Europe Bus Market Research Report – Segmented By Length ( 10–12 meter bus, buses below 6 meters) Fuel Type , Seating Capacity, Application & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Bus Market Size

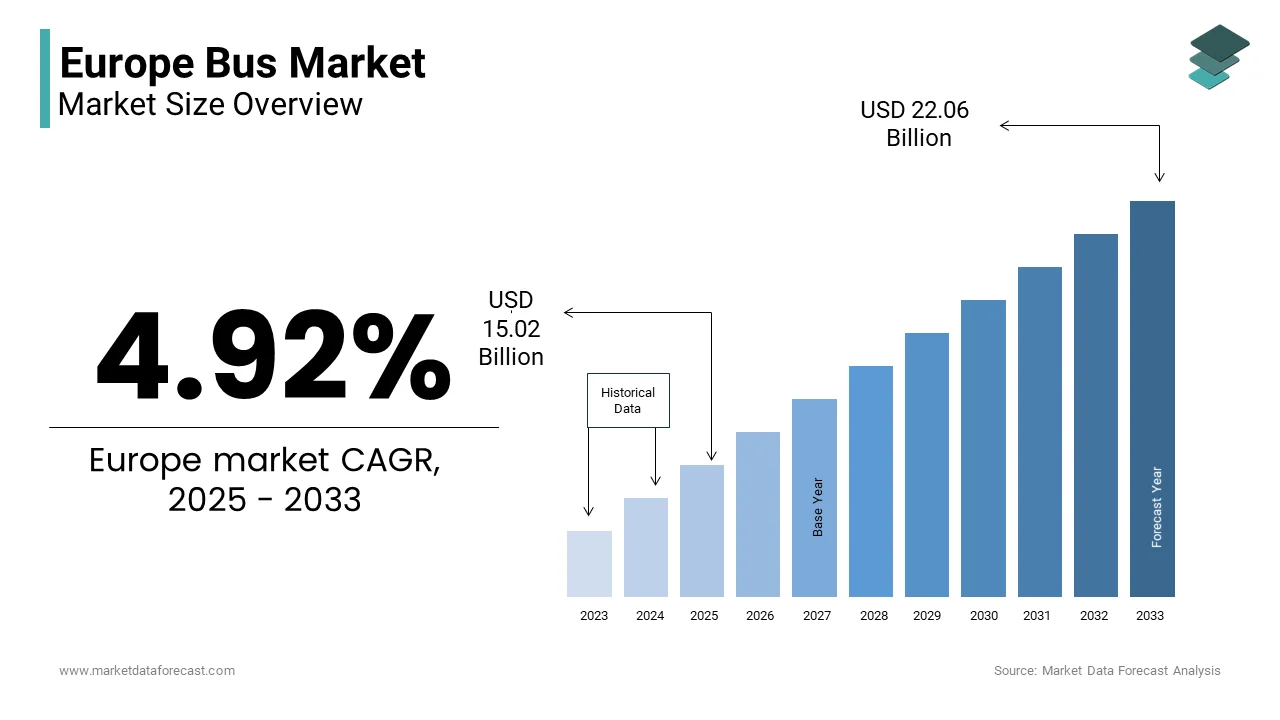

The Europe Bus Market Size was valued at USD 14.32 billion in 2024. The Europe Bus Market size is expected to have 4.92 % CAGR from 2025 to 2033 and be worth USD 22.06 million by 2033 from USD 15.02 billion in 2025.

The bus refers to a wide range of vehicles such as city buses, minibuses, articulated buses, and luxury coaches, serving both governmental and private sector needs. As per Eurostat, over 60% of urban public transport in Europe relies on buses, underlining their critical role in mobility infrastructure. The region has been increasingly focusing on sustainable transport solutions, with several countries investing in electric and hybrid bus fleets to meet climate targets. The European Union’s push for green mobility, along with the expansion of integrated transport systems in cities like Paris, Stockholm, and Amsterdam, has further reinforced the importance of the bus market. Additionally, advancements in telematics, route optimization software, and passenger information systems are transforming how bus services are managed and delivered. Moreover, as per the International Association of Public Transport (UITP), more than 40% of all public transport trips in medium-sized European cities are made via buses. This highlights their irreplaceable function in connecting suburban and rural areas where rail infrastructure is limited.

