Europe Automotive Start-Stop Battery Market Research Report – Segmented By Battery Type (Absorbent Glass Mat (AGM) Batteries, Lithium-Ion (Li-ion) Batteries), Vehicle Type, Sales Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Start-Stop Battery Market Size

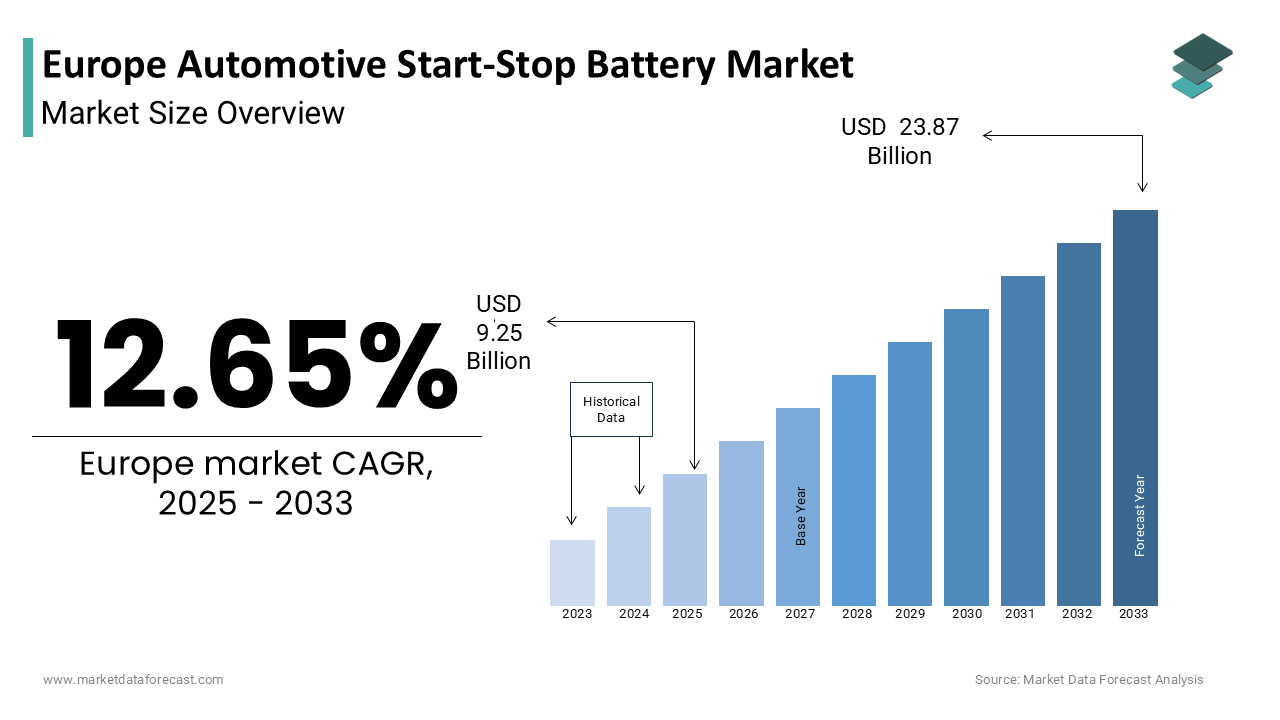

The Europe Automotive Start-Stop Battery Market was worth USD 2.62 billion in 2024. The Europe market is expected to reach USD 23.87 billion by 2033 from USD 9.20 billion in 2025, rising at a CAGR of 12.65% from 2025 to 2033.

The Europe automotive start-stop battery market refers to the segment of vehicle energy storage systems specifically designed for vehicles equipped with start-stop technology, which automatically shuts off and restarts the engine to reduce idling fuel consumption and emissions. This market has gained significant traction as automakers across the continent integrate fuel-efficient technologies to meet stringent emission norms set by regulatory bodies such as the European Union. The adoption of micro-hybrid systems, which rely heavily on advanced battery technologies like Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB), has surged in recent years.

According to data published by ACEA (European Automobile Manufacturers’ Association), over 60% of new passenger cars registered in the EU in 2023 were equipped with some form of electrified powertrain, including mild hybrids that utilize start-stop batteries. Germany remains the largest market within Europe for these batteries due to its robust automotive manufacturing base and high consumer preference for fuel-efficient vehicles. Moreover, France and the UK have shown strong growth in demand, driven by government incentives and rising environmental awareness.

