Europe Breast Cancer Therapeutics Market Size, Share, Trends & Growth Forecast Report Segmented Therapy, Cancer Type, Distribution Channel By And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Breast Cancer Therapeutics Market Size

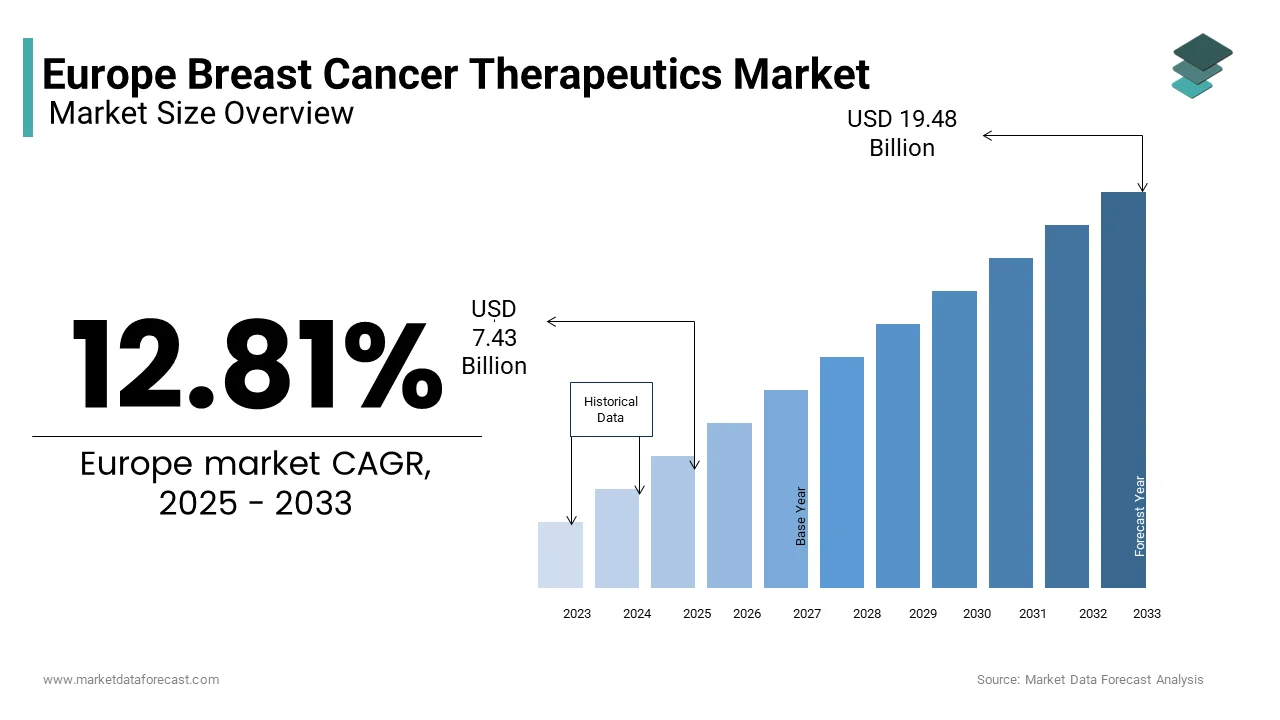

The Europe breast cancer therapeutics market was valued at USD 6.58 billion in 2024 and is anticipated to reach USD 7.43 billion in 2025 from USD 19.48 billion by 2033, growing at a CAGR of 12.81% during the forecast period from 2025 to 2033.

Breast cancer remains one of the most prevalent oncological conditions across Europe, significantly influencing healthcare policies and pharmaceutical investments. The Europe breast cancer therapeutics market involves a large array of treatment modalities, including hormonal therapy, targeted therapy, chemotherapy, and immunotherapy, aimed at improving survival rates and quality of life for patients. As per data from the European Cancer Information System, over 500,000 new cases of breast cancer were diagnosed in the region in 2023 alone, highlighting its widespread incidence and the urgent demand for effective therapeutic interventions.

The prevalence of risk factors such as sedentary lifestyles, obesity, and delayed childbearing has contributed to rising diagnosis rates, particularly in Western European nations like Germany, France, and the UK. Besides, early detection programs and national screening initiatives have improved diagnostic accuracy, leading to timely interventions. Moreover, the integration of precision oncology and biomarker testing into clinical practice has redefined treatment strategies, fueling innovation in drug development.

