Europe Air to Water Heat Pump Market Research Report – Segmented By Technology Type (Air Source Heat Pumps, Water Source Heat Pumps), Application, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Air to Water Heat Pump Market Size

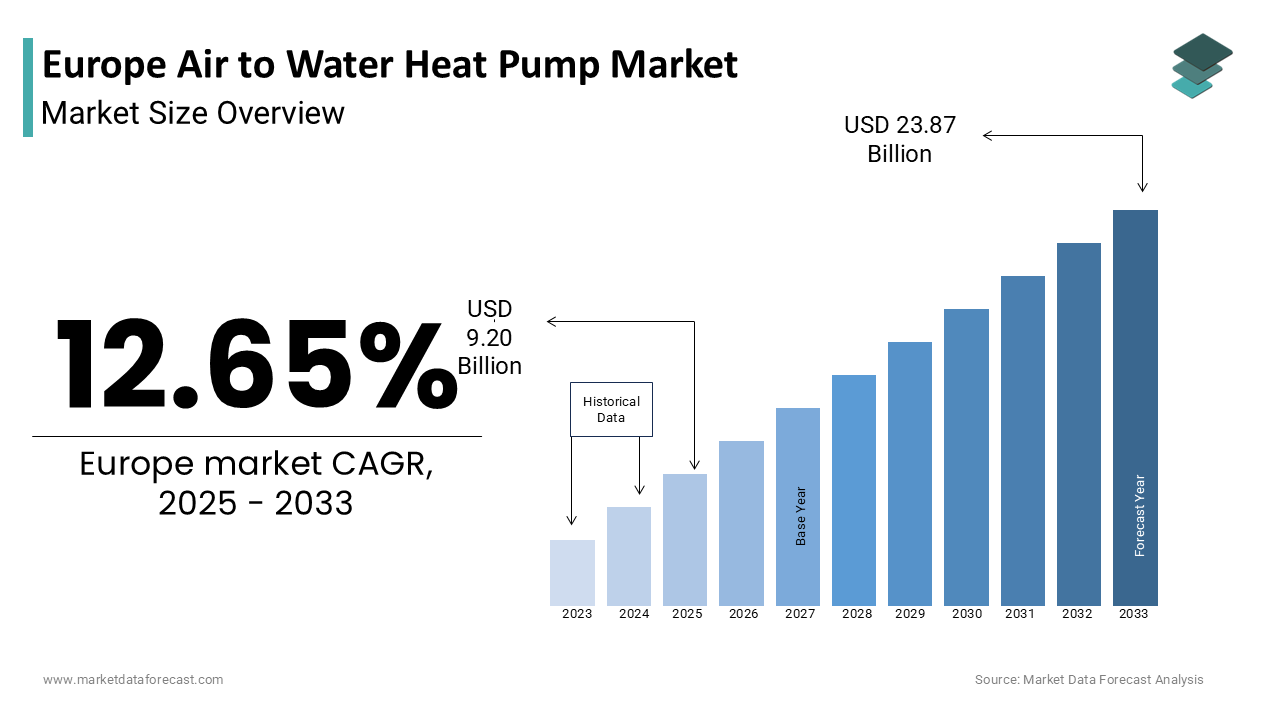

The Europe Air to Water Heat Pump Market was worth USD 8.17 billion in 2024. The Europe market is expected to reach USD 23.87 billion by 2033 from USD 9.20 billion in 2025, rising at a CAGR of 12.65% from 2025 to 2033.

The Europe air to water heat pump market refers to a category of heating systems that extract thermal energy from ambient air and transfer it to water for space heating, domestic hot water, and underfloor heating applications. These systems are gaining prominence as an efficient and environmentally sustainable alternative to fossil fuel-based heating technologies. With growing emphasis on carbon neutrality and energy efficiency across residential, commercial, and public infrastructure sectors, air to water heat pumps have become integral to Europe’s clean energy transition strategy.

The European Environment Agency highlights that heat pumps can reduce household CO₂ emissions majorly compared to conventional gas boilers. Countries such as France, Germany, and Sweden have integrated these systems into national building codes and renovation programs aimed at decarbonizing the built environment.