MARKET DRIVERS

Stringent Emission Regulations Across Europe

One of the primary drivers of the Europe automotive start-stop battery market is the enforcement of stringent carbon emission regulations by the European Union. In 2023, the EU mandated that new cars must emit no more than 95 grams of CO₂ per kilometer, a limit that most internal combustion engine vehicles struggle to meet without auxiliary technologies. Start-stop systems help bridge this gap by reducing idle emissions. Consequently, automakers are increasingly integrating these systems into their vehicle lineups. To curb this, governments across the region have introduced financial penalties for manufacturers failing to comply with emission targets, alongside tax benefits for consumers purchasing low-emission vehicles. For instance, Germany offers purchase incentives for cars equipped with micro-hybrid systems, encouraging OEMs to adopt start-stop technology. This policy-driven push not only accelerates the adoption of start-stop batteries but also ensures continued innovation in battery chemistry and durability to support frequent engine cycling under real-world driving conditions.

Rising Fuel Efficiency Awareness Among Consumers

Consumer demand for fuel-efficient vehicles is another key driver of the Europe automotive start-stop battery market. With fuel prices remaining volatile and environmental consciousness on the rise, European buyers are increasingly opting for vehicles that offer better mileage and lower running costs. Start-stop systems contribute to an improvement in fuel efficiency, particularly in urban driving scenarios where frequent stops are common, as noted by Bosch, a leading automotive supplier. According to the European Commission’s 2023 Mobility and Transport report, a notable share of car buyers in Western Europe consider fuel economy among the top three deciding factors when purchasing a new vehicle. This trend is especially pronounced in countries like France and Italy, where city congestion and high fuel taxes amplify the economic benefits of fuel-saving technologies. This growing preference directly translates into increased deployment of start-stop batteries, particularly AGM and EFB types, which are capable of handling the heightened electrical load and charge acceptance demands.

MARKET RESTRAINTS

High Cost of Advanced Battery Technologies

One of the major restraints facing the Europe automotive start-stop battery market is the relatively high cost associated with advanced battery technologies such as Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB). Compared to conventional lead-acid batteries, AGM units can cost up to 50% more, while EFB batteries typically carry a 20–30% price premium, as reported by S&P Global Mobility. This pricing disparity poses a challenge for both automakers and consumers, particularly in budget-conscious segments of the market. In Eastern European markets such as Poland and Romania, where affordability plays a crucial role in vehicle purchasing decisions, the additional cost of integrating start-stop systems often results in limited adoption. Even in Western Europe, cost sensitivity affects mass-market vehicle configurations, where manufacturers may opt to exclude start-stop features unless mandated by emission regulations. While the long-term benefits of improved fuel efficiency and reduced emissions are well documented, the upfront investment deters many consumers and fleet operators from choosing vehicles equipped with these systems.

Limited Lifespan and Durability Issues Under Frequent Cycling

Another significant restraint affecting the Europe automotive start-stop battery market is the shortened lifespan and durability challenges faced by these batteries under frequent engine cycling. Unlike traditional starter batteries, start-stop units endure repeated discharging and recharging cycles during daily urban commutes, which accelerates wear and tear. Like, AGM batteries in start-stop applications typically last between 3 to 5 years, compared to 5 to 7 years for standard lead-acid units under normal usage conditions. Frequent stop-start operations increase thermal stress and sulfation, particularly in colder climates such as Scandinavia and the Baltic states, where low temperatures already pose a challenge to battery performance. This leads to higher replacement frequency and maintenance costs, discouraging consumer confidence and affecting aftermarket sales. Furthermore, improper charging strategies or prolonged idling—common in heavy traffic—can exacerbate battery stress, reducing overall reliability. As a result, some automakers and fleet managers remain cautious about fully committing to start-stop technology, especially in commercial and industrial vehicle applications where operational uptime is critical.

