Europe Aluminium Cans Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Application And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Europe Aluminium Cans Market Size

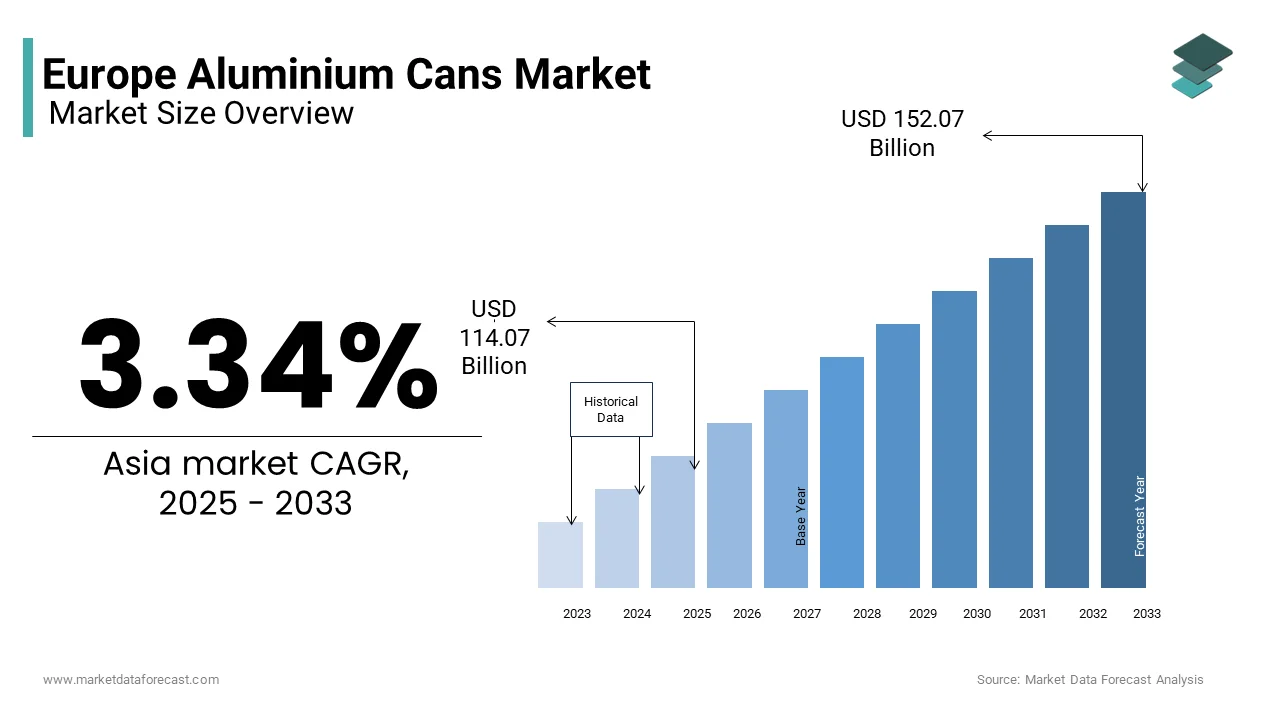

The European aluminum cans market was valued at USD 110.04 billion in 2024 and is anticipated to reach USD 114.07 billion in 2025 from USD 152.07 billion by 2033, growing at a CAGR of 3.34% during the forecast period from 2025 to 2033.

Aluminium cans are widely used for packaging carbonated soft drinks, beer, energy drinks, and ready-to-drink beverages. According to Eurostat, in 2023, the overall metal packaging industry in Europe contributed more than €25 billion to the manufacturing GDP, with aluminium cans accounting for a significant share. This robust growth trajectory is underpinned by evolving consumer preferences toward eco-friendly packaging, which is rising demand from craft breweries, and innovations in can design and coatings. Moreover, the expansion of e-commerce and convenience retail has further stimulated the usage of compact, portable aluminium cans across urban centers.

MARKET DRIVERS

Increasing Demand for Sustainable Packaging Solutions

One of the primary drivers of the Europe aluminium cans market is the growing emphasis on sustainability across industries within the beverage sector. Aluminium is among the most recycled materials globally, with a recycling rate exceeding 70% in Europe, as reported by the European Aluminium Association in 2023. In 2023, the EU passed updated directives under the Circular Economy Action Plan, mandating member states to increase packaging recycling rates to at least 75% by 2030. This regulatory push has prompted major beverage producers like Coca-Cola and Heineken to transition from plastic bottles to aluminium cans for select product lines. Moreover, consumer awareness regarding environmental issues has surged in recent years. A survey conducted by YouGov in late 2023 found that nearly 68% of European consumers prefer products packaged in recyclable materials, with aluminium cans being the most favored option.