MARKET DRIVERS

Increasing Stringency of Environmental Regulations

One of the primary drivers of the Europe air to water heat pump market is the tightening of environmental regulations aimed at reducing carbon emissions from the building sector. According to the European Environment Agency, buildings account for approximately 40% of total energy consumption and 36% of greenhouse gas emissions in the EU. In response, the European Union has introduced policies such as the Energy Performance of Buildings Directive (EPBD) and the Ecodesign for Sustainable Products Regulation (ESPR), which mandate higher energy efficiency standards and phase out high-emission heating systems. As per the European Commission, nearly 25 million fossil fuel boilers are expected to be replaced by 2030 under the Fit for 55 package, which seeks to cut net greenhouse gas emissions by at least 55% by the end of the decade. Air to water heat pumps, known for their ability to deliver three to four units of heat for every unit of electricity consumed, align well with these regulatory objectives. Several member states, including the Netherlands and Belgium, have already implemented bans or restrictions on new gas boiler installations in residential buildings. Besides, the EU Taxonomy for Sustainable Activities includes heat pump deployment as a qualifying green investment, encouraging both public and private funding flows into this technology.

Government Subsidies and Financial Incentives

Another major driver of the Europe air to water heat pump market is the availability of substantial government subsidies and financial incentives aimed at promoting cleaner heating solutions. Across the continent, national governments have introduced grants, tax credits, and low-interest loans to offset the initial installation costs of heat pump systems, making them more accessible to homeowners and businesses. France’s MaPrimeRénov’ scheme, one of the largest renovation incentive programs in Europe, provides homeowners with direct financial support for installing renewable heating systems, including air to water heat pumps. Similarly, Germany’s Federal Office of Economics and Export Control (BAFA) offers rebates covering up to 35% of installation costs for eligible households. The UK’s Boiler Upgrade Scheme also promotes heat pump adoption by offering £5,000 grants to replace gas boilers with low-carbon alternatives.

MARKET RESTRAINTS

High Initial Installation Costs

A significant restraint impeding the growth of the Europe air to water heat pump market is the relatively high initial cost of installation compared to traditional heating systems. Although air to water heat pumps offer long-term energy savings and reduced carbon emissions, the upfront investment required for equipment purchase and system integration remains a deterrent for many consumers. This expense is notably higher than the cost of replacing a standard gas or oil boiler. While government subsidies help mitigate some of these costs, they do not fully eliminate the financial burden, especially for lower-income households. Moreover, retrofitting older buildings with compatible heating infrastructure, such as underfloor heating or larger radiators—adds further expenditure, limiting widespread adoption. These economic and structural challenges continue to slow down market penetration despite strong policy backing and environmental benefits.

Seasonal Efficiency Variability in Colder Climates

Another critical constraint affecting the Europe air to water heat pump market is the decline in efficiency during periods of extreme cold, particularly in Northern and Eastern European regions. Unlike ground source heat pumps, which maintain stable performance year-round, air to water heat pumps rely on ambient air temperature to extract thermal energy. According to the European Environment Agency, when outdoor temperatures fall below freezing, the coefficient of performance (COP) of air source heat pumps can drop significantly, sometimes below 2.0, reducing overall energy efficiency. This limitation poses a challenge in countries such as Sweden, Finland, and Poland, where winter temperatures frequently dip below -10°C. In such conditions, supplementary heating systems are often required to meet indoor comfort demands, increasing operational costs and diminishing the perceived value proposition of air to water heat pumps. As per the International Energy Agency (IEA), even with advancements in cold-climate models, the performance gap between air and ground source systems remains a concern for policymakers and consumers alike. Also, awareness gaps regarding system sizing, insulation requirements, and optimal operating conditions further hinder adoption in colder regions

MARKET OPPORTUNITIES

Integration with Smart Home and Building Management Systems

A promising opportunity for the Europe air-to-water heat pump market lies in the integration of these systems with smart home and intelligent building management platforms. As digitalization transforms the built environment, there is a growing trend toward connected, data-driven energy solutions that optimize heating efficiency, monitor usage patterns, and enhance user experience. Heat pump manufacturers are increasingly incorporating IoT-enabled controls and AI-driven optimization algorithms to improve system responsiveness and energy savings. For instance, companies like Vaillant and Mitsubishi Electric have launched smart-compatible air to water heat pumps that integrate seamlessly with mobile apps and home automation systems. The European Telecommunications Network Operators' Association (ETNO) notes that smart heating solutions can reduce annual energy consumption reinforcing their appeal in residential and commercial applications.

