Europe Agricultural Machinery Market Size, Share, Trends & Growth Forecast Report By Type (Tractors, Plowing and Cultivating Machinery, Planting Machinery, Irrigation Machinery, Harvesting Machinery, Haying and Forage Machinery, and Other Types), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Agricultural Machinery Market Size

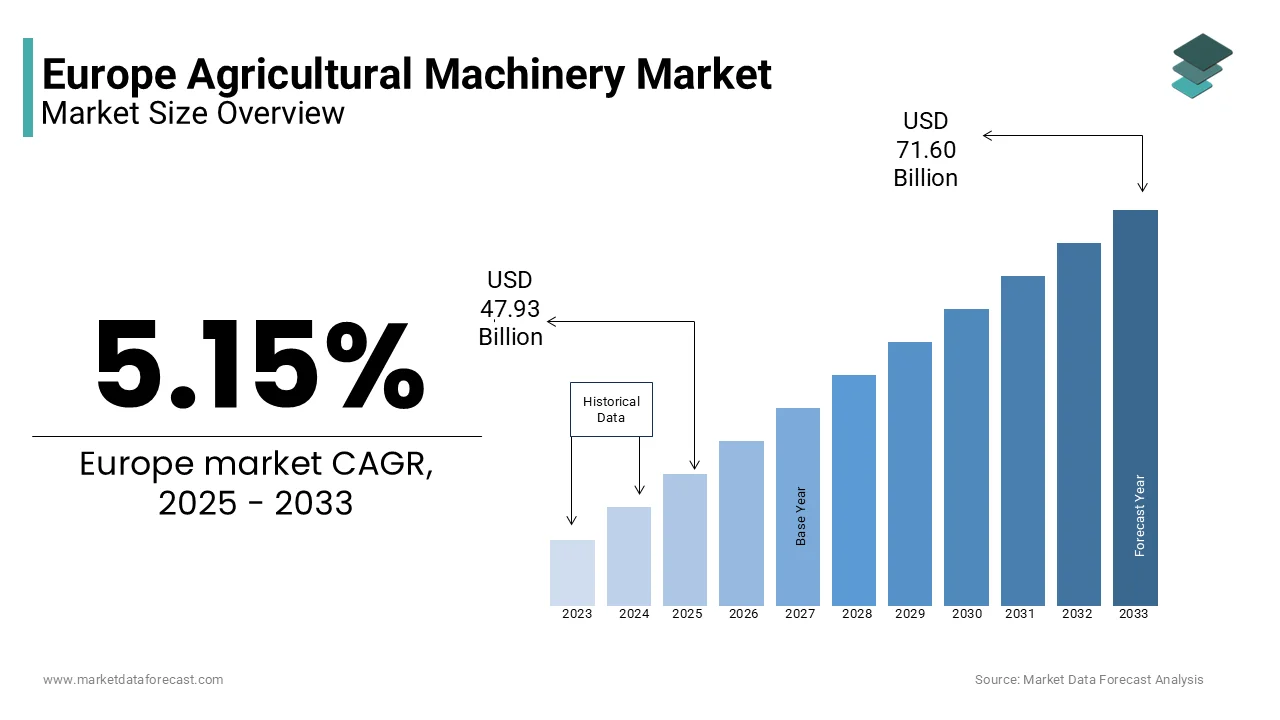

The Europe Agricultural Machinery market size was valued at USD 45.58 billion in 2024. The European market is estimated to be worth USD 71.60 billion by 2033 from USD 47.93 billion in 2025, growing at a CAGR of 5.15% from 2025 to 2033.

The Europe agricultural machinery market thrives on a foundation of technological sophistication and sustainability-driven innovation, making it one of the most advanced markets globally. Market conditions are shaped by the increasing integration of digital technologies, such as GPS-guided tractors and IoT-enabled equipment, which enhance productivity while reducing environmental impact. Also, the aging farming population has spurred demand for user-friendly, automated systems.

MARKET DRIVERS

Adoption of Precision Farming Technologies

The Europe agricultural machinery market is significantly propelled by the widespread adoption of precision farming technologies, driven by the need for enhanced productivity and resource optimization. According to the European Commission's Joint Research Centre, a large share of large-scale farms in Western Europe have integrated precision agriculture tools such as GPS-guided tractors, drones, and soil sensors into their operations. These technologies enable farmers to monitor crop health, optimize fertilizer usage, and reduce water wastage, leading to an increase in yield efficiency. The growing emphasis on sustainability further amplifies this trend, with the Food and Agriculture Organization noting that precision farming can reduce fuel consumption. Additionally, government initiatives, such as subsidies under the EU Common Agricultural Policy, encourage investments in high-tech machinery. For instance, financial incentives have resulted in an annual growth in the adoption of automated equipment across key markets like Germany and France.