MARKET DRIVERS

Expansion of Urban Mobility and Public Transportation Networks

One of the key drivers of the Europe bus market is the growing emphasis on expanding urban mobility and enhancing public transportation networks. As European cities continue to grow, governments are prioritizing sustainable and efficient transport options to reduce congestion and emissions. According to the European Environment Agency, road transport accounts for nearly 20% of total CO₂ emissions in the EU. In response, many municipalities have invested heavily in bus rapid transit (BRT) systems, dedicated bus lanes, and integrated ticketing platforms to encourage greater use of public transport. Additionally, the European Commission's Green Deal initiative aims to make transport carbon-neutral by 2050, which is prompting member states to replace aging diesel fleets with cleaner alternatives.

Increasing Government Funding and Subsidies for Sustainable Transit Solutions

Another major driver of the Europe bus market is the significant increase in government funding and subsidies aimed at promoting sustainable transit solutions. National and regional authorities are allocating substantial budgets to support the transition from conventional diesel buses to electric and hydrogen-powered models. As per the European Investment Bank, over €8 billion was approved in 2023 for green transport projects across the EU, including large-scale procurement of low-emission buses. Countries like France and Sweden have implemented national grant programs that cover up to 50% of the cost of purchasing electric buses by making it financially viable for local transit agencies. In addition, the EU’s Connecting Europe Facility (CEF) Transport program provides direct financial support for cross-border and urban transport infrastructure development, which includes funding for electric charging stations and depot upgrades. These initiatives reflect a broader commitment to decarbonization and energy efficiency in public transport.

MARKET RESTRAINTS

High Initial Costs of Electric and Hybrid Buses

A major restraint affecting the Europe bus market is the high initial cost of electric and hybrid buses, which limits widespread adoption despite strong policy backing. According to BloombergNEF, an electric bus in Europe costs approximately two to three times more than a conventional diesel model. Furthermore, the need for supporting infrastructure such as charging stations, upgraded depots, and grid enhancements adds to the overall investment required. In Italy, for instance, some local transit agencies delayed electric bus procurements due to budget constraints related to infrastructure upgrades. This economic burden discourages rapid fleet turnover and slows down the pace of electrification across the continent.

Supply Chain Disruptions and Component Shortages

Supply chain disruptions and component shortages have emerged as a critical constraint on the Europe bus market. The global semiconductor shortage is exacerbated by geopolitical tensions and pandemic-related factory closures, has affected vehicle production timelines.

According to McKinsey, European bus manufacturers faced delays of up to six months in receiving critical electronic components in 2023. Moreover, rising raw material prices, particularly for lithium, nickel, and copper used in electric bus batteries, have added pressure on production costs. In Germany, several major bus producers reported reduced output due to inconsistent supply of essential parts from Asian suppliers. These disruptions hinder the ability of manufacturers to meet growing demand, especially for electric models that require more advanced components.

MARKET OPPORTUNITIES

Growth of Electrified and Autonomous Bus Technologies

One of the most promising opportunities in the Europe bus market is the rapid advancement of electrified and autonomous bus technologies. With increasing focus on sustainable mobility, European cities are piloting electric and self-driving bus services to enhance efficiency and reduce environmental impact. According to the International Energy Agency, Europe accounted for nearly 30% of global electric bus deployments outside of China in 2023. Moreover, the European Commission has funded multiple Horizon 2020 research projects focused on integrating AI, connectivity, and automation into bus operations. Several manufacturers, including Volvo Buses and Scania, have already developed prototypes for autonomous electric buses.

Development of Integrated Mobility Platforms and Digital Ticketing Systems

Another major opportunity for the Europe bus market lies in the development of integrated mobility platforms and digital ticketing systems. Governments and transport operators are investing in unified mobility apps that allow passengers to plan routes, book tickets, and pay seamlessly across multiple transport modes. As per UITP, over 50 European cities have launched multi-modal mobility applications that incorporate real-time bus tracking, contactless payments, and subscription-based services. These platforms enhance user experience and encourage higher ridership by simplifying access to public transport.