MARKET OPPORTUNITIES

Expansion of Micro-Hybrid Vehicle Production in Europe

A major opportunity for the Europe automotive start-stop battery market lies in the expanding production of micro-hybrid vehicles across the continent. As automakers seek cost-effective electrification solutions that do not require full hybrid or electric drivetrains, micro-hybrids, which rely on start-stop batteries, have emerged as a preferred option. Germany, France, and Spain have been at the forefront of this shift, with major OEMs such as Volkswagen, Renault, and BMW incorporating 48V mild hybrid architectures into their mainstream models. This trend is expected to accelerate as automakers look to balance compliance with emission standards while maintaining competitive pricing. Given that each micro-hybrid vehicle requires a high-performance AGM or EFB battery capable of supporting regenerative braking and rapid engine restarts, this production boom presents a substantial growth avenue for battery suppliers. Moreover, with the European Investment Bank increasing funding for green mobility projects, infrastructure development for battery manufacturing and recycling is also gaining momentum, further strengthening the market outlook.

Increasing Aftermarket Demand Due to Battery Replacement Cycles

The rising frequency of battery replacements in existing vehicle fleets represents a significant opportunity for the Europe automotive start-stop battery market. Unlike traditional lead-acid batteries, start-stop units endure greater strain due to repeated engine shutdowns and restarts, leading to shorter lifespans and higher replacement rates. This accelerated replacement cycle is creating a robust aftermarket segment, particularly in countries with high vehicle parc density such as Germany, Italy, and the UK. Data from the European Automotive Battery Association (EABA) indicates that in 2023, a key share of all automotive battery replacements in Europe involved AGM or EFB units, up from that in 2019. Independent workshops and online retailers are capitalizing on this demand surge, offering branded and aftermarket-compatible start-stop batteries at varying price points. Companies like Banner Batteries and Hoppecke Industrial Batteries have expanded their distribution networks across Central and Eastern Europe to meet this growing need.

MARKET CHALLENGES

Complexity in Recycling and Disposal of Advanced Battery Chemistries

A significant challenge confronting the Europe automotive start-stop battery market is the complexity involved in recycling and disposing of advanced battery chemistries such as AGM and EFB units. While lead-acid batteries have long benefited from mature recycling infrastructures, newer start-stop battery technologies incorporate specialized materials and construction methods that complicate end-of-life processing. This discrepancy arises due to the presence of glass mat separators and enhanced lead alloys in AGM batteries, which require specialized dismantling procedures to recover valuable components effectively. In response, the European Union has imposed stricter waste management regulations under the End-of-Life Vehicles (ELV) Directive, mandating higher recycling quotas and traceability requirements. However, many smaller recycling facilities lack the infrastructure to handle these newer battery types, resulting in inefficiencies and potential environmental risks. Additionally, the cost of compliant recycling has risen, impacting profit margins for both battery producers and recyclers.

Technological Competition from Full Electrification Trends

The rapid advancement of full electrification in the automotive sector poses a growing challenge to the Europe automotive start-stop battery market. As governments and automakers prioritize zero-emission mobility, investment is increasingly shifting towards battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), which do not rely on traditional start-stop systems. According to BloombergNEF, BEV sales in Europe reached 1.5 million units in 2023, accounting for over 18% of the total passenger car registrations figure projected to exceed 30% by 2027. With major European OEMs such as Volvo, Mercedes-Benz, and Renault announcing aggressive electrification roadmaps, the relevance of micro-hybrid technologies is being questioned, particularly in urban mobility segments where BEVs are gaining dominance. Also, public policy incentives are increasingly skewed toward zero-emission vehicles; for example, the Netherlands and Norway offer stronger subsidies and tax exemptions for BEVs compared to mild hybrids. This shift in focus threatens to marginalize start-stop battery demand in the long term. Furthermore, as lithium-ion battery costs decline and charging infrastructure expands, the economic viability of full electrification improves, further diminishing the appeal of incremental efficiency solutions like start-stop systems.]