Rising Demand for Sustainable Machinery

Sustainability has emerged as a critical driver for the Europe agricultural machinery market, fueled by stringent environmental regulations and shifting consumer preferences. As per the European Environment Agency, a significant portion of European farmers prioritize machinery that minimizes greenhouse gas emissions and energy consumption. This demand is reflected in the market’s steady shift toward electric and hybrid-powered equipment. Furthermore, sales of machinery equipped with emission-reducing technologies have surged in the past five years. Governments also play a pivotal role, offering tax benefits and grants for eco-friendly machinery purchases. For example, under the EU Green Deal, farmers receive subsidies to replace outdated equipment with modern, energy-efficient alternatives. This dual push from regulatory frameworks and consumer awareness ensures that sustainable machinery remains a cornerstone of the market’s growth trajectory, addressing both ecological concerns and operational efficiency.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints impacting the Europe agricultural machinery market is the high initial investment required for advanced machinery, which often deters small and medium-sized farmers. This significant financial burden is further compounded by the need for complementary equipment, such as plows, harvesters, and seed drills. As per insights shared by the European Commission’s Directorate-General for Agriculture, nearly 40% of European farmers cite affordability as a major barrier to adopting cutting-edge machinery. Additionally, the depreciation rates for agricultural equipment are relatively high, averaging 10-15% annually, which adds to the long-term financial strain. While subsidies under the EU Common Agricultural Policy aim to alleviate these costs, they often fall short of addressing the needs of smaller farms. The disparity in adoption rates between large-scale commercial farms and smaller operations highlights the inequity in access to advanced machinery, ultimately slowing down the market's overall growth potential.

Complex Regulatory Frameworks

The Europe agricultural machinery market also faces challenges due to the region’s complex and evolving regulatory frameworks, which can hinder innovation and increase compliance costs. According to the European Environment Agency, manufacturers must adhere to stringent emissions standards, such as the EU Stage V regulations, which mandate significant reductions in nitrogen oxide (NOx) and particulate matter emissions from machinery engines. Compliance with these standards often requires substantial investments in research and development. Furthermore, as per the Food and Agriculture Organization, the time required to obtain certifications for new machinery can extend up to two years, delaying product launches and increasing operational costs. These regulatory hurdles disproportionately affect smaller manufacturers, who lack the resources to navigate the bureaucratic processes efficiently. Also, regional variations in subsidies and incentives create inconsistencies in market access, further complicating the operational landscape.

MARKET OPPORTUNITIES

Expansion of Smart Farming Solutions

The Europe agricultural machinery market stands to benefit significantly from the growing integration of smart farming solutions, driven by the increasing demand for data-driven decision-making in agriculture. This surge is fueled by the need to address labor shortages, with a notable share of farms face challenges due to an aging workforce. Smart farming technologies not only automate repetitive tasks but also optimize resource allocation, reducing input costs. For instance, precision irrigation systems can lower water usage, aligning with EU sustainability goals. Furthermore, governments are actively supporting this transition through initiatives like the Horizon Europe program. With Europe aiming to become a global leader in smart farming, manufacturers have a unique opportunity to develop cutting-edge solutions tailored to regional needs, fostering both market expansion and environmental stewardship.

Growth in Export Potential to Emerging Markets

Another significant opportunity for the Europe agricultural machinery market lies in its strong export potential to emerging markets, particularly in Africa and Asia. European manufacturers, known for their high-quality and durable equipment, are well-positioned to capitalize on this trend. The rising focus on mechanization in countries like India and Nigeria presents lucrative opportunities, as these nations aim to boost agricultural productivity to meet food security goals. Also, trade agreements, such as the EU-Africa partnership, facilitate easier access to these markets by reducing tariffs and regulatory barriers. By leveraging their reputation for innovation and reliability, European manufacturers can expand their global footprint while addressing the increasing demand for efficient and sustainable farming solutions in emerging economies.

