Europe Animal Disinfectants Market Size, Share, Trends & Growth Forecast Report By Type, Application, Form and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis 2025 to 2033

Europe Animal Disinfectants Market Size

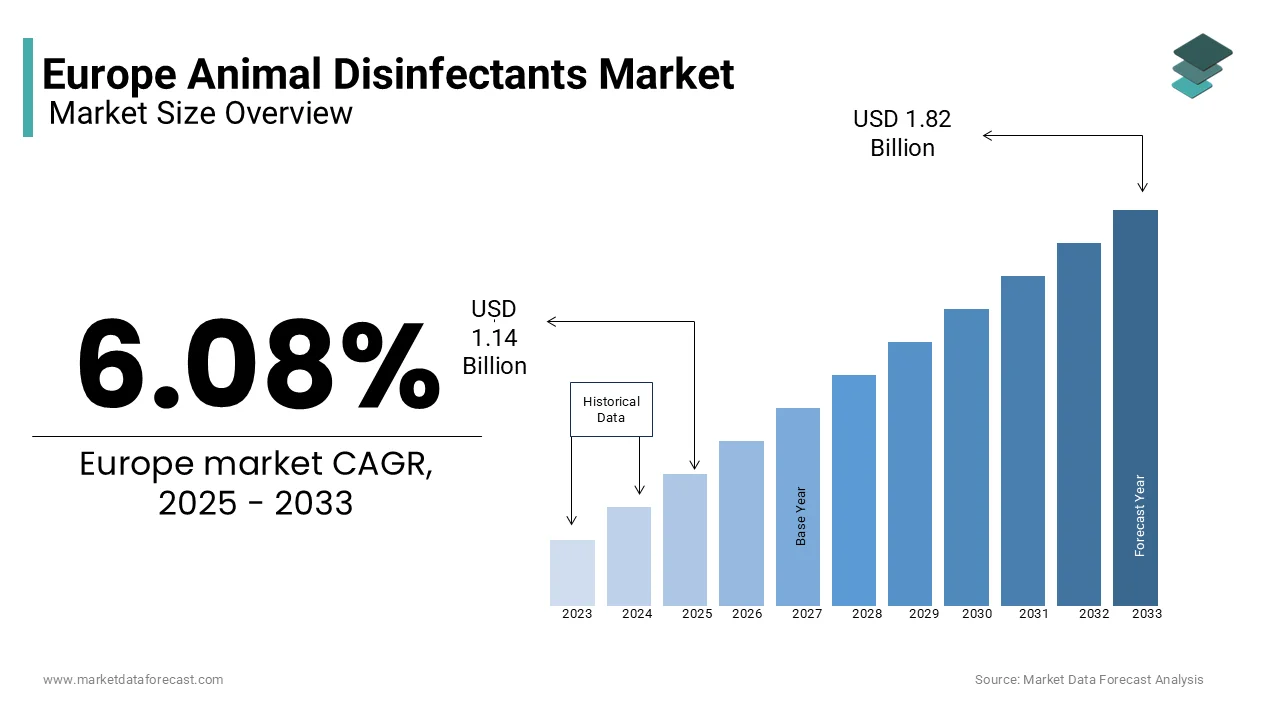

The animal disinfectants market size in Europe was valued at USD 1.07 billion in 2024. The European market is expected to reach USD 1.14 billion in 2025 from USD 1.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.08% during the forecast period from 2025 to 2033.

The Europe animal disinfectants market is witnessing substantial growth, driven by rising concerns about animal health, food safety, and biosecurity in livestock management. Animal disinfectants are chemical or biological agents used to eliminate pathogens such as bacteria, viruses, and fungi from animal housing, equipment, and transport vehicles. These disinfectants play a critical role in maintaining hygiene, reducing disease outbreaks, and ensuring the overall well-being of animals, particularly in the livestock and poultry industries.

The market's expansion aligns with Europe’s stringent regulatory frameworks aimed at promoting animal welfare and food safety. For instance, the European Union’s Animal Health Law emphasizes preventive measures, including the use of disinfectants, to control diseases like African Swine Fever and Avian Influenza. Sustainability is another significant focus in the market, with an increasing shift toward eco-friendly and biodegradable disinfectants. Companies are innovating to meet these demands while adhering to EU environmental standards. Top of FormBottom of Form

MARKET DRIVERS

Rising Concerns About Zoonotic Diseases

The increasing prevalence of zoonotic diseases is a major driver of the animal disinfectants market. The European Centre for Disease Prevention and Control reported that zoonotic diseases accounted for over 310,000 human cases in the EU in 2021, with pathogens like Salmonella and Campylobacter being the most common. Such incidents highlight the critical need for effective disinfection practices to mitigate disease transmission between animals and humans. Livestock farming, a significant contributor to Europe’s food supply chain, relies on disinfectants to maintain biosecurity and prevent outbreaks, ensuring food safety and public health while supporting market growth.

