Europe AMI Electric Meter Market Size, Share, Trends & Growth Forecast Report By Product Type Smart Metering Devices, Services), End User, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe AMI Electric Meter Market Size

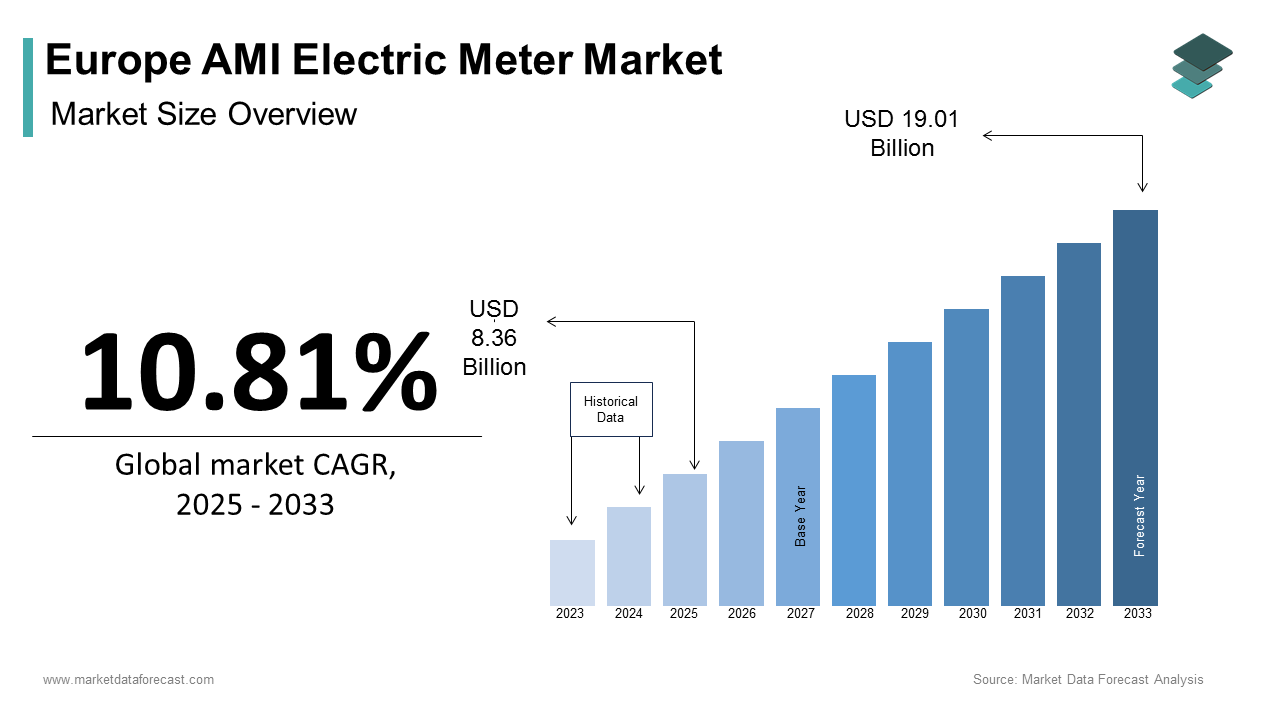

The Europe AMI Electric Meter Market size was calculated to be USD 7.55 billion in 2024 and is anticipated to be worth USD 19.01 billion by 2033, from USD 8.36 billion in 2025, growing at a CAGR of 10.81% during the forecast period.

Advanced Metering Infrastructure (AMI) electric meters are intelligent devices that enable two-way communication between utilities and consumers, allowing real-time monitoring, remote data collection, and improved energy management. In Europe, the adoption of AMI systems has been a strategic response to evolving energy policies, sustainability goals, and digital transformation in the utility sector. The European market is characterized by strong regulatory frameworks, proactive government support, and increasing investments in smart grid technologies.

As of 2024, over 150 million smart electricity meters have been deployed across the European Union, with countries like Italy, Sweden, and the Netherlands leading the implementation. This expansion aligns with the European Commission’s Clean Energy Package, which mandates member states to evaluate the cost-effectiveness of smart meter rollouts by 2029.

MARKET DRIVERS

Regulatory Mandates and Policy Support for Smart Grid Development

One of the primary drivers fueling the growth of the Europe AMI electric meter market is the robust regulatory environment promoting smart grid development and energy efficiency. The European Commission has implemented several directives aimed at modernizing energy infrastructure and reducing carbon emissions, directly influencing the adoption of AMI systems. For instance, the Third Energy Package enacted in 2009 laid the foundation for smart meter deployment by emphasizing consumer empowerment through accurate and timely energy usage data.