Expansion of District Heating Networks Using Decentralized Air Source Units

An emerging opportunity for the Europe air to water heat pump market is their application within decentralized district heating networks, particularly in urban and semi-urban areas. Traditional district heating systems rely heavily on centralized fossil fuel plants; however, there is a growing shift toward low-carbon alternatives, including modular heat pump clusters that serve multi-unit residential and commercial buildings. According to the International Energy Agency (IEA), decentralized heat pump-based district heating could supply up to 25% of urban heating demand in Europe by 2030. Cities such as Copenhagen, Amsterdam, and Vienna have pioneered pilot projects integrating air to water heat pumps into localized heating grids, leveraging excess heat recovery and renewable electricity sources. These configurations offer advantages over large-scale central systems by reducing distribution losses and minimizing infrastructure investment. As per the European Environment Agency, decentralized district heating with heat pumps can achieve lower CO₂ emissions compared to conventional gas-fired networks.

MARKET CHALLENGES

Supply Chain Constraints and Component Shortages

A major challenge confronting the Europe air to water heat pump market is the ongoing disruption in global supply chains, particularly concerning key components such as compressors, heat exchangers, and refrigerants. The post-pandemic economic recovery, geopolitical tensions, and raw material shortages have led to extended lead times and increased manufacturing costs for heat pump producers. According to the European Heat Pump Association (EHPA), delivery delays for core components surged in 2023 compared to pre-2020 levels. Manufacturers reliant on semiconductor chips for electronic controls and variable-speed compressors have faced production bottlenecks, impacting order fulfillment across the region. Apart from these, fluctuations in copper and aluminum prices—both essential for heat exchanger production—have added financial pressure. The European Commission has acknowledged these concerns, urging diversification of supplier bases and strengthening of local manufacturing capacity through initiatives such as the Critical Raw Materials Act.

Lack of Skilled Installers and Technical Expertise

Another significant challenge facing the Europe air to water heat pump market is the shortage of skilled installers and technical professionals capable of deploying and maintaining these advanced heating systems. Unlike conventional boilers, air to water heat pumps require specialized knowledge in refrigeration cycles, hydronic design, and system integration with existing building infrastructure. According to the European Centre for the Development of Vocational Training (CEDEFOP), fewer than 15% of HVAC technicians in the EU possess formal qualifications in heat pump installation and commissioning. This skills gap has resulted in inconsistent service quality, longer installation times, and suboptimal system performance, discouraging potential adopters. Industry associations such as the European Association of Refrigeration, Air Conditioning and Heat Pumps (REHVA) highlight that training programs have not kept pace with the rapid market expansion driven by policy mandates. Governments and vocational institutions are beginning to address this issue through certification schemes and apprenticeship programs, but progress remains uneven across member states.

SEGMENTAL ANALYSIS

By Technology Type Insights

The Air source heat pumps segment was at the forefront of the Europe air to water heat pump market in 2024. According to the European Heat Pump Association (EHPA), over 2.4 million heat pumps were installed across Europe in 2023, with more than 90% of these being air source variants. The dominance of this segment stems from its relatively simple installation process compared to ground or water source alternatives, which require extensive groundwork or access to a water body. One major driver is the adaptability of air source heat pumps to both new and existing buildings. Moreover, technological advancements have improved cold-weather performance, allowing broader adoption even in Northern Europe. Government policies also play a crucial role. Countries such as France and Germany offer higher subsidies for air source heat pumps compared to other types, making them more financially accessible.

Water source heat pumps represent the fastest-growing segment in the Europe air to water heat pump market, projected to expand at a CAGR of a 11.5%. While currently smaller in volume compared to air source units, their adoption is accelerating due to superior efficiency and suitability for district heating applications. According to the International Energy Agency (IEA), water source heat pumps typically maintain a coefficient of performance (COP) above 4.0 year-round, significantly higher than air source models in colder conditions. This makes them particularly attractive for large-scale residential and commercial developments in urban areas where centralized heating networks are expanding. In cities like Copenhagen and Vienna, municipal authorities are implementing large-scale pilot projects using lake-source and river-source heat pump installations to decarbonize public housing and office complexes.

By Application Insights

The residential application segment accounts for approximately 70% of the Europe air to water heat pump market, driven primarily by increasing home renovation activities and government-led decarbonization initiatives. One key factor behind the dominance of the residential segment is the growing preference for low-carbon heating alternatives among homeowners. Government subsidy programs such as France’s MaPrimeRénov’ and Germany’s KfW funding schemes have made it financially viable for households to replace aging gas boilers with efficient air to water heat pump systems. These trends collectively reinforce the residential sector as the largest and most influential application segment in the European air to water heat pump market.

The commercial application segment is emerging as the fastest-growing within the Europe air to water heat pump market, projected to expand at a CAGR of 13% through 2033. This growth is fueled by stringent sustainability mandates for non-residential buildings and the increasing integration of renewable heating technologies in corporate environmental, social, and governance (ESG) strategies. Moreover, the rise of green building certifications like BREEAM and LEED has incentivized businesses to invest in high-efficiency air to water heat pump systems. In urban centers such as Amsterdam, Stockholm, and Berlin, real estate firms are retrofitting office spaces with smart-enabled heat pumps to align with net-zero targets.