Growth in Craft Brewing and Specialty Beverages Sector

Another key driver fueling the Europe aluminium cans market is the rapid expansion of the craft brewing and specialty beverage industry. Over the past decade, there has been a notable rise in microbreweries and independent beverage brands, especially in countries like Germany, the UK, and the Netherlands. Craft brewers increasingly favor aluminium cans over traditional glass bottles due to their portability, light weight, and ability to protect contents from UV exposure and oxygen ingress—factors critical to maintaining beverage quality. Furthermore, cans offer greater flexibility in design and branding, allowing small-scale producers to stand out in competitive markets. Additionally, the rise of ready-to-drink (RTD) cocktails and functional beverages, such as sports drinks, energy drinks, and hard seltzers that has further bolstered demand for aluminium cans.

MARKET RESTRAINTS

Volatility in Raw Material Prices

One of the major restraints affecting the Europe aluminium cans market is the volatility in raw material prices, particularly for primary and secondary aluminium. The cost of aluminium, which constitutes the majority of production expenses for can manufacturers, is heavily influenced by global supply chain dynamics, energy prices, and geopolitical tensions. This fluctuation has placed pressure on companies such as Ball Corporation and Ardagh Group, two of the largest can manufacturers in Europe, to absorb rising input costs or pass them on to beverage clients. In 2023, several contract renegotiations between can producers and beverage brands were observed, with some customers seeking alternative packaging solutions to mitigate financial risk. Additionally, the European Union’s Carbon Border Adjustment Mechanism (CBAM), introduced in pilot phase in 2023, added further complexity to pricing structures by imposing indirect carbon costs on imported metals.

Moreover, energy-intensive smelting processes required for primary aluminium production have been impacted by soaring electricity prices, particularly in regions reliant on fossil fuels. Data from Eurostat revealed that industrial electricity prices in Germany rose by 22% in 2023 compared to the previous year, directly influencing domestic aluminium output.

Regulatory Constraints on Metal Packaging Migration Levels

Regulatory scrutiny concerning the migration of metallic substances into food and beverages presents another significant challenge to the Europe aluminium cans market. The European Food Safety Authority (EFSA) sets strict limits on the permissible levels of aluminium that can migrate into consumables, especially acidic beverages such as fruit juices and carbonated drinks. These regulations necessitate the use of high-quality internal lacquers and coatings to prevent direct contact between the beverage and the metal surface. However, developing compliant coating technologies increases production costs and requires additional testing protocols.

Furthermore, the ongoing revision of the EU’s Regulation (EC) No 1895/2004 on food contact materials may lead to even stricter thresholds shortly. Consumer advocacy groups have also raised concerns about the potential leaching of bisphenol A (BPA) from epoxy coatings used in can linings, prompting some manufacturers to switch to BPA-free alternatives at a higher expense. These evolving regulatory landscapes pose a persistent constraint on the growth and profitability of the aluminium can industry in Europe.

MARKET OPPORTUNITIES

Expansion of E-commerce and On-the-Go Consumption Trends

A major opportunity driving the Europe aluminium cans market is the rapid expansion of e-commerce and the growing trend of on-the-go consumption. According to Eurostat, online retail sales in the EU food and beverage sector grew by 11% in 2023 compared to the previous year, which indicates a structural shift in purchasing behavior. Aluminium cans are particularly well-suited for e-commerce due to their compact size, stackability, and resilience during transit. Brands such as Carlsberg and PepsiCo have launched exclusive can-only packs designed specifically for online sales, capitalizing on the convenience factor. Moreover, the rise of mobile lifestyles, especially among urban professionals and millennials, has amplified demand for portable and easy-to-carry beverage options. Nielsen data from late 2023 showed that 62% of European consumers prefer buying beverages in single-serve cans for outdoor activities, travel, and workplace consumption. This behavioral shift has encouraged manufacturers to invest in lightweight, resealable, and aesthetically appealing can designs, which is creating fresh growth avenues in the European market.

Technological Innovations in Can Manufacturing Processes

Technological advancements in can manufacturing are opening new opportunities for the Europe aluminium cans market. The adoption of digital printing, ultra-thin gauge materials, and automated production systems is enhancing efficiency while enabling greater customization for brand differentiation. In 2023, Ball Corporation introduced a fully digital printing line at its facility in Gliwice, Poland, allowing beverage brands to launch limited-edition can designs without minimum order requirements, with a breakthrough for small and medium-sized beverage producers.

