Europe Cable Joint Market Size, Share, Trends, & Growth Forecast Report by Type (Indoor Cable Joints, Outdoor Cable Joints), Voltage, Industry Vertical, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Cable Joint Market Size

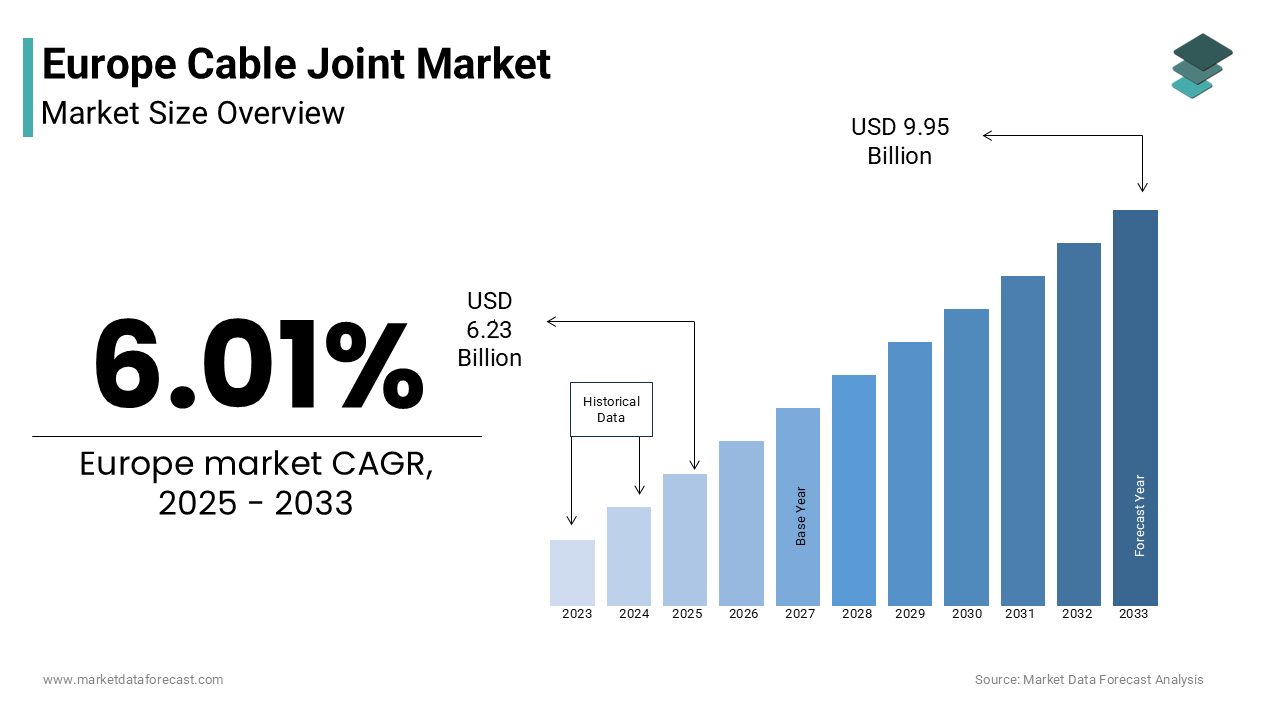

The Europe Cable Joint Market was worth USD 5.88 billion in 2024. The Europe market is expected to reach USD 9.95 billion by 2033 from USD 6.23 billion in 2025, rising at a CAGR of 6.01% from 2025 to 2033.

The Europe cable joint market involves the use of specialized connectors, splices, and terminations designed for joining electrical cables in power transmission and distribution systems. These joints ensure continuity, mechanical strength, and insulation integrity in underground and overhead power networks. They are widely used across high-voltage transmission lines, medium-voltage distribution systems, and low-voltage applications in both urban and rural settings. With Europe’s aging power infrastructure and increasing investments in grid modernization, demand for reliable and durable cable joints has surged. Moreover, the European Union’s push toward decarbonization has led to a significant rise in renewable energy integration, particularly from offshore wind farms in countries like Germany, Denmark, and the UK. This has increased the need for high-performance cable joints capable of handling fluctuating loads and extreme environmental conditions.