SEGMENTAL ANALYSIS

By Battery Type Insights

The absorbent Glass Mat (AGM) batteries segment dominated the Europe automotive start-stop battery market by accounting for 58.5% of total sales in 2024. This segment's position is primarily attributed to AGM’s superior performance characteristics, including high charge acceptance, deep cycling capability, and vibration resistance—critical attributes for vehicles equipped with frequent engine stop-start systems. The dominance of AGM batteries is further reinforced by regulatory mandates aimed at reducing CO₂ emissions across the EU. As per ACEA, more than 65% of new vehicle registrations in Western Europe in 2023 included some form of micro-hybrid system, which relies heavily on AGM units due to their ability to support regenerative braking and rapid engine restarts. Additionally, Bosch reports that AGM batteries offer better energy efficiency compared to Enhanced Flooded Batteries (EFB), making them a preferred choice among automakers seeking compliance with Euro 6d emission standards. The increasing integration of advanced driver-assistance systems (ADAS) also boosts electrical load requirements, further cementing AGM’s position as the go-to solution for modern start-stop applications.

The lithium-ion batteries are projected to grow at the fastest rate in the Europe automotive start-stop battery market, registering a CAGR of 12.4%. This rapid expansion is driven by growing experimentation with lightweight and high-energy-density alternatives, particularly in compact urban vehicles and next-generation micro-hybrids. According to McKinsey, several European OEMs, including BMW and Renault, have begun pilot programs integrating Li-ion-based mild hybrid architectures to reduce vehicle weight and improve fuel economy. A key factor behind this growth is the declining cost of lithium-ion cells. With increasing R&D investments from companies like Northvolt and CATL to localize production in Europe, the adoption of Li-ion batteries in start-stop systems is expected to accelerate, especially in high-end hatchbacks and electric-assisted combustion models targeting urban mobility.

By Vehicle Type Insights

The passenger cars represented the largest segment in the Europe automotive start-stop battery market by capturing substantial share in 2024. This is due to the widespread adoption of start-stop systems in both entry-level and premium passenger vehicles across the continent. According to the European Automobile Manufacturers’ Association (ACEA), over 12 million passenger cars were registered in the EU in 2023, with nearly two-thirds featuring micro-hybrid or mild hybrid configurations relying on AGM or EFB batteries. Germany leads in passenger car integration of start-stop technology, where major manufacturers such as Volkswagen, Mercedes-Benz, and BMW equip most of their internal combustion engine (ICE) lineups with these systems. Moreover, the rising popularity of city driving, coupled with stringent emission norms, has increased the relevance of idle-reduction technologies.

The segment of Light commercial vehicles (LCVs) are emerging as the fastest-growing segment in the Europe automotive start-stop battery market, with a projected CAGR of 9.1% over the next seven years. This progress is mainly fueled by the expansion of last-mile delivery networks and increasing fleet electrification initiatives in the logistics sector. According to ACEA, LCV registrations in the EU reached 2.3 million units in 2023, marking a 6.5% year-over-year increase—the highest growth among all vehicle categories. Major logistics operators such as DHL, Amazon Logistics, and DB Schenker have committed to greening their fleets, prompting original equipment manufacturers (OEMs) to incorporate start-stop systems into their LCV offerings. For instance, Stellantis and Ford have introduced mild hybrid versions of their best-selling LCV models such as the Fiat Ducato and Transit Custom that utilize AGM batteries to manage frequent stops typical in urban deliveries. Data from McKinsey reveals that start-stop-equipped LCVs can achieve improvement in fuel efficiency, translating into significant operational cost savings for fleet owners. Moreover, the European Commission’s push for cleaner urban freight transport through initiatives like the Clean Delivery Zones policy is further accelerating the adoption of fuel-saving technologies in this segment.

By Sales Channel Insights

The OEM channel had the maximum share of the Europe automotive start-stop battery market, contributing 67.8% of total sales in 2024. This is largely driven by the mandatory integration of start-stop systems into new vehicles to comply with tightening EU emission regulations. Automotive OEMs such as BMW, Audi, and PSA Group have established long-term partnerships with battery suppliers like Varta, Exide, and Hoppecke to ensure seamless integration of start-stop systems during vehicle production. Furthermore, the European Union’s Real Driving Emissions (RDE) testing regime incentivizes automakers to adopt factory-fitted fuel-saving technologies rather than retrofitting solutions post-sale.

