Europe Audiobook Market Size, Share, Trends, & Growth Forecast Report by Genre (Fiction, Non-Fiction, Preferred Device, Distribution Channel, Target Audience, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Audiobook Market Size

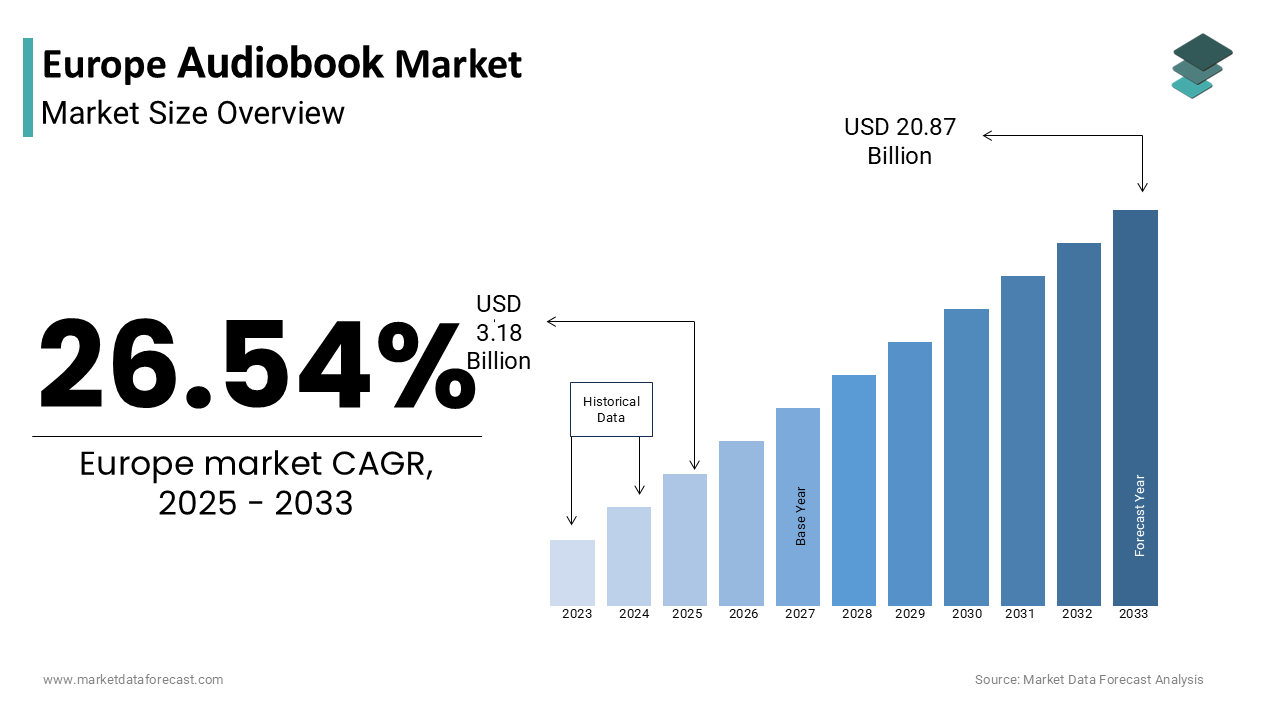

The Europe audiobook market was worth USD 2.51 billion in 2024. The Europe market is expected to reach USD 20.87 billion by 2033 from USD 3.18 billion in 2025, rising at a CAGR of 26.54% from 2025 to 2033.

The Europe audiobook market growth is driven by technological advancements, rising internet penetration, and increasing consumer preference for on-the-go content consumption.

According to Nielsen BookScan, audiobook sales in Europe grew by 19% in 2023 compared to the previous year, with the UK, Germany, and France leading in terms of volume and revenue. The proliferation of smartphones and smart speakers has significantly contributed to this growth trajectory, enabling seamless access to audiobooks through subscription platforms such as Audible, Storytel, and Google Play Books.

Additionally, as per the European Publishers Council, more than 40% of Europeans reported consuming audio-based educational or literary content during their daily commute or leisure time in 2023. Moreover, the rise of voice-enabled technologies, coupled with improved narration quality and localized language support, has further expanded the market’s reach.

MARKET DRIVERS

Rise in Smartphone and Smart Speaker Adoption

One of the primary drivers of the Europe audiobook market is the widespread adoption of smartphones and smart speakers, which have made audiobooks more accessible and convenient for consumers. They enable users to engage with audiobooks during commutes, workouts, or household tasks, effectively transforming idle time into productive or leisurely engagement. This trend is further supported by the integration of audiobook services into voice assistants like Amazon Alexa and Google Assistant, enhancing user experience through hands-free control. As per Ofcom, British consumers spent an average of 2.5 hours daily on mobile audio content in 2023, with audiobooks forming a significant portion of this usage.

