Europe Biochips Market Research Report - Segmented By Type, End User & By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) – Industry Analysis (2025 to 2033)

Europe Biochips Market Size

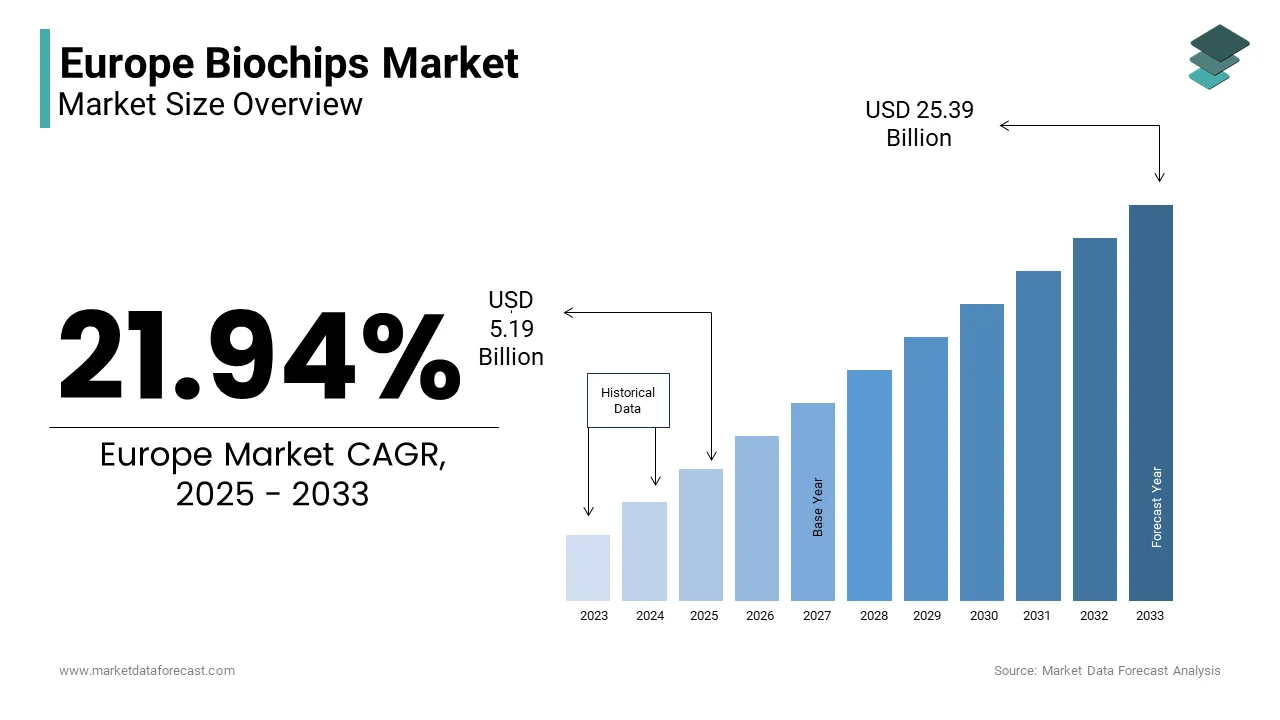

The Europe Biochips Market Size was valued at USD 4.26 billion in 2024. The Europe Biochips Market Size is expected to have 21.94% CAGR from 2025 to 2033 and be worth USD 25.39 billion by 2033 from USD 5.19 billion in 2025.

The biochips are widely used in diagnostics, drug discovery, environmental monitoring, and personalized medicine. Germany, France, and the UK are leading contributors due to their robust healthcare infrastructure and strong presence of key industry players. Additionally, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), over 1,800 biotech firms were operational across Europe in 2023, many of which are engaged in developing biochip-based diagnostic platforms. The integration of nanotechnology and microfabrication techniques has further enhanced the sensitivity and specificity of biochips, enabling faster disease detection and improved patient outcomes.