The aftermarket segment is experiencing the highest rise in the Europe automotive start-stop battery market, expanding at a CAGR of 10.8%. This surge is primarily driven by the aging vehicle parc in Europe and the rising need for replacement batteries compatible with existing start-stop systems. According to the European Automobile Manufacturers’ Association (ACEA), the average age of passenger cars in the EU exceeded 11 years in 2023, indicating a large base of vehicles requiring periodic battery replacements. As AGM and EFB batteries degrade faster than traditional lead-acid units due to frequent engine cycling, replacement demand is outpacing vehicle sales. Independent workshops and online retailers such as Europart and BatterySpares have capitalized on this trend by offering a wide range of branded and compatible aftermarket batteries at competitive prices. Additionally, consumer awareness regarding proper battery selection for start-stop vehicles has increased, thanks to digital marketing campaigns by brands like Banner and Varta.

REGIONAL ANALYSIS

Germany stands at the forefront of the Europe automotive start-stop battery market by holding a 23.5% share in 2024. As the largest automotive manufacturing hub in Europe, Germany produces over 3 million vehicles annually, many of which are equipped with micro-hybrid systems utilizing AGM or EFB batteries. According to ACEA, more than 75% of new cars registered in Germany in 2023 featured start-stop technology, reflecting strong OEM adoption. This prowess is reinforced by stringent domestic emission policies aligned with EU directives. Besides, local battery manufacturers such as Varta play a crucial role in supplying OEMs like BMW, Mercedes-Benz, and Audi. The presence of a mature automotive supply chain and government-backed research initiatives, such as those funded by the Fraunhofer Institute, further bolsters the country’s dominance in the start-stop battery space.

France is a strong contributor to the market, driven by strong domestic demand and supportive public policy. Government incentives such as the “Bonus Écologique” provide financial benefits for purchasing fuel-efficient vehicles, encouraging OEMs like Renault and Peugeot to integrate micro-hybrid technologies. Additionally, the rise in urban mobility and traffic congestion has heightened interest in idle-reduction solutions. The country's expanding network of independent battery distributors and service centers has also facilitated higher aftermarket penetration. With continued investment in green transportation infrastructure and growing consumer awareness, France remains a pivotal market for start-stop battery adoption.

The United Kingdom holds a key position in the Europe automotive start-stop battery market, with demand driven by shifting consumer preferences and environmental policies. Despite Brexit-related uncertainties, the UK continues to align its emission reduction targets with EU standards. Fuel cost volatility and the government’s Ultra Low Emission Zone (ULEZ) expansion have incentivized buyers to choose fuel-efficient vehicles. Additionally, the aftermarket segment is gaining momentum, with retailers like Halfords and Battery Centre expanding their AGM and EFB product lines. As the UK transitions away from full electric subsidies toward broader efficiency measures, start-stop battery adoption is expected to remain robust.

Italy is steadily moving forward in the Europe automotive start-stop battery market, with growth propelled by dense urban environments and evolving consumer behavior. Cities like Rome and Milan experience high levels of traffic congestion, leading to increased interest in idle-reduction technologies. Additionally, rising diesel scrappage programs and regional incentives have accelerated the shift toward fuel-efficient technologies. As Italy continues to invest in smart city initiatives, the demand for start-stop batteries is expected to gain further traction across both OEM and aftermarket channels.

Spain is growing mid-market demand, with progress propelled by expanding mid-market vehicle sales and rising fuel consciousness. This reflects a strategic shift by automakers like SEAT and Citroën to enhance fuel efficiency without significantly increasing vehicle costs. Spanish consumers are becoming increasingly aware of fuel-saving benefits. Also, the country’s growing urbanization and traffic density, particularly in Madrid and Barcelona, have boosted the relevance of start-stop technology. The aftermarket segment is also expanding, with retailers such as Norauto and Pit Point offering specialized AGM battery services.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Clarios, Exide Technologies, VARTA AG, Bosch, Banner Batteries, GS Yuasa Corporation, East Penn Manufacturing, and FIAMM Energy Technology are some of the key market players.

The competition in the Europe automotive start-stop battery market is intense, marked by the presence of both global leaders and regional specialists striving to secure contracts with major OEMs while expanding their reach in the aftermarket. Established brands leverage technological expertise, production capabilities, and strong supply chain networks to maintain dominance, particularly in high-volume markets like Germany and France. At the same time, emerging players are focusing on cost-effective solutions and localized manufacturing to gain traction. The shift toward more efficient and durable battery types, such as AG, M, is driving continuous innovation, pushing companies to invest in R&D and sustainability initiatives. Additionally, as the automotive industry transitions toward partial electrification, battery suppliers are adapting their strategies to remain relevant in an evolving mobility ecosystem. The interplay between regulatory pressures, consumer preferences, and technological advancements ensures that the competitive dynamics remain fluid and highly responsive to market shifts.