The Clean Energy for All Europeans Package, adopted in 2019, further reinforced this momentum by requiring member states to assess the economic viability of smart metering systems by 2029. In addition, the EU Digital Strategy emphasizes integrating digital technologies into energy systems, fostering innovation and interoperability in AMI deployments.

Countries such as France and Germany have made substantial progress under these policy frameworks. France’s Linky smart meter rollout, led by Enedis, has reached over 36 million installations as of 2024, covering nearly 95% of households.

Rising Demand for Real-Time Energy Monitoring and Consumer Empowerment

A key demand-side driver behind the rapid adoption of AMI electric meters in Europe is the growing need for real-time energy monitoring and greater consumer control over electricity consumption. With rising energy costs and increasing environmental awareness, both residential and commercial users are seeking tools to optimize their energy usage. AMI technology enables dynamic pricing models, facilitates demand response programs, and provides detailed consumption insights, thereby enhancing transparency and engagement in energy management. In response, utility providers have expanded their offerings to include digital platforms linked to AMI meters, enabling users to track hourly consumption and adjust usage patterns accordingly. Moreover, the integration of renewable energy sources and decentralized generation models has heightened the necessity for bidirectional communication capabilities offered by AMI systems.

MARKET RESTRAINTS

High Initial Deployment Costs and Financial Constraints

Despite the long-term benefits associated with Advanced Metering Infrastructure (AMI), one of the most significant restraints on the European AMI electric meter market is the high initial capital expenditure required for large-scale deployment. The installation of smart metering systems involves considerable investment in hardware, communication networks, software platforms, and workforce training. These upfront expenses pose a major challenge, particularly for smaller utility providers and emerging markets within the EU. For instance, Eastern European countries such as Bulgaria and Romania have lagged in smart meter adoption due to limited public and private funding. The disparity underscores the financial barriers that hinder uniform market growth. Additionally, while the European Investment Bank and other institutions provide financing for smart grid projects, many utilities face difficulties in securing long-term funding amid fluctuating energy prices and regulatory uncertainties.

Data Privacy Concerns and Cybersecurity Vulnerabilities

Another critical restraint affecting the Europe AMI electric meter market is the growing concern around data privacy and cybersecurity risks associated with smart metering systems. AMI meters collect granular, real-time data on household and industrial electricity consumption, which can reveal sensitive behavioral patterns. Cybersecurity threats also pose a serious challenge to the integrity of AMI networks. The interconnected nature of smart metering infrastructure makes it vulnerable to hacking attempts, ransomware attacks, and unauthorized access. These vulnerabilities raise alarms among regulators and consumers alike, delaying deployment timelines and increasing compliance costs for utility companies. In response, the EU has introduced stringent data protection measures under the General Data Protection Regulation (GDPR), mandating the secure handling of consumer information. However, compliance often necessitates additional investments in encryption, authentication protocols, and system audits, further escalating deployment expenses.

MARKET OPPORTUNITIES

Integration with Decentralized Energy Resources and Prosumer Models

A compelling opportunity driving the Europe AMI electric meter market is the increasing integration of decentralized energy resources (DERs), particularly rooftop solar photovoltaics, battery storage, and microgrids. As Europe transitions toward a more flexible and resilient energy system, AMI meters play a crucial role in enabling bidirectional energy flows and facilitating peer-to-peer energy trading. According to the International Renewable Energy Agency, DER capacity in Europe is expected to surpass 500 GW by 2030, up from 250 GW in 2024, highlighting the growing need for advanced metering infrastructure to manage distributed generation effectively. AMI meters provide the necessary communication backbone for net metering, time-of-use tariffs, and dynamic pricing mechanisms, which incentivize prosumers—consumers who generate their electricity—to participate actively in the energy market. Similarly, the Netherlands’ V2G (Vehicle-to-Grid) pilot programs rely on AMI-enabled smart charging stations to balance grid demand using electric vehicle batteries. Furthermore, the rise of local energy communities, supported by the European Commission’s Clean Energy Package, has created new business models centered on localized energy sharing.

