Europe AI Chipsets Market Size, Share, Trends, & Growth Forecast Report By Chipset (CPU, GPU, FPGA, ASIC, Others), Workload Domain, Computing Technology, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe AI Chipsets Market Size

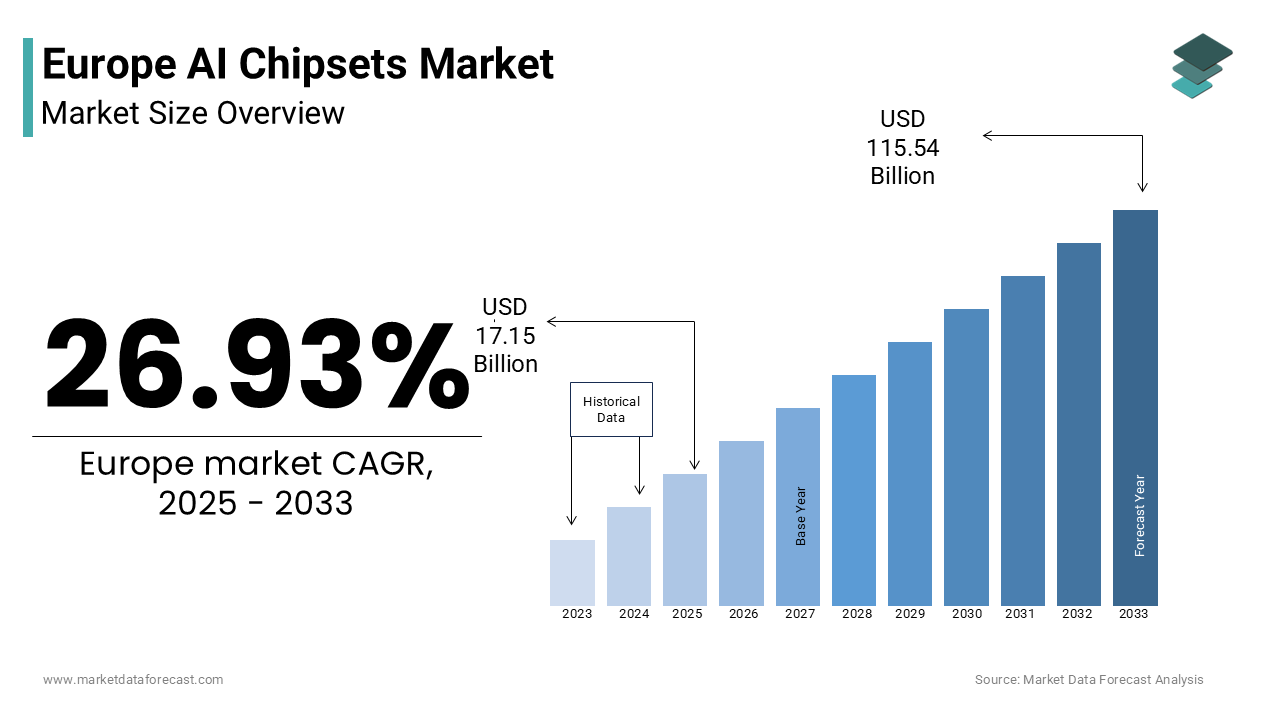

The Europe AI Chipsets Market was worth USD 13.51 billion in 2024. The Europe market is expected to reach USD 115.54 billion by 2033 from USD 17.15 billion in 2025, rising at a CAGR of 26.93% from 2025 to 2033.

The AI chipsets are specially designed to accelerate artificial intelligence tasks such as machine learning, deep learning, and neural network processing. These chipsets include GPUs, TPUs, FPGAs, and ASICs tailored for high-performance computing in data centers, automotive systems, industrial automation, and consumer electronics. According to Eurostat, in 2023, over 68% of large enterprises in the EU had adopted AI-driven solutions in at least one business function, indicating a growing reliance on dedicated hardware infrastructure.

Regulatory frameworks such as the European Union’s Artificial Intelligence Act have also played a role in shaping the development and deployment of AI technologies, emphasizing transparency, accountability, and ethical use. As per the European Commission, these policies are influencing how companies design and implement AI hardware to meet compliance standards while maintaining innovation momentum.