Increasing Demand for Multitasking and Time-Efficient Content Consumption

Another key driver of the Europe audiobook market is the growing demand for multitasking-friendly and time-efficient content consumption among working professionals, students, and commuters. The consumers are seeking ways to maximize productivity and leisure without dedicating exclusive time to reading. According to a survey conducted by Ipsos in 2023, nearly 55% of European respondents stated that they preferred audiobooks because they allowed them to consume content while performing other activities such as driving, exercising, or cooking. Furthermore, as per the European Foundation for the Improvement of Living and Working Conditions, the average work commute in major European cities exceeds one hour daily by offering a prime opportunity for audiobook consumption. Educational institutions and corporate training programs have also started integrating audiobooks and audio-based learning modules to accommodate diverse learning preferences.

MARKET RESTRAINTS

High Licensing and Production Costs for Audiobooks

A major restraint affecting the Europe audiobook market is the high cost associated with licensing and producing audiobooks, which limits the availability of diverse content and increases pricing for consumers. Unlike e-books or print editions, audiobooks require additional resources such as professional narrators, sound engineers, and post-production editing, all of which contribute to elevated production expenses.

According to the Publishers Association, the average cost of producing an audiobook in Europe ranges between €15,000 and €40,000 depending on the length and complexity of the title. These costs are often passed on to consumers, resulting in higher retail prices compared to e-books or printed materials, which can deter potential buyers.

Moreover, licensing agreements with authors, agents, and publishers can be complex and expensive, particularly for independent audiobook producers or smaller platforms aiming to expand their catalogues. In France, for example, some publishers have been reluctant to license audiobook rights due to concerns about copyright management and revenue sharing models.

Limited Availability of Regional Language Audiobooks

Another significant constraint on the Europe audiobook market is the limited availability of audiobooks in regional and minority languages, which restricts market penetration in non-English-speaking countries. While English-language audiobooks dominate the market, many European languages lack sufficient content offerings by limiting accessibility for native speakers.

As per the European Commission’s Directorate-General for Translation, only 12% of audiobooks released in 2023 were available in regional European languages such as Catalan, Polish, Hungarian, or Finnish. This scarcity discourages potential listeners who prefer consuming content in their native tongue rather than translated versions.

Furthermore, according to the European Audiovisual Observatory, the cost of translating and dubbing audiobooks into local languages remains prohibitively high for many publishers, especially when targeting smaller linguistic markets. In response, some governments and cultural organizations have launched initiatives to promote local language audiobook development. However, until production costs decline and infrastructure improves, the lack of regional language content will continue to impede broader market adoption across Europe.

MARKET OPPORTUNITIES

Expansion of Subscription-Based Audiobook Platforms

One of the most promising opportunities in the Europe audiobook market is the expansion of subscription-based platforms that offer unlimited access to audiobook libraries for a fixed monthly fee. This model has gained traction as consumers seek cost-effective and flexible ways to access a wide variety of content. These services provide personalized recommendations, offline listening capabilities, and a synchronized text-audio format, enhancing user engagement.

Additionally, as per PwC’s Global Entertainment & Media Outlook, European consumers are becoming more accustomed to paying for digital content via subscriptions, mirroring trends observed in music and video streaming. This shift presents a lucrative avenue for audiobook providers to scale their user base and generate recurring revenue. Moreover, several platforms have begun introducing tiered pricing models tailored to different income groups by allowing wider demographic access.

Integration of Audiobooks into Education and Corporate Training Programs

Another significant opportunity for the Europe audiobook market lies in its growing integration into education and corporate training programs. Institutions and businesses are increasingly recognizing the benefits of audio-based learning in delivering flexible, scalable, and engaging content.

According to the European Commission’s Digital Education Action Plan, audiobooks and audio-based modules are being incorporated into school curricula and vocational training to cater to diverse learning styles, particularly for visually impaired students and those with attention-related challenges.

Furthermore, as per Deloitte Insights, over 60% of large European corporations have adopted digital learning platforms that include audiobooks and podcast-style training materials to enhance employee development and knowledge retention. Companies in sectors such as finance, healthcare, and logistics are leveraging audiobooks for compliance training, dominant development, and product education. This trend is supported by the rise of microlearning and just-in-time training approaches, where short-form audio content delivers targeted information efficiently.

