Europe Bread Improvers Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Emulsifiers, Enzymes, Oxidizing Agents, Reducing Agents, Acidulants), Application, Form, End Users, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2024 to 2032)

Europe Bread Improvers Market Size

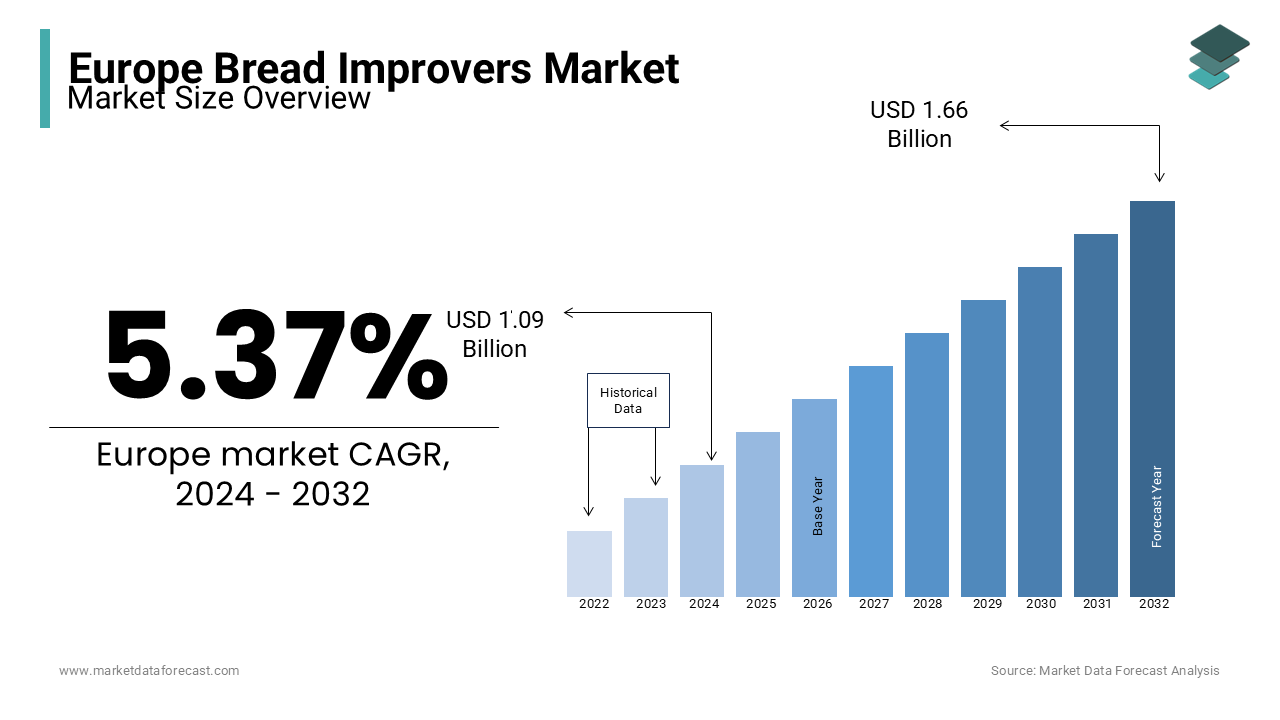

The Europe bread improvers market size was calculated to be USD 1.04 billion in 2023 and is anticipated to be worth USD 1.66 billion by 2032 from USD 1.09 billion In 2024, growing at a CAGR of 5.37% during the forecast period.

Bread improvers, a blend of enzymes, emulsifiers, and other additives, optimize dough handling, improve volume, and enhance crumb structure, meeting the needs of artisanal and industrial bakeries.

In Europe, where bread consumption is deeply ingrained in cultural diets, the demand for clean-label and gluten-free products is reshaping the market. Approximately 10% of European consumers actively seek gluten-free options, spurring innovation in bread improvers to cater to this segment according to Food Allergy Europe in 2023.

Sustainability trends are also influencing product development, with manufacturers sourcing plant-based enzymes and emulsifiers to align with eco-conscious values. Advanced technologies, such as enzymatic solutions, reduce reliance on chemical additives with both consumer health concerns and regulatory compliance. Collaboration between bakeries and ingredient manufacturers drives continuous innovation in this dynamic market.

