Europe Candy Market Research Report - Segmented Based on Type, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends, & Growth Forecast (2025 to 2033)

Europe Candy Market Size

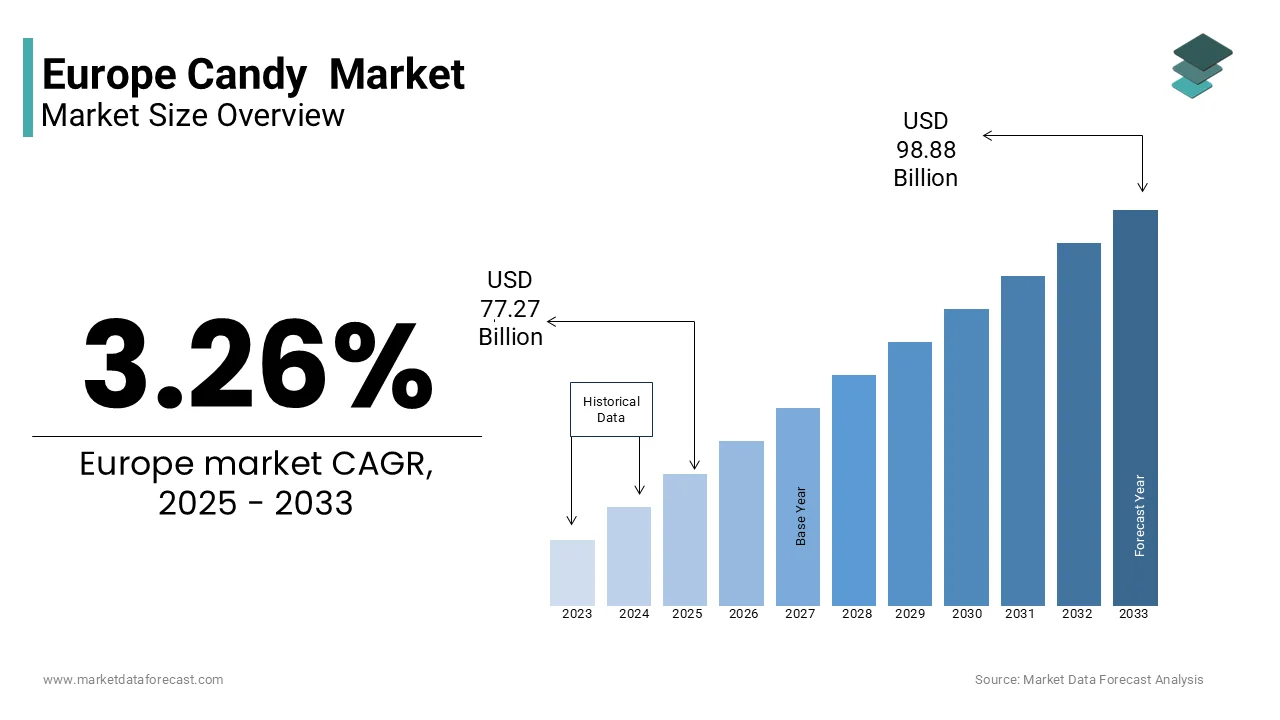

The Europe candy market size was valued at USD 74.83 billion in 2024, and the market size is expected to reach USD 98.88 billion by 2033 from USD 77.27 billion in 2025. The market's promising CAGR for the predicted period is 3.26%.

Confectioneries are another name for candies. Candy is made with sugar, honey, and other natural or artificial sweeteners, as well as chocolate, milk, fruit, nuts, or other ingredients or flavours, and is made in the form of bars, drops, or bits. Certain varieties of candy can provide important proteins, minerals, and vitamins that aid with bodybuilding and overall health. Candy is classified as part of the confectionery market by the food and beverage industry, which interchangeably uses the terms confectionery and candy. Canned goods, pastries, and ice cream are ideal candidates. The presence of chocolate has been used to segment the worldwide candy business. The candy industry is considered a seasonal industry, with sales peaking around the holidays. Manufacturers are adding employment to fulfil the demands of assembling candies over the Christmas season. Candy containing cocoa or chocolate ingredients, such as cocoa butter, are known as chocolate candies. Non-chocolate confectionery or chocolate mimics, such as marshmallows, licorice, hard candy, and jelly beans, are examples of chocolate-free candy.

The steady rise of the Europe candy market has been aided by the increasing number of innovative product developments. In the European market, there are a variety of delicious sweets in various shapes.

Mars Incorporated, for example, makes Big Red, a cinnamon-flavored chewing gum. The businesses are also involved in the launch of new items, which helps to boost the Europe candy market's demand. In addition, product innovation is intended to address the rising health risks linked with candy consumption, such as diabetes. As a result, the main industry companies are now offering sugar-free sweets to diabetics, as well as lowering the risk of diabetes in their clientele. Because of rising consumer health concerns, changing preferences, and declining sugar prices with low selling prices, industry demand is expected to be moderate. Companies offering health-enhancing products must also promote their products, which is a major impediment to Europe candy market expansion.