MARKET DRIVERS

Expansion of Renewable Energy Projects Across Europe

One of the primary drivers fueling the Europe cable joint market is the rapid deployment of renewable energy projects, particularly in wind and solar power generation. As part of its Green Deal initiative, the European Union has committed to achieving climate neutrality by 2050, which has spurred large-scale investments in clean energy infrastructure. According to the International Renewable Energy Agency (IRENA), Europe saw a significant increase in new wind and solar capacity in 2023 alone, with major developments concentrated in Germany, Spain, and the UK. These renewable sources often require long-distance transmission via underground or submarine cables, where high-voltage cable joints play a crucial role in ensuring seamless connectivity and system stability. Offshore wind farms, especially in the North Sea and Baltic regions, rely heavily on robust cable jointing solutions to connect turbines to onshore grids. Additionally, the increasing complexity of grid interconnection projects such as the NordLink and ElecLink initiatives has further boosted demand for high-performance cable joints.

Aging Electricity Infrastructure and Need for Grid Modernization

Another major driver of the Europe cable joint market is the urgent need to replace and upgrade aging electricity infrastructure across multiple countries. Much of Europe’s power grid was constructed several decades ago and is now reaching the end of its operational life, leading to frequent outages and inefficiencies. As reported by the European Network of Transmission System Operators for Electricity (ENTSO-E), a large share of the underground power cables in France, Italy, and Poland were installed before 1990 and are prone to insulation degradation and mechanical failure. Replacing these cables involves extensive use of high-quality joints to ensure safe and efficient operation. In response, national utilities and private operators are investing in grid rehabilitation programs that include cable replacement, splice upgrades, and installation of smart monitoring systems. Furthermore, the shift toward decentralized energy systems where microgrids and distributed generation sources are integrated into the main grid—requires additional cable joint installations to maintain system integrity.

MARKET RESTRAINTS

High Cost of Advanced Cable Joints and Installation Services

One of the primary restraints affecting the Europe cable joint market is the high cost associated with advanced cable jointing materials and professional installation services. High-voltage and extra-high-voltage cable joints, particularly those used in offshore and subsea applications, require precision engineering, specialized labor, and extensive testing to ensure performance under extreme conditions. This financial burden is particularly challenging for smaller utility providers and municipal energy companies operating under tight budget constraints. Moreover, the complexity involved in joining high-capacity cables used in offshore wind farms significantly increases project expenditures. A report noted that approximately 15–20% of total capital expenditure in offshore wind projects is attributed to cable jointing and connection systems. These elevated costs can delay or scale back infrastructure upgrades, especially in emerging markets such as Greece, Portugal, and certain Eastern European countries where public funding for grid improvements remains limited.

Supply Chain Disruptions and Material Shortages

Another significant constraint in the Europe cable joint market is the ongoing volatility in global supply chains and raw material availability. Cable joints, particularly those used in high-voltage applications, rely on critical components such as cross-linked polyethylene (XLPE), copper conductors, and silicone rubber insulation materials, all of which have faced procurement challenges in recent years. A report by the European Raw Materials Alliance (ERMA) noted that disruptions in the supply of copper, a core component in conductor manufacturing, led to price surges in 2023 compared to the previous year. These fluctuations directly impact production timelines and increase overall project costs for cable joint manufacturers. In addition, geopolitical tensions and trade restrictions have disrupted the flow of essential raw materials from traditional suppliers in Asia and South America.

MARKET OPPORTUNITIES

Growth of Smart Grid Development and Digital Asset Management

An emerging opportunity for the Europe cable joint market lies in the development of smart grids and digital asset management systems that enhance the performance and longevity of electrical infrastructure. As European nations transition toward intelligent energy networks, there is a growing emphasis on real-time monitoring, predictive maintenance, and fault detection in power distribution systems. According to the European Technology and Innovation Platform for Smart Networks for Electricity (ETIP SNET), more than 40 pilot smart grid projects were launched across the EU in 2023, many of which included advanced cable jointing solutions equipped with embedded sensors and condition-monitoring capabilities. These next-generation cable joints, often referred to as “smart joints,” integrate IoT-enabled diagnostics to track temperature variations, insulation degradation, and load fluctuations. Utilities in Germany and Sweden have already begun deploying such technology to reduce unplanned downtime and extend asset lifespan. Furthermore, regulatory bodies such as the Agency for the Cooperation of Energy Regulators (ACER) encourage the adoption of digitalized grid components to meet future energy demands efficiently.