MARKET DRIVERS

Expansion of Edge Computing and Real-Time Data Processing Needs

One of the primary drivers of the Europe AI chipsets market is the rapid expansion of edge computing applications that require real-time data processing capabilities. Unlike traditional cloud-based models, edge computing processes data closer to the source, such as in manufacturing plants, autonomous vehicles, and smart cities, which is necessitating powerful yet energy-efficient AI chipsets capable of handling complex computations locally.

According to the European Commission’s 2023 Digital Economy and Society Index, over 55% of EU businesses had deployed some form of edge computing infrastructure, with industrial IoT and robotics being key adoption areas. This shift has increased demand for AI accelerators optimized for low latency and high throughput in constrained environments.

In Germany, for instance, leading automotive manufacturers such as BMW and Bosch have integrated AI-enabled vision chips into their production lines to support real-time quality inspection and predictive maintenance. Moreover, public sector investments in smart city infrastructure have further fueled this trend. Cities like Amsterdam and Copenhagen are leveraging AI-powered video analytics chips for traffic management and public safety by enhancing urban efficiency without relying on centralized cloud resources.

Increasing Government Investments in Domestic Semiconductor Development

Another significant driver of the Europe AI chipsets market is the surge in government-backed investments aimed at strengthening domestic semiconductor capabilities. Recognizing the strategic importance of semiconductors in securing technological sovereignty, the European Union launched the “EU Chips Act” in 2023 by allocating €43 billion to boost local chip design, manufacturing, and supply chain resilience. Several member states have aligned with this strategy through national funding programs. Additionally, institutions such as IMEC (Belgium) and CEA-Leti (France) are spearheading collaborative research efforts involving both academic and corporate stakeholders to develop next-generation AI accelerators tailored for European industry needs. These coordinated efforts not only enhance regional self-sufficiency but also attract global tech firms to establish partnerships and innovation hubs within Europe by reinforcing the continent’s position in the global AI hardware landscape.

MARKET RESTRAINTS

High Capital Intensity and Long Development Cycles for AI Chipsets

A major restraint affecting the Europe AI chipsets market is the high capital intensity and extended development timelines required to bring new AI processors from concept to commercialization. Unlike software-based AI solutions, which can be iteratively improved and deployed quickly, hardware development involves substantial upfront investment in research, prototyping, testing, and fabrication. According to McKinsey’s 2023 Semiconductor Industry Report, developing a new generation of AI chipsets typically requires an average investment of €1.5–2 billion and takes between three to five years before reaching market readiness.

Furthermore, the complexity of designing AI-specific architectures that balance performance, power efficiency, and cost-effectiveness presents technical challenges. The European Semiconductor Industry Association noted in its 2023 report that only a handful of European companies had successfully scaled custom AI chip designs beyond pilot phases due to resource constraints. Additionally, reliance on third-party foundries outside of Europe adds another layer of risk and uncertainty.

Talent Shortage and Limited Skilled Workforce Availability

Another critical restraint impacting the Europe AI chipsets market is the shortage of skilled professionals capable of designing, optimizing, and deploying next-generation AI hardware. The semiconductor industry requires expertise in fields such as microarchitecture, embedded systems, AI algorithms, and thermal engineering areas where Europe faces a growing talent gap. According to Eurostat’s 2023 Labour Market Analysis, there was a 22% year-over-year increase in job vacancies related to semiconductor design and AI hardware engineering, with only 35% of positions filled due to a lack of qualified candidates. Universities and research institutions across Europe are working to bridge this gap through specialized AI and chip design programs, but the results take time. As per the European University Association, only 18 out of 100 surveyed universities offered dedicated courses in AI accelerator design, which is limiting the pipeline of trained professionals.

Moreover, competition from North America and Asia, where top-tier tech firms offer lucrative compensation packages and cutting-edge R&D opportunities that further exacerbates the brain drain. The European Commission acknowledged this challenge in its 2023 Digital Skills Action Plan, calling for enhanced collaboration between academia, industry, and policymakers to retain and cultivate AI hardware talent within the region.

MARKET OPPORTUNITIES

Growth of Autonomous Systems and Smart Industrial Applications

An emerging opportunity in the Europe AI chipsets market lies in the expansion of autonomous systems and smart industrial applications that rely on real-time decision-making and onboard AI processing. From automated guided vehicles (AGVs) in warehouses to robotic process automation in manufacturing, these applications demand high-efficiency AI accelerators capable of operating in dynamic and often unpredictable environments.