MARKET CHALLENGES

Copyright and Royalty Management Complexities

A major challenge facing the Europe audiobook market is the complexity of managing copyrights and royalties across multiple jurisdictions, which complicates content distribution and monetization. According to the International Federation of Reproduction Rights Organisations (IFRRO), inconsistencies in copyright enforcement across European countries create legal uncertainties for audiobook distributors, particularly when repurposing existing works into audio format. Some publishers remain hesitant to release audiobooks in certain territories due to unclear royalty-sharing mechanisms and fears of unauthorized redistribution. Additionally, as per the European Audiovisual Observatory, disputes over performance rights for narrators have led to delays in audiobook releases and limited the availability of certain titles in specific markets. These issues hinder the scalability of audiobook platforms and discourage investment in new content creation.

Low Awareness and Penetration in Rural and Older Demographics

Another pressing challenge in the Europe audiobook market is the relatively low awareness and adoption among rural populations and older age groups, which limits overall market penetration. Despite strong growth in urban centers, audiobooks remain underutilized in less digitally connected regions and among individuals unfamiliar with digital content consumption.

According to Eurostat, only 32% of individuals aged above 65 in rural parts of Eastern Europe used online audio content in 2023, compared to 70% of younger urban users. Furthermore, as per a study by the University of Manchester, audiobooks are not yet widely promoted in public libraries outside major metropolitan areas, reducing access for communities without private digital subscriptions. Additionally, concerns around screen fatigue and discomfort with voice-controlled devices persist among older consumers.

SEGMENTAL ANALYSIS

By Genre Insights

The fiction segment was the largest by holding 56.4% of the Europe audiobook market share in 2024, with the widespread appeal of storytelling, particularly among younger audiences and commuting professionals who prefer immersive narratives during daily routines. According to Nielsen BookScan, fiction titles accounted for more than half of all audiobook sales across Western Europe in 2023, with fantasy, mystery, and romance genres leading in popularity. Publishers have responded by accelerating audio adaptations of popular novels and partnering with celebrity narrators to enhance listening experiences. Streaming platforms such as Audible have further amplified this trend by curating genre-specific playlists and offering exclusive audiobook releases that cater to niche reader communities, reinforcing fiction’s stronghold in the European audiobook landscape.

The non-fiction is likely to grow with a CAGR of 18.4% from 2025 to 2033. This rapid expansion is driven by increasing consumer interest in self-improvement, business strategies, personal finance, and educational content delivered through audiobooks.

As per PwC’s Global Entertainment & Media Outlook, non-fiction audiobook consumption in Europe rose by nearly 22% in 2023, with business and prominent titles dominating downloads on platforms like Google Play Books and Storytel. The rise of remote learning and digital upskilling programs has also contributed to higher adoption rates among students and professionals. Moreover, according to Ofcom, British consumers increased their intake of educational and informational audio content by 27% compared to the previous year, reflecting a broader shift toward lifelong learning. In Sweden and Denmark, government-backed initiatives promoting audiobook access for visually impaired individuals have further boosted the availability and consumption of non-fiction titles.

By Preferred Device Insights

The smartphones dominated the Europe audiobook market with a prominent share in 2-24. Their ubiquity, portability, and integration with major audiobook platforms make them the most convenient option for consumers across different age groups. According to Eurostat, smartphone ownership among Europeans aged 16–74 reached over 85% in 2023, providing a strong foundation for audiobook accessibility. The ability to download or stream audiobooks while commuting, exercising, or traveling has made smartphones the go-to device for multitasking listeners.

The laptops and tablets segment is likely to grow with a CAGR of 14.9% in the coming years. According to Ofcom, tablet-based audiobook consumption in the UK grew by 19% in 2023, as users sought larger screens and better sound quality for multitasking while listening. Educational institutions and corporate training centers increasingly rely on tablets for interactive audiobook integration into courses and professional development programs. Moreover, as per the European Commission’s Digital Education Action Plan, schools and universities in countries like Sweden and the Netherlands have adopted audiobooks as part of e-learning modules accessible via tablets, enhancing student engagement and accessibility.

By Distribution Channel Insights

The subscription-based model segment accounted in holding 60.1% of the share in the Europe audiobook market by making it the dominant distribution channel in 2023. Consumers increasingly favor monthly access to unlimited content over one-time purchases, drawn by affordability, convenience, and continuous updates to audiobook libraries. Additionally, as per PwC’s Global Entertainment & Media Outlook, European consumers are shifting toward recurring payment models similar to those seen in music and video streaming, valuing flexibility and scalability in content access.

