting

- crop spraying

- livestock

- agriculture photography

- others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the agricultural drone market in Europe?

Rising demand for precision farming, labor shortages, and strong EU support for smart agriculture are major growth drivers.

How are drones used in European agriculture?

They’re used for crop monitoring, spraying, soil analysis, irrigation management, and field mapping to boost yield and efficiency.

Which countries in Europe lead in drone adoption for agriculture?

Germany, France, and the UK are leading due to advanced farming infrastructure and tech-forward policies.

What challenges does the market face?

High costs, strict drone regulations, and limited farmer training are key barriers to widespread adoption.

What is the market outlook for agricultural drones in Europe?

The market is growing fast—expected to nearly triple by 2030, driven by innovation and demand for sustainable farming.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]