Expansion of IoT and AI Technologies in Smart Grid Applications

The growing integration of Internet of Things (IoT) and artificial intelligence (AI) technologies into smart grid applications presents a significant opportunity for the Europe AMI electric meter market. These advancements enable real-time analytics, predictive maintenance, and automated demand-side management, enhancing the efficiency and reliability of energy distribution systems. AMI meters serve as foundational nodes in this digital ecosystem, collecting vast amounts of consumption data that can be processed using machine learning algorithms to detect anomalies, forecast demand, and optimize energy dispatch. Similarly, in Finland, Fortum utilizes IoT-connected AMI systems to integrate weather forecasting with grid performance metrics, enabling proactive adjustments during extreme climate events. By leveraging IoT and AI capabilities, AMI electric meters are poised to become central enablers of next-generation smart grids, unlocking unprecedented levels of automation and responsiveness across Europe’s energy landscape.

MARKET CHALLENGES

Interoperability Issues Across Diverse AMI Platforms

One of the foremost challenges confronting the Europe AMI electric meter market is the lack of standardized interoperability across different metering systems and communication protocols. Given the fragmented nature of Europe’s energy market—with varying technical specifications, vendor ecosystems, and regulatory requirements—ensuring seamless integration between AMI platforms remains a complex endeavor. According to the European Committee for Electrotechnical Standardization (CENELEC), inconsistencies in data formats, communication standards, and cybersecurity protocols have resulted in compatibility issues that hinder cross-border data exchange and system scalability. For instance, while Germany predominantly employs the DLMS/COSEM standard for smart meter communication, France utilizes the PRIME protocol, creating integration hurdles for multinational utilities operating across borders. Moreover, the presence of multiple proprietary systems from vendors such as Landis+Gyr, Sagemcom, and Kamstrup complicates efforts to establish a unified digital infrastructure. The European Commission has acknowledged this issue, advocating for harmonized technical frameworks under the Smart Grids and Meters Expert Group.

Public Resistance and Low Consumer Awareness Regarding AMI Benefits

Public resistance and limited consumer awareness regarding the benefits of Advanced Metering Infrastructure (AMI) represent a persistent challenge for the European AMI electric meter market. Despite the technological and economic advantages of smart meters, skepticism persists among certain population segments due to misconceptions about health impacts, data usage, and perceived loss of control over energy consumption. This resistance has manifested in legal and political pushbacks in several countries. Similarly, in Poland, opposition groups have filed petitions challenging mandatory smart meter deployment, arguing for the right to opt-out based on privacy grounds. Low awareness further exacerbates the issue. Utilities have responded with targeted education campaigns, but inconsistent messaging and delayed engagement strategies have slowed acceptance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.81% |

|

Segments Covered |

By Product Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Landis+Gyr, Siemens AG, Schneider Electric, Itron Inc., Kamstrup A/S, Sagemcom, Iskraemeco, Aclara Technologies, Honeywell International Inc., Holley Technology |

SEGMENTAL ANALYSIS

By Product Type Insights

The smart metering devices constitute the largest segment in the Europe AMI electric meter market, accounting for 58.8% of total market value in 2024. This dominance is primarily driven by the widespread deployment of smart electricity meters across EU member states as part of national modernization programs aimed at upgrading aging grid infrastructure and enhancing energy efficiency. The rapid adoption of these devices is fueled by regulatory mandates like the Clean Energy Package, which requires member states to assess the cost-effectiveness of smart metering systems by 2029. Moreover, the integration of advanced communication technologies such as NB-IoT and PRIME PLC into smart meters enhances their functionality beyond basic measurement, supporting real-time data exchange and remote diagnostics.

The services segment of the Europe AMI electric meter market is projected to grow at the fastest CAGR of 12.4%. This segment encompasses consulting, system integration, cybersecurity, maintenance, and analytics services that support the deployment and operation of AMI systems. One of the key factors driving this high growth rate is the increasing complexity of smart grid ecosystems, which necessitates specialized expertise for implementation and ongoing management. In addition, the rise in cyberattacks targeting critical infrastructure has led to a surge in demand for security and managed services. ENISA reported that over 250 cyber incidents affected the European energy sector in 2023 alone, prompting regulators and operators to invest heavily in secure communication protocols and threat monitoring solutions.