MARKET DRIVERS

Increasing Prevalence of Chronic Diseases Across Europe

One of the primary drivers fueling the growth of the Europe Biochips Market is the rising prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and neurodegenerative conditions. According to the World Health Organization (WHO), non-communicable diseases account for nearly 86% of all deaths and 77% of the disease burden in the European Region. This alarming trend has intensified the need for early diagnosis and targeted therapies, where biochips play a pivotal role by enabling rapid, multiplexed biomarker detection. For instance, biochips integrated with microarrays are increasingly being used in oncology for identifying genetic mutations linked to breast and colorectal cancers. This surge necessitates cost-effective and portable diagnostic solutions, where lab-on-a-chip technologies offer significant advantages. As per the European Commission’s health strategy, there has been a notable shift toward preventive healthcare and personalized treatment approaches, both of which rely heavily on biochip-enabled diagnostics. The ability of biochips to deliver high-speed, accurate results using minimal sample volumes aligns perfectly with this evolving healthcare landscape, thereby driving sustained demand across hospitals, research labs, and diagnostic centers in the region.

Expansion of Genomic Research and Personalized Medicine Initiatives

Another significant driver of the Europe Biochips Market is the expansion of genomic research and the growing emphasis on personalized medicine. Europe has emerged as a global leader in genomics, supported by government-funded initiatives such as the UK Biobank, Estonia's Genome Center, and the French Genomic Medicine Plan. These programs aim to sequence large populations to better understand genetic predispositions to diseases and tailor treatments accordingly. As per the Wellcome Sanger Institute, over 500,000 whole-genome sequences have been analyzed in the UK as part of its national biobanking initiative, generating massive datasets that require high-throughput analytical tools like biochips. Microarray-based biochips are extensively used in genome-wide association studies (GWAS) to identify single nucleotide polymorphisms (SNPs) linked to various diseases. In addition, next-generation sequencing (NGS) platforms often incorporate biochip technology for efficient sample processing and data generation. According to the European Association of Hospital Pharmacists, the adoption of pharmacogenomics in clinical settings is steadily increasing, particularly in countries like Sweden and the Netherlands, where biochip-based tests guide medication selection based on individual genetic profiles.

MARKET RESTRAINTS

High Development and Regulatory Compliance Costs

A major restraint impeding the growth of the Europe Biochips Market is the high cost associated with product development and regulatory compliance. Biochip development involves extensive research, design validation, prototype testing, and integration with complex software systems, all of which require significant capital investment. Additionally, stringent regulatory frameworks governed by the European Medicines Agency (EMA) and the Medical Device Regulation (MDR) impose rigorous approval processes, increasing both time-to-market and financial burden. Small and medium-sized enterprises (SMEs), which constitute a significant portion of the biochip ecosystem, often struggle to meet these financial and procedural demands.

Limited Reimbursement Policies for Advanced Diagnostic Technologies

Another critical challenge restraining the Europe Biochips Market is the inconsistent reimbursement policies for advanced diagnostic technologies across different EU member states. Unlike traditional diagnostic methods, biochip-based assays often face delays in securing coverage under national healthcare systems due to unclear pricing structures and lack of standardized evaluation criteria. According to a 2023 report by the European Observatory on Health Systems and Policies, only 12 out of 27 EU countries have established dedicated reimbursement pathways for molecular diagnostics, including those enabled by biochips. In countries like Italy and Spain, despite growing adoption of precision medicine, reimbursement remains fragmented at the regional level, creating uncertainty for manufacturers and healthcare providers alike. The German Federal Joint Committee (G-BA) requires extensive clinical evidence before approving coverage for novel diagnostic tools, a process that can take several years. As per the European Patients’ Forum, patients in Eastern Europe frequently bear out-of-pocket costs for cutting-edge diagnostics due to limited insurance coverage, reducing the uptake of biochip-based tests. The lack of harmonized reimbursement strategies not only limits market penetration but also discourages investment in innovation.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence with Biochip Platforms

One of the most promising opportunities shaping the future of the Europe Biochips Market is the integration of artificial intelligence (AI) with biochip platforms to enhance diagnostic accuracy and accelerate decision-making. AI-powered algorithms are increasingly being deployed to analyze complex datasets generated by biochips, particularly in applications such as disease screening, biomarker identification, and real-time monitoring. Companies like Owlstone Medical and Siemens Healthineers are pioneering the use of machine learning models in conjunction with breath biopsy biochips to detect volatile organic compounds indicative of lung cancer and inflammatory diseases. In clinical trials conducted at University College London, AI-enhanced biochip systems demonstrated a 92% accuracy rate in distinguishing between bacterial and viral infections, significantly outperforming conventional methods.