The majority of them are backed up by scientific studies and research. Candy has a lot of sugar, so it's no surprise that it's linked to diabetes and obesity. The advent of sugar-free candy replacements will most likely remedy this problem. However, due to increased expenditures in consolidation and innovation by major multinationals, the performance of the Europe candy market is expected to accelerate. As a result, candy manufacturers are likely to produce healthier confectionery alternatives in order to reduce consumers' negative attitudes toward candy. Furthermore, in recent years, the trend of gifting confectionery products such as cookies, chocolates, bakery items, and others has aided Europe's candy market growth. Confectionery products are frequently purchased as a consequence of impulse purchases, thus brands are always developing novel engaging techniques to attract consumer attention. These forces have combined to propel the market for confectionery products forward.However, the Europe candy market's expansion may be hampered by the volatility of sugar and cocoa raw material costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.26% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Arcor, August Storck KG, Yildiz Holding, Cemoi, Chocoladefabriken Lindt & Sprungli AG, United Confectionary Manufacturers, Crown Confectionary Co. Ltd, DeMet’s Candy Co, Ezaki Glico Co. Ltd, Ferrero Group, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

In terms of product type, chocolate candy was the most popular in 2019, accounting for 35.2 percent of the market. Chocolate confectionary is consumed by people of all ages to please their taste buds. Moreover, the European market for chocolate has been fueled by an increase in economic affluence, especially in emerging countries. Furthermore, chocolate is the most popular confectionary product per capita (kg) in a number of countries.

By Distribution Channel Insights

Based on distribution channel, the supermarket/hypermarket tends to dominate the Europe candy market share during the forecast period. The increase in supermarket/hypermarket adoption in mature and emerging markets is attributable to the growth of the supermarket/hypermarket segment in the Europe candy market. These retail formats are particularly popular among consumers since they give a one-stop shopping experience. During the forecast period, however, the e-commerce segment is expected to grow at a faster CAGR. The expansion of the market is aided by the establishment of online portals for confectionary items, particularly in emerging nations with big populations who use the internet. To attract more clients, this site offers a variety of discounts on online candy purchases. The rise of online business is aided by the advancement of advanced technologies.

REGIONAL ANALYSIS

Due to the presence of industry leaders as well as a huge population of candy consumers, the United Kingdom has the largest share in the Europe candy market. Moreover, U.K candy market is expanding rapidly due to rising demand, product innovation, and disposable income.

Germany continues to be the region's largest consumer market, boosted in part by Europe's expanding demand for packaged assortments. Due to the growing habit of giving chocolates as gifts during holidays, sales of box assortments are rapidly increasing, the Germany candy market can experience a robust growth. Assorted self-lines are included in boxed assortments, and the chocolates included within are identical. They could also be a box containing many chocolate flavors. Dark, milk, or white chocolate, with or without fillings, are available. Consumers' online purchases have increased in recent years. As a result, major firms are bolstering their internet presence in order to sell this type of chocolate.

KEY MARKET PLAYERS

Key Market Players of the Europe Candy Market are Arcor, August Storck KG, Yildiz Holding, Cemoi, Chocoladefabriken Lindt & Sprungli AG, United Confectionary Manufacturers, Crown Confectionary Co. Ltd, DeMet’s Candy Co, Ezaki Glico Co. Ltd, Ferrero Group.

RECENT HAPPENINGS IN THE MARKET

- Russell Stover Chocolates introduced Joy Bites, a line of Fairtrade chocolate bars made with non-GMO, organic ingredients and no added sugar, in 2021.

- Perfetti Van Melle USA Inc., which has strong origins in Europe, introduced its first soft gummy product in the United States in 2020 under the Fruit-tella brand. Fruit-tella Soft Gummies are produced with pectin instead of gelatin and contain actual fruit puree. Each gummy is shaped like a whimsical fruit figure and comes in Strawberry and Raspberry, Peach and Mango flavors.

MARKET SEGMENTATION

This Research Report on Europe candy market is segmented and sub segmented into following categories

By Product Type

- Chocolate Candy

- Non-Chocolate Candy

By Distribution Channel

- Supermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1.Are there any emerging trends in the Europe Candy Market?

Yes, emerging trends in the Europe Candy Market include a shift towards premium and artisanal candies, the introduction of healthier options with reduced sugar content or natural ingredients, and the popularity of seasonal and novelty candies for gifting and special occasions.

2.Where can consumers purchase candies in Europe?

Consumers can purchase candies from a variety of retail outlets, including supermarkets, convenience stores, specialty candy shops, online retailers, and even vending machines located in public places

3.Are there any regulations or guidelines for candy manufacturers in Europe?

Yes, candy manufacturers in Europe are subject to various regulations and guidelines regarding food safety, labeling, and ingredients. These regulations ensure that candies meet certain standards for quality and consumer safety.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com