MARKET DRIVERS

Rising Incidence of HER2-Positive Breast Cancer Cases

One of the key drivers propelling the Europe breast cancer therapeutics market is the increasing incidence of HER2-positive breast cancer, which necessitates advanced targeted therapies. HER2-positive subtypes are known for their aggressive progression and poor prognosis if left untreated. According to the European Society for Medical Oncology (ESMO), approximately 15–20% of all breast cancer cases diagnosed in Europe are HER2-positive, translating to more than 75,000 annual cases across major markets such as Germany, France, and Italy.

This rising patient pool has directly amplified the demand for monoclonal antibodies and tyrosine kinase inhibitors, including trastuzumab, pertuzumab, and tucatinib, which have become integral components of first-line treatment regimens. Clinical evidence demonstrating improved survival outcomes with dual HER2-targeted therapy has further reinforced adoption trends. For instance, data from the APHINITY trial, as analyzed by Roche, showed a reduction in the risk of invasive disease recurrence among patients receiving dual therapy compared to single-agent trastuzumab. Moreover, the growing emphasis on companion diagnostics to identify HER2 status accurately before initiating therapy has streamlined patient selection and optimized treatment efficacy.

Expansion of Biosimilar Uptake in Breast Cancer Treatment

A significant growth driver in the Europe breast cancer therapeutics market is the increasing adoption of biosimilars, particularly for well-established biologics like trastuzumab and bevacizumab. Biosimilars offer cost-effective alternatives to originator drugs without compromising efficacy or safety, thereby enhancing treatment accessibility across both public and private healthcare systems. According to the European Medicines Agency (EMA), the approval of multiple trastuzumab biosimilars since 2017 has led to a major reduction in average treatment costs in several EU member states, as reported by the IQVIA Institute for Human Data Science.

Germany, France, and Spain have emerged as early adopters of biosimilars, driven by favorable reimbursement policies and proactive government initiatives to reduce healthcare expenditure. This shift not only eases budgetary constraints on national health systems but also facilitates broader patient access to life-extending treatments.

Furthermore, the EMA’s rigorous yet streamlined biosimilar approval pathway has instilled confidence among clinicians and payers regarding the interchangeability of these agents.

MARKET RESTRAINTS

High Cost of Novel Therapies and Limited Reimbursement Coverage

One of the primary restraints affecting the Europe breast cancer therapeutics market is the prohibitively high cost of novel therapies, particularly antibody-drug conjugates (ADCs) and next-generation CDK4/6 inhibitors. These advanced treatments often come with high annual price tags per patient, posing significant affordability challenges for healthcare systems, especially in mid-tier economies such as Poland, Portugal, and Greece. As per a report published by the European Observatory on Health Systems and Policies, several innovative therapies face restricted access due to stringent cost-effectiveness evaluations by national health technology assessment (HTA) bodies.

For example, despite demonstrated survival benefits, the uptake of sacituzumab govitecan—a novel ADC approved for metastatic triple-negative breast cancer—has been limited in certain EU markets due to pricing disputes. In Italy, the AIFA (Italian Medicines Agency) initially rejected full reimbursement for the drug, citing cost concerns, delaying patient access by over six months post-EU approval. These financial barriers hinder equitable treatment distribution and slow down the integration of cutting-edge therapies into routine clinical practice.

Stringent Regulatory Requirements Delaying Market Entry

Another critical restraint impeding the Europe breast cancer therapeutics market is the protracted and complex regulatory approval process, which often delays the commercial availability of new treatments. Unlike the United States, where expedited pathways like Breakthrough Therapy and Priority Review are frequently utilized, the European Medicines Agency (EMA) maintains a centralized authorization procedure that can take up to 210 days for standard reviews, excluding clock stops for additional data requests. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), approximately 30% of oncology drugs experience at least a six-month lag between EMA and FDA approvals.