MARKET DRIVERS

Rising Demand for Clean-Label Products

European consumers are increasingly prioritizing clean-label baked goods, free from artificial additives and preservatives. A survey by the European Food Information Council (EUFIC) in 2023 revealed that 72% of consumers prefer products with simple and recognizable ingredients. This trend drives the development of bread improvers using natural enzymes and plant-based emulsifiers to meet these preferences. Clean-label bread improvers not only improve dough elasticity and texture but also address health-conscious demands and also with stricter EU food regulations. The shift toward natural solutions is reshaping the industry by encouraging manufacturers to innovate while maintaining product functionality and transparency.

Growth in Gluten-Free and Specialty Diets

The increasing prevalence of gluten intolerance and dietary preferences for gluten-free products significantly drives the market. Accounting 1 in 100 Europeans is diagnosed with celiac disease, and demand for gluten-free bread is rising by 10% annually according to Food Allergy Europe, 2023. Bread improvers designed to enhance gluten-free formulations help bakers achieve desired texture and volume. Additionally, specialty diets like keto and high-fiber preferences further boost demand for customized improvers by enabling manufacturers to target niche segments effectively and expand their market reach.

MARKET RESTRAINTS

Stringent EU Regulations on Additives

The Europe bread improvers market faces challenges due to stringent regulatory frameworks governing food additives and enzymes. The European Food Safety Authority (EFSA) requires rigorous testing and approval for every ingredient by prolonging product development timelines and increasing costs for manufacturers. For example, a 2023 report highlighted that over 30% of additive applications faced delays due to compliance issues. These regulatory hurdles limit the introduction of innovative bread improvers with adoption of new enzyme technologies shall creates a barrier for smaller companies unable to absorb the costs of compliance.

Consumer Skepticism Toward Additives

Consumer skepticism about processed ingredients and additives remains a restraint with the trend towards clean-label. A survey by Food Navigator in 2023 found that 48% of Europeans associate bread improvers with artificial chemicals, impacting purchase decisions. Misconceptions about the role of enzymes and emulsifiers in enhancing bread quality leads to reluctance among health-conscious consumers. This skepticism forces manufacturers to invest heavily in consumer education and transparent labeling to build trust, which can slow market growth.

MARKET OPPORTUNITIES

Adoption of Plant-Based and Sustainable Ingredients

The growing consumer preference for plant-based products presents significant opportunities in the Europe bread improvers market. Bread improvers formulated with plant-derived enzymes, such as amylases and lipases, align with eco-conscious and vegan-friendly trends. In 2023, over 40% of European consumers reported a preference for plant-based alternatives in baked goods according to Plant-Based Foods Association. This shift encourages manufacturers to innovate sustainable formulations that reduce reliance on synthetic emulsifiers and additives. Additionally, using upcycled ingredients, such as by-products from grain milling that offers a dual benefit of cost reduction and sustainability by appealing to both producers and environmentally aware consumers.

Technological Advancements in Enzyme Applications

Advances in enzyme technology are creating opportunities for developing highly specific bread improvers. For instance, enzymatic solutions like maltogenic amylases enable extended shelf life without compromising bread softness or flavor. Research indicates that these enzymes can extend product freshness by 50% longer compared to traditional additives according to European Bakery Innovation Forum, 2023. Such innovations are particularly relevant for industrial bakeries seeking to reduce waste and improve supply chain efficiency. Manufacturers can cater to evolving consumer demands for healthier and longer-lasting baked goods while reducing costs and maintaining quality by integrating cutting-edge enzyme solutions.

MARKET CHALLENGES

Volatility in Raw Material Prices

Fluctuating prices of raw materials like wheat, soy, and other grain derivatives used in bread improvers pose a significant challenge. For example, in 2023, wheat prices in Europe increased by 20% due to climate change impacts and geopolitical tensions affecting supply chains according to European Grain Council. Such volatility directly impacts production costs for bread improvers and squeezing margins for manufacturers. Small-scale producers, in particular, face difficulties maintaining competitive pricing which can hinder market growth. The dependency on imported raw materials for specialty enzymes further exacerbates this issue.