Additionally, innovations in can coatings and barrier technologies have enabled improved shelf life and taste preservation, addressing key concerns of beverage producers. In 2023, Valspar launched a next-generation water-based internal coating system that eliminated the need for solvent-based applications, aligning with sustainability goals.

MARKET CHALLENGES

Intensifying Competition from Alternative Packaging Materials

One of the foremost challenges confronting the Europe aluminium cans market is the intensifying competition from alternative packaging materials such as glass bottles, PET plastics, and paper-based containers. While aluminium offers distinct advantages in terms of recyclability and barrier properties, competing materials continue to innovate and capture market share in specific beverage categories.

Glass bottles, for example, remain popular among premium beer and artisanal beverage producers due to their perceived premiumness and reusability. According to the British Glass Manufacturers’ Confederation, in 2023, glass bottle sales in the UK beverage sector grew by 6%, partly driven by the resurgence of refill schemes and local bottling initiatives. Paper-based packaging, backed by major players like Tetra Pak and SIG Combibloc, is gaining traction in the juice and dairy sectors due to its renewable sourcing claims. In 2023, Tetra Pak reported a 12% increase in carton sales across Western Europe, fueled by partnerships with eco-conscious brands aiming to reduce reliance on metals and plastics.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability and supply chain disruptions present a significant challenge to the Europe aluminium cans market. Europe relies heavily on imports for both raw aluminium and semi-finished can sheet materials, with Russia historically being a major supplier before the imposition of sanctions following the Ukraine conflict. According to data from the International Aluminium Institute, Russian imports accounted for nearly 25% of Europe’s primary aluminium supply before 2022.

Since the escalation of hostilities, European manufacturers have had to seek alternative sources, often at higher costs and with longer lead times. In 2023, the European Commission reported a 14% increase in import costs for non-Russian aluminium, which is primarily sourced from North America and the Middle East. This dependency on external suppliers exposes the market to fluctuations in international trade policies and logistical bottlenecks.

Furthermore, ongoing conflicts in regions such as the Red Sea have disrupted maritime shipping routes, delaying raw material deliveries and increasing freight costs. In Q1 2024, the Baltic Dry Index recorded a spike of over 30% due to the rerouting of cargo vessels around Africa, impacting the availability of timely inputs for can production. These supply-side constraints have forced companies to reassess procurement strategies and consider localized sourcing options, though establishing new supply chains remains a complex and time-consuming endeavor.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.34% |

|

Segments Covered |

By Application, And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

Ball Corporation, Ardagh Group S.A., Crown Holdings Inc., Silgan Holdings Inc., CAN-PACK SA, CCL Container Inc. (CCL Industries Inc.), Tecnocap Group, Saudi Arabia Packaging Industry WLL (SAPIN), Massilly Holding SAS, CPMC HOLDINGS Limited (COFCO Group). |

SEGMENT ANALYSIS

By Application Insights

The beverages segment was the largest with a prominent share of the Europe aluminium cans market in 2024. One of the key factors fueling this segment’s growth is the rising demand for carbonated soft drinks and beer. In 2023, Germany alone consumed over 12 billion aluminium beverage cans, with beer and soft drinks making up more than 85% of that volume, as reported by Statista. Moreover, the growing popularity of craft beers and premium canned cocktails has further strengthened the demand for aluminium cans. Another driving factor is the increasing adoption of sustainable packaging solutions across the beverage sector. This high recyclability makes aluminium cans an attractive option for environmentally conscious consumers and brands aiming to meet stringent EU circular economy targets.

The food segment is swiftly growing with an anticipated CAGR of 6.4% in the coming years. One of the primary drivers behind this rapid growth is the surge in demand for ready-to-eat (RTE) and preserved food products, especially in urban centers. Additionally, the ongoing shift toward metal-based containers in the pet food sector is contributing to the expansion of this segment. According to the Pet Industry Trends Report 2023, over 45% of pet owners in France and Germany prefer aluminium canned pet food over plastic pouches due to perceived freshness and safety benefits. The ability of aluminium to protect contents from light, moisture, and oxygen enhances product longevity without requiring refrigeration, which is particularly beneficial in off-grid and outdoor settings. Moreover, regulatory support for sustainable packaging alternatives is also boosting the food can market. The European Commission’s Packaging and Packaging Waste Regulation (PPWR) proposal mandates that all food contact packaging should be reusable or recyclable by 2030.