Rise in Point-of-Care Testing and Decentralized Diagnostics

The expanding adoption of point-of-care testing (POCT) and decentralized diagnostic services represents a major growth opportunity for the Europe Biochips Market. POCT enables rapid diagnosis outside traditional laboratory settings, making it particularly valuable in emergency care, rural clinics, home healthcare, and ambulatory services. Biochips, especially lab-on-a-chip systems, are central to this transformation due to their compact size, low sample requirement, and ability to perform multi-analyte testing simultaneously. In response to the pandemic, several European nations have accelerated investments in decentralized testing infrastructure. Companies such as Abionic and Micropoint Bioscience have introduced handheld biochip analyzers capable of diagnosing cardiac markers, sepsis indicators, and allergens within minutes. Moreover, the European Commission’s “Healthier Together” initiative emphasizes strengthening primary healthcare networks through digital and mobile diagnostics, further supporting the integration of biochips into decentralized settings.

MARKET CHALLENGES

Complexity in Manufacturing and Scaling Production

A significant challenge facing the Europe Biochips Market is the complexity involved in manufacturing and scaling production processes for biochip-based systems. Unlike conventional diagnostic tools, biochips require highly specialized fabrication techniques that integrate biological elements with microfluidic channels, sensors, and electronic interfaces. This multidisciplinary approach necessitates expertise in biotechnology, materials science, and semiconductor engineering, complicating the production pipeline. Additionally, maintaining batch consistency and sterility during mass production remains a persistent issue. This inefficiency translates into higher unit costs and slower deployment cycles. Startups and mid-sized companies, in particular, struggle to secure access to cleanrooms, specialized equipment, and skilled personnel required for scalable production. The European Commission acknowledges these challenges in its Industrial Strategy for Pharmaceuticals, noting that supply chain bottlenecks and technical hurdles in biochip manufacturing hinder broader market adoption.

Ethical and Data Privacy Concerns in Genomic and Diagnostic Applications

Ethical and data privacy concerns pose a formidable challenge to the expansion of the Europe Biochips Market, particularly in applications involving genomic profiling and personalized diagnostics. As biochips generate vast amounts of sensitive biological and health-related data, ensuring compliance with data protection regulations such as the General Data Protection Regulation (GDPR) becomes imperative. In genomic applications, where biochips are used to detect hereditary risks and predispositions, issues around informed consent, data ownership, and potential misuse of genetic information become even more pronounced. Moreover, as per the European Parliamentary Research Service, ambiguity persists regarding the legal status of anonymized genetic data, complicating its use in research and commercial applications. These ethical dilemmas and regulatory uncertainties create hesitancy among both consumers and healthcare providers in adopting biochip-based diagnostics at scale. Addressing these concerns will require robust governance frameworks, transparent data handling practices, and public education initiatives to build trust in emerging biochip technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.94 % |

|

Segments Covered |

By Type, End User and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Agilent Technologies Inc., Fluidigm Corporation, PerkinElmer Inc., Bio-Rad Laboratories Inc. |

SEGMENT ANALYSIS

By Type Insights

The DNA chips segment was the largest and held 38.4% of the Europe Biochips Market share in 2024. One key driver behind the dominance of DNA chips is the surge in demand for genetic testing across Europe , fueled by increasing awareness of hereditary diseases and rising investments in national genomic initiatives. For instance, the UK’s Genomics England completed sequencing over 100,000 whole genomes by early 2024, significantly boosting the need for high-density DNA microarrays. Another major factor is the expansion of personalized medicine programs , particularly in oncology and rare disease treatment.

The Lab-on-a-chip technology segment is lucratively growing with a CAGR of 14.2% from 2025 to 2033. A primary growth driver is the rising deployment of point-of-care diagnostic systems , especially in remote and underserved regions. Furthermore, the integration of AI and IoT technologies into lab-on-a-chip systems is enhancing real-time data processing and remote monitoring capabilities.