Stringent Biosecurity Regulations in Livestock Farming

Stringent regulatory frameworks across Europe emphasize biosecurity measures in livestock production, boosting the demand for animal disinfectants. The European Union’s Animal Health Law mandates the use of disinfectants in controlling diseases such as African Swine Fever and Avian Influenza. Germany and France, as leading livestock producers, have implemented robust protocols for animal hygiene and disease prevention. These regulations not only drive disinfectant adoption but also encourage innovation in eco-friendly solutions, shaping the market’s growth trajectory. Top of FormBottom of Form

MARKET RESTRAINTS

High Costs of Advanced Disinfectants

The adoption of advanced and eco-friendly animal disinfectants is often hindered by their high costs, particularly for small and medium-sized farms. These farms may struggle to afford premium disinfectant products that meet stringent EU environmental and safety standards. In addition, the European Commission has highlighted that transitioning to sustainable farming practices, including the use of eco-friendly disinfectants, requires substantial investment, potentially reducing the affordability and widespread adoption of such products.

Impact of Regulatory Complexity

The stringent and complex regulatory environment governing disinfectant use in Europe presents challenges for market players. Disinfectants must comply with the European Biocidal Products Regulation (BPR), which requires extensive testing and documentation to ensure product safety and efficacy. Furthermore, the time-consuming approval process can delay the introduction of new products, restricting innovation and market entry. This regulatory complexity disproportionately affects smaller businesses, reducing competition and potentially limiting the availability of diverse disinfectant solutions.

MARKET OPPORTUNITY

Shift Toward Sustainable and Eco-Friendly Disinfectants

The increasing focus on environmental sustainability presents a significant opportunity for the development and adoption of eco-friendly animal disinfectants. According to the European Commission, over 26% of EU agricultural land was managed under organic farming practices in 2021, reflecting the region's commitment to reducing environmental impact. This shift drives demand for biodegradable and non-toxic disinfectants that align with organic farming standards. Innovative solutions meeting EU environmental regulations are likely to gain market traction, enabling manufacturers to cater to environmentally conscious consumers and industries, thereby expanding their market share.

Rising Demand for Livestock Products

The growing demand for animal-derived products, including meat, dairy, and poultry, directly contributes to the expansion of the animal disinfectants market. This surge in livestock farming necessitates stringent hygiene practices to ensure animal health and prevent contamination, boosting the use of disinfectants. In addition, the Food and Agriculture Organization emphasizes the importance of biosecurity measures in meeting the increasing demand for safe, high-quality animal products, providing substantial growth opportunities for market players.Top of Form

MARKET CHALLENGES

Rising Antimicrobial Resistance (AMR)

The increasing prevalence of antimicrobial resistance poses a major challenge to the efficacy of animal disinfectants. The European Food Safety Authority highlights that AMR is responsible for over 33,000 deaths annually in the EU, with misuse of disinfectants contributing to the problem. Improper usage or overuse of disinfectants in livestock farming can lead to resistant strains of bacteria, diminishing the effectiveness of biosecurity measures. This issue compels manufacturers to invest in advanced formulations, increasing production costs and complicating regulatory compliance, further affecting market dynamics.

Lack of Awareness and Training Among Farmers

Limited awareness and inadequate training on the proper use of disinfectants among farmers create barriers to effective implementation. The European Centre for Disease Prevention and Control notes that many small and medium-sized farms lack access to updated biosecurity practices. This knowledge gap leads to inconsistent application of disinfectants, reducing their effectiveness in disease prevention. This lack of awareness and technical support hampers the optimal utilization of disinfectants, affecting their potential market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.08% |

|

Segments Covered |

By Type, Form Application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Zoetis (US), The Chemours Company (US), Nufarm Limited (US), The Dow Chemical Company (US), and Neogen Corporation (US) |