Limited Awareness Among Small-Scale Bakers

Small-scale bakeries, which constitute a significant portion of Europe’s baking industry, often lack awareness of the benefits of bread improvers. A 2023 survey by the European Bakers’ Association found that 35% of small bakers still rely on traditional methods by perceiving bread improvers as unnecessary or too expensive. This limited understanding restricts the adoption of innovative improvers in rural areas where access to training and technical support is minimal. Bridging this gap requires focused educational campaigns and partnerships by adding an additional burden for manufacturers looking to expand their reach.

SEGMENTAL ANALYSIS

By Type Insights

Emulsifiers are the largest segment in the Europe bread improvers market, accounting for 45% of the market share in 2024. Emulsifiers are essential for enhancing dough stability, improving volume, and extending the shelf life of baked goods, making them indispensable in industrial and artisanal bakeries. For instance, emulsifiers like lecithin and monoglycerides optimize texture and moisture retention, addressing consumer demands for soft and long-lasting bread. According to a 2023 report by the European Food Safety Authority (EFSA), 70% of large-scale bakeries in Europe rely on emulsifiers to ensure consistent product quality. The rising popularity of clean-label emulsifiers derived from plant sources further solidifies their dominance in the market.

The enzymes segment is growing at the fastest rate, with a projected compound annual growth rate (CAGR) of 6.7% from 2024 to 2032. Enzymes such as amylases and lipases are gaining traction due to their natural origin and multifunctionality with clean-label trends. These enzymes enhance dough strength, reduce staling and improve overall bread quality without the need for synthetic additives. A 2023 study by the European Bakery Association found that enzymatic solutions reduce production waste by 15%, appealing to sustainability-conscious manufacturers. Additionally, advancements in enzyme technology, like maltogenic amylases do support extended shelf life, meeting consumer and retailer demands for fresher baked goods. This innovation drives the rapid adoption of enzymes in the bread improvers market.

By Application Insights

The bread, buns, and rolls segment holds the largest share, accounting for 45% of the Europe bread improvers market. This dominance is attributed to the staple status of these products in European diets, with per capita bread consumption averaging 50 kg per year in countries like Germany and France. Bread improvers are essential in enhancing dough quality, texture, and shelf life, meeting consumer expectations for freshness and consistency. The increasing demand for convenience foods and the popularity of sandwiches and fast-food items further bolster this segment's leading position.

The pastries segment is experiencing the fastest growth, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2032. This rapid expansion is driven by the rising popularity of indulgent bakery items and the expanding café culture across Europe. Consumers' increasing preference for premium and artisanal pastry products has led to a surge in demand for high-quality pastries. Bread improvers play a crucial role in achieving the desired flakiness, volume, and mouthfeel in pastries, making them indispensable in pastry production. The growing trend of on-the-go snacking and the introduction of innovative pastry flavors and varieties are further contributing to the rapid expansion of this segment.

By Form Insights

Powdered improvers constitute the largest segment, accounting for 60% of the market share. Their dominance is attributed to versatility, ease of use, and longer shelf life compared to liquid forms. Powdered bread improvers are preferred in large-scale industrial baking because they can be easily mixed with flour and other dry ingredients by ensuring consistent distribution throughout the dough. Additionally, the stability of powdered improvers during storage and transportation makes them more convenient for manufacturers and retailers.

Liquid improvers are experiencing the fastest growth, with a projected compound annual growth rate (CAGR) of 5.4% during the forecast period from 2024 to 2032. This rapid expansion is driven by the increasing adoption of automated and continuous mixing processes in industrial bakeries, where liquid improvers can be precisely dosed, enhancing production efficiency. Liquid forms also offer superior dispersion in dough, improving consistency and quality of the final baked product. The growing demand for specialty and artisanal bread products often require customized formulations achievable through liquid improvers that further contributes to their accelerated market growth.

By End Users Insights

In the Europe bread improvers market, industrial bakeries represent the largest end-user segment, accounting for 45% of the market share. This dominance is due to the high production volumes and the necessity for consistent product quality in large-scale baking operations. Industrial bakeries utilize bread improvers to enhance dough handling, improve texture, and extend shelf life, meeting consumer demands for uniform and long-lasting baked goods. The efficiency and cost-effectiveness achieved through the use of bread improvers are crucial for maintaining competitiveness in the mass production sector.