The one-time download segment is lucratively growing with a CAGR of 12.1% during the forecast period. According to Nielsen BookScan, one-time audiobook purchases surged in Poland and the Netherlands, where users prefer owning titles rather than rotating through subscription libraries. Independent bookstores and publishers have capitalized on this trend by offering direct audiobook downloads without platform lock-ins. Moreover, as per the Publishers Association, independent creators and small publishing houses have seen a 23% increase in direct audiobook sales through personal websites and niche online stores, bypassing large subscription platforms to retain higher profit margins.

REGIONAL ANALYSIS

The United Kingdom was the largest and held 24.3% of the Europe audiobook market share in 2024. According to Nielsen BookScan, the UK audiobook market grew by 21% in 2023, outpacing many other European nations. Platforms like Audible, Google Play Books, and Apple Books have a strong presence, supported by a wide selection of locally produced and internationally sourced titles.

Moreover, as per the Publishers Association, audiobooks now account for nearly 15% of total book revenue in the UK, with fiction titles and celebrity-narrated editions proving particularly popular. Government-backed audiobook lending programs in public libraries have also expanded access,

Germany was positioned second with 19.2% of the Europe audiobook market share in 2024. The country’s robust publishing sector, high disposable income levels, and growing preference for digital media have fueled steady audiobook adoption among urban professionals and students.

According to Statista, audiobook revenues in Germany increased by 17% in 2023, with educational and business titles gaining traction among working professionals. The rise of bilingual audiobooks has also attracted multilingual consumers among expatriates and language learners. Additionally, as per the German Publishers and Booksellers Association, audiobook lending through public libraries has expanded significantly, facilitated by platforms like OverDrive and Libby.

France is the fastest growing country in the Europe audiobook market owing to the increasing urbanization, digital literacy, and a rich literary heritage that supports audiobook adaptation. Public and private sectors have collaborated to promote digital reading, particularly in educational and professional settings. Moreover, as per Médiamétrie, audiobook consumption has risen sharply among young professionals, with 40% of listeners aged between 25 and 40. Streaming platforms have adapted by offering localized narration and curated content recommendations tailored to French tastes.

The Italian audiobook market is likely to grow with growing interest in digital content consumption and strong support from cultural institutions. According to AIE (Italian Publishers Association), audiobook revenues in Italy increased by 18% in 2023, with a notable rise in classical literature and poetry adaptations. Additionally, as per ISTAT, audiobook usage among Italian university students has doubled over the past three years, driven by flexible study schedules and improved access through institutional partnerships.

Spain audiobook market growth is driven by growing internet penetration, mobile-first content consumption, and rising awareness of audiobooks as an alternative to traditional reading. The country has experienced significant growth in recent years among younger audiences seeking flexible learning and entertainment options.

According to FGEE (Spanish General Council of the Book), audiobook sales in Spain rose by 20% in 2023, with a particular focus on Spanish- and Catalan-language titles. Local publishers have embraced digital-first strategies by partnering with voice actors and AI-driven narration tools to accelerate production.

Moreover, as per Kantar, Spanish consumers increasingly use audiobooks during commutes and leisure activities, with mobile listening forming a substantial portion of daily audio consumption.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Amazon.com Inc., Apple Inc., Audible Inc., Storytel AB, Spotify AB, Google LLC, Rakuten Group Inc., Scribd Inc., Barnes & Noble Booksellers Inc., and W.F. Howes Ltd. are some of the key market players in europe.

The competition in the Europe audiobook market is highly dynamic, driven by rapid technological advancements, shifting consumer preferences, and a growing emphasis on digital literacy. Dominant global players like Audible, Google Play Books, and Apple Books coexist with emerging regional platforms that offer specialized content tailored to local tastes and languages. This diversity fosters a competitive environment where differentiation is achieved through exclusive titles, superior narration quality, and innovative delivery mechanisms.

Subscription-based services continue to dominate, but one-time purchase options and hybrid models are gaining traction, particularly among niche audiences seeking permanent ownership of audiobooks. Additionally, public libraries and non-profit organizations are playing an increasingly important role by offering free or low-cost audiobook access, which is broadening the market beyond traditional commercial channels.

Technological integration with voice assistants, smart home systems, and learning applications is further intensifying competition, compelling companies to continuously enhance user interfaces, personalization features, and device compatibility. In this evolving landscape, success depends not only on content volume but also on the ability to deliver seamless, engaging, and culturally relevant listening experiences across Europe’s diverse linguistic and demographic segments.