By End User Insights

The hospitals and diagnostic centers segment was accounted in holding 39.3% of the Europe Biochips Market share in 2024. One of the leading drivers is the increasing burden of chronic diseases such as cancer, diabetes, and cardiovascular disorders , which require timely and accurate diagnosis. Additionally, the adoption of digital pathology and molecular diagnostics in hospital settings has surged in recent years. Moreover, the implementation of national health digitization strategies , especially in Germany and France, has enabled seamless integration of biochip-generated data into electronic health records (EHRs).

The academic and research institutes segment is lucratively to register a CAGR of 13.6% in the next coming years. One of the key driving forces is the substantial government funding directed toward life sciences and biotechnology research. In addition, the establishment of specialized biochip research hubs across Europe has accelerated the pace of technological advancement. Institutions like ETH Zurich, Leiden University, and Karolinska Institute have launched dedicated biochip laboratories, attracting global talent and private-sector partnerships. Moreover, the growing emphasis on preclinical drug testing alternatives to animal models has boosted the adoption of organ-on-a-chip platforms developed within academic institutions.

COUNTRY LEVEL ANALYSIS

Germany was the largest and held 22.3% of the Europe Biochips Market share in 2024. The presence of world-class research institutions and universities , including the Max Planck Institute and Fraunhofer Society, which are actively engaged in biochip innovation is substantially to grow in the next coming years. Additionally, Germany's well-developed healthcare ecosystem supports widespread adoption of advanced diagnostic tools , including DNA chips and lab-on-a-chip platforms. Moreover, the country’s proactive regulatory environment and digital health strategy facilitate the commercialization of new biochip technologies.

The UK ranked second in the Europe Biochips Market with a share of 16.3% in 2024. A major contributing factor is the Genomics England initiative , which has positioned the UK at the forefront of large-scale genomic research. By early 2024, the program had sequenced over 100,000 whole genomes , generating significant demand for DNA microarrays and next-generation biochip platforms. Another key driver is the strong presence of international and domestic biochip manufacturers , including Oxford Nanopore Technologies and Congenica, which are pioneering novel applications in real-time diagnostics and portable sequencing. Furthermore, the UK’s favorable regulatory landscape post-Brexit has allowed faster approval pathways for innovative diagnostics , encouraging biochip startups and SMEs to scale rapidly.

France biochips market is likely to have a fastest growth in the next coming years. The national push for digital health and personalized medicine is exemplified by the PIA (Programme d'Investissements d'Avenir), which has funded numerous biochip-related projects. In 2023, the French Ministry of Higher Education, Research and Innovation reported that over €300 million had been allocated to biochip R&D under the PIA4 initiative , focusing on applications in oncology and neurodegenerative diseases. Moreover, the country is home to several innovative biotech clusters , such as Lyonbiopôle and Paris Biotech Santé, which foster collaboration between academia, startups, and multinational corporations. According to Biocat, a pan-European biotech association, French biochip firms saw a 35% increase in cross-border collaborations between 2021 and 2023, which is accelerating the commercialization of novel platforms.

Italy Biochips Market is expected to have steady growth opportunities throughout the forecast period. A key driver is the expansion of molecular diagnostics in both public and private healthcare facilities . The Italian Ministry of Health reported that the number of molecular diagnostic tests conducted in hospitals rose by 38% from 2020 to 2023, with biochips playing a central role in detecting infectious diseases and guiding antimicrobial therapy. Furthermore, Italy has witnessed a notable rise in academic and industrial partnerships in the field of organ-on-a-chip technology. The National Research Council (CNR) partnered with several European firms in 2023 to develop liver-on-a-chip models for drug toxicity screening, aligning with EU-wide efforts to reduce animal testing.

Sweden Biochips Market growth is driven with the innovation-driven economy and strong healthcare system, Sweden plays a crucial role in advancing biochip applications, particularly in life science research and diagnostics. Additionally, Sweden’s thriving medtech startup ecosystem has led to the emergence of innovative biochip companies such as Olink Proteomics and Sense Biodetection.