By Capacity Insights

The small-scale air to water heat pumps dominated the European market by holding an estimated 65.5% of total market share in 2024. The widespread adoption of this capacity segment is attributed to the prevalence of individual household heating needs and favorable policy support for residential users. A key driver is the compatibility of small-scale systems with typical domestic heating infrastructures, including radiator setups and underfloor heating. As per the International Energy Agency (IEA), a significant share of European homes operate with decentralized heating systems, making small-scale heat pumps an ideal replacement for conventional boilers. Besides, manufacturers have optimized product designs to ensure ease of installation and lower upfront costs, enhancing affordability for homeowners. Furthermore, national incentive programs such as Germany’s BAFA grants and France’s MaPrimeRénov’ scheme disproportionately target small-scale installations, offering generous rebates that encourage adoption.

The medium-scale air to water heat pumps are experiencing the highest expansion rate in the Europe market, projected to expand at a CAGR of 14.8%. This category typically serves multi-dwelling residential buildings, small commercial facilities, and community heating systems, aligning with the increasing trend toward decentralized yet collective heating solutions. According to the International Energy Agency (IEA), medium-scale heat pump installations grew in 2023, driven by urban housing modernization and the expansion of district heating networks. Moreover, local governments are promoting medium-scale installations through targeted funding and streamlined permitting processes. Cities such as Copenhagen and Vienna have launched municipal programs integrating these systems into public housing and mixed-use developments. The European Commission’s Renovation Wave Strategy further supports this shift by encouraging the adoption of modular heating solutions that can be deployed rapidly without requiring a full infrastructure overhaul.

REGIONAL ANALYSIS

Germany was in the top position in the Europe air to water heat pump market by accounting for 25.2% of total regional revenue. As Europe’s largest economy and a leader in sustainable energy transition, Germany has aggressively pursued heat pump adoption to meet its climate neutrality goals by 2045. The country’s regulatory framework, including the Renewable Energies Heat Act (EWärmeG), mandates the use of renewable heating in new constructions, reinforcing market growth. Also, the German government provides generous subsidies through the Federal Office of Economics and Export Control (BAFA), covering a notable share of installation costs.

France is another key player in the market. The country’s commitment to reducing carbon emissions from buildings has spurred significant investment in clean heating technologies, with air to water heat pumps playing a central role in national decarbonization efforts. This initiative has been instrumental in replacing outdated oil and gas boilers with high-efficiency heat pump systems.

Italy contributes a key share of the Europe air to water heat pump market, driven by increasing awareness of energy efficiency and supportive fiscal policies. The Mediterranean climate, particularly in southern regions, enhances the efficiency of air source models, making them a preferred choice for homeowners seeking alternatives to traditional gas heating.

The Swedish market is supported by a long-standing commitment to renewable energy and carbon neutrality. According to Statistics Sweden (SCB), over 900,000 heat pumps are currently in operation across the country, with air to water models representing a growing share due to advancements in cold-climate performance. The Swedish Energy Agency promotes heat pump adoption through financial incentives, including investment grants and reduced VAT for residential installations. Additionally, Sweden’s national climate policy aims for net-zero emissions by 2045, with heat pumps serving as a core component of building decarbonization strategies.

The Netherlands market is driven by aggressive policy interventions aimed at phasing out natural gas in residential buildings. The Dutch government has implemented several initiatives to promote heat pump adoption, including the ISDE subsidy program, which provides financial support based on system efficiency and carbon reduction potential. Also, these incentives have helped accelerate the transition away from gas, particularly in densely populated urban areas where pipeline decommissioning is underway. Additionally, the Netherlands has pioneered the development of heat pump clusters integrated with district heating networks, especially in cities like Utrecht and Rotterdam.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The competition in the Europe air to water heat pump market is marked by a convergence of global leaders, regional specialists, and emerging local players striving to capture a growing share of the renewable heating sector. Established multinational corporations leverage their technological expertise, financial strength, and established distribution channels to maintain dominance, particularly in high-demand markets such as Germany, France, and Sweden. At the same time, regional brands are gaining traction by offering cost-competitive, locally adapted solutions that align with national policy incentives and installer preferences.