Expansion of Electric Vehicle Charging Infrastructure

Another promising opportunity for the Europe cable joint market is the rapid expansion of electric vehicle (EV) charging infrastructure, which necessitates extensive underground cabling and secure jointing solutions. As EV adoption accelerates across the continent, governments and private enterprises are investing heavily in nationwide fast-charging networks. According to the European Alternative Fuels Observatory, over 50,000 new public EV charging points were deployed across the EU in 2023, with plans to install more than 3.5 million by 2030. Each charging station requires multiple cable joints to connect transformers, switchgear, and power lines, creating sustained demand for high-quality jointing products. In addition, the deployment of ultra-fast DC charging stations—capable of delivering 150 kW or higher—demands superior thermal and electrical performance from cable joints, driving innovation in heat-resistant and high-conductivity materials. Countries such as the Netherlands, France, and Austria are leading in EV charging infrastructure rollouts, with dedicated funding from the Connecting Europe Facility (CEF) and national green mobility funds.

MARKET CHALLENGES

Technical Complexity and Lack of Skilled Labor for Jointing Operations

One of the most pressing challenges in the Europe cable joint market is the technical complexity involved in jointing operations and the shortage of skilled technicians trained to perform them. Cable jointing, especially for high-voltage applications, requires precise execution to avoid insulation defects, partial discharges, and premature failures. However, the aging workforce and declining number of qualified cable jointers pose a growing concern. According to the European Centre for the Development of Vocational Training (CEDEFOP), a major percentage of electrical maintenance professionals in Germany and the UK are nearing retirement age, with insufficient replacements entering the field. Training institutions and industry associations are working to address this gap through apprenticeship programs and certification courses.

Stringent Regulatory Standards and Compliance Requirements

Another critical challenge facing the Europe cable joint market is the increasingly stringent regulatory environment governing product quality, safety, and environmental compliance. Cable joints must adhere to rigorous standards set by organizations such as CENELEC, IEC, and ENTSO-E to ensure compatibility with grid specifications and long-term reliability. For instance, the Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive impose strict design and testing requirements on cable accessories, including joints and terminations. Non-compliance can result in costly product recalls or rejection by utility buyers. Moreover, the introduction of the EU Ecodesign for Sustainable Products Regulation (ESPR) mandates that electrical components demonstrate reduced environmental impact throughout their lifecycle. This has prompted manufacturers to invest in eco-friendly insulation materials and recyclable components, adding to R&D and production costs.

SEGMENTAL ANALYSIS

By Type Insights

The Indoor cable joint segment held the largest market share by accounting for 58.5% of the Europe cable joint market in 2024. This dominance is primarily attributed to the extensive deployment of indoor cable joints in substations, industrial facilities, and commercial buildings where controlled environmental conditions ensure long-term performance and reliability. Moreover, aging electricity infrastructure in urban centers has led to a surge in indoor cable joint replacements. Additionally, the expansion of smart grid infrastructure, particularly in countries like the Netherlands and Sweden has increased the need for high-performance indoor joints equipped with condition monitoring sensors.

The Outdoor cable joint segment is projected to grow at the fastest CAGR of 6.3% during the forecast period, outpacing the indoor segment due to rising investments in renewable energy integration and expansion of overhead transmission lines in remote and rural areas. Outdoor cable joints are essential in connecting overhead power lines to underground cables, particularly in wind farms, solar parks, and cross-border interconnection projects. Furthermore, government-led electrification programs in Eastern Europe have spurred the installation of new overhead distribution networks in underserved regions. Also, advancements in weather-resistant materials such as silicone rubber and ethylene propylene diene monomer (EPDM) have improved the durability of outdoor joints against UV exposure, moisture, and extreme temperatures.