Such delays have real-world consequences for patients. For instance, alpelisib, a PI3K inhibitor indicated for hormone receptor-positive, HER2-negative advanced breast cancer, was approved by the FDA in May 2019 but did not receive EMA marketing authorization until November 2019. During this interim period, eligible patients in Europe had no legal access to the therapy, despite its demonstrated clinical benefit. Moreover, post-marketing requirements, including Risk Management Plans (RMPs) and pharmacovigilance obligations, add another layer of complexity for manufacturers seeking to maintain compliance while scaling commercial operations.

MARKET OPPORTUNITY

Advancements in Personalized Medicine and Biomarker Testing

A transformative opportunity emerging in the Europe breast cancer therapeutics market is the rapid advancement of personalized medicine, underpinned by innovations in biomarker testing and genomic profiling. The ability to tailor treatment regimens based on molecular characteristics of individual tumors has significantly enhanced therapeutic outcomes and minimized unnecessary exposure to toxic therapies. Technologies such as next-generation sequencing (NGS) and liquid biopsy platforms are gaining traction across academic and clinical centers, enabling earlier detection of resistance mutations and dynamic monitoring of disease progression. For example, the use of circulating tumor DNA (ctDNA) assays is increasingly being integrated into clinical decision-making, particularly in managing metastatic disease. As per a study published by the European Journal of Cancer, ctDNA-based monitoring improved progression-free survival in patients undergoing endocrine therapy combinations.

Apart from these, the proliferation of companion diagnostics has allowed for better stratification of patients eligible for targeted therapies such as CDK4/6 inhibitors and PARP inhibitors. Countries like Germany and the Netherlands have implemented national frameworks to support the integration of molecular testing into routine oncology care, setting benchmarks for others to follow.

Expansion of Digital Health Platforms in Oncology Care

Digital health technologies are creating substantial opportunities for growth in the Europe breast cancer therapeutics market by streamlining clinical workflows, enhancing patient engagement, and optimizing treatment adherence. The integration of electronic health records (EHRs), telemedicine platforms, and mobile health applications has facilitated remote monitoring of patients undergoing long-term therapies, particularly those on oral oncolytics such as CDK4/6 inhibitors and SERDs. Notably, AI-powered decision support tools are increasingly being used to assist oncologists in selecting the most appropriate treatment regimens based on real-time patient data. Furthermore, wearable devices capable of tracking vital signs, medication adherence, and symptom progression are enabling more proactive management of side effects, thereby reducing hospital readmissions and improving quality of life. In addition, digital platforms are playing a pivotal role in accelerating patient recruitment for clinical trials, particularly for niche indications such as HER2-low and triple-negative breast cancers.

MARKET CHALLENGES

Disparities in Access to Advanced Therapies Across European Countries

A persistent challenge facing the Europe breast cancer therapeutics market is the disparity in access to advanced therapies between Western and Eastern European countries. Despite the presence of a unified regulatory framework through the European Medicines Agency (EMA), significant variations exist in the time to market entry and reimbursement coverage of novel oncology drugs. According to a report by the European Cancer Patient Coalition (ECPC), patients in Central and Eastern Europe often wait several months longer to access newly approved breast cancer therapies compared to their Western European counterparts. These delays are primarily attributed to slower health technology assessment (HTA) processes, budget constraints, and limited negotiation capacity within national pricing frameworks. The lack of harmonized reimbursement policies across EU member states exacerbates inequities, leaving many patients reliant on out-of-pocket payments or compassionate use programs. Moreover, disparities in healthcare spending per capita contribute to unequal access.

Shortage of Skilled Oncology Professionals Impacting Treatment Delivery

An escalating challenge within the Europe breast cancer therapeutics market is the shortage of skilled oncology professionals, including medical oncologists, radiation oncologists, and specialized nurses, which hampers efficient treatment delivery and patient management. According to a workforce analysis conducted by the European Society for Medical Oncology (ESMO), there is a projected deficit of over 2,500 oncologists across the EU by 2030, driven by an aging workforce and insufficient training program capacity.

In several Southern and Eastern European countries, the ratio of oncologists per 100,000 population falls below the recommended threshold set by the European Union. For instance, as per data from the European Observatory on Health Systems and Policies, Greece has only 2.5 medical oncologists per 100,000 people, compared to Germany’s 7.3. This imbalance leads to prolonged appointment wait times, delayed initiation of therapy, and suboptimal adherence to treatment protocols.