Top Players in the Europe Automotive Start-Stop Battery Market

Varta AG

Varta is a leading European manufacturer of automotive batteries and holds a strong position in the start-stop battery segment. The company has built a reputation for high-performance AGM and EFB technologies that cater to major European automakers. Varta’s focus on innovation, reliability, and OEM partnerships has enabled it to maintain a dominant presence across Germany and other Western European markets. Its extensive R&D initiatives and strategic collaborations with automotive giants ensure continuous adaptation to evolving vehicle electrification needs.

Exide Technologies

Exide is a globally recognized name in energy storage solutions and plays a vital role in the European start-stop battery market. The company offers a wide range of AGM and EFB batteries designed specifically for micro-hybrid applications. Exide's strength lies in its established distribution network and long-standing relationships with automotive manufacturers. It emphasizes sustainable manufacturing practices and has been actively investing in advanced battery recycling infrastructure to align with European environmental standards.

Hoppecke Industrial Batteries GmbH

Hoppecke is a key player known for its durable and high-efficiency battery solutions tailored for automotive applications. While traditionally strong in industrial sectors, the company has expanded significantly into the automotive space, particularly in the start-stop battery domain. Hoppecke differentiates itself through customized product offerings and a commitment to quality, making it a preferred supplier for several European OEMs and aftermarket channels.

Top Strategies Used by Key Market Participants

Strategic Partnerships with OEMs

Major players are strengthening their foothold by forming long-term supply agreements with leading automobile manufacturers. These partnerships ensure consistent demand and allow battery producers to integrate their products seamlessly into new vehicle platforms. Collaborations also enable co-development of battery technologies tailored to specific vehicle requirements, enhancing performance and compatibility.

Investment in Advanced R&D and Product Innovation

To stay ahead in a competitive landscape, companies are heavily investing in research and development to improve battery efficiency, durability, and recyclability. Innovations in AGM and EFB chemistries, as well as early exploration of lithium-ion alternatives, are being prioritized to meet evolving automotive demands and regulatory standards.

Expansion of Aftermarket Distribution Networks

Recognizing the growing replacement cycle of start-stop batteries, leading firms are expanding their presence in the aftermarket segment. This includes developing robust service networks, offering technical support, and partnering with independent retailers to ensure broader availability and accessibility of their products across Europe.

RECENT MARKET DEVELOPMENTS

- In March 2024, Varta announced the expansion of its AGM battery production line at its Hanover facility to better serve increasing demand from German automakers integrating micro-hybrid systems.

- In July 2023, Exide Technologies launched a new EFB battery variant specifically designed for urban delivery vehicles, targeting the growing light commercial vehicle segment in Europe.

- In November 2023, Hoppecke Industrial Batteries formed a strategic partnership with a leading European auto parts distributor to enhance its aftermarket presence and improve product accessibility across Central Europe.

- In February 2024, Banner Batteries introduced a digital diagnostic tool for start-stop batteries, enabling workshops to assess battery health more accurately and streamline replacements in the aftermarket.

- In May 2023, Leclanché entered into a joint venture with a French mobility solutions provider to explore integration opportunities of its lithium-based battery technology in next-generation start-stop systems for compact city cars.

- In April 2024, DynaTouch, a kiosk solutions provider, acquired KioWare, a kiosk management software company. This acquisition is anticipated to allow DynaTouch to offer more comprehensive kiosk solutions and strengthen its market presence.

MARKET SEGMENTATION

This research report on the Europe automotive start-stop battery market is segmented and sub-segmented into the following categories.

By Battery Type

- Absorbent Glass Mat (AGM) Batteries

- Lithium-Ion (Li-ion) Batteries

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Automotive Start-Stop Battery Market?

The market growth is driven by increasing demand for fuel-efficient vehicles, stricter emission regulations, and growing adoption of hybrid and start-stop technologies.

What is the expected growth outlook for this market?

The market is expected to grow steadily in the coming years due to ongoing advancements in battery technology and increasing adoption of eco-friendly automotive solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com