By End User Insights

The residential end-user segment commanded the Europe AMI electric meter market, holding 52.5% of the total market share in 2024. This leading position is primarily attributed to large-scale government-backed smart meter rollouts aimed at empowering households with greater visibility and control over their energy consumption. The UK’s Smart Metering Implementation Programme (SMIP), overseen by Ofgem, has resulted in over 22 million installations in homes as of early 2024. Furthermore, rising consumer awareness regarding energy efficiency and dynamic pricing models has increased the willingness to adopt smart meter-linked services Coupled with regulatory mandates under the Clean Energy Package, which emphasize consumer-centric energy policies, the residential segment remains the cornerstone of AMI market expansion in Europe.

The industrial segment of the Europe AMI electric meter market is experiencing the highest growth rate, registering a CAGR of 11.7%. This acceleration is driven by the increasing demand for precise energy monitoring, process optimization, and carbon footprint reduction among manufacturing and heavy industries. Industrial consumers are increasingly adopting AMI-enabled smart meters to comply with stringent sustainability regulations and improve operational efficiency. In response, companies are integrating smart metering systems with industrial IoT platforms to monitor real-time consumption patterns and optimize load distribution. Germany, being the continent’s largest industrial economy, has witnessed a surge in AMI adoption among factories and production units. As per the German Federal Environment Agency (UBA), industrial energy efficiency investments rose by 18% in 2023, with over 40% of surveyed enterprises incorporating smart metering into their energy management strategies. These developments underscore the industrial sector’s transition toward intelligent energy management, positioning it as the fastest-growing segment in the Europe AMI electric meter market.

REGIONAL ANALYSIS

Germany held the largest market share in the European AMI electric meter industry, contributing 22.6% of total regional revenue in 2024. As Europe’s largest economy and a global leader in energy transition, Germany has made significant strides in deploying smart metering systems to support its ambitious decarbonization goals. The country’s Smart Meter Gateway (SMGW) initiative, mandated by the Federal Network Agency (Bundesnetzagentur), aims to install smart meters in large portions of households and major industrial consumers by 2032. Moreover, the integration of renewable energy sources, particularly wind and solar, has necessitated robust metering infrastructure to manage intermittent generation and ensure grid stability. With continued investment from both public and private sectors, Germany remains at the forefront of smart meter adoption in Europe.

France has achieved one of the highest smart meter penetration rates in Europe due to its well-structured and centrally coordinated deployment strategy. Enedis, the national grid operator, completed the rollout of its Linky smart meter program ahead of schedule. The success of the Linky rollout has set a benchmark for other EU nations considering large-scale smart meter implementations. Furthermore, France’s energy policy emphasizes nuclear-powered baseload generation alongside expanding renewable capacity, necessitating advanced metering for efficient demand-side management. With strong government backing and high consumer acceptance, France continues to be a key driver of AMI market growth in Europe.

Italy was among the first countries globally to implement a nationwide smart metering system, having launched its Telegestore project back in 2001—making it a pioneer in the space. According to a report by Eurelectric, Italy’s early adoption of smart metering has led to substantial operational savings, reducing non-technical losses and enabling dynamic tariff structures that encourage off-peak consumption. Italy’s strategic focus on digitalizing its energy infrastructure aligns with broader European Union objectives.

The United Kingdom has made significant progress in smart meter deployment through its nationwide Smart Metering Implementation Programme (SMIP), managed by Ofgem. Additionally, the UK government’s net-zero strategy, which targets a fully decarbonized power system by 2035, has reinforced the necessity of smart metering for managing distributed energy resources and demand response programs. With a strong emphasis on consumer engagement and digital innovation, the UK remains a key player in the European AMI market.

Spain is emerging as a key growth market driven by digital transformation and decentralization of energy resources. The country’s national smart metering program. Spain’s commitment to renewable energy expansion has intensified the need for smart metering systems that can accommodate variable generation from distributed solar PV installations.

LEADING PLAYERS IN THE EUROPE AMI ELECTRIC METER MARKET

One of the leading players in the Europe AMI electric meter market is Landis+Gy, a Swiss-headquartered company specializing in energy management technologies. Landis+Gyr has been instrumental in supplying advanced smart metering solutions across multiple European countries, supporting large-scale deployments aligned with EU regulatory mandates. The company's strong focus on interoperability, cybersecurity, and grid modernization has positioned it as a trusted partner for utilities seeking scalable AMI systems.

Another major player is Sagemcom, a French technology firm known for its comprehensive smart metering offerings tailored to both electricity and gas networks. Sagemcom has played a key role in France’s Linky smart meter rollout, contributing significantly to one of the largest national smart meter programs in Europe. Its commitment to innovation and integration with digital ecosystems has reinforced its presence in both residential and commercial segments across the region.