In Spain, Barcelona implemented a digital ticketing system that supports NFC-enabled smartphones and wearable devices, significantly boosting convenience for commuters. Similarly, Poland’s “e-Podróżnik” app integrates train, tram, and bus services into one interface, improving accessibility in both urban and rural areas. These developments align with broader smart city initiatives across Europe, fostering greater efficiency and transparency in public transport. It offers a robust avenue for modernizing the bus sector and expanding its appeal among tech-savvy travelers as digital integration continues to evolve.

MARKET CHALLENGES

Regulatory and Policy Variability Across European Countries

A major challenge facing the Europe bus market is the variability of regulatory and policy frameworks across different countries. While the European Union promotes harmonized standards for transport and emissions, individual member states maintain distinct rules regarding vehicle specifications, operator licensing, and subsidy allocation. According to the European Automobile Manufacturers’ Association (ACEA), differences in national regulations around electric bus incentives, charging infrastructure mandates, and emission norms create operational complexities for manufacturers and transport providers. For example, while Germany and France offer generous subsidies for electric buses, other countries impose stricter eligibility criteria or provide minimal financial support.

Additionally, variations in technical standards such as plug types for electric charging or data requirements for digital ticketing hinder pan-European fleet management and interoperability. This fragmentation increases compliance costs and slows down the deployment of standardized solutions across borders.

Aging Workforce and Lack of Skilled Technicians for Advanced Bus Technologies

Another pressing challenge in the Europe bus market is the aging workforce and shortage of skilled technicians capable of maintaining and operating advanced bus technologies. As the industry transitions to electric and digitally integrated vehicles, traditional mechanical expertise is no longer sufficient to support the complex electrical and software-driven systems in modern buses.

According to the European Transport Workers’ Federation, over 40% of bus maintenance personnel in the EU are above the age of 50, with insufficient younger workers entering the profession to replace retirees. This skills gap is particularly evident in rural regions where vocational training centers struggle to keep pace with technological changes.

Moreover, the introduction of electric buses requires specialized knowledge in battery management, charging infrastructure, and software diagnostics. In response, organizations like CLEPA have called for enhanced training programs to upskill existing workers and attract new talent to the sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.92 % |

|

Segments Covered |

By Length ,Fuel Type , Seating Capacity ,Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Daimler AG (Mercedes-Benz Buses), Volvo Group, MAN Truck & Bus, Scania AB |

SEGMENT ANALYSIS

By Length Insights

The 10–12 meter bus segment dominated the Europe bus market by accounting for 45.3% of share in 2024. This length is the standard for urban transit buses and is widely used across European cities due to its optimal balance between passenger capacity and maneuverability in city environments.

According to ACEA (European Automobile Manufacturers’ Association), over 60% of new bus registrations in Germany and France during 2023 were within this size category, driven by their suitability for dense urban transport networks. These buses typically accommodate 70–80 passengers, making them ideal for high-frequency city routes where efficiency and space utilization are crucial.

Additionally, public procurement policies in many EU countries favor standardized 12-meter buses for ease of fleet management and infrastructure compatibility. In Italy, municipal transport authorities have prioritized this segment for renewal programs under the National Recovery and Resilience Plan. The widespread adoption of electric variants in this length further supports its dominance, as major manufacturers like Volvo and MAN offer competitive zero-emission models tailored to urban transit needs.

The buses below 6 meters in length segment is likely to grow with an anticipated CAGR of 9.4% during the forecast period. These compact vehicles are increasingly deployed in last-mile connectivity, school transportation, and rural route operations where larger buses are impractical.

As per UITP (International Association of Public Transport), demand for micro-bus solutions has surged in Scandinavian countries and the Netherlands, where flexible on-demand transport systems are being piloted to reduce reliance on private cars. Norway, for instance, introduced over 300 small electric shuttles in suburban areas in 2023 by enhancing accessibility without requiring extensive infrastructure. Moreover, these buses are favored for corporate shuttle services and hotel transportation in urban centers, offering agility in congested zones. According to McKinsey, shared mobility providers in Spain and Portugal have integrated sub-6m buses into their fleets to serve niche markets efficiently.

By Fuel Type Insights

The diesel buses segment is likely to grow with 58.4% of the Europe bus market share in 2024. Despite aggressive policy pushes toward electrification, diesel remains the dominant fuel type due to its cost-effectiveness, established refueling infrastructure, and reliability in long-haul and regional transport. Additionally, in countries like Greece and Poland, diesel buses remain essential for connecting rural communities where electric charging infrastructure is still under development.