Top Players in the Europe Audiobook Market

Audible (Amazon)

Audible, a subsidiary of Amazon, is the leading audiobook platform globally and holds a dominant position in the Europe audiobook market. It offers an extensive library of audiobooks across multiple genres and languages, catering to a diverse audience. Audible has significantly contributed to mainstreaming audiobook consumption by integrating with voice assistants, developing original audio content, and introducing personalized recommendations. The company's investment in localized narration and multilingual content has enhanced accessibility for European listeners. Additionally, its partnerships with publishers, authors, and narrators have expanded the availability of premium titles. Audible’s presence in major European markets such as the UK, Germany, and France has helped set industry benchmarks in terms of user experience, subscription models, and digital distribution infrastructure, making it a key driver of the region’s audiobook growth.

Storytel

Storytel is a prominent player in the Europe audiobook market, particularly in Nordic and Southern European countries. As a subscription-based platform, Storytel provides unlimited access to a vast collection of audiobooks and e-books, emphasizing flexibility and affordability for consumers.

The company has played a crucial role in expanding audiobook availability in regional languages, supporting local publishing ecosystems while also curating international bestsellers. Its adaptive business model allows users to switch between reading and listening seamlessly, enhancing engagement. Storytel has also been instrumental in promoting audiobook adoption among younger audiences through educational collaborations and mobile-first design.

Google Play Books

Google Play Books is a significant contributor to the Europe audiobook market, leveraging Google’s global digital ecosystem to provide seamless audiobook discovery and playback across Android devices. The platform integrates with Google Assistant and other smart technologies, offering users an intuitive listening experience tailored to their habits. Google Play Books appeals to both casual and dedicated audiobook listeners. Its support for independent publishers and self-published authors has diversified the available content pool by encouraging innovation and competition.

Additionally, Google’s integration of audiobooks into broader entertainment offerings such as YouTube and Google Podcasts—has created new pathways for content discovery. This strategic alignment with consumer technology trends reinforces Google Play Books’ influence in shaping the future of the European audiobook landscape.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Europe audiobook market is expanding localized content production and multilingual narration capabilities. Companies are investing heavily in producing high-quality audiobooks in regional languages to cater to diverse linguistic populations across the continent, thereby increasing accessibility and listener engagement.

Another critical approach is leveraging artificial intelligence and data analytics to personalize user experiences. Leading platforms use advanced algorithms to recommend audiobooks based on individual listening habits, search history, and genre preferences, which enhances customer retention and satisfaction.

The firms are integrating audiobooks into broader digital ecosystems, including smart speakers, podcasts, and educational platforms, to drive cross-platform usage. This omnichannel strategy not only increases visibility but also aligns audiobook consumption with existing digital behaviors, reinforcing long-term market penetration.

RECENT MARKET DEVELOPMENTS

- In January 2024, Audible launched a new line of AI-narrated audiobooks specifically designed for less popular titles and academic texts, aiming to expand its catalog without significantly increasing production costs.

- In February 2024, Storytel partnered with a leading European university to integrate audiobooks into digital learning modules, targeting students and educators seeking flexible, audio-based study resources.

- In March 2024, Google Play Books introduced a feature allowing users to sync audiobook progress across multiple devices, enhancing convenience and accessibility for multitasking listeners.

- In April 2024, Libro.fm expanded its presence in continental Europe by launching localized language versions of its app, focusing on independent bookstores and community-driven audiobook sales.

- In May 2024, Bol.com, a major Dutch online retailer, launched its audiobook platform to complement its existing e-book offerings, tapping into the growing demand for digital reading alternatives in Western Europe.

MARKET SEGMENTATION

This research report on the Europe audiobook market is segmented and sub-segmented into the following categories.

By Genre

- Fiction

- Non-Fiction

By Preferred Device

- Smartphones

- Laptops & Tablets

- Personal Digital Assistants

- Others

By Distribution Channel

- One-time download

- Subscription-Based

By Target Audience

- Kids

- Adult

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the audiobook market in Europe?

Key growth drivers include increased smartphone and internet penetration, growing popularity of multitasking-friendly content, busy lifestyles, and the rise of subscription-based audiobook services.

What challenges does the European audiobook market face?

Challenges include content piracy, regional language barriers, licensing restrictions, and competition from other digital media formats like podcasts and eBooks.

What is the future outlook for the Europe audiobook market?

The Europe audiobook market is expected to witness steady growth over the next decade, driven by advancements in AI narration, expansion into regional languages, and increased demand for on-the-go content.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com