MARKET CHALLENGES

Fragmentation in Farm Sizes and Economic Disparities

A significant challenge for the Europe agricultural machinery market is the fragmentation in farm sizes and economic disparities across the region, which hinder uniform adoption of advanced machinery. According to the European Commission’s Directorate-General for Agriculture, over 60% of European farms are classified as small-scale operations, with less than 5 hectares of land. These smaller farms often lack the financial capacity to invest in high-cost machinery, such as automated harvesters or precision farming equipment. This disparity creates a segmented market where innovation is concentrated among wealthier, larger farms, leaving smaller operators at a competitive disadvantage. Besides, regional economic differences exacerbate the issue, with Eastern European countries like Romania and Bulgaria reporting significantly lower machinery adoption rates due to limited access to credit and subsidies.

Supply Chain Disruptions and Rising Material Costs

Another pressing challenge for the Europe agricultural machinery market is the impact of supply chain disruptions and escalating material costs, which have intensified since the global pandemic. According to industry experts, the cost of raw materials such as steel and aluminum has surged in the past two years, directly affecting production expenses for machinery manufacturers. The European Environment Agency highlights that these rising costs have led to an increase in machinery prices, making them less affordable for farmers already grappling with tight margins. Furthermore, geopolitical tensions, such as those involving Russia and Ukraine, have disrupted the supply of critical components like semiconductors, which are essential for smart farming technologies. Such challenges not only strain manufacturer-farmer relationships but also impede the timely adoption of innovative solutions, threatening the market’s ability to meet growing agricultural demands efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.15% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

John Deere, CNH Industrial (Case IH, New Holland Agriculture), AGCO Corporation (Fendt, Massey Ferguson), CLAAS Group, Kubota Corporation, SDF Group (Same Deutz-Fahr), Lely Industries, and others. |

SEGMENT ANALYSIS

By Type Insights

Tractors dominated the Europe agricultural machinery market by holding a market share of 35.4% in 2024. This leading position is supported by their versatility and indispensability in modern farming operations, ranging from plowing to hauling. The demand for tractors is further bolstered by advancements in technology, such as GPS-integrated systems and hybrid engines, which enhance efficiency while reducing environmental impact. Apart from these, government subsidies under the Common Agricultural Policy have incentivized tractor purchases, with financial aid covering a portion of costs in certain regions. Another driving factor is the aging farmer demographic, which has increased the need for user-friendly, automated machinery. With an estimated annual production of 600,000 units in Europe, tractors remain the backbone of agricultural mechanization, driven by innovation and regulatory support.

Precision farming machinery is emerging as the fastest-growing segment in the Europe agricultural machinery market, with a projected CAGR of 19% through 2033. This rapid expansion is fueled by the increasing adoption of IoT-enabled equipment, such as drones, soil sensors, and autonomous harvesters, which optimize resource use and boost productivity. Moreover, stringent environmental regulations are accelerating this trend, with the EU mandating sustainable practices to achieve its 2050 carbon neutrality goals. Financial incentives also play a pivotal role; for instance, Horizon Europe has allocated €10 billion to digital agriculture initiatives, encouraging farmers to invest in smart machinery.

REGIONAL ANALYSIS

Germany is the epicenter of agricultural innovation in the Europe agricultural machinery market, commanding a 25.3% share. This dominance is rooted in the country's robust manufacturing sector and its reputation for engineering excellence. German manufacturers, such as CLAAS and John Deere’s local operations, are at the forefront of producing high-tech machinery, including autonomous tractors and precision farming equipment. According to industry experts, a significant portion of Germany’s agricultural machinery production is exported, contributing significantly to its global influence. The country’s prowess is further bolstered by strong government support through subsidies under the EU Common Agricultural Policy, which incentivizes farmers to adopt advanced machinery. Additionally, Germany’s focus on sustainability has driven innovation, with a notable share of new machinery models meeting stringent emissions standards. As per the Food and Agriculture Organization, German farms utilizing modern machinery have reported a key increase in productivity over the past decade, underscoring the nation’s pivotal role in shaping the future of the European market.

France is a hub for diverse agricultural needs. The country’s vast agricultural landscape, spanning diverse crops like wheat, maize, and vineyards, drives the demand for versatile machinery. French farmers prioritize efficiency, with a large majority of them investing in plowing, cultivating, and harvesting equipment, as per industry analysts. The French government plays a crucial role, offering tax incentives and grants that cover a notable share of machinery costs, encouraging adoption. Furthermore, France’s commitment to sustainability aligns with EU Green Deal objectives, spurring the adoption of low-emission machinery.