The quick-service restaurants (QSRs) segment is projected a compound annual growth rate (CAGR) of 6.2% from 2024 to 2032. This rapid expansion is driven by the increasing consumer preference for convenience foods and the proliferation of fast-food chains across Europe. QSRs require bread products with specific qualities, such as softness and extended freshness, to enhance customer satisfaction. Bread improvers enable QSRs to maintain the desired quality of their bread offerings by supporting menu consistency and operational efficiency. The growing trend of dining out and the demand for quick-service options contribute significantly to the accelerated adoption of bread improvers in this segment.

COUNTRY LEVEL ANALYSIS

Germany leads the Europe bread improvers market, holding the largest share of 20% in 2024. Known for its rich bread culture, with over 300 types of bread, the country’s high per capita consumption of 56 kg annually drives demand for bread improvers. Industrial bakeries dominate, ensuring consistent quality and extended shelf life. Germany’s bread improvers market is projected to grow at a CAGR of 4.2% from 2024 to 2032 owing to the innovations in clean-label improvers to meet stringent EU regulations and health-conscious consumer preferences.

The UK holds a significant share, accounting for 15% of the regional market, with a projected CAGR of 4.4% from 2024 to 2032. The rise in bakery chains and quick-service restaurants fuels demand for bread improvers to ensure uniform quality and texture. The increasing popularity of gluten-free and specialty bread further propels the market, as 1 in 100 Britons is diagnosed with celiac disease.

France, with its strong artisanal bread tradition is set to have the fastest growth rate during the foreseen years. The rising demand for premium and diverse baked goods is enhancing the growth rate of the market. French consumers favor traditional breads like baguettes and brioche that requires high-quality improvers to maintain authenticity while enhancing volume and crumb structure.

Italy is esteemed to have the significant growth rate in the next coming years with a focus on traditional breads like ciabatta and focaccia. The demand for improvers in Italy is growing with the expansion of artisanal bakeries and export-driven production. Improvers help balance traditional recipes with modern production efficiencies to cater to both domestic and international markets.

The traditional baked goods and packaged bread have significant opportunities in Spain which is promoting the growth rate of the market during the forecast period.

Spanish bakeries are incorporating enzyme-based improvers to enhance shelf life and texture particularly in urban centers where convenience foods are gaining popularity.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major key players of the Europe bread improvers market include Lesaffre Group, Puratos Group, Corbion N.V., AB Mauri (Associated British Foods plc), DuPont (IFF – International Flavors & Fragrances Inc.), Bakels Group, Kerry Group plc, Lallemand Inc., Novozymes A/S, and DSM-Firmenich

The Europe bread improvers market is highly competitive is driven by the increasing demand for innovative and high-quality baked goods. Key players such as Lesaffre Group, Puratos Group, and Corbion N.V. dominate the market with their extensive portfolios of bread improvers tailored to artisanal, industrial, and quick-service bakery segments. These companies leverage advanced technologies to develop clean-label and enzyme-based improvers meeting consumer preferences for healthier, sustainable, and natural ingredients.

Regional and niche players, including Bakels Group and Lallemand Inc., focus on providing customized solutions for local markets, emphasizing traditional bread products and specialty diets like gluten-free and vegan options. The competition is further intensified by innovation in enzymatic and emulsifier-based solutions that enhances dough handling, shelf life, and bread texture.

Global giants such as Kerry Group and DuPont (IFF) actively invest in R&D to create improvers that comply with stringent European regulations while aligning with emerging trends, such as reduced food waste and clean-label formulations. The market also witnesses strategic collaborations between ingredient manufacturers and bakeries to co-develop products that cater to evolving consumer tastes.

As consumer preferences shift toward premium, artisanal, and sustainable bakery products, the competitive landscape is expected to remain dynamic, driven by continuous innovation and strategic partnerships.

RECENT HAPPENINGS IN THE MARKET

- In November 2023, Bakels Sweden introduced two innovative bread improvers, Lecimax 3000 and Lecisoft Rye. Lecimax 3000 is designed to enhance bread volume and improve overall loaf structure, making it ideal for high-volume industrial bakeries. Lecisoft Rye, on the other hand, focuses on enhancing softness and crumb texture, particularly for rye-based bread, which has unique handling challenges. These launches aim to meet consumer demands for superior quality baked goods, bolstering Bakels’ reputation for innovation in bread improvement solutions.