Additionally, the complexity of modern breast cancer therapies, including intravenous biologics, requires trained personnel for administration and monitoring. Nurse shortages further compound the issue, limiting infusion center capacities and contributing to treatment backlogs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.81% |

|

Segments Covered |

By Therapy, Cancer Type, Distribution Channel, and By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

Genentech (F. Hoffmann-La Roche Ltd) (South San Francisco, U.S.), Eli Lilly and Company (Indianapolis, U.S.), Novartis AG (Basel, Switzerland), AstraZeneca (Cambridge, U.K.), Pfizer Inc. (New York City, U.S.), Sanofi (Paris, France), Eisai Co. Ltd. (Tokyo, Japan), Kyowa Kirin (Tokyo, Japan), Bristol Myers Squibb (Celgene Corporation) (New York City, U.S.), Merck & Co., Inc. (Kenilworth, U.S.). |

SEGMENTAL ANALYSIS

By Therapy Insights

The hormonal therapy remained the largest segment in the Europe breast cancer therapeutics market, accounting for 38.4% of total revenue in 2024. This dominance is primarily attributed to its widespread use in treating hormone receptor-positive (HR+) breast cancer, which constitutes a significant portion of all diagnosed cases across the region, as per the European Cancer Information System. The high prevalence of HR+ subtypes, particularly among postmenopausal women, has led to a consistent demand for aromatase inhibitors (AIs) such as letrozole, anastrozole, and selective estrogen receptor modulators like tamoxifen. According to the European Society for Medical Oncology (ESMO), over 250,000 patients in Western Europe were on adjuvant endocrine therapy in 2023, contributing significantly to sustained market growth.

Additionally, the long-term nature of hormonal treatment—often extending beyond five years—fuels continuous drug consumption. The integration of CDK4/6 inhibitors such as palbociclib and abemaciclib into first-line regimens further enhances therapeutic efficacy and prolongs survival, reinforcing the clinical and commercial importance of this segment.

Immunotherapy is coming forward as the swiftest advancing segment in the Europe breast cancer therapeutics market, projected to expand at a CAGR of 18.1%. Although currently a niche player, its rapid ascent is driven by breakthrough approvals and expanding indications in triple-negative breast cancer (TNBC), a historically difficult-to-treat subtype.

Pembrolizumab (Keytruda), approved by the European Medicines Agency (EMA) for PD-L1-positive TNBC in combination with chemotherapy, has been pivotal in reshaping treatment guidelines. Clinical trial data from Merck’s KEYNOTE-355 study demonstrated a 35% improvement in progression-free survival among patients receiving pembrolizumab-based regimens compared to chemotherapy alone.

Moreover, growing investments in immuno-oncology research across academic institutions and pharmaceutical companies are accelerating pipeline development. In Germany, the University Hospital Heidelberg has launched multiple investigator-initiated trials assessing novel immune checkpoint inhibitors and bispecific antibodies in early-stage disease. As per the European Organisation for Research and Treatment of Cancer (EORTC), immunotherapy-related clinical trials in breast cancer have surged since 2020.

By Cancer Type Insights

The hormone receptor-positive (HR+) breast cancer continued dominating the cancer type segment in the Europe breast cancer therapeutics market by commanding around 62.5% of the total market share in 2024. This preeminence is due to the high incidence of HR+ disease, which accounts for nearly two-thirds of all new breast cancer diagnoses across major European countries. The aging demographic in Western Europe, particularly in nations like Germany and France, contributes significantly to the rising number of postmenopausal women at risk for HR+ tumors. These tumors are typically more responsive to endocrine therapies, leading to extended treatment durations and higher drug utilization. As reported by the European Cancer Observatory, over 300,000 HR+ cases were recorded in the EU in 2023, underscoring the scale of therapeutic demand. Furthermore, the evolution of treatment protocols incorporating CDK4/6 inhibitors alongside aromatase inhibitors has enhanced clinical outcomes, thereby driving prescription volumes.

The HER2-positive breast cancer is the rapidly developing segment in the Europe breast cancer therapeutics market, expected to grow at a CAGR of 4.1 % during the forecast period. This subtype is witnessing rapid market expansion due to the influx of targeted therapies and dual HER2 blockade regimens.