Italy is renowned for its specialized machinery tailored to vineyards, orchards, and small-scale farms, Italy excels in niche markets. The country’s prowess in precision farming is evident. This trend is supported by Italy’s strong manufacturing base, home to global leaders like Argo Tractors and Same Deutz-Fahr. Financial incentives under the EU Horizon Europe program have also fueled investments in smart machinery, driving an annual growth in technology adoption. Moreover, Italy’s focus on sustainability has led to a surge in demand for electric and hybrid machinery, particularly in regions like Lombardy and Emilia-Romagna.

The United Kingdom agricultural machinery market is driven by its rapid embrace of technological advancements. British farmers are increasingly shifting toward automated and data-driven solutions. Brexit has further reshaped the market dynamics, prompting domestic manufacturers to innovate and reduce reliance on imports. Government initiatives, such as the Environmental Land Management Scheme, incentivize sustainable practices, boosting demand for low-emission equipment. Also, the UK’s focus on research and development has positioned it as a leader in developing autonomous farming technologies.

Spain is seeing rising demand for irrigation and harvesting solutions. The country’s arid climate and extensive cultivation of water-intensive crops like olives and almonds drive the demand for advanced irrigation systems and harvesting machinery. Spanish farmers also prioritize durable machinery suited to large-scale operations, particularly in regions like Andalusia and Castilla-La Mancha. Government subsidies under the EU CAP have accelerated this trend, with financial aid covering a share of machinery costs for small and medium-sized farms.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

John Deere, CNH Industrial (Case IH, New Holland Agriculture), AGCO Corporation (Fendt, Massey Ferguson), CLAAS Group, Kubota Corporation, SDF Group (Same Deutz-Fahr), Lely Industries are playing dominating role in the Europe agricultural machinery market.

The Europe agricultural machinery market is characterized by intense competition, with key players leveraging innovation, sustainability, and strategic collaborations to maintain their dominance. The market is led by global giants like John Deere, CLAAS, and CNH Industrial, alongside regional manufacturers such as AGCO and Same Deutz-Fahr. According to industry experts, the competitive landscape is shaped by the demand for advanced technologies like precision farming, autonomous machinery, and eco-friendly solutions. Companies are increasingly focusing on compliance with EU regulations, particularly emissions standards under Stage V, to gain a competitive edge. Additionally, partnerships with local dealerships and digital platforms have enabled manufacturers to enhance market penetration. As per the European Agricultural Machinery Association, mergers, acquisitions, and R&D investments are pivotal strategies driving growth. The market also witnesses competition from emerging players offering cost-effective machinery tailored to small-scale farms. This dynamic environment fosters continuous innovation, with companies striving to balance affordability, efficiency, and sustainability. The result is a highly fragmented yet collaborative ecosystem where technological advancements dictate market leadership.

TOP PLAYERS IN THIS MARKET

John Deere

John Deere is a global powerhouse in the agricultural machinery sector, with a strong foothold in Europe. The company’s innovative approach to precision farming has set it apart, offering advanced solutions like GPS-guided tractors and AI-driven analytics platforms. The company also emphasizes digital integration is enabling farmers to optimize resource use through tools like the John Deere Operations Center. Its commitment to R&D ensures cutting-edge products, while partnerships with local dealerships enhance accessibility across Europe. With a reputation for durability and efficiency, John Deere continues to shape the future of mechanized farming globally.

CLAAS

CLAAS is a leader in the European agricultural machinery market is renowned for its high-performance harvesting equipment and innovative engineering. Headquartered in Germany, the company dominates the harvester segment, with products like the LEXION series setting benchmarks in efficiency and capacity. CLAAS invests heavily in automation and digitalization by introducing features such as autonomous driving systems and IoT-enabled diagnostics. The company’s focus on sustainability aligns with EU regulations, promoting fuel-efficient machinery that reduces environmental impact. CLAAS also collaborates with research institutions to develop next-generation technologies by ensuring its dominance in both regional and global markets. Its robust distribution network further strengthens its influence worldwide.