COUNTRY ANALYSIS

Germany was the largest contributor to the Europe aluminium cans market by holding 22.3% of the share in 2024. One of the major driving forces behind Germany’s leading position is its well-established brewing culture. In 2023, the country produced over 8.5 billion litres of beer, with approximately 30% of that volume packaged in aluminium cans, according to the Central Association of the German Brewing Industry (CAB). The rise of microbreweries and the growing preference for portable, eco-friendly packaging have further accelerated can adoption.

Additionally, Germany leads in sustainability initiatives, boasting an aluminium can recycling rate of over 90%, one of the highest in Europe, as reported by the Federal Environment Agency (UBA). Stringent environmental regulations and proactive government policies promoting circular economy practices have encouraged beverage producers to adopt aluminium packaging. Furthermore, the presence of major can manufacturing facilities operated by companies like Ball Corporation and Ardagh Group ensures a stable supply chain, reinforcing Germany’s dominant position in the regional market.

France was positioned second with 14.3% of the Europe aluminium cans market share in 2024. One of the key drivers of demand in France is the expanding soft drink sector. In 2023, the country consumed over 6 billion aluminium cans, with carbonated soft drinks accounting for nearly 55% of that volume, as per INSEE, the national statistical institute. Major beverage corporations such as PepsiCo and Danone have increasingly adopted aluminium cans for their bottled water and flavored drinks due to their recyclability and consumer appeal.

Furthermore, the French government’s commitment to reducing single-use plastics has played a crucial role in shaping packaging trends. Under the Anti-Waste for a Circular Economy Law (AGEC), introduced in 2023, businesses are required to phase out non-recyclable plastic bottles for beverages under 3 liters by 2025. This regulatory push has prompted a shift towards aluminium cans, which offer a more sustainable alternative. Additionally, a survey conducted by IFOP in late 2023 found that 64% of French consumers prefer aluminium cans over plastic bottles, citing environmental concerns as the primary reason.

United Kingdom aluminium cans market is lucratively growing with prominent CGAR during the forecast period. A key driver of the UK’s robust aluminium can consumption is the thriving craft beer industry. According to The Society of Independent Brewers (SIBA), there were over 2,500 active breweries in the UK in 2023, many of which opted for aluminium cans due to their portability, protection against UV degradation, and branding flexibility. Additionally, the UK government’s implementation of the Plastic Packaging Tax in April 2022 has significantly influenced packaging choices. The tax imposes a levy of £200 per tonne on plastic packaging containing less than 30% recycled content, encouraging beverage brands to switch to alternative materials like aluminium.

The Italian aluminium cans market is likely to grow steadily throughout the forecast period. The country’s long-standing tradition in beverage production, particularly beer and soft drinks, contributes significantly to its market standing. In 2023, beer accounted for over 50% of all aluminium can usage in the country, with domestic consumption reaching nearly 2.5 billion units, as reported by Unionbirrai, the Italian Brewers Association. Craft breweries, in particular, have embraced aluminium cans due to their convenience, lightweight nature, and superior preservation qualities, which help maintain flavor integrity. Another notable driver is the growing trend of on-the-go consumption among urban consumers. Nielsen data from late 2023 indicated that 58% of Italian consumers prefer single-serve aluminium cans for soft drinks and energy beverages when purchasing from convenience stores or vending machines.

Spain's aluminium cans market growth is likely to be driven by the beverage sector, and progressive environmental policies support its strong market position. A major driver of Spain’s aluminium can market is the expanding beer industry. The rise of local craft breweries and the increasing export of Spanish beers have further stimulated demand for lightweight, stackable, and easily transportable packaging options.

KEY MARKET PLAYERS

Ball Corporation, Ardagh Group S.A., Crown Holdings Inc., Silgan Holdings Inc., CAN-PACK SA, CCL Container Inc. (CCL Industries Inc.), Tecnocap Group, Saudi Arabia Packaging Industry WLL (SAPIN), Massilly Holding SAS, and CPMC HOLDINGS Limited (COFCO Group) are the market players that are dominating the Europe aluminium cans market.

Top Players in the Market

Ball Corporation is a leading global manufacturer of aluminium beverage cans and a dominant player in the European market. The company has a strong presence across Western and Eastern Europe, supplying to major beverage brands such as Coca-Cola, PepsiCo, and Heineken. Its focus on reducing carbon footprint through increased use of recycled aluminium aligns with evolving consumer and regulatory demands.