According to the European Society for Medical Oncology (ESMO), over 70,000 HER2-positive cases were diagnosed in Europe in 2023, with Germany, Italy, and Spain leading in patient volume. The approval of next-generation agents such as trastuzumab deruxtecan (Enhertu) and tucatinib (Tukysa) has significantly improved outcomes in both early and advanced stages. Clinical data from the DESTINY-Breast03 trial revealed a 72% reduction in disease progression or death among patients treated with trastuzumab deruxtecan compared to T-DM1. Also, the increasing use of companion diagnostics to confirm HER2 status before initiating therapy has streamlined treatment decisions and boosted drug uptake.

By Distribution Channel Insights

The Hospital pharmacies dominated the distribution channel segment in the Europe breast cancer therapeutics market by holding a 68.7% of total market share in 2024. This overwhelming dominance is largely due to the administration of intravenous (IV) and injectable therapies—including monoclonal antibodies, antibody-drug conjugates, and chemotherapy—which require specialized infusion centers and trained personnel typically found within hospital settings. In countries like Germany and the Netherlands, over 85% of biologic and targeted therapies are dispensed through hospital pharmacy departments, as highlighted by the European Association of Hospital Pharmacists (EAHP). The centralized procurement model adopted by national health systems further reinforces hospital pharmacies as the primary route for high-cost oncology drugs. Moreover, regulatory frameworks in several European nations restrict the dispensing of certain IV chemotherapies and biosimilars outside hospital environments, limiting alternative distribution avenues.

Online pharmacies are the fastest-growing distribution channel in the Europe breast cancer therapeutics market, projected to expand at a CAGR of 12% through 2033. This surge is primarily driven by the increasing availability of oral oncolytics, such as CDK4/6 inhibitors, SERDs, and PARP inhibitors, which can be safely self-administered at home under physician supervision. The digital transformation of healthcare delivery, especially post-pandemic, has accelerated the adoption of e-pharmacies for chronic disease management. In addition, regulatory reforms in select markets, including Sweden and Denmark, have expanded the scope of online dispensing for prescription-only medicines, enabling greater access to oral breast cancer therapies. Platforms such as LloydsPharmacy Online Doctor in the UK and DocMorris in Germany now offer integrated teleconsultation and home delivery services, improving adherence and continuity of care.

COUNTRY-LEVEL ANALYSIS

Germany prevailed in the Europe breast cancer therapeutics market by capturing 22.1% of the total market value in 2024. The country’s prowess is underpinned by a robust healthcare infrastructure, strong reimbursement policies, and high per capita healthcare expenditure. Germany's early adoption of innovative therapies, including CDK4/6 inhibitors and antibody-drug conjugates, is supported by favorable pricing mechanisms and transparent health technology assessment (HTA) procedures conducted by the IQWiG (Institute for Quality and Efficiency in Health Care). Moreover, the country leads in biosimilar penetration. Public awareness campaigns and nationwide screening programs also contribute to early diagnosis and timely treatment initiation.

France is another key player in the market. The country’s prominence is attributable to a well-developed public healthcare system, proactive government initiatives in cancer control, and a high rate of clinical trial participation. France has made significant strides in integrating personalized medicine into standard oncology care, with HER2 and HR testing being routine components of diagnostic workflows. The Haute Autorité de Santé (HAS) plays a crucial role in evaluating the cost-effectiveness of new therapies, which influences reimbursement decisions and ensures responsible budget allocation. Moreover, the French government has introduced managed entry agreements (MEAs) for premium-priced drugs such as alpelisib and sacituzumab govitecan, facilitating patient access while managing fiscal impact. The presence of major pharmaceutical R&D hubs in Paris and Lyon further supports market dynamism, positioning France as a key contributor to therapeutic advancements in breast cancer care.

The United Kingdom occupies a key position in the Europe breast cancer therapeutics market. Despite Brexit-related uncertainties, the UK maintains a strong foothold due to its centralized National Health Service (NHS) framework, which streamlines drug procurement and distribution. Early diagnosis initiatives, including the NHS Breast Screening Programme, have contributed to improved detection rates and timely treatment commencement. Furthermore, the UK has been at the forefront of adopting innovative therapies, particularly in the HER2-positive and metastatic spaces. The National Institute for Health and Care Excellence (NICE) plays a pivotal role in guiding drug reimbursement decisions, often influencing broader European market trends.