According to the International Federation of Robotics (IFR), Europe accounted for 32% of global industrial robot installations in 2023, with Germany alone responsible for nearly half of that figure. In Sweden, for example, ABB has been integrating AI-enabled inference chips into its robotic arms to improve precision in assembly-line tasks. Startups like Paris-based Hailo and Munich-based Alea iacta are developing compact AI chips specifically for these applications, which is catering to a rapidly evolving industrial ecosystem.

Rise of AI-Driven Healthcare and Medical Imaging Innovations

Another transformative opportunity for the Europe AI chipsets market is the rising adoption of AI-driven healthcare and medical imaging innovations that require high-performance, low-latency processors. Hospitals and diagnostic centers across Europe are increasingly deploying AI-powered tools for radiology, pathology, and personalized treatment planning by necessitating robust hardware capable of processing vast amounts of visual data in real time.

According to the European Health Information Initiative, over 60% of hospitals in Western Europe had implemented AI-assisted diagnostic imaging systems by mid-2023. In Finland, VTT Technical Research Centre developed an AI-based early cancer detection system using custom-designed inference chips, significantly improving diagnosis speed and reducing workload pressure on medical staff. Moreover, mobile health clinics and remote diagnostics platforms are leveraging AI chipsets to deliver real-time insights in rural and underserved regions. Companies like Oxford Nanopore Technologies in the UK are integrating AI accelerators into portable DNA sequencing devices, enabling faster disease identification and genomic analysis.

MARKET CHALLENGES

Supply Chain Disruptions and Global Semiconductor Shortages

A pressing challenge confronting the Europe AI chipsets market is the ongoing volatility in global semiconductor supply chains, exacerbated by geopolitical tensions, trade restrictions, and logistical bottlenecks. Despite growing demand for AI processors, manufacturers face difficulties in securing essential components, particularly advanced node wafers and packaging materials.

According to the European Semiconductor Industry Association, lead times for certain AI chip components remained above 40 weeks in 2023, significantly delaying product launches and customer deployments. This situation has been compounded by export controls imposed by the United States on high-end chipmaking equipment destined for China, indirectly affecting European firms reliant on shared global supply chains. Moreover, disruptions in raw material sourcing, such as rare earth metals used in semiconductor fabrication, have added to the instability. The European Commission’s 2023 Critical Raw Materials Strategy identified risks associated with over-reliance on non-EU suppliers, prompting calls for localized alternatives. Additionally, transportation bottlenecks and rising freight costs have further impacted production schedules and pricing structures.

Regulatory Complexity and Ethical Concerns Around AI Hardware Deployment

Another significant challenge facing the Europe AI chipsets market is the regulatory complexity and ethical concerns surrounding the deployment of AI hardware in sensitive domains such as surveillance, defense, and autonomous decision-making. The European Union’s Artificial Intelligence Act, enacted in 2024, imposes stringent requirements on high-risk AI applications, directly influencing the design and use of underlying hardware components. According to the European Data Protection Board, AI processors used in biometric identification systems must comply with strict transparency, auditability, and human oversight mandates. These requirements necessitate additional layers of security, traceability, and fail-safe mechanisms, increasing the complexity and cost of AI chipset development.

Ethical concerns around AI-enabled surveillance have also prompted legislative pushback in several countries. In Austria and the Netherlands, municipal authorities banned facial recognition systems powered by AI inference chips due to privacy concerns, reflecting broader societal resistance to unchecked AI implementation.

Moreover, the classification of AI chipsets under dual-use export controls has introduced compliance burdens for manufacturers seeking to expand beyond European borders. As per the European External Action Service, exports of certain AI accelerators now require special licenses, slowing international market penetration.

SEGMENTAL ANALYSIS

By Chipset Insights

The GPU (Graphics Processing Unit) segment held the largest share of the Europe AI chipsets market by capturing 42.3% of total share in 2024 due to the attributed to the widespread use of GPUs in deep learning, neural network training, and high-performance computing applications across academia, research institutions, and enterprise data centers. Additionally, major cloud service providers operating in Europe such as AWS, Microsoft Azure, and Google Cloud have heavily invested in GPU-accelerated infrastructure to support enterprise AI development.