Ardagh Group is another major player in the Europe aluminium cans market, offering a diverse portfolio of metal and glass packaging solutions. With multiple production facilities across Germany, France, and the UK, Ardagh plays a crucial role in meeting the region’s rising demand for sustainable beverage containers. The company differentiates itself through advanced printing technologies, customer-centric design capabilities, and investments in circular economy initiatives. Its ability to offer tailored packaging solutions has made it a preferred partner for both multinational and craft beverage producers.

Crown Holdings Inc. holds a significant share in the European aluminium cans market, known for its extensive manufacturing network and technological expertise. The company supplies high-quality aluminium cans to a wide range of beverage categories, including beer, soft drinks, and energy drinks. Crown’s emphasis on innovation, particularly in easy-open ends and eco-friendly coatings, enhances its competitive edge. Its continuous expansion and modernization of production lines support efficiency and responsiveness to regional market dynamics.

Top Strategies Used by Key Market Participants

One of the primary strategies adopted by key players in the Europe aluminium cans market is product innovation and differentiation. Companies are investing heavily in developing lightweight, recyclable, and visually appealing can designs to cater to evolving consumer preferences and brand-specific marketing needs. Customizable printing, unique shapes, and functional features like resealable lids are being introduced to enhance shelf appeal and consumer engagement.

Another critical strategy is expanding production capacities and geographic footprint. Leading manufacturers are setting up new facilities or upgrading existing ones in emerging European markets to meet growing demand and reduce logistics costs. These expansions are often aligned with sustainability goals, incorporating energy-efficient machinery and processes that minimize environmental impact while ensuring scalability.

COMPETITION OVERVIEW

The competition in the Europe aluminium cans market is characterized by a mix of established global giants and regional players vying for dominance through innovation, sustainability, and operational efficiency. With increasing demand from the beverage industry and growing emphasis on recyclability, companies are under pressure to differentiate themselves not only through product quality but also through environmental performance and customization capabilities. Strategic acquisitions and capacity expansions are common tactics used to consolidate market presence and improve supply chain resilience. Manufacturers are also focusing on enhancing design flexibility, adopting digital printing technologies, and improving coating systems to meet stringent food safety regulations. The market remains highly consolidated, with a few key players controlling a majority of the supply, though niche players are gaining traction by catering to specialized segments such as craft breweries and premium beverage brands.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Ball Corporation announced the launch of a new state-of-the-art aluminium can manufacturing facility in Poland, which aimed at expanding its production capacity and better serving Central and Eastern European markets.

- In June 2023, Ardagh Group introduced an innovative digital printing technology across several of its European plants by enabling beverage brands to adopt customized and short-run can designs without compromising on speed or efficiency.

- In February 2024, Crown Holdings invested in upgrading its can end manufacturing line in Germany, focusing on producing eco-friendly, BPA-free can lids to align with evolving health and sustainability standards in the EU.

- In October 2023, Novelis, a key supplier of aluminium can sheet materials, entered into a long-term partnership with Ball Corporation to secure a consistent supply of high-recycled content aluminium for European production units.

- In May 2024, Rexam, now part of Graphic Packaging International, expanded its collaboration with independent craft brewers in the UK by offering tailored can packaging solutions designed to enhance brand visibility and consumer appeal in niche markets.

MARKET SEGMENTATION

This research report on the Asia Pacific aluminium cans market is segmented and sub-segmented into the following categories.

By Application

- Beverages

- Food

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s driving the growth of aluminium cans in Europe?

Rising consumer demand for sustainable packaging and strong EU regulations on single-use plastics are accelerating the shift to 100% recyclable aluminium cans in beverage and food sectors.

How are European recycling targets impacting aluminium can production?

EU mandates like the Circular Economy Action Plan require a 75% recycling rate for aluminium packaging by 2025, pushing producers to design cans for closed-loop recycling and reduce material loss.

Which industries are the biggest users of aluminium cans in Europe?

Beverages dominate—especially beer, energy drinks, and ready-to-drink cocktails—while pet food and nutraceuticals are growing segments due to longer shelf life and portability

How is innovation shaping aluminium can design in Europe?

Lightweighting, BPA-free linings, and resealable tops are gaining popularity, especially in Western Europe, where eco-conscious consumers prefer sustainable yet functional packaging.

What role does regional supply chain strength play in the aluminium can market?

Countries like Germany, France, and Poland lead in aluminium smelting and can manufacturing, offering robust infrastructure and lower transportation emissions for local sourcing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com