Italy is progressively moving ahead in the market. The country’s market dynamics are shaped by a mix of centralized and regionalized healthcare governance, which influences drug availability and pricing negotiations. Italy has seen increased utilization of biosimilars and generic alternatives to reduce financial strain on the Servizio Sanitario Nazionale (SSN). However, disparities exist between northern and southern regions regarding access to novel therapies. Moreover, Italy is actively involved in multinational clinical trials, particularly through the European Organisation for Research and Treatment of Cancer (EORTC), enhancing its role in shaping future treatment paradigms.

Spain is a developing landscape for the Europe breast cancer therapeutics market. The country's healthcare system, known for its universal coverage and decentralized structure, presents both opportunities and challenges in terms of equitable drug access. Spain has made notable progress in adopting targeted therapies, particularly in HER2-positive and hormone receptor-positive cancers. The Ministry of Health has prioritized the inclusion of precision oncology approaches, supported by genomic profiling initiatives in major academic centers such as Vall d’Hebron University Hospital in Barcelona. Despite economic constraints affecting healthcare budgets, Spain has leveraged managed entry agreements and early access programs to introduce novel therapies ahead of full reimbursement approval. Additionally, the country benefits from a strong presence of international pharmaceutical companies and contract research organizations, fostering innovation and clinical trial participation.

KEY MARKET PLAYERS

Genentech (F. Hoffmann-La Roche Ltd) (South San Francisco, U.S.), Eli Lilly and Company (Indianapolis, U.S.), Novartis AG (Basel, Switzerland), AstraZeneca (Cambridge, U.K.), Pfizer Inc. (New York City, U.S.), Sanofi (Paris, France), Eisai Co. Ltd. (Tokyo, Japan), Kyowa Kirin (Tokyo, Japan), Bristol Myers Squibb (Celgene Corporation) (New York City, U.S.), Merck & Co., Inc. (Kenilworth, U.S.). are the market players that are dominating the Europe breast cancer therapeutics market.

Top Players in the Market

Roche Holding AG

Roche is a dominant force in the Europe breast cancer therapeutics market, with a strong portfolio that includes HER2-targeted therapies such as Herceptin (trastuzumab) and Perjeta (pertuzumab). The company continues to innovate with next-generation treatments like Kadcyla (T-DM1) and Enhertu (trastuzumab deruxtecan), which have redefined care for HER2-positive and HER2-low patients. Roche's emphasis on companion diagnostics and personalized medicine has positioned it at the forefront of targeted oncology in Europe.

AstraZeneca plc

AstraZeneca plays a pivotal role in shaping the hormonal therapy landscape through its flagship drug, Faslodex (fulvestrant), and more recently, the CDK4/6 inhibitor Kisqali (ribociclib). The company’s commitment to advancing endocrine-based combination therapies has strengthened treatment options for hormone receptor-positive breast cancer. Additionally, AstraZeneca’s expanding pipeline, including PARP inhibitors like Lynparza, reinforces its strategic influence in both early and advanced-stage breast cancer care across Europe.

Pfizer Inc.

Pfizer has solidified its presence in the European market with its leading CDK4/6 inhibitor, Ibrance (palbociclib), which remains a cornerstone in HR+/HER2- metastatic breast cancer treatment. The company continues to invest in clinical research to expand indications and improve patient outcomes. With a robust commercial infrastructure and ongoing collaborations with academic and biotech partners, Pfizer maintains a strong competitive edge in the evolving breast cancer therapeutics space in Europe.

Top Strategies Used By Key Market Participants

One major strategy employed by key players in the Europe breast cancer therapeutics market is expanding their oncology pipelines through internal R&D and strategic acquisitions. Companies are investing heavily in novel modalities such as antibody-drug conjugates, immune checkpoint inhibitors, and oral selective estrogen receptor degraders to diversify their offerings and capture emerging therapeutic niches.