CNH Industrial

CNH Industrial, parent company of brands like New Holland and Case IH, plays a pivotal role in the Europe agricultural machinery market. The company excels in producing versatile machinery, from tractors to specialized plowing equipment, catering to diverse farming needs. CNH Industrial prioritizes alternative energy solutions, launching methane-powered tractors that reduce carbon footprints by up to 80%. Its focus on precision farming tools, such as PLM technology that enables data-driven decision-making for farmers. CNH Industrial’s global reach is bolstered by strategic acquisitions and collaborations by enhancing its innovation pipeline.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Focus on Sustainability and Eco-Friendly Innovations

Key players in the Europe agricultural machinery market are prioritizing sustainability to align with stringent EU environmental regulations and shifting consumer preferences. Companies like John Deere and CLAAS are investing heavily in developing low-emission machinery, such as electric and hybrid tractors, which reduce greenhouse gas emissions by up to 30%, as per industry experts. For instance, CNH Industrial has introduced methane-powered tractors that significantly cut carbon footprints while maintaining high performance. Additionally, manufacturers are integrating precision farming technologies to optimize resource usage, reducing water and fertilizer consumption by up to 25%. This strategy not only strengthens their market position but also enhances brand loyalty among environmentally conscious farmers. By offering machinery that meets both regulatory standards and sustainability goals, these companies are future-proofing their operations while addressing global climate challenges.

Expansion of Digital and IoT-Enabled Solutions

The adoption of digitalization and IoT-enabled solutions is a cornerstone strategy for key players aiming to dominate the European market. According to the European Commission’s Joint Research Centre, over 60% of new machinery models now incorporate smart technologies like GPS guidance, remote monitoring, and predictive maintenance systems. For example, John Deere’s Operations Center platform allows farmers to monitor field conditions and machinery performance in real-time, improving efficiency by up to 20%. Similarly, CLAAS has integrated autonomous driving systems and IoT diagnostics into its equipment, enabling seamless data-driven decision-making. These innovations cater to the growing demand for precision farming, particularly among large-scale commercial farms. By leveraging digital tools, manufacturers are not only enhancing operational efficiency but also creating new revenue streams through subscription-based software services.

Strategic Partnerships and Collaborations

To strengthen their foothold in the competitive European market, key players are forming strategic partnerships with technology firms, research institutions, and local distributors. For instance, CNH Industrial collaborates with tech companies to develop advanced telematics systems, ensuring compatibility with cutting-edge farm management software. As per industry analysts, such collaborations have led to a 15% increase in product innovation cycles. Additionally, companies like CLAAS work closely with agricultural universities to test and refine prototypes, ensuring their machinery meets the evolving needs of modern farmers. Local partnerships with dealerships and service providers further enhance market penetration, particularly in rural areas. By fostering these alliances, manufacturers can accelerate R&D efforts, improve product accessibility, and maintain a competitive edge in an increasingly dynamic market landscape.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, John Deere launched its fully autonomous tractor in Europe, equipped with AI-driven analytics. This innovation strengthened its position by addressing labor shortages and enhancing farm productivity.

- In June 2023, CLAAS partnered with a German IoT firm to integrate predictive maintenance tools into its machinery. This collaboration improved operational efficiency and reduced downtime for farmers.

- In September 2023, CNH Industrial introduced methane-powered tractors in Italy, reducing carbon emissions by up to 80%. This move aligned with EU sustainability goals, boosting its market appeal.

- In November 2023, AGCO acquired a French precision farming startup, enhancing its portfolio of data-driven solutions. This acquisition expanded its presence in Western Europe.

- In January 2024, Same Deutz-Fahr launched solar-powered irrigation systems in Spain, targeting water-intensive crops. This initiative addressed regional needs and positioned the company as a leader in sustainable solutions.

MARKET SEGMENTATION

This research report on the Europe agricultural machinery market is segmented and sub-segmented into the following categories.

By Type

- Tractors

- Plowing and Cultivating Machinery

- Planting Machinery

- Irrigation Machinery

- Harvesting Machinery

- Haying and Forage Machinery

- Other Types

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the compound annual growth rate (CAGR) of the Europe Agricultural Machinery market from 2025 to 2033?

The Europe Agricultural Machinery market is expected to grow at a CAGR of 5.15% during this period.

2. What factors are driving the growth of the Europe Agricultural Machinery market?

Key drivers include increasing mechanization, demand for advanced farming solutions, adoption of precision farming technologies, and government support for sustainable agriculture.

3. What are challenges faced by the Europe Agricultural Machinery market?

Challenges include high costs of automation, raw material supply constraints, and inflation impacting machinery affordability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com