While newer technologies are gaining traction, the upfront affordability of diesel buses continues to make them a preferred choice for operators with limited capital. As reported by ACEA, several public transport agencies in Italy and Austria extended contracts for diesel fleet replacements beyond 2025, which is citing operational readiness concerns with electric alternatives.

The electric buses segment is lucratively to grow with a CAGR of 26.7% in the next coming years. This rapid acceleration is driven by stringent emissions regulations, government incentives, and increasing consumer demand for sustainable mobility solutions. According to BloombergNEF, Europe recorded over 10,000 electric bus deliveries in 2023, with Germany and Sweden leading adoption rates. Major cities such as London, Madrid, and Stockholm have set ambitious targets to achieve full fleet electrification by 2030, backed by substantial funding from national and EU-level programs.

Furthermore, advancements in battery technology have improved vehicle range and reduced operating costs, making electric buses more viable for both urban and regional applications. Manufacturers like BYD, Scania, and Solaris are scaling production to meet rising demand, while charging infrastructure investments from companies like A Better Routeplanner and Siemens Mobility further support sector growth.

By Seating Capacity Insights

The 31–50 seating capacity segment was the largest and held 42.3% of the Europe bus market share in 2024. According to Statista, nearly half of all coach bus purchases in France and Spain during 2023 fell within this category, catering to medium-distance travel demands. These buses are particularly suited for regional carriers that require flexibility in route planning without the overheads associated with larger vehicles. In addition, as per the International Road Union, minibuses and mid-sized coaches in this segment are increasingly utilized for airport transfers, business travel, and touristic itineraries, especially in mountainous and coastal areas where road conditions may limit the use of larger buses. Moreover, school transport operators in Belgium and the Netherlands have adopted 40-seater buses for multi-route scheduling, reducing idle time and improving fleet utilization. This broad applicability across multiple sectors ensures the sustained dominance of the 31–50 seater segment in the European bus market.

The above-50 seater bus segment is experiencing the highest growth in the Europe bus market, expanding at a CAGR of 8.1% through 2030. This increase is primarily driven by rising demand for long-distance travel and the modernization of intercity transport fleets across the continent. According to ACEA, intercity bus operators in Germany and Poland placed significant orders for large-capacity buses in 2023 to replace aging fleets and enhance comfort levels for passengers. These vehicles typically accommodate 60–80 passengers and are equipped with amenities such as Wi-Fi, USB ports, and reclining seats, attracting more travelers compared to traditional rail options. Furthermore, as per UITP, the revival of cross-border coach services post-pandemic has spurred demand for high-capacity buses that can operate economically on longer routes. Companies like Flixbus and Eurolines have expanded their fleets significantly, leveraging economies of scale to offer competitive pricing.

By Application Insights

The transit buses segment held 42.1% of the Europe bus market share in 2024. These vehicles are integral to urban mobility strategies, providing daily commuting solutions across major metropolitan areas and smaller municipalities alike. According to the European Environment Agency, over 65% of public transport journeys in cities like Berlin, Paris, and Amsterdam are made via transit buses. Their role in reducing traffic congestion and lowering carbon emissions makes them a focal point of municipal transport policies aligned with the EU Green Deal. In addition, as per UITP, more than 300 urban transit projects received EU funding in 2023, many of which involved procuring new-generation transit buses. Cities such as Prague and Vienna have accelerated fleet renewals with hybrid and electric models to comply with stricter emission norms. These developments reinforce the centrality of transit buses in shaping sustainable urban transport ecosystems across Europe.

The tourist buses segment is esteemed to grow lucratively with a CAGR of 10.3% in the next coming years. This surge is attributed to the rebound in international tourism following pandemic-related restrictions and the increasing popularity of organized group travel across scenic and cultural destinations. According to the World Travel & Tourism Council, Europe welcomed over 500 million international tourists in 2023, marking a return to pre-pandemic levels. Countries like Italy, Switzerland, and Croatia experienced heightened demand for luxury coach tours, which is prompting operators to invest in modern, comfortable buses with onboard amenities. Additionally, as per the European Travel Commission, there has been a notable rise in eco-conscious travel packages that incorporate energy-efficient tourist buses powered by hybrid or electric drivetrains. Moreover, event-driven tourism, including music festivals, sports events, and heritage tours, has created new demand for specialized transport solutions.