Another critical approach is strengthening partnerships with academic institutions and biotech firms to accelerate clinical trial recruitment and enhance biomarker-driven drug development. These collaborations allow pharmaceutical giants to integrate cutting-edge science into their therapeutic portfolios while improving patient stratification and treatment personalization.

Lastly, companies are increasingly focusing on market access strategies, including risk-sharing agreements, managed entry schemes, and biosimilar substitution programs. By engaging proactively with regulatory bodies and payers, manufacturers aim to overcome reimbursement barriers and ensure broader patient access to high-cost therapies across diverse healthcare systems in Europe.

COMPETITION OVERVIEW

The competition in the Europe breast cancer therapeutics market is highly dynamic and characterized by continuous innovation, strategic collaborations, and intense rivalry among global pharmaceutical leaders. As the prevalence of breast cancer remains high across the region, companies are aggressively pursuing differentiation through novel drug development, expanded indications, and improved treatment modalities. The market is witnessing a shift toward precision oncology, where therapies are increasingly tailored based on molecular profiling, intensifying the race for targeted and personalized solutions. Established players are leveraging their strong R&D capabilities, established distribution networks, and deep regulatory expertise to maintain dominance, while emerging biotech firms are disrupting the landscape with innovative pipeline assets. Additionally, pricing pressures, reimbursement challenges, and the growing adoption of biosimilars are reshaping competitive dynamics. Companies are also focusing on value-based approaches, digital health integration, and patient support programs to strengthen their foothold in this evolving therapeutic space.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Roche launched a real-world evidence initiative across Germany and France to demonstrate the long-term efficacy of Enhertu in HER2-low breast cancer patients, aiming to reinforce its position in this newly defined patient population.

- In March 2024, AstraZeneca entered into a collaborative agreement with a leading European diagnostics firm to co-develop companion tests for its next-generation CDK4/6 inhibitors, enhancing treatment personalization and patient selection accuracy.

- In May 2024, Pfizer initiated a pan-European patient access program to expand the availability of palbociclib in Eastern European markets, addressing disparities in treatment access and strengthening its regional footprint.

- In July 2024, Novartis announced a partnership with a digital health platform to integrate AI-powered decision support tools into oncology clinics across Italy and Spain, improving treatment adherence and physician engagement with its breast cancer therapies.

- In September 2024, Merck KGaA expanded its manufacturing capacity in Switzerland to meet rising demand for immuno-oncology agents, ensuring a consistent supply of key investigational therapies in development for triple-negative breast cancer.

MARKET SEGMENTATION

This research report on the Europe breast cancer therapeutics market is segmented and sub-segmented into the following categories.

By Therapy

- Targeted Therapy

- Abemaciclib

- Ado-Trastuzumab Emtansine

- Everolimus

- Trastuzumab

- Ribociclib

- Palbociclib

- Pertuzumab

- Olaparib

- Others

- Hormonal Therapy

- Selective Estrogen Receptor Modulators (SERMs)

- Aromatase Inhibitors

- Estrogen Receptor Downregulators (ERDs)

- Chemotherapy

- Immunotherapy

By Cancer Type

- Hormone Receptor

- HER2+

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving growth in Europe’s breast cancer therapeutics market?

An aging population, increased screening rates, and rising incidence—especially in Western Europe—are fueling demand, alongside access to advanced biologics and precision therapies.

How are targeted therapies changing treatment outcomes in Europe?

HER2-targeted drugs, CDK4/6 inhibitors, and PARP inhibitors are improving progression-free survival rates, especially in HR+/HER2− and triple-negative breast cancer subtypes.

What role does national healthcare policy play in drug accessibility across Europe?

Reimbursement policies and HTA (Health Technology Assessment) decisions vary by country, leading to faster access in markets like Germany and slower adoption in Eastern Europe.

How is the EU encouraging innovation in breast cancer therapeutics?

Programs like Horizon Europe and the EU Cancer Mission fund R&D for next-gen treatments such as antibody-drug conjugates (ADCs), mRNA therapies, and immuno-oncology.

What are the emerging trends in breast cancer treatment personalization in Europe?

Growth in genomic profiling, liquid biopsy diagnostics, and AI-driven treatment planning is enabling more personalized and less toxic therapeutic strategies across major EU hospitals.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com