By Voltage Insights

The Medium Voltage (MV) cable joint segment accounted for the majority of the market by contributing 48.5% of the total Europe cable joint market in 2024. This influence is driven by the widespread use of MV cables in urban power distribution networks, industrial applications, and commercial infrastructure. As per the European Distribution System Operators Association (EDSO), more than 60% of electricity distribution in Western Europe occurs via medium voltage grids operating between 1 kV and 36 kV. These networks rely heavily on reliable jointing solutions to maintain system integrity and minimize downtime. Moreover, the rapid development of microgrids and localized renewable energy installations, such as rooftop solar and small-scale wind farms, has further boosted demand for MV cable joints. In addition, aging distribution infrastructure in cities like London, Paris, and Berlin has prompted utilities to replace legacy MV cables with modern XLPE-insulated systems, which in turn increases jointing requirements.

The High Voltage (HV) cable joint segment is transforming into the fastest-growing, registering a CAGR of 7.1% over the forecast period. This is largely fueled by the increasing deployment of high-voltage direct current (HVDC) and alternating currentACAC) transmission systems to support long-distance power transfer and cross-border interconnectors. Offshore wind farms in the North Sea, such as Dogger Bank and NordLink, are major contributors to this trend. A study by the Fraunhofer Institute for Wind Energy Systems found that each offshore HVDC project typically involves more than 100 high-voltage cable joints, including splice and termination types designed for harsh marine environments. Additionally, regulatory initiatives such as the EU Trans-European Networks for Energy (TEN-E) Regulation have accelerated investments in cross-border HV links between Germany, Denmark, France, and the UK.

By Industry Vertical Insights

The Energy and Power industry vertical possessed the maximum market share by contributing 42.6% of the overall Europe cable joint market. This control is caused by the critical role of cable joints in ensuring uninterrupted power supply across transmission and distribution networks. These configurations necessitate high-quality joints to maintain electrical continuity and mechanical strength. Moreover, national grid operators are investing heavily in network upgrades to accommodate renewable energy sources. Additionally, the EU-funded Connecting Europe Facility (CEF) continues to allocate billions toward reinforcing transnational electricity corridors, many of which involve high-voltage cable jointing. The growing reliance on underground and subsea transmission systems further reinforces the importance of advanced cable jointing technologies in maintaining grid stability and safety.

The Industrial vertical is coming out as the thriving category, with a CAGR of 6.9% over the forecast period. This progress is mainly propelled by the modernization of manufacturing plants, chemical processing units, and data center infrastructure, all of which depend on stable and secure electrical connectivity. These upgrades often include replacing outdated low-voltage joints with insulated and fire-resistant alternatives. In addition, the expansion of large-scale industrial complexes such as automotive factories and pharmaceutical production hubs in Southern and Eastern Europe has increased the demand for customized cable jointing solutions. Furthermore, the rise of electric arc furnaces and automated production lines in steel mills and foundries has intensified the need for high-temperature-resistant joints capable of withstanding continuous electrical stress.

REGIONAL ANALYSIS

Germany was the largest market share by contributing 23.2% of the overall Europe cable joint market. It maintains its leadership position due to its well-developed power infrastructure, significant investments in renewable energy integration, and ongoing grid modernization efforts. With one of the largest offshore wind capacities in Europe, Germany relies heavily on high-voltage cable joints to link offshore turbines to onshore transmission systems. Besides, Germany’s Energiewende policy has spurred massive investments in grid expansion and underground cabling to reduce visual impact and enhance reliability. These strategic initiatives, coupled with a strong domestic manufacturing base for cable accessories, reinforce Germany’s dominant role in shaping the European cable joint market.