The ASIC (Application-Specific Integrated Circuit) segment is swiftly emerging with a CAGR of 18.6% during the forecast period. Unlike general-purpose processors, ASICs are designed for specific AI functions, offering superior performance efficiency and lower power consumption by making them ideal for edge devices and embedded AI applications. In the healthcare sector, medical imaging startups are leveraging ASIC-based accelerators to enhance diagnostic accuracy while reducing reliance on cloud connectivity. The Swedish Agency for Health and Care Sciences reported that AI-assisted radiology tools powered by ASIC chips improved early disease detection rates by up to 33%, which is contributing to faster clinical decision-making. Furthermore, automotive manufacturers like BMW and Volvo are integrating ASICs into advanced driver assistance systems (ADAS) to enable real-time object detection and situational awareness. As per Deloitte’s 2024 Automotive Tech Forecast, ASIC adoption in autonomous vehicle platforms is expected to double by 2027 with the demand for energy-efficient, high-speed inference engines.

By Workload Domain Insights

The training workload domain held the largest share of the Europe AI chipsets market by accounting for 58.3% of the total share in 2024. One key factor driving this segment is the increasing volume of AI research and development activities conducted by universities, government agencies, and private enterprises across Europe. According to the European Commission’s 2024 AI Research Landscape report, over 400 AI-focused research centers were operational in EU member states, all requiring powerful hardware for model iteration and optimization. Another significant driver is the expansion of cloud-based AI services, where model training is typically performed on centralized servers before deployment at the edge. Additionally, national AI strategies in countries like France and Germany have prioritized investment in supercomputing resources dedicated to AI model training.

The inference workload domain is lucratively growing with a CAGR of 22.3% in the next coming years. Inference involves deploying trained AI models to perform real-time decision-making, which is making it essential for applications such as facial recognition, voice assistants, and industrial automation. A primary driver of this rapid expansion is the proliferation of edge AI devices that require low-latency, energy-efficient processing without relying on cloud connectivity. According to Eurostat’s 2023 Edge Computing Adoption Survey, over 50% of European manufacturers had deployed AI inference chips in robotic arms and automated quality inspection systems to improve production line responsiveness. Additionally, the rise of smart cities and intelligent transportation systems has boosted demand for on-device AI inference. In the Netherlands, for example, municipal authorities integrated inference-capable chipsets into traffic cameras to enable real-time congestion monitoring and adaptive signal control, improving urban mobility.

Consumer electronics manufacturers are also accelerating inference adoption, embedding AI accelerators in smartphones, wearables, and smart speakers. As per the European Consumer Electronics Association, shipments of AI-enhanced personal devices in Europe grew by 38% in 2023, reflecting strong consumer appetite for intelligent features.

By Computing Technology

The cloud AI computing segment dominated the Europe AI chipsets market share in 2024 with the concentration of AI model training and large-scale data processing in centralized data centers operated by global cloud providers and enterprise IT departments. Additionally, enterprises across banking, healthcare, and logistics prefer cloud AI computing for its scalability and cost-efficiency in managing fluctuating AI workloads. Moreover, national AI strategies in countries like Germany and France emphasize cloud-based AI research infrastructure. The cloud AI computing remains the cornerstone of Europe’s artificial intelligence advancement with ongoing investments in sovereign cloud initiatives such as Gaia-X and cloud-native AI frameworks.

The edge AI computing segment is projected to grow at a CAGR of 24.1% from 2025 to 2033. This surge is driven by the increasing demand for real-time, low-latency AI processing in autonomous systems, smart manufacturing, and distributed IoT networks that cannot rely solely on cloud connectivity. A major catalyst is the expansion of Industry 4.0 applications, where AI-powered vision systems and predictive maintenance tools operate directly on factory floors using embedded AI chipsets. According to the European Commission’s 2024 Industrial Digitization Strategy, over 55% of manufacturing firms in Western Europe had adopted edge AI solutions to reduce latency and improve operational resilience.

By Vertical Insights

The Banking, Financial Services, and Insurance (BFSI) vertical held 25.4% of the Europe AI chipsets market share in 2024. One key factor behind this dominance is the increasing deployment of AI-driven cybersecurity and transaction monitoring systems to comply with stringent financial regulations. Additionally, banks and insurance firms are investing in AI-powered chatbots and virtual assistants to enhance customer engagement and streamline claims processing. Moreover, hedge funds and asset management firms are leveraging AI chipsets for high-frequency trading and portfolio optimization.