STMicroelectronics is also a critical contributor to the Europe AMI electric meter market, though not directly a meter manufacturer. As a global semiconductor leader, STMicroelectronics provides essential components such as microcontrollers and secure communication chips used in smart meters. Its technological advancements enable enhanced data processing, real-time monitoring, and robust security features, making it an enabler of next-generation AMI infrastructure across Europe.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by leading players in the Europe AMI electric meter market is strategic partnerships and collaborations with utility providers, government agencies, and technology firms. These alliances help companies align their product development with evolving regulatory requirements and regional deployment needs while ensuring seamless integration with existing grid infrastructure.

Another crucial strategy is product innovation and R&D investments, particularly focused on enhancing metering capabilities through IoT, AI, and cybersecurity enhancements. Companies are continuously upgrading their offerings to support bidirectional communication, real-time analytics, and secure data transmission, which are vital for managing decentralized energy resources and improving grid resilience.

Lastly, expanding service portfolios beyond hardware has become a key differentiator among top players. By offering end-to-end solutions including cloud-based analytics, cybersecurity services, and system integration, companies are positioning themselves as full-service providers capable of delivering long-term value throughout the AMI lifecycle.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Europe AMI electric meter market include Landis+Gyr, Siemens AG, Schneider Electric, Itron Inc., Kamstrup A/S, Sagemcom, Iskraemeco, Aclara Technologies, Honeywell International Inc., and Holley Technology.

The competition in the Europe AMI electric meter market is marked by a dynamic interplay between established multinational corporations and agile regional players, all striving to capture a larger share of the expanding smart grid ecosystem. With regulatory mandates pushing for near-complete smart meter penetration across the continent, companies are under pressure to differentiate themselves through technological innovation, compliance expertise, and customer-centric solutions. The market sees intense rivalry not only in hardware manufacturing but also in software platforms, cybersecurity frameworks, and managed services that support the entire lifecycle of AMI deployment. Vendors are increasingly focusing on interoperability, data privacy, and integration with renewable energy systems to meet the evolving demands of utilities and consumers. Additionally, as public awareness and scrutiny around data usage grow, companies must balance performance with transparency and consumer trust, further intensifying competitive pressures. This landscape fosters continuous innovation and strategic adaptation among market participants aiming to maintain leadership positions.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Landis+Gyr launched a new generation of smart electricity meters designed specifically for high-voltage industrial applications, enhancing its ability to serve diverse energy sectors across Europe. This move was aimed at strengthening its foothold in the rapidly growing industrial smart metering segment.

- In May 2024, Sagemcom announced a strategic partnership with a leading European telecom provider to integrate NB-IoT connectivity into its smart metering solutions, improving data transmission reliability and network efficiency across remote regions.

- In July 2024, STMicroelectronics introduced a new line of secure microcontroller units optimized for smart metering, reinforcing its role as a foundational technology supplier in the AMI value chain.

- In September 2024, Siemens Energy Management Division expanded its digital twin capabilities for smart meter networks, enabling predictive maintenance and real-time simulation for utility operators across several EU countries.

- In November 2024, Hexing Electrical, a global smart meter manufacturer, opened a dedicated European innovation center in the Netherlands to accelerate localized R&D efforts and better serve regional clients with tailored AMI solutions.

MARKET SEGMENTATION

This research report on the Europe AMI Electric Meter Market has been segmented and sub-segmented based on product type, end user, and region.

By Product Type

- Smart Metering Devices

- Services

By End User

- Residential

- Industrial

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe AMI electric meter market?

Key drivers include increasing focus on energy efficiency, government initiatives for smart grid development, and the need for real-time energy monitoring and billing accuracy.

2. Which countries are leading the AMI deployment in Europe?

Leading countries include Germany, the United Kingdom, France, Italy, and the Netherlands, due to strong regulatory support and advanced infrastructure.

3. Who are the major players in the Europe AMI electric meter market?

Key players include Landis+Gyr, Siemens AG, Schneider Electric, Itron Inc., Kamstrup A/S, Sagemcom, Iskraemeco, Aclara Technologies, Honeywell International Inc., and Holley Technology.

4. How are governments supporting AMI adoption in Europe?

Many European governments and regulatory bodies are mandating smart meter rollouts and providing funding or incentives for utilities to upgrade existing infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com