COUNTRY LEVEL ANALYSIS

Germany held 22.3% of the Europe bus market share in 2024. The country's well-developed public transport infrastructure and commitment to sustainable mobility have fueled steady demand for both urban transit and intercity buses. According to the German Federal Ministry of Transport, over 15,000 new buses were registered in 2023, with a significant portion being electric or hybrid models. Major cities like Munich and Hamburg have accelerated fleet electrification under the National Action Plan for Zero-Emission Mobility, supported by generous subsidies and charging infrastructure investments. In addition, as per the German Road Transport Authority, intercity and regional bus operators have expanded services to complement rail networks in rural areas where train coverage is sparse. The presence of leading manufacturers such as MAN and Mercedes-Benz further strengthens domestic production capabilities.

France was positioned second in the Europe bus market with 17.3% of share in 2024. The country benefits from strong public investment in urban mobility and a growing focus on decarbonizing transport systems. According to the French Ministry of Ecological Transition, over 6,000 new buses were delivered to local transit authorities in 2023, with nearly 40% being electric or hybrid models. Cities like Lyon, Bordeaux, and Toulouse have implemented comprehensive fleet renewal programs aimed at achieving climate neutrality by 2030. Additionally, as per Systra, a leading transport consultancy, France saw a 12% increase in intercity bus usage compared to the previous year, driven by affordable fares and expanded coverage. The government-backed "Mobilités" strategy has encouraged the adoption of cleaner buses through grants and preferential financing.

The United Kingdom bus market is likely to grow with a combination of urban transit modernization efforts and regional transport expansion. London remains a key hub for bus deployment, with over 8,000 buses operating across the city. According to Transport for London, the capital’s fleet includes more than 4,000 ultra-low-emission buses, supporting the city’s air quality improvement targets. Outside of London, regional authorities have also launched electrification initiatives in Manchester, Birmingham, and Edinburgh.

Italy bus market growth is likely to a robust public transport network and a growing emphasis on environmental sustainability. Urban centers like Rome, Milan, and Naples rely heavily on buses for daily commuting in areas not well-served by metro lines. According to ANAV, the Italian Association of Road Transport Companies, over 4,500 new buses were purchased by municipal transport agencies in 2023, with a significant portion dedicated to replacing older diesel models with cleaner alternatives. Additionally, as per ISTAT, intercity bus travel in Italy has seen a resurgence, particularly among younger demographics seeking cost-effective and flexible travel options. Regional operators have responded by expanding routes and introducing higher-comfort buses on popular corridors.

Spain bus market growth is driven by strong demand for both urban and intercity transportation. The country has been actively investing in fleet modernization and sustainable mobility solutions in major cities like Madrid, Barcelona, and Valencia. According to the Spanish Ministry of Transport, over 3,000 new buses were registered in 2023, with a growing share featuring low-emission or electric powertrains. Madrid’s Metro de Superficie program, for example, has introduced over 200 electric buses to improve air quality in densely populated areas.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe bus market are Daimler AG (Mercedes-Benz Buses), Volvo Group, MAN Truck & Bus, Scania AB, Iveco Bus, VDL Bus & Coach, Solaris Bus & Coach, Alexander Dennis, Van Hool, Temsa, Irizar, BYD Europe.

The competition in the Europe bus market is highly dynamic, shaped by a mix of established manufacturers, emerging electric vehicle specialists, and shifting policy priorities. Traditional players continue to dominate due to their extensive distribution networks, engineering expertise, and deep-rooted relationships with public transport authorities. However, new entrants particularly those focused on zero-emission technologiesar e gaining traction by leveraging innovation and agility. The push toward greener mobility has intensified rivalry, which is prompting companies to differentiate themselves through advanced propulsion systems, intelligent transport integration, and superior passenger experiences. Additionally, governments play a pivotal role in influencing market dynamics through subsidies, emission regulations, and procurement policies that favor clean energy solutions. While larger firms benefit from economies of scale and brand recognition, smaller manufacturers are capitalizing on niche segments such as lightweight urban shuttles or modular electric platforms. This evolving landscape fosters continuous technological advancement and strategic positioning by making the European bus market one of the most competitive and transformative in the global transportation sector.