The United Kingdom has strong renewable integration and grid upgrades and is driven by aggressive offshore wind development and nationwide grid reinforcement programs. The country’s commitment to achieving net-zero emissions has resulted in a surge in subsea cable installations, all of which require high-voltage joints for safe and efficient operation. As reported by National Grid ESO, the UK’s offshore wind capacity reached over 14 GW in 2023, with several gigawatt-scale projects in development off the coasts of Scotland and East Anglia. Each of these wind farms depends on hundreds of high-voltage cable joints to facilitate power export from turbine arrays to onshore substations. Moreover, the Ofgem Strategic Innovation Fund has supported research into next-generation cable jointing technologies aimed at improving longevity and reducing failure rates in deep-sea environments. Companies such as Siemens Energy and Prysmian Group have established dedicated R&D centers in the UK to develop advanced jointing solutions tailored for offshore applications.

France is seeing high adoption of underground transmission and smart grid initiatives, supported by its focus on underground power transmission and digitalized grid management. The French government has prioritized the transition from overhead to underground cables in urban areas, necessitating extensive use of cable joints to maintain system reliability. These projects involved thousands of cable joints, including medium and high-voltage variants. Furthermore, France’s push toward smart grid adoption has increased the demand for intelligent cable joints equipped with real-time diagnostics. The French Ministry of Ecological Transition has mandated condition-monitoring features in new cable installations to improve fault detection and reduce unplanned outages. Private-sector players such as Nexans and Leoni AG are actively engaged in supplying jointing solutions for these modernization projects.

Spain has a growing emphasis on integrating renewable energy sources into the national grid. The Spanish government has set ambitious targets for wind and solar power expansion, necessitating extensive underground and subterranean cabling solutions. As per the Spanish Renewable Energy Association (APPA), Spain added over 4 GW of new wind and solar capacity in 2023, much of which was connected via underground MV and HV cables. These installations require numerous cable joints to ensure seamless power flow and system stability. Moreover, Spain’s National Integrated Energy and Climate Plan (PNIEC) includes provisions for expanding the country’s interconnection capacity with France and Portugal. These cross-border projects involve high-voltage cable systems that depend on precision-engineered joints for long-term performance. Additionally, municipal authorities in Barcelona and Madrid have launched undergrounding initiatives to enhance city aesthetics and reduce outage risks.

Italy captures a notable share of the Europe cable joint market, driven by ongoing urban electrification projects and the decentralization of energy generation. The country’s aging power infrastructure, particularly in cities like Milan and Rome, has prompted extensive underground cable replacement campaigns, increasing jointing requirements. Additionally, the proliferation of rooftop solar installations and local microgrids has increased the need for MV cable joints to interconnect distributed energy resources.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nexans, Prysmian Group, NKT A/S, 3M, TE Connectivity, ABB, HellermannTyton, Elastimold (a subsidiary of Hubbell), Sumitomo Electric Industries, Ltd., and Tyco Electronics are some of the key market players in the Europe cable joint market.

The competition in the Europe cable joint market is marked by a mix of established global manufacturers, regional specialists, and emerging players striving to capture market share through technological differentiation and strategic positioning. While multinational firms like Nexans, Prysmian Group, and ABB dominate due to their extensive product portfolios and deep integration with major infrastructure projects, mid-sized companies are gaining traction by offering customized, cost-effective solutions tailored to specific applications such as urban distribution and industrial electrification.

Strategic differentiation is increasingly being driven by material innovation, digital diagnostics, and compliance with stringent European safety and environmental regulations. Companies are also focusing on after-sales services, including predictive maintenance and condition monitoring, to enhance customer retention and service value. Additionally, the push toward decarbonization and the rapid expansion of offshore wind energy are reshaping competitive dynamics, prompting firms to invest in specialized jointing solutions for marine environments and long-distance transmission corridors.

Collaboration between cable joint suppliers, grid operators, and research institutions is also playing a vital role in defining the future trajectory of the market. In this environment, only those who can combine technical excellence with agile response to policy shifts and infrastructure needs will be able to sustain leadership in the rapidly evolving European cable joint sector.

Top Players in the Europe Cable Joint Market

Nexans S.A.

Nexans is a global leader in cable technology and plays a pivotal role in the Europe cable joint market through its comprehensive range of high-voltage, medium-voltage, and low-voltage jointing solutions. The company specializes in advanced materials and insulation technologies that ensure long-term reliability in both underground and subsea power systems.