Top Players in the Market

One of the leading players in the Europe Biochips Market is Siemens Healthineers , a division of Siemens AG. The company has made significant contributions to the advancement of diagnostic technologies in integrating biochip-based assays with automated laboratory systems. Their focus on developing high-throughput, multiplexed diagnostic platforms has enabled faster and more accurate disease detection across hospitals and research centers in Europe. Another major player is Oxford Nanopore Technologies , a UK-based biotech firm known for its pioneering work in portable DNA sequencing solutions. The company's innovative biochip-driven sequencing devices have transformed genomic research by enabling real-time, decentralized analysis. Its commitment to scalable and accessible molecular diagnostics has positioned it as a key influencer in both academic and clinical applications across the region. Bosch Healthcare Solutions , a subsidiary of Robert Bosch GmbH, plays a crucial role in advancing point-of-care diagnostics through microfluidic biochip technology. The company has been instrumental in developing compact, user-friendly diagnostic devices suitable for home healthcare and ambulatory settings.

Top Strategies Used by Key Market Participants

A primary strategy employed by key players in the Europe Biochips Market is strategic partnerships and collaborations , particularly between industry leaders and academic institutions. These alliances help accelerate innovation, streamline R&D processes, and facilitate early commercialization of advanced biochip platforms tailored for clinical use.

Another widely adopted approach is product diversification and portfolio expansion , wherein companies introduce new generations of biochips that cater to multiple applications such as genomics, proteomics, and disease diagnostics. This allows firms to serve a broader customer base while addressing evolving clinical and research demands.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europea biochips market profiled in the report are Agilent Technologies Inc., Fluidigm Corporation, PerkinElmer Inc., Bio-Rad Laboratories Inc., GE Healthcare, Cepheid Inc., Illumina Inc., and Thermo Fisher Scientific Inc.

The competition in the Europe Biochips Market is marked by a blend of established multinational corporations and agile startups striving to capture market share through innovation and strategic positioning. The presence of well-entrenched players with strong R&D capabilities fosters an environment where technological differentiation and application-specific customization are key success factors. At the same time, emerging biotech firms are leveraging niche expertise to challenge incumbents, particularly in areas such as organ-on-a-chip development and portable diagnostics. Collaborative ecosystems involving academia, government bodies, and private enterprises further shape the competitive landscape by driving standardization and accelerating adoption.

RECENT HAPPENINGS IN THE MARKET

In February 2024, Oxford Nanopore Technologies launched a next-generation sequencing chip designed specifically for rapid pathogen identification in hospital settings, which is expanding its footprint in clinical diagnostics.

In June 2023, Siemens Healthineers partnered with a leading European research institute to co-develop AI-integrated biochip platforms for early cancer detection by reinforcing its dominance in precision oncology.

In October 2024, Bosch Healthcare Solutions introduced a new line of biochip-enabled home diagnostic kits aimed at improving chronic disease monitoring, which is marking a strategic move into consumer-focused healthcare.

In March 2023, a prominent French biotech startup collaborated with a global pharmaceutical company to deploy organ-on-a-chip models for drug toxicity screening by enhancing preclinical testing efficiency.

In November 2024, a German medtech firm acquired a specialized microfluidics company to strengthen its lab-on-a-chip capabilities, which is aiming to expand its offerings in point-of-care diagnostics across Europe.

MARKET SEGMENTATION

This research report on the europea biochips market has been segmented and sub-segmented into the following categories.

By Type

- DNA chips

- Lab-on-a-chip technology

By End User

- hospitals and diagnostic centers

- academic and research institutes

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are biochips and how are they used in Europe?

Biochips are miniaturized laboratories that can perform numerous biochemical reactions, such as DNA analysis, protein identification, and drug testing. In Europe, they are widely used in diagnostics, genomics, proteomics, and personalized medicine.

What is driving the growth of the biochips market in Europe?

The key factors include the increasing demand for personalized medicine, rising adoption of point-of-care diagnostics, technological advancements in biotechnology, and a growing focus on disease prevention and early detection.

What types of biochips are most popular in the European market?

The most popular types include DNA microarrays, protein microarrays, and lab-on-a-chip (LOC) devices. DNA microarrays are particularly popular in genomics research, while protein microarrays are commonly used in drug development.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com