The automotive segment in the Europe AI chipsets market is expected to expand at a CAGR of 26.4% in the next coming years. This rapid ascent is fueled by the automotive industry’s shift toward electrification, autonomy, and intelligent driver assistance systems that rely heavily on AI processors for real-time decision-making and sensor fusion. A major driver is the increasing integration of AI chipsets into Advanced Driver Assistance Systems (ADAS) and autonomous vehicles. Leading automakers such as BMW, Mercedes-Benz, and Volvo are partnering with AI chipset vendors to develop proprietary AI platforms optimized for vehicular performance and safety. Moreover, governments across the region are incentivizing the development of green and intelligent transport ecosystems. The European Commission’s “Fit for 55” package includes funding for AI-powered mobility solutions by encouraging both public and private stakeholders to invest in next-generation vehicle AI hardware.

REGIONAL ANALYSIS

Germany was the top performer in the Europe AI chipsets market with 22.3% of share in 2024. As Europe’s largest economy and a global leader in engineering and industrial innovation, Germany benefits from a robust ecosystem of semiconductor research institutions, automotive manufacturers, and AI-driven manufacturing facilities. The country's industrial base, particularly in automotive and mechanical engineering, has been an early adopter of AI accelerators for robotics, autonomous driving, and predictive maintenance. Additionally, national policy initiatives such as the "National Strategy for Artificial Intelligence" and the "EU Chips Act" have spurred investment in domestic AI hardware development.

The United Kingdom is next by holding 15.4% of the Europe AI chipsets market share in 2024. Cambridge and Oxford universities remain at the forefront of AI hardware research, producing breakthroughs in neuromorphic computing and quantum-inspired processors. The financial services sector is another major contributor, with institutions like Barclays and HSBC leveraging AI chipsets for fraud detection, algorithmic trading, and customer service automation. The Bank of England reported that in 2024, nearly 70% of AI-driven transactions in London’s financial district relied on GPU-accelerated infrastructure.

France AI chipsets market growth is likely to be driven by the aggressive government-led investments in semiconductor development and AI research. CEA-Leti, one of Europe’s leading microelectronics research institutes, plays a central role in developing next-generation AI accelerators tailored for automotive, defense, and industrial applications. Major French automakers such as Renault and Stellantis are integrating AI chipsets into next-generation electric vehicles for autonomous navigation and battery optimization.

The Netherlands AI chipsets market growth is expected to grow by shaping global semiconductor technology roadmaps, influencing AI chipset design and fabrication standards worldwide. Dutch universities, particularly Delft University of Technology and Eindhoven University of Technology, contribute significantly to AI accelerator research, with several spin-offs focusing on embedded AI and low-power inference solutions.

Sweden AI chipsets market growth is distinguished by a strong emphasis on sustainability, healthcare innovation, and AI-driven industrial automation. The country’s commitment to green technology has led to the development of energy-efficient AI accelerators tailored for environmental monitoring, smart grids, and sustainable manufacturing. In healthcare, institutions like Karolinska Institute and Ericsson are collaborating on AI-powered diagnostic tools that leverage specialized chipsets for real-time medical imaging analysis.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Europe AI Chipsets Market includes NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), IBM Corporation, Qualcomm Incorporated, Samsung Electronics Co., Ltd., Micron Technology Inc., Xilinx Inc., Graphcore, and Axelera AI are some of the key market players.s

The competition in the Europe AI chipsets market is marked by a dynamic mix of global technology leaders, emerging European startups, and state-backed initiatives aimed at achieving strategic autonomy in AI hardware. Established players like NVIDIA, Intel, and AMD continue to dominate due to their extensive R&D capabilities, mature product portfolios, and strong footholds in enterprise and cloud computing domains.

However, the rise of specialized AI chipmakers both independent and backed by European innovation programs is adding new dimensions to the competitive landscape. Companies focusing on FPGA-based and ASIC-based AI accelerators are gaining traction by offering domain-specific optimization, particularly in edge computing, robotics, and embedded AI applications.

Government policies, including the EU Chips Act and national funding programs in Germany, France, and the Netherlands, are reshaping the environment by encouraging domestic semiconductor development and attracting foreign investment. This policy-driven momentum is fostering homegrown innovation while intensifying competition among global players seeking to capture a share of Europe’s expanding AI hardware demand. Moreover, ethical AI concerns and regulatory scrutiny are influencing chipset design and deployment strategies by pushing vendors toward more transparent, energy-efficient, and secure computing solutions.

Top Players in the Europe AI Chipsets Market

NVIDIA Corporation

NVIDIA is a dominant force in the Europe AI chipsets market by offering high-performance GPUs that power deep learning, neural network training, and edge computing applications. The company’s CUDA architecture and Tensor Core technologies have become industry standards for AI development across academic, enterprise, and industrial sectors in Europe.