With a strong presence across France, Germany, and the UK, Nexans contributes significantly to European grid modernization and offshore wind energy projects. Its commitment to sustainability and innovation has positioned it as a preferred supplier for critical infrastructure developments, reinforcing its influence on both regional and global cable joint markets.

Prysmian Group

Prysmian Group is a key player in the Europe cable joint market, offering cutting-edge jointing solutions tailored for high-voltage transmission lines, industrial applications, and renewable energy integration projects. As one of the world’s largest manufacturers of power and telecommunication cables, the company brings deep expertise in cable system design and performance optimization.

Prysmian supports major cross-border interconnection initiatives and offshore wind farm deployments, delivering precision-engineered joints capable of withstanding extreme environmental conditions. Its strategic collaborations with European utilities and grid operators have strengthened its position in large-scale energy infrastructure programs, making it a dominant force in the region's cable joint ecosystem.

ABB Ltd.

ABB is a leading provider of electrification and automation technologies, playing a crucial role in the Europe cable joint market through its integrated power distribution and grid connectivity solutions. The company offers high-performance cable joints designed for smart grids, industrial networks, and renewable energy installations.

ABB's contribution extends beyond product development to include digital monitoring systems that enhance cable joint longevity and system efficiency. With a strong R&D footprint in Switzerland and Germany, ABB continues to shape the evolution of intelligent cable jointing technologies, supporting Europe’s transition toward resilient and sustainable power networks.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Europe cable joint market is product innovation and material advancement, focusing on developing high-performance, durable, and environmentally resilient cable joints. Companies are investing heavily in R&D to introduce joints with enhanced insulation properties, reduced failure rates, and improved compatibility with smart grid technologies.

Another critical approach is expanding production capabilities and localized manufacturing facilities to meet rising demand while reducing lead times and logistics costs. By establishing regional hubs in Germany, Italy, and Poland, leading firms can better serve national utility providers and renewable energy project developers.

Lastly, strengthening partnerships with grid operators, engineering firms, and regulatory bodies is a growing trend among market leaders. These collaborations help companies align product development with evolving industry standards, secure long-term contracts, and support large-scale infrastructure upgrades across Europe.

RECENT MARKET DEVELOPMENTS

- In February 2024, Nexans announced the launch of a new line of eco-friendly high-voltage cable joints featuring recyclable insulation materials, aiming to align with EU sustainability targets and strengthen its position in green infrastructure projects.

- In May 2024, Prysmian Group expanded its manufacturing facility in the Netherlands to increase production capacity for submarine cable joints, specifically targeting offshore wind farm connections in the North Sea and Baltic regions.

- In July 2024, ABB introduced an AI-driven cable joint diagnostic platform designed to predict insulation degradation and thermal stress, enhancing preventive maintenance capabilities for European utilities and industrial clients.

- In September 2024, Siemens Energy signed a partnership agreement with a leading European grid operator to co-develop next-generation cable joints with integrated digital monitoring features, improving fault detection and network reliability.

- In November 2024, Leoni AG acquired a German cable jointing specialist to bolster its portfolio of industrial-grade connectors and expand its reach into automotive and data center power infrastructure markets across Central Europe.

MARKET SEGMENTATION

By Type

- Indoor Cable Joints

- Outdoor Cable Joints

By Voltage

- Medium Voltage (MV) Cable Joints

- High Voltage (HV) Cable Joints

By Industry Vertical

- Energy and Power

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the Europe cable joint market?

The growth of the Europe cable joint market is driven by the expansion of power infrastructure, increasing renewable energy projects, urbanization, industrialization, grid modernization, and the growing need for reliable underground and subsea cable connections.

What are some of the challenges faced by the cable joint market?

The market faces challenges such as high installation and maintenance costs, complex deployment in harsh environmental conditions, and regulatory hurdles for the approval of new technologies and materials.

What is the future outlook for the Europe cable joint market?

The future outlook for the Europe cable joint market is positive, with steady growth expected due to ongoing infrastructure upgrades, increasing demand for renewable energy integration, and advancements in smart grid technology.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com