Top Players in the Market

MAN Truck & Bus

MAN Truck & Bus, a subsidiary of Volkswagen Group, is a leading manufacturer in the European bus market. Known for its engineering excellence and reliability, MAN offers a wide range of urban, intercity, and electric buses tailored to meet diverse operational needs. The company has been instrumental in advancing sustainable mobility by introducing eco-friendly models equipped with hybrid and electric drivetrains. Its strong distribution network and commitment to innovation have promoted its position as a key player not only in Europe but also in global markets seeking efficient public transport solutions.

Volvo Buses

Volvo Buses has long been recognized for its emphasis on safety, comfort, and environmental responsibility. As part of Volvo Group, it plays a crucial role in shaping the future of public transportation through its prominence in electric and autonomous bus technologies. The company's dedication to developing integrated transport systems has influenced policy and infrastructure planning worldwide.

Solaris Bus & Coach

Solaris is one of Europe’s foremost producers of environmentally friendly urban buses. Based in Poland, the company has gained recognition for its advanced electric and hydrogen-powered bus models that align with the continent’s green mobility goals. Solaris has significantly contributed to the modernization of public transport fleets across numerous European cities, offering customized, high-quality vehicles that meet evolving regulatory standards. Its growing influence extends beyond Europe, where its products are increasingly adopted in markets seeking cleaner transit alternatives.

Top strategies used by the key market participants

One major strategy employed by leading players in the Europe bus market is investing heavily in electrification and alternative fuel technologies. Companies are prioritizing the development and production of electric and hydrogen-powered buses to align with regional decarbonization goals and respond to increasing demand for sustainable transport solutions.

Another critical approach is enhancing product customization and after-sales services. Manufacturers are focusing on offering tailored bus configurations based on specific city requirements while also improving service networks to ensure longer vehicle uptime and customer satisfaction. This includes digital diagnostics, remote monitoring, and preventive maintenance solutions.

The firms are expanding partnerships and collaborations with technology providers, energy companies, and municipalities. These alliances help integrate smart mobility features, charging infrastructure, and fleet management systems into bus operations by ensuring a more seamless and efficient passenger experience across urban and intercity networks.

RECENT HAPPENINGS IN THE MARKET

In January 2024, MAN Truck & Bus announced a strategic collaboration with Siemens Mobility to develop next-generation electric bus charging infrastructure tailored for European cities. This partnership aimed at enhancing the efficiency and scalability of urban electric bus deployments.

In February 2024, Volvo Buses launched an updated version of its fully electric articulated bus model designed specifically for high-capacity urban routes by reinforcing its commitment to sustainable public transport solutions across major European capitals.

In March 2024, Solaris Bus & Coach secured a long-term supply agreement with a major German transit authority to deliver over 100 hydrogen-powered buses by marking a significant step in expanding its presence in the alternative fuel segment.

In April 2024, Daimler Buses introduced a new digital fleet management system for its European clients, integrating real-time performance tracking, predictive maintenance, and route optimization to improve operational efficiency for public transport operators.

In May 2024, Alexander Dennis Limited (ADL) unveiled a new lightweight electric double-decker bus developed in partnership with BYD, targeting mid-sized cities looking for cost-effective and environmentally friendly urban transit options.

MARKET SEGMENTATION

This research report on the europe bus market has been segmented and sub-segmented into the following categories.

By Length

- 10–12 meter bus

- buses below 6 meters

By Fuel Type

- diesel buses

- electric buses

By Seating Capacity

- 31–50 seating capacity

- above-50 seater bus

By Application

- transit buses

- tourist buses

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

Which countries dominate the Europe bus market?

Germany, France, the United Kingdom, and Italy are key players due to well-established public transport systems, tourism, and government support for green mobility.

How is the electric bus segment performing in Europe?

The electric bus market is growing rapidly due to EU climate targets and urban low-emission zones. Countries like the Netherlands and Norway lead in electric bus adoption.

What is the future outlook for the Europe bus market?

The market is expected to grow steadily, with a strong shift toward electric and hydrogen buses, supported by government funding and rising environmental awareness.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com