- In June 2023, Kerry Group plc launched Biobake, an enzyme-based bread improver aimed at reducing reliance on eggs in baking processes. This product offers a cost-effective and sustainable alternative for industrial and artisanal bakers, addressing growing concerns over ingredient costs and the environmental impact of animal-derived products. Biobake is designed to maintain bread quality while providing a cleaner, eco-friendly option, reinforcing Kerry Group’s commitment to sustainability.

- In 2023, Puratos Group expanded its bread improver portfolio to include clean-label solutions. These products are formulated with natural ingredients, eliminating artificial additives to cater to the increasing consumer preference for transparency and simplicity in food labeling. This expansion enhances Puratos’ ability to support bakers in meeting health-conscious consumer demands while complying with stringent European food regulations.

- In 2023, Lesaffre Group invested heavily in R&D to enhance its range of enzyme-based bread improvers. By leveraging advanced enzyme technologies, Lesaffre aims to improve dough consistency, extend bread shelf life, and reduce food waste. This move highlights Lesaffre’s strategic focus on providing natural and sustainable solutions to meet evolving consumer and industrial needs in the baking sector.

- In 2023, International Flavors & Fragrances Inc. (IFF) launched clean-label bread improvers as part of its efforts to align with health-conscious consumer preferences. These improvers address the growing demand for natural ingredients while maintaining product quality and functionality. IFF’s initiative strengthens its position as a leading provider of bakery solutions tailored to market trends.

- In 2023, Corbion N.V. prioritized the development of clean-label bread improvers that utilize natural emulsifiers and enzymes. These products are designed to enhance bread texture, extend shelf life, and meet regulatory requirements. Corbion’s focus on clean-label solutions positions it as a key player in the transition toward healthier and more transparent bakery products.

- In 2023, AB Mauri continued its innovative approach by introducing new bread improvers that optimize texture, volume, and processing efficiency. These developments target both industrial and artisanal bakers, ensuring consistent product quality while addressing diverse baking challenges. AB Mauri’s ongoing innovation strengthens its competitive edge in the market.

- In 2023, Lallemand Inc. expanded its enzyme-based bread improver portfolio to cater to the growing demand for sustainable baking practices. By using natural enzymes, Lallemand enhances dough performance and reduces reliance on synthetic additives, aligning with the trend toward cleaner, greener baking solutions.

- In 2023, Novozymes A/S focused on advancing enzyme-based bread improvers that improve dough strength, texture, and shelf life. These innovations support industrial bakeries in meeting consumer expectations for high-quality bread while ensuring sustainable production processes.

- In 2023, DSM-Firmenich invested in developing clean-label and enzyme-based bread improvers. These products are tailored to address consumer demands for healthier, natural bakery options while ensuring compliance with European food safety standards. DSM-Firmenich’s efforts solidify its position as a leader in sustainable bakery ingredient solutions.

MARKET SEGMENTATION

This research report on the Europe bread improvers market has been segmented and sub-segmented based on type, application, form, end users, and region.

By Type

- Emulsifiers

- Enzymes

- Oxidizing Agents

- Reducing Agents

- Acidulants

By Application

- Bread, Buns, and Rolls

- Fresh

- Frozen/Chilled

- Long Life

- Cakes

- Fresh

- Frozen/Chilled

- Long Life

- Pastries

- Fresh

- Frozen/Chilled

- Long Life

- Pizza Dough

- Fresh

- Frozen/Chilled

- Long Life

- Other Bakery Products

By Form

- Powdered Improvers

- Liquid Improvers

By End Users

- Artisanal Bakeries

- Bakery Chains

- Industrial Bakeries

- Quick-service Restaurants

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who regulates the use of bread improvers in Europe?

Regulatory bodies like the European Food Safety Authority (EFSA) and national food safety agencies.

2. What challenges does the market face?

Regulatory restrictions, consumer demand for fewer additives, and increasing ingredient costs.

3. Which European countries have the highest demand for bread improvers?

Germany, France, Italy, and the UK.

4. How do bread improvers impact baking processes?

They improve dough strength, fermentation tolerance, and overall product quality.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com