Innovation is a key battleground, with companies racing to develop more efficient, cold-resistant models that can operate effectively across diverse climatic zones. Strategic collaborations between manufacturers, utilities, and housing developers are also shaping competitive dynamics, as firms seek to embed heat pumps into broader energy transition initiatives. Additionally, the emphasis on digitalization, including smart controls and predictive maintenance, is becoming a differentiator in an increasingly sophisticated market. As demand accelerates due to regulatory mandates and consumer awareness, the battle for market leadership is intensifying, prompting companies to refine their value propositions and expand their footprint across Europe.

Top Players in the Europe Air to Water Heat Pump Market

Daikin Industries, Ltd.

Daikin is a leading global manufacturer of heating and cooling solutions with a strong presence in the European air to water heat pump market. The company has positioned itself as an innovator by offering high-efficiency, cold-climate-compatible models tailored for diverse residential and commercial applications across Europe. Daikin’s commitment to sustainability aligns with EU climate goals, enabling it to support large-scale building decarbonization initiatives. Its extensive distribution network and local service infrastructure have made it a trusted brand among installers and end users alike.

Mitsubishi Electric Corporation

Mitsubishi Electric plays a pivotal role in shaping the European air to water heat pump landscape through its advanced inverter-driven technology and smart integration capabilities. The company emphasizes energy efficiency, system durability, and user-friendly controls, making its products ideal for both retrofit and new-build projects. Mitsubishi Electric collaborates closely with European governments and energy agencies to promote renewable heating adoption and contributes to research on grid-responsive heat pump systems that enhance energy flexibility across the continent.

Vaillant Group

Vaillant is a key player in the European heating industry and a major contributor to the air to water heat pump segment. Known for its deep understanding of regional heating needs, Vaillant designs highly adaptable heat pump systems suited for various climatic conditions and building types. The company actively participates in national subsidy programs and works with installers to improve technical training and after-sales service.

Top Strategies Used by Key Market Participants in the Europe Air to Water Heat Pump Market

One of the primary strategies employed by leading companies in the Europe air to water heat pump market is product innovation focused on cold-climate performance. Manufacturers are continuously enhancing compressor technology and refrigerant cycles to ensure efficient operation even in sub-zero temperatures, expanding their usability in Northern and Eastern Europe. These advancements make heat pumps a viable alternative to traditional heating systems in regions previously considered unsuitable.

Another key strategy involves strengthening partnerships with government bodies and installer networks. Companies are working closely with policymakers to influence subsidy frameworks and building regulations while also investing in technician training programs. This dual approach ensures smoother adoption and better post-installation support, improving consumer confidence in heat pump technology.

Lastly, firms are increasingly adopting digital integration and smart control features in their heat pump systems. By incorporating IoT-enabled thermostats, remote monitoring, and adaptive learning algorithms, manufacturers are enhancing system efficiency and user engagement, positioning heat pumps as intelligent, future-ready heating solutions.

RECENT MARKET DEVELOPMENTS

- In March 2024, Daikin expanded its production facility in Belgium to increase output capacity for air to water heat pumps, aiming to meet rising demand across Western and Central Europe while reducing lead times for local customers.

- In June 2024, Mitsubishi Electric launched a dedicated European training academy for HVAC professionals, focusing on heat pump installation and maintenance to address skill shortages and improve system performance and reliability.

- In October 2024, Vaillant introduced a new line of AI-integrated air to water heat pumps designed to optimize energy use based on occupancy patterns and weather forecasts, enhancing efficiency and user experience in residential settings.

- In January 2025, NIBE Industrier AB acquired a German-based smart thermostat startup to integrate intelligent control systems into its heat pump portfolio, strengthening its position in the connected heating solutions space.

- In February 2025, Bosch Thermotechnology announced a strategic partnership with a leading European utility provider to co-develop turnkey heat pump packages for multi-family housing units, facilitating large-scale deployment in urban areas.

MARKET SEGMENTATION

This research report on the Europe air to water heat pump market is segmented and sub-segmented into the following categories.

By Technology Type

- Air Source Heat Pumps

- Water Source Heat Pumps

By Application

- Residential

- Commercial

By Capacity

- Small Scale

- Medium Scale

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the air to water heat pump market in Europe?

Growth is driven by strict EU climate goals, carbon emission reduction policies, rising energy efficiency standards, and increasing demand for low-carbon heating solutions in residential and commercial buildings.

What is the future outlook for the Europe air to water heat pump market?

The market is expected to grow significantly as Europe moves toward net-zero emissions, with strong demand for energy-efficient and climate-friendly heating solutions.

What challenges does the market face?

Key challenges include high initial installation costs, retrofit complexity in older buildings, and lack of consumer awareness in some regions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com