In research institutions across Germany and France, NVIDIA's GPU platforms are widely used for large-scale model training and scientific simulations. Additionally, automotive manufacturers like BMW and Volvo integrate NVIDIA’s DRIVE platform into autonomous vehicle systems for real-time AI inference.

Beyond hardware, NVIDIA actively supports AI ecosystem development through software tools like NGC (NVIDIA GPU Cloud) and partnerships with European startups and cloud providers. Its influence extends beyond chipset manufacturing, which is shaping how AI workloads are structured, optimized, and deployed across the continent.

Intel Corporation

Intel plays a crucial role in the Europe AI chipsets market by providing a broad portfolio of processors tailored for both training and inference applications. Through its acquisition of Habana Labs and continued development of Movidius and Nervana technologies, Intel offers dedicated AI accelerators alongside its Xeon CPUs optimized for AI workloads.

The company collaborates closely with European data centers, industrial automation firms, and defense agencies to deliver scalable AI solutions. In Germany and the Netherlands, Intel’s AI chipsets are integrated into smart factories, enabling real-time analytics and predictive maintenance. Intel also works with academic institutions through its AI: Europe initiative, supporting research, education, and talent development.

Advanced Micro Devices (AMD)

AMD has steadily increased its footprint in the Europe AI chipsets market through its Radeon Instinct series, which competes directly with leading GPU-based AI accelerators. The company’s focus on open ecosystems and performance-per-watt efficiency makes its AI chipsets attractive to enterprises seeking cost-effective alternatives to proprietary solutions.

In the UK and Nordic countries, AMD collaborates with cloud service providers and AI research labs to offer competitive AI infrastructure tailored for sustainability-conscious organizations. Its ROCm software stack enables developers to leverage open-source frameworks for accelerated AI development.

Additionally, AMD partners with German and French automotive companies to supply AI accelerators for next-generation electric and autonomous vehicles. With growing emphasis on energy-efficient computing and flexible integration, AMD continues to expand its influence in the European AI hardware landscape.

Top Strategies Used by Key Market Participants

A primary strategy employed by key players in the Europe AI chipsets market is deepening partnerships with academic and research institutions by allowing companies to co-develop cutting-edge AI hardware tailored to emerging computational needs and ensuring long-term technological dominance.

Another major approach involves expanding localized R&D and manufacturing collaborations, especially within the framework of the EU Chips Act by enabling global vendors to align with regional semiconductor strategies and reduce dependency on external supply chains.

The companies are investing heavily in software ecosystems and developer tools by ensuring that AI chipsets are not only powerful but also easy to program and integrate with existing AI frameworks, thereby strengthening adoption across industries such as healthcare, finance, and automotive in Europe.

RECENT MARKET DEVELOPMENTS

- In January 2024, NVIDIA announced a collaboration with the Max Planck Institute in Germany to establish an AI supercomputing hub focused on climate modeling and biomedical research, reinforcing its position in academic and government AI initiatives.

- In March 2024, Intel launched a joint venture with the Technical University of Munich to develop next-generation AI accelerators optimized for industrial automation and autonomous mobility, enhancing its presence in Germany’s advanced manufacturing sector.

- In June 2024, AMD partnered with Siemens to integrate Radeon Instinct accelerators into industrial AI applications for predictive maintenance and digital twin development, marking a strategic expansion into the European Industry 4.0 ecosystem.

- In September 2024, Graphcore, a UK-based AI chipmaker, expanded its partnership with CERN to deploy IPU-powered systems for particle physics simulations by demonstrating strong support for mission-critical AI applications in scientific research.

- In November 2024, Qualcomm extended its Snapdragon Smart Protect technology to European automakers by enabling real-time AI inference for in-vehicle security and driver assistance systems, strengthening its foothold in the European automotive AI segment.

MARKET SEGMENTATION

This research report on the Europe AI chipsets market is segmented and sub-segmented into the following categories.

By Chipset

- CPU

- GPU

- FPGA

- ASIC

- Others

By Workload Domain

- Training

- Inference

By Computing Technology

- Cloud AI Computing

- Edge AI Computing

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the AI chipsets market in Europe?

Growth is driven by rising demand for AI-powered applications across automotive, healthcare, industrial automation, and consumer electronics sectors, along with government support for AI development.

What are the main applications of AI chipsets in Europe?

AI chipsets are used in self-driving cars, facial recognition systems, industrial robotics, smart assistants, and data centers for faster AI model processing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com