SEGMENTAL ANALYSIS

By Type Insights

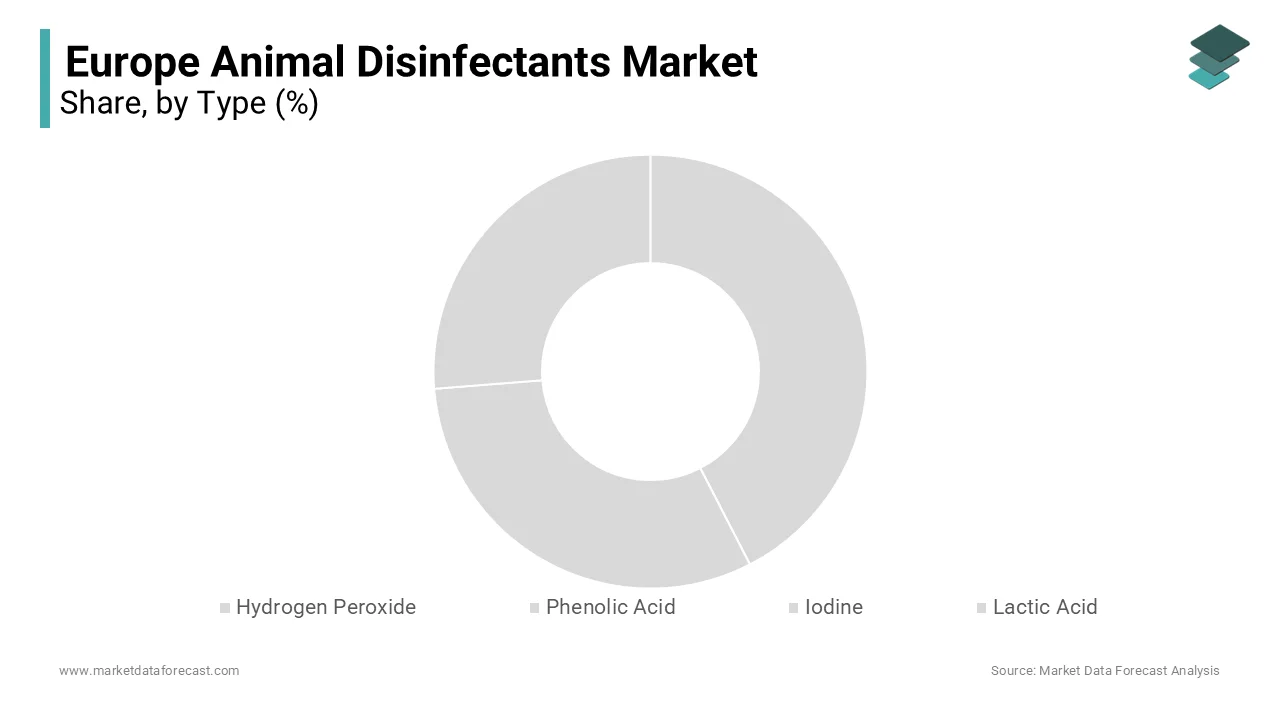

Based on type, the Iodine segment holds the protruding portion of the market due to its augmenting uses.

Based on form, the liquid segment had the major share of the European market in 2023 and is likely to hold the domination throughout the forecast period, owing to its benefits.

Based on application, the dairy cleaning segment holds the major share of the European market.

REGIONAL ANALYSIS

Germany was a leading country in the Europe animal disinfectants market in 2024 due to its robust livestock industry and strict biosecurity regulations. The German Federal Ministry of Food and Agriculture emphasizes biosecurity to prevent outbreaks like African Swine Fever, driving significant demand for disinfectants. Advanced agricultural practices and the widespread adoption of eco-friendly solutions also position Germany as a market leader, underscoring its commitment to sustainable livestock farming and disease prevention.

France ranks among the top-performing countries in the Europe animal disinfectants market, supported by its strong poultry and cattle industries. The French Ministry of Agriculture enforces rigorous biosecurity standards, particularly in preventing Avian Influenza, boosting disinfectant demand. In addition, the country’s significant investment in sustainable farming practices aligns with EU environmental goals, encouraging the adoption of biodegradable disinfectants to reduce environmental impact while ensuring animal health and food safety.

The Netherlands played a pivotal role in the Europe animal disinfectants market, driven by its high livestock density and advanced farming infrastructure. Additionally, the Netherlands’ prowess in sustainable farming initiatives, including the adoption of organic disinfectants, further strengthens its market position, aligning with its environmental objectives and ensuring compliance with EU standards for biosecurity and sustainability.

KEY MARKET PLAYERS

Zoetis (US), The Chemours Company (US), Nufarm Limited (US), The Dow Chemical Company (US), and Neogen Corporation (US) are a few of the notable companies in the Europe animal disinfectants market.

RECENT HAPPENINGS IN THE MARKET

- In July 2017, Virox Animal Health company launched a new high-level disinfectant prevention HLD8, globally for reprocessing semi-critical medical devices.

- In March 2017, Neogen launched Companion Cleaner disinfectant, a hand sanitizer for veterinary practices, animal care facilities, and animal laboratories.

MARKET SEGMENTATION

This research report on the European animal disinfectants market has been segmented and sub-segmented into the following categories.

By Type

- Hydrogen Peroxide

- Phenolic Acid

- Iodine

- Lactic Acid

- Others

By Form

- Powder

- Liquid

By Application

- poultry

- dairy cleaning

- swine

- equine

- dairy and ruminants

- aquaculture

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What’s driving the demand for animal disinfectants in Europe?

Increased focus on biosecurity in livestock farming, rising outbreaks of zoonotic diseases (e.g., avian influenza, ASF), and stricter EU hygiene mandates are key demand drivers.

Which disinfectant types are most commonly used in European livestock operations?

Peracetic acid, quaternary ammonium compounds (QACs), and iodine-based solutions dominate due to their efficacy, environmental safety, and compliance with EU biocide regulations (BPR).

How do EU regulations impact the use of animal disinfectants?

The Biocidal Products Regulation (BPR, Regulation (EU) 528/2012) requires rigorous efficacy, toxicity, and environmental safety data, pushing manufacturers toward more sustainable and traceable formulations.

Which livestock sectors have the highest demand for disinfectants?

Poultry and swine farming lead usage due to intensive housing systems and high disease risk, especially in countries like the Netherlands, Spain, and Germany with dense animal populations.

What innovations are shaping the future of animal disinfectants in Europe?

Growth in automated misting/fogging systems, plant-based disinfectants, and smart monitoring technologies is enhancing efficiency and reducing labor while supporting sustainability goals.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com